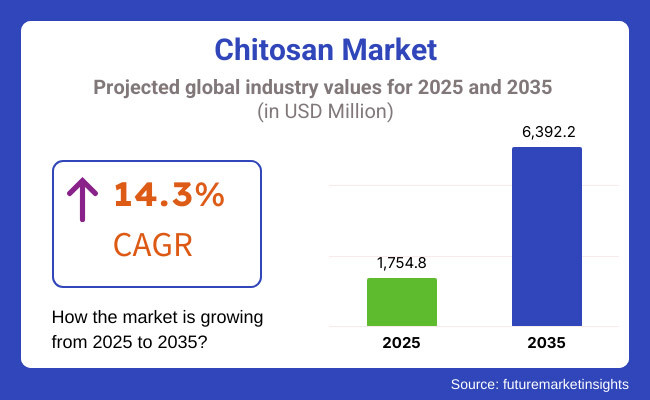

The global chitosan market is poised to witness exponential growth over the next decade, anchored in its multifaceted applications and growing demand across key industries. The market is expected to be valued at USD 1,754.8 million in 2025 and expand at an impressive CAGR of 14.3%, ultimately reaching USD 6,392.2 million by 2035.

This growth outlook is underpinned by intensifying regulatory pressures for biodegradable and non-toxic alternatives, particularly in water treatment, food preservation, cosmetics, pharmaceuticals, and agriculture. Stakeholders across industrial sectors have increasingly emphasized the need for environmentally benign biopolymers, and chitosan has emerged as a preferred solution due to its excellent film-forming, chelating, antimicrobial, and bioadhesive properties.

In the water treatment sector-which is expected to dominate with a 33.1% market share in 2025-the functionality of chitosan as a flocculant and heavy metal ion scavenger has been thoroughly validated through both academic research and industrial case studies.

Rising contamination levels in freshwater systems and stringent effluent discharge norms globally are projected to fuel its adoption across municipal and industrial wastewater applications. In parallel, pharmaceutical and nutraceutical industries are leveraging chitosan’s biocompatibility and mucoadhesive nature for drug delivery systems and dietary supplements.

Moreover, cosmetic brands are increasingly deploying chitosan derivatives in skincare formulations for their moisture retention, anti-aging, and wound-healing benefits. This surge is compounded by growing consumer awareness around clean-label, eco-conscious personal care products.

On the supply side, technological advancements in chitosan extraction-especially from fungal sources or crustacean shell waste-have improved yield, purity, and molecular customization, widening its commercial viability.

However, the market does face constraints related to high production costs and variability in raw material supply depending on seasonality and marine catch volumes. Still, emerging applications in biomedical engineering, tissue regeneration, biodegradable packaging, and agriculture (e.g., seed coatings and plant immunity boosters) continue to open promising frontiers.

With aggressive research investments and strategic partnerships among biopolymer firms and end-use industries, the chitosan market is expected to evolve from a specialty material to a mainstream sustainable ingredient solution across global markets.

The water treatment segment is projected to command 33.1% of the chitosan market in 2025. The segment's dominant position reflects the convergence of industrial decarbonization targets and escalating freshwater contamination, both of which demand scalable, biodegradable alternatives to synthetic flocculants.

Chitosan's efficacy in chelating heavy metals, removing turbidity, and enabling eco-safe discharge has been consistently validated, positioning it as a biologically derived disruptor within municipal and industrial wastewater treatment frameworks. Unlike traditional polymeric coagulants, chitosan offers superior floc strength with minimal secondary pollution risk-a feature increasingly favored by regulatory bodies in Europe, Japan, and North America.

Strategic adoption by water utilities, particularly in regions grappling with industrial runoff or low recycling ratios, is expected to sustain demand. Additionally, favorable policy shifts and subsidies toward natural treatment agents will likely enhance procurement momentum. Despite supply constraints tied to crustacean harvest cycles, extraction advancements from fungal biomass present a viable path toward scale. Over the coming decade, this segment is expected to shift from experimental to essential, catalyzing chitosan’s trajectory as a cornerstone of circular water economies.

The pharmaceutical and nutraceutical segment is expected to expand rapidly, with a projected CAGR surpassing the overall market average of 14.3% between 2025 and 2035.

The rising integration of chitosan in drug delivery systems and dietary supplements marks its transition from functional excipient to therapeutic enabler. In pharmaceutical applications, its mucoadhesive and biocompatible properties have allowed it to serve as a platform for controlled-release formulations, particularly for peptides, vaccines, and gene therapies.

Clinical studies have validated its absorption-enhancing and site-specific release capabilities, encouraging broader adoption in both generic and innovative drug categories. Meanwhile, in nutraceuticals, chitosan has gained traction as a cholesterol-lowering and fat-binding agent, aligning with preventive health trends and expanding aging populations.

Growth is further accelerated by the convergence of clean-label consumer preferences and clinical efficacy requirements. Regulatory approvals for chitosan as a GRAS (Generally Recognized as Safe) ingredient in functional supplements have helped diversify its portfolio, particularly in North America and Asia.

Additionally, strategic collaborations between biopolymer innovators and pharma majors are expected to drive faster translational research, bridging bench-scale insights with commercial-scale applications. As personalized medicine and gut-health-oriented formulations rise in prominence, chitosan’s multifunctionality is poised to secure a more central role in therapeutic innovation pipelines.

Challenge

High Production Costs and Limited Raw Material Availability

The high cost of extraction and processing is a major challenge to the chitosan market. Chitosan is mainly sourced from crustacean shells that should undergo thorough DE acetylation and purification before producing on a large scale is expensive. The availability of raw materials is also volatile, as it is reliant on seafood industry by-products, which vary by season and region.

This limitation constraints the scalability and reduces the cost-effectiveness of chitosan-based applications especially in the pharmaceutical and premium biomedical fields.

Opportunity

Expansion into Biomedical and Sustainable Packaging Applications

These properties of chitosan including its biocompatibility, biodegradability and antimicrobial activity render it a highly effective and beneficial bio polymeric material in numerous biomedical applications like in wound healing, drug delivery and tissue engineering.

Additionally, companies are aiming at chitosan-based biodegradable films and coatings and their applications in various packaging solutions due to industries seeking sustainable alternatives. There are also growth avenues with the increasing demand for sustainable packaging materials and rising need for natural food preservatives in food and beverage sectors.

The USA chitosan market is characterized with healthy growth owing to the growing demand from pharmaceutical, biomedical and water treatment applications. Growing awareness regarding biodegradable and sustainable materials is driving the use of chitosan in food packaging, cosmetics and personal care products.

Moreover, the USA is significantly focusing on R&D to improve the utilization of chitosan in drug delivery systems, wound healing, and bioplastics. Additionally, the agricultural sector's growth, in which chitosan is employed as a bio pesticide and growth promoter, contributes towards the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 14.2% |

Driven by the growing popularity of sustainable materials and biodegradable technological formulations in bioscience, food preservation and water treatment, the UK Chitosan industry is on the rise. A strong emphasis on sustainability and plastic waste reduction in the country is fostering innovation in chitosan-based biodegradable films and packaging materials.

Chitosan is also proving useful in pharmaceutical and biomedical applications; it is being studied for its anticancer and antimigraine properties, as well as its utility in tissue engineering, coating and wound healing. Additionally, rising number of research collaboration between biotechnology companies and academia are facilitating the development of novel chitosan formulation for numerous applications.

As a result, stringent rules relating to synthetic preservatives within the food and beverage industry is also fuelling the popularity of chitosan as a natural preservative.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 13.5% |

The EU chitosan market is growing significantly, placements, as it complements environmental policies favoring biodegradable and bio-based materials. Laws in the EU that promote reducing the use of chemical fertilizers and pesticides in agriculture have resulted in higher use of chitozan in seed treatment and organic farming.

Germany, France and Italy are the leading nations in chitosan adoption, particularly in the biomedical, pharmaceutical and cosmetic sectors. Increasing recognition of the antimicrobial and antioxidant benefits of chitosan is further promoted for use in skin care products and wound healing.

Furthermore, increasing investments in wastewater treatment infrastructure facilities in the EU are anticipated to drive the product demand for use as a natural flocculants in water purification systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 13.4% |

The growth of the Japan chitosan industry can be attributed to the emergence of biotechnology in Japan and the rising demand for natural ingredients in pharmaceutical and cosmetic products. In Japan, chitosan is one of the most popular well-reported health products, used in dietary supplements, products for weight management, and cholesterol-lowering applications.

The country is also a leader in the development of chitosan-based biomedical applications such as wound dressings, drug delivery systems, and regenerative medicine. The Japan market is focused on sustainability and new eco-friendly materials, which drives the application of chitosan in biodegradable plastics and green food packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.9% |

The chitosan market in South Korea-Industry Analysis & Outlook (2018-2025) analyses the development, market size, futures, and rates in one of the world's biggest Chitosan manufacturers. South Korea’s thriving cosmetic industry also has adopted chitosan-based products because of its anti-aging, moisturizing and antimicrobial properties.

South Korea is also investing in clever applications for chitosan in bioplastics, sustainable food packaging and water purification. The growth of healthcare industries and increased research activities in producing nanotechnology-based drug delivery systems through chitosan is another factor fueling the market growth.

Increasing government initiatives for organic farming and reduction of pesticide use are the factors supporting the demand for chitosan-based agricultural solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.7% |

KitoZyme S.A. (18-22%)

KitoZyme leads the market with a strong focus on non-animal-derived chitosan used in medical, food, and agricultural applications. The company’s innovative chitosan products are widely utilized in biodegradable packaging and dietary supplements.

Heppe Medical Chitosan GmbH (14-18%)

Heppe Medical Chitosan is known for its high-purity chitosan used in pharmaceutical and biomedical applications. The company has a significant presence in Europe and North America, with its products being extensively used in drug delivery systems and wound healing.

Primex EHF (12-16%)

Primex EHF is a leading supplier of marine-based chitosan, focusing on nutraceuticals and medical applications. The company’s ChitoClear® product line is widely recognized for its use in dietary supplements and cosmetics.

Golden-Shell Pharmaceutical Co., Ltd. (10-14%)

Golden-Shell Pharmaceutical produces industrial and pharmaceutical-grade chitosan, catering to sectors such as wastewater treatment, wound care, and cosmetics. The company exports its products globally and is expanding its research in biodegradable medical materials.

Qingdao Yunzhou Biochemistry Co., Ltd. (8-12%)

Qingdao Yunzhou is a key player in the bulk chitosan supply market, particularly for agricultural, food preservation, and antimicrobial applications. Its products are widely used in Asia-Pacific markets, particularly in organic farming and food packaging.

Other Key Players (26-32% Combined)

Several regional and emerging players are strengthening the market with innovative and cost-effective chitosan solutions, including:

The overall market size for chitosan market was USD 1,754.8 million in 2025.

The chitosan market is expected to reach USD 6,392.2 million in 2035.

The growth of the chitosan market will be driven by increasing demand in biomedical applications, advancements in water treatment solutions, and rising adoption in cosmetics and agriculture for its biodegradable and antimicrobial properties.

The top 5 countries which drives the development of chitosan market are USA, European Union, Japan, South Korea and UK.

Powder Chitosan to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by End Use, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Source, 2023 to 2033

Figure 23: Global Market Attractiveness by End Use, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 45: North America Market Attractiveness by Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Source, 2023 to 2033

Figure 47: North America Market Attractiveness by End Use, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 93: Europe Market Attractiveness by Form, 2023 to 2033

Figure 94: Europe Market Attractiveness by Source, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by End Use, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 141: MEA Market Attractiveness by Form, 2023 to 2033

Figure 142: MEA Market Attractiveness by Source, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chitosan Powder Market Size and Share Forecast Outlook 2025 to 2035

Chitosan-based Seed Coatings Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Chitosan Market Share & Provider Insights

Chitosan Oligosaccharides and Glucosamine Market Analysis by Product Type, Source, Application, and Form Through 2035

Chitosan Oligosaccharides Market Growth - Source & Grade Trends

UK Chitosan Market Outlook – Size, Share & Forecast 2025–2035

USA Chitosan Market Analysis – Size, Share & Industry Trends 2025–2035

ASEAN Chitosan Market Analysis – Growth, Applications & Outlook 2025–2035

Europe Chitosan Market Report – Trends, Demand & Industry Forecast 2025–2035

Australia Chitosan Market Growth – Demand, Trends & Forecast 2025–2035

North America Chitosan Market Size and Share Forecast Outlook 2025 to 2035

Latin America Chitosan Market Trends – Growth, Demand & Analysis 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA