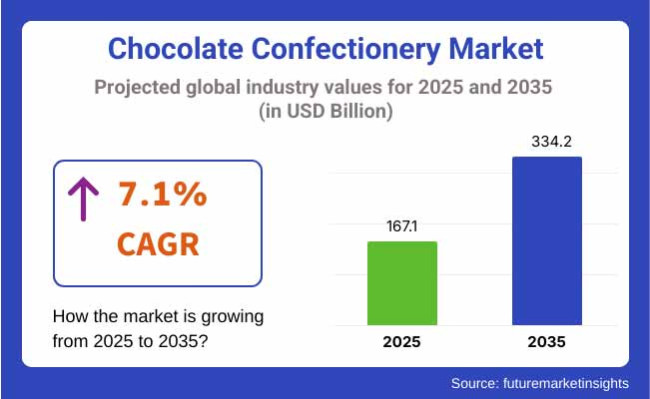

The global chocolate confectionery market is slated to reach USD 167.1 billion in 2025. The industry is poised to witness 7.1% CAGR from 2025 to 2035, registering USD 334.2 billion by 2035.

Chocolate confectionery industry is experiencing a steady development driven by various factors. Increasing demand among consumers for luxury and craft chocolates is a major driver, wherein consumers are willing to pay a premium for enhanced quality products with distinguishing flavor and experience propositions.

Holiday periods, celebrations, and festivities contribute substantially to the industry, as chocolate becomes easily used as a gift item. Innovation in packaging and combinations of flavors also generate demand, as businesses constantly seek to experiment with new concepts. Increased middle-class demand in developing markets is also creating high demand, with better disposable incomes allowing greater consumer affordability for high-end products.

Consumer trends in the chocolate confectionery industry are moving towards premium and healthier products. There has been increasing demand for high-quality and artisanal chocolates, with consumers opting for products that contain unique flavors, ethically sourced ingredients, and greater craftsmanship.

As more health-conscious food is being consumed, there is a definite shift towards low-sugar, dark chocolate, and products with added health benefits like antioxidants. The growth of the vegan and dairy-free category is also a sign of the shift towards plant-based products based on dietary needs and ethical concerns.

The industry during 2020 to 2024 was predominantly impacted by increased emphasis on health foods, and dark chocolate as well as sugar-free options gained traction with customers. High-quality and premium chocolates were also becoming increasingly popular because consumers wanted richer products with exciting tastes and responsible sources of materials.

The pandemic due to the COVID-19 outbreak also pushed people to eat more chocolates since comfort foods helped alleviate uncertainty and fear. In addition, e-commerce emerged as a major platform for the sale of chocolates, with online sites experiencing a surge in consumer buying.

The era witnessed a surge in demand for vegan and dairy-free chocolates, fueled by growing awareness of plant-based diets and lactose intolerance. Moreover, consumers started giving greater value to sustainability and ethical sourcing of ingredients, prompting companies to be more responsible.

Forward to 2025 to 2035, the chocolate confectionery industry will see more focus on sustainability, with businesses aiming to minimize their environmental impact and source ingredients sustainably. Plant-based and vegan chocolates will continue to grow, driven by increasing demand for dairy-free products.

Customized chocolate products, targeting health benefits like added antioxidants or functional ingredients, will also grow. In addition, the industry will witness increased innovation in product flavor, form, and packaging.

Chocolate businesses will focus more on employing environmentally friendly packaging materials and carbon-neutral certifications. Interest among consumers in artisanal and gourmet chocolates will persist, based on the drive for premium, superior, and ethically sourced products. E-commerce will expand further, and direct-to-consumer business models will provide customized, premium chocolate experiences.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Shoppers increasingly seek low-sugar, dark chocolates. They have fewer calories and more antioxidants, addressing the increasing consciousness for health and well-being. | Further emphasis on low-sugar and dark chocolates but a very sharp rise in demand for plant-based, dairy-free chocolates. They are preferred by those who have lactose intolerance, vegans, or moral consumers. |

| An increase in demand for upscale, artisanal, and gourmet chocolate items. Customers started appreciating the quality and distinctiveness of the chocolate they buy, choosing expert products. | Premium chocolates will diversify even further, with a focus on ethically obtained ingredients like Fair Trade cocoa, organic approvals, and distinctive, high-end chocolate experiences. |

| Higher sales of chocolates online as consumers shifted to e-commerce for convenience, particularly amid the pandemic. Businesses invested in e-commerce platforms, providing quicker deliveries and web-exclusive products. | E-commerce will remain dominant, with chocolate brands improving online purchasing experience through personalized suggestions, subscription services, and limited-edition products. |

| Responsible sourcing of cocoa and other materials was also a central focus, with brands advertising Fair Trade and Rainforest Alliance certifications as a way to appeal to sustainable-conscious consumers. | Increased emphasis on sustainable packaging, carbon-neutral production, and green practices. Consumers will insist on transparency in sourcing, such as minimizing environmental footprints and social responsibility. |

| Meaningful expansion of experimental and novel chocolate flavors, such as international flavors and mixing with fruits, spices, and herbs, providing a richer taste experience. | Flavor innovation will proceed, with brands venturing into new, exotic, and regional flavors, such as the addition of superfoods, adaptogens, and functional ingredients like CBD, collagen, or probiotics. |

| Increase in the popularity of vegan and dairy-free chocolates, targeting lactose-intolerant consumers and vegans. | Vegan and plant-based chocolates will go mainstream, no longer a niche category. Brands will continue to innovate with plant-based versions of milk chocolate, appealing to a wider audience. |

| As consumers took a greater interest in high-end products, there was increased emphasis on providing distinctive eating experiences through artisanal chocolates, specialty packaging, and gift-giving. | The experience-based trend will gain greater popularity, with chocolates positioned as lifestyle items. Customized gifting items, limited-series flavors, and experience chocolates (e.g., chocolate tasting sets) will gain momentum. |

The chocolate confectionery industry is exposed to various risks that may affect its profitability and growth. The most significant risk is the price volatility of raw materials, particularly cocoa. Cocoa is very sensitive to climate change and political tensions, and changes in these factors can create price volatility and supply chain interference.

Also, growing health concerns, such as obesity and diabetes at higher levels, might reduce the demand for high-sugar chocolates. With consumers growing more health-minded, there is also a danger that demand for regular chocolate will decrease as consumers shift to healthier alternatives like sugar-free or dark chocolates.

Growing criticism of sustainability practices is another possible risk. Other brands that do not embrace responsible sourcing, ethical working practices, and sustainable packaging may see their reputations tarnished, losing share to more sustainable competitors. Labeling and sugar content regulatory pressures will also rise, with associated compliance costs.

Economic recessions or downturns may, in turn, impact consumer expenditure on premium chocolate, given that such products tend to be discretionary luxury purchases. Finally, disruptions to distribution channels, such as shifts in consumer behavior towards online shopping, may pose challenges to conventional retail models that chocolate firms depend on.

| Segment | Value Share (2025) |

|---|---|

| Chocolate Bars | 31.7% |

The chocolate bars segment is poised to register 31.7% share in 2025. Chocolate bars are retailed extensively for a number of reasons, mostly because they are convenient, inexpensive, and versatile. One of the primary reasons chocolate bars are so popular is that they are portable.

Chocolate bars are simple to carry in a bag or pocket, and this makes them an easy snack for busy consumers on the go. This convenience aspect makes them a favorite treat for individuals seeking a quick indulgence at work, school, or while traveling.

Also, chocolate bars are highly available and suitable for different budget plans, ranging from low-cost, mass-produced ones to high-end, handcrafted ones. Such a broad price range makes chocolate bars suitable for people of diverse incomes. The competitiveness of chocolate bars as an impulse-buying choice in convenience stores, supermarkets, and vending machines is based on their affordability.

| Segment | Value Share (2025) |

|---|---|

| Milk | 46.4% |

The milk segment is projected to observe 46.4% share in 2025. Milk chocolate confectionery is in common sale for a number of important reasons, mostly because of its long popularity, versatility, and wide consumer acceptance.

Milk chocolate, a blend of cocoa, milk powder, sugar, and other elements, finds the perfect balance between sweetness and richness that suits a variety of tastes. This combination of rich texture and smooth, sweet taste makes it a comfort food that appeals to consumers of all ages, making it a confectionery staple.

Another explanation for its mass sale is its well-established industry presence. Milk chocolate has existed for more than a century, and its brand name is gigantic. Large chocolate companies have spent a lot of money on marketing and distribution, making milk chocolate the most widely consumed form of chocolate globally. This long history implies that customers have been exposed to milk chocolate since childhood, and it is still a default choice for indulgence and gift-giving.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.9% |

| UK | 7.2% |

| France | 7.5% |

| Germany | 6.8% |

| Italy | 7.3% |

| South Korea | 8.0% |

| Japan | 7.6% |

| China | 8.5% |

| Australia | 7.4% |

| New Zealand | 7.5% |

The USA chocolate confectionery market will grow at a CAGR of 6.9% during the period from 2025 to 2035, just under the worldwide rate but nonetheless strong given the maturity and size of the industry. The United States is one of the largest chocolate product markets, supported by high consumer demand from a variety of demographics.

The most preferred segment is milk chocolate, followed by growth in dark chocolate with consumers becoming more health-conscious. Premium chocolate products with greater cocoa content, organic status, and artisanal production are gaining popularity as consumers develop increasingly sophisticated tastes.

The other driving force for industry expansion in the USA is growing demand for plant-based and healthier versions of traditional chocolate products, such as sugar-free and vegan alternatives. The producers are responding to these trends through product formulation innovations.

Additionally, the usage of e-commerce platforms and direct-to-consumer selling channels is causing more convenience and availability when it comes to the purchase of chocolate products. Celebratory holidays also drive USA chocolate consumption, with a lot of customers enjoying chocolate gifts.

However, the industry is challenged by price volatility in cocoa and sugar that may impact production costs and, indirectly, retail prices.

The United Kingdom industry is expected to expand at a marginally higher CAGR of 7.2% from 2025 to 2035, driven by high demand for chocolate products, especially across festive seasons and special occasions.

The British industry is still one of the biggest consumers of chocolate and has a long history of eating chocolate confectionery as a snack or present. With growing demand for premium chocolates, including ethically traded cocoa, there is increasing growth in the industry as consumers increasingly care more about quality rather than quantity.

Demand for healthier alternatives is also increasing in the UK. Low-sugar, organic, and vegan chocolates are being opted for by consumers who are increasingly becoming health-aware.

Growing awareness about ethical and sustainable practices in chocolate production is impacting buying decisions as well, with companies that engage in fair trade practices and green packaging becoming popular. Premium chocolate, including premium chocolates from local, small manufacturers, has also experienced a steep rise in demand.

French industry is forecast to experience a 7.5% CAGR between 2025 and 2035, fueled by both traditional and contemporary trends. French consumers have a long-standing cultural affinity for chocolate, and it is therefore an integral component of the local diet.

Although milk chocolate is still the leading category, dark chocolate has experienced robust growth because of its perceived health benefits and greater cocoa content. France's established premium chocolate industry, comprising gourmet and artisanal offerings, is also playing a role in this favorable growth trend.

In Germany, the chocolate confectionery market will develop at a CAGR of 6.8% between 2025 and 2035, marginally lower than the world average but nevertheless with strong growth potential. Germany is a key industry in the European chocolate sector, with chocolate consumption being high across all demographics.

Demand for high-quality, dark chocolate is especially robust, as consumers increasingly look for healthier options. German consumers have a growing preference for chocolates made from sustainably sourced cocoa, as sustainability and fair trade certifications continue to be important purchasing criteria.

The industry for chocolate confectionery in Italy is forecast to expand at a CAGR of 7.3% between 2025 and 2035. Italy has a strong cultural tradition in the production of chocolate, especially in areas such as Piedmont, where chocolates based on hazelnuts are a local specialty, which drives the industry growth.

The industry is led by high-end, artisanal chocolates, and Italian consumers are increasingly turning towards high-end chocolate products based on single-origin cocoa beans and with added ingredients such as nuts and fruit.

The trend towards health-consciousness has also helped boost dark chocolate consumption in Italy, with consumers opting for products containing more cocoa and less sugar. Vegan and organic chocolate products are also gaining popularity as consumers prefer clean-label products.

Chocolate usage in Italy is highly related to festive traditions, especially Easter and Christmas, during which time festive chocolate products like chocolate eggs feature prominently.

In South Korea, the industry for chocolate confectionery is anticipated to expand at a strong CAGR of 8.0% during 2025 to 2035. South Korean consumers increasingly have a taste for chocolate, especially as the nation witnesses an increase in disposable income and shifting food trends.

Chocolate consumption is becoming more popular among young adults and teenagers, and as South Korea embraces more Western consumption patterns, demand for chocolate confectionery keeps rising.

Online shopping and e-commerce are major contributors to the South Korean chocolate industry, especially among the younger, digitally savvy population. Yet, growth in the industry might be moderated by volatile cocoa prices and competition from other snacking options that trend with health-based movements.

The industry in Japan is also expected to grow at a CAGR of 7.6% between 2025 and 2035, as the consumer population keeps on adopting various types of chocolate products. The chocolate industry in Japan is established and advanced, and consumers pay high prices for superior, novel chocolate products.

Japanese chocolatiers have perfected the art of blending traditional ingredients with Western chocolate fashions, providing a broad range of products, from upscale artisanal chocolate to mass-market affordable products.

There is a growing demand for dark chocolate and chocolate products with less sugar as health consciousness keeps on rising. Japanese consumers also appreciate chocolate products with unique textures and innovative flavors, thus creating an industry for premium chocolate gift items and limited quantities. The trend comes within the general gifting culture within Japan, where chocolate products are used for gifting on special occasions.

In China, the chocolate confectionery market is expected to expand at a remarkable CAGR of 8.5% from 2025 to 2035, mirroring the rising demand for indulgent snacks within the country as consumer buying power picks up.

Traditionally, the Chinese have consumed less chocolate compared to Western markets, but such is the trend these days as Chinese consumers are increasingly adopting Western dietary patterns. Urbanization, rising disposable income, and exposure to global chocolate brands are all the reasons behind this expansion.

Demand for high-end chocolate is on the rise, especially among China's younger consumers, who are more open to novelty flavors. Chocolate bars, pralines, and novelty items are gaining popularity as gift items during Chinese New Year and other celebrations. Dark chocolate is becoming increasingly popular as consumers in China are increasingly becoming health-conscious and demanding products with increased cocoa content and reduced sugar.

The Australian chocolate confectionery market is expected to expand at a CAGR of 7.4% from 2025 to 2035. Chocolate demand in Australia is robust, with milk chocolate continuing to be the largest segment, although premium chocolate is growing in popularity with consumers opting for better quality.

Australians are increasingly health-minded, and consequently, demand for dark chocolate with more cocoa, organic chocolates, and chocolates with reduced sugar levels is on the increase. Demand for chocolates containing added functional ingredients, including vitamins and minerals, is also gaining momentum.

Ethical sourcing and sustainability are increasingly valued by Australian consumers, and chocolate companies are meeting this with products carrying Fair Trade and Rainforest Alliance labels. As interest in vegan and plant-based diets increases, vegan chocolate products are also growing strongly.

There is immense demand for chocolate in the country and milk chocolate is the most widely consumed type. However, premium, artisanal, and luxury chocolate items are being led by increasing consumer interest in improved quality ingredients and sustainable sourcing. The demand for ethical and organic chocolate is growing, as consumers become ever more eco-friendly and in need of products which represent their lifestyle.

The competitive scenario for the chocolate confectionery sector is influenced by leading world players competing to hold their share of the industry while responding to shifting consumer needs. Large companies are concentrating on new product development, premium products, and expanding product portfolios to appeal to a wider audience. There is increasing demand for dark chocolate and healthier options, including sugar-free or vegan chocolates, as consumers increasingly emphasize health.

Several brands are also catching the sustainability trend by having ethically sourced products and sustainable packaging. Strategic alliances, acquisitions, and broadening of product lines to growth markets are typical moves made to consolidate industry presence. Moreover, internet marketing and influencer partnerships are becoming more widely used to target younger, technology-savvy customers.

| Company | Industry Share |

|---|---|

| The Hershey Company | 15-20% |

| Ferrero | 10-15% |

| Chocoladefabriken Lindt & Sprüngli AG | 7-10% |

| Mars, Incorporated | 12-16% |

| Mondelēz International | 8-12% |

| Nestlé | 7-10% |

| CEMOI Group | 2-4% |

| Barry Callebaut | 3-5% |

| Lake Champlain Chocolates | 1-2% |

| LOTTE | 2-4% |

| Company | Key Offerings/Activities |

|---|---|

| The Hershey Company | Has a big portfolio of chocolate bars, candies, and snacks such as Hershey's Milk Chocolate, Reese's, and Kisses. Is developing its product portfolio with healthier, sugar-free products and sustainable cocoa sourcing. |

| Ferrero | Premium chocolate brands like Ferrero Rocher, Kinder, and Mon Chéri are famous under it. It prioritizes sustainability by ensuring cocoa is sourced responsibly and environmental footprint is minimized. |

| Chocoladefabriken Lindt & Sprüngli AG | Provides high-end chocolate products, such as Lindt Swiss Chocolate, Lindor truffles, and Lindt Gold Bunny. Emphasizes luxury, high-quality chocolates and building its worldwide presence through creative marketing. |

| Mars, Incorporated | Brands include M&M's, Snickers, and Mars bars. Spends significantly on product innovation, healthier choices, and sustainability, such as the Cocoa for Generations initiative to secure sustainable cocoa supply. |

| Mondelēz International | Responsible for brands such as Cadbury, Toblerone, and Milka. Seeks to diversify its products with healthier snacks, low-sugar, and premium chocolate products, and places emphasis on sustainability and responsible sourcing. |

| Nestlé | Has a large portfolio of chocolate products under brands such as KitKat, Nesquik, and Smarties. Significant focus on healthier product alternatives, sustainability programs, and innovation in plant-based chocolate substitutes. |

| CEMOI Group | Produces high-end chocolate products and focuses on its cocoa supply chain's traceability and sustainability. Both retail and bulk chocolate solutions are available. |

| Barry Callebaut | Leading supplier of cocoa and chocolate products to the food industry. Specializes in offering customized chocolate solutions and is a proponent of sustainability efforts such as sourcing 100% certified sustainable cocoa. |

| Lake Champlain Chocolates | Offers artisanal and gourmet chocolates, including truffles, bars, and hot chocolate. Focuses on high-quality, handcrafted products made with ethically sourced ingredients. |

| LOTTE | Famous for chocolate brands such as Lotte Choco Pie and Ghana Chocolate. Invests in spreading its industry footprint in Asia and diversifying its offerings with emphasis on novel combinations of flavors and innovative packaging. |

Key Company Insights

The Hershey Company (15-20%)

The Hershey Company is one of the world leaders in the world chocolate confectionery category with its iconic brands of Hershey's Milk Chocolate, Reese's, and Kisses. Hershey is also building its product portfolio with healthier variants such as sugar-free and low-calorie variants.

The company is also focusing on sustainability with promises of sustainably sourced cocoa and green packaging. Hershey has been increasing its presence in international markets and employing advanced digital marketing strategies to appeal to younger generations.

Ferrero (10-15%)

Ferrero is a global premium chocolate leader with brands such as Ferrero Rocher, Kinder, and Mon Chéri. Ferrero has focused on expanding its product base to healthier items such as organic chocolates and reduced-sugar content products.

Ferrero's efforts towards sustainability include attempts at the sourcing of 100% certified sustainable cocoa. The company also seeks to increase its industry share in emerging markets and consolidate its presence through strategic acquisitions, such as acquiring Nestlé's USA confectionery business.

Chocoladefabriken Lindt & Sprüngli AG (7-10%)

Lindt & Sprüngli is renowned for its upscale high-quality chocolates and is renowned for brands like Lindt Swiss Chocolate and Lindor truffles. The company has been expanding its global presence and range of products, including sugar-free, plant-based, and organic chocolates to respond to the growing demand for healthier confectionery.

Lindt also focuses on sustainable cocoa sourcing and enhancing traceability across its supply chain, thus its products can meet the growing consumer demand for ethically sourced and quality confectionery.

Mars, Incorporated (12-16%)

Mars is a global leader in international chocolate commerce with well-known brands of M&M's, Snickers, and Mars Bars. It has been an eager follower in introducing healthier types of chocolate brands to its portfolio, i.e., less sugar, low-calorie chocolates, and plant-based options.

Mars has also taken the pledge towards environmental sustainability with "Cocoa for Generations," an initiative aimed at cocoa farmer sustainability. The firm also continues to invest in growth markets and digitalization to further connect with the consumer.

Mondelēz International (8-12%)

Mondelēz possesses some of the most recognized chocolate brands in the world, such as Cadbury, Toblerone, and Milka. The company has been most fixated on innovation and has introduced into the market products that cater to health-conscious consumers, such as products containing less sugar and more protein.

Mondelēz is also socially responsible and sustainable through initiatives like the Cocoa Life program that focuses on sustainable cocoa sourcing and engaging farmers. The firm is increasing its business in mature as well as emerging markets while seeking growth through digital as well as e-commerce platforms.

Nestlé (7-10%)

Nestlé is a global industry leader in chocolate with robust brands such as KitKat, Smarties, and Nesquik. Nestlé has been evolving with the industry by introducing a variety of healthier versions of its chocolate products, including low-sugar, gluten-free, and vegan products.

Nestlé is also committed to sustainability, having committed to sourcing 100% sustainable cocoa through its Nestlé Cocoa Plan. It keeps expanding into emerging markets and investing in research and development to meet consumer demands for healthier and more sustainable food products.

CEMOI Group (2-4%)

CEMOI Group is among the leading players in the luxury chocolate industry with its premium products. CEMOI focuses on producing luxury pralines and chocolates while emphasizing the use of sustainable cocoa sources. CEMOI has also been diversifying its products by bringing in organic chocolates and niche products due to growing demand for healthier products.

The company is also furthering its industry share in Europe and elsewhere in the world while promoting environmentally friendly packaging and sustainable sourcing.

Barry Callebaut (3-5%)

Barry Callebaut is a leading supplier of quality cocoa and chocolate ingredients to the food sector. The company excels at offering customized chocolate solutions and believes in sustainability through its "Forever Chocolate" commitment, aimed at improving the livelihood of the cocoa farmers and increasing traceability of the cocoa supply chain.

Barry Callebaut is spreading its wings globally and keeps innovating with a diverse portfolio of products ranging from sugar-free, plant-based, to organic chocolate options.

Lake Champlain Chocolates (1-2%)

Lake Champlain Chocolates is a local artisanal chocolate manufacturer that makes premium, handcrafted chocolate items. The company specializes in high-end truffles, chocolate bars, and hot chocolates.

The company focuses highly on organic and fair-trade ingredients and is popular among health-conscious as well as eco-conscious consumers. The company also focuses on regional markets and has gained a loyal consumer base through focus on local, sustainable, and ethical sourcing practices.

LOTTE (2-4%)

LOTTE is one of the largest producers of chocolate confectionery at the international level, particularly in Asia. Household names such as Lotte Choco Pie and Ghana Chocolate are dominantly present in its portfolio, as the company prepares to expand its customer base in both developing and emerging markets.

LOTTE is also venturing beyond its current product portfolio to diversify, introducing new-generation products with unique flavors and promoting healthier forms of chocolate with low-sugar and plant-based offerings. The company is spending on both offline and online marketing strategies to cover a wider industry base globally.

In terms of product, the industry is divided into boxed, chocolate bars, chips & bites, truffles & cups, and others.

With respect to type, the industry is classified into milk, dark, and white.

By distribution channel, the industry is divided into supermarkets & hypermarkets, convenience stores, online, and others.

Regionally, the industry is analyzed across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is slated to reach USD 167.1 billion in 2025.

The industry is predicted to reach a size of USD 334.2 billion by 2035.

Key companies include The Hershey Company, Ferrero, Chocoladefabriken Lindt & Sprüngli AG, Mars, Incorporated, Mondelēz International, Nestlé, CEMOI Group, Barry Callebaut, Lake Champlain Chocolates, and LOTTE.

China, slated to grow at 8.5% CAGR during the forecast period, is poised for the fastest growth.

Chocolate bars are being widely purchased.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Type, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Type, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chocolate Powdered Drinks Market Forecast and Outlook 2025 to 2035

Chocolate Bar Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Flavoring Compounds Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Wrapping Machine Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Couverture Market Size, Growth, and Forecast for 2025 to 2035

Chocolate Processing Equipment Market Size, Growth, and Forecast 2025 to 2035

Chocolate Wrapping Films Market from 2025 to 2035

Chocolate Flavors Market Analysis by Product Type, and Application Through 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Industry Share Analysis for Chocolate Bar Packaging Companies

Chocolate Syrup Market

Non-Chocolate Candy Market

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premium Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compound Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sugarless Chocolate Market

Industrial Chocolate Market Analysis by Product, Application, Type, and Region through 2035

Analysis and Growth Projections for Low-calorie Chocolate Business

Sugar-Free White Chocolate Market Trends - Demand & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA