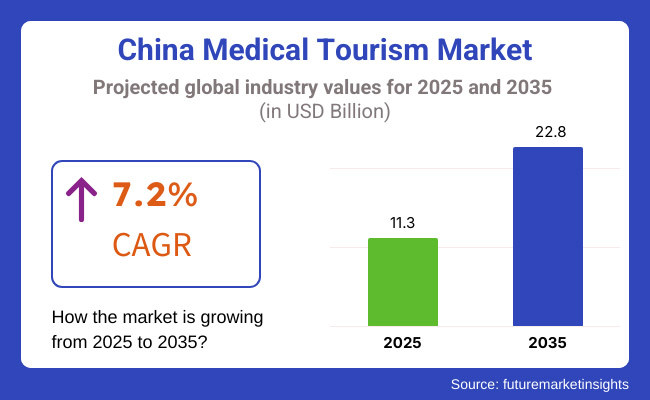

The China Medical Tourism Industry is poised to experience substantial growth, with projections indicating an increase from an estimated USD 11.3 billion in 2025 to USD 22.8 billion by 2035, growing at a CAGR of 7.2% during the forecast period. This expansion is driven by a rising demand for affordable and high-quality medical services, advancements in technology, an increasing number of international patients seeking treatments, and a strategic push by the Chinese government to enhance healthcare infrastructure.

The Chinese medical tourism market is benefiting from the growing reputation of hospitals offering advanced treatments, including stem cell therapies, cancer treatments, and fertility solutions. Additionally, China's focus on low-cost healthcare in contrast to Western nations is attracting international patients, especially from surrounding Asian nations, the Middle East, and Africa, to come for treatment within its borders. Quality care at competitive prices is making China a popular destination for medical tourism.

Explore FMI!

Book a free demo

The following chart outlines the projected shifts in CAGR for the China medical tourism market, comparing growth trends between 2024 and 2025.

CAGR Values for China Medical Tourism Industry (2024 to 2025)

It is expected that the China Medical Tourism Industry will grow at a CAGR of 6.4% in the first half of 2024, with a slight increase to 6.8% in the second half. The growth rate will accelerate to 7% in the first half of 2025 and further rise to 7.2% in the second half, driven by the increasing interest in specialized procedures such as cosmetic surgery and cancer treatment.

| Category | Details |

|---|---|

| Market Value | The China medical tourism industry is expected to generate USD 10.6 billion in 2024, representing 20% of Asia’s medical tourism market. |

| Domestic Market Share | Domestic patients represent 30% of the market, with cities like Beijing, Shanghai, and Guangzhou being primary centers for specialized treatments. |

| International Market Share | International patients represent 70%, with major source countries including South Korea, Japan, Russia, and the Middle East, seeking treatments ranging from fertility treatments to stem cell therapy. |

| Key Destinations | Popular destinations include Shanghai for IVF treatments, Beijing’s top-tier cancer centers, and Guangzhou’s advanced cosmetic surgery clinics. |

| Economic Impact | The medical tourism sector generates billions annually, benefiting local hospitals, specialized clinics, and research institutions like Peking Union Medical College Hospital. |

| Key Trends | Innovations in stem cell therapy, growth in high-quality cosmetic treatments, and increasing awareness of wellness tourism for preventive care. |

| Top Treatment Seasons | Spring and autumn are peak seasons, especially for patients seeking IVF, cosmetic procedures, and treatments for chronic diseases. |

China has become an emerging destination for Asian medical tourism, with Beijing and Shanghai emerging as international patient hubs. Top facilities such as Peking Union Medical College Hospital and Fudan University Shanghai Cancer Center are already attracting patients all over the world. In addition, the cheapness of healthcare coupled with top-of-the-range technologies in Chinese healthcare facilities further supports China's image as a preferred destination for medical tourists. International patients from neighboring countries such as South Korea, Japan, and Russia, along with those from the Middle East, are drawn to China for its highly competitive pricing for treatments like IVF, cancer treatments, and advanced surgeries. Domestic patients are increasingly traveling within China to access specialized care not available in their local regions, contributing to the rise of internal medical tourism.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of International Stem Cell Program: Beijing’s Stem Cell Research Center introduced a groundbreaking stem cell treatment program for chronic pain management and neurological conditions, attracting patients from Southeast Asia. |

| Dec 2024 | Expansion of Cosmetic Surgery Clinics: Guangzhou’s top cosmetic surgery centers unveiled an all-inclusive package for international patients, including consultations, recovery care, and luxurious accommodations. |

| Nov 2024 | Opening of Advanced Cancer Treatment Center: The Fudan University Shanghai Cancer Center launched a state-of-the-art unit for targeted therapies and immunotherapies, attracting patients from the Middle East. |

| Oct 2024 | Telemedicine Services for International Patients: The Shanghai International Medical Center launched telemedicine services for international patients seeking consultations before traveling for treatment. |

| Sept 2024 | Fertility Tourism Growth: Shenzhen’s renowned IVF clinics reported a 20% increase in international fertility tourism, thanks to the affordability and success rate of their procedures. |

Cosmetic Treatments Lead the Market

Cosmetic procedures are fast becoming the dominant industry in China's medical tourism sector, with a forecasted 30% market share by 2025. This trend is fueled chiefly by the increasing worldwide interest in beauty, wellness, and self-esteem. The attraction of high-end plastic surgery, such as rhinoplasty, facelift, liposuction, and body contouring, is particularly irresistible to foreign patients who want to enjoy sophisticated treatments at affordable rates. China’s cosmetic surgery industry has earned a reputation for offering world-class services with skilled surgeons using cutting-edge techniques, which draws patients from across Asia, the Middle East, and even Western countries.

Guangzhou and Shanghai are emerging as the country’s most sought-after cities for cosmetic procedures. Guangzhou is famous for having plenty of seasoned plastic surgeons who offer a blend of affordability and quality. Most of the clinics within the city specialize in a variety of procedures, and most patients select this destination for its low prices relative to other international cosmetic surgery centers. Shanghai, meanwhile, is a pacesetter in having cutting-edge technology and high-class facilities. The international reputation of the city as a sophisticated, advanced center for modern cosmetic surgery guarantees it to receive medical tourists in search of the most up-to-date non-invasive and conventional surgeries.

In addition, the popularity of minimally invasive treatments like Botox, dermal fillers, and non-surgical facelifts has been a major factor in the boom in cosmetic procedures. They provide quicker recovery, reduced risk, and lower expenses compared to conventional surgeries and thus are highly sought after by young patients. With a combination of low-cost and high-level care, as well as rising access to such advanced non-invasive treatments, China's cosmetic surgery industry is set to see further expansion, making the country a leading world medical tourism destination for aesthetic upgrades.

Independent Travelers Dominate the Market

By 2025, independent travelers will comprise around 55% of medical travelers to China, a strong reflection of the transition towards self-arranged medical travel. The trend is predominantly fueled by rising access to information on the web, which puts patients in the position to inform themselves about hospitals, compare their treatment options, read patient comments, and correspond directly with health facilities. The openness offered by internet platforms has provided medical tourists with greater independence and self-assurance in controlling their healthcare experience, avoiding conventional middlemen like medical tourism companies.

Shanghai and Beijing are leading the way in this trend, with international patients preferring these cities due to their state-of-the-art medical facilities. These cities are famous for having top-notch healthcare infrastructure, which comprises world-class hospitals with specializations in cosmetic surgery, fertility treatments, and cancer treatment. With the use of online information, patients are able to decide on the best hospitals and doctors that provide quality services, customized to their needs.

Independent travelers appreciate the convenience of coordinating their travel and medical plans at the same time. Numerous patients are currently integrating their medical treatments with leisure tourism, making the most of China's wealth of history, cultural sites, and renowned landmarks. For example, patients receiving treatments in Shanghai or Beijing can readily visit historic sites such as the Great Wall of China, the Forbidden City, or contemporary sites like the Shanghai Tower. This flexibility allows medical tourists to not only receive high-quality care but also enjoy an enriching travel experience, turning their medical journey into a dual-purpose trip.

In addition, independent medical tourists also enjoy cost savings by making direct reservations with hospitals or specialized websites, which enable them to bypass the extra charges usually imposed by medical travel agencies. This degree of personalization and control over treatment and travel has made independent medical tourism a more appealing choice for individuals who want to access healthcare overseas.

The China Medical Tourism Industry is increasingly competitive, with numerous players including United Family Healthcare, WeDoctor, and PlacidWay China, offering a range of treatments for international patients.

2025 Market Share of China Medical Tourism Players

Leading players in the industry include United Family Healthcare, WeDoctor, and PlacidWay China, followed by various regional hospitals providing niche services such as fertility treatments, cosmetic surgery, and traditional Chinese medicine.

The China Medical Tourism Industry is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The market is projected to reach USD 22.8 billion by 2035.

Key drivers include affordable high-quality medical care, growing demand for specialized treatments, and an increase in international patients seeking treatments like stem cell therapy and cosmetic surgeries.

Key players include United Family Healthcare, WeDoctor, PlacidWay China, and leading IVF centers in Beijing and Guangzhou, offering world-class medical care and cutting-edge treatments.

The industry is segmented into Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopedic Treatment, Infertility Treatment, Ophthalmic Treatment, and Other Treatments.

The market is analyzed by age groups (Less than 15 years, 15 - 25 years, 26 - 35 years, 36 - 45 years, 46 - 55 years, Over 55 years).

Segmentation includes Domestic and International tourists.

The industry includes Public Provider, Private Provider.

Independent Traveler, Tour Group, Package Traveler

The market is analyzed by gender (Men, Women) and age (Children).

The industry is segmented into Phone Booking, Online Booking, and In-person Booking.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

China Destination Wedding Market Insights – Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.