Citrus Pectin Market shows consistent growth between 2025 and 2035 because its usage increases in food and beverages together with pharmaceuticals and cosmetic applications. The food industry employs citrus pectin extracted from citrus peel to create thick thickening agents as well as stabilizers and gelling agents in jams and dairy foods and confectionery products and functional food items.

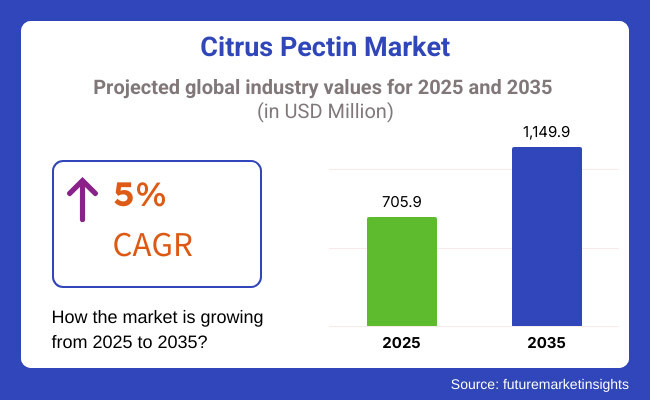

From 2025 through 2035 the citric Acid market will grow to reach USD 1,149.9 Million as it demonstrates a Constant Annual Growth Rate (CAGR) of 5% starting from USD 705.9 Million in 2025.The market growth continues because customers select plant-based ingredients and substance requirements with clean labelling and dietary fibers and functional food additives. The pharmaceutical industry now uses citrus pectin’s as key ingredients for digestive health-related medicine development and treatment preparations.

The business faces technical hurdles from recurring price instabilities in citrus markets and high processing costs in combination with existing food additive rules. Manufacturers reach higher yields together with improved products through their commitment to sustainable sourcing practices and better extraction methods.

The citrus pectin market divides itself into two sections according to product types and applications. HM pectin and LM pectin are the main product types available in the citrus pectin industry. The dominant food market uses HM pectin as a gelling agent for jams together with jellies and confectionery products but dairy manufacturers choose LM pectin for its performance in low-sugar formulations and pharmaceutical applications.

Food and beverage companies lead the market use of citrus pectin primarily because they need natural stabilizers and texturizers. The pharmaceutical industry continues to increase its use of citrus pectin across dietary supplements while implementing the substance for drug development and manufacturing gut health products. Skincare products now include citrus pectin because of its properties to hydrate and form protective films in cosmetic products.

Explore FMI!

Book a free demo

The purchase of products such as citrus pectin is primarily done with a growing demand for functional foods, clean-label ingredients, and dietary supplements in North America owing to which region holds significant shares in the market. Citrus pectin has gained widespread usage in plant-based food products, low-sugar beverages, and nutraceuticals across the USA and Canada. Moreover, market growth in the region is supported by improved extraction technology and sustainability practices.

The citrus pectin market in Europe is comparatively large backed by stringent regulatory practices for natural food additives and robust processed food industry. Germany, France, and the UK are the regions showing significant growth in the adoption of citrus pectin for the bakery, confectionery, and dairy applications. In this region, the increasing transition toward the consumption of organic & non-GMO food ingredients significantly bolsters the sales of citrus pectin.

Asia-Pacific will witness the fastest growth in the citrus pectin market due to the growing food processing industries, increasing consumer awareness of health and wellness, and increasing demand for plant-based ingredients. Growing applications of citrus pectin in traditional and functional foods are observed in countries such as China, Japan, South Korea, and India.

Booming Market Growth Because Of Demand Led by the Nutraceutical and Pharmaceutical Sectors the pharmaceutical and nutraceutical sectors are also growing using citrus pectin in nutritional fibre supplements.

Challenge

Supply Chain Constraints and Price Volatility

Citrus pectin market is already facing issues with supply chain disruptions and disruptions in production of citrus fruits. Because citrus pectin is derived from citrus peels, it is scarcer than apple pectin (which is driven by higher seasonal juice processing industries) and is plagued by market fluctuations, climate changes, and crop diseases like citrus greening.

Geopolitical trade restrictions and transportation costs also exacerbate price volatility. Manufacturers’ ability to two, maintain stable production is at risk, as the reliance on a limited number of citrus-producing regions increases supply risk. Long-term, to ensure market stability, companies should look into diversifying sourcing strategies, investing in extraction processes, and promising alternative sources of fruit-derived pectin.

Opportunity

Expanding Applications in Health and Functional Foods

Increasing consumer demand for natural, plant-based, and clean-label ingredients is turning citrus pectin into a popular ingredient for functional foods,beverages, and dietary supplements.Citrus pectin has a beneficial prebiotic feature and is being incorporated into gut health formulations, low-sugar jams, dairy alternatives, and plant-based meat products.

Furthermore, pharmaceutical applications are being explored, such as the use of modified citrus pectin for detoxification and immune health. This opens up room for manufacturers to improve their pectin formulations to increase solubility, bioavailability, and multifunctional properties suited for food and healthcare applications. Consumers are looking at natural options, investing in organic and non-GMO citrus pectin will complement market growth.

The increasing introduction of plant-based food alternatives and clean-label formulations drives the demand for the citrus pectin market between 2020 and 2024. Citrus pectin was between food applications as a natural gelling and stabilizing agent, and pharmaceutical and nutraceutical companies investigating its potential health benefits. Price stability was impacted by supply chain challenges and raw material shortages.

Progress in extraction processes, sustainability initiatives, and increasing applications in functional health products will facilitate growth between 2025 and 2035. Manufacturers will work to improve yield efficiency, source alternative fruits that are rich in pectin, and broaden the applications of citrus pectin in dietary supplements and pharmaceuticals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Raw Material Sourcing | It is dependent on by-products of citrus peel from the juice processing industries. |

| Food & Beverage Applications | Image Caster used as gelling, thickening, and stabilizing agent in jams, dairy, and confectionery. |

| Health & Wellness Trends | Limited applications in dietary supplements and prebiotic formulations. |

| Sustainability & Waste Utilization | Initial efforts in utilizing citrus peels for pectin extraction. |

| Processing & Extraction | Traditional acid-based extraction methods with moderate efficiency. |

| Consumer Awareness | General understanding of citrus pectin as a food additive. |

| Regulatory Landscape | Compliance with food safety regulations and organic labelling for premium products. |

| Market Shift | 2025 to 2035 |

|---|---|

| Raw Material Sourcing | Diversified sourcing with alternative fruit-based pectin (apple, sunflower) and sustainable citrus waste recovery. |

| Food & Beverage Applications | They are entering functional drinks, vegan meat replacements, and low-sugar processed products. |

| Health & Wellness Trends | Growing demand for modified citrus pectin in gut health, detoxification, and immune-boosting products. |

| Sustainability & Waste Utilization | Advanced zero-waste extraction methods and circular economy approaches for sustainable production. |

| Processing & Extraction | Enzymatic and eco-friendly extraction technologies improve yield, purity, and functional properties. |

| Consumer Awareness | Increased consumer education on citrus pectin’s health benefits and multifunctional applications. |

| Regulatory Landscape | Stricter clean-label requirements, sustainability certifications, and transparency in sourcing. |

Since there is a growing demand from the food and beverage, pharmaceutical, and personal care industries, the USA citrus pectin market is stable. The frequent use of citrus pectin for the purpose of gel, thickener, and stabilizer for jams, dairy, and drinks is inducing the market growth.

The increasing acceptance of natural and clean-label ingredients in ready-to-eat foods is driving demand for citrus pectin across diverse formulations. In addition, demand is being boosted due to soaring usage of citrus pectin in the pharmaceutical industry for the preparation of drug delivery systems and cholesterol-lowering supplements.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK citrus pectin market is slowly increasing as there is a growing demand for natural-based plant and functional food ingredients. Market Trend: The growing trend for low sugar and sugar free food formulations is driving the demand for the usage of citrus pectin as a fat replacer and sugar substitute in bakery and confectionery applications.

Besides, in the cosmetic segment, the personal care industry is adopting more amounts of citrus pectin due to its skin-conditioning and emulsifying properties which are used in toiletries and beauty products including moisturizers, anti-aging creams, and hair care. Additionally, the increasing consumer demand for sustainable and natural additives is also driving the demand for the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

Germany, France and Italy are leading the demand in the European lemon pectin market. However the market for lemon pectin in Europe is growing at a stable rate. With applications in jams, dairy items and fruit-based drinks, the food and refreshment industry is still the biggest shopper segment.

The rising emphasis on dietary fibers and functional ingredients is further encouraging the use of citrus pectin in health supplements and digestive health products. Also, with increasing consumption of vegan and plant-based food products is also positively influencing market growth, as it is used as a natural substitute for gelatine in diverse food applications.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Japan’s citrus pectin market expands because it finds growing applications in functional foods together with pharmaceuticals and nutraceuticals products.The market demand for digestive supplements with prebiotic content and fiber-enriched beverages is increasing due to rising consumer preference for gut health products.

Industrial applications of citrus pectin within the pharmaceutical sector result in drug encapsulation and both cosmetic and pharmaceutical development of skincare products and anti-aging formulations. The movement toward natural biodegradable ingredients promotes manufacturers to investigate new applications of citrus pectin.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

The market for citrus pectin in South Korea continues its expansion because manufacturers seek dietary fibers and clean-label food additives simultaneously. The growth of functional beverages along with health supplements stimulates demand for citrus pectin as it appears in multiple weight management products as well as energy drinks and detox juices.

The market for cosmetics utilizes citrus pectin as they incorporate it into moisturizers while using it for both skincare and hair brand serums to block pollutants. Sustainable food processing together with eco-friendly packaging stimulates research into citrus pectin as key component of natural emulsifiers and biodegradable coatings.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The citrus pectin market shows its largest shares in oranges and dairy products & frozen desserts segments because industries require natural plant-derived food and beverage stabilizers and emulsifiers as well as thickening agents. This essential ingredient derived from citrus plays a vital function by creating better product textures while stabilizing viscosity and improving the integrity of frozen and dairy products for the manufacturing and processing industries of food items and functional brands.

The market pushes manufacturers to upgrade citrus pectin extraction capabilities as they work on improved formulation match and broad product applications between dairy alternatives and frozen desserts to satisfy changing customer needs.

Demand for high quality pectin extraction has led to the increase in market demand for oranges.

Among citrus sources, oranges are gaining popularity in the pectin market for high pectin content, better gelling properties and higher extraction efficiency compared to various other citrus sources. The pectin derived from alternative citrus fruits are not as functional as the orange-derived pectin, as it contributes better viscosity, emulsification and stability in food and beverage formulations.

The adoption is mainly attributed to the high purity grade orange pectin, with standardized molecular weight distribution, optimized gel strength and enhanced solubility. According to studies, more than 60% of pectin manufacturers are using orange as the main raw material as it is abundant, economical, and offers high pectin yield, which is expected to maintain high demand for this segment.

The increasing adoption of sustainable methods for extracting pectin, supported by environmentally clean processing approaches, enzyme-aided pectin recovery, and a variety of AI-renovated used-value techniques that optimize citrus waste valorisation processes, have bolstered market consumption, leading to a higher adherence rate of sustainability objectives and lesser waste during the manufacture and usage of pectin by citrus processing sectors.

All of these advancements have contributed to adoption as AI-driven raw material optimization (including automated orange peel sorting, real-time pectin content analysis, and AI-based supply chain monitoring) drives quality control and pectin extraction efficiency.

In the past few years, customized solutions, such as dry-blend low-methyl, high-methyl and low-methyl pectin gelling agents have been developed that have enabled optimised development for the market growth, enabling better compatibility with upcoming clean-label food formulations.

While this offers advantages in terms of borrowers' ability to improve food structure, enhance gelling efficiency, and enable clean-label formulations, its orange-based pectin segment faces challenges, including seasonal variations in citrus production, changing raw material costs, and changing regulatory requirements related to pectin standardization.

Nevertheless, novel techniques in enzyme-modified pectin extraction, block chain-enabled traceability measures, and AI-driven citrus sourcing analytics are not only facilitating such transformations to be carried out in a cost-effective, product-consistent and market scalable manner but are also ensuring higher market growth for orange-derived pectin across the globe.

Strong Adoption of Oranges Segment As the functional food industry, high-performance beverage manufacturers, and dairy product segment gain momentum, the adoption of orange-derived pectin has risen significantly, as they are increasingly used to improve mouthfeel, stability, and shelf life of products.

Pectin derived from oranges provides better market positioning in clean-label and natural ingredient formulations compared to synthetic stabilizers as they are better accepted by the consumers with added health & texture enhancing benefits.

Adoption has been propelled by the demand for next-generation citrus pectin with optimized molecular binding characteristics, AI-enhanced gelation kinetics and dynamic control of rheology in real time. According to studies, over 70% of high-performance functional food brands employ orange pectin to help enhance texture, promote viscosity, and sensory permanency, accounting for a high growth of this segment.

Furthermore, sustainable pectin applications are expanding, including citrus peel upcycling, biodegradable food packaging films, and alternative plant-based emulsifiers, play a major role in enhancing their adoption in the market and optimize the compatibility with sustainable food goals and circular economy frameworks worldwide.

Advanced precision fermentation technologies, such as AI-enabled microbial pectin transformation, intelligent enzymatic degradation control, and tailored polysaccharide augmentation, also play a key role in driving adoption of polysaccharides for high-value food products while enhancing product consistency and optimized functionality.

While the orange-derived pectin segment benefits from factors such as the improving stability of the product; value addition to active constituents in many beverages, jams, and confectionery; and proper sourcing of raw materials to ensure sustainable, citrus processing is subject to competition from other plant-derived stabilizers, developing Market trend of sugar-free formulations, and bunching of supply chain congestion on citrus processing market.

Nonetheless, the potential for global expansion of orange-derived pectin is still here with advances in technologies for AI-enabled formulation adaptation, enzymatic cross-linking optimisation, and next-generation high-yield citrus pectin extraction markedly improving product performance, enhancing market competitiveness and increased formulation scalability.

Within dairy and frozen applications, pectin can increase the richness, stability, and mouthfeel of ice-cream so that ice crystals are less likely to form.

The dairy products & frozen desserts segment of the citrus pectin market is one of the most preferred application segments for this product, as it allows dairy brands, ice cream manufacturers and producers of plant-based alternatives to improve formulations by stabilizing them, enhancing creaminess, and preventing phase separation of refrigerated & frozen products.

Compared to traditional thickeners, pectin provides superior water-holding capacity, better heat and freeze-thaw stability for an improved texture and an extended shelf life.

Adoption has been driven by increasing demand for high-performance citrus pectin, including low-methyl pectin for dairy gels and acid-stable emulsifiers for fermented products, as well as texture-enhancing blends for frozen desserts.

Due to its clean-label appeal, improved digestibility and natural texture-enhancing properties, more than 65 % of dairy and frozen dessert manufacturers choose citrus-derived pectin over synthetic stabilizers, ensuring sustained high demand for this segment with respect to the global pectin market.

The increasing population of plant based dairy alternatives such as oat based yogurts, almond milk ice creams, and coconut based cheese alternatives has positively influenced the market demand for citrus pectin, providing more opportunities for their use as natural thickening and gelling agent.

Joining the ranks of these core players are other technology innovations including AI-based formulation customization with machine learning viscosity prediction, automated modelling of dairy protein-pectin interactions, and AI-based predictive sensory optimization, all of which have translated into real-world use cases for this technology, further expanding the market due to increased consumer satisfaction and greater formulation consistency.

Customized pectin solutions for dairy and dairy products, including hydrocolloids that enhance fat-reduction, functional protein-binding pectin mixtures and stabilizers conducive to probiotics, have allowed for better adaptation to changing health-conscious consumers demand and thus catalysed the market growth.

It shows promise in enhancing dairy texture, stabilizing frozen formulations, and adding creaminess without artificial additives, but the dairy products & frozen desserts segment questions its merits especially given the mass-market nature of the dairy business (which comes down to cost), regulatory scrutiny of ingredient labelling and the changing preferences of consumers now seeking out lower-sugar options.

Nonetheless, new advancements in pectin structuring enabled through enzymatic modification, AI-enabled fat-replacement technologies and hybrid polysaccharide-stabilizer formulations are enhancing product differentiation, cost-effectiveness and clean-label credentials and driving the future of market growth for citrus pectin for dairy products and frozen desserts globally.

Across dairy and frozen desserts segments, pectin's compatibility with these applications has contributed to important penetrations among premium dairy companies, functional frozen desserts manufacturers, and high protein dairy alternative producers as industries increasingly strive towards texture optimization, mouthfeel enhancement, and superior sensory this application. Pectin delivers superior consumer perception and digestibility on top of its natural gelling functionality and therefore is better able to cross into health-oriented and premium product categories compared to synthetic stabilizers.

Adoption has been driven by advances in next-generation dairy stabilizers, such as AI-assisted formulation balancing, enzymatically modified pectin blends, and sugar-free texture enhancers. According to studies, more than 75% of dairy brands that use clean-label stabilization use this pectin over others as it has been shown to have exemplary thickening properties; few have even better freeze-thaw stability, thus guaranteeing bullish demand for this segment.

While offering benefits to improved dairy texture, formulation stability, and plant-based innovation, the dairy products & frozen desserts segment is challenged by supply chain variances, and the complexity of ingredient claims related to regulation, and also competition from alternative gelling agents.

Nevertheless, innovative developments in precision-formulated hydrocolloids, AI-aided sensory modelling, and sustainable pectin sourcing are bolstering competitive market positioning, cost and consumer adoption which will keep citrus pectin expanding across the globe.

The citrus pectin market shows growing stability because manufacturers increasingly incorporate this substance for food & beverage uses and pharmaceutical as well as cosmetic applications. Citrus peels provide the sources for citrus pectin which serves generally as gelling agent and stabilizer and thickener in products like jams and confectionery and dairy products and beverages. Industry demand for citrus pectin rises because of its functional applications in digestive health together with its utility in weight management and cholesterol reduction in nutraceutical and pharmaceutical fields.

The market continues to advance because of the increasing consumer preference for clean-label ingredients and ingredients derived from plant sources. Major pectin manufacturers support industry developments through sustainable production technologies and by providing organic certified low-methoxyl LM pectin and high-methoxyl HM pectin formulations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| CP Kelco (J.M. Huber Corporation) | 18-22% |

| Cargill, Incorporated | 15-19% |

| DuPont (IFF) | 12-16% |

| Herbstreith & Fox GmbH | 9-13% |

| Naturex (Givaudan) | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| CP Kelco (J.M. Huber Corporation) | Produces high-quality LM and HM citrus pectin for food, beverage, and pharmaceutical applications. |

| Cargill, Incorporated | Develops functional citrus pectin solutions, focusing on texture enhancement and dietary fiber benefits. |

| DuPont (IFF) | Offers pectin-based stabilizers for dairy, confectionery, and fruit-based products with clean-label formulations. |

| Herbstreith & Fox GmbH | Specializes in premium citrus pectin for food processing, medical applications, and plant-based formulations. |

| Naturex (Givaudan) | Focuses on organic and natural citrus pectin extracts for functional foods, cosmetics, and nutraceuticals. |

Key Company Insights

CP Kelco (J.M. Huber Corporation) (18-22%)

CP Kelco is a leading supplier of citrus pectin, offering high-performance gelling and stabilizing solutions for food and pharmaceutical applications.

Cargill, Incorporated (15-19%)

Cargill specializes in citrus pectin formulations for enhanced texture and dietary benefits, catering to food and nutraceutical industries.

DuPont (IFF) (12-16%)

DuPont (now part of IFF) focuses on citrus pectin as a natural stabilizer, with clean-label and high-functional properties for dairy, beverages, and confectionery.

Herbstreith & Fox GmbH (9-13%)

Herbstreith & Fox provides customized pectin solutions for food manufacturing, particularly for jams, fruit fillings, and plant-based alternatives.

Naturex (Givaudan) (7-11%)

Naturex offers organic and natural citrus pectin extracts, targeting the growing demand for functional food ingredients and clean-label formulations.

Other Key Players (30-40% Combined)

The market incorporates various manufacturer participation through creation of sustainable organic solutions and specialized pectin products. Notable players include:

The overall market size for Citrus Pectin Market was USD 705.9 Million in 2025.

The Citrus Pectin Market is expected to reach USD 1,149.9 Million in 2035.

The demand for the citrus pectin market will grow due to increasing applications in food and beverage as a natural gelling agent, rising demand for clean-label and plant-based ingredients, expanding use in pharmaceuticals and cosmetics, and growing consumer preference for functional and dietary fiber-rich products.

The top 5 countries which drives the development of Citrus Pectin Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Oranges and Dairy Products & Frozen Desserts Form to command significant share over the forecast period.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

USA Bubble Tea Market Analysis from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.