The chloridometer industry is valued at USD 4.7 million in 2025. As per FMI's analysis, the chloridometer industry will grow at a CAGR of 4.6% and reach USD 7.4 million by 2035. The industry is propelled by the increasing need for precise determination of the chloride ion in clinical diagnostics, especially for the detection of electrolyte imbalance, cystic fibrosis, and kidney disease.

In 2024, the chloridometer landscape included significant developments in sensor technologies. Manufacturers incorporated ion-selective electrodes (ISEs) and solid-state electrodes into their systems, have improved the accuracy and reliability of chloride detection. This patent-filed innovation catered to the increasing clinical demand for accurate diagnostics in the healthcare environment, particularly in cystic fibrosis and kidney disorders.

By 2025, the industry is likely indicative of nascent growth supported by technology integration and a growing awareness. Sustained innovation and growing healthcare infrastructure in developing economies are likely to propel demand over the next decade. North America and Europe lead the way because of sophisticated healthcare systems, the Asia Pacific region is also becoming a significant growth force with increasing investment in medical diagnostics and laboratory automation.

Key Market Insights

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 4.7 million |

| Industry Size (2035F) | USD 7.4 million |

| CAGR (2025 to 2035) | 4. 6% |

This growth is attributed to the rising demand for automated and rapid chloride testing in clinical diagnostics. The further evolution of automation and portability of devices is also making testing easier and quicker. There are gains to be had for diagnostic labs, hospitals, and device manufacturers and a potential loss for providers who continue to work manually.

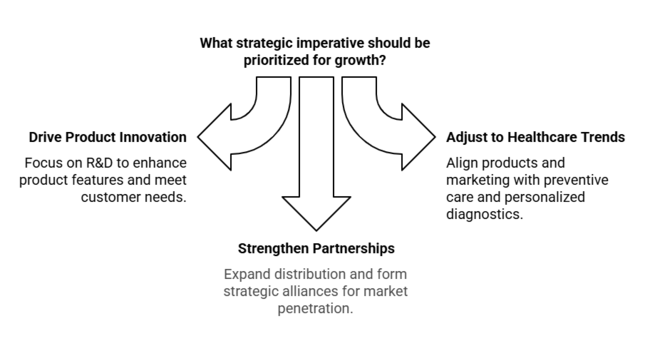

Drive Product Innovation Faster

Invest in R&D to improve the accuracy, portability, and integration with digital health platforms. Focus on building features such as automation, wireless data exchange, and real-time analytics to address changing customer needs.

Adjust to Changing Healthcare Trends

Match product lines and marketing efforts to the global trend of preventive care, point-of-care testing, and personalized diagnostics. Partner with healthcare providers to identify emerging clinical needs.

Strengthen Distribution & Strategic Partnerships

Expand regional distribution networks, particularly in growth markets such as Asia Pacific. Establish strategic partnerships with diagnostic labs, hospitals, and health tech platforms to increase industry penetration and pursue M&A opportunities to grow operations and access new technology.

| Risk | Probability-Impact |

|---|---|

| Regulatory Delays in Device Approvals | Medium-High |

| Technological Obsolescence from Rapid Innovation | High-Medium |

| Supply Chain Disruptions for Key Components | Medium-High |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Expand Point-of-Care Product Line | Conduct a feasibility on a portable chloridometer design with wireless connectivity |

| Improve Customer Responsiveness | Initiate OEM feedback loop on automation features and usability enhancements |

| Strengthen Segment Access | Launch channel partner incentive pilot in Asia Pacific diagnostic segments |

To stay ahead, company must focus on fast-tracking research and development of next-gen chloridometers that address the increasing need for point-of-care and remote diagnostics.

This segment intelligence validates a strong movement toward portability, automation and integrated digital functionality - all of which must now be central to the product roadmap. Moreover, as emerging sectors such as Asia Pacific demonstrating significant adoption potential, the company must realign its go-to-market strategy and establish regional partnerships to gain early mover advantage.

Regional Variance

High Variance

ROI Perspectives

72% of USA stakeholders said automation led to clear ROI within 12 months vs. only 34% in Japan, where devices are used at lower throughput.

Consensus

Anti-corrosive casings (e.g., coated steel or medical-grade polymers) were selected by 69% globally, especially in humid lab environments.

Regional Details

Shared Concern

87% cited rising component costs (notably sensors and specialized electrodes) as a major purchasing hurdle.

Regional Differences

Manufacturers

Distributors

End-Users (Labs/Hospitals)

Alignment

76% of manufacturers plan to invest in enhanced sensor technology and auto-calibration systems.

Regional Priorities

USA

66% said evolving FDA standards (especially on cybersecurity and data reporting) were causing moderate to significant delays.

Western Europe

83% cited EU MDR and sustainability mandates as strong drivers for next-gen designs.

Japan/South Korea

Just 34% said regulation influenced buying decisions-procurement remains price-driven and less compliance-focused.

High Consensus: Accuracy, long-term cost of ownership, and technical reliability were shared concerns across all regions.

Key Variances

Strategic Insight: Success in the chloridometer market demands regional differentiation: high-performance models in the USA, compliant and sustainable options in Europe, and affordable, space-saving devices in Asia.

| Country/Region | Policy & Regulatory Impact |

|---|---|

| United States | The FDA (21 CFR Part 862) regulates clinical laboratory devices, including electrolyte analyzers like chloridometers. Devices must pass 510(k) clearance. Upcoming policies around cybersecurity in medical devices (per the PATCH Act) are increasingly relevant for connected medical devices. State-level data privacy laws (e.g., CCPA in California) may affect data integration and storage features. |

| Western Europe (EU) | Devices fall under the EU Medical Device Regulation (MDR 2017/745), requiring CE Marking, post-market surveillance, and strict clinical evaluation. EU’s Green Deal and EcoDesign Directive are pushing manufacturers toward eco-friendly and recyclable materials. Data interoperability under GDPR impacts software-integrated units. |

| Germany (EU) | Enforces MDR rigorously. Known for strict documentation and BfArM registration requirements. Local hospitals demand IHE (Integrating the Healthcare Enterprise) compliance for LIS integration. |

| France (EU) | Prioritizes traceability and safety reporting under MDR. Local institutions often require HAS (Haute Autorité de Santé) conformity assessment, particularly for public procurement. |

| Japan | Devices are regulated under the Pharmaceutical and Medical Device Act (PMD Act). Requires Shonin or Ninsho certification depending on device class. Less pressure on environmental regulation, but strong emphasis on space-saving designs. Importers must register as MAH (Marketing Authorization Holders). |

| South Korea | Chloridometers are regulated under the Ministry of Food and Drug Safety (MFDS). Requires KGMP (Korea Good Manufacturing Practice) certification. Some hospitals, especially in Seoul, require EMR integration compliance. Importers need to be registered with K-CARE. |

| China (emerging sectors) | Regulated by NMPA (National Medical Products Administration). Devices must obtain CFDA registration and pass local clinical evaluations. Government is encouraging localized production for public tenders. Cybersecurity and data compliance regulations are evolving, especially around cloud-connected devices. |

The chloridometer sector in the USA is expected to grow at a CAGR of 3.7% during the forecast period 2025 to 2035. This continual growth can be attributed to well-developed healthcare systems in the country as well as rising incidence of conditions requiring patients to undergo electrolyte monitoring regimen such as kidney disorders and cystic fibrosis.

Growing focus on early diagnosis and personalized medicine further drives the need for accurate measurement equipment of chloride. Regulatory frameworks put in place by the FDA are ensuring that these chloridometers adhere to high standards of safety and efficacy, and that can influence sector dynamics.

The sector for chloridometer in the UK is expected to grow at a CAGR of 3.8% during the forecast period 2025 to 2035. Focused on cost-effective and efficient diagnostic solutions for patients and clinicians in UK National Health Service (NHS) In line with maintaining high standards of safety and effectiveness.

The UK has committed to continuing to follow the standards set by EU Medical Device Regulation (MDR) following Brexit, meaning that ensuring chloridometers remain compliant. The increasing focus on patient safety and quality of care has led to the widespread adoption of reliable diagnostic equipment such as chloridometers.

The chloridometer sector in France is also expected to exhibit a CAGR of 4.0% during the forecast period 2025 to 2035. The healthcare structure in the country promotes preventive care and early detection, driving the demand for diagnostic devices such as chloridometers.

EU MDR is a required regulatory pathway; this means that all devices must adhere to strict safety and effectiveness thresholds. French healthcare facilities prefer equipment that provides precision and reliability, coherent with the country’s obsession with high patient quality care. Alongside that, France also invests in health care infrastructure and technology, which helps in applying innovative diagnostic tools and thereby driving industry growth.

Germany is projected to make a CAGR of 4.2% in chloridometer sector during the forecast period. Rigorous regulatory framework and high quality requirements for medical devices Germany ensures that the EU MDR and other national regulations are complied with.

The adoption of advanced diagnostic equipment is driven by the robust healthcare infrastructure and emphasis on technological innovation in the country. Offerings must be dynamic, robust, and align seamlessly with German healthcare requirements. Moreover, the emphasis of Germany on research and development in medical technology enables the continuous improvements in the functionalities of chloridometers, meeting the dynamic needs of healthcare professionals.

The chloridometer sector in Italy is expected to grow at a CAGR 3.9% from 2025 to 2035. Italy's healthcare system, which has a combination of public and private providers, is speeding up adoption of advanced diagnostic tools to improve patient outcomes.

This can be achieved by ensuring compliance with the EU MDR for chloridometers, which means that they fulfil key criteria in the context of safety and performance. Rising awareness of importance of electrolytes balance in the management of various health conditions drives the demand for devices for accurate measurement of chloride. Moreover, the emphasis on enhancing healthcare services and infrastructure in Italy is facilitating the incorporation of advanced diagnostic technologies, which complement the growth of the sector.

The chloridometer sector in South Korea will showcase growth at CAGR of 6.0% through 2035. The innovative environment and high-tech nature of the nation lend to the usage of high-tech devices. Korea MFDS (Ministry of Food and Drug Safety) regulations and the Korea good manufacturing practice certification help to ensure product quality and safety.

The healthcare sector in South Korea is evolving with the rapid digitalisation alongside, automation and connectivity in the fields of chloridometers. Furthermore, the government's efforts to improve healthcare facilities and infrastructure also drive industry growth.

Japan chloridometersector is anticipated to increase with a CAGR of 6.2%.Japanhas a well-established healthcare system that is driven by technological advancements and aims to adopt accurate and reliable diagnostic tests. The medical device regulation is governed under Pharmaceutical and Medical Device Act (PMD Act), it is required to obtain Shonin or Ninsho certification in order to help the medical devices.

The need for accurate electrolyte monitoring in the background of Japan's growing elderly population and rising number of chronic diseases has driven demand for chloridometers.

The chloridometer sector in China is expected to observe a CAGR growth rate of 6.4% during the tenure2025 to 2035. The development of advanced diagnostic devices is propelled by the rapid expansion of China's healthcare infrastructure and increasing healthcare expenditure.

The NMPA (National Medical Products Administration) is responsible for regulating medical devices in China, which involves CFDA registration and conducting local clinical evaluations. The data highlights the fact that China is investing significantly in making healthcare more affordable and accessible, especially to the urban population, which allows for the wide negotiation of chloridometers.

Australia and New Zealand chloridometers sector is projected to expand at a CAGR of 4.0% across the 2025 to 2035 assessment period. Increasing health care diagnostics investments coupled with advanced hospital infrastructure and robust public health care framework advocating for early diagnosis in this region fuels the growth.

Both countries have a relatively low population densities, but a high per capita healthcare expenditure facilitating the rapid implementation of small-scale precision instruments such as chloridometers in public and private settings and institutions.

The chloridometer sector in India is anticipated to be driven by growing access to healthcare, an increasing burden of chronic diseases, and catalytic investments in diagnostic infrastructure, which will propel the growth of chloridometer in India by recording a CAGR of 5.8% during the period of 2025 to 2035.

This has led to increased demand for chloridometers & producers of nephrology, emergency medicine, & pediatric units. Furthermore, the increasing prevalence of morbidities such as hyponatremia, cystic fibrosis, and electrolyte imbalance owing to anorexia or dehydration also provide an impetus for sector growth.

Digital chloridometers are gaining rapid popularity due to their automation, reduced need for human intervention, enhanced precision, and time efficiencyprojected to expand at a CAGR of 5.9% from 2025 to 2035.

Advanced laboratories and hospitals are abandoning conventional manual titration techniques and instead embracing smaller-sized, touchscreen digital versions with instant readout capabilities and connectivity of data with Laboratory Information Management Systems (LIMS). Higher digitization of healthcare and rising need for bedside or near-patient diagnosis also support this sector.

Growth in the chloridometer segment, the biological analysis is projected to grow at a CAGR of 5.4% during the next decade, between 2025 and 2035. The concentration of chloride ions in biological fluids, including blood serum, plasma, cerebrospinal fluid, and urine, is important for the diagnosis and management of various clinical conditions.

The incidence of chronic kidney disease (CKD) continues to increase globally, with more than 850 million people affected worldwide. Combined with the rise in lifestyle-related disorder-related disorders and the geriatric populace, this is making an enormous growth in demand for routine and acute biological electrolyte testing.

The chloridometer landscape is segmented into hospital laboratories, research laboratories, and others, of which hospital laboratories are anticipated at a strong CAGR of 5.6%, thereby making it the most lucrative among all the end-user segments in the chloridometer sector.

Hospitals remain the frontline diagnostic environment for acute and chronic patient care needs, and hospital dependence on fast, accurate, and automated electrolyte measurement is increasing. Large hospital groups are moving to centralized procurement for high-throughput, multi-parameter analyzers and including chloridometers in larger diagnostic contracts.

The chloridometer sector is gradually becoming competitive as several key players are competing with each other in terms of offerings and geographical reach and partnerships, product development and pricing. Companies are focusing on economical manufacturing and technological innovation, as demand continues to grow for accurate electrolyte analysis in both clinical and industry settings.

Strategies for Growth are focusing more on portfolio extension and internationalization. Moreover, firms are forming original equipment manufacturer (OEM) agreements with the producers of diagnostic platforms and integrating chloridometer modules into a larger laboratory systems.

Market Share Analysis

Key Developments

The industry is segmented into Manual Chloridometer and Digital Chloridometer

The industry is segmented into Biological, Chemical, Industrial, and Environmental Analysis

The industry is segmented into Diagnostic Laboratories, Academic & Research Institutes, Hospital Laboratories, Biopharmaceutical Companies, Others

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

Table 01: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 02: Global Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 03: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 04: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 05: Global Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Region

Table 06: North America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 07: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 08: North America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 09: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 10: North America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 11: Latin America Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 12: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 13: Latin America Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 14: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 15: Latin America Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 16: Europe Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 17: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 18: Europe Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 19: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 20: Europe Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 21: South Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 23: South Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 24: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 25: South Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 26: East Asia Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 27: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 28: East Asia Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 29: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 30: East Asia Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 31: Oceania Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 32: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 33: Oceania Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 34: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 35: Oceania Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Table 36: Middle East & Africa Market Value (US$ Million) Analysis 2012 to 2022 and Forecast 2023 to 2033, by Country

Table 37: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, by Product

Table 38: Middle East & Africa Market Volume (Units) Analysis and Forecast 2012 to 2033, by Product

Table 39: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By Application

Table 40: Middle East & Africa Market Value (US$ Million) Analysis and Forecast 2012 to 2033, By End User

Figure 01: Global Market Volume (Units), 2012 to 2022

Figure 02: Global Market Volume (Units) & Y-o-Y Growth (%) Analysis, 2023 to 2033

Figure 03: Pricing Analysis per unit (US$), in 2022

Figure 04: Pricing Forecast per unit (US$), in 2033

Figure 05: Global Market Value (US$ Million) Analysis, 2012 to 2022

Figure 06: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 07: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2023 to 2033

Figure 08: Global Market Value Share (%) Analysis 2023 and 2033, by Product

Figure 09: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Product

Figure 10: Global Market Attractiveness Analysis 2023 to 2033, by Product

Figure 11: Global Market Value Share (%) Analysis 2023 and 2033, By Application

Figure 12: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By Application

Figure 13: Global Market Attractiveness Analysis 2023 to 2033, By Application

Figure 14: Global Market Value Share (%) Analysis 2023 and 2033, By End User

Figure 15: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, By End User

Figure 16: Global Market Attractiveness Analysis 2023 to 2033, By End User

Figure 17: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 18: Global Market Y-o-Y Growth (%) Analysis 2023 to 2033, by Region

Figure 19: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 20: North America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 21: North America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 22: North America Market Value Share, by Product (2023 E)

Figure 23: North America Market Value Share, By Application (2023 E)

Figure 24: North America Market Value Share, By End User (2023 E)

Figure 25: North America Market Value Share, by Country (2023 E)

Figure 26: North America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 27: North America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 28: North America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 29: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 30: USA Market Value Proportion Analysis, 2022

Figure 31: Global Vs. USA Growth Comparison

Figure 32: USA Market Share Analysis (%) by Product, 2023 & 2033

Figure 33: USA Market Share Analysis (%) By Application, 2023 & 2033

Figure 34: USA Market Share Analysis (%) By End User, 2023 & 2033

Figure 35: Canada Market Value Proportion Analysis, 2022

Figure 36: Global Vs. Canada. Growth Comparison

Figure 37: Canada Market Share Analysis (%) by Product, 2023 & 2033

Figure 38: Canada Market Share Analysis (%) By Application, 2023 & 2033

Figure 39: Canada Market Share Analysis (%) By End User, 2023 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis, 2012 to 2022

Figure 41: Latin America Market Value (US$ Million) Forecast, 2023 to 2033

Figure 42: Latin America Market Value Share, by Product (2023 E)

Figure 43: Latin America Market Value Share, By Application (2023 E)

Figure 44: Latin America Market Value Share, By End User (2023 E)

Figure 45: Latin America Market Value Share, by Country (2023 E)

Figure 46: Latin America Market Attractiveness Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Attractiveness Analysis By Application, 2023 to 2033

Figure 48: Latin America Market Attractiveness Analysis By End User, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 50: Mexico Market Value Proportion Analysis, 2022

Figure 51: Global Vs Mexico Growth Comparison

Figure 52: Mexico Market Share Analysis (%) by Product, 2023 & 2033

Figure 53: Mexico Market Share Analysis (%) By Application, 2023 & 2033

Figure 54: Mexico Market Share Analysis (%) By End User, 2023 & 2033

Figure 55: Brazil Market Value Proportion Analysis, 2022

Figure 56: Global Vs. Brazil. Growth Comparison

Figure 57: Brazil Market Share Analysis (%) by Product, 2023 & 2033

Figure 58: Brazil Market Share Analysis (%) By Application, 2023 & 2033

Figure 59: Brazil Market Share Analysis (%) By End User, 2023 & 2033

Figure 60: Argentina Market Value Proportion Analysis, 2022

Figure 61: Global Vs Argentina Growth Comparison

Figure 62: Argentina Market Share Analysis (%) by Product, 2023 & 2033

Figure 63: Argentina Market Share Analysis (%) By Application, 2023 & 2033

Figure 64: Argentina Market Share Analysis (%) By End User, 2023 & 2033

Figure 65: Europe Market Value (US$ Million) Analysis, 2012 to 2022

Figure 66: Europe Market Value (US$ Million) Forecast, 2023 to 2033

Figure 67: Europe Market Value Share, by Product (2023 E)

Figure 68: Europe Market Value Share, By Application (2023 E)

Figure 69: Europe Market Value Share, By End User (2023 E)

Figure 70: Europe Market Value Share, by Country (2023 E)

Figure 71: Europe Market Attractiveness Analysis by Product, 2023 to 2033

Figure 72: Europe Market Attractiveness Analysis By Application, 2023 to 2033

Figure 73: Europe Market Attractiveness Analysis By End User, 2023 to 2033

Figure 74: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 75: UK Market Value Proportion Analysis, 2022

Figure 76: Global Vs. UK Growth Comparison

Figure 77: UK Market Share Analysis (%) by Product, 2023 & 2033

Figure 78: UK Market Share Analysis (%) By Application, 2023 & 2033

Figure 79: UK Market Share Analysis (%) By End User, 2023 & 2033

Figure 80: Germany Market Value Proportion Analysis, 2022

Figure 81: Global Vs. Germany Growth Comparison

Figure 82: Germany Market Share Analysis (%) by Product, 2023 & 2033

Figure 83: Germany Market Share Analysis (%) By Application, 2023 & 2033

Figure 84: Germany Market Share Analysis (%) By End User, 2023 & 2033

Figure 85: Italy Market Value Proportion Analysis, 2022

Figure 86: Global Vs. Italy Growth Comparison

Figure 87: Italy Market Share Analysis (%) by Product, 2023 & 2033

Figure 88: Italy Market Share Analysis (%) By Application, 2023 & 2033

Figure 89: Italy Market Share Analysis (%) By End User, 2023 & 2033

Figure 90: France Market Value Proportion Analysis, 2022

Figure 91: Global Vs France Growth Comparison

Figure 92: France Market Share Analysis (%) by Product, 2023 & 2033

Figure 93: France Market Share Analysis (%) By Application, 2023 & 2033

Figure 94: France Market Share Analysis (%) By End User, 2023 & 2033

Figure 95: Spain Market Value Proportion Analysis, 2022

Figure 96: Global Vs Spain Growth Comparison

Figure 97: Spain Market Share Analysis (%) by Product, 2023 & 2033

Figure 98: Spain Market Share Analysis (%) By Application, 2023 & 2033

Figure 99: Spain Market Share Analysis (%) By End User, 2023 & 2033

Figure 100: Russia Market Value Proportion Analysis, 2022

Figure 101: Global Vs Russia Growth Comparison

Figure 102: Russia Market Share Analysis (%) by Product, 2023 & 2033

Figure 103: Russia Market Share Analysis (%) By Application, 2023 & 2033

Figure 104: Russia Market Share Analysis (%) By End User, 2023 & 2033

Figure 105: BENELUX Market Value Proportion Analysis, 2022

Figure 106: Global Vs BENELUX Growth Comparison

Figure 107: BENELUX Market Share Analysis (%) by Product, 2023 & 2033

Figure 108: BENELUX Market Share Analysis (%) By Application, 2023 & 2033

Figure 109: BENELUX Market Share Analysis (%) By End User, 2023 & 2033

Figure 110: East Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 111: East Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 112: East Asia Market Value Share, by Product (2023 E)

Figure 113: East Asia Market Value Share, By Application (2023 E)

Figure 114: East Asia Market Value Share, By End User (2023 E)

Figure 115: East Asia Market Value Share, by Country (2023 E)

Figure 116: East Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 117: East Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 118: East Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 119: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 120: China Market Value Proportion Analysis, 2022

Figure 121: Global Vs. China Growth Comparison

Figure 122: China Market Share Analysis (%) by Product, 2023 & 2033

Figure 123: China Market Share Analysis (%) By Application, 2023 & 2033

Figure 124: China Market Share Analysis (%) By End User, 2023 & 2033

Figure 125: Japan Market Value Proportion Analysis, 2022

Figure 126: Global Vs. Japan Growth Comparison

Figure 127: Japan Market Share Analysis (%) by Product, 2023 & 2033

Figure 128: Japan Market Share Analysis (%) By Application, 2023 & 2033

Figure 129: Japan Market Share Analysis (%) By End User, 2023 & 2033

Figure 130: South Korea Market Value Proportion Analysis, 2022

Figure 131: Global Vs South Korea Growth Comparison

Figure 132: South Korea Market Share Analysis (%) by Product, 2023 & 2033

Figure 133: South Korea Market Share Analysis (%) By Application, 2023 & 2033

Figure 134: South Korea Market Share Analysis (%) By End User, 2023 & 2033

Figure 135: South Asia Market Value (US$ Million) Analysis, 2012 to 2022

Figure 136: South Asia Market Value (US$ Million) Forecast, 2023 to 2033

Figure 137: South Asia Market Value Share, by Product (2023 E)

Figure 138: South Asia Market Value Share, By Application (2023 E)

Figure 139: South Asia Market Value Share, By End User (2023 E)

Figure 140: South Asia Market Value Share, by Country (2023 E)

Figure 141: South Asia Market Attractiveness Analysis by Product, 2023 to 2033

Figure 142: South Asia Market Attractiveness Analysis By Application, 2023 to 2033

Figure 143: South Asia Market Attractiveness Analysis By End User, 2023 to 2033

Figure 144: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 145: India Market Value Proportion Analysis, 2022

Figure 146: Global Vs. India Growth Comparison

Figure 147: India Market Share Analysis (%) by Product, 2023 & 2033

Figure 148: India Market Share Analysis (%) By Application, 2023 & 2033

Figure 149: India Market Share Analysis (%) By End User, 2023 & 2033

Figure 150: Indonesia Market Value Proportion Analysis, 2022

Figure 151: Global Vs. Indonesia Growth Comparison

Figure 152: Indonesia Market Share Analysis (%) by Product, 2023 & 2033

Figure 153: Indonesia Market Share Analysis (%) By Application, 2023 & 2033

Figure 154: Indonesia Market Share Analysis (%) By End User, 2023 & 2033

Figure 155: Malaysia Market Value Proportion Analysis, 2022

Figure 156: Global Vs. Malaysia Growth Comparison

Figure 157: Malaysia Market Share Analysis (%) by Product, 2023 & 2033

Figure 158: Malaysia Market Share Analysis (%) By Application, 2023 & 2033

Figure 159: Malaysia Market Share Analysis (%) By End User, 2023 & 2033

Figure 160: Thailand Market Value Proportion Analysis, 2022

Figure 161: Global Vs. Thailand Growth Comparison

Figure 162: Thailand Market Share Analysis (%) by Product, 2023 & 2033

Figure 163: Thailand Market Share Analysis (%) By Application, 2023 & 2033

Figure 164: Thailand Market Share Analysis (%) By End User, 2023 & 2033

Figure 165: Oceania Market Value (US$ Million) Analysis, 2012 to 2022

Figure 166: Oceania Market Value (US$ Million) Forecast, 2023 to 2033

Figure 167: Oceania Market Value Share, by Product (2023 E)

Figure 168: Oceania Market Value Share, By Application (2023 E)

Figure 169: Oceania Market Value Share, By End User (2023 E)

Figure 170: Oceania Market Value Share, by Country (2023 E)

Figure 171: Oceania Market Attractiveness Analysis by Product, 2023 to 2033

Figure 172: Oceania Market Attractiveness Analysis By Application, 2023 to 2033

Figure 173: Oceania Market Attractiveness Analysis By End User, 2023 to 2033

Figure 174: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 175: Australia Market Value Proportion Analysis, 2022

Figure 176: Global Vs. Australia Growth Comparison

Figure 177: Australia Market Share Analysis (%) by Product, 2023 & 2033

Figure 178: Australia Market Share Analysis (%) By Application, 2023 & 2033

Figure 179: Australia Market Share Analysis (%) By End User, 2023 & 2033

Figure 180: New Zealand Market Value Proportion Analysis, 2022

Figure 181: Global Vs New Zealand Growth Comparison

Figure 182: New Zealand Market Share Analysis (%) by Product, 2023 & 2033

Figure 183: New Zealand Market Share Analysis (%) By Application, 2023 & 2033

Figure 184: New Zealand Market Share Analysis (%) By End User, 2023 & 2033

Figure 185: Middle East & Africa Market Value (US$ Million) Analysis, 2012 to 2022

Figure 186: Middle East & Africa Market Value (US$ Million) Forecast, 2023 to 2033

Figure 187: Middle East & Africa Market Value Share, by Product (2023 E)

Figure 188: Middle East & Africa Market Value Share, By Application (2023 E)

Figure 189: Middle East & Africa Market Value Share, By End User (2023 E)

Figure 190: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 191: Middle East & Africa Market Attractiveness Analysis by Product, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness Analysis By Application, 2023 to 2033

Figure 193: Middle East & Africa Market Attractiveness Analysis By End User, 2023 to 2033

Figure 194: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 195: GCC Countries Market Value Proportion Analysis, 2022

Figure 196: Global Vs GCC Countries Growth Comparison

Figure 197: GCC Countries Market Share Analysis (%) by Product, 2023 & 2033

Figure 198: GCC Countries Market Share Analysis (%) By Application, 2023 & 2033

Figure 199: GCC Countries Market Share Analysis (%) By End User, 2023 & 2033

Figure 200: Türkiye Market Value Proportion Analysis, 2022

Figure 201: Global Vs. Türkiye Growth Comparison

Figure 202: Türkiye Market Share Analysis (%) by Product, 2023 & 2033

Figure 203: Türkiye Market Share Analysis (%) By Application, 2023 & 2033

Figure 204: Türkiye Market Share Analysis (%) By End User, 2023 & 2033

Figure 205: South Africa Market Value Proportion Analysis, 2022

Figure 206: Global Vs. South Africa Growth Comparison

Figure 207: South Africa Market Share Analysis (%) by Product, 2023 & 2033

Figure 208: South Africa Market Share Analysis (%) By Application, 2023 & 2033

Figure 209: South Africa Market Share Analysis (%) By End User, 2023 & 2033

Figure 210: Northern Africa Market Value Proportion Analysis, 2022

Figure 211: Global Vs Northern Africa Growth Comparison

Figure 212: Northern Africa Market Share Analysis (%) by Product, 2023 & 2033

Figure 213: Northern Africa Market Share Analysis (%) By Application, 2023 & 2033

Figure 214: Northern Africa Market Share Analysis (%) By End User, 2023 & 2033

The increasing chronic illnesses such as kidney diseases, and cystic fibrosis, and an automation trend worldwide in diagnostics, are factors that drive the adoption of digital chloridometer as these are extremely accurate and efficient.

chloridometers are utilized in healthcare diagnostics, pharmaceutical research, industrial quality control, environmental monitoring, as well as in academic laboratories.

Stricter health and safety regulations, especially in Europe and North America, are driving the increased adoption of certified, compliant chloridometers for clinical and research applications.

This includes the direct-feed revenue these reagents, consumables, and calibration solutions represent, and in high-throughput laboratories where high-frequency testing occurs.

The introduction of features such as IoT connectivity, automated sampling, and multi-parameter integration, enables differentiation in the marketplace and appeal to data-oriented diagnostic scenarios.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA