The sales of high tibial osteotomy (HTO) plates in China is projected to grow from USD 27.1 million in 2025 to USD 59.6 million by 2035, exhibiting an 8.2% CAGR throughout the period.

| Attributes | Values |

|---|---|

| Estimated China Industry Size (2025) | USD 27.1 million |

| Projected China Value (2035) | USD 59.6 million |

| Value-based CAGR (2025 to 2035) | 8.2% |

The sales of HTO plates is expanded in China at a tremendous rate, due to the population rate and along with it increasing risk of in knee diseases.

Older people tend to stay in cities like Beijing, Shanghai, or Guangzhou, where life is getting relatively easy. However, advanced medical facilities being present in these cities are the primary drivers of an increased demand for joint preservation surgeries like HTO.

Orthopedic surgeons are encouraging HTO as a minimal invasive alternative for patients between the ages of 40 and 50 with knee osteoarthritis rather than total knee replacement. More emphasis is given on preventive treatment with patients preferring interventions that help in maintaining their range of movement for as long as possible before major surgeries set in.

Some of the companies that are shaping the HTO plate market in China include Arthrex, Jeil Medical Corporation, and Changzhou Zener Medtec. Arthrex is a global leader in orthopedics, and it is capitalizing on the growing trend of robot-assisted and minimally invasive surgeries by introducing innovative, cutting-edge solutions that are quickly gaining popularity in major hospitals.

Jeil Medical Corporation, with a huge orthopedic footprint across China, is entering this market with its high-quality HTO plates at a relatively affordable price to cater to the rising demand for cost-effective joint-preserving treatments.

Changzhou Zener Medtec, a local entity, is starting to flow into the market with locally produced titanium plates targeting more affordable options for urban and rural medical centers. Such companies are finding a way to reach the high-growing demand in the country for sophisticated orthopedic solutions.

Explore FMI!

Book a free demo

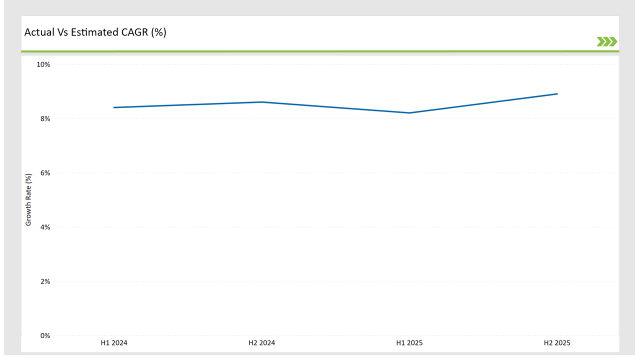

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China high tibial osteotomy (HTO) plates market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

High tibial osteotomy (HTO) plates market of the China is expected to grow at 8.4% CAGR for the first half of 2023, followed by an upgradation to 8.6% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 8.2% in H1 and is expected to rise to 8.9% in H2.

This pattern presents a decline of -17.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 27.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing high tibial osteotomy (HTO) plates market of the China, which is primarily affected by regulations, consumer trends, and improvements in high tibial osteotomy (HTO) plates. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Training and Educational Programs: Arthrex is looking to expand its market footprint in Tier 2 and Tier 3 cities of China by providing training and educational programs to local orthopedic surgeons. This is crucial in areas where there are fewer specialized hospitals. The company is forming collaborations with the Chinese medical universities so as to enhance R&D collaboration. Arthrex is producing HTO plates that are modified according to the needs of the Chinese population. Furthermore, Arthrex is investing in robot-assisted surgical solutions, which China is greatly interested in, including minimally invasive, high-precision surgeries. This has placed their products on a more favorable level by the hospitals with advanced capabilities. |

| 2024 | Strategic Partnerships: Jeil Medical Corporation focuses its strategic partnership locally with local distributors of orthopedic devices. Jeil appreciates that some of the regions in smaller cities and rural locations are highly cost-sensitive; the company will present affordable high quality HTO plates to provide value for money together with the new technology. The company is also tailoring products to meet the Chinese regulatory landscape by ensuring compliance with national standards and gaining government support for public hospital distribution, further solidifying its presence in China's state-funded healthcare system. |

| 2024 | Focuses on Local Manufacturing: Changzhou Zener Medtec's growth strategy focuses on local manufacturing and tailoring products for the domestic market, allowing for shortened supply chains and reduced production costs. The company is investing in research partnerships with Chinese hospitals for co-development of orthopedic solutions that can be aligned to the specific anatomical requirements of the Chinese population. In addition, Zener Medtec is capitalizing on the government's push for local innovation in healthcare by seeking endorsements and tenders from state-run hospitals and public health centers for gaining traction in the lower-cost, high-volume segments. |

Government Support for Advances in Orthopedic Surgery

The Chinese government's focus on improving the overall healthcare infrastructure coupled with the issuance of subsidies related to joint replacement and preservation processes is a prominent growth factor of the HTO plates market.

The government has heavily invested into the upgrading hospital facilities and launching advanced medical technology across the entire country. For instance, public hospitals in Tier 1 cities are nowadays taking up innovative surgical procedures like HTO due to national funding toward joint-preserving surgery as relatively more cost-effective than knee replacement surgery.

Reduction of healthcare costs, thus far improved patient outcomes, have resulted in the increased provision of state-funded hospitals and clinics offering HTO surgery, which has led to increased demand for HTO plates. This support enables both local and international companies to enter the market because they can now participate in government tenders and provide advanced affordable solutions tailored to Chinese patients.

Rise in adoption of advanced medical technologies in orthopedic care

China witnessed a rapid upsurge in the adoption of robot-assisted surgery, 3D printing technologies, and patient-specific instrumentation (PSI) in orthopedic care. Hospitals in tier-1 cities such as Beijing, Shanghai, and Shenzhen are gradually adopting robotic platforms for the accurate placement of HTO plates. This has been improving surgical results.

Another reason is the customized HTO plates, 3D printed with the alignment exactly matching the individual's specific knee structure. It is quite advantageous for the young patients, as this increasing trend of technology advancements is fostering the growth in the HTO plates market as the patients want to have the treatment more customized, efficient, and minimally invasive.

The demand for such advanced solutions is further fueled by China's initiative to become the global leader in healthcare innovation; it is offering grants and subsidies to ingrain cutting-edge technologies into local medical practices. Consequently, there is an increasing demand for state-of-the-art HTO solutions, thereby fueling market growth across the country.

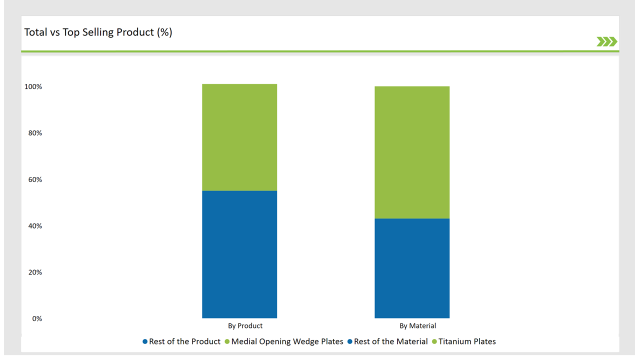

% share of Individual categories by Product Type and Material in 2025

Medial Opening Wedge Plates records significant surge in China High Tibial Osteotomy (HTO) Plates, By Product

Medial opening wedge plates dominate the Chinese HTO plates market because it can efficaciously correct valgus deformities and preserve joint function in relatively younger and active patients. These plates also do a more precise alignment of the tibial plateau especially in cases with advanced knee arthritis or misaligned knee joints.

As the Chinese population ages, and more individuals look for alternatives to knee replacement, Medial Opening Wedge Plates are favored more and more because of their minimal invasiveness and better stability. The procedure associated with medial opening wedge plates also ensures faster recovery, which is beneficial for working age group patients who do not want to spend more time in the rehabilitation process.

More specialized orthopedic surgeons are emerging in China, and they are more skilled in such techniques, enabling them to become the first preference in knee deformity correction surgery, thereby catapulting their market dominance even further.

Titanium plates constitute an overwhelming market share of Chinese HTO plates due to their material properties like high strength-to-weight ratio, lightweight, and superior biocompatibility, thus being the ideal candidate for surgical purposes.

Titanium is known for its corrosion resistance, which is vital for long-term implantation and ensures minimal complications or rejections by the body. The durability of the material also supports the trend of joint preservation surgeries to extend the functional life of the knee joint in younger patients.

In addition, the increasing interest of China in advanced materials for healthcare devices fuels the demand for titanium-based implants. The local manufacturing capacity in China of titanium plates further reduced the costs, making it affordable for both private and public healthcare settings, especially as the country's middle class seeks better treatment options.

Note: above chart is indicative in nature

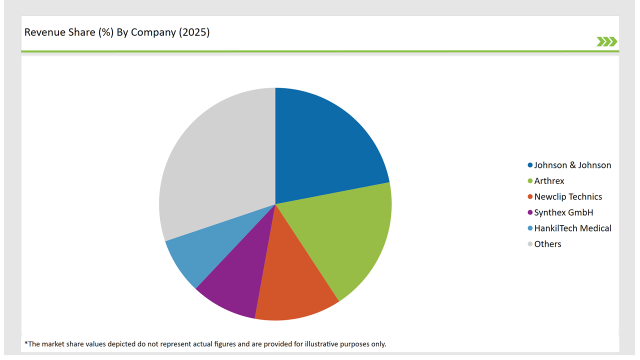

Local companies such as Changzhou Zener Medtec and Shandong Weigao Orthopedic have managed to establish a strong presence by taking advantage of low-cost production and local distribution networks, thereby making their products more accessible to government hospitals and regional clinics.

These companies benefit from the government's efforts to promote local manufacturing and are at an advantage because they can offer lower-priced solutions, which makes them competitive in the price-sensitive segments of the market.

In contrast, companies such as Arthrex, Zimmer Biomet, and Jeil Medical Corporation remain leading players in the premium segment due to advanced technologies, such as robot-assisted surgeries and implants tailored to particular patient anatomies.

They have been engaging increasingly in strategic collaborations with the country's leading hospitals to train surgeons and extend their reach in the tier-1 cities and high-end private medical facilities.

Thus, as is apparent from the above discussion, the fragmented competitive landscape today seems to be leading towards specialization and advanced surgical techniques, with a clear divide between high-cost innovation and cost-effective, local solutions.

By 2025, the China high tibial osteotomy (HTO) plates market is expected to grow at a CAGR of 8.2%.

By 2035, the sales value of the China high tibial osteotomy (HTO) plates industry is expected to reach is USD 59.6 million.

Key factors propelling the China high tibial osteotomy (HTO) plates market include government support for advances in orthopedic surgery and rise in adoption of advanced medical technologies in orthopedic care.

The key players operating in the global high tibial osteotomy plates market include Johnson & Johnson, Synthex GmbH, Newclip Technics, Arthrex, Intrauma S.p.a., aap Implantate, Aplus Biotechnology, Astrolabe, Changzhou Zener Medtec, Corentec, DTM - Deva Tibbi Malzemeler, Groupe Lépine, HankilTech Medical, I.T.S., Intercus, Jeil Medical Corporation and Others.

In terms of product, the industry is divided into- Medial Opening Wedge Plates, Lateral Closing Wedge Plates, Biplanar Osteotomy Plates, Locking Compression Plates (LCPs), Contoured Plates and Spacer Plates.

In terms of material, the industry is segregated into- medial opening wedge plates, lateral closing wedge plates, biplanar osteotomy plates, locking compression plates (LCPs), contoured plates and spacer plates

In terms of indication, the industry is segregated into- Knee Osteoarthritis, Knee Valgus/Varus Deformities, Sports Injuries and Trauma and Other Indications

In terms of end user, the industry is segregated into- Hospitals, Ambulatory Surgical Centers and Independent Orthopedic Centers

Hyperammonemia Treatment Market Trends – Growth & Therapeutic Advances 2025 to 2035

Veterinary Auto-Immune Therapeutics Market Growth - Trends & Forecast 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Digital Telepathology Market is segmented by Application and End User from 2025 to 2035

Generalized Myasthenia Gravis Management Market - Growth & Treatment Advances 2025 to 2035

Hutchinson-Gilford Progeria Syndrome Market Growth – Innovations & Therapies 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.