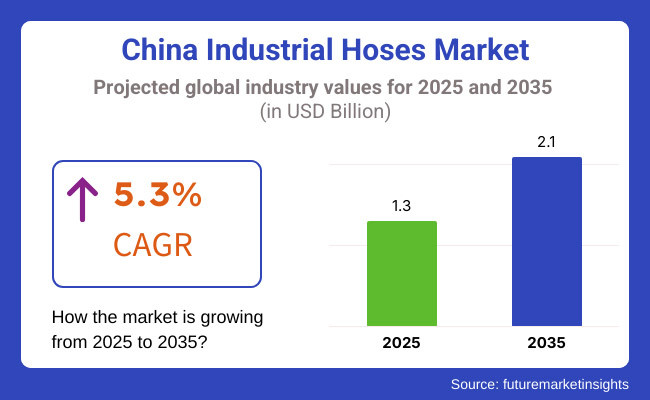

The China industrial hoses market is poised for steady growth, with its market value expected to increase from USD 1.3 billion in 2025 to USD 2.1 billion by 2035, registering a CAGR of 5.3% over the forecast period. The expansion of key industries, including manufacturing, construction, automotive, and oil & gas, is driving demand for industrial hoses. Advancements in materials and hose technologies, alongside stringent safety and environmental regulations, are shaping the market's evolution.

China's industrial hoses market is witnessing a transformative phase driven by technological advancements, stringent regulations, and increasing industrial automation. The demand for high-performance hoses with enhanced durability, flexibility, and resistance to extreme conditions is rising, especially in high-growth industries like oil & gas, construction, and manufacturing.

China's emphasis on environmental sustainability and safety standards is leading to the development of eco-friendly and energy-efficient hoses. The expanding infrastructure projects and a thriving export market further contribute to the steady demand and long-term growth of industrial hoses in China.

The fast growth of industrialization in China, the rise of infrastructure development, and a powerful manufacturing industry all work hand in hand to fuel the demand for industrial hoses. These hoses are primarily used in various industries for the transportation of fluids, gases, and materials in bulk. The rise of sectors like chemical processing, food & beverage, and pharmaceuticals has also increased market development.

Innovations in technology, such as high-performance synthetic rubber and thermoplastic hoses, have been developed that have greater flexibility and durability, as well as improved chemical resistance, making them suitable for much harsher operating conditions. Government regulations emphasizing workplace safety and environmental sustainability are encouraging the adoption of high-quality, eco-friendly industrial hoses.

Explore FMI!

Book a free demo

Eastern China is home to factories and industries manufacturing a vast array of products, making it one of the most industrialized regions in the country. The area has a notable presence of automotive, electronics, and petrochemical sectors that require industrial hoses for transporting fluids and gases.

The increase in the production of vehicles and the erection of advanced manufacturing facilities in the region are the main factors causing the demand for flexible, heat-resistant, and durable hoses to rise.

The promotion of green manufacturing and industrial safety by the government has a role to play in industries, which are very keen now to adopt green hose solutions. The presence of both local and global leading manufacturers of hoses in Eastern China has made the region a critical market driver for the development of the industrial hoses sector.

Northern China is crucial in heavy industries, power generation, and construction and is thus a major consumer of industrial hoses. The Beijing and Tianjin cities act as economic centers while the Hebei province contains huge-scale steel production and petrochemical industries. The coal mining industry in Inner Mongolia is adding even more demand, with the need for high-pressure and abrasion-resistant hoses.

The infrastructure projects such as highways, airports, and energy facilities are fast becoming a bottleneck for growth, thus, creating more demand for construction-grade industrial hoses. The government is paving the way for further investments in green hose materials, while on the other, it is promoting the use of advanced materials that are both chemical and temperature resistant thus, giving growth chances to the manufacturers of hoses in the region.

The main manufacturing hub southern China has become is a magnet for global companies, especially in the automotive, electronics, and shipbuilding industries, which in turn is boosting the demand for industrial hoses. The Pearl River Delta Economic Zone, which includes Shenzhen and Guangzhou as its main cities, is the world's number one in electronics production, and some production lines require hoses that can be used in precision manufacturing and cooling applications.

They are also the port and shipbuilding in Fujian and Hainan that must use resilient hoses for marine and oil transfer applications. The inauguration and development of smart factories along with the introduction of automation technologies led to the increased requirement of high-performance thermoplastic hoses. The strategic location of southern China as a trading and export hub boosts its position as a leading supplier of industrial hoses to the domestic and international markets.

Central China is growing as a developed industrial region by building infrastructure very quickly, raising transportation and manufacturing sectors hence adding to the demand for industrial hoses. Wuhan, Changsha and Zhengzhou being the industrial cities are the major areas driving demand for high-pressure hoses due to the construction and heavy machinery applications. Agriculture in Henan and Anhui also uses industrial hoses for irrigation and pesticide spraying systems.

Furthermore, China's "Rise of Central China" project that endeavours manufacturing activities is attracting new investments which then results in the demand for hoses used in logistics, industrial automation, and material handling. Linking with the Eastern and Western China, the central region gets the advantage of the supply of industrial hoses from the domestic market.

Sichuan and Chongqing in Western China are the leaders in the industrial sector which grows thanks to government investments in sectors such as transportation, energy, and mining. The Xinjiang oil & gas exploration, which will involve pipelines in Tibet, will need high-performance industrial hoses that are operable in extreme environments.

Construction of railways, roads, and bridges in remote areas further creates demand for heavy-duty construction hoses. Besides, tasks in the power sector such as the installation of hydro and solar plants provide new niches for specialized hoses for fluid transfer and power plant maintenance. The Go West Policy of the government is responsible for pushing the plan and turning the region into an expanding market for industrial hose suppliers.

Raw Material Price Volatility

The Chinese industrial hose market is vulnerable to fluctuations in the prices of raw materials, including rubber, thermoplastics, and metal parts. Prices for natural rubber and synthetic polymers are affected by global chain issues, the price of oil, and trade rules. China’s environmental rules that limit chemical production affect the availability and price of crucial raw materials and create more strains for the manufacturers.

In the end, rising material costs can further lead to higher product prices, and products from such industries being less affordable will mean that they are not in demand. Companies, therefore, are compensating for this difficulty by finding alternative materials, recycling procedures, and buying from local businesses thus, they are reducing their reliance on the global supply chain which is undependable in times of volatility and assuring stability in costs.

Compliance with Stringent Environmental Regulations

The stringent environmental laws and regulations in China mean that companies that manufacture industrial hose have to find ways to cut their emissions, reduce their waste, and develop environmentally friendly products. The implementation of the China VI Emission Standard and the Green Manufacturing Initiative is putting manufacturing companies under pressure to apply sustainable practices.

Companies that fail to accomplish those goals could face penalties and other teeth-cutting issues such as factory closures, or would be forced to slow hours. On the other hand, the change from conventional rubber-based hoses to environment-friendly ones involves a huge amount of R&D spending.

A lot of small and medium-sized manufacturers are not able to meet the compliance thresholds while still being cost-efficient. Yet, those who manage to keep with green standards are more likely to get an edge over the competition on the local and international markets.

Growing Demand for Smart and Automated Manufacturing

The China industry's arrival at dawn in the digital transformation is taking place. The IoT and smart manufacturing trends have turned into a meteoric demand for the high-performance industrial hoses. In highly automated production settings, applications for precision fluid transfer, pneumatic control, high-speed material handling etc. all need advanced hose solutions.

In particular, sensor-integrated and IoT-enabled hoses are witnessing an emerging trend with real-time monitoring of pressure, temperature, and wear conditions. This integration provides better operational efficiency, less downtime, and greater safety to the industries like electronics, automotive, and high-tech manufacturing. As the sector progresses with innovations in Industry 4.0, it is expected that the markets for both intelligent and durable industrial hoses will blossom.

Expansion of Renewable Energy and Infrastructure Projects

China's capital in resuming energy, integrating infrastructures, and carrying out transportation projects is one of the factors in gestation of many specialized industrial hoses. Wind and solar power facilities, for example, which require heat-proof and corrosion-proof hoses for fluid transfer and cooling systems are among them. Heavy construction projects like the Belt and Road Initiative (BRI) are also opening a chance for the use of heavy-duty hoses in tunnelling, bridge construction, and highway development where they are specifically applied.

The government is moneymaking the plan by the promotion of renewable energy besides that, it is advancing the project on life-cycle products by the use of green and durable industrial hoses which are innovations in this area. So, there is a win-win situation where both the renewable and the industrial sector grow as hose manufacturers have the room to make more products and also go into different market segments.

Between 2020 and 2024, the China industrial hoses market underwent a remarkable upward trend, mainly as a result of rapid industrialization, increased funding in infrastructure, and the burgeoning production sector. The quick expansion of industrial hoses needed for their use stage in the construction, oil + gas, chemicals, and automotive sectors is what lies behind the achievements. What is more, the inquiry of new materials such as reinforced rubber and thermoplastics was crucial in transforming the market.

The industrial hoses market is set to see more shifts in the near future, with the quest continuing for China to attain its status as the world's top manufacturing base. Amongst the developments that are to come will be the very eco-friendly industrial hoses, which will be made from lightweight and high-durability materials. The strict environmental regulations will again play a major role in this transition along with the further uptake of IoT and dealer smart and industrial hoses.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Moderate environmental policies; early-stage emission control measures. |

| Technological Advancements | Development of multi-layered rubber and thermoplastic hoses; introduction of hydraulic and pneumatic hoses. |

| Industry-Specific Demand | High demand from construction, oil & gas, and chemical sectors. |

| Sustainability & Circular Economy | Initial efforts to improve recycling and reduce emissions. |

| Market Growth Drivers | Urbanization, infrastructure projects, and increased automation in industrial processes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental regulations and sustainability mandates requiring eco-friendly materials. |

| Technological Advancements | Integration of IoT-enabled smart hoses for predictive maintenance and monitoring. |

| Industry-Specific Demand | Expansion into renewable energy, electric vehicle production, and high-tech manufacturing. |

| Sustainability & Circular Economy | Greater emphasis on biodegradable and recyclable hose materials. |

| Market Growth Drivers | Smart factory integration, green initiatives, and demand for high-performance industrial hoses. |

The industrial hoses market in Guangdong, which is among the top industrial centers in China, is set to experience a cumulative annual growth rate (CAGR) of 5.6%. This is powered by the province's robust manufacturing industry, predominantly in electronics, automotive, and chemical processing, which is a major force behind the need for specialized hoses.

The development of new infrastructure, including the construction of ports and industrial parks, also plays a big role in market growth. The push for smart manufacturing and automation in Guangdong interacts with the high-performance hoses' introduction, while environmental rules prompt the use of materials that are bio-friendly. The regional logistic networks that are already in place extensively go along with industrial hose sales. Thus, the market will continue to expand reliably during the next decade.

| Province | CAGR (2025 to 2035) |

|---|---|

| Guangdong | 5.6% |

The industrial hoses market in Jiangsu is predicted to experience a growth of 5.4% according to CAGR due to its dynamic chemical, steel, and automotive sectors. The province's highly developed manufacturing capabilities and the large number of industrial parks are the key reasons for the continuous demand. The policies of the government advocating clean energy and environmental sustainability are the main factors behind the requirement of highly durable and corrosion-resistant hoses.

The Jiangsu province with its significant ports and logistics centers is the linchpin in industrial supply chains that stimulate the adoption of hoses in diverse sectors. Furthermore, the increasing investments in the petrochemical and semiconductor industries will bring in more demand for exclusive industrial hoses, thereby, continually expanding the market.

| Province | CAGR (2025 to 2035) |

|---|---|

| Jiangsu | 5.4% |

Zhejiang's industrial hoses market is projected to witness a CAGR of 5.2% in the next coming years, primarily driven by its flourishing textile, machinery, and electronics industries. The provincial's aim at industrial automation and smart factories is the main factor in the rise of advanced technologies hoses.

Besides, the massive port infrastructure of the province supports international trade, thus increasing the market opportunities for many. The increase in consciousness about the surrounding environment plays in the role alongside the state policies about the quality of materials for production of sustainable and durable hoses.

However, the main factor is the massive growth of the automotive component manufacturing sector in Zhejiang which leads to the additional industrial hose requirement, thereby contributing to the province's steady market growth.

| Province | CAGR (2025 to 2035) |

|---|---|

| Zhejiang | 5.2% |

The market for industrial hoses in Shandong is expected to grow at a compound annual growth rate of 5.3%, in line with the national average. The province is a key player in China's heavy industries, such as petroleum, shipbuilding, and machinery, which create a substantial need for lightweight and robust hoses.

Government measures that are in favour of the industrial upgrades and the environment are also market value drivers. The province's developed logistics networks and port terminals also promote the distribution of industrial hoses.

What's more, the province's increasing investments in the chemical and marine industries guarantee a steady demand for specialized industrial hoses and consequently ensure GDP as well as development targets over the coming period.

| Province | CAGR (2025 to 2035) |

|---|---|

| Shandong | 5.3% |

The industrial hoses market in Sichuan is set to evolve, with predictions indicating a CAGR of 5.1%. This growth rate is slightly lower than the national average. One of the relevant factors for the increased hose demand is the province's booming manufacturing sector, especially in the industries of aerospace, energy, and heavy machinery. Investing in newish infrastructure projects such as railways and energy plants is causing the market to skyrocket.

Sichuan’s initiatives concerning green manufacturing and industrial modernization stand as a basis for the introduction of high-performance and environmentally friendly hoses. The market development is affected due to the province’s lesser growth in industrial production than coastal regions, but as before, energy and equipment manufacturing sectors show a steady and long-term market.

| Province | CAGR (2025 to 2035) |

|---|---|

| Sichuan | 5.1% |

Hydraulic Hoses Dominate Due to High Demand in Heavy Industries

In the construction, manufacturing, and heavy machinery sectors, hydraulic hoses play a pivotal role as they are one of the vital components found in China. The increasing market for the use of hydraulic systems in automation and construction projects has deeply affected the market. The product line is built explicitly for applications at high pressure; thus, they are appropriately used in hydraulic-operated machines.

Following strict safety rules and a commitment to enduring long in industrial spaces are further factors distinguishing the use of top-quality hydraulic hoses. The longstanding demand, especially in regions such as Guangdong and Jiangsu, is a result of the rapid urbanization and expansion of infrastructure in China. On top of this, the market will be influenced by the development of strengthened materials and environmentally friendly hydraulic fluids, which, in turn, will lead to the production of more efficient and sustainable hydraulic hoses.

Pneumatic Hoses Experience Growth Due to Expanding Manufacturing Sector

In China, pneumatic hoses are in great demand in the manufacturing industry where compressed air systems are highly utilized for automation, robotics, and assembly lines. The growth of Industry 4.0 has advanced the use of pneumatic systems in the automotive, electronics, and consumer goods sectors. These hoses provide flexibility, lightweight structure, and wear resistance which is the reason why they are widely used in high-speed production environments.

The government's mission of industrial efficiency improvement and energy saving, government has spurred investment in such advanced pneumatic technologies. The major sector of pneumatic solutions building is going towards saving the environment and which in turn is definitely going to contribute to the demand. Large cities like Shanghai, Shenzhen, and Chengdu are experiencing pneumatic hoses being adopted more and more for automation of production lines.

Manufacturing Sector Leads Due to Widespread Industrial Applications

Industrial hoses in China are predominantly used in the manufacturing sector, which is the single biggest application site of all and is in line with the nation being the world's largest manufacturing hub. The market growth is fueled primarily by the long-lasting, high-output hoses used in the assembly of production lines, machining centers, and material handling systems.

Hydro pneumatic hoses have universal usage in the electronics, automotive, and industrial machinery assembly areas. Due to China being the forefront of smart manufacturing and technology, the demand for high-pressure, abrasion-resistant, and chemical-resistant hoses has increased significantly.

The state’s influx investment in high-tech manufacturing parks and special economic zones only serves as an additional advantage for the market. The expected increase in foreign capital in China's industry is likely to help the growth of industrial hose applications in the long run.

Energy Sector Drives Demand for High-Performance Hoses

The energy industry, a mix of oil & gas, electricity, and renewable energy, greatly affects the industrial hoses market in China. The requirement for special hoses in refineries, power plants, and LNG facilities is rising as a result of China's focus on energy security and infrastructure enhancement. In this case, cryogenic transfer hoses, hydraulic hoses, and fuel hoses are the ones that carry and deal with the energy resources in the safest way.

The reinforcement of China's investment in LNG terminals and offshore wind farms means the increasing demand for long-lasting and corrosion-proof hoses. The transformation to cleaner energy resources is a stimulating factor in developing advanced hoses that work for hydrogen and biofuel. Thus, strategic initiatives such as renewing the focus on renewable energy projects will still be at the forefront of driving industrial hoses, thus, they will keep growing in this sector.

The China Industrial Hoses Market is growing rapidly due to increased demand from manufacturing, construction, chemicals, oil & gas, food & beverages, and pharmaceuticals industries. Key drivers include technological advancements, high-performance materials, and sustainability initiatives. International players like Eaton Corporation, Parker Hannifin, Gates Industrial Corporation, and Continental AG compete with strong domestic manufacturers such as Tianjin Pengling Rubber Hose Co., Ltd.

The market is evolving with trends such as mergers & acquisitions, eco-friendly hose materials, and smart hose technology. China’s government policies promoting industrial automation and infrastructure growth further fuel market expansion. Companies are focusing on high-pressure, heat-resistant, and flexible hose technologies to stay competitive.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Gates Corporation | 12-17% |

| Eaton Corporation | 10-14% |

| Parker Hannifin Corp | 8-12% |

| Continental AG | 5-9% |

| Kurt Manufacturing Company Inc | 3-7% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Gates Corporation | Produces high-performance hoses for automotive and industrial applications; emphasizes innovation and sustainability. |

| Eaton Corporation | Specializes in hydraulic and industrial hoses; invests in eco-friendly solutions and regulatory compliance. |

| Parker Hannifin Corp | Develops motion and control technologies; focuses on efficiency and resource optimization. |

| Continental AG | Supplies rubber and plastic hoses for various industries; targets specialized applications. |

| Kurt Manufacturing Company Inc. | Manufactures precision-engineered hoses; utilizes vertically integrated production. |

Key Company Insights

The Eaton Corporation

Eaton Corporation is an eminent enterprise in hydraulic and industrial hose production, water quickly discounting the pressure of safety, durability, and energy efficiency. This company, Eaton, is the world's largest manufacturer of hydraulic & industrial hoses, and with its commitment to sustainable and superior materials, it has a strong presence in the market. Eaton, a company that specializes in the manufacturing of fire-resistant, abrasion-resistant, and ecological hoses, is the first choice for the construction, oil and gas, and mining industries.

The company's introduction of IoT-connected monitoring systems for predictive maintenance is the source of greater competitive edge. Collaborations with OEMs and industrial firms in China provide a drive for its growth in that country.

Research in the field of lightweight, high-pressure hose technology signifies that Eaton is moving with the times and is going to remain a top player in the global market. The distribution network expansion and the local production development bring more products at lower prices, which makes Eaton a more preferred choice for industrial hoses in the Chinese market.

Parker Hannifin

Parker Hannifin is an eminent manufacturer of hydraulic and pneumatic hoses, and its offering of high-pressure, heat-resistant, and lightweight solutions research and development are its priority. The corporation is working on smart hose technology, which is a trend that facilitates the integration of real-time monitoring and predictive maintenance features into the products to elevate the performance and safety levels.

The company has aced the automotive, aerospace, and heavy machinery sectors with the thermoplastic and rubber hoses they have developed for specialized applications. Parker Hannifin's successful integration with local Chinese industrial firms and OEMs has resulted in a strong distribution network and local manufacturing.

The core priority is sustainability, out of which the company has set recyclable materials as a goal, developing a friendlier manufacturing process. The ongoing shift in the emphasis on the distribution of customized industrial hose solutions to Parker Hannifin stays as the leader in the long term in the Industrial Hose Market in China.

Gates Industrial Corporation

Gates Industrial Corporation manufactures the full range of lightweight and high-temperature-resistant industrial hoses. Of the many industries it serves, automotive, oil & gas, and construction are its major traction markets where it focuses on energy efficiency and performance optimization.

The company invests in R&D to develop next-generation industrial hoses with enhanced flexibility, reduced weight, and improved pressure resistance. Gates has a strong presence in China with regional manufacturing facilities and a distribution network. Its approach to biodegradable and recyclable hose materials helps the company to realize important aspects of China's sustainability goals.

The company's ongoing investment in automation, and the establishment of quality control systems, guarantee the highest product reliability, which gives it a competitive edge in the market.

Continental AG

Continental AG is one of the primary suppliers of industrial and automotive hoses and has distinguished itself for the chemical endurance, high-pressure capabilities, and customization of its products. The organization is well versed in the fabrication of rubber and thermoplastic hoses servicing sectors such as chemical processing, mining, and automotive manufacturing.

Recently, it has focused on production expansions in China to meet the increasing demand from the local market. Continental AG is adding smart technology to its hoses that will have the ability to be monitored in real-time and will send maintenance notes.

The eco-friendly production and low emissions, which are the areas where this company invests the most, are in line with global trends. Continental is growing its market share in China through acquisitions, alliances, and is competing both against international firms and domestic companies.

Tianjin Pengling Rubber Hose Co., Ltd.

Tianjin Pengling Rubber Hose Co., Ltd. is a leading home-grown manufacturer in China specializing in cost-effective rubber hoses, mainly for automotive, industrial, and construction applications. The firm has established a prominent position in the automotive sector by manufacturing hoses for fuel, coolant, and hydraulic applications. A distinct advantage is obtained through localized production, lower prices, and the proximity of Chinese OEM partners thus making Tianjin Pengling a prime choice.

Tianjin Pengling is expanding through investments in technological advancements, as they are focusing on high-pressure and chemical-resistant hoses, thus strengthening their position with international players. The company is on the move by penetrating the export market taking advantage of its inexpensive and outstanding product offerings. Through R&D investments which are constant, and automation driven production Tianjin Pengling is determined to achieve long-term success.

The China Industrial Hoses market is projected to reach USD 1.3 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 5.3% over the forecast period.

By 2035, the Industrial Hoses market in China is expected to reach USD 2.1 billion.

The Hydraulic Hoses segment is expected to dominate the market due to extensive use in construction, mining, and manufacturing, driven by rapid industrialization, infrastructure projects, and high demand for durable, high-pressure fluid transfer solutions.

Key players in the China Industrial Hoses market include Eaton Corporation, Parker Hannifin, Gates Industrial Corporation, Continental AG, Tianjin Pengling Rubber Hose Co., Ltd.

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.