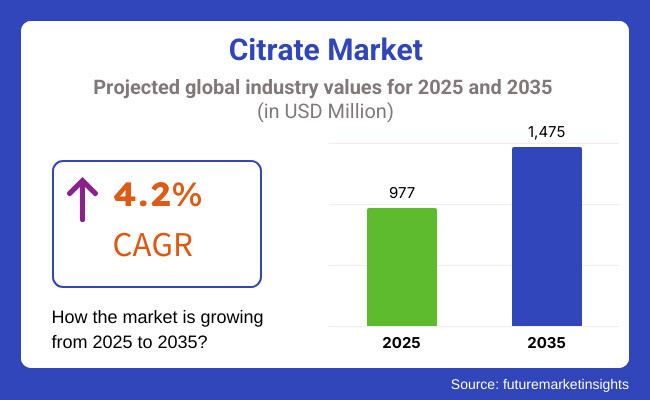

The Citrate Market shows continuous expansion between 2025 and 2035 because manufacturers utilize citrates increasingly in the food and beverage industry as well as pharmaceuticals and chemicals. Citrates perform triple functions as acid regulators while also working as preservatives and buffering agents in diverse products comprising beverages and foods and different forms of medication and industrial cleaners. Research indicates the Citrate Market will expand to USD 1,475 million by 2035 from its 2025 value of USD 977 million at a projected 4.2% CAGR during this time.

Citrates show increasing market demand because of their multiple functional benefits and the rising consumer interest in natural food additives. Market expansion is fuelled by consumers who seek natural food additives while the use of citrates expands in dietary supplements as well as personal care products.

The market dynamics experience challenges coming from raw material price changes and regulatory constraints that affect synthetic citrates. The manufacturing industry makes investments to develop better production methods as well as environmentally friendly substitute ingredients because of these market constraints.

The citrate market is further be classified based on product types and applications. Common citrates consist of calcium citrate potassium citrate sodium citrate and ferric ammonium citrate. By application, sodium citrate is the largest segment owing to its extensive use in food preservation, pharmaceuticals, and industrial applications. Calcium citrate has become the second major form of calcium in the dietary supplement market, with a number of available versions in the industry that emphasize bone health and calcium absorption in the body.

Citrates are commonly used as acidity regulators, emulsifiers, and flavour enhancers in the food and beverage industry. Citrates are used in anticoagulant drugs, effervescent drugs, and pharmaceutical pH stabilizers in the pharmacy sector. The chemical and cleaning industries also use citrates as chelating agents in biodegradable detergents and metal-cleaning agents.

Explore FMI!

Book a free demo

North America is a major citrates market, supported by robust growth in the food and beverage as well as drug industries. Citrates are being utilized increasingly in sports drinks in the USA and Canada, alongside functional beverages, and dietary supplements. Moreover, the firm regulations regarding food safety are driving the adoption of citrates as natural preservatives. The growing pharmaceutical industry, along with new citrate-based drugs formulations, further propels market growth in the region.

Europe accounts for a significant share of the citrate market due to food additive and preservative regulatory approvals and increasing demand for preservatives based on organic acids. Citrates are highly demanded in Europe with increasing sales of clean-label food products and functional beverages in countries like Germany, France, and the UK Moreover, the international drug formulation market in Europe is experiencing a shift towards citrate-based excipients in medicines, further complementing the market growth. Manufacturers are also developing bio-based citrates due to sustainability concerns, which is closely aligned with the region’s environmental policies.

Increased industry and processed food consumption, as well as an expanding health care sector, are projected to propel the growth of the citrate market in the Asia-Pacific region at the fastest growth rate. Several citrates are consumed significantly and produced by countries such as China, India, Japan, and South Korea, wherein the usefulness of citrates is prominent in applications such as food processing, pharmaceuticals, and industrial cleaning. The growing incidence of lifestyle-related health conditions is expected to drive the demand for citrates in supplements and functional foods. The market is also anticipated to witness growth across the region due to government regulations regarding food safety and the use of natural food additives.

Challenge

Price Volatility and Supply Chain Disruptions

Volatility in raw material prices and disrupted supply chains serve as challenges for the citrate market. Citrate production relies on citric acid to make its key component, which in turn is dependent on agricultural feedstocks such as corn and sugarcane that are subject to price spikes from factors such as crop failures, climate change and geopolitical trade restrictions. Global supply chain disruptions - ; largely from transportation delays and rising logistics costs - resulted in bottlenecks in the consistent availability of citrate-based ingredients. They need to work with suppliers to put in place strategic sourcing, diversify them, and invest in more localized production to ensure these and other risks are mitigated, allowing steady supply into end users.

Opportunity

Increasing Adoption in Pharmaceuticals and Clean-Label Food industry

This creates a significant market opportunity for citrate-based compounds for pharmaceuticals and clean-label food products. Citrates are important multifunctional agents as pH regulators, anticoagulants and excipients in drug formulations among other applications in healthcare. Moreover, the clean-label trend has contributed to increasing demand for natural preservatives and acidity regulators in food and beverage manufacturing, making citrates a more favourable alternative to synthetic substances. Plant-based citrate vendors have the potential to capitalize on the trend by developing further bio-based citrate formulations, broadening into the nutraceutical market and integrating sustainability initiatives into their market strategies.

From 2020 to 2024, the citrate market will sustain growth, fuelled by rising demand from pharmaceuticals, food & beverages, and industrial applications. Market growth was also aided by a shift towards natural ingredients and an adoption of clean-label formulations. Manufacturers struggled with cost efficiency due to supply chain constraints and fluctuating raw material prices.

In 2025 to 2035, developments in bio-based citrate production, tighter regulations relating to synthetic additives, and enhanced sustainable sourcing practices will shape the market. The development of pharmaceutical-grade citrates and increasing demand of citrates in the plant-based foods and supplements will propel the growth of citrates market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Raw Material Sourcing | Dependence on corn and sugarcane-based citric acid. |

| Pharmaceutical Applications | Widespread use in anticoagulants and pH regulators. |

| Food & Beverage Industry | Growth driven by demand for acidity regulators and preservatives. |

| Sustainability Practices | Initial focus on reducing production waste and improving energy efficiency. |

| Industrial Applications | Use in cleaning agents, water treatment, and cosmetics. |

| Regulatory Landscape | Compliance with food safety and pharmaceutical-grade standards. |

| Consumer Awareness | Moderate consumer knowledge of citrates in food and health products. |

| Market Shift | 2025 to 2035 |

|---|---|

| Raw Material Sourcing | Diversification into alternative bio-based sources and fermentation-derived citric acid. |

| Pharmaceutical Applications | Expansion into advanced drug delivery systems and precision medicine formulations. |

| Food & Beverage Industry | Clean-label formulations prioritize citrates as natural, non-GMO ingredients. |

| Sustainability Practices | Full-scale adoption of circular economy practices, sustainable packaging, and carbon-neutral production. |

| Industrial Applications | Enhanced role in eco-friendly industrial applications, including biodegradable cleaners and green solvents. |

| Regulatory Landscape | Stricter regulations on synthetic additives and increased oversight on sustainability claims. |

| Consumer Awareness | High consumer demand for natural, plant-based, and functional citrate-infused products. |

The USA citrate market is also growing steadily, supported by increasing demand from food and beverage, pharmaceutical, and personal care sectors. Market growth is facilitated by the rising use of citrates as acidity regulators and preservatives in soft drinks, baked products, and dairy products.

One of the major contributing factors for the growth of this market is the pharmaceutical applications; citrates are commonly utilized in anticoagulants, pain relievers, and kidney disorder treatments. In addition, increased consumer preference for clean label and natural food additives is driving manufacturers to use citrates instead of synthetic substitutes. The growth of the market is also driven by the increasing demand for biodegradable and sustainable citrate-based cleaning agents.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The citrate market in the UK is witnessing steady growth, supported by the growing applications of citrates in food preservation and pharmaceutical formulations. Industry expansion is driven by pH stabilization demand for citric acid in beverages and processed foods.

The personal care & cosmetics industry is another segment that has growing demand for citrates, working as buffering agents in skin care products. Moreover, changing regulations favouring the use of natural and organic ingredients in food and pharmaceutical sector are making it mandatory for manufacturers to develop citrate in their product offerings.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Citrates are gaining popularity across industries, and the same is the case in Europe, especially in Germany, France, and Italy, where citrates are expected to evolve as a growing market over the forecast period. The stronghold of citrates are in the food and beverage industry, where it finds a wide range of application in carbonation of soft drinks, sweets, and dairy products.

The pharmaceutical and nutraceutical industries also are big consumers, employing citrates in dietary supplements and drugs for kidney and metabolic diseases. Increasing emphasis on sustainable and plant-based additives is driving the shift toward naturally derived citrates, in line with strict EU regulations on synthetic preservatives.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

The citrate market in Japan is its efficient growth driven by robust food and beverage, pharmaceutical, and cosmetics industries. Rising demand for dietary supplements as well as functional foods with citrates is driving market growth.

Moreover, the increasing requirement for citrates as buffering agents and stabilizers is an outcome of the growing technology innovations pertaining to pharmaceutical formulations and biotechnology applications. Japan’s focus on low-calorie and health-oriented food products is also bolstering consumption of citrates in sugar-free and electrolyte-fortified beverages.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

In South Korea, the citrate market is growing due to increased demand from processed foods, pharmaceuticals, and cosmetics. Consumers are becoming more health conscious, leading to wider use of citrates in nutraceuticals and sports drinks.

Moreover, personal care formulations are another area where citrates are used as a pH adjuster in skin and hair care products and this helps the market grow. Moreover, the transition to biodegradable and eco-friendly cleaning agents is stoking the demand for citrates in household and industrial applications.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

The citrate market segments based on the citrate form include citrate in calcium citrate and powder form, which have a dominant share in the citrate market as industries are demanding high purity, multifunctional, easily absorbable citrate compounds for use in nutraceuticals, pharmaceuticals, food and beverages processing and industrial applications. Citrate formulations settle various pharmaceutical product management requirements by extending the calcium bioavailability, acidity stabilizing, and also food product conservation attributes; hence, their demonstration is a lot of explored in the dietary supplement, pharmaceutical and also food handling agencies.

In parallel to rising consumer cognition towards bone health, electrolyte balance, and the regulation of each condition, manufacturers are forwards to extend the utilities of calcium citrate, augment implication, and even improve product architecture in powdered forms ensuring that one can acquire better solubility and ease of use.

Calcium Citrate Health Benefits Free from Their Individual Limitations and Ideal for Multiple Applications

Calcium citrate segment has become one of the strongest categories of the citrate market since they have greater calcium bioavailability as compared to other citrate market types, better digestion absorption receptivity and several acid-neutralizing properties. Calcium citrate promotes enhanced solubility in both neutral and acidic environments compared to other calcium supplements, leading to better absorption rates and less gastrointestinal distress.

Adoption has been catalysed by a demand for formulations of high-purity calcium citrate, with micronized granules, fortified blends and pharmaceutical-grade compositions. As more than 60% of retail calcium supplement manufacturers target calcium citrate segment owing to its better absorption characteristics and independence of stomach acid for dissolution, calcium citrate is anticipated to maintain its position as a significant segment with strong demand.

Market demand outlook has gained impetus through the proliferation of bone health supplements including, calcium citrate fortified products for prevention of osteoporosis, post-menopausal bone density maintenance, and nutrition related to sports recovery, facilitating improved adoption among aging populations and athletes.

The combination of novel calcium citrate products with nano-calcium crystallization, AI-purposed mineral formulation optimization, and multi-nutrient fortification has also enhanced acceptance, ensuring good product efficacy matched with better consumer acceptance.

Rise of bespoke calcium citrate products (including chewable tablets, effervescent powders, and liquid calcium suspensions) has further driven the market growth by enhancing the accessibility and convenience for various consumer segments.

The calcium citrate segment's advantages like better calcium supplementation, improved acid regulation, and increased industrial applications are shadowed by challenges like its high production price compared to calcium carbonate along with changing regulatory frameworks for dietary supplements and varied rivals from other calcium sources. Nonetheless, recent developments in AI-driven ingredient profiling, block chain-powered supply chain tracing, and microencapsulated forms of calcium delivery systems are enhancing cost-effectiveness, quality guarantees, and product differentiation, which will further uphold calcium citrate market growth worldwide.

For instance, the calcium citrate segment is most-chosen by industries that are focused on integrating highly bioavailable calcium compounds such as calcium citrate and calcium carbonate into their formulas to drive greater health benefits and improve food quality, and it is witnessing strong adoption from pharmaceutical companies, dietary supplement brands, and food processing manufacturers. Calcium citrate, unlike inorganic calcium salts, offers pH stability, improved palatability, and increased functional versatility, contributing to better formulation possibilities and consumer preference.

Adoption has been fuelled by demand for nutrient-rich calcium citrate supplements, including vitamin D3 fortification, magnesium co-supplementation and organic acid stabilization. According to studies, more than 70% of premium dietary supplement brands stack calcium citrate formulations due to their excellent absorption attributes and few intestinal adverse effects, which will maintain a large demand for this segment.

Market adoption of calcium citrate-based acid regulators, mineral-fortified beverages, and calcium-enriched baked goods has been bolstered by the increase in applications in functional food, supporting improved consumer acceptability and compliance with nutritional regulations governing health foods.

Utilization of AI-enabled formulation optimizer that can predict mineral interactions, automate the testing for nutrient bioavailability and leveraging AI to facilitate product stability evaluation has encouraging adoption, giving rise to improved formulation accuracy and higher marketplace differentiation.

The calcium citrate segment benefits from its potential to enhance calcium supplementation, support industrial applications, and promote consumer adherence to dietary guidelines; however, it is also subject to supply chain variations of raw materials, changing consumer demand for plant-derived calcium substitutes, and policy changes in mineral fortification policies. Yet new developments in nanotechnology based calcium fortification, intelligent ingredient tracking, and bioactive minerals optimization are enhancing market scalability, increasing production efficiency, lowering consumer access-points, and guaranteeing upward growth for calcium citrate across the globe.

The powder form segment has become one of the most popular citrate product forms in the market, as it allows food manufacturers, pharmaceutical companies, and industrial processing companies to incorporate well-soluble and stable citrate forms into their applications. This powdered citrate is overcome drawbacks associated with liquid citrate solutions such as limitation of shelf life, limited formulation flexibility, and less ease of storage and transportation offering better cost-to-benefit ratio allowing higher penetration in the market.

There has been increasing adoption of fine-milled citrate powders due to their better dispensability, fast dissolution rates, and controlled pH stabilization properties. According to studies, the over 65% of industrial-scale manufacturers reported preference of powdered citrate over liquid formulations due to ease of handling, shelf stability and compatibility with multiple ingredients ensuring the strong demand for this segment.

The growing adoption of functional ingredient-based applications, such as powdered citrate as a pH-modulating agent in food formulation, a stabilizing mineral in pharmaceuticals and a buffering agent during industrial processing stages, has driven market demand adding tremendous versatility to drive the growth across the industry.

The advent of next-gen powdered citrate solutions which involve AI-assisted particle size optimization, moisture-resistant microencapsulation, and high-purity manufacturing techniques have also contributed to the heightened uptake, thanks to their better stability and enhanced solubility performance.

Development of personalized powdered citrate blends (according to acidity ranges) neutral flavoured citrate compounds (to prevent interference with flavouring agents) and fortified mineral composition (to balance changing nutrition requirements) has been optimized in market growth determination by improving product formulation adaptability.

Although walks above benefits, increasing ingredient solvability, enhancing product stability, and enabling suitability for a wide range of industries, the powdered citrate segment is going through risks such as handling accidents due to pulverized particles, the granulating of specific ingredients that are greater exact in powdered form, and customer tendencies altering in the direction of living ligand usage. However, advancing technologies tailored to optimized moisture-controlled powder processing, AI-powered product stability characterization and biodegradable packaging alternatives are enhancing cost optimization, product performance and market penetration which will ensure a sustained growth for powdered citrate on a global scale.However, powdered citrate is starting to be adopted in food processing, pharmaceutical formulations, and industrial applications.

The powdered citrate category has seen considerable traction demand especially across food processing, nutritional food brands, and chemical formulation manufacturers as industries are gradually moved towards powdered forms of ingredients for improved stability, and as well as ease of application and cost-effective bulk handling. Powdered citrate provides a unique and highly effective source of citrate in dry formulations, flooding the formulation with citrate ions immediately once dissolved, ensuring that citrate is evenly distributed across the formulation, supporting pH control and allowing for easily adjustable molar ratios of citrate, providing better control over formulations and greater processing throughput when compared to liquid citrate solutions.

Adoption has been spurred by demand for next-gen powdered citrate solutions, including nano-sized dispersion technology, high-solubility granule formulations and AI-assisted stability enhancement. According to research, more than 70% of food-grade citrate applications are in the form of powder due to its longer shelf stability and better adaptability to formulations, creating strong demand for the segment.

While Corn syrup has proved better in solubility, reduced contact time, minimal oxidation risk, and compactness, the powdered citrate isn't completely challenge-free as the segment is criticized over the regulations for fine-particle inhalation, more competitive environment from liquid formulation and consumer requirement towards pre-dissolution citrate. But previously untapped advancements in novel particle-forming techniques, intelligent moisture-hindering citrate packaging technologies, and AI-integrated ingredient formulation tracking are mitigating product life and boosts processing safety and manufacturing scale, guaranteeing further global growth for powdered citrate.

Industry Overview

The global citrate market has observed a healthy growth on account of its broad application in the food & beverage, pharmaceuticals, and personal & industrial care industries. Citric acid-based citrates are used as preservatives, acidulates, buffering agents & stabilizers in a diverse range of industries. The market is growing with the increase in demand for natural and clean label ingredients in food & beverages, high pharmaceutical applications for citrate based anticoagulants and excipients, and also growing use in water treatment and detergents. Top manufacturers are emphasizing sustainable production, organic sourcing and customized formulations addressing specific industry needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Jungbunzlauer Suisse AG | 18-22% |

| Archer Daniels Midland (ADM) | 15-19% |

| Cargill, Incorporated | 12-16% |

| Gadot Biochemical Industries | 9-13% |

| Tate & Lyle PLC | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Jungbunzlauer Suisse AG | Specializes in high-quality citrates for food, pharmaceutical, and industrial applications, focusing on sustainable and bio-based production. |

| Archer Daniels Midland (ADM) | Produces citric acid and citrate derivatives, catering to food & beverage and health & nutrition sectors. |

| Cargill, Incorporated | Offers a range of citrates for food preservation, pharmaceutical excipients, and industrial applications. |

| Gadot Biochemical Industries | Develops customized citrate solutions for nutritional supplements, sports drinks, and pharmaceutical applications. |

| Tate & Lyle PLC | Focuses on food-grade citrates, particularly for flavour enhancement, acidity regulation, and stability in beverages. |

Key Company Insights

Jungbunzlauer Suisse AG 18- 22%

Partner Press Release: Jungbunzlauer, a global leader in citrate production, supplies high-quality, sustainable and bio-based citrates for food, beverage and pharmaceutical applications.

Archer Daniels Midland (ADM) (15- 19%)

ADM offers a wide spectrum of citrate-based solutions for food preservation, health & wellness, and industrial applications.

Cargill, Incorporated (12-16%)

Cargill is active in food-grade and pharmaceutical citrates with sustainable sourcing and processing for global distribution.

Biochemical Industries Gadot (9- 13%)

The pharmaceutical and nutritional citrate market provides market analysis of personalized solutions, dietary supplements and functional beverages through Gadot.

Tate & Lyle PLC (7-11%)

Tate & Lyle manufacturer’s premium food-grade citrates, popular for acidity regulation, flavour enhancement, and shelf-life extension in a multitude of beverages and food products.

Others Key Contributors (30-40% Together)

Some other manufacturers directly involved in the citrate market are also taking care of industry-specific formulations coupled with sustainable production methodologies. Notable players include:

The overall market size for Citrate Market was USD 977 Million in 2025.

The Citrate Market is expected to reach USD 1,475 Million in 2035.

The demand for the citrate market will grow due to increasing applications in food and beverage, pharmaceuticals, and personal care industries, rising demand for acidity regulators and preservatives, expanding use in dietary supplements, and growing consumer preference for natural and organic ingredients.

The top 5 countries which drives the development of Citrate Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Calcium Citrate and Powder Form to command significant share over the forecast period.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.