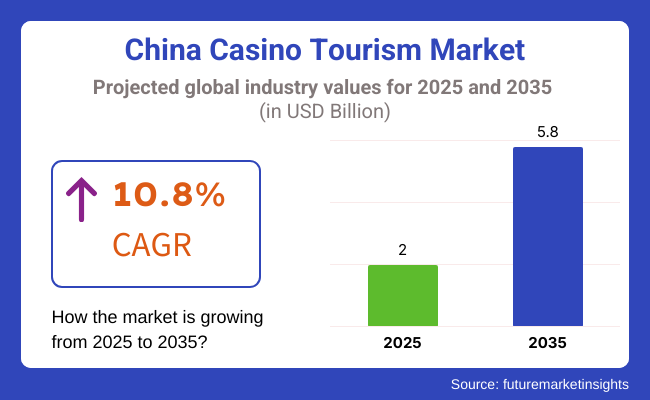

The Chinese casino tourism industry is projected to grow substantially, from a projected USD 2 billion in 2025 to USD 5.8 billion in 2035, at a CAGR of 10.8% between 2025 and 2035. The growth is due to the rising popularity of Macau as an international casino center, the development of integrated resorts, and luxury tourism. Both local and foreign tourists are fueling the demand, as casino tourism in China grows to provide not just gaming but top-notch entertainment, shopping, and dining experiences.

The casino tourism sector in China is seeing significant growth because of the huge popularity of Macau's integrated resorts, China's leading gaming hub. The resorts provide tourists with an immersive experience of gambling along with fine dining, entertainment, and luxury stays. Macau remains the key driver, drawing high-roller and leisure travelers from all over Asia and the world. In addition, the easing of some regulatory restrictions on a gradual basis and the emergence of new casino resorts are likely to support market growth.

Explore FMI!

Book a free demo

The chart below compares the changes in CAGR for the base year, 2024, and the current year, 2025, reflecting shifts in market dynamics.

CAGR Values for China Casino Tourism Market (2024 - 2025)

The China casino tourism market is expected to grow at a CAGR of 9.3% in the first half of 2024, with a slight increase to 9.4% in the second half. Growth is expected to accelerate to 10.4% in the first half of 2025 and continue climbing to 10.8% in the second half of 2025, as new integrated resorts open in key regions like Macau and Hainan, and existing properties enhance their non-gaming offerings to attract a broader range of tourists.

Growth is expected to accelerate in the first half of 2025, driven by new developments such as the opening of luxury integrated resorts and the continued integration of advanced technology within the gaming experience. As the Chinese government relaxes certain gaming restrictions in nearby regions, new tourist markets are expected to emerge.

| Category | Details |

|---|---|

| Market Value | The China casino tourism industry is projected to generate USD 4.8 billion in 2024, making up 60% of Asia’s casino tourism market. |

| Domestic Market Share | Domestic tourists make up 45% of the market, with Macau, Hainan, and Sanya emerging as key destinations. |

| International Market Share | International tourists account for 55%, with the majority coming from mainland China, Hong Kong, Taiwan, and Southeast Asia. |

| Key Destinations | Major destinations include The Venetian Macao, Galaxy Macau, and Wynn Palace. |

| Economic Impact | Generates billions in direct spending on accommodation, dining, and entertainment in cities like Macau and Sanya. |

| Key Trends | Expansion of luxury casino resorts, integrated resorts combining casinos with non-gaming attractions, and increasing focus on VIP and high-roller experiences. |

| Top Travel Seasons | Chinese New Year, Golden Week (October), and summer holidays see the highest number of visitors. |

Macau remains the undisputed leader in China's casino tourism market, attracting millions of tourists every year. Dubbed the "Gambling capital of Asia," Macau takes advantage of its special status as the sole destination in China where it is legal to gamble in casinos. This has made Macau a top destination for both local and foreign tourists looking for high-end gambling experiences. Macau's charm goes beyond casinos. Integrated resorts such as The Venetian Macao and City of Dreams appeal to a broad range of tourists by fusing upscale casinos with upscale entertainment, luxury retail shopping, and haute cuisine. The Venetian, for instance, has a Venice canal replica and hosts upscale performances such as "The House of Dancing Water," which appeals to tourists interested in more than gambling. Likewise, City of Dreams features The House of Dancing Water and fine dining restaurants by celebrity chefs, providing an immersive entertainment experience that is attractive to both gaming and non-gaming visitors. Furthermore, Macau’s proximity to mainland China has fueled its growth, with thousands of tourists traveling from nearby regions like Guangdong and Hong Kong, where gambling options are limited. Additionally, the recent focus on attracting a wider audience-including family-oriented tourists-has led to the development of resorts like Studio City, which offers attractions such as a Warner Bros. movie-themed park and the world’s highest figure-8 Ferris wheel. In essence, Macau’s continued evolution through innovative integrated resorts and its strategic position close to mainland China ensures it remains the largest revenue generator in China’s casino tourism industry.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of High-roller Suites at Galaxy Macau: Galaxy Macau unveiled a series of exclusive high-roller suites that include private gaming rooms, personalized services, and access to celebrity chef dining experiences. |

| Dec 2024 | Expansion of Non-Gaming Facilities: Sands China announced the expansion of its non-gaming facilities in The Venetian Macao, including additional luxury retail shops, a massive indoor entertainment park, and new shows featuring international performers. |

| Nov 2024 | Introduction of Family-Friendly Casino Packages: MGM Macau launched a family-friendly package offering childcare services, kid-friendly gaming education programs, and special access to non-gaming attractions, targeting family tourists. |

| Oct 2024 | Sports Betting Integration: The Macau Jockey Club introduced an innovative sports betting experience that combines traditional horse racing with integrated casino gaming, attracting a younger, tech-savvy audience. |

| Sept 2024 | Opening of New Luxury Resort in Sanya: A new luxury resort with a casino was opened in Sanya, Hainan, offering an exclusive beachfront gaming experience for international tourists, especially from Southeast Asia. |

Baccarat is among the most profitable and in-demand game varieties in China's casino tourism market, especially in Macau, where its popularity among local as well as foreign players is beyond question. Simple in nature and quick to play, Baccarat involves low barriers to entry, hence appeals to new players without compromising on sophistication and high stakes that experienced players look for. It is this adaptability that enables the game to overwhelm casino floors in the region, with Macau's flagship casinos allocating huge space to Baccarat tables.

Casinos such as The Venetian Macao and Wynn Palace offer VIP high-limit Baccarat areas for their high-roller guests, which offer a luxurious and intimate gaming experience. The Venetian Macao, for example, has private Baccarat rooms with luxurious facilities and personalized services for its high-roller guests. Wynn Palace, too, has designed its gaming floors to accommodate the tastes of high-roller players, with opulent Baccarat salons in which players can experience a high-end atmosphere and the excitement of big bets.

Baccarat's influence on Macau casino tourism is not limited to the casino floor. Large casinos often host high-stakes Baccarat tournaments, like those at the Grand Lisboa, which appeal to both local and foreign tourists. These tournaments, combined with generous bonuses for high-rollers, make Baccarat a significant revenue earner. The game's connection to China's traditional gambling culture and glamour only adds to its popularity, and it stands as a staple of Macau's casino tourist scene. Baccarat basically continues to attract tourists in great numbers, becoming the focal point of Macau's gambling industry.

Macau's commercial casinos will still dominate China's casino tourism sector with not only comprehensive gaming amenities but also luxurious resort experiences. These casinos, such as Wynn Palace and The Venetian Macao, offer an end-to-end experience that merges gaming with luxurious stays, quality dining, and global-class shopping.

For instance, The Venetian Macao is more than a casino, evolving into an entire vacation resort. Visitors can walk along a replica of Venice's famous canals, eat in celebrity chef restaurants like Wolfgang Puck's, and shop at high-end labels in a vast retail area. The resort also hosts global performances, including Cirque du Soleil and Broadway productions, appealing to visitors who want an upscale entertainment experience. This one-of-a-kind mix attracts hardcore gamblers as well as individuals seeking a high-end vacation, further solidifying the commercial casinos' grip on the area.

Aside from its varied offerings, Macau's business casinos are also embracing cutting-edge technology to improve the visitor experience. The Venetian Macao, for example, has embraced mobile gaming platforms, enabling visitors to bet on-the-go, in addition to its conventional casino alternatives. Further, cashless payment systems have been implemented across some properties, streamlining transactions and providing a seamless experience for international tourists. These advances in technology draw younger, technologically savvy tourists and further solidify the position of Macau's commercial casinos as all-encompassing entertainment centers. By continuing to innovate and diversify their products, commercial casinos in Macau will continue to lead China's casino tourism market.

The China casino gambling market is very competitive, spearheaded by big operators such as Sands China, MGM Resorts, and Wynn Macau. They control the market, while local casinos in regions such as Hainan are creating niche markets.

2025 Market Share of China Casino Tourism Players

The China casino tourism industry is dominated by the large players, where Galaxy Entertainment controls 35% share, Sands China controls 30% of the market, followed by MGM Resorts at 11%, and Wynn Resorts Macau at 7%. Other significant players, like Galaxy Entertainment Group and Melco Resorts, also have important roles to play, providing distinctive luxury experiences for both local and international visitors. Sands China, with its signature properties such as The Venetian Macao and Sands Cotai Central, remains in high demand by high-rollers due to its luxury gaming and entertainment. Meanwhile, MGM Resorts, with its luxury and diversified experiences, has a strong lead with resorts including MGM Cotai. These top operators offer a combination of high-stakes gaming, culinary delights of international standards, and premium entertainment to ensure a competitive and dynamically changing market in China's casino tourism industry.

The China casino tourism market is expected to grow at a CAGR of 10.8% from 2025 to 2035.

The market is projected to reach USD 5.8 billion by 2035.

Key drivers include the expansion of luxury integrated resorts, increasing popularity of high-roller experiences, and the rising demand for world-class entertainment and leisure services.

Major players include Sands China, MGM Resorts, Wynn Macau, and Galaxy Entertainment Group, who are all heavily involved in the development of integrated resorts and luxury casinos.

The industry is segmented into 3 Card Poker, Roulette, Baccarat, and Other casino games.

The market is categorized into Commercial, Tribal, Limited Stakes, and I-Gaming casinos.

Segmentation includes Gambling Enthusiasts, Social Exuberants, and Others.

The industry includes Independent Travelers, Package Travelers, and Tour Groups.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.