The China protein a resins market size is likely to increase at a CAGR of 5.2%. From a value of USD 83.2 million in 2025, the market size will reach USD 138.1 in 2035.

Market Overview

| Attributes | Values |

|---|---|

| Estimated China Market Size 2025 | USD 83.2 Million |

| Projected China Value 2035 | USD 138.1 Million |

| Value-based CAGR from 2025 to 2035 | 5.2% |

This China protein A resins market is on the expansion growth due to rising demand in the biopharmaceutical industry for highly selective purification resins. Next-generation recombinant protein A resins and further chromatography technique innovations are continually raising efficiency levels for the processes involved in purifying antibodies.

In addition, with increased importance towards personalized medicine, and higher volumes of monoclonal antibodies that are currently in production for treatment of cancers and autoimmune diseases, the demand has been high. Advances in bioseparation technologies, such as high-capacity and multi-cycle resins, improve process scalability and reduce production costs.Additionally, regulatory support for biopharmaceutical advancements and the expansion of manufacturing facilities are driving further adoption of protein A resins across multiple applications.

Explore FMI!

Book a free demo

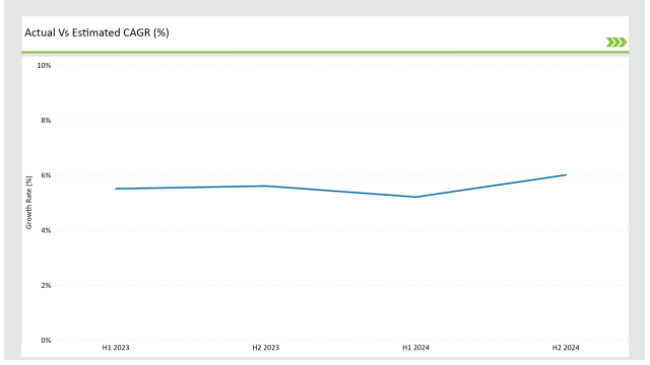

The table below highlights key shifts in the compound annual growth rate (CAGR) over six-month intervals for the base year (2024) and the current year (2025), providing insights into revenue realization trends.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 5.4 |

| H2 Growth Rate (%) | 5.6 |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.2 |

| H2 Growth Rate (%) | 6.0 |

The market has demonstrated steady growth, with an decline of 19 basis points in H1 2025 compared to H1 2024. H2 2025 is projected to grow by 34 basis points, driven by increasing adoption of recombinant protein A resins and innovations in bioseparation technologies. Rising investments in next-generation chromatography systems and automation in downstream processing are further fueling market expansion. The integration of AI-driven analytics for resin performance optimization is also enhancing process efficiency.

Additionally, growing collaborations between biotech firms and academic institutions are leading to advancements in protein purification methodologies, further strengthening the market outlook for protein A resins.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Product Launch: Kanika company is leading biopharmaceutical firm, which is focusing on launches of high-capacity recombinant protein A resin. |

| Sep-24 | Investment: Merck company is mainly focusing on Investment in advanced agarose-based matrix technology for improved antibody purification. |

| Jul-24 | Partnership: Cytiva company is focusing on Growth in strategic partnerships between resin manufacturers and biotech firms. |

Biotechnology Advancements in Protein A Resin Development

The integration of advanced biotechnological methods, such as engineered ligands and genetic modifications, is revolutionizing the protein A resins market. Companies like Sartorius AG and Lonza Group are at the forefront of developing highly efficient resins with improved stability and binding capacity. Government funding in biopharmaceutical innovation is further enhancing R&D efforts, leading to the creation of resins with longer lifespans and better cost efficiency.

Rising Investments in Sustainable Resin Manufacturing

Sustainability is becoming a critical focus area for production in protein A resins. Major manufacturers are making a transition towards more eco-friendly ways through minimizing the consumption of solvents and optimizing waste management during resin manufacturing. This is in line with green bioprocessing initiatives from the China government for allowing environmentally responsible methods for the manufacture of chromatography resins.

Automations and AI-based Integration in Bioprocessing

AI-based analytics are now improving resin performance monitoring, so yield and quality control are even better. Automated chromatography systems are also reducing human intervention, leading to greater precision and efficiency in biopharmaceutical manufacturing.

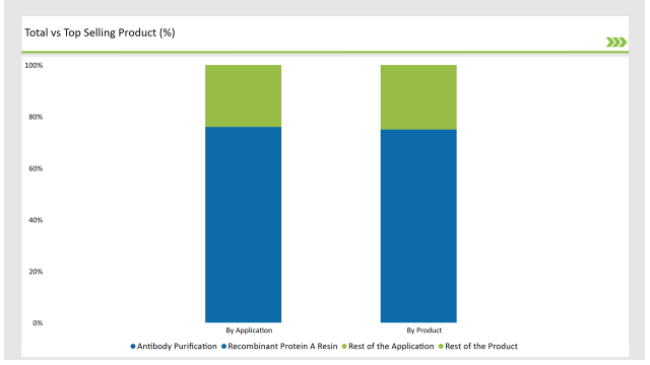

Natural protein A resins continue to be widely used for their high specificity in antibody purification. However, recombinant protein A resins are gaining traction due to their improved binding capacity and stability. By 2035, recombinant resins are expected to capture over 55% of the market share, driven by advancements in engineered ligands and enhanced resin durability.

Agarose-based matrices remain the most commonly used platform for protein A resins due to their superior binding efficiency and scalability. Glass or silica-based matrices are witnessing moderate growth, while organic polymer-based matrices are emerging as alternatives for enhanced purification efficiency and cost-effectiveness.

The biggest application of protein A resins is for antibody purification, which has over 70% of the market. The high-performance resins are in demand because of the rising monoclonal antibody-based therapeutics. The immunoprecipitation techniques are also on the rise, especially in research applications, with the advances in precision medicine that requires highly selective purification methodologies.

Protein A resins have widely been applied to the industry; the end use is by large biopharmaceutical manufacturers and for broad application in the process of producing and downstream processing antibodies. Research institutes in the clinics are adopting increasing use in the experimental and preclinical applications while academic institutions bring innovation with developments of novel resin applications.

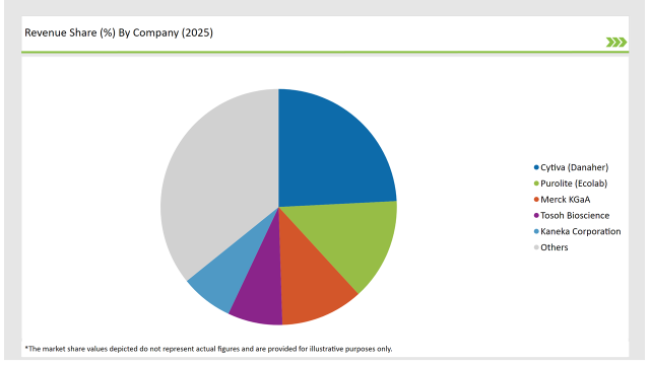

The China protein A resins market is moderately consolidated. The key players are Samsung Biopharmaceuticals, Celltrion, SK Biopharmaceuticals, and LG Chem who invest in increasing resin production capacity.

There is the entry of smaller biotechnology firms and university-based research centers with innovative, lower-cost resins and other relatively inexpensive, yet better bioseparation technologies for gaining market position. Further public and private investments in bioprocessing infrastructure most likely will support the growth and expansion of protein purification solutions to this market.

By 2025 to 2035, the China Protein A resin market is expected to grow at a CAGR of 5.2%.

By 2035, the sales value of the China protein A resin industry is expected to reach is 138.1 million.

Key factors propelling the China protein A resin market include biopharmaceutical growth, R&D investment, regulatory support, rising health awareness, technological advancements, CDMO Growth.

The key players operating in the global electrosurgery generators space include Medtronic Plc, Ackermann Instrument, B. Braun Melsungen AG, Symmetry Surgical Inc. (Aspen Surgical), Chengdu Mechan Electronic Technology Co., Ltd, Miconvey SURGICAL, Telea Electronic Engineering S.r.l., Olympus Corporation, Ethicon US, LLC (Johnson and Johnson Surgical Technologies) and others.

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Eosinophilia Therapeutics Market Insights – Trends & Forecast 2025 to 2035

Endometrial Ablation Market Analysis - Size, Share & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Encephalitis Treatment Market - Growth & Future Trends 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.