The Citrus Gummies Market will demonstrate consistent growth from 2025 until 2035 because consumers want functional candy that is both health-conscious and vitamin-infused supplements. People use citrus gummies as a simple replacement for standard dietary supplements because these products contain necessary nutrients along with vitamin C.

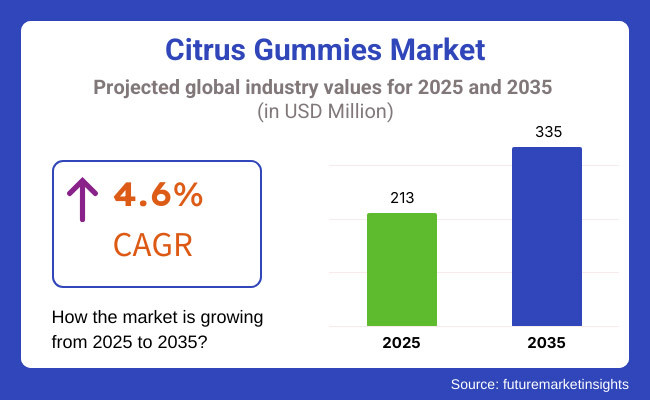

Market analysts predict citrus gummies to achieve a business valuation of USD 213 million in 2025 while forecasting a value of USD 335 million for 2035 which would result in a 4.6% compound annual growth rate (CAGR) throughout the forecast period.

The market continues to grow because more people including children and young adults prefer to take their vitamins in chewable forms or functional candy format. The market appeal of citrus-flavoured gummies continues to rise because consumers find them easy to consume and delicious while receiving immune benefits from their consumption.

The market expansion could face barriers from high sugar content in products and government inspection of health benefits declarations. The production of sugar-free and organic and plant-based solutions by manufacturers caters to customers who prioritize their health.

Global Citrus Gummy Key Trends and Analysis The citrus gummies market can be segmented based on product type and application. These include the vitamin-infused citrus gummy, organic citrus gummy, and sugar-free citrus gummy product categories.

With a rise in the adoption of vitamin-infused gummies as dietary supplements, gummy immune vitamins command the highest share in the global market, followed by sugar-free and organic variants, as manufacturers are looking at addressing the concerns of weight-conscious consumers.

Based on applications, global orange gummies market can be segmented into dietary supplements, functional confectionery and OTC health products. In the dietary supplement segment, there is a surge in demand for citrus gummies containing vitamin C, zinc and antioxidants for immune health.

Moreover, citrus gummies have also started to be marketed as a healthier/smarter alternative to conventional candies, targeting both the healthy and indulgent consumer segments.

Explore FMI!

Book a free demo

North America is a significant market due to increased health awareness, rising demand for functional foods, and the growing adoption of gummy supplements. The vitamin-enriched confectionery is becoming more popular in USA and Canada, especially among children and working professionals who are looking for a quick, tasty way to take supplements. Product development in the region is being further defined by the clean-label movement and regulatory focus on transparency in ingredients.

The Europe citrus gummies market is likely to have a prominent share driven by the growing demand for plant-based and sugar-free confectionery. Countries including Germany, France, and the UK lead the way in functional gummies innovation, with manufacturers creating fortified, organic and non-GMO solutions.

The rising appeal of reduced sugar consumption promoted by European regulatory frameworks is catalysing the demand for alternative sweeteners in gummy inclusions, contributing to market growth.

Citrus gummies market in Asia-Pacific is anticipated to grow at the fastest pace owing to growing disposable incomes, changing dietary patterns, and increasing requirement for immunity-boosting supplements.

In countries such as China, Japan, South Korea, and India, citrus gummies are experiencing strong demand as increasing awareness about preventive healthcare and functional confectionery drives up sales. The rise of e-commerce, as well as the emergence of direct-to-consumer supplement brands, is making the market even more accessible and expanding consumer reach across the region.

Challenge

Managing Sugar Reduction without Compromising Taste and Texture

However, due to increased health consciousness among consumers, the citrus gummies market continues to face challenges because consumers are looking for healthier options with lower sugar content. And while citrus flavours like lemon, orange and grapefruit have natural sourness, many gummy formulations work in extra sugars to counter acidity and boost palatability.

When reformulating gummies with alternate sweeteners such as stevia, monk fruit or erythritol it infamously can’t mimic traditional gummy because the mouthfeel is changed. And there is growing regulatory pressure around sugar reduction in confectionery products - an upstream driver that is pushing manufacturers to innovate even further.

And to overcome this issue, organizations need to adopt in-depth food technology approaches, including pectin-based formulations, fiber-rich bases, and natural fruit concentrates, to make sure that the reduced-sugar citric gummy retains its taste, chewiness, and consumer acceptability.

Opportunity

Rising Demand for Functional and Clean-Label Citrus Gummies

Consumers are able to find everything from daily vitamins to functional gummies that provide some health benefit beyond simple candy indulgence. Vitamin C-enriched, immune-boosting, and gut-health-promoting citrus gummies are experiencing increasing demand in nutraceutical and dietary supplement fields.

Health-conscious buyers concerned with transparency in ingredient sourcing gravitate toward clean-label formulations that use organic citrus extracts, plant-based ingredients, and natural colorants. Food companies can contribute to this growing trend by creating citrus gummies infused with probiotics, electrolytes, collagen, or adaptogens to better suit wellness-oriented customers.

This, along with the introduction of premium and organic products, the availability of sugar-free and vegan-friendly varieties will further propel the market growth.

Over the period from 2020 to 2024, the citrus gummies market grew substantially, driven by increasing consumer interest in gummies infused with vitamins and confectioneries of natural fruit origin. The trend for organic, non-GMO and clean-label formulations continued to grow, with manufacturers introducing innovative product lines containing reduced artificial ingredients. Nonetheless, issues surrounding sugar reduction and product stability remained.

Technological advancements in gummy formulation and the way ingredients are sourced will have major impact on the market from 2025 to 2035. Demand for functional ingredients, including immune-supporting vitamins and botanical extracts, will spur innovation. Sustainability work in biodegradable packaging and upcycled citrus ingredients will also continue to influence product development.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Sugar Reduction Strategies | Reformulated initially with artificial sweeteners and sugar alcohols. |

| Functional Ingredients | Growth in vitamin C and immunity-boosting citrus gummies. |

| Clean-Label Movement | Shift toward organic and non-GMO citrus-based formulations. |

| Texture & Stability Innovations | Gelatine-based gummies remained dominant, with some pectin-based alternatives. |

| Consumer Preferences | Demand for indulgent and fruit-flavoured gummies with moderate health benefits. |

| Sustainability Practices | Initial efforts to reduce artificial colorants and improve ingredient sourcing. |

| Regulatory Landscape | Stricter regulations on sugar content and labelling transparency. |

| Market Shift | 2025 to 2035 |

|---|---|

| Sugar Reduction Strategies | Natural sugar alternatives, fiber-based sweeteners and monk fruit extracts go mainstream. |

| Functional Ingredients | Expansion into adapt genic, probiotic, and electrolyte-enhanced citrus gummies. |

| Clean-Label Movement | Full transparency in ingredient sourcing, with plant-based and preservative-free formulations becoming standard. |

| Texture & Stability Innovations | Advanced formulation techniques improve chew ability in plant-based, sugar-free, and heat-stable gummies. |

| Consumer Preferences | Preference for multifunctional, wellness-driven citrus gummies with added nutrients and botanical extracts. |

| Sustainability Practices | Use of upcycled citrus peels, biodegradable packaging, and carbon-neutral production. |

| Regulatory Landscape | Mandatory clean-label certifications, sugar taxation policies, and stricter health claims validation. |

The USA citrus gummies market showcases steady growth, propelled by a growing consumer preference towards vitamin-infused functional gummies and natural fruit-based confectionery. Immune-supporting vitamin C gummies are currently in high demand, with citrus flavours being the most popular option at the 2025 dietary supplements marketplace.

Market drivers also include growing availability of sugar-free and organic gummy formulations. Moreover, growing investment in plant-based and pectin-based gummy alternatives is addressing the demand for vegan and allergen-free products. The trend of fortified gummies with probiotics and collagen is also shaping the market.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

The market for citrus gummies in the UK is growing due to the increasing popularity of nutritional and functional gummies, including in the immune health and energy-boosting categories. The rising trend across the world toward natural and clean-label ingredients is driving manufacturers to make preservative-free and organic citrus gummies.

The emergence of adult-gummy supplements with various functionalities, such as gut health and skin health, is also influencing demand in the market. Innovations in low-sugar and fiber-enriched gummies are also soothing consumer concerns around sugar consumption without losing product palatability.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

In Europe, the market for citrus gummies is growing steadily, with a continued demand in Germany, France, and Italy. Industry growth is being driven by the rising popularity of citrus-infused multivitamin gummies across dietary supplements for children and adults.

The move toward organic and non-GMO citrus ingredients is in line with the EU’s strict food safety and sustainability regulations. The innovation witnessed in the segment is further driven by the expanding trend of fortified confectionery products, especially those containing electrolytes, herbal and botanical extracts.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan’s growing gummies market is led by demand for functional snacks and fortified confectionery. Higher collagen-infused and hyaluronic acid-infused gummies are emerging growth.tw as a trend, especially among beauty products.

In gummies, new forms of differentiation are being crafted not only by unique combinations of functional plants, which isn't that new at all, but by the introduction of previously underused citrus extracts, such as yuzu, kabosu or sudachi. Moreover, the increase in health-oriented gummies aimed at digestion, energy, and immunity is boosting market expansion.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

Increasing health consciousness and demand for vitamin fortified sturdy are pushing up the South Korea citrus gummies market. The country’s beauty and wellness industry is a significant growth engine, with citrus gummies being incorporated into collagen and skincare supplement routines.

The rising need for sugarless and functional citrus gummies, especially among youth consumers, is spurring innovation in the segment. Furthermore, the product demand is being aided by K-pop and celebrities who are essentially publishing citrus-infused gummy products.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Growing Demand for Organic Citrus Gummies as Consumers Prefer Clean-Label & Chemical-Free Ingredients.

Natural Gummies Support Better Absorption, Natural Nutrition, and Higher Customer Trust. Among them, the organic segment has emerged as one of the fastest-growing categories in fortifying citrus gummies market players focusing on offering clean-label, pesticide-free, and non-GMO formulations that align with consumers' preferences for natural, sustainably sourced, and minimally processed nutritional supplements.

Organic gummies, unlike traditional citrus gummies, contain no artificial sweeteners, synthetic preservatives, or chemically processed food, providing more nutritional benefits and better confidence for consumers.

Adoption is driven by the demand for certified organic citrus gummies with non-GMO vitamin C ingredients, naturally derived citrus flavours and plant-based gelatine alternatives. According to studies, more than 65% of supplement consumers look for organic products in the food much because of their values for human health as well as responsible food production, meaning that there is a tempting demand for this segment.

As such, the market has witnessed a rise in organic vitamin supplementation, including all-natural vitamin C extracted from plants, citrus fruit extracts and immune-enhancing antioxidants, which has reinforced its demand and increased market penetration and compliance amongst a range of consumer demographics.

AI-driven nutrient optimization, real-time quality verification and block chain-organic certification ensure better regulatory compliance and enhanced consumer trust, which has also contributed to driving adoption.

Custom organic citrus gummies are yet another boon for better market growth, whether it is sugar-free formulations or fortified blends with probiotics, allergen-free ingredients are also prompting a healthy diet--that drives higher penetration among the health-conscious segment, diabetics, and special dietary needs.

However, manufactured organic citrus gummies make true clean nutrition challenges by increasing production costs, limiting raw materials, and typically pricing-sensitive mass-market retail channels. But the upward market trajectory for organic citrus gummies globally remains due to the continuous innovations based on AI-based ingredient profiling passing a positive cost-benefit analysis, smart supply chain management, sustainable; organic farming partnerships that keep driving product differentiation and scaling in the markets.

Organic Citrus Gummies Receive Traction at Health Food Stores, Grocery Chains, and Online Supplement Retailers

The organic citrus gummies segment has been widely adopted, especially by premium dietary supplement brands, natural food retailers, and online wellness platforms, as industries place greater emphasis on plant-based nutrition, it also encourages transparency in product labelling and the sourcing of eco-friendly and sustainable products.

These benefits certainly help differentiate organic citrus gummies from synthetic firing vitamin formulations, which taste awful, are harder to digest, and have a lower consumer preference for whole-food storage based supplements-factors proven to ensure reliable brand trust and increased long-term consumer retention.

Adoption has been driven by demand for natural fruit-based citrus gummies that come with bioflavonoids and added vitamin C, with extracts like organic orange, lemon, and grapefruit. Studies indicate that 7 out of 10 consumers prefer citrus-flavoured organic gummies to traditional vitamins, thanks to their improved taste profile and non-synthetic ingredient list, which assures strong demand in this segment.

Increase production of eco-friendly supplements in sustainable packaging, sustainably sourced citrus extracts, and carbon-neutral manufacturing processes ensure better rapport with the market and between supplements and other formulations in the context of global sustainability priorities and accelerated social expectations for eco-conscious solutions.

AI-powered customization is high on the radar with customized vitamins given on the grounds of dietary needs, medical conditions, and genetic conditions, increasing adoption rate further with improved absorption of customers to personalized nutrition trends and consumer lifestyle preferences.

Although its benefits include increased consumer welfare, promotion of plant-based innovation and alignment with clean-label nutrition trends, the organic citrus gummies segment shares disadvantages of higher price points than conventional alternatives, supply chain constraints on organic raw materials, and changing consumer attitudes about carb content that call for sugar-free formulations.

Nonetheless, new technologies that enable AI-assisted nutrient delivery systems, enzyme-modified flavour extraction, and smart biodegradable packaging are making organic citrus gummies increasingly cost-effective, sustainable, and consumer-friendly, promoting growth in organic citrus gummies globally.

Product Protection with Bottles & Jars Improves Shelf Life and Beneficial for the Premium Brand Image

Among the various types of packaging that have emerged in the citrus gummies’ market, the bottles & jars segment has established itself as one of the most widely used packaging types, enabling dietary supplement brands, functional food companies, and premium health product manufacturers to provide a secure, tamper-proof, and eco-friendly packaging solution for their product.

As stand-up pouches and plastic sachets provide limited protection owing to their higher moisture permeability, bottles & jars are beneficial for proper preservation to avoid the stickiness of the gummy texture which is otherwise affected by moisture, and chewy and hard texture can repel customers, ROPP & LDP closures in hard plastic bottles & jars provide surpassing product visibility compared to pouches and stand-up bags that offer limited clear visibility, which in turn results in strong consumer inclination towards durable and resalable supplement packaging.

Adoption has been driven by demand for high-quality glass and PET bottles, with ultraviolet (UV) resistant coatings, airtight sealing and recyclable packaging materials. According to studies, more than 75% of premium health brands are focusing on bottles & jars for their citrus gummies on account of increased product protection and branding benefits, which ensures the segments will be in high demand.

The growing number of environmentally friendly packaging options such as plant-based plastic alternatives, reusable glass jars, and biodegradable label substrates have reinforced market demand delivering enhanced adherence to environmental regulations and sustainable product positioning.

All of these have contributed to the advancement of adoption powered by Ai applications, as well as improving adoption with smart expiration tracking, real-time temperature monitoring, and QR-code-enabled product authentication integrated into smart packaging, allowing companies to engage with consumers on deeper levels around their products while also building trust around safety and freshness.

Customized packaging is another global trend of ergonomic jars with multi-serving portion control solutions for the consumer market as well as child-resistant closure mechanisms have further augmented the market growth by being more consumer-friendly and effective.

As the specifications of glass packaging are comparatively higher as compared to flexible packaging, the bottles & jars segment can prove to be major restraint as bottles & jars require higher manufacturing costs, are heavier than flexible packaging, and can get broken during transportation.

Nevertheless, new technologies, such as advances in the manufacturing of lightweight glass and in AI-based supply chain efficiency, as well as refillable packaging programs, are making cost-effectiveness, sustainability and brand competitiveness more favourable, so that despite recent setbacks the indulgence of citrus gummies sold in bottles & jars look set to continue growth globally.

Demand for Bottles & Jars Raised by Premium Supplement Brands, Retail Pharmacy Chains, and E-Commerce Platforms

Owing to most industries progressively gravitating towards tamper grotesque, premium see packages they believe carry items desired with respect to safe and effective packaging, the bottles & jars segment is one of the most widely used options, at least as far as top health supplement manufacturers, cosmetic brands and retail pharmacy outlets are concerned.

Bottles & jars ensure extended shelf life, better product presentation, and increased resistance to external contaminants unlike flexible packaging formats, thereby ensuring better brand visibility and long-term marketability.

Additionally, next-gen packaging solutions, such as smart-labelling technologies, AI-driven shelf-life monitoring, and biodegradable plastic alternatives have been in favour in the market which has facilitated its adoption.

According to studies, more than 80% of high-end supplement brands use bottle packaging for citrus gummies as it features a tamper-evident design that enhances product longevity which is the top priority of all high-end brands and ensures strong demand for this segment.

The bottles & jars segment does benefit from improved product presentation, sustainability compliance, and consumer convenience, but also faces concerns related to higher packaging costs, increased transportation weight, and changing regulatory requirements for single-use plastics.

Yet, novel technologies awakened in recyclable glass processing, AI-backed packaging design and blockchain-fueled packaging traceability are sustaining market resilience, production sustainability and brand differentiation, facilitating further ascension for bottles & jars in the global citrus gummies market.

A growing consumer interest in functional gummies combined with vitamin-enriched natural fruit-based candies drives the expansion of the citrus gummies market. Citrus gummies represent a majority consumer food choice because they consist of oranges, lemons, limes and grapefruits that people use to consume vitamin C and antioxidants with their immune-boosting properties.

Health awareness rise together with clean-label and organic product demands and functional gummy use for dietary supplements drive market expansion. Modern manufacturers are launching sugar-free, plant-based citrus gummies with added vitamins together with probiotics and natural sweeteners to satisfy customers who demand different product options.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bayer AG | 18-22% |

| Church & Dwight Co., Inc. | 15-19% |

| The Clorox Company (Nutranext) | 12-16% |

| SmartyPants Vitamins | 9-13% |

| Hero Nutritionals | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bayer AG | Produces citrus-flavored multivitamin gummies under brands like One A Day and Flintstones. |

| Church & Dwight Co., Inc. | Offers vitamin C-enriched citrus gummies through the Vitafusion and L’il Critters brands. |

| The Clorox Company (Nutranext) | Develops organic and non-GMO citrus gummy vitamins under brands such as Rainbow Light. |

| SmartyPants Vitamins | Specializes in premium, sugar-free, and allergen-friendly citrus gummy supplements for all age groups. |

| Hero Nutritionals | Provides natural and pectin-based citrus gummies for immune support and overall wellness. |

Key Company Insights

Bayer AG (18-22%)

Bayer leads the citrus gummies market with its widely recognized vitamin brands, offering immune-boosting and multivitamin formulations.

Church & Dwight Co., Inc. (15-19%)

Church & Dwight is a major player in the gummy vitamin industry, producing citrus-based gummies under Vitafusion and L’il Critters, catering to children and adults.

The Clorox Company (Nutranext) (12-16%)

Clorox focuses on organic and clean-label citrus gummy vitamins, promoting plant-based ingredients and high bioavailability.

SmartyPants Vitamins (9-13%)

SmartyPants specializes in premium-quality citrus gummies with functional benefits such as immune support, cognitive health, and digestive wellness.

Hero Nutritionals (7-11%)

Hero Nutritionals is known for its natural and allergen-free citrus gummies, targeting the clean-label and wellness-conscious consumer segment.

Other Key Players (30-40% Combined)

Several other companies contribute to the citrus gummies market by offering innovative, organic, and functional gummy formulations. Notable players include:

The overall market size for Citrus Gummies Market was USD 213 Million in 2025.

The Citrus Gummies Market is expected to reach USD 335 Million in 2035.

The demand for the citrus gummies market will grow due to increasing consumer preference for functional and vitamin-infused confectionery, rising demand for natural and organic ingredients, growing health awareness, and expanding product innovation in sugar-free and immunity-boosting gummy formulations.

The top 5 countries which drives the development of Citrus Gummies Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Organic and Bottles & Jars Drive Form to command significant share over the forecast period.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.