The global sector for circuit materials is projected to steadily grow through 2035, with continuing demand across electronics, telecommunications, and automotive sectors. The market is projected to grow from USD 41.9 billion in 2025 to USD 63.3 billion by 2035, at a CAGR of 4.2%. The need for high-performance circuit materials driven by technological developments, including 5G networks, IoT devices, and electric vehicles, contributes to this growth.

During 2024, the market for circuit materials was growing steadily on the back of rising demand for high-performance electronics, miniaturized circuits, and sophisticated substrates. The automotive industry played a leading role, with EVs and autonomous driving technologies needing more advanced PCBs.

Consumer electronics also boosted segment growth, especially with growing demand for AI-enabled devices, foldable mobile phones, and wearable technology. Regionally, Asia-Pacific, led by China, continued to dominate because of robust semiconductor production and government support for local manufacturing.

Moreover, the growing use of flexible and high-frequency circuit materials in consumer electronics, industrial applications, is further augmenting the segment growth. However, there are hurdles such as volatile raw material prices and supply chain disruptions.

Despite such challenges, the industry is projected to receive benefits from rising investments in research and development, along with increasing focus on miniaturization and energy efficiency in electronic devices. The opportunity therefore exists to leverage the circuit materials segment and drive modernization of circuitry for electronics industries, both now and over the next decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 41.9 billion |

| Industry Value (2035F) | USD 63.3 billion |

| CAGR (2025 to 2035) | 4.2% |

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Predominantly silicon-based materials | Wider adoption of graphene, gallium nitride, and 2D materials |

| Early adoption of flexible and stretchable electronics | Mainstream use of flexible, biodegradable, and self-healing materials |

| Copper remains the primary interconnect material | Shift towards carbon nanotubes and other nanomaterials for interconnects |

| Initial integration of AI-driven material design | AI-optimized and self-assembling materials become standard |

| Limited commercial applications of quantum materials | Quantum circuit materials see widespread adoption, due to advancements in quantum computing |

| Sustainability concerns emerge but are secondary | Eco-friendly, recyclable, and energy-efficient materials prioritized |

| 5G circuit materials under development | 6G and beyond drive new ultra-high-frequency materials |

| Early-stage bioelectronics research | Bio-integrated circuit materials become mainstream in medical and wearable tech |

Future Market Insights (FMI) conducted a survey with key constituents in the circuit materials ecosystem, which includes manufacturers, suppliers, researchers, and end-users. The survey addressed material trends, technological developments, and segment requirements of the future. With the demand for improved performance and sustainability, the respondents noted an increased interest in emerging technology materials such as graphene, gallium nitride and biodegradable substrates. AI-powered material development could also revolutionize circuit manufacturing over the next few years, experts said.

Flexibility and stretchability of electronic devices and systems have enabled researchers to develop devices such as stretchable batteries, displays, sensors, and circuits. The demand for recyclable and sustainable materials is driven by government regulatory frameworks and corporate sustainability goals.

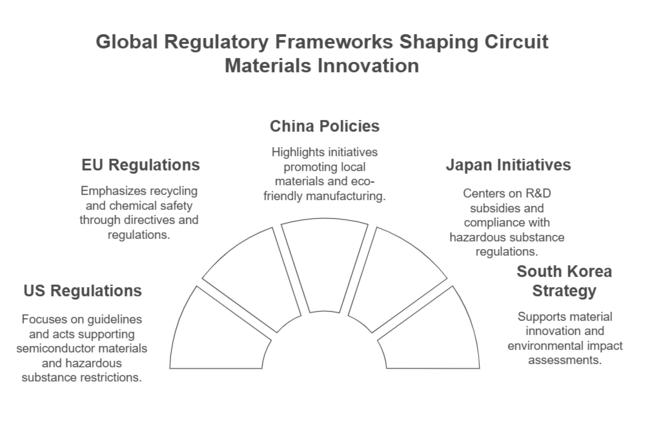

Additionally, the survey found that government policies and regulations were key to creating the circuit materials landscape. According to several stakeholders, compliance with regulations, particularly related to hazardous substances and electronic waste management, is now driving material selection. As governments around the world strive to enforce stricter environmental and safety standards, businesses are turning to the development of greener, more sustainable circuit materials.

| Countries | Regulations & Policies |

|---|---|

| United States | Restriction of hazardous substances (RoHS), National Institute of Standards and Technology (NIST) guidelines on advanced electronics materials, CHIPS and Science Act supporting semiconductor materials |

| European Union | EU RoHS Directive (restricting lead, cadmium, and other hazardous substances), Waste Electrical and Electronic Equipment (WEEE) Directive for recycling, REACH regulations on chemical safety |

| China | Made in China 2025 initiative promoting local semiconductor materials, strict import-export controls on rare earth materials, National Green Manufacturing policy encouraging eco-friendly materials |

| Japan | Japan RoHS compliance for electronics, subsidies for R&D in advanced semiconductor materials, focus on silicon carbide (SiC) and gallium nitride (GaN) research |

| India | Production-Linked Incentive (PLI) scheme for electronics manufacturing, e-waste management rules, new incentives for semiconductor and PCB material production |

| South Korea | National semiconductor strategy supporting material innovation, strict environmental impact assessments for electronics manufacturing, investment in high-frequency materials for 6G |

Industry leaders in the circuit material industry are aggressively competing using a combination of price strategies, technological advancement, strategic alliances, and geographical expansions. Most companies are prioritizing innovation as a means of differentiation, heavily investing in research and development (R&D) to develop sophisticated materials with greater conductivity, which helps to enhanced thermal resistance, and environmentally friendly alternatives.

Firms such as DuPont and Panasonic are breaking new ground with high-frequency substrates for 5G and beyond 6G applications, while others are working on flexible and stretchable electronics for next-generation devices.

To maintain growth, leading players are embracing tactics such as mergers and acquisitions to consolidate their supply chains and widen their technological base. Strategic collaborations with semiconductor makers, EV producers, and PCB manufacturers are gaining traction, allowing firms to integrate smoothly into emerging industry trends.

Market Share Analysis of Leading Companies

| Company | Industry Share & Notes |

|---|---|

| Shin-Etsu Chemical Co., Ltd. | 18% - A leading manufacturer of semiconductor silicon wafers and other electronic materials. |

| Sumco Corporation | 15% - Specializes in silicon wafers for semiconductor applications. |

| Samsung Electronics | 12% - Diversified electronics company with significant operations in semiconductor materials. |

| Applied Materials, Inc. | 10% - Supplies equipment, services, and software for semiconductor manufacturing. |

| Amkor Technology, Inc. | 9% - Provides semiconductor packaging and test services. |

| JCET Group | 8% - Offers integrated circuit (IC) packaging and testing services. |

| Dow Inc. | 7% - Produces materials used in semiconductor fabrication. |

| Kyocera Corporation | 6% - Manufactures ceramic components and electronic devices, including materials for circuits. |

| Tokyo Electron Limited | 5% - Develops and sells semiconductor production equipment. |

| Rogers Corporation | 4% - Provides specialty materials for high-performance circuit applications. |

| BASF SE | 3% - Supplies chemicals and materials used in electronics manufacturing. |

| CoorsTek | 2% - Produces technical ceramics and advanced materials for electronic applications. |

| Prysmian Group | 1% - Specializes in energy and telecom cables, with a minor segment in electronic materials. |

| Siltronic AG | 1% - Manufactures silicon wafers for the semiconductor industry. |

| Others | 3% - Includes various smaller companies and new entrants of the total industry share. |

Amcor plc's Acquisition of Berry Global Group Inc.

In November 2024, Amcor announced an USD 8.4 billion deal to acquire Berry Global. This merger combines Amcor's global flexibles and regional containers businesses with Berry's regional flexibles and global containers and closures businesses, resulting in a combined entity with annual sales of USD 24 billion.

Novolex Holdings' Acquisition of Pactiv Evergreen Inc.

Also in late 2024, Novolex acquired Pactiv Evergreen for USD 6.7 billion, further consolidating the packaging sector and expanding Novolex's product offerings.

Amphenol Corporation's Acquisition of Carlisle Interconnect Technologies (CIT)

In May 2024, Amphenol completed its acquisition of CIT, broadening its product options for highly designed harsh environment connectivity solutions in the commercial aviation, defense, and industrial sectors.

Molex's Acquisition of AirBorn Inc.

Molex acquired AirBorn, a company specializing in rugged connectors and electronic components for OEMs in aerospace, defense, medical, and industrial sectors, enhancing Molex's capabilities in these sectors.

HEICO Corporation's Exxelia Subsidiary Acquired 70% of SVM Private Limited

HEICO's Exxelia subsidiary acquired a majority stake in SVM, a designer and manufacturer of high-performance electronic passive components and sub-systems, strengthening its position in the healthcare and industrial end-markets.

Global technological development, supply chains, and regulatory policies are among the major macroeconomic factors that influence the circuit materials industry. As semiconductor manufacturing continues to expand, the rollout of 5G networks increases, and AI and quantum computing grow, the industry for high-performance materials continues to increase steadily. New EVs, medical electronics, and IoT applications also fuel the segment.

There has been a shift toward recyclable and bio-based materials with a focus on sustainability. In addition to that, countries are implementing regulations on e-waste and toxic materials, compelling businesses to innovate sustainability. The industry is expected to experience significant growth as AI-based material discovery and automation enhance production capacity. The Asia-Pacific region offers significant opportunities due to its robust semiconductor manufacturing infrastructure.

This segment significantly contributes to the rising product sales in the global circuit materials segment. Between 2025 and 2035, the circuit materials segment will undergo a series of advancements in substrate technology that cater to the demands for durable, flexible, and high-performance materials. Fiberglass epoxy, projected to grow at a 4% CAGR, will remain the dominant substrate due to its superior mechanical strength, electrical insulation, and cost-effectiveness making it the material of choice for many mainstream electronic applications. Few-speckled, paper-phenolic substrates are less common but will be retained for cost-sensitive applications requiring moderate thermal resistance and electrical insulation.

The demand for new conducting materials in circuit boards is expected to evolve significantly between 2025 and 2035 due to increasing industry requirements. Due to superior conductivity, reliability, and compatibility with present fabrication processes, copper will undoubtedly remain the dominant conducting material.

By conducting material, the copper segment is expected to progress at a 3.8% CAGR over the forecast period. As the utilization of high-frequency communication systems, advanced computing, and power electronics has expanded, copper’s essential role will be fortified. But other conducting materials will come for needs like cost reduction, weight minimization, and improved thermal management.

The outer layer of circuit materials will be one of the key contributors to the service life, reliability, and efficacy of electronic components in the coming decade. Photo imageable solder masks in liquid ink form will continue to be a popular option because they can offer excellent patterning precision, as well as high adhesion and chemical resistance like that achieved in high-density PCBs or advanced electronic devices.

Dry film photo imageable layers will remain as niche applications where high precision, good control of thickness, and good property in harsh environment are needed. The introduction of next-generation nanocoatings, advanced protective layers, and other innovations will address the growing need for improved protection and sustainability.

Circuit materials will find an increasing number of applications across a wide range of industries, with communication, industrial electronics, automotive, and aerospace & defense witnessing the most significant growth drivers.

Due to the faster and more accurate 6G networks, satellite communication, and AI data centers, high-frequency and low-loss circuit materials are expected to be in higher demand. In the sector of industrial electronics, these trends are reinforced by the increasing use of automation, robotics, and IoT-enabled smart factories, all of which require durable and heat-resistant materials to resist demanding surroundings and prolonged service life.

Between 2025 to 2035, the circuit materials segment will increase rapidly due to increased technology advancement, raise necessity for high-performance electronic devices and a transition toward sustainable electronics.

Growth opportunities will emerge across a few essential metrics, ranging from forming ultra-thin, flexible, and high-frequency circuit materials to underpin next-gen gadgets. Subsequently, the emergence of 6G networks, AI, and quantum computing will be based on sophisticated substrates and interconnects that reduce loss and increase the speed of calculations.

Companies should in turn leverage these growth opportunities by pursuing strategic initiatives that emphasize innovation, sustainability, and supply chain resilience. R&D on next-gen materials like biodegradable substrates, graphene-based conductors, and self-healing coatings will be important to ensure a competitive advantage and you can also gather more info from organizations who can provide data-backed insights based on industry investment trends.

To that end, adopting green manufacturing habits, reducing hazardous waste and using circular economy approaches can assist organizations in fulfilling their regulatory obligations and enhancing their image as a desirable brand in an increasingly sustainability-oriented place. As the circuit materials landscape evolves, businesses that embrace innovation and strategic partnerships will flourish.

The USA circuit materials segment is expected to grow at a CAGR of 3.8% throughout the forecast period and reach USD 10.7 billion by 2035. Steady growth in the United States circuit materials industry will be fueled by the growing investment in semiconductor production, the rollout of 5G networks and the widespread adoption of electric vehicles.

Government programs, such as the CHIPS Act, will help fund domestic integrated circuit manufacturing, generating market opportunities for advanced substrates, conducting materials, and protective layers. However, the defense and aerospace industries are responsible for much of the material innovation seen today; the need for military and space applications to have radiation-resistant and high-durability circuit materials will drive this trend forward.

The United Kingdom circuit materials segment is projected to grow at a CAGR of 3.5% throughout the forecast period, and is predicted to reach USD 2.3 billion by 2035.

This growth, however, will be moderate, as demand from sectors, such as industrial automation, renewable energy, and telecommunication systems, will directly drive the circuit materials market. The deployment of 5G and the transition to smart grids will increase the demand for high-quality circuit materials with excellent thermal stability and electrical conductivity.

With the UK government concentrating on sustainability as well as stricter environmental regulations, this will lead to increased adoption of recyclable and biodegradable materials in electronic manufacturing. The aerospace and defense industries will also require specialized circuit materials for advanced avionics and military applications. Strategic collaborations with European tech companies will underline sector growth further.

The circuit materials sector in Germany is predicted to grow at a CAGR of 3.9% through the assessment period and is anticipated to achieve USD 4.1 billion by 2035.

The circuit materials sector holds a promising growth trajectory in Germany, driven by a robust automotive sector, advancements in semiconductor manufacturing, and growth in industrial automation.

The shift to electric vehicles is already a major force for future demand for high-performance circuit materials with the sufficient electromagnetic characteristics to handle higher loads of power and thermal stress.

The advent of Industry 4.0 initiatives and smart manufacturing will also drive the demand for long-lasting and dependable electronic materials. In addition, Germany's emphasis on sustainability will stimulate the improvement of recyclable and energy-saving circuit elements.

France’s circuit materials market will grow steadily, supported by advancements in electric mobility and aerospace. The circuit materials segment in France is expected to grow at a CAGR of 3.7% from 2025 to 2035 and the expected valuation of the segment is USD 3.1 billion by 2035.

The country’s focus on expanding its EV charging infrastructure and renewable energy networks will drive demand for durable, high-efficiency circuit materials.

France's aerospace sector, particularly in satellite technology and defense applications, will require high-performance, radiation-resistant materials.

Additionally, the government’s emphasis on sustainable manufacturing and e-waste reduction will lead to an increased adoption of eco-friendly circuit substrates.

The Italian circuit materials industry is projected to reach 2.7 billion USD by 2035. From 2025 through 2035, the circuit materials industry is anticipated propel at a 3.5% CAGR growth sales.

Hence, moderate growth in Italy’s circuit materials segment will be spurred primarily by of automotive and industrial automation developments. India’s shift towards electric mobility will demand thermally stable and high-reliability circuit materials for power electronics and battery management systems.

As the industry continues expanding from industrial automation and smart manufacturing, there will be a growing demand for durable and high-performance circuit substrates. The demand for eco-friendly materials will be pushed, in particular in the consumer electronics and renewable energy sectors.

The Circuit Materials market in Australia and New Zealand is poised to expand at a steady pace in the wake of increasing renewable energy projects, intelligent infrastructure, and growing electric cars adoption. Australia and New Zealand forecasted at USD 2.5 billion by 2035.

Demand for circuit materials is expected to grow at a CAGR of 4.0% through 2035. Developing 5G networks and smart grid technologies will also drive demand for high-performance circuit materials with superior electrical properties and durability.

Manufacturers will be able to provide these environments using sustainable circuit substrates as the region focuses on sustainability and recycling initiatives. Government policies that promote local semiconductor and electronics manufacturing will also help propel growth in the industry.

China’s circuit materials market will be the largest growing among major economies, due to the dominance of semiconductor manufacturing with rapid adoption of 5G and AI technologies, and expansion of electric vehicles.

The China’s industry will be worth USD 11.8 billion in 2035. Circuit materials sales are expected to witness 4.8% CAGR growth through 2035. The government's insistence on self-reliance in semiconductor production will drive up demand for advanced circuit materials tremendously.

The increasing demand for EV batteries, automation, and smart electronics in the country will further boost the demand for high-performance substrates and conductive materials. Moreover, China’s planning in sustainable and biodegradable circuit materials boosts long-term development.

South Korea’s circuit materials segment will see strong growth, primarily fueled by its leadership in semiconductor manufacturing and high-tech electronics production.

The circuit materials segment in South Korea is expected to grow at a CAGR of 4.5% from 2025 to 2035. The expected valuation of the industry is USD 3.4 billion by 2035.

The rise of AI-driven computing, 6G research, and miniaturized semiconductor devices will drive demand for advanced circuit materials with superior electrical and thermal performance.

The country’s push for EV and battery innovations will further expand the need for high-efficiency substrates and conductive materials. South Korea’s government-backed R&D programs and strategic partnerships with global technology firms will reinforce its position in the sector.

Japan’s circuit materials sector will expand steadily, driven by its advanced semiconductor industry, robotics, and automotive electrification.

The Japan circuit materials segment is poised to exhibit a CAGR of 4.0% during the assessment period and is expected to reach USD 9.2 billion by 2035. The country’s leadership in precision electronics and miniaturized circuit technology will fuel demand for high-performance materials with exceptional reliability and thermal efficiency.

The automotive sector’s transition toward hybrid and electric vehicles will further boost the demand for circuit substrates and conductive materials. Japan’s investment in next-generation electronics, including quantum computing and AI-driven devices, will also create new growth avenues. Sustainability initiatives will encourage the adoption of recyclable and biodegradable circuit materials.

India's circuit materials segment is poised for strong growth, fueled by accelerated industrialization, government support, and increasing demand for high-performance electronics. The industry is anticipated to grow at a CAGR of 4.6% to reach USD 4.9 billion by 2035.

The growth in 5G rollouts, electric vehicles (EVs), and AI-enabled devices is driving the demand for next-generation circuit materials with better conductivity and thermal efficiency.

Furthermore, India's developing semiconductor ecosystem, spearheaded by new fabrication facilities and collaborations with international tech companies, will spur segment growth. Businesses are increasingly investing in green and recyclable materials as sustainability gains momentum. As India moves further as a global electronics hub, strategic partnerships, infrastructure growth, and expansion of skilled manpower will be instrumental in molding the circuit materials industry of the country.

Increased demand for miniaturization and high-speed computing driven by advancements in semiconductor technology, the rise of electric vehicles, the expansion of 5G networks, and increasing automation in industrial and consumer electronics are the key factors driving the demand for circuit materials.

Major industries using circuit materials include telecommunications, automotive, aerospace, industrial electronics, and consumer electronics. The growing adoption of IoT, AI-driven devices, and renewable energy systems is further expanding the scope of applications.

Government policies on environmental sustainability and incentives for semiconductor manufacturing are shaping production trends. Stricter e-waste and carbon footprint regulations are pushing manufacturers toward eco-friendly and energy-efficient materials.

Recent innovations include the development of ultra-thin, flexible, and heat-resistant substrates, high-conductivity materials for advanced semiconductor applications, and biodegradable alternatives to reduce electronic waste. AI-driven design optimization is also playing a role in improving material efficiency.

Asian manufacturers, particularly in China and South Korea, are aggressively expanding capacity, while Western firms focus on material innovation and supply chain security.

Fiberglass Epoxy, Paper-Phenolic, CEM, Polyimide, Other

Copper and Other

Liquid Ink Photoimageable Solder Mask, Dry Film Photoimageable, Other

Communication, Industrial Electronics, Automotive, Aerospace & Defense, Other

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and the Pacific, Middle East and Africa

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.