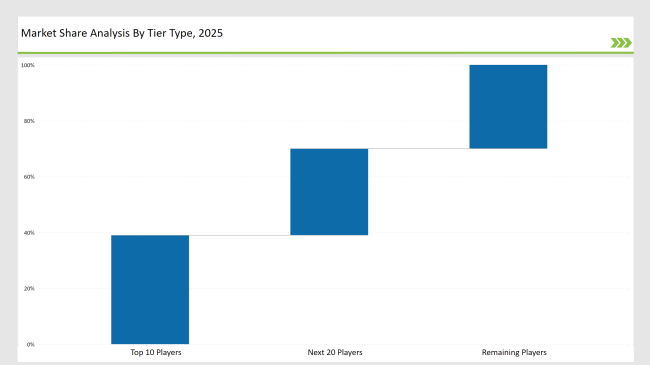

Steady growth is anticipated for the cigarette packaging machine market because of a steady growth rate of automated, high-speed, and efficient packaging solutions in the future. Based on the production capacity, Tier 1, Tier 2, and Tier 3 segments can be defined among players based on the market share.

Some players together make up the combined market share of 39% as G.D S.p.A, Hauni Maschinenbau, and ITM Group. These companies lead the market due to their advanced machinery, strong global distribution network, and continuous technological innovations.

Tier 2 players, such as Molins PLC and Proco Machinery, account for 31% of the market. These companies serve mid-sized tobacco manufacturers by providing flexible and customized packaging solutions. Their competitive advantage is cost-efficient, high-precision packaging technologies Tier 3 players hold the remaining 30%, comprising regional and niche manufacturers specializing in industry-specific packaging solutions.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share % |

|---|---|

| Top 3 (G.D S.p.A, Hauni Maschinenbau, ITM Group) | 19% |

| Rest of Top 5 (Molins PLC, Proco Machinery) | 13% |

| Next 5 of Top 10 (Focke & Co, Sasib, Jornen Machinery, AMF Automation, Coesia Group) | 7% |

The Cigarette Packaging Machine Market serves multiple industries, including

To meet evolving industry demands, companies offer

Companies concern themselves with generating fewer material wastes and using eco-friendly packaging materials.

They are investing more in automation, AI-driven quality control, and sustainability to stay ahead. Efficiencies and cost savings are enhanced from strategic partnerships with major tobacco manufacturers.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | G.D S.p.A, Hauni Maschinenbau, ITM Group |

| Tier 2 | Molins PLC, Proco Machinery |

| Tier 3 | Focke & Co, Sasib, Jornen Machinery, AMF Automation, Coesia Group |

| Manufacturer | Latest Developments |

|---|---|

| G.D S.p.A | Launched AI-powered cigarette packaging solutions in early 2024. |

| Hauni Maschinenbau | Introduced precision engineering for sustainability. |

| ITM Group | Developed modular packaging systems. |

| Molins PLC | Expanded cost-effective, high-speed packaging technologies. |

| Proco Machinery | Innovated in flexible, compact packaging solutions. |

The future of the Cigarette Packaging Machine Market will be shaped by AI, automation, and sustainability. Companies are focusing on enhancing efficiency with blockchain-based traceability, eco-friendly materials, and high-speed automation.

Leading players include G.D S.p.A, Hauni Maschinenbau, ITM Group, Molins PLC, and Proco Machinery.

The top 3 players collectively account for approximately 19% of the global market.

The market concentration is medium, with top players controlling 39% of the industry.

Automation, AI-driven quality control, sustainability, and regulatory compliance.

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Utility Cases Market Insights - Growth & Demand 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Ventilated FIBC Market Growth - Demand & Forecast 2025 to 2035

Telescopic Tool Boxes Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.