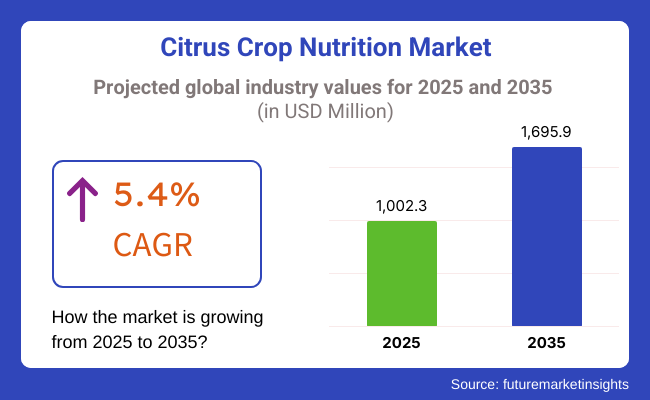

The citrus crop nutrition market is projected to reach USD 1002.3 million by 2025 and is expected to grow to USD 1695.9 million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.3% over the forecast period. The growth can be attributed to the rising demand for premium citrus fruits and a requirement for effective nutrient management to improve yield and fruit quality.

The increasing global population and health awareness among consumers have increased the demand for citrus fruits, which are rich in vitamin C and other nutrients. In response to this demand, citrus producers are looking to fine-tune their nutrient management regimes, including the use of citric-specialized fertilizers and soil amendments. Not only does this improve yield, but it also improves fruit quality to meet consumer demands and market needs.

Reducing inputs is part of sustainable agriculture, and sustainable citrus is becoming more and more important. The use of organic fertilizers, bio-based products, and integrated nutrient management practices is in line with general sustainability targets and meets the increasing consumer demand for organically-grown fruits. Such practices are also good for soil health and the long-term productivity of farms.

Regionally, among the most important countries growing citrus are the United States, Brazil, China, India, and Mexico, where they have a climate well suited to growing this fruit. The government also encourages the adoption of advanced nutrient management techniques in these regions as high-quality fruits and vegetables are desired in the market. On the other hand, lesser-developed economies are slowly incorporating modern citrus nutrition methods as familiarity increases and farming practices reform.

The citrus crop nutrition market is witnessing significant investments in research and development from key players to develop innovative products that meet the specific nutritional needs of citrus plants. This includes controlled-release fertilizer, micronutrient formulations, and soil conditioners to enhance nutrient uptake efficiency.

As part of this, collaborations amongst fertilizer manufacturers, agricultural research institutions, and citrus growers are driving the use of tailored nutrition programs that not only boost productivity but also improve sustainability.

Despite this positive picture, there are challenges, including volatile raw material prices, regulatory restrictions, and the need for farmers to be educated in advanced nutrition practices. To combat these challenges, persistent innovation, enabling legislation, and incremental capacity building are necessary for the safe uptake of efficacious citrus nutrition solutions.

The citrus crop nutrition market is segmented on the basis of nutrition types, formulations, and regions. Over the next couple of years, advancements on these fronts will materialize thanks to the partnership among stakeholders to address the current barriers. These advancements will yield benefits for producers, consumers, and the environment.

Explore FMI!

Book a free demo

Efficiency, sustainability, and regulatory compliance largely drive purchasing criteria in the citrus crop nutrition market. For citrus growers and farmers, the focus is mainly on nutrient-dense formulations designed to enhance fruit yield, soil quality, and disease resistance.

Growers are seeking sustainable solutions that boost their output without harming ecology, so products with bio-stimulants or micronutrient-enriched fertilizers, or those with organic compositions, are popular. Farmers aim for reliability for a long-term payoff, and the factors that play a strong role in purchasing decisions also include the ease of application and cost efficiency of a product.

Agricultural input suppliers and cooperative members specialize in providing consistent formulation quality, availability, and efficacy upon which growers can rely to enhance their crop productivity. Our customers want products that are compliant with industry standards and have a proven performance record in improving citrus fruit quality.

Buyers are increasingly looking for sustainable and eco-friendly fertilizers that can minimize chemical runoff, and traceability through transparent sourcing is an important requirement. Sustainability organizations and regulatory law bodies stress compliance with environmental directives, mentioning products that prevent soil degradation and water pollution.

With increasing global demand for high-quality citrus crops, the market for specialized crop nutrition solutions is also yielding great opportunity. Fertilizers that are new and green are proof that you are investing a lot in the research to get it done. The citrus crop nutrition market will be governed by citrus growers who align with precision agriculture and eco-friendly farming trends.

The awareness of the importance of balanced fertilization for yield and fruit quality led to the growth of the citrus crop nutrition market during the historical period. Recognizing that a nutrition program developed for specific soil deficiencies is a more efficient way for farmers to apply fertilizer and achieve better crop results.

A transformative market phase where control systems for soil health are integrated with advanced satellite data to provide on-demand control for crop nutrition. Sustainable methods with organic fertilizers and bio-stimulants are expected to come into play with environmental and consumer health in mind. Keeping in mind elevated temperatures and changing precipitation, the future development of climate-resilient citrus varieties may affect nutrient management strategies. The higher resilience of some varieties would need reconsideration of fertilizer management to promote their sustainability.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The citrus crop nutrition market experienced steady growth, driven by increasing demand for citrus fruits and the need for effective nutrient management. | The market is projected to continue its expansion, with advancements in sustainable agricultural practices and precision farming enhancing nutrient application efficiency. |

| Applications focused on macronutrients and traditional fertilizers to support citrus yield and quality. | There is an expected shift towards balanced nutrient management, incorporating both macro and micronutrients, along with biofertilizers to improve soil health and crop resilience. |

| Asia-Pacific and North America were key markets, with significant citrus production and consumption driving nutrient demand. | Asia-Pacific is anticipated to maintain its leading position, with emerging markets in Latin America and Africa experiencing increased adoption due to expanding citrus cultivation. |

| Challenges included soil nutrient depletion and environmental concerns related to fertilizer overuse. | Emphasis on sustainable sourcing and cultivation practices is expected to address environmental challenges and support market growth. |

| Research focused on optimizing fertilizer formulations and application timing to enhance nutrient uptake. | Innovations in biotechnology and sustainable agriculture are projected to enhance production methods and application development. |

| Consumer awareness of the health benefits associated with citrus fruits contributed to market demand. | Growing consumer preference for organic and sustainably produced citrus products is likely to drive further market expansion. |

| Investments in citrus farming and nutrient management technologies increased, reflecting a trend toward improved agricultural practices. | Continued investments in sustainable practices and regulatory support are expected to bolster market growth. |

The citrus crop nutrition market is crucial to ensure adequate yield and quality of the citrus crop and faces a range of risks that could adversely affect long-term growth. One of those risks is climate change, which impacts soil fertility, water availability, and the production of citrus. Extreme weather events like droughts and floods can disrupt nutrient absorption and hit crop yields, impacting fertilizer demand.

Soil degradation and nutrient depletion are worries, too. Imbalanced soil conditions have arisen due to intensive farming practices, leading to a more utilized fertilizer. Nevertheless, the overapplication of synthetic fertilizers raises environmental issues. Transitioning to organic and sustainable fertilizers should be a goal for agriculture, but it will need additional technologies and cost reductions.

Regulatory uncertainties present another risk. Because of the environmental toll of chemical fertilizers, governments around the world are increasingly tightening restrictions, outraging farmers, and forcing companies to reformulate products and adapt to new standards. Compliance with changing regulations is vital for market growth.

The other hurdle is market volatility. Trade policy, economic trends, and global supply chain disruptions influence citrus production and demand. Stabilizing growth can be achieved through diversifying product applications and investing in precision agriculture technologies. The key to mitigating risks in this industry lies in sustainable nutrient solutions, adaptability to regulation, and strategic positioning in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.20% |

| UK | 6.80% |

| France | 6.90% |

| Germany | 7.00% |

| Italy | 6.50% |

| South Korea | 7.30% |

| Japan | 7.10% |

| China | 7.40% |

| Australia | 6.40% |

| New Zealand | 6.30% |

Due to the growing need for high-yield citrus production and improved extended farming processes, untreated soil leads to micronutrients, organic fertilizers, and controlled-release fertilizers due to shared concerns of soil degradation and nutrient depletion.

Now, these precision agriculture technologies are helping farmers use fertilizers more efficiently while increasing citrus yield, according to the USA. Department of Agriculture (USDA). Furthermore, the nutritional deficiency correction market for citrus fruits is encouraged by expanding investments in nutrient-enhancing solutions that increase fruit quality and shelf-life.

The industry is growing as climate change adaptation strategies and investing in nutrient management solutions are growing. Since the UK has such a small citrus farming industry, the demand is mainly due to greenhouse and hydroponic citrus growers.

Strict environmental regulations are driving demand for organic and sustainable fertilizers. Moreover, the increasing import of citrus fruits is contributing to a growing investment in post-harvest nutrient treatments that help to improve the longevity of fruits and maintain quality standards.

With the emphasis on sustainable farming, France's citrus crop nutrition market is prospering. In France, the citrus sector focuses on integrated nutrient management (INM) programs requiring and encouraging the use of micronutrient biofertilizers and micronutrient-enriched fertilizers, especially in southern regions.

This is driving investments in natural and organic solutions as the country girds itself to reduce dependence on chemical fertilizers. France's growing wine and fruit juice industries are also driving demand for high-quality citrus with added nutritional properties.

The market for citrus crop nutrition in Germany is comparatively consolidated due to innovative research in agriculture and advancements in fertilizer formulations. As a result, sensor-based nutrient monitoring systems have been introduced in the country to optimize fertilizer application based on the assessed nutrient levels (in the soil) over time in citrus farming.

Sustainability measures are providing support for the use of biostimulants, organic compost, and controlled-release fertilizers by citrus growers. Furthermore, increased consumption of citrus-based beverages in Germany is fueling demand for better fruit quality with focused nutrient management.

Italy is also among the leaders in the production of oranges, lemons, and mandarins in Europe, contributing to its citrus crop nutrition market with large citrus-growing regions in Sicily and Calabria. The Italian government's support for sustainable agriculture encourages eco-friendly fertilizers and soil enhancers.

But, as organic citrus grows, the need for microbial fertilization and potassium-based nutrition solutions increases. Italy's export-oriented citrus sector is also investing in nutrient management programs to enhance fruit size and flavor and build resistance to diseases.

Jinju-based soil management company Oran developed the product to tap into the robust South Korean citrus crop nutrition market, which has been contributing immensely to the productivity of the country's largest citrus-producing region, Jeju Island. This includes the use of soil conditioners, soil malleability agents, and foliar feeds for better fruit yield advancement and quality.

The authorities are supporting precision agriculture and organic citriculture to decrease fertilizer pollution. Moreover, the growing consumer interest in functional products, including vitamin C-fortified drinks, has been fueling investments in enhanced nutrient production from citrus.

Government-supported research into sustainable fertilizer solutions is driving growth in Japan's citrus crop nutrition market. Japan also produces some of the best premium citrus varieties, like Mikan oranges and Yuzu, requiring specialized nutritional formulations for flavor and quality.

Biome, seaweed-based fertilizers, and slow-release nutrients with advanced soil management techniques perfecting growth for the country's citrus. Moreover, the producers of high-end citrus products in the Japanese export market are creating demand for tailored nutrient solutions.

China is among the top citrus producers globally, and this has led to a growing citrus crop nutrition market due to increased domestic consumption and demand for exports. Government policies are also being implemented to make citrus farming more efficient by promoting precision fertilizer for optimal nutrient absorption and soil enhancers for soil treatment.

After realizing that traditional agriculture used too many people and resources, provinces like Guangdong, Hunan, and Sichuan agricultural provinces with excellent advantages in fruits, have gradually applied high-efficiency nutrient delivery systems to citrus planting.

Moreover, the improved standards of living lead to a greater demand for fortified, citrus-based beverages, as more and more Chinese people consume fewer micronutrients; therefore, there is a strong investment demand for nutrition-improved citrus cultivation in China.

Growing citrus exports to Asia and Europe are driving growth in the market for citrus crop nutrition in Australia. Nutrient management initiatives focusing on soil boosting and dry spell resistance are foundering. The government is promoting soil health through the adoption of regenerative agriculture practices, including bio-fertilizers and compost-based soil conditioners. Moreover, systems for nutrient optimization aimed at improving fruit flavor and oil content are also being driven by Australia's citrus processing industry, particularly for juices and essential oils.

New Zealand's citrus crop nutrition market is gaining from the country's burgeoning citrus farming industry, especially in areas such as Northland and Gisborne. Thus, the sustainable management of nutrients is forcing farmers to turn to organic fertilizers with slow-release nutrient formulations.

The administration promotes precision farming technologies to avoid over-application of fertilizers and land degradation. Another big driver is the increasing exports of citrus fruits to New Zealand, which is driving demand for both pre-harvest and post-harvest nutrient treatments.

The most commonly used fertilizers are potassium based fertilizers, which is known to affect yield while increasing both fruit quality and sugar content. They improve the firmness of fruits and prolong the shelf life. Zinc and Magnesium are some of the micronutrients that are emerging to cure bacterial diseases like citrus greening disease, which is a severe threat to crop production worldwide.

In addition, boron is important for the development of fruits and seeds and prevents the dropping of fruits. Such balanced nutrition programs are essential for sustainable citrus cultivation, enhancing resistance to pests and diseases whilst maximizing fruit yield.

Foliar spray, fertigation, and soil application are the three main methods of nutrient delivery. The best nutrient uptake and disease resistance comes from foliar sprays. They can be quickly corrected and will lead to a better fruit set. An overview of fertigation technology in precision agriculture-an efficient method to deliver the nutrients directly by irrigation design to the surface surrounding the roots and minimize the amount of fertilizers used.

This means that soil application is very important for the long-term management of soil health, where nutrient-depleting and root-development-improving applications must be made. Sustainable agriculture and organic farming practices are gaining more and more attention, leading to a rise in demand for bio-based and eco-friendly fertilizers that can enhance citrus productivity without adverse effects on the environment.

The citrus crop nutrition market will increase due to the rising demand for high-yield and good-quality citrus crops and soil fertility, and it will contribute towards sustainable farming practices. Farmers have faced significant challenges with soil degeneration, climate change, and diminished nutrient levels in citrus orchards. However, they have turned to modern fertilization methods and micronutrient solutions to increase their output.

The key products include macronutrients (nitrogen, phosphorus, potassium), micronutrients (zinc, boron, magnesium), biostimulants, and organic fertilizers. As farmers are becoming increasingly knowledgeable about nutrient absorption and low environmental impact, demand for precision agriculture solutions such as slow-release fertilizers and foliar sprays is also growing.

Competition in this industry is determined by product innovation, product regulatory requirements, and the provision of tailor-made nutrition based on soil and climatic conditions. Topmost companies invest in R&D, strategic acquisitions, and sustainable formulations of nutrients to gain market momentum.

This potential is currently both the reason for and against such strain on the market due to the volatility of raw material prices, environmental regulations , and sustainable farming becoming a preference over organic farming. However, as citrus production continues to expand, particularly in North America, Latin America, and Asia-Pacific locations, the market for premium crop nutrition solutions will only continue to follow suit.

Major Market Players

| Company Name | Estimated Market Share (%) |

|---|---|

| Yara International | 18-22% |

| Nutrien Ltd. | 14-18% |

| The Mosaic Company | 12-16% |

| ICL Group | 10-14% |

| Haifa Group | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Yara International | Provides tailored citrus fertilization programs with precision agriculture integration. |

| Nutrien Ltd. | Focuses on micronutrient-enriched fertilizers and sustainable crop nutrition. |

| The Mosaic Company | Specializes in potash and phosphate-based fertilizers for citrus production. |

| ICL Group | Develops controlled-release fertilizers and bio-based solutions for citrus crops. |

| Haifa Group | Offers high-efficiency foliar fertilizers and water-soluble nutrient solutions. |

Key Company Insights

Yara International (18-22%)

A global leader in crop nutrition, Yara offers customized citrus nutrient programs using precision farming technologies.

Nutrien Ltd. (14-18%)

Focuses on sustainable crop nutrition, with a strong portfolio of micronutrient-enriched and bio-based fertilizers.

The Mosaic Company (12-16%)

A key player in phosphate and potash fertilizers, Mosaic provides solutions for soil fertility management in citrus orchards.

ICL Group (10-14%)

Develops controlled-release and bio-stimulant solutions, helping farmers optimize nutrient uptake.

Haifa Group (6-10%)

Specializes in water-soluble fertilizers and foliar nutrition for maximizing citrus yield and quality.

Other Key Players (30-40% Combined)

The industry is expected to generate USD 1,002.3 million in revenue by 2025.

The market is projected to reach USD 1,695.9 million by 2035, growing at a CAGR of 5.3%.

Key players include The Mosaic Company, Yara International, Nutrien, Haifa Group, ICL Group, and Compass Minerals.

Latin America and Asia-Pacific, driven by increasing citrus production, soil nutrient depletion, and advancements in sustainable farming practices.

Macronutrients, particularly nitrogen and potassium, dominate due to their critical role in citrus fruit development, improving yield, and enhancing disease resistance.

Macronutrients (nitrogen, phosphorus, potassium) and micronutrients (zinc, boron, iron)

Foliar nutrition, fertigation, soil application, and others.

North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa (MEA)

Yeast Extract Market Analysis by Type, Grade, Form, and End Use

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.