The China pharmaceutical intermediate market is projected to be valued at USD 9,309.7 million in 2025 and is anticipated to witness a steady expansion at a CAGR of 6.4%, reaching USD 17,276.3 million by 2035.

| Attributes | Values |

|---|---|

| Estimated China Industry Size (2025) | USD 9,309.7 million |

| Projected China Value (2035) | USD 17,276.3 million |

| Value-based CAGR (2025 to 2035) | 6.4% |

Advanced intermediates are therefore required. Cost-effective manufacturing in China and scalability help attract pharmaceutical companies looking to cut production costs, thus driving the sector even further.

Other driving factors for producing high-quality pharmaceutical intermediates at increased efficiency are enhanced regulatory standards and technological manufacturing advances like continuous flow chemistry and automation.

Further, China's increasing export market for pharmaceuticals makes the country a key player in the global arena, thus raising demand for high-quality intermediates. Finally, the emergence of biologics and biosimilars creates added demand for special intermediates, further driving overall market growth.

Explore FMI!

Book a free demo

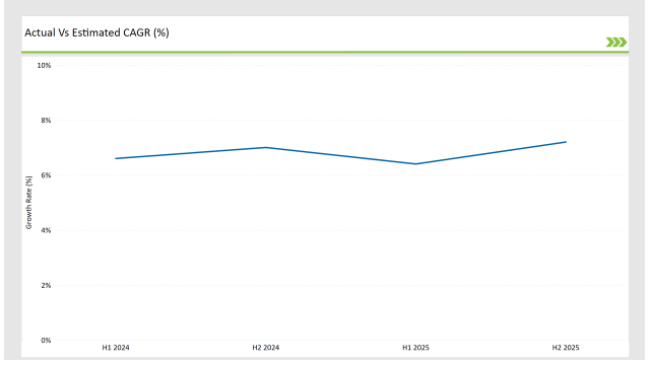

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the China pharmaceutical intermediate market.

The semiannual analysis underlines significant market trend shifts and revenues realized; thereby, this makes the growth trends within the year clearer for all stakeholders. It breaks it into two: the first half, H1 is January to June, while H2 represents the July to December period.

H1 stands for January to June, H2 stands for July to December

For the China market, the pharmaceutical intermediate sector is expected to grow at a CAGR of 6.6% during the first half of 2024 and an increase to 7.0% in the second half of the same year.

The growth rate for 2024 is expected to be slightly reduced to 6.4% in H1 and increase to 7.2% in H2. This pattern shows a decrease of 21 basis points from the first half of 2024 to the first half of 2025, and a rise of 26 basis points in the second half of 2025 relative to the second half of 2024.

The figures depict the dynamic and yet changing nature of the China pharmaceutical intermediate market, which is largely influenced by factors such as regulatory changes, growing focus of Chinese players on export of their products, and innovations of specialized intermediate. This semi-annual breakdown is critical for businesses planning their strategies to capitalize on the anticipated growth and navigate the complexities of the market.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Emphasis on Export: BASF SE is emphasizing on export of their intermediate products at an cost efficient price. |

| 2024 | Investment in Production Capabilities: Cambrex company is emphasizing on making strategic investments towards expansion of their production capabilities in different geographical locations |

| 2024 | International Conferences: Pharmaceutical intermediate manufacturers such as BASF SE is focusing on participating in international conferences |

Availability of Sophisticated Infrastructure for Production Will See the Emergence of the Pharmaceutical Intermediate market in the Country

This sector is very fast-developing in China, and growth is triggered by a need for generic drugs, innovative products. Pharmaceutical intermediates are strongly integrated in the formation of active pharmaceutical ingredients.

Important intermediates compose a critical part of the synthesis that is employed for the preparation of small-molecule drugs and the complex biologics. Considering China's development plans that ensure the enhancement of its domestic pharmaceutical manufacturing, an increase in this respect has directly reflected the demand for high-quality pharmaceutical intermediates.

Emphasis of Chinese Manufacturer on Export of their Pharmaceutical Intermediates Contribute to its Market Growth

The pharmaceutical intermediates export value chain highlights how the contribution of Chinese manufacturers helps boost the market growth by meeting global demand for affordable, quality intermediates.

Competitive pricing, large-scale manufacturing, and regulatory improvement have ascertained the increasing demand for China's pharmaceutical intermediates in international markets. China's intermediates become an important part of the supply chain in cost-efficient production for pharmaceutical companies worldwide.

Additionally, China's emphasis on adhering to international regulatory standards also guarantees the acceptability of its products, which increases its exports. Stronger export activity strengthens China's position in the global pharmaceutical market and encourages both domestic production and international sales of intermediates.

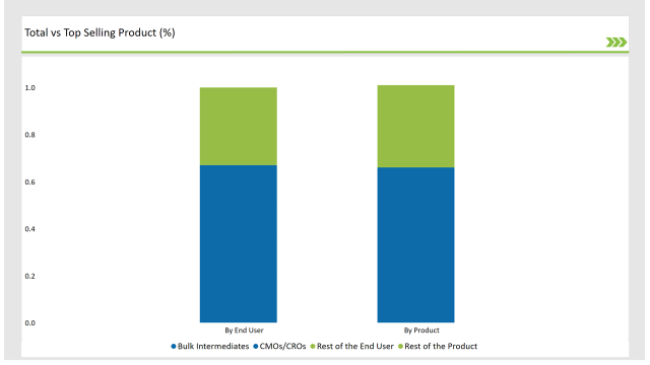

% share of Individual categories by Product Type and End User in 2025

Bulk drug intermediates records significant surge in the market owing to its growing adoption in manufacturing of dietary supplements

Bulk intermediates allow large-scale production of APIs, which helps control the price of drugs, especially generics. Biosimilars are increasingly in need of bulk intermediates because of mass production, which further fuels demand. A strong Chinese legal and regulatory regime ensures that bulk intermediates are quality-wise competitive both on the local and international markets.

With the incorporation of automation along with digital technologies in the production process, efficiency and scalability emerge to further help market growth. In this light, the strategic partnership between Chinese pharmaceuticals and the different contract manufacturing organizations makes provision for strong and flexible supply chain reliability necessary for global demand with increasingly affordable high-quality intermediates.

Besides, the recent strategic focus of China to expand its pharmaceutical export market increases more the demand for bulk intermediates; hence, making the country a major player within the supply value-chain of pharmaceuticals globally.

Emphasis on outsourcing their production facilities has aided CMOs to hold dominant position

CMOs occupy the commanding height in the market of China's pharmaceutical intermediates, reaching a share of 66.8%. There are several factors driving it to dominance.

First, it is cost-effective because CMO enables pharmaceutical firms to outsource their production and avoid huge fixed investments in setting up manufacturing facilities for the product range, reducing both capital expenditures and operational costs, thus letting a company develop drugs with higher inputs into R&D.

In addition, CMOs can offer scalability and flexibility, and specialized expertise in handling complex manufacturing processes-important ingredients toward meeting the increasing demand for generics and biologics in China's rapidly growing healthcare market.

The expansion of China's biosimilars and biologics market brought it to a whole new level of demand for CMOs. Moreover, CMOs guarantee compliance with both domestic and international regulatory standards, adding to their attraction in ensuring high-quality production of pharmaceutical intermediates.

Note: above chart is indicative in nature

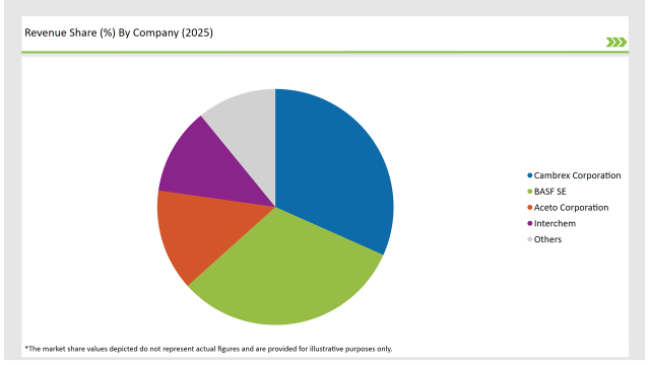

The China pharmaceutical intermediate market is moderately fragmented, with a mix of multinational corporations and regional players contributing to a dynamic competitive environment.

Companies like Cambrex Corporation, BASF SE, Aceto Corporation, Interchem, Cambrex Corporation, Arkema Inc. dominate the market by leveraging advanced technologies for streamlining their production process. However, smaller companies are also carving out niches by specializing in unique color solutions and catering to specific consumer needs.

The competitive landscape of the China pharmaceutical intermediate market features a blend of major multinational corporations and innovative regional companies.

By 2035, the China pharmaceutical intermediate market is expected to grow at a CAGR of 6.4%.

By 2035, the sales value of the China pharmaceutical intermediate industry is expected to reach USD 17,276.3 million.

Key factors propelling the China pharmaceutical intermediate market include the growing focus of market players on expansion of their geographical presence.

Prominent players in the China pharmaceutical intermediate manufacturing include BASF SE, Cambrex Corporation, Interchem, Arkema Inc, Pfizer, BMSetc, Midas Pharma GmbH, Chiracon GmbH, Codexis, Inc, A.R. Life Sciences Private Limited, Dishman Group and Dextra Laboratories Limited.

The industry includes chemical intermediates, bulk drug intermediates and custom intermediates.

Available in forms branded drug intermediates, and generic drug intermediates.

The industry is divided into analgesics, anti-inflammatory drugs, Cardiovascular Drugs, Anti-diabetic Drugs, Antimicrobial Drugs, Anti-cancer Drugs and others.

The industry is classified by end user as biotech and pharma companies, research laboratory and CMOs/CROs

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.