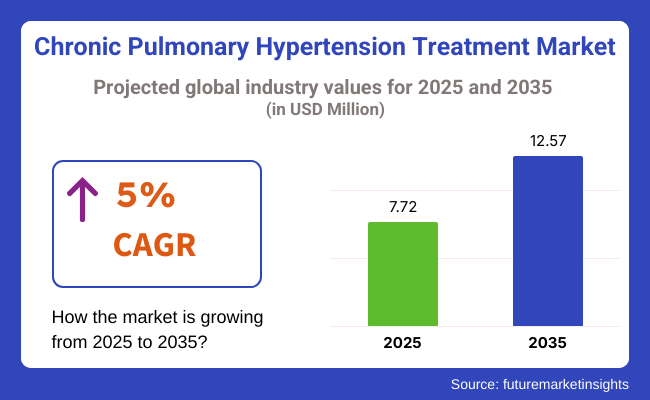

The chronic pulmonary hypertension treatment industry is valued at USD 7.72 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 5% and reach USD 12.57 billion by 2035.

In 2024, the industry witnessed significant growth driven by the rising prevalence of pulmonary hypertension, particularly in aging populations and individuals with underlying cardiovascular and respiratory conditions.Advancements in diagnostic techniques, including improved imaging and biomarker identification, enabled early disease detection, leading to timely and effective treatment interventions.

Additionally, pharmaceutical companies focused on expanding their pipelines, introducing innovative therapies like endothelin receptor antagonists and phosphodiesterase-5 inhibitors, which improved patient outcomes.

Industry players also formed strategic alliances to accelerate research and development, contributing to a competitive landscape. Regulatory approvals for novel drugs and increasing government investments in healthcare infrastructure further supported industry expansion. Meanwhile, heightened awareness campaigns and better access to healthcare facilities in emerging economies increased diagnosis and treatment rates.

According to the FMI research, in 2025 and beyond, the industry is anticipated to benefit from the continued development of targeted therapies and personalized medicine approaches. Technological innovations, including AI-powered diagnostic tools and wearable health devices, will further aid in early detection and continuous patient monitoring.

Additionally, expanding clinical trials and bio similar introductions will likely improve treatment affordability, ensuring broader patient access and driving sustained industry growth.

The Chronic Pulmonary Hypertension Treatment Industry is set for steady growth, driven by increasing disease prevalence and advancements in targeted therapies. Pharmaceutical companies and healthcare providers will benefit from rising demand for innovative treatments, while regulatory bodies and insurers will play a key role in industry access and affordability. Patients in developed and emerging landscapes alike will gain improved access to life-saving therapies, though cost and reimbursement challenges may pose hurdles.

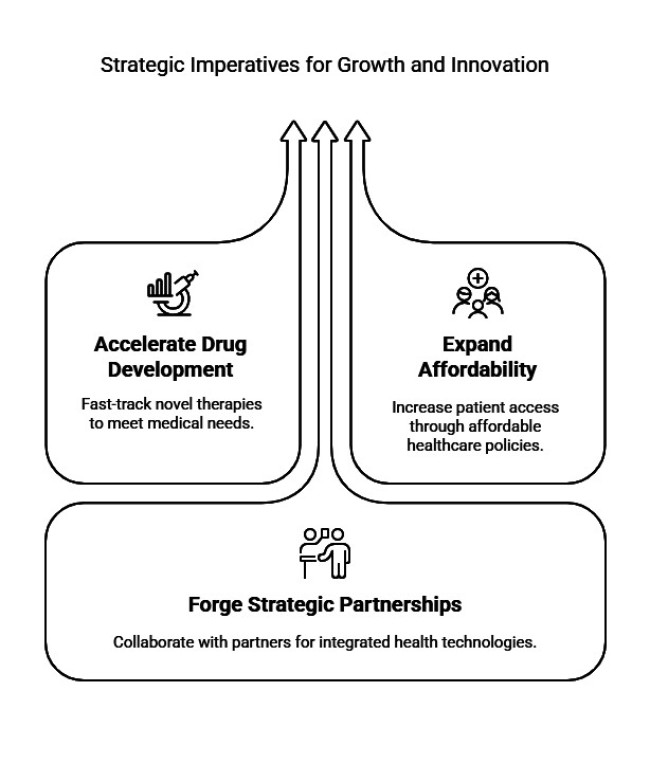

Accelerate Drug Development and Innovation

Invest in R&D for novel therapies, including targeted biologics and combination treatments, to address unmet medical needs and gain competitive advantage.

Expand Industry Access and Affordability

Collaborate with governments and insurers to establish favourable reimbursement policies and enhance patient affordability, especially in emerging landscapes.

Forge Strategic Partnerships

Pursue alliances with biotech firms, diagnostic companies, and digital health providers to integrate AI-driven diagnostics and remote monitoring, enhancing early diagnosis and patient management.

| Risk and Description | Probability and Impact |

|---|---|

| Regulatory Delays and Compliance Issues | High Probability, High Impact |

| Pricing Pressure and Reimbursement Challenges | Medium Probability, High Impact |

| Supply Chain Disruptions | Low Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Regulatory Compliance Management | Conduct feasibility on regulatory requirements for new product approvals |

| Industry Demand Analysis | Initiate feedback loop with healthcare providers on treatment needs |

| Channel Expansion Strategy | Launch pilot incentive program for distribution channel partners |

To stay ahead, companies must focus on the growing demand for innovative treatments and solutions within the Chronic Pulmonary Hypertension (CPH) industry. With increasing awareness, advancements in pharmacological treatments, and a surge in patient numbers, there is a clear opportunity to lead the industry through strategic partnerships, investment in research, and personalized care solutions.

Companies should prioritize developing advanced therapies and expanding their industry presence, all while adapting to regulatory shifts and patient-centric trends that will define growth. This intelligence shapes the roadmap for aligning with evolving patient needs and harnessing cutting-edge medical advancements in CPH treatment.

(Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across manufacturers, distributors, healthcare providers, and patients in the US, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

End-Users (Healthcare Providers):

Alignment:

Divergence:

USA:

Western Europe:

Japan/South Korea:

High Consensus:

Key Variances:

Strategic Insight:

| Countries | Impact of Policies and Regulations |

|---|---|

| The USA | Regulatory complexity with FDA approvals; compliance with animal welfare laws; mandatory certifications like GMP and ISO. |

| UK | Compliance with MHRA regulations; certifications like CE mark for medical devices; focus on sustainability in healthcare. |

| France | Strict adherence to EU medical device regulations (CE marking); emphasis on patient safety and compliance with EU standards. |

| Germany | Stringent EU compliance for medical devices; mandatory CE marking; focus on eco-friendly solutions under EU regulations. |

| Italy | EU regulations for product certifications; CE mark required for medical products; increasing focus on green healthcare. |

| South Korea | Regulatory standards for medical devices (KFDA certification); focus on quality control and safety standards. |

| Japan | Ministry of Health, Labor and Welfare (MHLW) approval required; certification for medical devices; stricter focus on patient safety. |

| China | Regulatory approvals by NMPA (National Medical Products Administration); certifications required for imported products. |

| Australia-NZ | TGA (Therapeutic Goods Administration) certification required for medical devices; strong emphasis on regulatory compliance. |

The global chronic pulmonary hypertension treatment industry is projected to grow at a compound annual growth rate (CAGR) of 5% from 2025 to 2035.

Among the drug types, endothelin receptor antagonists and PDE-5 inhibitors are expected to maintain a strong industry presence due to their established efficacy and demand, with a CAGR of around 4.5%. These drugs have proven track records in improving patient outcomes and managing disease progression.

Prostacyclin analogs are anticipated to grow rapidly at a CAGR of 6%, driven by the increasing adoption of targeted therapies and the growing need for more effective treatments. SGC stimulators, a newer class of drugs, are expected to experience significant growth, with a projected CAGR of 7%. As these stimulators gain traction in treatment regimens, they offer considerable potential for improving patient care and advancing therapeutic strategies over the next decade.

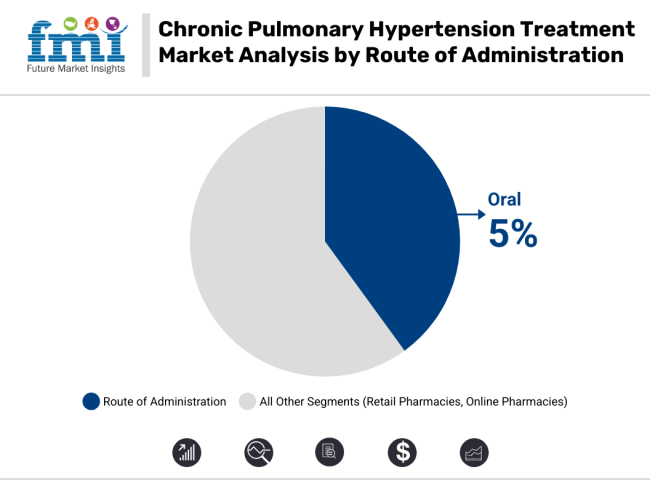

The chronic pulmonary hypertension treatment industry is expected to see growth across multiple routes of administration. The oral route is expected to dominate due to its convenience, ease of use, and patient preference, leading to a stable CAGR of 5%.

Oral treatments are widely preferred for chronic conditions as they offer a non-invasive and straightforward option for long-term management. Intravenous/Subcutaneous therapies are likely to see a moderate CAGR of 4%, driven by their higher efficacy for severe cases and rapid action.

However, these therapies are limited by patient preference, ease of administration, and the need for medical supervision. Inhalational therapies, which are gaining popularity for their ability to deliver medication directly to the lungs, will see a faster CAGR of 6%. Though their growth potential is promising, the complexity of the required equipment may slightly hinder their widespread adoption compared to oral treatments.

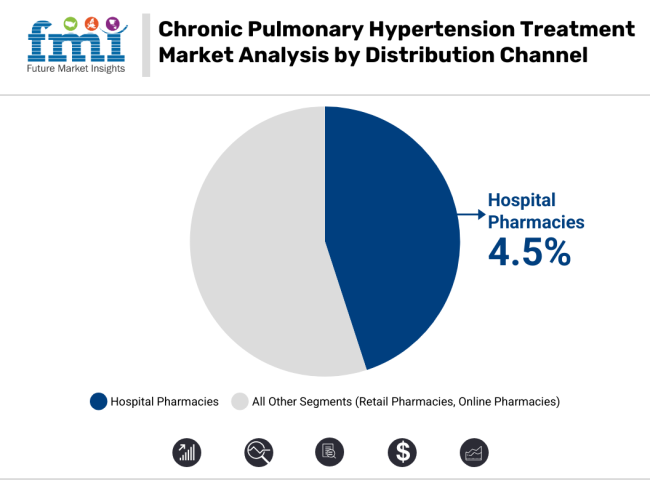

Hospital pharmacies currently lead the distribution of chronic pulmonary hypertension treatments, with a steady CAGR of 4.5%. This growth is driven by the large number of patients receiving care in specialized hospital settings, where treatment regimens are closely monitored.

Retail pharmacies are also experiencing steady growth, with a CAGR of 5%, thanks to increasing patient access, convenience, and the availability of both over-the-counter and prescription medications.

Online pharmacies, however, are growing rapidly at a 7% CAGR, as patients increasingly turn to digital platforms for ease of access and 24/7 availability. The convenience of having medications delivered directly to patients’ doors, combined with greater adoption of e-commerce and telemedicine, is propelling the rapid rise of online pharmacies in the landscape.

In 2024, the chronic pulmonary hypertension treatment industry saw significant developments. Vertex Pharmaceuticals acquired Alpine Immune Sciences for USD 4.9 billion, marking a major biopharma deal.

The global pulmonary arterial hypertension (PAH) industry is projected to experience continued growth, driven by rising prevalence and awareness. Future Market Insights indicates that the PAH drugs industry will see substantial expansion due to increasing demand for effective treatments.

Additionally, Dimension Industry Research highlights a strong upward trajectory for the PAH industry, fueled by advancements in drug development and growing industry penetration. These developments indicate a dynamic and expanding landscape, with strategic mergers and acquisitions accelerating progress.

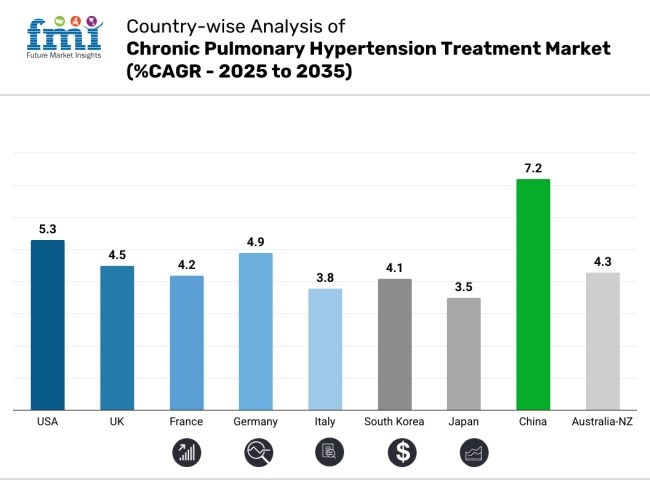

The USA is projected to experience a CAGR of 5.3% from 2025 to 2035, reflecting its lucrative industry for chronic pulmonary hypertension treatment. The country’s robust healthcare infrastructure, high prevalence of cardiovascular diseases, and ongoing advancements in medical research contribute to its strong growth potential.

The significant investment in healthcare innovation, coupled with regulatory support for new treatments, positions the US as a leader in the industry. The rise in awareness and improved diagnostic tools further drive the demand for better pulmonary hypertension therapies, reinforcing the growth trajectory.

The UK is expected to have a CAGR of 4.5% between 2025 and 2035. The National Health Service (NHS) plays a central role in providing treatment for chronic pulmonary hypertension, with increasing focus on early detection and management of the disease.

Regulatory initiatives and healthcare reforms are aimed at improving treatment accessibility, which is contributing to industry growth. While the UK faces budget constraints, the country is likely to maintain a steady demand for effective pulmonary hypertension therapies due to its well-established healthcare system and growing aging population.

France's chronic pulmonary hypertension treatment industry is anticipated to grow at a CAGR of 4.2% from 2025 to 2035. The country’s healthcare system is known for its high quality, ensuring that treatments are widely available.

France’s aging population and rising incidences of cardiovascular diseases drive the demand for pulmonary hypertension treatments.

Moreover, strong public and private investment in medical research and a favorable regulatory environment are boosting the landscape. The French industry's focus on improving quality of life for patients with chronic conditions adds to the long-term industry outlook.

Germany is projected to experience a CAGR of 4.9% from 2025 to 2035. As one of the largest healthcare industries in Europe, Germany benefits from advanced medical technology and a strong focus on research and development.

The demand for chronic pulmonary hypertension treatments is increasing, especially due to the rising geriatric population and advancements in drug therapies.

Government support for innovation and effective healthcare policies are also expected to drive the landscape. Germany's strong pharmaceutical sector and access to cutting-edge treatments make it a key industry in the European region.

Italy’s chronic pulmonary hypertension treatment industry is expected to grow at a CAGR of 3.8% from 2025 to 2035. While Italy faces challenges in healthcare financing, the country is actively working on improving treatment accessibility through public healthcare reforms.

The aging population and growing awareness about pulmonary diseases are increasing the demand for specialized treatments.

However, Italy's industry growth may be tempered by regional disparities in healthcare access and the country’s focus on cost-effective treatments. Nonetheless, government initiatives to address pulmonary hypertension will support steady industry growth.

South Korea is projected to see a CAGR of 4.1% from 2025 to 2035. Known for its advanced healthcare system and strong governmental support for medical research, South Korea is set for growth. The nation’s aging population, coupled with increasing incidences of heart and lung diseases, is expected to fuel demand.

Furthermore, the adoption of new technologies in treatment and diagnostic tools will contribute to industry expansion. South Korea's well-established medical infrastructure and high healthcare spending provide a favorable environment for industry growth.

Japan’s chronic pulmonary hypertension treatment industry is expected to grow at a CAGR of 3.5% from 2025 to 2035. Japan faces a high incidence of chronic diseases due to its aging population, making it an attractive industry for pulmonary hypertension treatments.

However, despite advanced medical technology, Japan's conservative approach to healthcare spending and regulatory challenges may limit rapid industry expansion. The government’s ongoing initiatives to improve the quality of life for elderly patients, as well as its commitment to healthcare innovation, will ensure steady growth over the next decade.

China is projected to grow at a CAGR of 7.2% from 2025 to 2035, reflecting a strong industry potential due to its large population and improving healthcare infrastructure. The country is witnessing rising rates of cardiovascular diseases, which is driving the demand for chronic pulmonary hypertension treatments.

The Chinese government is heavily investing in healthcare, making advancements in diagnostics and treatments more accessible. China’s rapidly expanding healthcare industry, coupled with growing awareness about chronic conditions, makes it one of the fastest-growing landscapes in the world for pulmonary hypertension treatments.

Australia and New Zealand together are expected to experience a CAGR of 4.3% from 2025 to 2035. Both countries have a well-developed healthcare system and strong government support for disease management.

The demand for chronic pulmonary hypertension treatments is growing due to the aging population and an increase in cardiovascular diseases. Australia’s focus on research and development, along with New Zealand's emphasis on improving healthcare access, creates a favorable industry environment. Both nations are expected to adopt newer technologies and treatment options, contributing to steady growth in this segment.

Johnson & Johnson (Actelion Pharmaceuticals)

United Therapeutics Corporation

Bayer AG

GSK (GlaxoSmithKline)

Teva Pharmaceutical Industries Ltd.

Merck & Co. (MSD)

Pfizer Inc.

Medtronic PLC

Liquidia Technologies

B. Braun Melsungen AG

the industry is divided into endothelin receptor antagonists, PDE-5 inhibitors, prostacyclin analogs, SGC stimulators

the industry is segmented into oral, intravenous/subcutaneous, inhalational

the industry is divided into hospital pharmacies, retail pharmacies, online pharmacies

the industry is studied across divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

The industry is driven by increasing smoking rates, pollution, an aging population, and advancements in treatment options.

The industry is expected to grow steadily, fueled by rising awareness, improved healthcare access, and innovations in drug treatments.

The key players in the industry include GlaxoSmithKline plc (GSK), AstraZeneca plc, Boehringer Ingelheim International GmbH, Novartis International AG, Teva Pharmaceutical Industries Ltd., Sanofi, Regeneron Pharmaceuticals, F. Hoffmann-La Roche Ltd., Merck & Co., Inc., Sunovion Pharmaceuticals Inc., Chiesi Farmaceutici S.p.A., NeuroVive Pharmaceutical AB, Integra LifeSciences Corporation, Medtronic PLC, Neuren Pharmaceuticals Ltd., Johnson & Johnson Services Inc., Smith & Nephew, Stryker, B. Braun Melsungen AG, Neural Analytics, Inc.

The bronchodilator segment is expected to dominate due to its widespread use in managing.

The chronic pulmonary disease industry is expected to reach a value of USD 12.57 billion by 2035, driven by increased treatment adoption and new drug launches.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Drug Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Route of Administration, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Drug Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Route of Administration, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Drug Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Drug Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Route of Administration, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Drug Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Route of Administration, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: South Asia Market Attractiveness by Drug Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: East Asia Market Attractiveness by Drug Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Route of Administration, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 137: Oceania Market Attractiveness by Drug Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Route of Administration, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Drug Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Route of Administration, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Drug Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Drug Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Drug Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Route of Administration, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Route of Administration, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Route of Administration, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 157: MEA Market Attractiveness by Drug Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Route of Administration, 2023 to 2033

Figure 159: MEA Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chronic Sarcoidosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Phase Markers Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Chronic Lymphocytic Leukemia Market Size and Share Forecast Outlook 2025 to 2035

Chronic Dryness Repair Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Chronic Skin Redness Care Market Size and Share Forecast Outlook 2025 to 2035

Chronic Hepatitis B Virus Testing Market Size and Share Forecast Outlook 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Chronic Disease Management Market Size and Share Forecast Outlook 2025 to 2035

Chronic Brain Damage Treatment: Trends, Growth, and Key Developments

Chronic Granulomatous Disease (CGD) Management Market – Size, Share & Trends 2025 to 2035

Chronic Pain Market Analysis – Growth, Demand & Forecast 2024 to 2034

Chronic Refractory Cough Treatment Market – Growth & Innovations 2025 to 2035

Chronic Venous Occlusions Treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Respiratory Diseases Treatment Market

Chronic Smell and Flavor Loss Treatment Market – Innovations & Growth 2025 to 2035

Chronic immune thrombocytopenia treatment Market Size and Share Forecast Outlook 2025 to 2035

Chronic Obstructive Pulmonary Disease (COPD) Market Trends – Growth & Forecast 2023-2033

Late Stage Chronic Kidney Disease Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Pulmonary Fibrosis Biomarker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA