The chitosan market is concentrated, with the top five firms controlling more than 60% of the overall market share. Major players like Primex Ingredients ASA, Kitozyme, Heppe Medical Chitosan GmbH, Novamatrix, and Biopharm lead industry developments in Chitosan extraction, purification, and commercialization.

These multinational corporations dominate the pharmaceutical and high-purity chitosan markets. Regional producers, making up 30% of the market, are targeting shrimp and crab-sourced chitosan for dietary supplements and food additives, specifically in Europe and Asia-Pacific. Startups and niche players make up the other 10% and are concentrated on bioengineered chitosan and environmentally friendly production methods.

With increasing uses in biomedical applications and functional food ingredients, the market will continue to witness steady consolidation with strong players enhancing supply chains and manufacturing efficiencies.

Explore FMI!

Book a free demo

| Global Market Share, 2025 | Industry Share % |

|---|---|

| Top Multinationals (Primex Ingredients ASA, Kitozyme, Heppe Medical Chitosan GmbH, Nova matrix, Biopharm) | 60% |

| Regional Leaders (Asian seafood processors, specialty biotech firms) | 30% |

| Startups & Niche Brands (Small-scale manufacturers focusing on sustainability) | 10% |

The market is consolidated, with multinationals dominating high-purity and pharmaceutical applications, whereas regional companies specialize in food and dietary chitosan applications.

Powdered chitosan holds the largest market share with 65%, mainly because of application in dietary supplements, food additives, and pharmaceuticals. Powdered chitosan is most used for encapsulation, coatings, and bioactive applications. Liquid chitosan at 35% is on the rise for cosmetics, medical uses, and bio-agriculture, with firms like Kitozyme and Nova matrix leading the way with innovations in liquid biopolymers.

Shrimp-derived chitosan accounts for 55% of the market, thanks mainly to the supply of shrimp shells as a byproduct in seafood processing industries, particularly in China, Thailand, and Vietnam. Crab-based chitosan accounts for 30%, with crab shell extraction techniques optimized by manufacturers in Norway and Canada. Lobster-based chitosan, accounting for 15%, is employed mainly in premium-grade applications such as in the medical and research sectors.

Food additives capture 40% of the market for chitosan, with uses in preservatives, stabilizers, and texture enhancers. Dietary supplements are 30%, mainly in North America and Europe, as consumers look for natural, functional ingredients. Pharmaceuticals account for 20%, with chitosan gaining in drug delivery, wound healing, and antimicrobial application. The cosmetic sector, small at 10%, is also developing rapidly with the attraction of biodegradability and skin repairing attributes.

2024 for the chitosan industry saw big mergers, acquisitions, and R&D advancements. Firms concentrated on producing high-purity, pharmaceutical-grade chitosan, broadening its use to biomedicine, tissue engineering, and wound healing. Sustainability picked up speed with biotech industries highlighting shrimp-free, fungi-derived chitosan alternatives. European Union and North American regulatory clearances pushed commercialization efforts towards drug and food uses.

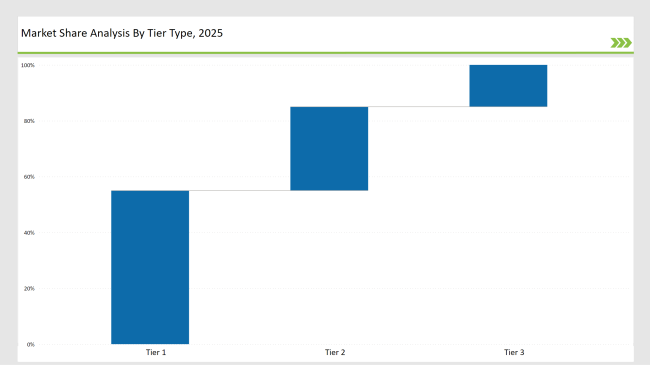

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Primex Ingredients ASA, Kitozyme, Heppe Medical Chitosan GmbH, Novamatrix, Biopharm |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 30% |

| Example of Key Players | Regional seafood processors, Asian biotech firms |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 20% |

| Example of Key Players | Startups, niche sustainability-focused brands |

| Brand | Key Focus |

|---|---|

| Primex Ingredients ASA | Expanded shrimp-derived chitosan production to meet rising pharmaceutical demand. |

| Kitozyme | Launched a liquid chitosan formulation with enhanced skin hydration and anti-aging properties. |

| Heppe Medical Chitosan GmbH | Strengthened research into chitosan-based nanocarriers for drug delivery. |

| Nova matrix | Developed biodegradable chitosan film for eco-friendly food packaging. |

| Biopharm | Secured EU regulatory approval for a pharmaceutical-grade chitosan formulation. |

| Asian Seafood Processors | Increased chitosan exports for food and dietary applications. |

| Biotech Startups | Explored sustainable, fungi-based chitosan alternatives. |

| European Research Institutions | Focused on regulatory approvals for chitosan-based wound dressings. |

| North American Agriculture Firms | Developed bio-based pesticides using chitosan for organic farming. |

| Japanese Pharmaceutical Sector | Expanded R&D into chitosan-based drug delivery mechanisms. |

The use of chitosan-based drug delivery systems and injectable drugs is likely to increase substantially in personalized medicine. As research into biodegradable chitosan nanoparticles goes on, pharmaceutical companies are integrating chitosan into precision drug delivery systems. This will enhance targeted treatment of cancer, infection, and metabolic disorders, particularly in North America and Europe, where nanomedicine technology is unfolding at a fast pace.

Chitosan's biodegradability and antimicrobial characteristics render it a choice substance for food preservation. Chitosan coatings on seafood, produce, and meats are expected to grow, saving the use of synthetic preservatives. Major food processors in the USA, South Korea, and Japan are already tapping chitosan-based edible coatings for extending the shelf life of perishable foods without lowering organic certification standards.

As the world shifts towards sustainable packaging, chitosan-based biodegradable coatings and films will substitute conventional plastic packaging. Biopolymer-specialized companies are developing chitosan-enriched smart packaging, which will enhance moisture control and food safety. Germany and France are among the top nations investing in R&D for compostable biopolymer packaging, with large retailers investigating plastic-free options.

The Chinese and Japanese pharmaceutical sectors are making significant investments in chitosan-based medical applications. Biocompatible chitosan research for wound healing, tissue engineering, and bone regeneration is on the rise. These developments will make Asia-Pacific a major hub for chitosan-based healthcare solutions, with government-supported funding fueling clinical trials and commercialization in the next few years.

The top five manufacturers-Primex Ingredients ASA, Kitozyme, Heppe Medical Chitosan GmbH, Novamatrix, and Biopharm-collectively control 60% of the global market.

The market is projected to grow at a high CAGR, driven by increasing demand for pharmaceutical, food, and cosmetic applications.

Asia-Pacific, particularly China, Japan, and Thailand, leads production, with extensive use in biomedical and food applications.

Chitosan is used for wound healing, drug delivery, and antimicrobial applications, with increasing FDA and EU approvals.

Supply chain constraints and extraction costs pose challenges, especially in shrimp- and crab-derived chitosan production.

A Detailed Analysis of Brand Share Analysis for Herbs and Spices Industry

A detailed analysis of the Australia Bakery Ingredient Market and growth outlook covering product type, and application segment

USA Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Europe Aqua Feed Additives Market by Additive Type, Species, Ingredient, and Country through 2035

UK Herbs and Spices Industry Analysis from 2025 to 2035

Comprehensive Analysis of Herbs and Spices Market by Product Type, Form, End Use, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.