China market, in generic injectable are significantly expanding. With rate of 7.8%, the market will reach to USD 26.7 million in 2035 from USD 12.5 million in 2025.

| Attributes | Values |

|---|---|

| Estimated China Industry Size (2025) | USD 12.5 million |

| Projected China Value (2035) | USD 26.7 million |

| Growth Rate from (2025 to 2035) | 7.8% |

The rise in chronic disease burdens like cancer, diabetes, cardiovascular disorders, and autoimmune conditions increased demand for generic injectables in China. The shift in preference toward self-administration injectables and the treatment solutions administered in hospitals have also supported the market growth. Innovations in biologics, nanoparticle drug formulations, and prefilled syringes further accelerate its adoption in urban and rural healthcare facilities.

The regulatory pharmaceutical landscape has hugely changed in China, where approval bodies such as NMPA have increasingly approved biosimilars and complex generics more quickly. Through its negotiating mechanism of a Volume-Based Procurement program, it has been putting pressure on them; hence, the manufacturing companies have an urge toward enhancing production efficiency and improving their drug quality profile.

Besides, China's dual-track medical system, comprising both public and private healthcare facilities, has further extended access to generic injectables. While public hospitals remain the biggest consumers, private hospitals and retail chains have started stocking oncology drugs, insulin, and biologic-based injectables to meet the growing demand.

Explore FMI!

Book a free demo

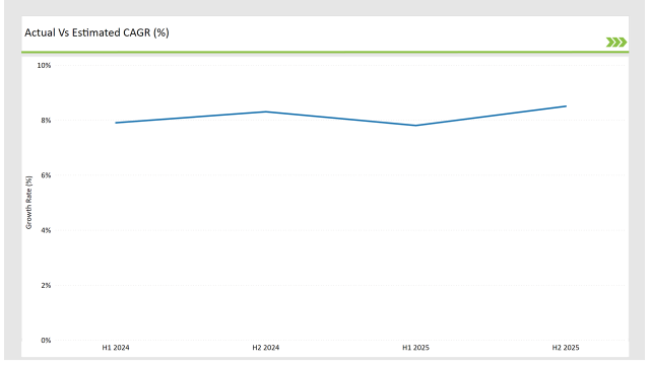

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China generic injectable market.

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The generic injectable sector for the China market is expected to rise at 7.9% growth rate in the first half of 2024, which will increase to 8.3% in the second half of the same year. In 2025, the growth rate is expected to slightly decline to 7.8% in H1 but is expected to rise to 8.5% in H2. This pattern shows a decline of 10.0 basis points from the first half of 2023 to the first half of 2025, in the second half of 2024, it is lower by 19.0 basis points compared to the second half of 2024.

The nature of the China generic injectable market is cyclical, with periodic shifts in government regulations, healthcare reforms, and patient needs. The performance review will, on a six-monthly basis, help any business stay competitive and correct course in changing market dynamics.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Fresenius Kabi concentrates on positioning itself as an international healthcare products and services provider. The company strengthened, for example, its business position in IV drugs through an acquisition in Brazil. |

| 2024 | Acquisition: Merck company is focusing on the acquisition of a clinical-stage biotech firms to develop novel therapeutics for autoimmune diseases. |

| 2024 | Collaboration: Teva company sought the cooperation in a biopharmaceutical firm which would launch a biosimilar in the China Market. |

Expansion of Domestic Manufacturing and Biopharmaceutical Innovation

There is an immense surge in injectables production from local manufacturing to significantly cut the dependence on importation. Biosimilars and complex generics investments with high-quality manufacturing development enable it to have self-sufficiency in supply and competitiveness at a global scale. This kind of strategic shift was compelled through incentives, government research funding, and strategic partnership of the country with biotech firms.

Growing Role of Online Pharmacies and Direct-to-Consumer Sales

Online pharmacies also take center stage in assuming an important place in the distribution channel for generic injectables, encouraged by the advent of advanced e-commerce and digital healthcare platforms.

More patients tend to order insulin, hormonal therapies, and pain management injectables at home for delivery, increasing accessibility and the affordability of such medication. This trend is further helped through integrations of AI-driven prescription management and digital consultations.

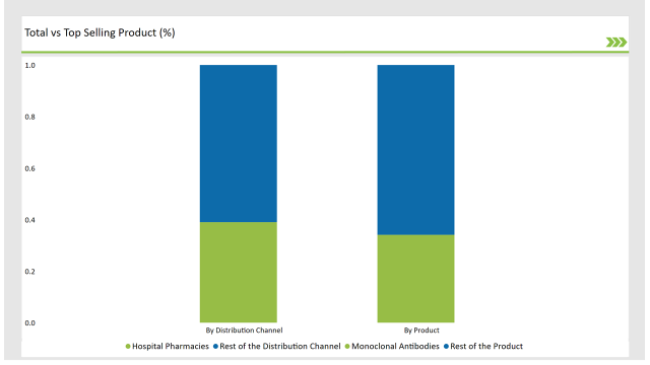

% share of Individual categories by Product Type and Distribution Channel in 2025

Monoclonal antibodies records significant surge in generic injectable market

Among product types, monoclonal antibodies (mAbs) dominate the market, particularly in oncology and autoimmune disease treatments. Additionally, chemotherapy agents, insulin-based injectables, and peptide hormones have witnessed increased adoption.

By distribution channel, hospital pharmacies account for the largest share, as most injectable medications are administered in clinical settings. However, retail and online pharmacies are expanding, especially for drugs like insulin, pain management injectables, and blood factor therapies, as patients seek more accessible and affordable treatment options.

Note: above chart is indicative in nature

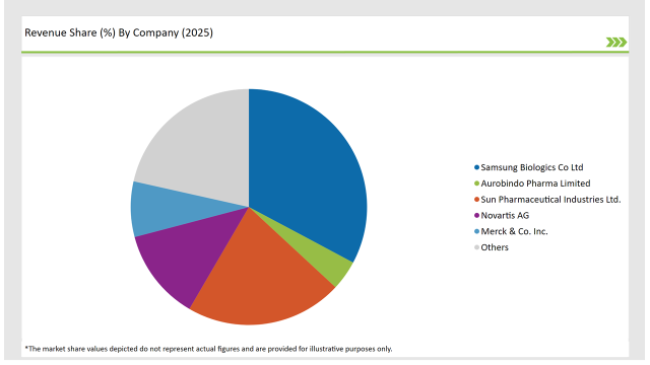

The injectables market in China is highly competitive, with a growing dominance of domestic companies, as supportive government policies spur local production to reduce the country's reliance on imports. Tier 1 companies are leading the market by focusing on biosimilars, complex generics, and regulatory compliance that guarantee a steady supply of high-quality injectable medications.

State support, research funding, and high-end manufacturing infrastructure are some of the benefits for leading firms to scale up their productions, thereby winning hospital tenders and increasing exports globally. Companies focus on efficient manufacturing, hospital partnerships, and retail pharmacy distribution to strengthen their presence.

New entrants and mid-sized firms are increasingly building their presence through competitive pricing strategies, investment in manufacturing capacity, and enhanced distribution networks. These companies focus on niche therapeutic areas and hospital-based injectables, enabling them to achieve a better market share in the increasing price-sensitive market.

The market is expected to grow at a CAGR of 7.8% from 2025 to 2035.

Monoclonal antibodies are the leading products in the market.

Key players include Samsung Biologics Co Ltd, Aurobindo Pharma Limited , Sun Pharmaceutical, ndustries Ltd., Novartis AG, Merck & Co. Inc., Cipla Ltd, Pfizer Inc., Fresenius Kabi, Sanofi S.A, AstraZeneca Plc, Teva Pharmaceuticals., Mylan N.A, Baxter International, Dr. Reddy’s Laboratories Ltd.

The industry includes various product type such as monoclonal antibodies, immunoglobulin, cytokines, insulin, peptide hormones, blood factors, peptide antibiotics, vaccines, small molecule antibiotics, chemotherapy agents, and others.

The industry includes various molecule type such as small molecule, large molecule.

The industry includes various indications such as oncology, infectious diseases, diabetes, blood disorders, hormonal disorders, musculoskeletal disorders, CNS diseases, pain management, cardiovascular diseases

Available in route of administration like intravenous (IV), intramuscular (IM) and subcutaneous (SC)

Epidemic Keratoconjunctivitis Treatment Market Overview – Growth, Trends & Forecast 2025 to 2035

Eosinophilia Therapeutics Market Insights – Trends & Forecast 2025 to 2035

Endometrial Ablation Market Analysis - Size, Share & Forecast 2025 to 2035

Endotracheal Tube Market - Growth & Demand Outlook 2025 to 2035

Encephalitis Treatment Market - Growth & Future Trends 2025 to 2035

Edward’s Syndrome Treatment Market – Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.