Natural green pigments produced from plant and algal sources, the chlorophyll color market caters to the food industry as a natural colourant, supplement the dietary requirements, pharmaceuticals for weight control drugs, and cosmetics. With a surge in consumer demand for clean-label, plant-based, and chemical-free products, chlorophyll-based colors are emerging popular.

One of the paramount driving factors for market growth is the growing preference for natural pigments as compared to their synthetic counterparts, especially in food & beverage vertical. Moreover, the increasing knowledge regarding the health benefits of chlorophyll, including its antioxidant, anti-inflammatory, and detoxification properties is bolstering its adoption in nutraceuticals and personal care products.

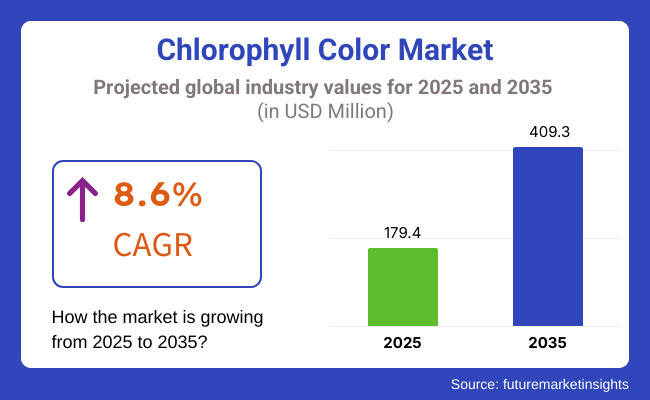

The global chlorophyll color market is expected to be worth USD 179.4 million in 2025, increasing to approximately USD 409.3 million in 2035, with a Compound Annual Growth Rate (CAGR) of 8.6% for the forecast period.

The estimated CAGR reflects since the growing regulatory approvals for the use of natural food colorants, growing consumer preference for organic products, advances in extraction and stabilization technologies for chlorophyll-based formulations. Also, the development of sustainable sourcing initiatives, along with the advent of water-soluble chlorophyll derivatives (chlorophyllin), is driving market opportunity in multiple end-use sectors.

Explore FMI!

Book a free demo

The North America chlorophyll color market accounts for a substantial share, owing to the increasing consumer trend towards natural and organic ingredients in food, beverages, and cosmetics. Leading demand for plant-based colorants is observed in the United States and Canada primarily due to regulatory restraints and an increasing health-conscious population. Furthermore, the growth of the nutraceutical and clean-label food segments is driving the growth of the market in this region.

Europe accounts for a significant part of the market, where Germany, France, and the United Kingdom are at the forefront of sustainable food innovations, as well as the adoption of organic products. EU (European Union) and EFSA (European Food Safety Authority). On top of this, both the rise of the vegan and plant-based food movement in the region, along with the growth in demand for chlorophyll-based colorants within the dairy alternatives, bakery and beverage sector, are also the highlighting factors driving growth.

Region-wise, Asia-pacific is expected to observe the higher growth in chlorophyll color market owing to increasing functional food industry, disposable income, and awareness of consumers toward natural ingredients. The demand for natural food additives, herbal supplements, and traditional medicine formulations with chlorophyll is growing in countries like China, India, and Japan. Additionally, strong government support for organic farming and developing plant-based products is expected to provide a more scope of the market on the rise.

Challenge

Stability Issues and Regulatory Constraints

The chlorophyll color market has stability issues as natural chlorophyll pigments degrade at temperatures, lights, and pH fluctuations, which limits their shelf life and scope for application in food, beverage, and cosmetics industries. Moreover, strict regulations about natural food colorants, mandatory labelling, and limiting the use of chlorophyll derivatives act as constraints for manufacturers. The production costs are remarkably high and the yields from plant sources are very low, making the extraction not cost effective at all.

Opportunity

Expansion in Clean Label Products and Functional Applications

Increasing adoption of chlorophyll-based colors in food, beverages, nutraceuticals, and cosmetics is being driven by demand for clean-label, plant-based, and organic food ingredients. Advancements in microencapsulation, stabilized formulations and algae-based chlorophyll are enhancing colour retention and heat stability, thus increasing its functionality. Besides being a colorant, chlorophyll as an ingredient is gaining attention for its potentially beneficial effects on health, particularly in immunity boosting and detox products, driven by the increasing consumer awareness of functional foods and natural antioxidants.

Contemplating upward demand of chlorophyll color in plant-based and clean-label formulations between 2020 to 2024 driven by increased natural ingredient awareness among consumers. But the propagation of market was slow owing to formulation difficulties, stability issues along with fewer usage in the heat sensitive products.

The market is expected to experience a range of innovative extraction techniques, including algae-based chlorophyll production and advanced encapsulation technologies, to improve stability by the years 2025 to 2035. The increased trend for bioactive colorants will also propel the use of chlorophyll in pharmaceuticals, functional foods and personal care products. Furthermore, eco-friendly and biodegradable packaging trends will favour sustainable sourcing and processing of chlorophyll-based colors.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Accelerated approvals for FGFR and IDH1 inhibitors |

| Treatment Innovations | Initial adoption of targeted therapies and combination treatments |

| Market Adoption | Increased use of FGFR and IDH inhibitors in advanced CCA cases |

| Early Detection & Diagnostics | Emerging use of NGS and biomarker-based diagnostics |

| Market Competition | Dominated by pharma giants developing targeted therapies |

| Healthcare Accessibility | High treatment costs limiting accessibility in developing regions |

| Sustainability & Drug Development Trends | Shift from chemotherapy to targeted therapy |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter regulations on companion diagnostics and biomarker-driven drug development |

| Treatment Innovations | Advancements in CAR-T therapy, RNA-based drugs, and next-gen immunotherapies |

| Market Adoption | Personalized medicine and AI-driven treatment strategies for early-stage intervention |

| Early Detection & Diagnostics | Expansion of liquid biopsy, AI-based imaging, and multi-omic profiling for early detection |

| Market Competition | Rise of biotech firms innovating in gene therapy, precision oncology, and tumor microenvironment targeting |

| Healthcare Accessibility | Government funding and expanded patient assistance programs to improve access |

| Sustainability & Drug Development Trends | Large-scale adoption of bioengineered drug delivery systems and nanomedicine-based treatments |

The United States chlorophyll color market is projected to grow significantly, attributed to the increasing utilization of natural food colorants from the food and beverage industry. Fortifying and balancing growing consumer demand for clean-label and plant-derived components drive the growth of chlorophyll-based organic colors in several food and beverages applications such as confections, dairy, and bakery.

This, along with strict FDA regulations preventing the use of synthetic food dyes and a rising popularity of organic and functional foods is boosting the market. In addition, the growth of the cosmetics and personal care industries, in which chlorophyll is being used as an active ingredient in skincare formulations owing to its antioxidant properties, is supporting market expansion.Furthermore, innovations in extraction and formulation technologies are improving the stability and versatility of chlorophyll colors, driving demand even higher.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.8% |

The incremental shift toward natural ingredients in food, cosmetic, and pharmaceutical industry is driving the UK chlorophyll color market further. As health-conscious consumers become more aware of the potential health risks from synthetic food dyes, the demand for natural alternatives is being driven by a growth in use of natural food colour.

Additionally, the increasing trend of plant-based and vegan products, with growing government support for sustainable food production, further fuel the market. Moreover, chlorophyll is also being used in functional beverages and dietary supplements for its detoxifying and antioxidant properties in the UK, helping to gain traction in the UK.Chlorophyll-derived formulations in skincare and haircare goods are also being used by the cosmetics industry in the UK, contributing to market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 8.3% |

The European Union (EU) Chlorophyll Color Market is one of the growing markets, due to New regulations regarding artificial Food colorants and the increased demand for natural Food ingredients. EFSA's promotion of the different plant-based colors has helped with the increased use of chlorophyll color in a number of applications.

Key Patent Holdings: Germany, France, Italy (organic food & beverage) Moreover, the growth of the nutraceutical and pharmaceuticals industry, where chlorophyll is used for its health benefits, is fueling the growth of the market.Moreover, the EU’s focus on sustainability is driving the production of natural and environmentally friendly colorants in cosmetics and personal care.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 8.2% |

Rising consumer demand for natural and health-promoting food ingredients is fueling the growth of Japan's chlorophyll color market. More importantly, the country’s emphasis on functional foods and beverages coupled with stringent food safety regulations are driving the move from synthetic to natural colorants.

Chlorophyll is also increasingly popular in Japan’s growing nutraceutical market, especially in detox and anti-aging products. Its robust biotechnology sector is also enabling new innovations in methods of extracting and formulating chlorophylls ways to improve the stability of color and widen the applications for use.In addition, the growing use of beauty and personal care products made with plant-based ingredients is also driving the demand for chlorophyll-based colorants.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.6% |

The market growth in South Korea is steady and is mainly backed by the increasing trend of natural and organic food ingredients among the food and beverage segment in the country. Due to the growing consumer demand for plant-based and functional foods, manufacturers are encouraged to deploy chlorophyll-based colorants in their products.

Also, the South Korean beauty industry that has focused on clean beauty and botanical formulations has embraced chlorophyll as a natural coloring and skin care ingredient. Additionally, the strong R&D focus of the country on sustainable and eco-friendly food additives is fostering market growth.The demand for chlorophyll-based natural colorants is further bolstered by government policies that encourage reducing synthetic additives in processed foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.4% |

As food and beverage manufacturers move toward clean-label and sustainable ingredients, the demand for organic chlorophyll color segment has increased significantly. Consumers are increasingly aware of the potential health risks of artificial additives, driving the move toward naturally derived colorants. With an increasing trend towards organic-certified products, with organic chlorophyll color, which is obtained from plants grown free of any synthetic fertilizer or pesticides, remains the leading in the market.

The organic segment is supported by strict regulations, as governing bodies work towards implementing cleaner formulations for foods. Both the European Food Safety Authority (EFSA) and the USA Food and Drug Administration (FDA) have guidelines supporting natural and organic color additives, leading to further adoption of them in the food and beverage industry. Moreover, innovative improvements of organic extraction methods have enhanced the stability and vibrancy of the color (chlorophyll color) which is anticipated to expand the application of these natural dyes into premium and health-oriented product formulations.

Although production costs on plant-based and/or organic diets are relatively high, this growing trend in the trends of gradually normalizing healthy diets has a positive impact on the rapid growth of organic chlorophyll color. This, along with rising investments in eco-friendly processing technologies and sustainable sourcing, is anticipated to create significant growth prospects for this segment, making it a preferred and reliable choice among environmentally responsible brands and health-conscious consumers.

Regular chlorophyll color is well established in the market segment, owing to its price advantage and wide industrial applications. For food, beverage and cosmetic companies looking to provide natural colours without the organic price tag, conventional chlorophyll colour is cost effective and reliable as it is derived through standardized processes.Largely used in mainstream food products, such as those related to dairy, confections, and bakery, this segment is capable of contributing bright green colors to attract consumers visually. Conventional chlorophyll color is also used in the cosmetic and pharmaceutical industries for its antioxidant effects and skin-friendly advantages, widening the market prospects.

Despite being a matter of concern and controversy due to synthetic processes and chemical residue remnants, further study on cleaner extraction processes is aiding in the safety and acceptance of regular chlorine dye. The low price and versatility of this segment make sure its relevance on the world stage, especially in sectors of food production that are sensitive to price.

The beverage industry is the most active consumer of the chlorophyll color market, and manufacturers are using natural pigments to emphasize their products and clean-label requirements. Chlorophyll-derived colors feature within a host of 'functional drinks' ranges from herbal teas and energy drinks, to relaxing drinks and detox offerings, as brands and manufacturers try to respond to consumer demand for plant-derived ingredients with health benefits.

Chlorophyll colours have also been adopted by plant milks like almond, oat and coconut milk to produce visually attractive formulations. Chlorophyll color is also gaining a foothold in terms of demand thanks to the emergence of green smoothies and vegetable-based beverages, which promote aesthetic principles of natural-ness while potentially delivering health benefits. The rising interest in sustainable and organic drinks has attracted mainstream industry players to esthetic specifications of chlorophyll color to ensure consistent market growth.

Aspects of color stability, particularly for chlorophyll colors in acidic environments continued to present challenges, but recent innovations in microencapsulation and emulsification have greatly benefited the coloration behaviour of these colorants in beverage applications. Chlorophyll color has a promising future, with great potential for growth as the demand for functional beverages continues to rise, and its applications expand to other applications allowing manufacturers to stand out from the competition with a natural colorant.

The bakery, snacks & cereal segment has gained strength over the past years for contributing to the growth of chlorophyll color market, as consumers are inclined towards products that looks appetizing and are formulated naturally. This trend towards clean-label bakery products has encouraged producers to replace synthetic colorants with nature-friendly alternatives particularly that can be explained by the unique characteristics of chlorophyll as a natural green colorant.

In the snacks segment, chlorophyll color improves the visual appeal of vegetable chips, granola bars, and protein snacks, in line with growing interest in nutritious and wholesome foods with minimal processing. To enhance the aesthetic appeal of organic and health-oriented cereal varieties, chlorophyll-based colors have also been used in the market for breakfast cereals, driving more consumers to opt for such products for wholesome breakfast options.

Product innovation remains a key driver in this sector as food manufacturers experiment with chlorophyll-injected bakery items including matcha-flavored pastries, green doughnuts and spinach-based bread. Although heat stability remains an issue in baking applications, continuous exploration of formulation techniques and temperature-resistant chlorophyll derivatives has addressed these challenges and contributed to sustained market growth.The facility is extended with proprietary know-how gained from years of experience in the bakery, snack and cereal segment where consumers are looking for natural and plant-based ingredients in their everyday food choices. As the food sector gravitates towards transparency and sustainability, the role of chlorophyll-based colors in setting the pace for sustainable natural solutions for food coloring will be increasingly critical.

The market for chlorophyll color is largely driven by increasing adoption of natural food colorants and in turn, the market for chlorophyll color is expected to achieve substantial growth during the forecast period. Various factors such as demand for clean-label products, increasing cognizance about plant-based ingredients, and strict regulations on the use of artificial colorants are propelling the market. Market opportunities are also growing with improvements in extraction technology and sustainable sourcing methods.

Market Share Analysis by Key Players

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| DDW, The Color House | 18-22% |

| Chr. Hansen Holding A/S | 14-18% |

| Sensient Technologies Corporation | 12-16% |

| Givaudan (Naturex) | 10-14% |

| Döhler Group | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| DDW, The Color House | Specializes in natural chlorophyll extracts with high solubility and stability for food and beverage applications. |

| Chr. Hansen Holding A/S | Offers chlorophyll-based natural colorants with enhanced heat and light stability for the dairy, confectionery, and nutraceutical industries. |

| Sensient Technologies Corporation | Provides customized chlorophyll solutions with high color vibrancy for confectionery, dairy, and pharmaceutical applications. |

| Givaudan (Naturex) | Develops organic and plant-based chlorophyll extracts for use in functional foods, supplements, and personal care products. |

| Döhler Group | Focuses on clean-label, plant-derived chlorophyll solutions for applications in beverages, bakery, and cosmetics. |

Key Market Insights

DDW, The Color House (18-22%)

DDW is the market leader in the brown and black color range by prioritizing high-performance natural colors. The company focuses on stable water- and oil-soluble chlorophyll extracts that can be used for a wide range of applications in food and beverages.

Chr. Hansen Holding A/S (14-18%)

Chr. Hansen is a key player in the high-stability natural colorant space, especially chlorophyll-based solutions for dairy, confectionery and plant-based food products. Its robust R&D capabilities allow it to create tailor-made solutions for international markets.

Sensient Technologies Corporation (12-16%)

Sensient Technologies provides customized and innovative food coloring solutions, developing chlorophyll based natural colorants adapted for pharmaceutical, dairy and confectioneries applications. Shelf-life stability and color intensity are emphasized by the company.

Givaudan (Naturex) (10-14%)

Naturex (a Givaudan company) offers organic chlorophyll extracts that meet the growing clean-label and sustainable trends. Their chlorophyll products have been broadly applied in factors meals, dietary supplements, and cosmetics.

Döhler Group (8-12%)

Strong supplier of plant derived chlorophyll colorants to the beverage, bakery, and personal care industry owing to the growing beverage industry, bourgeoning demand for clean label products, and increasing preferability for natural products, plant-derived extracts continue to be a significantly large segment in food and beverage applications.

Other Key Players (26-32% Combined)

The overall market size for chlorophyll color market was USD 179.4 million in 2025.

The chlorophyll color market is expected to reach USD 409.3 million in 2035.

The growth of the chlorophyll color market will be driven by increasing demand for natural food colorants, advancements in extraction and formulation technologies, and rising consumer preference for clean-label and plant-based ingredients in food and beverages.

The top 5 countries which drives the development of chlorophyll color market are USA, European Union, Japan, South Korea and UK.

Beverage Industry to command significant share over the assessment period.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.