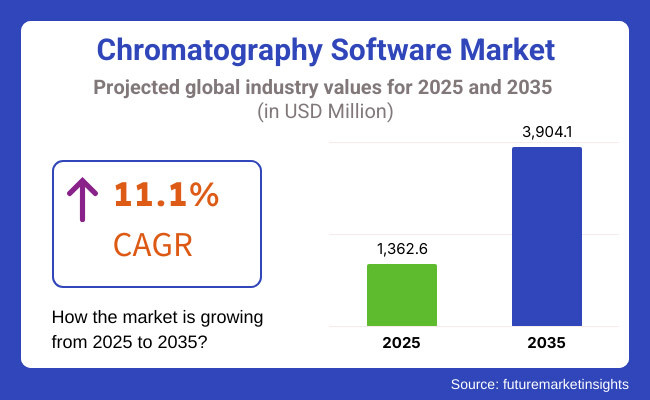

Demand for chromatography software solutions is expected to rise during the forecast period between 2025 and 2035 due to need for accurate data while complying with regulatory standards and digital lab solutions. The market is anticipated to be worth USD 1,362.6 Million in 2025 and is projected to reach USD 3,904.1 Million by 2035, witnessing a CAGR of 11.1% during the forecast period.

Chromatography software is essential for modern analytical laboratories by improving data management, automating workflows, and facilitating compliance with regulatory requirements including FDA and Good Laboratory Practices (GLP). The market is also growing due to the increasing adoption of cloud-based chromatography software, integration of artificial intelligence (AI), and advancements in data analytics. Nonetheless, the market may be hampered by certain challenges, such as increased software implementation costs, data security hazards, and the requirement for specialized training. Solutions to these problems include user-friendly interfaces, stronger cybersecurity features, and scalable solutions that can meet various laboratory needs.

North America leads the chromatography software market, with the USA at the forefront. Strong demand for advanced chromatography data systems is mainly driven by the presence of major pharmaceutical, biotechnology, and food safety testing companies. Regulatory compliance needs, particularly those of the USA FDA and Environmental Protection Agency (EPA) are speeding up the adoption even more. AI-driven analytics, cloud-based platforms, and cybersecurity features are on the rise and upgrading software capabilities. Moreover, surging investments in digital transformation across laboratories and increasing collaborations between software providers and research institutes are driving the market growth.

The chromatography software market in Europe is driven by high GDP input in Germany, the UK, and France. Demand for compliance-focused software solutions is being driven by the region’s strict legislative regulations on pharmaceutical quality control, environmental monitoring and food safety. There is a growing trend towards the use of digital data management systems in European laboratories to enhance workflow efficiency and traceability. Innovations in chromatography software are also driven by collaborations between academia, government-funded research institutions, and private organizations. In the transition of industries toward automated lab solutions and balance of paperless records, the sophistication of chromatography software is expected to further retrain.

Asia-Pacific will witness the highest growth for the chromatography software market, due to a rapid growth in the areas of the pharmaceutical manufacturing and biotechnology research, as well as food testing laboratories, especially, in China, Japan, and India. The demand from the market is being driven by government initiatives that promote laboratory automation and digitalization. The rising emphasis on drug safety, regulatory compliance, and precision medicine in the region is prompting laboratories to adopt advanced chromatography data systems. The increasing adoption of cloud-based solutions and AI-powered chromatography software is improving both efficiency and data integrity. The market growth is expected to continue despite challenges such as infrastructure limitations and different regulatory frameworks, which are factors offering high-throughput analytical solutions.

Challenge

High Implementation Costs and Data Security Concerns

High costs related to the implementation of chromatography software in terms of licensing fees, system integration, and user training, is one of the major challenges of the chromatography software market. Small and mid-sized laboratory budget constraints limit widespread adoption. Finally, issues of data security and regulatory compliance create obstacles especially in the case of cloud-based implementations. They are evolving their offerings into subscription-based models that are cost-effective and upgrading their cybersecurity functionality to protect data from any breach and to address any regulatory concerns.

Opportunity

Growth of Cloud-Based and AI-Powered Chromatography Software

Low Cost Based, Increasing use of Cloud Chromatography Software and AI Based Analyses, Growth Opportunities in these areas The cloud provides remote data access, scalability, and real-time collaboration, making it a perfect fit for multinational research organizations and CROs. Innovative AI-based software is increasingly optimizing the entire laboratory process, enabling accurate data, the identification of peaks, and predictive maintenance of their chromatography instruments. The progressive evolution of laboratories towards digital transformation will mean that next-gen chromatography software solutions will be in high demand, leading to long-standing market growth in the ushering decade.

Cloud-based chromatography data systems (CDS), AI-assisted peak integration, and electronic lab notebooks (ELNs) facilitated better data management and optimised workflows. Software development was guided by compliance with Good Laboratory Practices (GLP), Good Manufacturing Practices (GMP), and FDA regulations. But high software costs, complexities associated with integration with legacy chromatography instruments, and data security concerns have hindered the market growth.

The development of AI-powered chromatography analysis, blockchain-based data security, and real-time cloud-based monitoring will revolutionize the market from 2025 to 2035 and beyond. In order to increase efficiency and reproducibility, the use of components for machine learning for predictive analytics, smart automation for method development, and digital twin technology for simulational modeling chromatographically in real-time will all be augmented. Improvements in IoT-connected chromatography software, edge computing, and AI-driven automated troubleshooting will continue to reshape analytical workflows. Moreover, verification of data integrity by blockchain-enabled AI systems, robotic chromatography, and completely autonomous chromatography laboratories will usher in in a revolutionary approach to regulatory compliance and laboratory operations.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with FDA 21 CFR Part 11, GLP/GMP guidelines, and data integrity regulations. |

| Software Functionality | Widespread use of chromatography data systems (CDS), electronic lab notebooks (ELNs), and integrated laboratory information management systems (LIMS). |

| Industry Adoption | Growth in pharmaceutical, environmental, and food testing laboratories. |

| Automation & Smart Analytics | Early adoption of AI-driven peak detection and cloud-based CDS platforms. |

| Market Competition | Dominated by chromatography instrument manufacturers, software vendors, and laboratory informatics providers. |

| Market Growth Drivers | Demand fueled by regulatory compliance, efficiency in large-scale analytical labs, and cloud-based data management. |

| Sustainability and Environmental Impact | Focus on reducing paper-based documentation, implementing cloud storage, and optimizing resource utilization. |

| Integration of AI & Machine Learning | Limited AI use in data processing and peak integration. |

| Advancements in Cloud Computing & IoT | Cloud-based data storage and remote chromatographic analysis. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven audit trails, blockchain-backed regulatory compliance, and fully automated GLP-compliant software ecosystems. |

| Software Functionality | Expansion into AI-powered real-time data analysis, IoT-connected chromatography systems, and predictive chromatographic troubleshooting. |

| Industry Adoption | Adoption in autonomous research labs, AI-assisted pharmaceutical R&D, and real-time personalized medicine analytics. |

| Automation & Smart Analytics | Large-scale implementation of self-learning chromatography software, AI-assisted troubleshooting, and real-time digital twin modeling. |

| Market Competition | Increased competition from AI-driven analytics firms, blockchain-based lab security providers, and digital twin simulation platforms. |

| Market Growth Drivers | Growth driven by fully autonomous laboratories, AI-driven method optimization, and decentralized real-time chromatographic monitoring. |

| Sustainability and Environmental Impact | Adoption of carbon-neutral data centers, blockchain-enabled green computing, and predictive energy-efficient chromatography software. |

| Integration of AI & Machine Learning | AI-powered adaptive method development, automated anomaly detection, and predictive maintenance for chromatography instruments. |

| Advancements in Cloud Computing & IoT | Evolution of edge computing for real-time analytics, IoT-connected chromatography monitoring, and decentralized AI-driven software platforms. |

North America dominates the chromatography software market: due to the growing trend of automation in analytical laboratories, strong pharmaceutical and biotechnology industries, and regulatory compliance requirement by FDA and EPA, chromatography software and systems are widely accepted in this region.

The increasing demand for data integrity, increased workflow efficiency, and integration with laboratory information management systems drives the demand for advanced chromatography software solutions. Moreover, increasing funding towards AI-based data analytics and cloud-hosted chromatography platforms are improving the access to real-time data as well as remote monitoring. Moreover, growing use of high-throughput drug discovery and quality control testing in biopharmaceuticals will further fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 11.5% |

The United Kingdom chromatography software market is projected to capitalize on government investments in life sciences research, the expansion of pharmaceutical manufacturing, and increasing adoption of digital laboratory solutions. Cloud-based chromatography data systems (CDS) and AI-based analytical technologies are becoming more widespread as laboratories adjust to new demands for how data and workflows are managed.

The demand for advanced chromatography software with improved reporting and compliance capabilities is driven by the growing environmental and food safety testing market. Additional market growth is being driven by rising collaborations between academic institutions and private companies investing in R&D of precision medicine and biotechnology.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 10.8% |

The European Union chromatography software market is making the most of the leading corporations of Germany, France, and Italy to implement digital solutions in laboratories due to perceived stringent regulatory frameworks combined with advanced-research infrastructure. The increasing demand of secure and validated chromatography software solutions is attributed to the rise of emphasis on data security, audit trails and compliance with the guidelines pertaining to Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) across the EU. Beyond these options, the emergence of high-performance computing (HPC) and AI-enabled chromatography data interpretation is raising analytical accuracy and efficiency to new levels. The increasing applications of chromatography for drug development, forensic analysis, and environmental testing are driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.0% |

Japan’s chromatography software market is growing as a result of investments in pharmaceutical R&D, advances in analytical chemistry, and the country’s propensity for high-precision instrumentation. AI and machine learning are being embedded among chromatography software algorithms to streamline data processing, minimize human error, and bolster analytical sensitivity.

Furthermore, the push toward automation and digital transformation in clinical diagnostics and biopharmaceuticals in Japan is contributing to the demand for advanced chromatography data management systems. Market growth is further driven by the increase in the adoption of cloud-based and IoT integrated software solutions in quality control and industrial applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.7% |

Laboratories are challenged to be more operationally efficient driving increased demand for real-time data analysis, cloud connectivity and AI-enabled chromatography software in South korea. The need for advanced analytical software solutions is also being driven by the expansion of the country’s biopharmaceutical and semiconductor industries. Industry Trends Chromatography software integrated with robotic automation for application in industrial quality control procedures is shaping the market further.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.2% |

Chromatography Software market is further segmented into Standalone and Integrated based on the Segment, Standalone and Integrated holds a dominant share in the Chromatography Software Market as research institutions, pharmaceutical companies, and analytical laboratories are looking for advanced software solutions to streamline chromatographic processes, improve data interpretation, and enhance regulatory compliance. This software is necessary for rapid sample measurement, automating chromatographic workflows, and the ability to make real-time decisions. As laboratories continue to transform digitally and automate more of their processes, demand for high-performance chromatography software only increases.

Standalone chromatographic software has become widely used because they usually can run on different platforms, offering features for chromatographic analysis and peak recognition and quantification. Stand-alone software is capable of being used with various hardware configurations, so they are widely used throughout the lab.

This is owing to increasing demand for flexible and customized chromatographic software, especially among research institutions, contract research organizations (CROs), and academic laboratories. Over 60% of chromatography users prefer standalone software as it is independent of proprietary hardware and can support multiple chromatography instruments according to studies.

Additionally, the availability of high-performance stand-alone software solutions with enhanced user interfaces, AI-guided data interpretation, and advanced chromatogram processing has increased market demand, ultimately leading to workflow automation and improved analytical precision.

AI-driven analytical tools with predictive peak recognition, automated baseline correction, and real-time anomaly detection further accelerated market growth by guaranteeing enhanced chromatographic efficiency and data accuracy.

The last few years have seen the evolution of hybrid standalone software platforms, which have cloud-based backup features, remote troubleshooting abilities, and cross-platform compatibility due to which the market has grown as they ensure applicability on a wider scale and the accessibility of data more streamlined.

The focus on compliance and the adoption of sustainable software development practices with features such as energy-efficient algorithms optimization, automated error-correction mechanisms, improved cybersecurity and encrypted data storage have reinforced market expansion potential.

Standalone chromatography software can provide flexibility, compatibility with multiple devices, and execute functions independently, but the segment still encounters challenges due to high initial setup costs, limited integration with laboratory information management systems (LIMS), and data transfer inefficiencies. Increasing developments in AI-powered software structure, plug and play hardware coupling, and next-gen easy access to front-end interfaces are enhancing usability, affordability, and laboratory acceptance, which enable the standalone chromatography software market to flourish in the coming years across various developing countries worldwide.

By deployment, integrated chromatography software has remained the highest contributor in overall Chromatography Software Market sales owing to its synchronization with chromatography instruments, analytical workflow automation, and real time quality control. Integrated hardware software is designed to minimize human involvement, and allow our hardware to communicate to our analytical modules and vice-versa, hence rollout better results in a timely manner.

Adoption has been boosted by increasing demand for fully integrated laboratory systems, especially in pharmaceutical quality control, food safety testing and environmental monitoring. According to research, more than 65% of high-throughput analytical laboratories utilize integrated software solutions to reduce human error, speed up data processing, and enhance regulatory reporting.

The growth of sophisticated chromatography data systems (CDS) with improved compliance auditing, multi-user access, and automated management of sample sequences have also enhanced market demand, leading to enhanced laboratory efficiency and workflow standardization.

Adoption has been further propelled by the growing assimilation of cloud-based lab data management systems, which can provide remote monitoring, AI-enabled compliance reporting, and access to real-time performance analytics with better data security and access across global research networks.

In addition, the development of multi-device integrated chromatography software, enabling touchscreen compatible GUI's, mobile-device synchronization and IoT-enabled instrument connectivity has promoted the optimal growth of the market, assuring enhanced real-time monitoring and laboratory automation.

The emergence of artificially intelligent chromatographic data interpretation (ADCT-AI), characterized by self-learning algorithms, automated peak integration, and error predictive detection, has bolstered the market growth while providing greater accuracy, efficiency, and reproducibility in analytical workflows.

While offering a better outlook in terms of automation capabilities, real-time monitoring, and consolidation of data in one place, integrated chromatography software segment is challenged by the lack of cross-platform compatibility, higher costs of full-system upgrades, and complex software maintenance requirements. Nevertheless, the introduction of newly developed solutions, such as AI-based predictive maintenance, cloud-enabled automated calibration, and end-to-end blockchain-propelling compliance verification, are improving efficiency, scalability, and user experience, enabling continued growth for integrated chromatography software across the globe.

Chromatography Software Market Segments have a considerable share in both the On-Premise and Web & Cloud-Based segments which encompasses laboratories, pharmaceutical companies, and research institutions as the process of modernizing data management and analytical process continues. The deployment models significantly impact the accessibility, security, and operational efficiency of chromatographic techniques in software.

High adoption of on premise Chromatographic Software allows prompt reporting, personalized deployment, strict compliance, and avoidance of data hack. In contrast to cloud-based solutions, on premise deployment provides complete control over laboratory data, making it a suitable selection for stringently regulated fields such as pharmaceuticals, forensics, and biotechnology.

The adoption is driven by the rising demand for chromatography software deployment in-house, which is primarily coming from pharmaceutical manufacturers and regulatory agencies. Some studies show that more than 70% of pharmaceutical companies prefer an on-premise software solution that meets strict data security and confidentiality requirements.

The growing implementation of electronic on-premise chromatography systems, providing advanced encryption protocols, automated audit trails, and role-based access, has complemented market demand, ensuring considerable data integrity and regulatory compliance.

While on-premise chromatography software segment offers the advantage of data security, compliance and control over data, it demands high initial expenditure on IT infrastructure, complex working and poor scalability. But proprietary developments of AI-assisted cybersecurity solutions, automated data backup models, and next-gen hybrid deployment methods are bringing the much-needed cost efficiency, flexibility, and data protection improvements that will keep on-premise chromatography software flourishing in markets worldwide.

Laboratories continue to pursue flexible, scalable, and cost-effective deployment solutions, supporting the strong market growth for web & cloud-based chromatography software. The remote accessibility, real-time collaboration, and automatic software updates afforded by cloud-based chromatography software enable organizations like multi-location laboratories and contract research organizations to adopt the cloud in their operations, an option valuable in contrast with that of on-premise models.

This uptake has been spurred by increasing demand for laboratory data management systems integrated with cloud infrastructure, especially in high-throughput research environments. According to studies, more than 65% of modern laboratories use cloud chromatography software due to the easy data sharing capability, multi-user accessibility, and low IT maintenance costs.

Increased market demand for these solutions, which guarantee improved laboratory productivity and decision-making, has been driven by the proliferation of AI-enabled cloud platforms equipped with predictive analytics for the optimization of chromatographic processes, real-time outlier detection, and automated data trend analysis.

Around the world, this is followed by Europe and Asia, with cloud-based software providing benefits like scalability, remote accessibility, and reduced IT overhead, but cybersecurity risks, dependence on internet availability, and regulatory issues surrounding data storage regions remain the challenges faced by the market for cloud-based chromatography software. Consecutively, web & cloud based chromatography software can see sustained growth rate all across the globe, trackable through emerging technologies in AI enabled cloud security protocols, blockchain backed data integrity checking, automated disaster recovery solutions as increasingly relied upon courses of action that allow for trust, reliability, and deeper market acceptance.

The Chromatography Software Market is fuelled by rising demand for automation in analytical laboratories, regulatory compliance demands, as well as improvement in data integration and processing. Continuous expansion in demand for creative data handling systems across drug discovery, biotechnology, and environmental-testing applications is anticipated to drive the market growth. The latest trends in the industry include cloud-based software adoption, AI-driven analytics, and enhanced compliance features for regulatory reporting.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Agilent Technologies | 12-16% |

| Thermo Fisher Scientific | 10-14% |

| Waters Corporation | 8-12% |

| Shimadzu Corporation | 6-10% |

| PerkinElmer Inc. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Agilent Technologies | Develops advanced chromatography data systems (CDS) with cloud integration and regulatory compliance features. |

| Thermo Fisher Scientific | Specializes in chromatography software with real-time data processing and AI-driven analytics. |

| Waters Corporation | Offers laboratory information and chromatography software solutions tailored for pharmaceutical applications. |

| Shimadzu Corporation | Provides chromatography software with high-precision analytics and automated reporting capabilities. |

| PerkinElmer Inc. | Focuses on user-friendly chromatography software with enhanced connectivity for laboratory workflows. |

Key Company Insights

Agilent Technologies (12-16%)

Agilent leads in chromatography software innovation, providing advanced data management solutions with enhanced regulatory compliance tools.

Thermo Fisher Scientific (10-14%)

Thermo Fisher excels in AI-driven chromatography software, improving efficiency in data analysis and laboratory workflows.

Waters Corporation (8-12%)

Waters specializes in chromatography data systems (CDS) that support pharmaceutical and life science research applications.

Shimadzu Corporation (6-10%)

Shimadzu enhances its software portfolio with real-time analytics and automated regulatory compliance features.

PerkinElmer Inc. (4-8%)

PerkinElmer focuses on cloud-based and network-integrated chromatography software, enhancing laboratory efficiency.

Other Key Players (45-55% Combined)

Several software providers and analytical technology companies contribute to the expanding chromatography software market. These include:

The overall market size for the Chromatography Software market was USD 1,362.6 Million in 2025.

The Chromatography Software market is expected to reach USD 3,904.1 Million in 2035.

The demand for chromatography software will be driven by increasing adoption of automation in laboratories, rising need for efficient data management in pharmaceutical and biotech industries, advancements in analytical instruments, and regulatory compliance requirements for quality control.

The top 5 countries driving the development of the Chromatography Software market are the USA., Germany, China, Japan, and the UK.

The Integrated Chromatography Software segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Application , 2017 to 2033

Table 21: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Device Type, 2017 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Deployment Type, 2017 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application , 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 17: Global Market Attractiveness by Device Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Deployment Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Application , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 37: North America Market Attractiveness by Device Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Application , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Device Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Deployment Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 77: Europe Market Attractiveness by Device Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Deployment Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by Application , 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Device Type, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Deployment Type, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by Application , 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: Middle East and Africa Market Value (US$ Million) by Device Type, 2023 to 2033

Figure 102: Middle East and Africa Market Value (US$ Million) by Deployment Type, 2023 to 2033

Figure 103: Middle East and Africa Market Value (US$ Million) by Application , 2023 to 2033

Figure 104: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 106: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) Analysis by Device Type, 2017 to 2033

Figure 109: Middle East and Africa Market Value Share (%) and BPS Analysis by Device Type, 2023 to 2033

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) Projections by Device Type, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) Analysis by Deployment Type, 2017 to 2033

Figure 112: Middle East and Africa Market Value Share (%) and BPS Analysis by Deployment Type, 2023 to 2033

Figure 113: Middle East and Africa Market Y-o-Y Growth (%) Projections by Deployment Type, 2023 to 2033

Figure 114: Middle East and Africa Market Value (US$ Million) Analysis by Application , 2017 to 2033

Figure 115: Middle East and Africa Market Value Share (%) and BPS Analysis by Application , 2023 to 2033

Figure 116: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application , 2023 to 2033

Figure 117: Middle East and Africa Market Attractiveness by Device Type, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Deployment Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application , 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chromatography Resin Market Forecast and Outlook 2025 to 2035

Chromatography Instrumentation Market Size and Share Forecast Outlook 2025 to 2035

Chromatography Accessories & Consumables Market Growth – Trends & Forecast 2025 to 2035

Chromatography Reagent Market Growth – Trends & Forecast 2024-2034

Chromatography Silica Resins Market

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Gas Chromatography Columns Market

Gas Chromatography Detector Market

Immunochromatography Kits Market Size and Share Forecast Outlook 2025 to 2035

Liquid Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Portable Chromatography Systems Market Size and Share Forecast Outlook 2025 to 2035

Multimodal Chromatography Columns Market

Preparative Chromatography Market Size and Share Forecast Outlook 2025 to 2035

Supercritical Fluid Chromatography Market

Preparative and Process Chromatography Market Forecast and Outlook 2025 to 2035

Hydrophobic Interaction Chromatography Resins Market

Binary High Pressure Gradient Liquid Chromatography System Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA