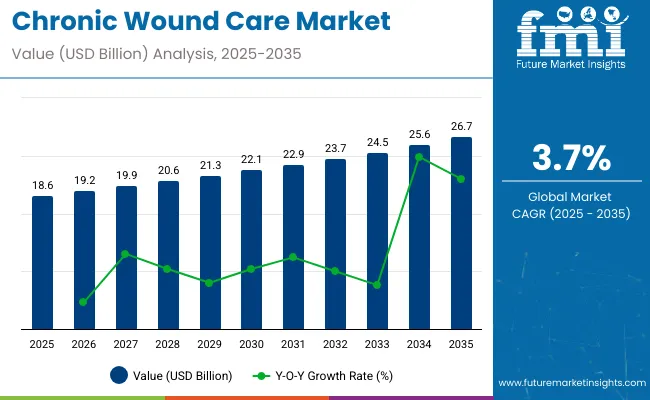

The global chronic wound care market is estimated to be valued at USD 18.6 billion in 2025 and is projected to reach USD 26.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 18.6 billion |

| Industry Value (2035F) | USD 26.7 billion |

| CAGR (2025 to 2035) | 3.7% |

The chronic wound care market has demonstrated sustained expansion as healthcare systems address the rising prevalence of diabetes, vascular insufficiency, and pressure-related injuries. An increasing emphasis has been placed on reducing wound-related complications and preventing hospital readmissions through evidence-based therapies and standardized care pathways.

Regulatory approvals and reimbursement frameworks have supported the adoption of advanced wound dressings, negative pressure therapies, and bioactive materials designed to accelerate healing and reduce infection risk. Hospitals and outpatient clinics have prioritized investments in training and specialized wound care teams to manage complex cases more effectively. Public health initiatives and clinical guidelines have reinforced early intervention strategies, driving higher demand for proven products and technologies.

Chronic wounds represent a major global health concern, significantly affecting patient quality of life and placing a heavy burden on healthcare systems. In the United States, a notable portion of the population experiences chronic wounds, illustrating how widespread the problem is.

Around the world, diabetic foot ulcers are a common complication of diabetes, with millions affected annually. Additionally, increasing rates of overweight and obesity, such as those seen in the United Kingdom, contribute to the growing prevalence and severity of chronic wounds by worsening underlying health conditions.

Governments worldwide are increasingly recognizing the importance of chronic wound care in improving patient outcomes and reducing healthcare costs. Additionally, significant funding is directed towards research and innovation through grants and subsidies provided by agencies like the NIH in the United States and the European Commission’s Horizon Europe program. These initiatives fuel the development of cutting-edge technologies such as antimicrobial dressings and smart wound monitoring devices, accelerating progress in effective wound management.

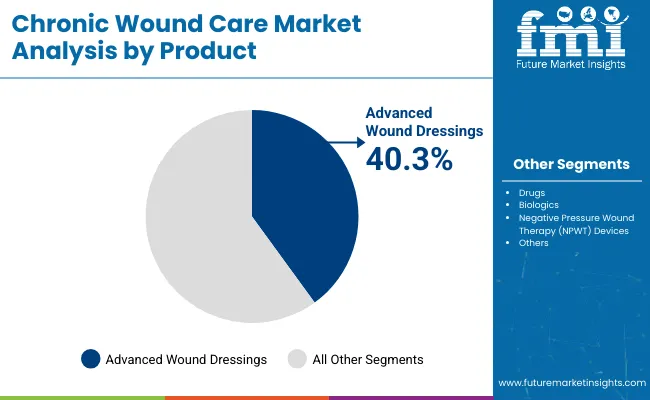

Advanced Wound Dressings holds a revenue share of 40.3% which has been attributed to their essential role in promoting faster healing and reducing complications in chronic wounds. Advanced Wound Dressings have been supported by clinical evidence demonstrating the effectiveness of moisture-retentive dressings in accelerating granulation tissue formation and preventing infection.

Advances in antimicrobial dressings, foam composites, and hydrocolloids have further strengthened clinician confidence in their use. Reimbursement policies in developed markets have recognized the cost-effectiveness of these products by reducing hospitalization days and avoiding secondary infections.

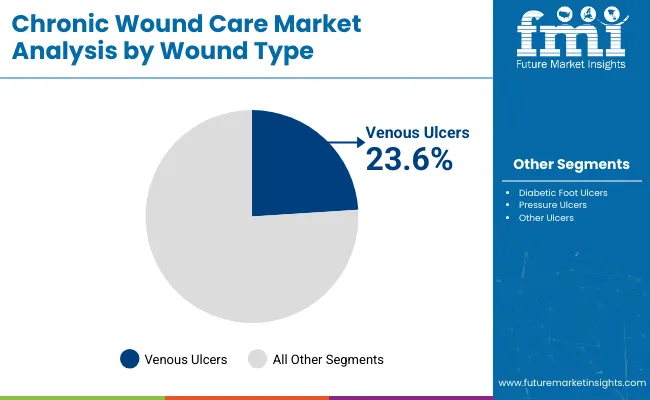

Venous Ulcers is holding a revenue share of 23.6% in the global chronic wound care industry, underscoring their prevalence as a major chronic wound type requiring prolonged treatment. The use of advanced wound care solutions has been driven by the high recurrence rates and complexity associated with venous insufficiency and impaired circulation.

Clinical guidelines have emphasized compression therapy combined with advanced dressings to improve healing and reduce recurrence risk. Hospitals and outpatient wound clinics have prioritized standardized care protocols to manage venous ulcers effectively and minimize complications such as infection and cellulitis.

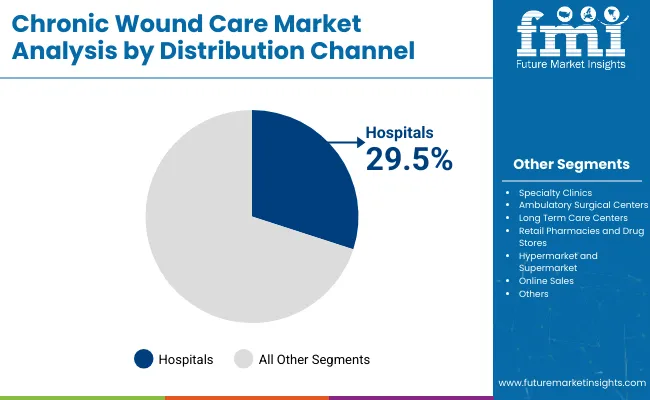

Hospitals have accounted for 29.5% of market revenue, reflecting their role as primary providers of advanced wound care for patients with complex comorbidities. Utilization has been reinforced by the presence of dedicated wound care units staffed by multidisciplinary teams, including wound care nurses, vascular specialists, and infectious disease experts.

Clinical protocols have standardized the use of advanced dressings, negative pressure wound therapy, and bioengineered skin substitutes within hospital settings. Reimbursement support for advanced therapies delivered in hospitals has further contributed to sustained adoption. Hospitals have prioritized early intervention strategies to prevent complications and reduce length of stay, strengthening their position as the leading end-user segment.

The quality of wound treatment still varies greatly when compared with the advances in wound care that have been made. Some medical own places use advanced bioengineered dressings or AI-powered monitoring systems that can help speed up wound healing and reduce complications.

Most places still find that outdated methods are usually practiced due to tight budgets, no trained specialists, or even ignorance about better and more modern treatments. The eventual effect of this disparity in care is that some patients would recover faster and with fewer problems; the reverse is true for some patients with longer healing and a likelihood of acquiring infections.

One way to do this is to standardize treatment protocols and avail modern wound care solutions to all healthcare facilities.

Smart wearable technology has just begun to make a significant impact on the field of wound monitoring and treatment. Use of smart bandages: by most clinicians nowadays, which are equipped with tiny sensors that monitor the healing progress; detect possible infections; and measure parameters like moisture levels and temperature changes.

With smart bandages, patients can be monitored but at home instead of visiting the doctor frequently, hence allowing the healthcare teams to adjust treatment according to what they are observing. This is not just wound care's convenience; it helps to prevent complications from becoming serious.

Companies and researchers keep improving them, adding AI analysis and wireless connectivity, to actually monitor the wound. With these new technologies will aid in smarter, faster, and more effective wound care as they become more widespread.

Intelligent dressings, AI-powered wound assessment, and skin grafts that are 3D-printed are revolutionizing the chronic wound care environment. The new technology supports accurate assessment of wounds, real-time monitoring, and custom-made treatment programs.

Wearable wound sensors that are becoming an attractive solution support the monitoring of healing from the comfort of the patient's home by the physician, or the nurse, thereby allowing quicker intervention when required and reduced unnecessary visits to the hospital.

Bioengineered skin substitutes, growth factors, and stem cell-based therapies are advanced wound care therapies that gained popularity over time. The goal of these advancements is the facilitation of chronic wound healing and acceleration in the healing process.

Increasingly popular is developing wound care programs designed around the specific needs of individual patients. These can take into account, for example, the nature of the wound, the health of the patient, lifestyle, and personal preferences.

United States chronic wound care market is witnessing phenomenal growth due to the increase in associated chronic conditions, such as diabetes and obesity, which are resulting in more diabetic and pressure ulcers. This demand further intensifies due to the aging population, as older people are more at risk of chronic wounds because of limited movement in addition to existing health problems.

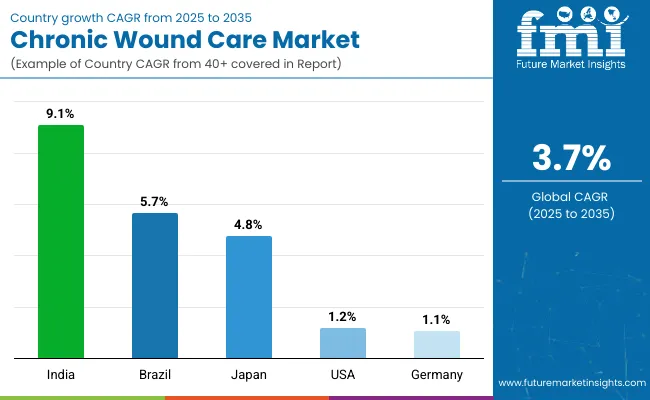

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 1.2% |

Germany's chronic wound care market is steadily growing, fueled by a highly efficient healthcare system and rising epidemiology of chronic diseases. Its commitment to advanced medical technologies and comprehensive healthcare coverage promotes the acceptance of innovative wound care solutions. The healthcare providers are getting their latest in treatments for best outcomes and quick recovery.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 1.1% |

The chronic wound care sector in India is expanding immensely, with increasing coverage being given to the concern of diabetes and the growing elderly population. Hospitals, clinics, and home care services are installing advanced wound care solutions in order to manage chronic wounds. Investment in healthcare infrastructure and education-related activities is one of the important factors contributing to awareness and accessibility of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 9.1% |

The market for chronic wound care in Japan continues to flourish alongside its highly advanced healthcare technologies and patient safety measures, as high standards come with an increased aging population. Healthcare providers have been adopting innovative wound care solutions, not only to achieve positive treatment outcomes but also to enhance patient comfort.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The chronic wound care market in Brazil is witnessing steady growth as the medical care providers are refining medical services and increasing awareness on wound management. The increasing burden of chronic diseases has hospitals and clinics putting in place advanced wound care solutions for better patient outcomes. Contributing to this are improving economic conditions and the expansion of private healthcare that is making modern treatments more possible for the masses.

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 5.7% |

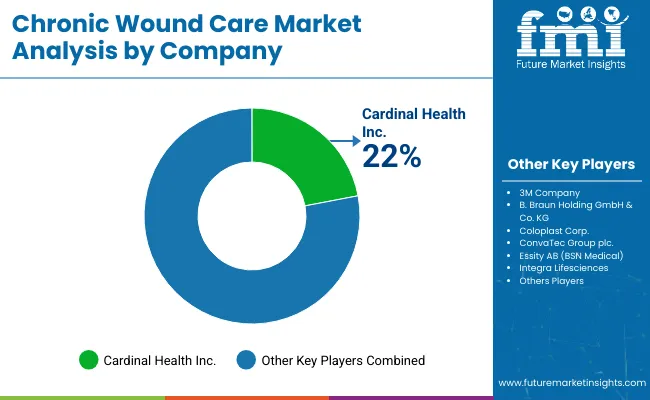

The competitive landscape has been shaped by companies investing in bioactive dressings, negative pressure wound therapy systems, and antimicrobial technologies to strengthen differentiation. Leading manufacturers have launched products with enhanced moisture management, infection control, and patient comfort features.

Strategic collaborations with hospitals and wound clinics have been established to validate outcomes and accelerate adoption. Global distribution networks have been expanded to reach underserved markets. These initiatives are expected to sustain competition and drive innovation as chronic wound prevalence continues to rise.

The overall market size for chronic wound care market was USD 18.6 billion in 2025.

The Chronic Wound Care Market is expected to reach USD 26.7 billion in 2035.

The widespread availability of chronic wound cares across supermarkets, pharmacies, online platforms, and specialty stores is making them more accessible to a larger consumer base.

The top key players that drives the development of chronic wound care market are Smith & Nephew, 3M, Mölnlycke Health Care, ConvaTec Group PLC and Coloplast Corp.

Advanced wound dressings in product type of chronic wound care market is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Chronic Pulmonary Hypertension Treatment Market Analysis and Forecast by Drug Type, Route of Administration, Distribution Channel, Region through 2035

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Chronic Respiratory Diseases Treatment Market

Chronic Skin Redness Care Market Size and Share Forecast Outlook 2025 to 2035

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA