The China preclinical medical device testing services market is expected to reach USD 103.3 million in 2025. The market is projected to grow at a CAGR of 7.6% and reach a total value of USD 214.7 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 103.3 million |

| Projected Value 2035 | USD 214.7 million |

| Value-based CAGR from 2025 to 2035 | 7.6% |

Several factors are bound to drive phenomenal growth in the UK preclinical medical device testing services market. High-level preclinical testing demand for enhanced testing services as there is development of strong health infrastructure.

These involve state-of-the-art technologies like simulation and imaging that enable rapid testing faster, more accurately. Further to this, as the ultimate goal of Chinese manufacturing will always be exporting to foreign markets, other aspects for the best practice include sustainable ones that can put a more patient-centric approach along with a well-established ecosystem for clinical trials within the country. This propels the market ahead, ensuring innovating while maintaining the power of regulatory compliances.

Explore FMI!

Book a free demo

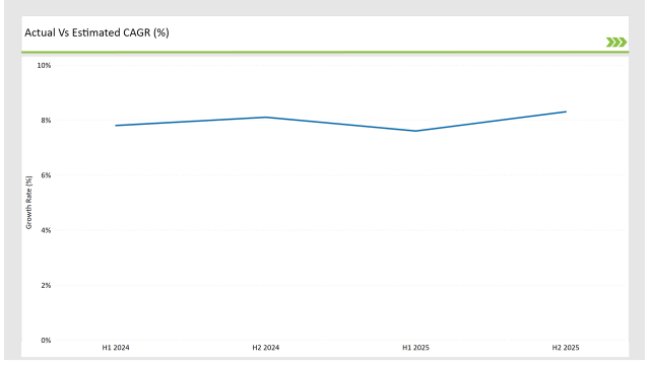

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the China preclinical medical device testing services market.

This semi-annual analysis highlights crucial shifts in market dynamics and provide with a more precise understanding of the growth trajectory within the year. The H1, which is the first half of the year shows the January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the China market, the preclinical medical device testing services sector is predicted to grow at a CAGR of 7.8% during the first half of 2024, with an increase of 8.1% in the second half of the same year. In 2024, the growth rate is anticipated to slightly decrease to 7.6% in H1 and increase to 8.3% in H2.

This pattern reveals a decrease of 21 basis points from the first half of 2024 to the first half of 2025, followed by a increase of 26 basis points in the second half of 2025 compared to the second half of 2024.

These figures illustrate the dynamic and evolving nature of the China preclinical medical device testing services market, impacted by factors such as regulatory changes, and innovations in different services provided by the service providers. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Growing Medical Device Market: The growing demand of America® Holdings for medical devices that has capability to detect accurate diagnosis anticipate market growth. |

| 2024 | Heavy Investment in Advanced Technologies: NAMSA is focusing on the Emphasis of manufacturers on investing heavily for integration of advanced technologies in Medical devices surges market growth |

| 2024 | Emphasis on Export of their Products: Intertek Group Plc is giving emphasis of manufacturers towards export of their products surges demand of the market. |

Growing Medical Device Industry across the globe anticipates the Growth of Market in the China

That large and relatively older population reflects a complete and significant expansion of chronic illnesses in cases related to diabetes, cardiovascular illnesses, and most instances of osteoarthritis. Which naturally means even increased demand due to the improved variety of medical treatment available for various life-threatening disorders that require specialized treatment by utilizing special, newly developed, more advanced models and units of these particular machines.

These are also, therefore, the devices that have to undergo comprehensive preclinical testing for their safety and performance before clinically practicing. With the growing demand for medical devices, there is an increased market share for preclinical testing services, especially because manufacturers are needed to ensure their products are performance-oriented in terms of meeting local and international regulatory requirements.

Growing Investments towards Development of Healthcare Infrastructure Anticipates its Market Growth in China

The growth of China's healthcare infrastructure is one of the major factors that drives the preclinical medical device testing services market. While developing the healthcare infrastructure of the country, it creates a favorable environment for the growth of the medical device industry.

New hospitals, research centers, and healthcare technologies results in increase in demand for innovative medical devices. To meet this growing demand, manufacturers are ensuring that their products meet strict standards for safety, performance, and regulations even before they reach clinical trials.

This requires extensive preclinical testing to raise red flags on potential risks while optimizing device functionality. While developing more devices on improved healthcare infrastructure in China, preclinical testing services will lay the main basis of quality in devices for safety and effectiveness before human trials, thus accelerating the growth in the market.

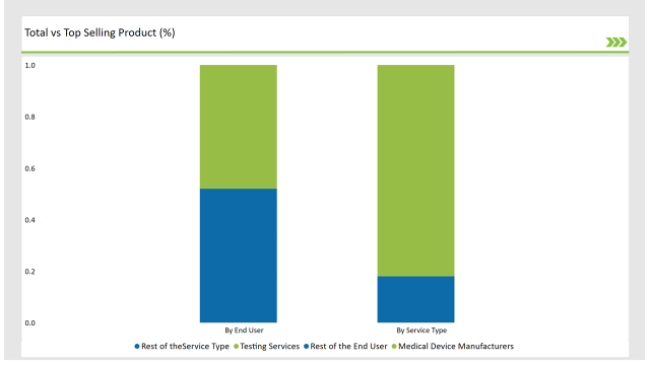

% share of Individual categories by Service Type and End User in 2025

The Critical Factor of Ensuring the Safety and Efficiency in Medical Device Aid Testing Services to dominate the Market

China's NMPA enforces rigorous standards which demands for extensive preclinical testing. This factors ensure that medical devices meet the required safety, and compliance criteria. Further expansion of China's healthcare infrastructure, demands for more sophisticated medical devices in severe cases of cardiology, oncology, and neurology.

The more these are digital health tools and AI-driven technologies, the more specialized testing is required because of unique risks and functionalities. Testing services support manufacturers in mastering the dynamic Chinese regulatory environment and, simultaneously, allow quicker market access due to their assurance of meeting local and international requirements for devices. This makes testing services highly required in China by medical device developers..

Comprehensive Testing Required by Medical Device aid them to hold Dominant Position

It dominated the preclinical medical device testing services market in China, given that medical devices are central in the design, development, and bringing to market of innovative devices. Growing success within the industry increases the demand for specialized testing services that can properly appraise the performance of a device, recognize early risks, and speed up market entry.

In essence, as the backbone of medical device development in China, manufacturers are in great need of preclinical testing services to support successful product launches and regulatory approvals.

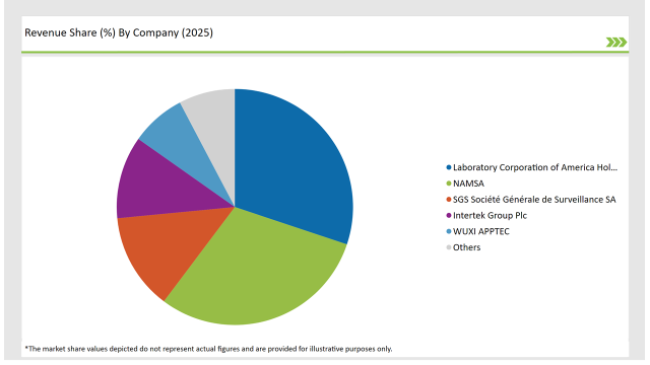

The China preclinical medical device testing services market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment. Companies such as Laboratory Corporation of America Holdings, Charles River Laboratories, WUXI APPTEC and Sotera Health dominate the market by leveraging advanced technologies for streamlining their production process.

The competitive landscape of the China preclinical medical device testing services market demonstrates a blend of top manufacturing companies in the country.

2025 Market share of China Preclinical Medical Device Testing Services

Note: above chart is indicative in nature

By 2035, the China preclinical medical device testing services market is expected to grow at a CAGR of 7.6%.

By 2035, the sales value of the China preclinical medical device testing services industry is expected to reach USD 214.7 million.

Key factors that are attributing to the growth of the China preclinical medical device testing services market include growing medical device industry across the globe along with major focus of manufacturers on advancing their products for introduction at minimal cost.

Prominent players in the China preclinical medical device testing services manufacturing include Laboratory Corporation of America® Holdings, NAMSA, SGS Société Générale de Surveillance SA., Intertek Group Plc, WUXI APPTEC, TÜV SÜD, Sotera Health, Eurofins Scientific, iuvo BioScience, llc, RQM+, Pace Analytical Services LLC, Pharmaron, Bioneeds India Pvt. Ltd., Porsolt, Gradient LLC and Goupe Icare.

The industry includes Testing Services (Biocompatibility Testing, Microbiological & Sterility Testing, Analytical chemistry {Material Characterization, Extractables and leachables, Storage and stability testing and Polymer Investigation}, Toxicology Testing { Cytotoxicity, Genotoxicity and Other Toxicology Testing}, Functional Testing, Electromagnetic Compatibility (EMC) Testing, Implantation Studies, Biological Safety Evaluation, Package Validation, Reusability Testing, Pyrogen Testing and Others, and Consulting Services (Device Designing/Engineering and Regulatory affairs Consulting).

In terms of device category, the industry is divided into Orthopedics, Cardiovascular, Respiratory, Diabetes, Dental, Neurology, Oncology, Ocular, Bariatrics, Wound Healing, General Health (Wearables), In Vitro Diagnostics, General Surgery, Drug Device Combination and Other Device Category.

The industry is divided into Class I, Class II and Class III.

The industry is classified by end user as medical device manufacturers, pharmaceutical and biotech companies, device design and engineering firms and academic and research institutions

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.