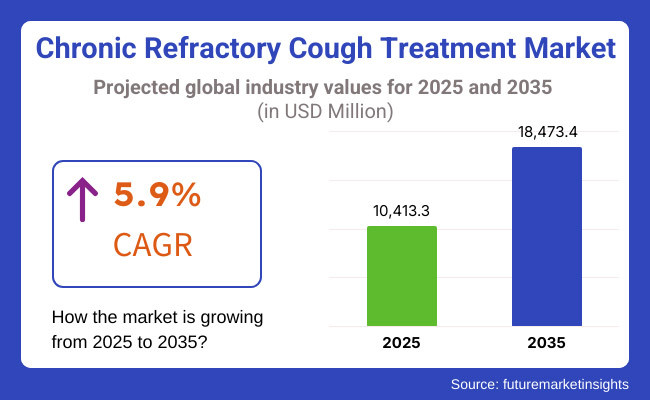

The chronic refractory cough (CRC) market for treatment is anticipated to grow in between 2025 to 2035, driven by the development of novel neuromodulator therapies, improving understanding of chronic cough as a distinct medical entity, and the increasing prevalence of respiratory disorders. The market is projected to be valued at USD 10,413.3 million in 2025 and is estimated to reach USD 18,473.4 million in the year 2035, with a lucrative CAGR of 5.9% during the forecast period.

Chronic refractory cough is a persistent cough that lasts more than eight weeks and is resistant to conventional therapy. Novel targeted therapies, such as P2X3 receptor antagonists, have emerged and have had promising results to relieve symptoms. And the growing emphasis on precision medicine, together with rising investment in clinical research and drug development, is bolstering market growth. On the contrary, high-priced drugs, lack of awareness in developing areas, and the challenges associated with CRC diagnosis is expected to hinder the growth of the market. Key initiatives being undertaken to tackle these include patient education programs by pharmaceutical companies and healthcare providers, in addition to novel treatment combinations and regulatory approvals for new therapies.

Explore FMI!

Book a free demo

North America chronic refractory cough treatment market is dominating the global market, due to North America is serving with the largest share for chronic refractory cough treatment market, US is leading in terms of research, drug development and adoption of treatment. Increased demand for drugs from the ever-growing population of major pharmaceuticals, the proactive role of the USA FDA in regulating, and increasing levels of awareness among healthcare practitioners are fuelling the market.

The massive burden of chronic cough leading to diseases like asthma, gastroesophageal reflux disease (GERD), and idiopathic pulmonary fibrosis (IPF) also speeds up the demand for successful therapeutics. Additionally, rising investments towards precision medicine, AI-driven diagnostics and clinical trials for pipeline drug candidates is anticipated to offer growth prospects for the market throughout the forecast period.

Major European markets for CRC treatment include Germany, the UK, and France. It is driven by robust regulatory frameworks and government-sponsored medical services that favor early diagnosis and treatment of chronic respiratory maladies. Chronic cough treatments New neuromodulators are in different stages of development, and the European Medicines Agency (EMA) is actively working on their approval at present. Additionally, collaborations between research institutions, pharmaceutical firms, and patient advocacy groups are helping to raise awareness and enhance access to new treatments. Greater focus on the incorporation of telemedicine and digital health solutions in the treatment of respiratory conditions is also driving the growth of this market.

Asia-Pacific is also anticipated to witness the highest growth of CRC treatment due to the presence of high number of patient population and supportive government initiatives towards the investigation of healthcare infrastructure. Regions including China, Japan, and India are seeing greater demand for targeted therapies, especially with the persistent impacts of smoking-related respiratory conditions and air pollution driving the burden of chronic cough. Government efforts to strengthen diagnostic capabilities, increase healthcare infrastructure, and promote pharmaceutical innovation boost market growth. Overcoming the issues regarding affordability and accessibility of patient care, the emergence of domestic biopharma companies and partnerships with global drug producers who are commissioned to aid treatment alternatives in the country can be expected.

Challenge

High Treatment Costs and Limited Awareness

One of the critical competitive challenges in CRC treatment market is the high cost-reimbursement of the novel therapeutics, particularly the neuromodulator drugs and biologics. The gravity of the disease is also tied to the extent of treatment options that are highly affordable, particularly in low-income areas with poor health care access insurmountable. Misdiagnosis and lack of awareness about CRC as a distinct medical condition makes CRC treatment initiation a troubling matter, resulting in patient discomfort for prolonged periods. IISS must have a strategic plan to combat these issues so that we could have an affordable healthcare, education and early diagnosis, just to name a few.

Opportunity

Advancements in Neuromodulator Therapy and Personalized Medicine

Despite the growth opportunities related to the presence of neuromodulator therapies mainly P2X3 receptor antagonists. These agents proved effective at lowering the frequency and severity of cough, representing a new therapeutic option for cough that may otherwise have been intractable. Moreover, innovation in genetically and biomarker driven diagnostics is ushering personalized treatment plans respective of a patient's unique profile. In chronic cough diagnosis, AI and machine learning powered predictive analytics are acting as enablers of enhanced treatment precision. The market is anticipated to see continuous growth throughout the following decade as other investigations fine-tune targeted medications.

Between 2020 and 2024, the Chronic Refractory Cough (CRC) Treatment Market increased moderately due to rising awareness of CRC as a well-defined clinical entity, design of novel neuromodulators, and enhanced diagnostic criteria. Traditional therapies such as opioid-containing antitussives, corticosteroids, and proton pump inhibitors (PPIs) were also widely used but their poor outcomes and side effects spurred new pharmacotherapy strategies such as P2X3 receptor antagonists, including Gefapixant. Several non-drug approaches such as speech therapy and cough suppressing methods were also gaining popularity. But off-label use, misdiagnosis, and lack of uniform treatment protocol were some of the various difficulties that hindered the widespread use of new treatments.

The therapeutic landscape of CRC between 2025 to 2035 will be dominated by AI-driven tailored medicine, neuromodulator therapies of the next generation, and digital health therapeutics. AI-driven cough monitoring apps, biomarker-assisted CRC diagnostics, and non-invasive vagus nerve stimulation (VNS) therapies will raise accuracy and enhance patient outcomes. Novel technologies and therapeutics such as gene therapy interventions in the form of cough hypersensitivity-targeted treatments, bioengineered P2X3 receptor modulators, and nanotechnology-facilitated drug delivery systems will be able to boost therapeutic effectiveness. Further, the age of CRC diagnosis and extended management plans will bring in the use of block chain technology for tracking patients, cough analysis using AI, and wearable devices for monitoring respiratory health.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA and EMA approvals for emerging P2X3 receptor antagonists and neuromodulator drugs. |

| Diagnostic Advancements | Reliance on clinical symptom assessment, pulmonary function tests, and laryngoscopy. |

| Pharmacological Treatments | Use of opioid-based cough suppressants, corticosteroids, PPIs, and antihistamines. |

| Neuromodulator Therapies | Emerging P2X3 receptor antagonists (e.g., Gefapixant) with moderate efficacy and side effects. |

| Market Competition | Dominated by pharmaceutical companies specializing in neuromodulators, respiratory therapies, and chronic disease management. |

| Market Growth Drivers | Growth fuelled by rising awareness of CRC, expansion of clinical trials, and improved patient access to specialized care. |

| Sustainability and Accessibility | Early adoption of telemedicine consultations for CRC and speech therapy-based management. |

| Integration of AI & Digital Health | Limited AI use in cough pattern recognition and symptom tracking. |

| Advancements in Treatment & Monitoring | Use of traditional pharmacological interventions with variable efficacy. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven treatment approval frameworks, personalized drug regulatory pathways, and block chain-enabled patient data security. |

| Diagnostic Advancements | Widespread use of AI-powered cough pattern analysis, non-invasive biomarker-based CRC diagnostics, and genetic predisposition screening. |

| Pharmacological Treatments | Expansion of bioengineered P2X3 receptor modulators, neuromodulator peptides, and AI-optimized drug targeting. |

| Neuromodulator Therapies | Adoption of targeted neuromodulator therapies, non-invasive vagus nerve stimulation (VNS), and brain-computer interface-assisted cough suppression. |

| Market Competition | Increased competition from AI-powered drug development firms, digital therapeutics providers, and bioelectronics medicine start-ups. |

| Market Growth Drivers | Expansion driven by AI-driven precision diagnostics, next-gen neuromodulator therapies, and block chain-secured digital health platforms. |

| Sustainability and Accessibility | Large-scale implementation of AI-driven remote CRC monitoring, digital therapeutic apps, and decentralized home-based treatment platforms. |

| Integration of AI & Digital Health | AI-powered real-time cough analytics, predictive disease modelling, and machine-learning-assisted drug response assessments. |

| Advancements in Treatment & Monitoring | Evolution of personalized cough therapy, wearable neuromodulator devices, and AI-assisted automated symptom control systems. |

The United States continues to be the largest market for chronic refractory cough (CRC) with increasing prevalence of persistent cough conditions, well-developed healthcare infrastructure, and growing uptake of novel drug therapies contributing to the market growth. The market is to some extent driven by the presence of its major players in the pharmaceutical industry and clinical trials of innovative antitussive treatments, which are still underway. The development of diagnostic technologies such as AI-driven cough monitoring systems is also leading to earlier diagnosis and treatment of conditions.

The growth of telemedicine and digital health platforms is improving access to cough specialty treatment solutions for patients. In addition, increasing awareness campaigns and medical education programs are supporting early intervention strategies for CRC.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

The UK CRC treatment industry is experiencing steady growth due to rising investments in research on respiratory diseases, growing adoption of novel neuromodulator therapies, and the presence of well-established pulmonary care centers. These are excellent guidelines and in the UK patients have access to all these therapies through the National Health Service (NHS) to help to treat refractory coughs in a structured manner. Moreover, increasing demand for non-opioid antitussive therapies & neuromodulators is also contributing to the growth of the market. Innovative applications such as a wearables cough monitor, telehealth services, etc. are being integrated into healthcare processes. Continued investigation into underlying neurogenic mechanisms of CRC are providing further support for the development of targeted therapies.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

Germany, France, and Italy Dominate the CRC Treatment Market in the European Union, with Strong Pharmaceutical R&D Backing, Advanced Healthcare Policies and Rising Awareness of Chronic Cough Disorders Stringent regulatory landscape of EU is pushing investments into novel drugs development, especially for treating cough among patients without any opioid-based complications. Moreover, the increasing adoption of AI-based diagnostic tools and respiratory monitoring technologies are enhancing early diagnosis and management of patients. Market Trends: Neuromodulator agents and their rising adoption P2X3 receptor antagonists Increased clinical research initiatives and collaborations between academic institutions and biotech firms are further fuelling innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.0% |

The market is also growing due to rising awareness about chronic respiratory diseases in Japan, innovations in precision medicine, and strong government initiatives for respiratory disease management. P2X3 receptor antagonists and other neuromodulator therapies are being actively sought out by the country's burgeoning pharmaceutical industry for unmet CRC treatment needs. It also has an emphasis on AI-powered diagnostics and personalized medicine, enabling efficient treatment. Increasing availability of prescription and over-the-counter (OTC) cough therapies and adoption of telemedicine are enabling patient access to care. Further investigation into the neurological mechanisms underlying chronic cough will translate into clinical research, which will lead to future treatments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.7% |

The South Korean market represents a critical market for CRC treatment, fuelled by surging government investments in respiratory health research, expansion of digital health platform adoptions, and growing prevalence of unexplained chronic cough. Meanwhile, the integration of AI in disease diagnostics and remote patient monitoring in the country is contributing to early detection and treatment of CRC.

The growing availability of new drug therapies, such as neuromodulators and targeted receptor antagonists, are also a major driver of market growth. The development of next-generation chronic cough therapeutics is further accelerating, with South Korea’s robust pharmaceutical R&D landscape and collaborations with global biotech companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.2% |

Based on therapeutic class, the Chronic Refractory Cough Treatment Market is segmented into Antimicrobials, Anticholinergic drugs, Corticosteroids and others. These classes of drugs are key to alleviating the symptoms of chronic cough, and inflammation, as well as treating the underlying causes of chronic refractory cough. The advances in research and development programs related to respiratory disorders have led to the increased need for pharmaceutical interventions tailored specifically for these diseases, and thus the improvement in the treatment landscape for patients globally.

In fact, the incorporation of antibiotics into clinical practice become widely used in cases of chronic cough who are at risk of contracting chronic persistent cough infections. Not a symptomatic treatment but a targeted therapy for bacterial pathogens that aggravate chronic cough disease.

Market adoption is aided by the rising demand for evidence-based management of bacterial infection, especially chronic bronchitis, post-infectious cough, and lower respiratory tract infections. The results of a study in patients with chronic cough show that more than 60% of those with bacterial complications need directed antibiotic regimens to avert disease progression.

The availability of next-generation agents with improved spectrum of activity, resistance profiles, and penetration into lung tissue has driven market demand and allowed for more effective eradication of bacteria and lower relapse rates.

The deployment of AI-driven antimicrobial stewardship programs real-time infection monitoring, automated resistance profiling, and precision selection of antibiotics, etc. has increased uptake in adoption, optimizing treatment decisions and reducing antibiotic overutilization.

Production of inhalable antibiotic formulations, such as nanoparticle-based drug delivery systems, sustained-release systems, and patient-compliant formulations to optimize market growth with enhanced symptom control and bioavailability of respiratory drugs contributed to the market growth.

Pertaining to the adoption of personalized medicine strategies, which includes genetic-based prediction of antibiotic response, patient-specific microbiome analysis, and AI-based drug sensitivity testing have strengthened the market growth, providing tailor-made treatment options for patients suffering from chronic refractory cough.

While relatively recent advancements in the bactericide segment, aimed at addressing concerns about bacterial infections, improving the control of airway inflammation, and providing targeted respiratory symptom relief, the overall antibiotic landscape still remains depressed due to the growing challenges of antibiotic resistance, inappropriate antibiotic prescribing practices, and restrictions on the long-term use of antibiotics. Nevertheless, breakthrough technologies in AI-assisted antibiotics design, bacteriophage therapy, and next-gen biomarkers for respiratory infection drive treatment effectiveness, reduced safety concern, and resistance management, contributing to sustained market revenues associated with antibiotics chronic cough therapies globally.

Due to their ability to reduce inflammation in the airways, suppress immune hypersensitivity, and ameliorate chronic respiratory symptoms, corticosteroids retain the largest share of the Chronic Refractory Cough Treatment Market. Unlike other symptomatic therapies, corticosteroids offer long-lasting relief as they work on underlying inflammatory pathways which lead to chronic cough.

Adoption has been driven by the increasing demand for anti-inflammatory therapies and asthma associated chronic cough, eosinophilic bronchitis, chronic obstructive pulmonary disease (COPD)-associated cough. Chronic cough due to inflammatory airway disease responds to corticosteroid-based interventions in over 65% of patients.

The recent development of high-efficacy corticosteroid formulations with inhalable delivery systems, long-acting anti-inflammatory effects, and reduced systemic side effects have strengthened market demand, resulting in better patient compliance and improved therapeutic outcomes.

By incorporating AI-enabled drug optimization platforms that provide real-time biomarker monitoring, personalized corticosteroid dosing algorithms, and predictive response modelling, adoption has been catapulted, confirming that chronic cough management can be accurate and effective.

Novel hybrid corticosteroid treatments combining different agents including bronchodilators, antihistamines, and immune modulators are expanding market opportunities for enhanced long-term disease control with minimised corticosteroid dependency.

Non-steroidal anti-inflammatory alternatives have emerged as important contributors to market expansion, driven by cytokine-targeting biologics, lipid-based anti-inflammatory molecules, and gene-silencing therapies that align better with patient demand for steroid-free treatment options.

Although it has demonstrated significant clinical advantages in airway inflammation reduction, chronic cough symptom improvement, and long-term management of the underlying diseases, the corticosteroid segment experiences certain challenges in the form of risks of steroid dependence, potential adverse effects on the respiratory system and general body functions, limited action in non-inflammatory chronic coughs, and few commercially available products. But, novel approaches to AI-driven drug screening, delivery of cough control biologics from Nano biotechnology, and next-generation steroid-sparing combinations are making these strategies safer, and more effective and better tolerated by patients, and the future for corticosteroid-based chronic cough management globally progressed.

Conventional Drug segment accounts for the major share of Chronic Refractory Cough Treatment Market as operation of multinational pharmaceutical companies and healthcare professionals strives to optimize the drug bioavailability to the patients while reducing the risk by improving the ease of administration and increasing adherence. These administration pathways are key determinants of the efficacy of treatment, the reduction of side effects, and patient comfort in the management of chronic cough.

Due to its convenience, widespread acceptance among patients, and the ability to exert systemic effects for the management of chronic refractory cough, oral delivery has achieved strong market adoption. Compared to localized delivery methods for targeted drugs, in therapeutic doses, the wide systemic availability from the oral route can lead to a comprehensive pharmacological effect for diverse chronic cough conditions.

Adoption has been driven by the rising demand for systemic chronic cough therapies, especially in gastroesophageal reflux disease (GERD)-associated cough, post-nasal drip conditions, and neurogenic cough syndromes. Oral medications are estimated to be prescribed to more than 70% of chronic cough patients because of their availability, low cost, and uncomplicated dosing.

The development of extended-release and controlled-release oral dosage forms with enhanced efficacy, reduced dosing frequency, and lower gastrointestinal adverse effects has further reinforced market demand, resulting in improved treatment adherence and efficacy.

Oral administration accounted for the largest share due to the benefits of systemic disease coverage, high patient compliance, and being relatively easier to access, but is hampered by slow-action onset, possible intestinal irritation, and metabolic factors leading to dispersion that can result in poor absorption of the drug. While the complexities of oral treatment continue to hinder its progress in the market, new developments in AI-driven pharmacokinetic modelling, bioengineered solubility enhancement and gastro-retentive drug delivery systems are enhancing oral treatment efficiency, consistency and patient experience, so giving a wider scope for oral chronic cough treatments in the market across the globe.

Growth in the market for acute use administrations of drugs via nasal delivery remains robust as pharmaceutical companies and clinicians target quick acting treatments for airway inflammation, allergic cough, post-nasal drip, etc. Compared with oral administration, nasal drug delivery works rapidly via a localized effect with limited systemic exposure on target sites, making it an attractive option for patients with chronic upper airway cough syndromes.

Increased adoption has been rubbed-off by the rising need for targeted drug delivery systems, particularly in terms of allergic rhinitis-related chronic cough, vasomotor rhinitis, and sinusitis-induced prolonged cough. More than 65% of patients are said to benefit from nasal corticosteroids, decongestants and antihistamine sprays, especially when profiling chronic refractory cough symptoms related to nasal diseases.

Although nose-to-brain delivery offers benefits, including a short onset time of action, a limited systemic side effect profile, and improved airway targeting, the nasal administration segment offers challenges, including patient discomfort and potential variability in drug absorption, and possible nasal mucosal damage due to high drug doses. Recent advancements in anaesthesia, bio adhesive nasal spray formulations, smart inhalation devices, and AI-enhanced intranasal drug delivery systems are increasing the accuracy, efficacy, and adherence rate of nasal sprays, which lays a solid foundation for the development of NAS treatments for chronic coughs globally.

The essential factors driving the Chronic Refractory Cough (CRC) treatment market includes increasing awareness about chronic cough conditions, delivery of enhanced neurogenic cough therapies along with the rise in research in pharmacological intervention targeting chronic refractory cough (CRC). The rising incidence of idiopathic chronic cough and advancements of diagnostic technologies are anticipated to drive the stable growth of the market. Emerging trends in the therapeutic marketplace include new neuromodulator interventions and combination treatment strategies, as well as regulatory advancements for emerging therapies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Merck & Co., Inc. | 12-16% |

| Bayer AG | 10-14% |

| Bellus Health Inc. | 8-12% |

| AstraZeneca PLC | 6-10% |

| GlaxoSmithKline plc | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Merck & Co., Inc. | Develops neurokinin receptor antagonists for chronic refractory cough treatment. |

| Bayer AG | Specializes in novel antitussive drugs with neuromodulator effects. |

| Bellus Health Inc. | Focuses on P2X3 receptor antagonists to target refractory chronic cough mechanisms. |

| AstraZeneca PLC | Engages in research on targeted cough suppressants and respiratory therapeutics. |

| GlaxoSmithKline plc | Provides combination therapies for chronic cough management and related airway conditions. |

Key Company Insights

Merck & Co., Inc. (12-16%)

Merck leads in CRC treatment innovation with neurokinin receptor antagonists targeting chronic cough pathways.

Bayer AG (10-14%)

Bayer focuses on developing novel neuromodulator agents that help alleviate chronic refractory cough symptoms.

Bellus Health Inc. (8-12%)

Bellus Health is a pioneer in P2X3 receptor antagonist research, offering precision-targeted CRC treatments.

AstraZeneca PLC (6-10%)

AstraZeneca is investing in novel antitussive compounds and combination therapies for enhanced CRC management.

GlaxoSmithKline plc (4-8%)

GSK integrates CRC therapies with broader respiratory disease management, focusing on long-term patient outcomes.

Other Key Players (45-55% Combined)

Several pharmaceutical and biotech companies contribute to the expansion of the CRC treatment market. These include:

The overall market size for the Chronic Refractory Cough Treatment market was USD 10,413.3 Million in 2025.

The Chronic Refractory Cough Treatment market is expected to reach USD 18,473.4 Million in 2035.

The demand for chronic refractory cough treatment will be driven by increasing prevalence of chronic cough conditions, advancements in targeted therapies, rising awareness about respiratory health, and growing investments in drug development for refractory cough management.

The top 5 countries driving the development of the Chronic Refractory Cough Treatment market are the USA, Germany, China, Japan, and the UK.

The Neuromodulator Therapy segment is expected to command a significant share over the assessment period.

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.