Cholesterol-based raw materials application is used in pharmaceutical, biotechnology, and cosmetic, cholesterol Active Pharmaceutical Ingredient (API) market is all about their production and supply. Liposomal drug delivery systems Cholesterol API is used in the production of liposomal drug delivery systems, lipid nanoparticles (LNPs) and vitamin D derivatives.

Rising demand for cholesterol-based excipients in mRNA vaccines and gene therapies and targeted drug delivery systems is a major driver for the growth. In addition to that, the increasing usage of cholesterol in cosmetics, nutraceuticals, and ophthalmic preparations is driving the market.

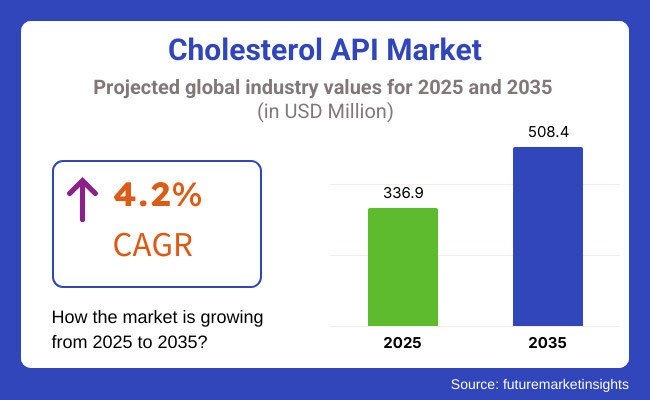

The worldwide cholesterol API market is expected to be USD 336.9 million by 2025 and likely to account for approximately USD 508.4 million by 2035, with a growth rate (CAGR) of 4.2% throughout considered years.

The overall compound annual growth rate (CAGR) is projected to correlate with a rise in lipid-based drug delivery technologies, the growing biopharmaceutical manufacturing and sustained development of lipid nanoparticle formulations. In addition, growing sustainability concerns and ethical sourcing policies are also expected to influence trends in the market towards the usage of synthetic and plant-based cholesterol API.

Explore FMI!

Book a free demo

The North American region accounted for a significant share of the cholesterol API market, owing to the strong presence of biopharmaceutical companies, rising demand for lipid-based drug formulations, and increasing focus of various companies in the country on developing mRNA vaccines. North America is spearheading the production of lipid excipients required to produce gene therapies, oncology drugs, and RNA-based therapeutics. Furthermore, regulatory approvals for the use of cholesterol-based excipients in vaccine formulations are expected to drive the growth of this market.

Europe accounts for a large share of the overall market, with Germany, France, and the UK venturing ahead in pharmaceutical research, biopharmaceutical production, and vaccines. In addition, the European Medicines Agency (EMA) focus on innovative drug delivery systems has led to an accelerated take up of cholesterol APIs in lipid-based formulations Furthermore, rising demand for high-purity cholesterol in dermatological and ophthalmic products in Latin America further bolsters the growth of the market.

The cholesterol API market in the Asia-Pacific region is expected to grow quickly on account of growing pharmaceutical manufacturing capabilities, drying contract development and manufacturing organization (CDMO) activities, and growing demand for lipid-based therapeutics. Strong investments in biotech innovations and vaccine production are seen in countries like China India and South Korea. Enjoying support from favorable government policies promoting local API manufacturing in the regions.

Challenge

High Production Costs and Regulatory Compliance

The Cholesterol API market restraints include the high costs related to purification, extraction, and synthesis. In addition, compliance burdens are increased with strict regulatory requirements regarding the quality, safety, and traceability of APIs. Moreover, raw material sourcing for animal-source cholesterol supply chain disruption may also disrupt the market and lead the price to fluctuate.

Opportunity

Rising Demand for Liposomal Drug Delivery and Plant-Derived Alternatives

The increasing pharmaceutical and biotechnology industries are driven the high demand for high purity cholesterol APIs, especially in liposomal drug formulations utilized in mRNA vaccines, targeted gifting and lipid-based delivery systems. Also, the new synthetic and plant-based cholesterol alternatives are helping to decrease dependence on animal-derived sources, providing a solution to sustainability concerns and expanding their regulatory approvals.

The cholesterol API market witnessed a significant push during the period 2020 to 2024 on account of its pivotal role in LNPs (lipid nanoparticles) utilized in mRNA vaccines, notably during the COVID-19 pandemic.

By 2025 to 2035 the market will be shifting to plant based and synthetic cholesterol substitutes to enhance product stability, quality and regulatory compliance. The market growth is also attributed to the technological advancements in bioprocessing and its use in fermentation-based cholesterol synthesis. Furthermore, the growing applications of nanomedicine, gene therapy, and lipid-based drug formulations will lead to opportunities for high-purity cholesterol APIs.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with GMP and pharmacopoeia standards (USP, EP, JP) |

| Technology Innovations | Traditional animal-derived cholesterol extraction |

| Market Adoption | Growth in mRNA vaccines, liposomal drug delivery, and nutraceutical applications |

| Supply Chain & Sourcing | High dependence on animal-derived cholesterol |

| Market Competition | Dominated by established API manufacturers and pharma giants |

| Sustainability Trends | Initial efforts in reducing dependency on animal sources |

| Consumer Trends | Demand from vaccine production and lipid-based drugs |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter oversight on API purity, traceability, and sustainability in raw material sourcing |

| Technology Innovations | Plant-based and synthetic cholesterol production for increased scalability and purity |

| Market Adoption | Expansion in gene therapy, personalized medicine, and advanced nanocarrier formulations |

| Supply Chain & Sourcing | Shift towards fermentation-based and biosynthetic cholesterol for consistent supply |

| Market Competition | Rise of biotech firms specializing in synthetic cholesterol and lipid-based formulations |

| Sustainability Trends | Large-scale adoption of plant-based and enzymatically synthesized cholesterol for greener production |

| Consumer Trends | Growth in cholesterol API applications in regenerative medicine and targeted drug delivery |

The United States Cholesterol API Market is projected to grow at a CAGR of around ~3% during the forecast period owing to prevalence of cardiovascular diseases and demand for lipid-based drug formulations. The robust pharmaceutical industry of the country, complemented by significant R&D expenditure in drug development, is driving the growth of cholesterol APIs for their utilization in a plethora of potent therapeutic applications, such as lipid nanoparticles for drug delivery.

Another key driver is the increasing usage of cholesterol-based APIs in vaccine formulations, including mRNA-based vaccines. Moreover, growing approval of cholesterol-based APIs by FDA for novel formulation of drugs is expected to drive the market growth, along with increasing trend of personalized medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK Cholesterol API market is based on growing investments in pharmaceutical research, biotechnology, and a wide range of bioactive compounds. Statements issued by its officials indicate that there is a strong emphasis on developing innovative drug delivery systems (such as lipid-based formulations) across the country, which will in turn result in high demand for APIs with high purity cholesterol.

Several factors such as the evolving biopharmaceutical industry in the UK, particularly vaccine and gene therapy, also play an important role in the continued growth of the market. The increasing incidence of metabolic disorders, along with cardiovascular diseases, is further driving the appetite for cholesterol-based APIs in lipid-regulating medicines.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The European Union (EU) Cholesterol API market is expected to grow moderately due to the countries in the region having growing pharmaceutical and biopharmaceutical industry. Strict regulatory measures put forth by the European Medicines Agency (EMA) for high-purity APIS are prompting investment in advanced cholesterol API production.

These three countries alone account for a significant portion of the API produced, with many of their pharmaceutical and biotech firms involved in the production of cholesterol-based drug formulations. The rising application of the cholesterol APIs across lipid-based nanoparticle drug delivery systems such as mRNA vaccine technology is a key factor driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.9% |

The Japan Cholesterol APIs market is increasing on account of the well-established pharmaceutical industry in Japan and the advancement of lipid-based formulations. Key Market Drivers Cholesterol-Based Pharmaceuticals in Demand due to Rising Elderly Population in Japan According to the World Population Ageing 2023 report, there are around 3.6 million people aged 65 and over suffering from cardiovascular diseases in Japan.

Further, the country's dominance in biopharmaceutical innovation, especially with respect to nanotechnology-enabled drug formulations, is creating a conducive environment for the growth of cholesterol APIs. Moreover, government-backed initiatives promoting research in precision medicine and vaccine development are driving the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korean Cholesterol API market is gradually growing owing to the growing pharmaceutical and biotechnology industries. This has increased the country demand for use of cholesterol API in lipid based drug formulation, candidate for targeted therapies and vaccine delivery.

Increase in chronic ailments like cardiovascular diseases and neurodegenerative disorders are further driving the adoption of cholesterol APIs in drug formulations. The country is also contributing to the growth of the market through its advances in nanomedicine and lipid-based drug delivery technologies.

Increasingly, government backing for pharmaceutical R&D, domestic and global API manufacturers' partnerships is further improving the country's stand in the cholesterol API market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Gross and bioavailability of pharmaceutical applications continue to dominate the global market for animal-derived cholesterol APIs. Animal-derived cholesterol is obtained mainly from sheep wool and bovine sources, which are essential components of drug formulations, lipid-based carriers, and vaccine adjuvants. Because it is structurally similar to human cholesterol, this source is favored by pharmaceutical companies as it increases drug efficacy and absorption.

With rising adoption of lipid-based carriers for targeted drug delivery, this segment is expected to garner significant traction. Moreover, animal-based cholesterol APIs are critical in the synthesis of corticosteroids, vitamin D analog, and in the creation of cell culture media for biopharmaceutical production.

Although there are regulatory challenges related to animal-based sourcing and contamination, stringent quality control measures employed and advances in purification techniques have strengthened the market stability of this segment. Pharmaceutical manufacturers are now investing in improving and refining extraction and processing methods in compliance with Good Manufacturing Practices (GMP) and global safety standards. With the growth of pharmaceutical and biotechnology sectors, the animal-derived cholesterol APIs will continue being important in development of advanced drug delivery systems and therapeutics formulations.

The segment of plant-derived cholesterol API is growing rapidly as consumers and pharmaceutical companies switch their will towards the sustainable and animal-free ingredients. Derived from the sterols of natural plants, this cholesterol substitute is practical for vegan formulations as well as for bio-based pharmaceutical products. This trend towards both ethical consumerism and broader regulation of sustainability has further cemented the use of plant-derived cholesterol across a range of both medical and cosmetic applications.

Plant-derived cholesterol is now widely used in the cosmetic industry to support the emollient and skin-barrier repair function in anti-aging, skincare, and hair care products.

Plant-derived cholesterol APIs really have the potential to flourish, albeit not without hurdles such as yield efficiency and their slightly different structure compared to animal-based cholesterol, however, with constant bioengineering and extraction technology research, they are also steadily gaining of commercial viability. Growing significance of vegan pharmaceutical formulations and a rapidly expanding plant-based nutraceutical market will present significant opportunities for such plant-derived cholesterol APIs and establish them as a sustainable alternative throughout the industry.

The market is dominated by GMP (Good Manufacturing Practice)-compliant cholesterol APIs owing to the emphasis on safety, consistency, and regulatory approval in drug development and production. These APIs are manufactured with strict quality control measures that comply with both the European and North American regulatory boards (USA) Food and Drug Administration (FDA), European Medicines Agency (EMA)), making them ideal for pharmaceutical and biotechnological use.

The cost of GMP-grade cholesterol APIs is still relatively high, owing to the stringent manufacturing and validation processes; nonetheless, pharmaceutical companies deploy resources for the proper validation, paving the way for the uptick in high-quality APIs. As such, constant developments in the biopharmaceuticals market and personalized medicine will further support the growth of this segment, thus leading to sustainable market growth for GMP-compliant cholesterol APIs.

Non-GMP cholesterol APIs are an economical choice for research, industrial formulations, and cosmetic manufacturing applications that don't require pharmaceutical-grade compliance. This division meets increasing demand for cholesterol-based ingredients in the food, feed and cosmetics industries, where regulatory scrutiny is typically less rigorous than in pharmaceuticals.

Non-GMP cholesterol APIs are used in cosmetics for products such as moisturizers, anti-aging creams and hair care products. Likewise; non-GMP cholesterol finds extensive use in preclinical studies, drug formulation work, and biotechnological developments by research institutions and contract research organizations (CROs).

In addition to the cost-effective and extensive application range of the production of cholesterol APIs, non-GMP cholesterol APIs have specific limitations in the use of high-end medicine due to changes in purity and different regulations.

The market for Cholesterol Active Pharmaceutical Ingredient is growing steadily, and is highly beneficial to pharmaceuticals, biotechnology, cosmetics, and dietary supplements. Due to their utilization in liposomal drugs (liposomal formulation, development of mRNA vaccines, and lipid-based drug delivery etc.), Cholesterol APIs are critical in pharmaceutical development

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Dishman Carbogen Amcis Ltd. | 20-24% |

| Croda International Plc | 16-20% |

| Nippon Fine Chemical Co., Ltd. | 12-16% |

| Sigma-Aldrich (Merck KGaA) | 10-14% |

| Tokyo Chemical Industry Co., Ltd. (TCI) | 8-12% |

| Others | 22-28% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Dishman Carbogen Amcis Ltd. | Specializes in high-purity cholesterol API for liposomal drug formulations and vaccine delivery. |

| Croda International Plc | Manufactures lipid-based cholesterol APIs for mRNA vaccines, pharmaceuticals, and cosmetic formulations. |

| Nippon Fine Chemical Co., Ltd. | Produces high-purity cholesterol for lipid nanoparticles (LNPs) and ophthalmic drug formulations. |

| Sigma-Aldrich (Merck KGaA) | Supplies research-grade and pharmaceutical-grade cholesterol for R&D and commercial applications. |

| Tokyo Chemical Industry Co., Ltd. (TCI) | Develops synthetic and natural cholesterol APIs for pharmaceutical and nutraceutical applications. |

Key Market Insights

Dishman Carbogen Amcis Ltd. (20-24%)

Dishman Carbogen Amcis leads the cholesterol API market with high-purity cholesterol solutions for liposomal drug delivery, vaccines, and gene therapy. The company has a strong presence in the pharmaceutical and biotech industries, supplying customized API solutions.

Croda International Plc (16-20%)

Croda is a key supplier of lipid-based cholesterol APIs, particularly for mRNA vaccines (e.g., COVID-19 vaccines) and gene therapy applications. The company has advanced manufacturing capabilities to support the global demand for lipid nanoparticles (LNPs).

Nippon Fine Chemical Co., Ltd. (12-16%)

Nippon Fine Chemical focuses on pharmaceutical-grade cholesterol production, catering to ophthalmic drug formulations, lipid-based drug delivery systems, and nutraceuticals.

Sigma-Aldrich (Merck KGaA) (10-14%)

Sigma-Aldrich, a subsidiary of Merck KGaA, provides high-purity cholesterol APIs for research, biotechnology, and pharmaceutical applications. The company plays a crucial role in R&D for drug formulation and lipid-based delivery systems.

Tokyo Chemical Industry Co., Ltd. (TCI) (8-12%)

TCI offers synthetic and natural cholesterol APIs, widely used in pharmaceutical formulations, cosmetics, and dietary supplements. The company has an expanding presence in Asia-Pacific and North American markets.

Other Key Players (22-28% Combined)

The overall market size for cholesterol API market was USD 336.9 million in 2025.

The cholesterol API market is expected to reach USD 508.4 million in 2035.

The growth of the cholesterol API market will be driven by increasing demand in pharmaceutical formulations, advancements in lipid-based drug delivery systems, and rising adoption in cosmetic and dietary supplement industries for enhanced product efficacy.

The top 5 countries which drives the development of cholesterol API market are USA, European Union, Japan, South Korea and UK.

Animal-Derived Cholesterol APIs to command significant share over the assessment period.

Anti-hyperglycemic Agents Market: Growth, Trends, and Assessment for 2025 to 2035

At Home Heart Health Testing Market Analysis - Size & Industry Trends 2025 to 2035

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.