The China market will be projected at USD 312.1 million by 2025. Moreover, it is also projected to reach the total value of a total value of USD 471.0 million until 2035, in which the CAGR of 4.2% occurred during the forecast period of 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 312.1 million |

| Projected Value 2035 | USD 471.0 million |

| Value-based CAGR from 2025 to 2035 | 4.2% |

This particular market of swab and viral transport medium for the near term will grow significantly in China, facilitated by solid public health initiatives. China is largest contributor in the expansion of the sector by 2025 in the East Asian market. This market will now gain a steady CAGR of 4.2% till 2035, and opportunity here reflects a sustainable growth and investment future.

Many have, as a result increased public awareness regarding the risks infectious diseases such as the COVID-19 and influenza present in China today to require constant testing. Thus, the necessity for early and accurate detection tools calls for reliable diagnosis tools such as swabs and viral transport mediums as the demand in the market keeps increasing with the increase of testing.

Explore FMI!

Book a free demo

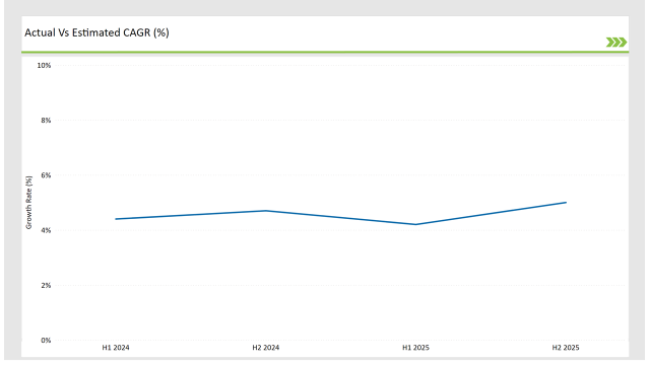

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China swab and viral transport medium market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year H1, covers January to June, while the second half, H2, spans July to December.

H1 means time between January to June, H2 means time between July to December

This swab and viral transport medium market will grow with an estimated rate of 4.4% during the first half of the year 2023 and grow further to achieve a rate of 4.7% for the second half of the year. In the case of growth, the expectation of 2024 will take some decline where in H1 is estimated as 4.2%, though for H2 is expected as 5.0%.

That will make it decline by 20 basis points from the first half of 2023 to the first half of 2024, but it is now fueled 26 basis points over the second half of 2023 in the second half of 2024.

These figures represent a dynamic and fast-changing China swab and viral transport medium market, largely influenced by China's government-backed public health programs, advanced healthcare infrastructure in China, and others. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Government Support: Becton, Dickinson and Company is expanding with Government funding and regulatory support for diagnostic testing and public health initiatives stimulate market growth. By endorsing widespread testing programs and pandemic preparedness, governments help ensure a steady demand for swabs and viral transport mediums in healthcare systems. |

| 2024 | Launch: Cardinal Health drives the growth by introducing innovative swabs and viral transport mediums with enhanced features, such as improved sample preservation and faster diagnostic compatibility. Strategic product launches target unmet healthcare needs, expanding market share and brand visibility. |

| 2024 | Expansion: Thermo Fisher strengthen their presence by entering new markets, building robust distribution networks, and forming partnerships with healthcare providers to cater to growing demand for diagnostic solutions across diverse regions. |

Growing Focus on Preventive Healthcare

The focus on proactive healthcare increases the usage of swabs and VTMs to facilitate rapid testing, which in turn fuels market growth as healthcare providers focus on timely diagnosis to manage disease spread effectively.

Research and Development Advancements

Advances in diagnostic technologies in China have led to the creation of better swabs and VTMs. New technologies, including automated systems and improved materials for sample preservation, have made diagnostic testing more efficient and reliable. The advancement in medical devices increases the demand for high-performance swabs and VTMs, leading to growth in the market as healthcare systems in the country continue to evolve.

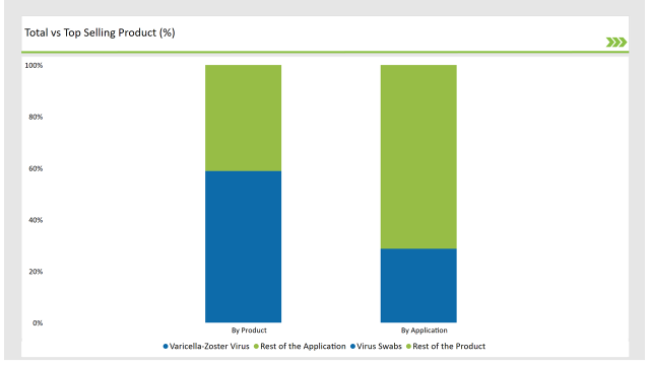

% share of Individual categories by Product Type and Application in 2025

Virus Swabs records significant surge in China Swab and Viral Transport Medium applications

Virus swabs dominate due to their critical role in accurate sample collection for diagnostic tests. High demand for precision, efficiency, and compatibility with advanced testing methods drives their market leadership.

The varicella-zoster virus segment will rise extensively, especially with an increased demand for accurate diagnostic testing for VZV infections. Varicella-Zoster Virus is known to cause chickenpox and shingles, which are highly contagious viral infections that require prompt diagnosis for proper treatment and management.

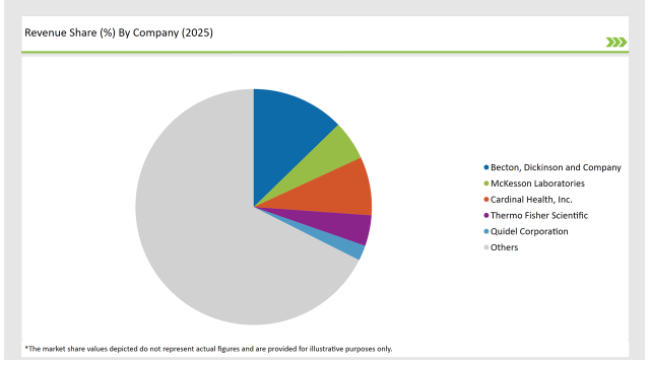

The China swab and viral transport medium market presents a moderate degree of fragmentation, owing to the presence of both multinational players and regional companies; this drives fierce competition. Multinationals have captured the marketplace with their groundbreaking technology, established infrastructure, and broad customer base.

Local players are similarly taking up valuable market share for their customized approach, especially tailored for niche use such as for field hospitals, emergency response, and remote/underserved rurality areas.

The competitive landscape is more and more dominated by technological progress and the demand for fulfilling different needs of clients. Companies are concentrating on R&D activities to make swab and viral transport medium compact, energy efficient, and cheaper. With the German sustainability agenda, most of the players are now incorporating environment-friendly features into their products.

Add to this the prevalence of partnerships and joint ventures, where companies are co-developing innovative solutions while expanding their market reach. The interplay between the global leaders and the agile regional competitors fosters a culture of constant innovation and adaptability in China’ swab and viral transport medium market.

2025 Market share of China Swab and Viral Transport Medium suppliers

Note: above chart is indicative in nature

By 2025, the China swab and viral transport medium market is expected to grow at a CAGR of 4.2%.

By 2035, the sales value of the China swab and viral transport medium industry is expected to reach China is USD 471.0 million.

Key factors propelling the China swab and viral transport medium market include growing focus on preventive healthcare, rapid technological advancements, ensuring widespread adoption of high-quality swabs and VTMs.

Prominent players in the China swab and viral transport medium manufacturing include Becton, Dickinson and Company, McKesson Laboratories, Cardinal Health, Inc., Thermo Fisher Scientific, Quidel Corporation, Copan Diagnostic, Inc., Deltalab, VIRCELL S.L., Titan Biotech, Inc., Medical wire & Equipment (MWE) and Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

The industry includes various product type such as viral transport medium (tissue culture medium, glycerol transport medium) and virus swabs (nasopharyngeal swabs, deep nasal swabs, combined nasal & throat swabs, culture swabs, vaginal swabs).

Available in application like influenza, respiratory syncytial virus, mumps virus, adenovirus, rhinovirus, herpes simplex virus, varicella-zoster virus and other indication

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Stable Angina Management Market Analysis by Drug Class, Distribution Channel, and Region: Forecast for 2025 to 2035

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Panuveitis Treatment Market Analysis & Forecast by Drug Class, Route of Administration, Distribution Channel, and Region Through 2035

Phenylketonuria Therapeutics Market Analysis & Forecast by Drug Type, Route of Administration, Distribution Channel, and Region Through 2035

Dental Practice Management Software Market Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.