The chlorhexidine gluconate (CHG) dressing industry is valued at USD 1.03 billion in 2025. As per FMI's analysis, the chlorhexidine gluconate dressing industry will grow at a CAGR of 4.4% and reach USD 1.58 billion by 2035. The chlorhexidine gluconate (CHG) dressing industry is anticipated to grow steadily in the coming years, owing to the growing emphasis on infection control and prevention in healthcare professional settings.

In 2024, the chlorhexidine gluconate (CHG) dressing landscape saw significant growth, driven by several important factors. One of the main reasons was the rise in infections people got while in the hospital, known as hospital-acquired infections (HAIs), especially those occurring at surgical sites. To tackle this issue, hospitals started using CHG dressings more widely because they are effective in preventing these infections.

The primary driving force behind this growth is the increasing prevalence of hospital-acquired infections (HAIs), a growing awareness concerning wound care management, and the rising use of advanced antimicrobial dressings in hospitals and clinics. Furthermore, the increased aging population and rising number of surgical procedures across the globe are also contributing to CHG dressings segment growth, as they are effective in reducing microbial load and preventing infection in catheter insertion and surgical sites.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.03 billion |

| Industry Size (2035F) | USD 1.58 billion |

| CAGR (2025 to 2035) | 4.4% |

The landscape for chlorhexidine gluconate (CHG) dressings is experiencing consistent growth. This can be attributed to a worldwide focus on reducing infections that patients get in hospitals. Improving wound care practices is a key part of this effort.

As the number of surgeries increases and hospitals enforce stricter infection control measures, more healthcare systems, whether advanced or developing, are using CHG dressings. Companies that produce medical devices and specialize in advanced wound care are poised to gain the most from this trend.

Drive Product Innovation and Differentiation

Invest in R&D to create next-generation CHG dressings with greater antimicrobial effectiveness, user comfort, and increased wear times to address changing clinical needs and differentiate from commodity competitors.

Align with Infection Control Guidelines and Regional Growth Patterns

Emphasize regulatory compliance and adapt go-to-market strategies to meet the infection prevention requirements of major regions, particularly in high-growth sectors such as Asia-Pacific and Latin America.

Build Distribution and Strategic Partnerships

Extend segment coverage across hospital procurement networks, healthcare provider strategic partnerships, and M&A initiatives to accelerate industry consolidation and size growth in underpenetrated sectors.

| Risk | Probability - Impact |

|---|---|

| 1. Regulatory Delays or Compliance Failures | Medium - High |

| 2. Emergence of Lower-Cost Alternatives | High - Medium |

| 3. Supply Chain Disruptions (raw materials/logistics) | Medium - Medium |

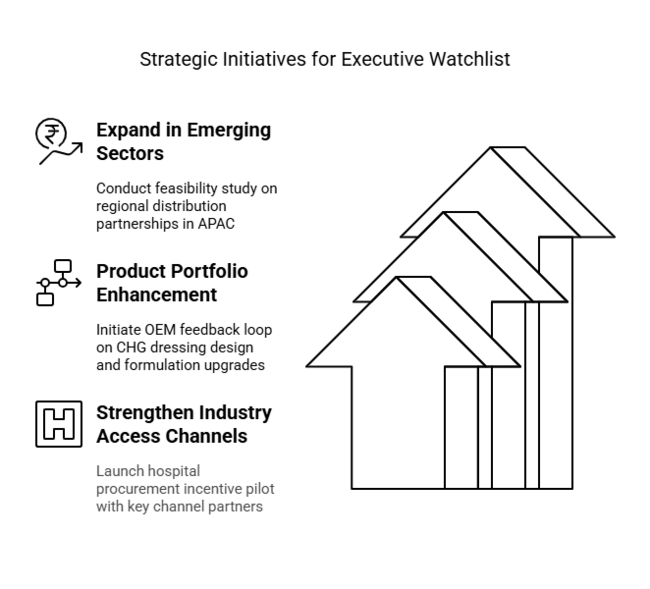

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Expand in Emerging Sectors | Conduct feasibility study on regional distribution partnerships in APAC |

| Product Portfolio Enhancement | Initiate OEM feedback loop on CHG dressing design and formulation upgrades |

| Strengthen Industry Access Channels | Launch hospital procurement incentive pilot with key channel partners |

To stay ahead, company must changing CHG dressing sector, the client should prioritize developing innovative products that meet infection control requirements. At the same time, they should focus on expanding into fast-growing regions. The industry is shifting from simply following regulations to actively preventing infections.

Thus, it's important to speed up research and development for new products and establish partnerships with hospitals. The strategy should emphasize launching products that comply with regulations, creating expansion plans for specific regions, and developing distribution models that can quickly adapt to healthcare system needs.

Regional Variance

ROI Perspectives

68% in the USA found advanced CHG solutions worth the investment; only 19% in Japan agreed, citing constrained budgets.

Consensus: 69% globally preferred dressings with transparent film for site visibility.

Regional Variance

Global Concern: 85% cited rising raw material and manufacturing costs as major procurement challenges.

Regional Preferences

Manufacturers

Distributors

Clinicians & Hospitals

Global Alignment: 72% of manufacturers plan investments in CHG innovation R&D through 2026.

Regional Divergence

High Consensus: Infection prevention, material cost inflation, and integration with hospital workflows are global priorities.

Key Divergences:

Strategic Insight: Success in the CHG dressing market demands regional customization-premium innovation in the USA, sustainability-first design in Europe, and affordability-focused solutions in Asia. A one-size-fits-all approach risks alienating key buyers.

| Country/Region | Policy & Regulatory Impact |

|---|---|

| United States | CDC guidelines and Joint Commission standards mandate infection prevention protocols, directly boosting CHG dressing adoption. FDA 510(k) clearance is required for segment entry. Reimbursement models favor products that demonstrate infection reduction. |

| Germany (EU) | EU Medical Device Regulation (MDR) requires extensive clinical evaluation and post-market surveillance. CHG dressings must meet Class IIa or IIb certification standards (CE mark mandatory). Environmental policies favor sustainable packaging. |

| France (EU) | Similar MDR compliance as Germany. Additional national health agency (HAS) guidelines emphasize evidence-based infection prevention, encouraging CHG dressing use in public hospitals. |

| United Kingdom | MHRA governs CHG dressing approvals post-Brexit. UKCA marking is now required for products sold in Great Britain. NICE clinical guidance supports CHG use in vascular access sites. |

| Japan | Regulated by the PMDA (Pharmaceuticals and Medical Devices Agency), with lengthy approval timelines. No mandatory use of CHG, so adoption is driven more by individual hospital policy than regulation. |

| South Korea | Ministry of Food and Drug Safety (MFDS) requires device registration and local clinical documentation. Infection control policies are tightening in urban hospitals, but CHG use is not yet mandated. |

| Canada | Health Canada classifies CHG dressings as Class II medical devices. Licensing and bilingual labeling are required. Infection prevention standards in hospitals support CHG dressing uptake. |

| Australia | Regulated by the TGA; CHG dressings require ARTG listing. National Safety and Quality Health Service (NSQHS) Standards promote antimicrobial dressings in central line care bundles. |

The projected compound annual growth rate (CAGR) for the USA CHG dressing sector will be around 4.5% for the period from 2025 to 2035. The increase in demand is fueled by stringent infection control measures and guidelines established by organizations such as the Centers for Disease Control and Prevention (CDC) and Joint Commission that stress the need for hospital-acquired infection (HAI) prevention.

There is also a high volume of surgical procedures and the presence of a well-established healthcare infrastructure, which add up to the increasing demand for the CHG dressings.

The landscape size of CHG dressing in the UK is growing at a CAGR of 3.9% during the forecast period. Stringent guidelines around infection control released by the National Health Service (NHS) are spurring their adoption, with an increasing number of hospitals adopting the guidelines, which in turn is driving the growth of the CHG dressings sector.

UKCA marking for medical devices in the context of post-Brexit regulatory frameworks. Patient safety and infection prevention remain a strong focus, leading to growing adoption of advanced wound care products across hospitals and clinics.

The CHG dressing sector in France is expected at a CAGR of 4.0% during the forecast period 2025 to 2035. Infection prevention is essential, and the French National Authority for Health (HAS) promotes the use of CHG dressings in clinical practice.

Healthcare system in the country, successful antiseptic solutions have been widely adopted. Moreover, continuous research and development activities and partnerships between healthcare institutions and industrial players are driving the growth of the sector.

The CHG dressing sector in Germany is expected to grow at a CAGR of 4.2% from 2025 to 2035. Advanced medical systems, including tightening regulatory rules, such as the EU Medical Device Regulation (MDR) compliance, in the country create a request for high-quality CHG dressings.

Large number of surgical procedures in Germany and a strong focus on patient safety and infection control are the factors that support further development of the sector. The ability of large local medical device companies and the continuous need for innovation also contribute to the dynamism of the sector.

From 2025 to 2035, the Italy CHG dressing sector for 2035 is anticipated to grow at a CAGR of 3.8%. The healthcare system in the country is focused on the prevention of infections, especially in the case of surgeries, which is boosting the growth of the sector for CHG dressings.

EU MDR and national health and safety regulations guarantee the availability of safe and effective products. However, industry growth might be restrained by economic challenges and budgetary constraints in the public healthcare sector. However, growing awareness regarding HAIs and the advantages offered by CHG dressings are expected to propel the industry’s steady growth.

The CAGRs for the South Korean CHG dressing sector are expected to be 5.0% during 2025 to 2035. The Ministry of Food and Drug Safety (MFDS) is responsible for approving medical devices, with infection control in health care facilities receiving increased attention.

Usage of CHG Dressings across healthcare wise in urban regions due to hospitals (especially in Seoul) adopting advanced wound care products to provide better patient outcomes. The sector is aided by a technically enabled medical device industry and increasing investments in medical infrastructure. However, price sensitivity and competition from substitutes could impact sector dynamics.

CHG dressing in Japan is expected to increase at a CAGR of 5.4% during 2025 to 2035. Medical devices are regulated by the Pharmaceuticals and Medical Devices Agency (PMDA), with an emphasis on safety and efficacy.

The growing geriatric population and high prevalence of surgical procedures are the key factors responsible for the demand for effective infection control measures, among which is the use of CHG dressings. Patient safety is of paramount importance to Japanese healthcare facilities, which is driving the growing adoption of advanced wound care solutions.

The CHG dressing sector in China is poised to expand at a healthy CAGR of 5.6% during 2025 to 2035. The sector growth is being driven by growing healthcare infrastructure development, a growing number of surgical procedures performed every year globally, and growing awareness about infection prevention.

The continued adoption of CHG dressings is being aided by government initiatives focused on enhancing healthcare quality and patient safety. Competition is intense in this sector as both domestic and foreign players fight for industry share. Indeed, regulation and the push for product standardization are important industry drivers, too.

From 2025 to 2035, the sector for Chlorhexidine Gluconate (CHG) dressing in Australia & New Zealand is estimated to increase at a CAGR of 4.3%. This steady growth is attributed to strong regulatory oversight, advanced healthcare systems, and a high focus on infection prevention in clinical settings.

High safety and efficacy standards in Australia, where all CHG dressings must be listed on the Australian Register of Therapeutic Goods (ARTG), regulated by the Therapeutic Goods Administration (TGA). Chlorhexidine (CHG) in the prevention of central line-associated bloodstream infection (CLABSI) bundles has been largely driven as a result of the National Safety and Quality Health Service (NSQHS) Standards.

The CHG dressing sector in India is set for robust growth during the forecast period, registering a CAGR of 5.8% from 2025 to 2035. This fast-tracking path is fueled by the expansion of healthcare infrastructure, increased concern over hospital-acquired infections (HAIs), and government-organized initiatives that encourage advanced wound care.

The increasing prevalence of surgical procedures, catheterization procedures, and diabetic foot ulcers continues to create the need for chlorhexidine gluconate (CHG)-based solutions. In addition, the ambitious Indian Ayushman Bharat scheme is helping to broaden access to secondary and tertiary care, which is increasing the procurement of infection-prevention consumables.

The CHG-impregnated gauze dressings is expected to dominate the chlorhexidine gluconate dressing industry with a CAGR of 5.2% from 2025 to 2035. CHG-impregnated gel dressings are becoming more popular because they are very effective at preventing infections linked to catheter use, specifically catheter-related bloodstream infections (CRBSIs).

The gel adheres well to the skin and releases CHG over time, making it a preferred option in intensive care units (ICUs) and for long-term catheter users. These dressings are increasingly being included in comprehensive infection control programs, particularly in wealthier countries, and they are also gaining more regulatory support in Asia-Pacific areas.

The Catheter-Related Blood Stream Infections (CRBSI) are expected to dominate the chlorhexidine gluconate dressing industry with a CAGR of 5.5% from 2025 to 2035. CRBSIs are among the most serious and costly hospital-acquired infections (HAIs).

Global health organizations like the CDC and WHO stress the importance of reducing them. CHG dressings are a verified, low-cost method to reduce CRBSI rates, which has led many major hospitals to make their use mandatory or incentivized. Catheters are used more frequently in ICUs, cancer treatments, and long-term care, the use of these dressings is expected to rise.

The hospital segment is expected to dominate the chlorhexidine gluconate dressing industry with a CAGR of 4.8% from 2025 to 2035. Hospitals are the largest users of these dressings when considering both quantities and spending, given that they are the main locations for surgeries, catheter insertions, and critical care procedures.

Government regulations focused on infection prevention, like NHSN guidelines in the USA and NABH standards in India, are making the use of CHG dressings standard practice in surgical and post-operative care settings. Hospitals often purchase them in large quantities and seek options that have been clinically proven to be effective, which is driving significant growth in this area.

Dominant players of the Chlorhexidine Gluconate (CHG) dressing sector are engaged in fierce competition via product innovation, pricing strategies, geographical expansion, and partnerships.

Further pioneering new solutions in the latter area, companies are actively exploring next-generation antimicrobial delivery methods, with significant investments in gel-based sustained-release technologies and composite dressings with moisture control infection-prevention benefits.

Growth strategies are looking more and more region-specific and customer-specific. They are also leveraging strategic partnerships with local distributors and group purchasing organizations (GPOs) to lower industry access hurdles.

Market Share Analysis

Key Developments

The industry is segmented into CHG-impregnated Gel, CHG-impregnated Gauze, CHG-impregnated Film, CHG-Impregnated Foam, Other Dressings

The industry is segmented into Surgical Site Infection (SSIs), Catheter-Related Blood Stream Infections (CRBSI), Catheter-Associated Urinary Tract Infections (CAUTI), Others (Burns, Ulcers, etc.)

The industry is segmented into Hospitals, Clinics, Diagnostic Centers, Homecare Settings, Ambulatory Surgical Centers

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, The Middle East & Afric

Greater emphasis on infection control measures, particularly on surgical and catheter site insertions, is driving greater use of CHG dressings in clinical settings.

CHG-impregnated gel dressings are likely to experience fast growth with their better antimicrobial activity and long-term release capabilities.

Tighter healthcare-associated infection (HAI) guidelines and reimbursement incentives in the USA, Europe, and Asia-Pacific are compelling healthcare professionals to adopt CHG dressings.

Hospitals dominate usage, but demand is increasing in homecare, ambulatory surgical centers, and specialty clinics as a result of growing outpatient procedures and aging populations.

Asia-Pacific, and specifically India, South Korea, and China, is experiencing fast-paced growth fueled by upgrading healthcare infrastructure and a heightened awareness of infection control.

Table 01: Global Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 02: Global Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 03: Global Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 04: Global Market Value (US$ Million) Analysis, By Region, 2017 to 2033

Table 05: North America Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 06: North America Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 07: North America Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 08: North America Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 09: Latin America Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 10: Latin America Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 11: Latin America Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 12: Latin America Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 13: Europe Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 14: Europe Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 15: Europe Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 16: Europe Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 17: East Asia Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 18: East Asia Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 19: East Asia Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 20: East Asia Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 21: South Asia Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 22: South Asia Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 23: South Asia Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 24: South Asia Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 25: Oceania Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 26: Oceania Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 27: Oceania Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 28: Oceania Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Table 29: Middle East and Africa Historical Market Value (US$ Million) Analysis, By Country, 2017 to 2033

Table 30: Middle East and Africa Market Value (US$ Million) Analysis, By Dressing Type, 2017 to 2033

Table 31: Middle East and Africa Market Value (US$ Million) Analysis, By Application, 2017 to 2033

Table 32: Middle East and Africa Market Value (US$ Million) Analysis, By End User, 2017 to 2033

Figure 01: Global Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity, 2023 to 2033

Figure 04: Global Market Share Analysis (%), By Dressing Type, 2022 & 2033

Figure 05: Global Market Y-o-Y Analysis (%), By Dressing Type, 2023 to 2033

Figure 06: Market Attractiveness Analysis By Dressing Type, 2023 - 2033

Figure 07: Global Market Share Analysis (%), By Application, 2022 & 2033

Figure 08: Global Market Y-o-Y Analysis (%), By Application, 2023 to 2033

Figure 09: Market Attractiveness Analysis By Application, 2023 - 2033

Figure 10: Global Market Share Analysis (%), By End User, 2022 & 2033

Figure 11: Global Market Y-o-Y Analysis (%), By End User, 2023 to 2033

Figure 12: Market Attractiveness Analysis By End User, 2023 - 2033

Figure 13: Global Market Share Analysis (%), By Region, 2022 & 2033

Figure 14: Global Market Y-o-Y Analysis (%), By Region, 2023 to 2033

Figure 15: Market Attractiveness Analysis By Region, 2023 - 2033

Figure 16: North America Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 17: North America Market Share Analysis (%), By Application, 2023 (E)

Figure 18: North America Market Share Analysis (%), By End User, 2023 (E)

Figure 19: North America Market Share Analysis (%), By Country, 2023 (E)

Figure 20: North America Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 21: North America Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 22: North America Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 23: North America Market Share Analysis (%), By Application, 2023 (E)

Figure 24: North America Market Share Analysis (%), By End User, 2023 (E)

Figure 25: North America Market Share Analysis (%), By Country, 2023 (E)

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs USA Y-o-Y Growth Comparison, 2023 to 2033

Figure 28: USA Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 29: USA Market Share Analysis (%) By Application, 2022 & 2033

Figure 30: USA Market Share Analysis (%) By End User, 2022 & 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs Canada Y-o-Y Growth Comparison, 2023 to 2033

Figure 33: Canada Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 34: Canada Market Share Analysis (%) By Application, 2022 & 2033

Figure 35: Canada Market Share Analysis (%) By End User, 2022 & 2033

Figure 36: Latin America Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 37: Latin America Market Share Analysis (%), By Application, 2023 (E)

Figure 38: Latin America Market Share Analysis (%), By End User, 2023 (E)

Figure 39: Latin America Market Share Analysis (%), By Country, 2023 (E)

Figure 40: Latin America Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 41: Latin America Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 42: Latin America Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 43: Latin America Market Share Analysis (%), By Application, 2023 (E)

Figure 44: Latin America Market Share Analysis (%), By End User, 2023 (E)

Figure 45: Latin America Market Share Analysis (%), By Country, 2023 (E)

Figure 46: Brazil Market Value Proportion Analysis, 2022

Figure 47: Global Vs Brazil Y-o-Y Growth Comparison, 2023 to 2033

Figure 48: Brazil Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 49: Brazil Market Share Analysis (%) By Application, 2022 & 2033

Figure 50: Brazil Market Share Analysis (%) By End User, 2022 & 2033

Figure 51: Mexico Market Value Proportion Analysis, 2022

Figure 52: Global Vs Mexico Y-o-Y Growth Comparison, 2023 to 2033

Figure 53: Mexico Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 54: Mexico Market Share Analysis (%) By Application, 2022 & 2033

Figure 55: Mexico Market Share Analysis (%) By End User, 2022 & 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Y-o-Y Growth Comparison, 2023 to 2033

Figure 58: Argentina Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 59: Argentina Market Share Analysis (%) By Application, 2022 & 2033

Figure 60: Argentina Market Share Analysis (%) By End User, 2022 & 2033

Figure 61: Europe Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 62: Europe Market Share Analysis (%), By Application, 2023 (E)

Figure 63: Europe Market Share Analysis (%), By End User, 2023 (E)

Figure 64: Europe Market Share Analysis (%), By Country, 2023 (E)

Figure 65: Europe Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 66: Europe Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 67: Europe Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 68: Europe Market Share Analysis (%), By Application, 2023 (E)

Figure 69: Europe Market Share Analysis (%), By End User, 2023 (E)

Figure 70: Europe Market Share Analysis (%), By Country, 2023 (E)

Figure 71: UK Market Value Proportion Analysis, 2022

Figure 72: Global Vs UK Y-o-Y Growth Comparison, 2023 to 2033

Figure 73: UK Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 74: UK Market Share Analysis (%) By Application, 2022 & 2033

Figure 75: UK Market Share Analysis (%) By End User, 2022 & 2033

Figure 76: Germany Market Value Proportion Analysis, 2022

Figure 77: Global Vs Germany Y-o-Y Growth Comparison, 2023 to 2033

Figure 78: Germany Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 79: Germany Market Share Analysis (%) By Application, 2022 & 2033

Figure 80: Germany Market Share Analysis (%) By End User, 2022 & 2033

Figure 81: France Market Value Proportion Analysis, 2022

Figure 82: Global Vs France Y-o-Y Growth Comparison, 2023 to 2033

Figure 83: France Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 84: France Market Share Analysis (%) By Application, 2022 & 2033

Figure 85: France Market Share Analysis (%) By End User, 2022 & 2033

Figure 86: Italy Market Value Proportion Analysis, 2022

Figure 87: Global Vs Italy Y-o-Y Growth Comparison, 2023 to 2033

Figure 88: Italy Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 89: Italy Market Share Analysis (%) By Application, 2022 & 2033

Figure 90: Italy Market Share Analysis (%) By End User, 2022 & 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Y-o-Y Growth Comparison, 2023 to 2033

Figure 93: Spain Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 94: Spain Market Share Analysis (%) By Application, 2022 & 2033

Figure 95: Spain Market Share Analysis (%) By End User, 2022 & 2033

Figure 96: Benelux Market Value Proportion Analysis, 2022

Figure 97: Global Vs Benelux Y-o-Y Growth Comparison, 2023 to 2033

Figure 98: Benelux Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 99: Benelux Market Share Analysis (%) By Application, 2022 & 2033

Figure 100: Benelux Market Share Analysis (%) By End User, 2022 & 2033

Figure 101: Russia Market Value Proportion Analysis, 2022

Figure 102: Global Vs Russia Y-o-Y Growth Comparison, 2023 to 2033

Figure 103: Russia Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 104: Russia Market Share Analysis (%) By Application, 2022 & 2033

Figure 105: Russia Market Share Analysis (%) By End User, 2022 & 2033

Figure 106: East Asia Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 107: East Asia Market Share Analysis (%), By Application, 2023 (E)

Figure 108: East Asia Market Share Analysis (%), By End User, 2023 (E)

Figure 109: East Asia Market Share Analysis (%), By Country, 2023 (E)

Figure 110: East Asia Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 111: East Asia Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 112: East Asia Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 113: East Asia Market Share Analysis (%), By Application, 2023 (E)

Figure 114: East Asia Market Share Analysis (%), By End User, 2023 (E)

Figure 115: East Asia Market Share Analysis (%), By Country, 2023 (E)

Figure 116: China Market Value Proportion Analysis, 2022

Figure 117: Global Vs China Y-o-Y Growth Comparison, 2023 to 2033

Figure 118: China Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 119: China Market Share Analysis (%) By Application, 2022 & 2033

Figure 120: China Market Share Analysis (%) By End User, 2022 & 2033

Figure 121: Japan Market Value Proportion Analysis, 2022

Figure 122: Global Vs Japan Y-o-Y Growth Comparison, 2023 to 2033

Figure 123: Japan Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 124: Japan Market Share Analysis (%) By Application, 2022 & 2033

Figure 125: Japan Market Share Analysis (%) By End User, 2022 & 2033

Figure 126: South Korea Market Value Proportion Analysis, 2022

Figure 127: Global Vs South Korea Y-o-Y Growth Comparison, 2023 to 2033

Figure 128: South Korea Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 129: South Korea Market Share Analysis (%) By Application, 2022 & 2033

Figure 130: South Korea Market Share Analysis (%) By End User, 2022 & 2033

Figure 131: South Asia Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 132: South Asia Market Share Analysis (%), By Application, 2023 (E)

Figure 133: South Asia Market Share Analysis (%), By End User, 2023 (E)

Figure 134: South Asia Market Share Analysis (%), By Country, 2023 (E)

Figure 135: South Asia Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 136: South Asia Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 137: South Asia Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 138: South Asia Market Share Analysis (%), By Application, 2023 (E)

Figure 139: South Asia Market Share Analysis (%), By End User, 2023 (E)

Figure 140: South Asia Market Share Analysis (%), By Country, 2023 (E)

Figure 141: India Market Value Proportion Analysis, 2022

Figure 142: Global Vs India Y-o-Y Growth Comparison, 2023 to 2033

Figure 143: India Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 144: India Market Share Analysis (%) By Application, 2022 & 2033

Figure 145: India Market Share Analysis (%) By End User, 2022 & 2033

Figure 146: Malaysia Market Value Proportion Analysis, 2022

Figure 147: Global Vs Malaysia Y-o-Y Growth Comparison, 2023 to 2033

Figure 148: Malaysia Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 149: Malaysia Market Share Analysis (%) By Application, 2022 & 2033

Figure 150: Malaysia Market Share Analysis (%) By End User, 2022 & 2033

Figure 151: Thailand Market Value Proportion Analysis, 2022

Figure 152: Global Vs Thailand Y-o-Y Growth Comparison, 2023 to 2033

Figure 153: Thailand Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 154: Thailand Market Share Analysis (%) By Application, 2022 & 2033

Figure 155: Thailand Market Share Analysis (%) By End User, 2022 & 2033

Figure 156: Indonesia Market Value Proportion Analysis, 2022

Figure 157: Global Vs Indonesia Y-o-Y Growth Comparison, 2023 to 2033

Figure 158: Indonesia Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 159: Indonesia Market Share Analysis (%) By Application, 2022 & 2033

Figure 160: Indonesia Market Share Analysis (%) By End User, 2022 & 2033

Figure 161: Oceania Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 162: Oceania Market Share Analysis (%), By Application, 2023 (E)

Figure 163: Oceania Market Share Analysis (%), By End User, 2023 (E)

Figure 164: Oceania Market Share Analysis (%), By Country, 2023 (E)

Figure 165: Oceania Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 166: Oceania Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 167: Oceania Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 168: Oceania Market Share Analysis (%), By Application, 2023 (E)

Figure 169: Oceania Market Share Analysis (%), By End User, 2023 (E)

Figure 170: Oceania Market Share Analysis (%), By Country, 2023 (E)

Figure 171: Australia Market Value Proportion Analysis, 2022

Figure 172: Global Vs Australia Y-o-Y Growth Comparison, 2023 to 2033

Figure 173: Australia Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 174: Australia Market Share Analysis (%) By Application, 2022 & 2033

Figure 175: Australia Market Share Analysis (%) By End User, 2022 & 2033

Figure 176: New Zealand Market Value Proportion Analysis, 2022

Figure 177: Global Vs New Zealand Y-o-Y Growth Comparison, 2023 to 2033

Figure 178: New Zealand Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 179: New Zealand Market Share Analysis (%) By Application, 2022 & 2033

Figure 180: New Zealand Market Share Analysis (%) By End User, 2022 & 2033

Figure 181: Middle East and Africa Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 182: Middle East and Africa Market Share Analysis (%), By Application, 2023 (E)

Figure 183: Middle East and Africa Market Share Analysis (%), By End User, 2023 (E)

Figure 184: Middle East and Africa Market Share Analysis (%), By Country, 2023 (E)

Figure 185: Middle East and Africa Historical Market Value (US$ Million) Analysis, 2017 to 2022

Figure 186: Middle East and Africa Current and Future Market Value (US$ Million), 2023 to 2033 & Y-o-Y Growth Trend Analysis, 2023 to 2033

Figure 187: Middle East and Africa Market Share Analysis (%), By Dressing Type, 2023 (E)

Figure 188: Middle East and Africa Market Share Analysis (%), By Application, 2023 (E)

Figure 189: Middle East and Africa Market Share Analysis (%), By End User, 2023 (E)

Figure 190: Middle East and Africa Market Share Analysis (%), By Country, 2023 (E)

Figure 191: GCC Countries Market Value Proportion Analysis, 2022

Figure 192: Global Vs GCC Countries Y-o-Y Growth Comparison, 2023 to 2033

Figure 193: GCC Countries Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 194: GCC Countries Market Share Analysis (%) By Application, 2022 & 2033

Figure 195: GCC Countries Market Share Analysis (%) By End User, 2022 & 2033

Figure 196: Türkiye Market Value Proportion Analysis, 2022

Figure 197: Global Vs Türkiye Y-o-Y Growth Comparison, 2023 to 2033

Figure 198: Türkiye Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 199: Türkiye Market Share Analysis (%) By Application, 2022 & 2033

Figure 200: Türkiye Market Share Analysis (%) By End User, 2022 & 2033

Figure 201: South Africa Market Value Proportion Analysis, 2022

Figure 202: Global Vs South Africa Y-o-Y Growth Comparison, 2023 to 2033

Figure 203: South Africa Market Share Analysis (%) By Dressing Type, 2022 & 2033

Figure 204: South Africa Market Share Analysis (%) By Application, 2022 & 2033

Figure 205: South Africa Market Share Analysis (%) By End User, 2022 & 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sodium Gluconate Market Growth – Trends & Forecast 2024-2034

Calcium Gluconate in Pharmaceuticals Analysis - Size Share and Forecast outlook 2025 to 2035

Calcium Gluconate Demand Analysis - Size Share and Forecast Outlook 2025 to 2035

Calcium Gluconate Market Trends - Growth, Demand & Forecast 2025 to 2035

Ferrous Gluconate Market Size and Share Forecast Outlook 2025 to 2035

Sour Dressings Market

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Combat Dressing Market Trends – Growth & Forecast 2023-2033

Sauces, Dressings, And Condiments Market Size and Share Forecast Outlook 2025 to 2035

Egg-Free Dressing Market Trends – Growth & Innovation 2025 to 2035

Vascular Dressings Market

Tube and Dressing Securement Products Market

Dairy-Based Dressings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Salad Dressing Market - Growth & Demand 2025 to 2035

Organic Salad Dressing Market Forecast and Outlook 2025 to 2035

Advanced Wound Dressing Market by Product, Wound Type, End User and Region 2025 to 2035

Fat Free Salad Dressings Market

Interactive Wound Dressing Market Insights – Growth & Forecast 2024-2034

Demand for Sauces, Dressings, and Condiments in Europe Outlook - Share, Growth & Forecast 2025 to 2035

Hydrokinetic Fibre Dressings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA