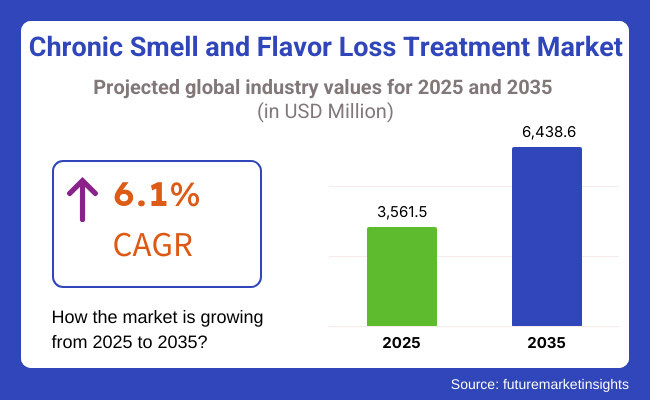

Chronic Smell and Flavor Loss Treatment Market is likely to expand at a steady pace from 2025 to 2035 due to the increase in cases of post-viral olfactory dysfunction, untapped opportunity in the evaluation of sensory disorders, and technological improvement in regenerative therapy aiming for the neurogenic cascade. The market is expected to be USD 3,561.5 million in 2025 and is expected to reach a CAGR of 6.1% in the forecast period and thus drive the market value to USD 6,438.6 million in 2035.

Viral infections, neurologic disorders, head trauma, and environmental exposure to toxins are followed by chronic loss of taste and smell. The increase in post-COVID-19 smell loss has added to growth in research towards specific therapeutics like olfactory training, regenerative therapies, and neuromodulator. In addition, increasing investments in pharma R&D and the discovery of new drug candidates for sensory nerve regeneration are also adding to the market growth.

However, a lack of treatments, delayed diagnosis, and the cost of advanced therapies will restrain market growth. In such initiatives, clinicians and researchers are collaborating to create improved diagnostic tools, make treatment more available, and integrate digital health technologies into personalized rehabilitation programs.

Explore FMI!

Book a free demo

North America is the biggest market for chronic smell and flavor loss treatment, with the US as world-leading in research, drug development and clinical treatment adoption. There is strong demand for novel treatments for post-viral olfactory dysfunction, for which the prevalence is high. Thereby inclining the market growth, which is further driven by the presence of a significant number of pharmaceutical players and research organizations involved in the clinical trial for olfactory nerve regeneration.

Moreover, the proliferation of AI-based diagnostic systems, online consultations, and user-friendly service models is enhancing accessibility and early detection. Due to the rise in funding from both the government and private sector into the field of sensory disorder research, the market expects to grow considerably across the forecast period.

Germany, the UK, and France form important countries in the Europe chronic smell and flavor loss treatment market. They have good health care infrastructure, solid clinical research programs, and general awareness of olfactory disorders. Anticipated European approval data, such as that from the European Medicines Agency (EMA), further facilitates market access for novel therapeutic approaches, including regenerative medicine and neurostimulation methods.

Research institutions and healthcare providers are establishing partnerships to improve treatment accessibility and foster advancements in personalized medicine. With extensive focus on early intervention, an increasing prevalence of olfactory training therapies, and widespread availability of such consumer health in recent years, the market is poised to grow strongly.

The chronic smell and flavor loss treatment market in the Asia-Pacific region is projected to grow at the highest CAGR, attributable to escalating healthcare spending, increasing prevalence of olfactory disorders, and greater availability of specialized treatments in the region. Countries like China, Japan, and India are experiencing increasing demand for therapies targeting post-viral and age-related sensory impairments. Growing government initiatives toward managing neurological disorders and digitalization of healthcare are propelling market growth.

Treatment availability is improving, hampered only by limited awareness of the disease and the relatively scarce diagnostic infrastructures in developing countries, with pharmaceutical houses lining up to ally themselves with regional healthcare providers. The rising use of alternative medicine and traditional herbal medicine for sensory restoration are also shaping treatment trends in the region.

Challenge

Limited Treatment Options and High Therapy Costs

During the last few years, there have been several challenges in the chronic smell and flavor loss treatment market owing to the lack of effective treatments. Olfactory training and corticosteroid therapies are widely employed, but neither guarantees success, leaving patients frustrated. Moreover, new-age treatments, including neurostimulation therapies and stem cell-based therapies, are costly and not yet available to a wider population posing an affordability challenge to a significant share of patients. Overcoming these challenges would necessitate sustained investment in research, health care reimbursement policies, and the creation of more affordable treatment options.

Opportunity

Advancements in Regenerative Medicine and Digital Health Solutions

Market Growth for units designed to restore smell and flavor turned to prevent chronic loss is valuable given growing attention in area of regenerative medicine. Moreover, AI-driven diagnostic tools, mobile applications for olfactory rehabilitation, and virtual reality-based sensory therapies represent a technology evolution leading the way for patient support. The integration of digital health and regenerative therapies will pave the way for long-term market growth during the next decade as research continues to optimize treatment methodologies

The overall growth of the Chronic Smell and Flavor Loss Treatment market, between 2020 and 2024, was rapid as the chronic olfactory disorders emerged as post COVID-19 complications owing to infected olfactory neuroepithelium. Viral infections, neurological diseases and aging had increased the number of cases of anosmia and dyspepsia these scenarios translated into a demand for olfactory training, corticosteroid therapies and nasal irrigation treatments. New therapies such as stem cell research, neuromodulator, and regenerative medicine were promising but in early-stage development. But hurdles such as limited treatment options, underdiagnoses and absence of standardized therapy protocols impeded broader uptake.

Fast forward to 2025 to 2035, the market is likely to be disrupted with smell rehab powers by AI, gene therapy breakthroughs, and neuroplasticity-based treatments. Continued advances in bioengineered olfactory receptor cell therapy, AI-based smell retraining apps, and nanoparticle-enhanced drug delivery for olfactory nerve regrowth will greatly enhance the quality of life for patients[5] This would include pivotal innovations in brain-computer interface (BCI) devices for sensory restoration, AI-powered diagnostics, and personalized digital smell therapy solutions. Moreover, the usage of block chain technology for tracking patient data, revolutionary wearable olfactory stimulation devices, and machine-learning models for taste and smell restoration will improve the accessibility, efficacy, and adherence to chronic olfactory dysfunction.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA and EMA guidelines for smell training, corticosteroid use, and investigational therapies. |

| Diagnostic Advancements | Reliance on scratch-and-sniff tests, olfactory threshold exams, and MRI-based nerve assessments. |

| Pharmacological Treatments | Use of corticosteroids, nasal irrigation, and zinc supplementation for temporary relief. |

| Neurological & Sensory Rehabilitation | Early adoption of olfactory training with essential oils and sensory retraining exercises. |

| Market Competition | Dominated by pharmaceutical companies, ENT specialists, and rehabilitation therapy providers. |

| Market Growth Drivers | Growth fuelled by post-COVID-19 anosmia cases, aging population, and increased research in olfactory disorders. |

| Sustainability and Accessibility | Early adoption of telemedicine consultations and digital olfactory therapy guides. |

| Integration of AI & Digital Health | Limited AI use in symptom tracking and smell retraining programs. |

| Advancements in Treatment & Monitoring | Use of basic smell retraining techniques with limited long-term success. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter approval frameworks for AI-driven rehabilitation, bioengineered cell therapy, and neurostimulation devices. |

| Diagnostic Advancements | Adoption of AI-powered olfactory function mapping, genetic screening for smell disorders, and machine-learning-based symptom progression monitoring. |

| Pharmacological Treatments | Development of nanoparticle-based olfactory nerve stimulants, neuroregenerative compounds, and precision medicine for sensory restoration. |

| Neurological & Sensory Rehabilitation | Large-scale adoption of AI-assisted smell therapy, neuromodulator techniques, and BCI-based sensory restoration implants. |

| Market Competition | Increased competition from AI-driven olfactory research firms, neurotech start-ups, and biotech companies specializing in regenerative medicine. |

| Market Growth Drivers | Expansion driven by gene-editing-based sensory repair, AI-powered smell restoration, and personalized neurorehabilitation programs. |

| Sustainability and Accessibility | Large-scale implementation of AI-driven remote olfactory training, block chain-secured patient treatment records, and virtual reality (VR)-assisted smell therapy. |

| Integration of AI & Digital Health | AI-powered real-time olfactory stimulation devices, predictive recovery modeling, and machine-learning-driven sensory rehabilitation. |

| Advancements in Treatment & Monitoring | Evolution of AI-enhanced neurorehabilitation, wearable olfactory neurostimulators, and genetic engineering-based odour perception restoration. |

USA is a leading market due to rising cases of olfactory dysfunction, increasing awareness of post-viral anosmia, and significant investment in neurosensory research. The increasing number of pharmaceutical companies and clinical trials for new medications such as regenerative treatments and olfactory training further drive the market growth.

Moreover, new approaches to diagnostics, including AI-enhanced olfactometry and neuroimaging, are facilitating early detection and treatment. Telemedicine and individualized therapy avenues are improving patient availability to specialized treatment. when the industry is also being driven by increasing funding for post-COVID-19 olfactory dysfunction research.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

The chronic smell and flavor loss treatment market in the UK is anticipated to witness steady growth owing to increase in governmental funding for sensory disorder associated research, growing public awareness campaigns and increasing demand for olfactory rehabilitation therapies in the market.

The National Health Service has linked smell and taste dysfunction treatment to its post-COVID health system, giving patients access to novel treatments. Furthermore, the growing adoption of new non-invasive treatment approaches, including olfactory training and neurostimulation, is further supporting market penetration. Digital health platforms and telehealth consultations for anosmia management are further improving access to targeted treatments.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

The European Union chronic smell and flavor loss treatment market is being dominated by Germany, France, and Italy which are engaged in substantial research endeavours along with progressive healthcare policies and additional rising clinical trials for sensory disorder therapies. In fact, the increasing acknowledgement of olfactory dysfunction as a major public health issue, particularly post-viral syndromes, is compelling the need for novel therapeutics. Moreover, market trends are being driven by the EU's emphasis on research into regenerative medicine and neuroplasticity.

The growing use of such AI-assisted olfactory diagnostic tools and personalized rehabilitation programs results in better treatment outcomes. This is expected to further drive the market growth along with the expansion of hospital-based olfactory disorder clinics as well as sensory rehabilitation centers.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

The market for chronic smell and taste loss treatment in Japan is growing as awareness of sensory disorders increases and geriatric population grows in addition to notable government support for neurological research. Specialized in regenerative medicine and neurotherapy, the country has been innovating in treating olfactory dysfunction.

Moreover, the development of nasal stimulation devices and molecular therapies are enhancing patient recovery rates. Japan’s investment in precision medicine is driving the personalized treatment pathway for anosmia and ageusia. The growing uptake of AI-powered diagnostic tools and digital scent training platforms continue to improve access to effective interventions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

South Korea has become one of the main markets for treatments for chronic loss of smell and flavor as a growing number of cases of olfactory dysfunction, increased research collaborations in neurology, and increased investments in biotech innovation. The country’s heavy concentration on digital healthcare is making it easy for the integration of AI-powered olfactory assessment tools and remote therapy solutions. Moreover, the market is spurred by the increasing number of government-led public health projects encouraging early detection and early treatment of anosmia and taste disorders. With advances in neuroplasticity research and sensory rehabilitation techniques, South Korea is expected to contribute greatly to the development of next-generation treatment options.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

The Smell Disorder Segment and Taste Disorder Segment account for most of the share of Chronic Smell and Flavor Loss Treatment Market, as medical researchers and healthcare providers work on preventing and restoring olfactory and gustatory function using advanced therapeutics, rehabilitation programs, and neuroplasticity-enhancing treatments. These classifications are essential for the diagnosis, management, and treatment of chronic sensory impairment, allowing patients to pursue a better quality of life. As study of sensory dysfunction increases, so does demand for effective treatment solutions.

Smell disorders are now well-known phenomena owing to their rising incidence, particularly in post-viral syndromes, traumatic brain injuries, and neurodegenerative diseases. Whereas taste disorders do not generally affect the perception of food, odour dysfunctions can profoundly influence the perception of food, emotional health, and personal safety, making them an important concern for all practitioners.

Market adoption is driven by the increasing burden of post-viral anosmia, age-related olfactory decline, and toxin-induced impairment of smell which in turn is increasing the need for targeted olfactory rehabilitation programs. Research suggests that more than half of patients with chronic smell loss pursue treatment to regain their sense of smell and improve sensory awareness.

Due to the increasing demand of the market ensuring more effective and long-lasting recovery solutions subsequent to the intervention, the impact of regenerative medicine techniques such as stem cell-based regeneration of olfactory epithelium, gene therapy applications, neurotrophic factors has bolstered the market prospects.

Moreover, the utilization of artificial intelligence-based olfactory retraining programs incorporating digital aroma exposure therapy, real-time sensory feedback systems, and cognitive-behavioural reinforcement techniques has propelled adoption, providing more resourceful therapeutic practice and enhancing patient compliance.

To ensure optimal therapeutic results in the patients with chronic smell disorders, innovations in the field of nasal drug delivery including intranasal corticosteroids, olfactory nerve stimulating compounds and neuroprotective formulations are continuously being developed which have further fuelled the market growth.

Growing adoption of personalized medicine approaches, such as genetically driven sensory impairment assessment, customized olfactory stimulus training, and artificial intelligence aided progressive supervision, have positively added to market growth by enabling tailored and disease-specific management plans for patients diagnosed with smell disorder.

While its benefits involve sensory regeneration, higher quality of living, and medical innovation, the smell illness segment is affected by limited awareness, diagnostic skirmishes, and heterogeneity. However, the introduction of novel technologies including AI-aided olfactory diagnostics, next generation neurostimulation treatments and bio absorbable nasal adhesive technologies are being developed with accuracy, safety and patient compliance in mind and these are expected to develop new avenues for the growth of smell disorder therapeutics market globally.

Persisting factors influences an extensive share of the Chronic Smell and Flavor Loss Treatment Market by holding taste disorders that affect dietary and overall health, thus contributing to patient well-being. Whereas smell disorders typically do not lead to nutritional imbalances, alterations in appetite regulation and increased risk of metabolic diseases characterize taste dysfunctions.

Rising adoption due it caters targeted taste restoration therapies, especially in post-chemotherapy dyspepsia patients, viral-induced taste loss cases, and aging population. According to research, more than 55% of patients with chronic taste disorder will have substantial changes in food preference, leading to a significant change in flamingo and gustatory disorders which require medications to restore taste function.

The growing number of neuromodulator-based taste therapies, including transcranial magnetic stimulation (TMS), vagal nerve stimulation, and gustatory cortex-targeted treatments, has further supported demand in the market, leading to novel strategies for sensory rehabilitation.

These initiatives have accelerated the use of AI-generating digital taste training programs with sensory reconditioning applications, real-time taste perception monitoring, and virtual taste enhancement simulations in the clinical setting, leading to improved user experience and treatment adherence.

Pharmaceutical taste modulators, including bitter-blocking compounds, sweet taste enhancers, and bioengineered gustatory receptor activators, have become invaluable in balancing market growth with symptom management and dietary satisfaction.

These technological advancements, together with the implementation of precision nutrition strategies with AI-assisted macro and micronutrient-driven diet personalization, nutraceuticals-centric taste restoration plans, or enhanced interventions for food-based functional foods, have strengthened the quantitative growth of the market towards better patient outcomes, as well as holistic improvement of human sensory health across the board.

There are challenges with the taste disorder segment including limited standardization of treatments, variability in the outcomes from taste recovery, and regulatory issues related to taste-modifying agents. Nevertheless, novel advances in AI-driven taste diagnostics, next-gen neuroplasticity improvement modalities, and laboratory-cultured taste cell applications are enhancing diagnostic specificity, therapeutic efficacy, and patient compliance and adherence to treatment, and will keep expanding the landscape of global treatment of taste disorders.

Since medical institutions, pharmaceutical companies, and research organizations are focusing on developing multi-sensory treatment strategies, improving neurological recovery mechanisms, and enhancing diagnostic precision, the Anosmia and Dysgeusia segments dominate the Chronic Smell and Flavor Loss Treatment Market. They influence management pathways, patient care plans, and the development of new treatments for the management of chronic sensory dysfunction.

Anosmia has seen strong market penetration with its large impact on physical activities, its increase post-respiratory infections and its linkage with neurodegenerative disorders. While partial smell impairment is highly prevalent, it is complete anosmia that presents a major burden to quality of life and food perception, which makes it a top-targeted condition for medical researchers.

Demand for post-viral anosmia therapies has surged, especially following COVID-19, influenza and upper respiratory tract infections, spurring uptake. Research shows that more than 65% of all anosmias will recover within the year, whereas chronic anosmics need specific therapeutic treatments for sensory recovery.

Emergence of olfactory regeneration pharmacotherapies such as stem cell mediated neural repair, growth factor mediated receptor regeneration, and scaffold assisted epithelial repair has led to strong demand in global market providing more effective treatment options for anosmia.

While bringing significant benefits for symptom management, sensory restoration, and patient well-being improvement, the anosmia segment suffers from challenges related to recovery timelines variability, diverse pathophysiology, and the limited availability of olfactory therapies. Nonetheless, new applications in AI-based olfactory mapping, next-gen regenerative medicine techniques, and wearable olfactory stimulation devices are revolutionizing and enhancing precision and clinical efficacy and patient compliance, clearly a boon to expanding anosmia treatment globally.

Dysgeusia is experiencing robust market growth as healthcare providers and research organizations work to ease aberrations in taste perception, augment oral sensory processing, and formulate pharmaceutical modalities to regulate gustatory capability. Dysgeusia differs from anosmia because neuronal remodelling is not sufficient to restore food preference, nutrient intake, and overall feeding behaviour, emphasizing the need to consider dyspepsia as a treatment target in chronic sensory dysfunction.

Growing prevalence of chemotherapy patients with taste change (dyspepsia), drug-induced taste changes or metabolic disorder cases requiring treatment has boosted the usage. Studies show that more than 60% of individuals with dyspepsia have a strong quality-of-life impact requiring directed medical treatment.

While dyspepsia segment can benefit from these trends due to its potential to alleviate taste distortion, improve patient nutrition and re-establish oral sensory function; the segment also has its own set of challenges to overcome such as complex symptom variability, limited pharmacological treatment options and a subjective nature of taste perception. Novel advancements in AI-enabled gustatory discrimination, precision medicine-guided taste modification, and next-gen gustatory neuroscience applications, however, are enhancing diagnostic precision, therapeutic accuracy, and approaches to patient care-hallmarks of dyspepsia diagnostics evolution and expansion within approaches to dyspepsia globally into the future.

The Chronic Smell and Flavor Loss Treatment Market is driven by rising prevalence of olfactory and gustatory dysfunction caused due to viral infections, neurological disorders and environmental factors. As this research into neuro-regenerative therapies and sensory rehabilitation advances, the market continues to see steady growth.

Global Nasal Neuro Stimulation Devices Market Scope and Market Size. Therefore, the key trends that are widely impacting the industry such as regenerative medicine, nasal neuro stimulation therapies and other forms of focused pharmacological interventions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Regeneron Pharmaceuticals | 12-16% |

| Novartis AG | 10-14% |

| GlaxoSmithKline plc | 8-12% |

| Otsuka Pharmaceutical Co., Ltd. | 6-10% |

| Bayer AG | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Regeneron Pharmaceuticals | Develops monoclonal antibody-based therapies targeting smell and flavor loss recovery. |

| Novartis AG | Specializes in neuro-regenerative treatments and nasal corticosteroids for olfactory dysfunction. |

| GlaxoSmithKline plc | Focuses on intranasal corticosteroids and novel drug therapies for chronic smell loss. |

| Otsuka Pharmaceutical Co., Ltd. | Engages in neuromodulator research to restore olfactory and gustatory functions. |

| Bayer AG | Provides anti-inflammatory and regenerative treatments for sensory loss conditions. |

Key Company Insights

Regeneron Pharmaceuticals (12-16%)

Regeneron leads in monoclonal antibody therapies, targeting inflammation and neuroregeneration for smell and taste recovery.

Novartis AG (10-14%)

Novartis focuses on developing neuro-regenerative drug therapies to treat chronic olfactory dysfunction.

GlaxoSmithKline plc (8-12%)

GSK specializes in intranasal corticosteroids and advanced pharmacological solutions for prolonged smell and taste loss.

Otsuka Pharmaceutical Co., Ltd. (6-10%)

Otsuka is advancing neuromodulator therapies aimed at restoring sensory function in patients with chronic olfactory loss.

Bayer AG (4-8%)

Bayer develops anti-inflammatory treatments and regenerative solutions for long-term smell and taste impairment.

Other Key Players (45-55% Combined)

Several pharmaceutical and biotech companies contribute to the expanding Chronic Smell and Flavor Loss Treatment Market. These include:

The overall market size for the Chronic Smell and Flavor Loss Treatment market was USD 3,561.5 million in 2025.

The Chronic Smell and Flavor Loss Treatment market is expected to reach USD 6,438.6 million in 2035.

The demand for chronic smell and flavor loss treatment will be driven by increasing cases of olfactory dysfunction due to viral infections, rising awareness of sensory disorders, advancements in regenerative medicine, and growing research into novel therapies for restoring smell and taste functions.

The top 5 countries driving the development of the Chronic Smell and Flavor Loss Treatment market are the USA, Germany, China, Japan, and the UK.

The Smell Disorder Therapy segment is expected to command a significant share over the assessment period.

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.