With consumer response to demand, sustainability targets, and requirements for improved product protection, packaging of chocolate bars is evolving across the world. As premium, environmentally friendly, and personalized packaging demand keeps increasing, businesses are focusing on new materials, flexible packaging, and innovative packaging solutions.

Some of the key industry developments include sustainable choices, simple and appealing container design, and sophisticated barrier coatings for extended shelf life. The use of recyclable and compostable materials is becoming a more significant differentiation as consumer awareness and regulatory restrictions increase.

Explore FMI!

Book a free demo

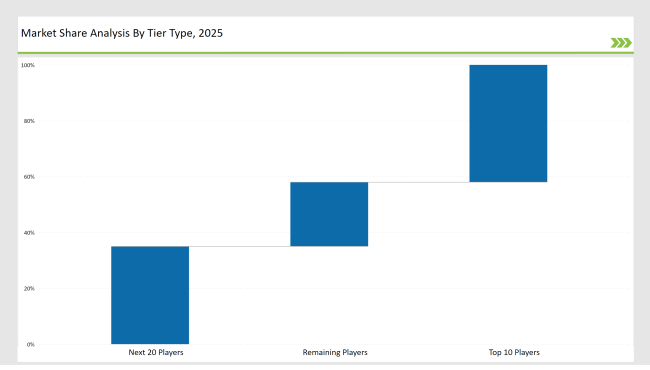

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Mondi, WestRock) | 15% |

| Rest of Top 5 (Huhtamaki, Berry Global) | 11% |

| Next 5 of Top 10 | 9% |

The need for high-quality, sustainable, and protective chocolate bar packaging is growing across several industry segments:

Manufacturers are investing in innovative solutions to meet evolving industry requirements:

Industry leaders are spearheading advancements in sustainability, smart packaging, and material efficiency.

Year-on-Year Leaders

To remain competitive in the evolving chocolate bar packaging market, suppliers should prioritize sustainability, automation, and material innovations. Key investment areas include:

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Mondi Group, WestRock |

| Tier 2 | Huhtamaki, Berry Global, Sonoco |

| Tier 3 | Constantia Flexibles, Smurfit Kappa, Innovia Films |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Launched compostable barrier films (March 2024) |

| Mondi Group | Introduced recyclable paper-based packaging (July 2023) |

| WestRock | Expanded lightweight packaging production (October 2023) |

| Huhtamaki | Developed plant-based biodegradable wraps (February 2024) |

| Berry Global | Innovated moisture-resistant chocolate bar films (May 2024) |

The chocolate bar packaging industry is shifting towards sustainability, branding enhancements, and high-performance materials. Key players are emphasizing:

The industry is expected to continue advancing in:

Rising demand for sustainable, premium, and protective packaging.

Amcor, Mondi Group, WestRock, Huhtamaki, and Berry Global.

Compostable packaging, premium aesthetics, and smart packaging technology.

Asia-Pacific, North America, and Europe.

Companies are investing in recyclable, compostable, and bio-based materials.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.