The foley catheter market in China is expected to reach USD 101.7 million in 2025 and is projected to reach a total value of USD 260.1 million by 2035. This represents a CAGR of 9.8% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated China Industry Size (2025) | USD 101.7 million |

| Projected China Value (2035) | USD 260.1 million |

| Value-based CAGR (2025 to 2035) | 9.8% |

Increased access to healthcare and an increasingly ageing population, continuous improvement in the quality of medical technologies supports the Foley catheter market of China to progress at a great pace. Several international companies operate in this sector, with well-acknowledged international manufacturers such as BD, Coloplast and Medtronic plc.

At the same time, there are numerous local players with a strong foothold through offering cost-effective devices made-to-order for very unique specific requirements of the Chinese healthcare. Key players are manufacturing various Foley catheters with emphasis on comfort to the patient, prevention of infection, and ease of handling in both hospitals and homecare.

The favorable government policies of China for the development of healthcare, along with an increasing number of healthcare facilities, are reshaping the market landscape into a competitive environment where both global and local players can enjoy this business.

This emerging market is also giving way to collaborations between multinational corporations and Chinese medical institutions, driving product innovation to meet local needs.

Explore FMI!

Book a free demo

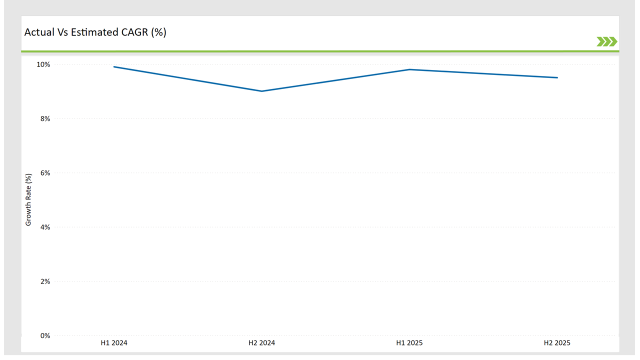

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China foley catheter market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The foley catheter sector for the China market is expected to rise at 9.9% growth rate in the first half of 2023, which will increase to 10.3% in the second half of the same year. In 2024, the growth rate is expected to slightly decline to 9.8% in H1 but is expected to rise to 10.5% in H2.

This trend now reflects a decline of 5.0 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it has gone up by 26.0 basis points compared to the second half of 2023.

The Foley catheter market of China is one of the fastest-growing markets, which keeps on changing with the frequent modification of government regulations, increasing healthcare needs, and rapid technological changes. The companies must assess the market semi-annually to be in know-how of the dynamics and changes occurring.

There is an upward trend toward advanced materials for catheters, such as silicone and hydrophilic coatings, which provide better comfort and a decreased risk of infection.

Coupled with the desire for affordability of the healthcare system, demand was created for effective but affordable alternatives for Foley catheters. As China further modernizes its healthcare system, market conditions would continue to get even better to impact the strategies employed by both global and local companies in such a competitive setting.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Product Development: Coloplast, is focused on development of foley catheter with embedded sensors to monitor urine output and detect early signs of infection, improving patient safety and hospital efficiency. |

| 2024 | Expansion of Manufacturing Facilities: Teleflex Inc. is involved in the expansion of its production facility in Asia to meet increasing global demand and streamline supply chain operations. |

| 2023 | Acquisition: In July 2023, Teleflex Incorporated announced its definitive agreement to acquire the privately held Palette Life Sciences AB for an USD 600 million. This would expand the company's product portfolio related to urology. |

Rapid Aging Population and Increasing Prevalence of Urological Conditions

The highly rising aging population in China is one of the major reasons for growth in the Foley catheter market. An increase in the aged population leads to the rise in aged-related urological conditions, like urinary incontinence and bladder dysfunction, which require the long-term use of catheters.

Foley catheters are highly necessary in these cases, especially for home care and long-term care. Local and international manufacturers extend their production with the growing demand for these kinds of solutions being raised in China.

Expansion of Healthcare Infrastructure and Government Support

The government of China has greatly increased investment in health, developing the network of hospitals to treat more patients and cure various chronic conditions. This expansion is what has propelled the demand for sophisticated medical devices, including Foley catheters.

Government health initiatives also emphasize infection prevention and quality care, stimulating innovation in design and material makeup of catheters. With the development of rural and urban health infrastructures, there is an emerging need for more reliable yet moderately priced catheters.

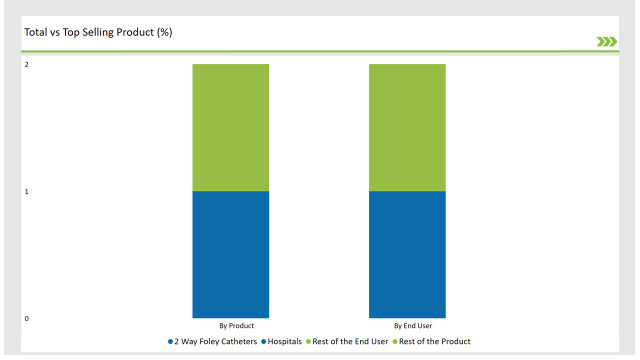

% share of Individual categories by Product Type and End User in 2025

2-way foley catheters records significant surge in China foley catheter market

Practical design and wide range of applicability in various clinical fields make 2-Way Foley catheters lead the Chinese market. In addition, indications for the usage of such catheters include short-term catheterization, operated patients, and retained urine.

Their simple, effective two-lumen design enables them to be cost-effective with dependably good drainage and balloon retention. Furthermore, their widespread use in both urban and rural hospitals contributes to their leadership in the market.

The hospital segment represents the largest end-use segment in the Chinese Foley catheter market due to enormous demand for the product within acute care environments.

Chinese hospitals have recently faced higher volumes of surgeries and-more importantly-are seeing more elderly patients undergoing surgery; hence, these Foley catheters become obligatory for the management of urinary function during and after surgeries.

Furthermore, the adoption of enhanced infection control policies in hospitals contributes to the demand for high-quality, antimicrobial, and silicone-based Foley catheters that are strictly regulated in the healthcare sector. The segment has remained dominant due to modernization and growth in the hospital sector.

Note: above chart is indicative in nature

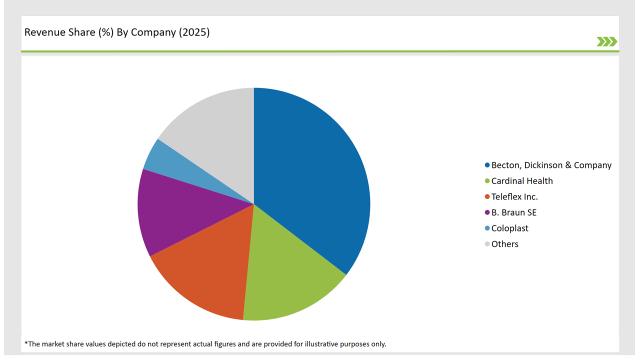

Competition is strongly competitive in the China for Foley catheter market, with local manufacturers pitted against big companies like Becton, Dickinson & Company, Coloplast, and Medtronic.

The global players are better positioned with more advanced technologies and strong brand presence, while the local players focus on being cheap and try to design products that would be more appealing for the Chinese healthcare system.

This has also entailed an increased focus by local manufacturers on the quality of the product and the building out of distribution networks, particularly into rural and remote areas where access to advanced medical devices remains limited; innovation through partnerships with multinational corporations adapts global technologies to local needs.

This rising demand for high-quality, affordable, and infection-resistant Foley catheters encourages more innovations by global and local companies, increasing competitive pressure. Thus, the modernization of healthcare in China is going to promote the growth and development of the Foley catheter market.

By 2025, the China foley catheter units market is expected to grow at a CAGR of 9.8%.

By 2035, the sales value of the China foley catheter units industry is expected to reach China is 260.1 million.

Prominent players in the China foley catheter units manufacturing include Becton, Dickinson & Company, Cardinal Health, B. Braun SE, Coloplast, Medtronics, ConvaTec Group Plc, Teleflex Inc., Medline Industries, LP., Optimum Medical Limited, Polymedicure, AdvaCare Pharma, Well Lead Medical Co.,Ltd. and Advin Health Care.

The industry includes various product type such as 2-way foley catheter, 3-way foley catheter and 4-way foley catheter

The industry includes various materials such as latex foley catheter, silicone foley catheter and other materials.

The industry includes various indications such as urinary incontinence, urethral stricture, chronic obstruction, neurogenic bladder, enlarged prostate gland/bph, prostate cancer and other indications.

Available in end user like hospitals, long-term care facilities, ambulatory surgical centers.

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.