By 2025, the China axillary hyperhidrosis treatment market is forecast to reach USD 96.3 million, with a 9.6% compound annual growth rate, culminating at USD 240.8 million in 2035.

| Attributes | Values |

|---|---|

| Estimated China Industry Size in 2025 | USD 96.3 million |

| Projected China Value in 2035 | USD 240.8 million |

| Value-based CAGR from 2025 to 2035 | 9.6% |

Axillary hyperhidrosis in China is still growing very fast. It is mainly due to increasing awareness of such a condition coupled with well-established effective treatment options now available. The people are mainly urbanites, among whom the people in cities like Beijing, Shanghai, and Guangzhou are very keen on seeking treatments for excessive sweating, which were sometimes under-diagnosed in the past. There is a cultural shift toward addressing such concerns due to evolving attitudes toward healthcare and cosmetic procedures.

Leaders of the market are Allergan plc. (AbbVie) with the help of Botox, a widely accepted product, due to its efficacy and Chinese healthcare professionals' familiarity with the drug. Although clinical therapies are on an upward trend, the market is still relatively immature, and patients are slowly accepting such treatments as injections with Botox for hyperhidrosis. Journey Medical Corporation (Dermira, Inc.) is taking the market to a wider arena with Qbrexza topical therapy by educating not only the medical fraternity but also consumers about non-invasive treatments.

Meanwhile, the OTC segment is growing with products such as Riemann A/S (Orkla)'s Perspirex, which is easily available in pharmacies and online. Retail pharmacy chains like Watsons and local e-commerce giants such as Alibaba and JD.com are expanding their presence, making treatments more accessible across China's vast geography.

Regulatory support for healthcare, and increasing availability of dermatology care, enhance the market's expansion. As a result of these factors, especially the growing concentration of Chinese citizens on personal wellbeing and aesthetic health, the number of hyperhidrosis treatments is likely to increase in coming years, but especially in urban centers.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

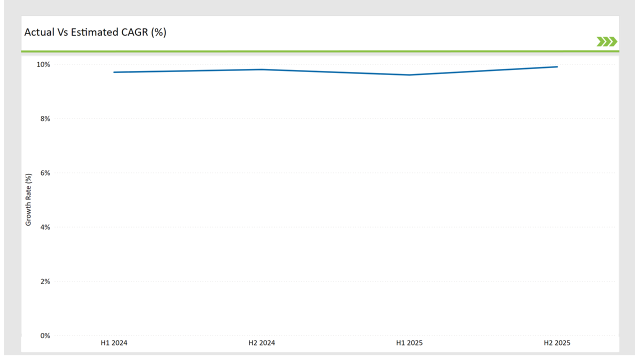

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China axillary hyperhidrosis treatment market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Axillary hyperhidrosis treatment market of the China is expected to grow at 9.7% CAGR for the first half of 2023, followed by an upgradation to 10.1% in the same year's second half. For 2024, the growth is forecasted to go a little down and reach 9.6% in H1 and is expected to rise to 10.3% in H2. This pattern presents a decline of -10.0 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 26.0 basis points compared with the second half of 2023.

These figures are for a dynamic and fast-changing axillary hyperhidrosis market of the China, which is primarily affected by regulations, consumer trends, and improvements in axillary hyperhidrosis treatment. This semestral breakup becomes important for businesses as they plan their strategies, keeping in consideration these growth trends and going through the market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: Journey Medical continues to enhance its presence in China by pushing Qbrexza, a non-invasive drug for hyperhidrosis. The company is investing in local partnerships with dermatology clinics and distributors, educating physicians and patients about the benefits of topical therapies. Furthermore, Journey Medical is navigating through China's regulatory environment to improve product access, hoping to meet the increasingly growing demand for specialty treatments. |

| 2024 | Distribution Network: GlaxoSmithKline is looking to be stronger their presence in China with their consumer health division as well as its existing OTC products, such as Drysol. GSK is strengthening local distribution through e-commerce platforms like Alibaba and JD.com, focusing on affordability and availability. The company is also looking to partner with Chinese healthcare providers to increase awareness and develop localized solutions for the growing middle-class population. |

| 2024 | Home Based Treatments: Duradry is capturing an increasingly large share of China's growing hyperhidrosis market by striking on affordability and convenience, focusing on home-based treatment options. Through the expansion of e-commerce in China, the company sells its products to Taobao and Tmall, achieving universal coverage for a significant proportion of consumers in rural and urban locations. Other growth strategies of Duradry include pursuing young, health-conscious consumers through social media-driven convenience and effectiveness campaigns. |

Rising Middle-Class Health Consciousness

Indeed, the rapidly growing middle class in China increasingly emphasizes personal health and aesthetics. It is very prominent in the two biggest cities: Beijing and Shanghai. As people have more disposable income, the propensity to spend money on axillary hyperhidrosis treatment will be increased.

The rising need for personal care and wellness, in fact, fuels the demand for both clinical treatments, like Botox, and over-the-counter products. With changes in the perception of society, there is no more shyness about seeking a solution for hyperhidrosis, which was once considered a private affair. This cultural change is driving market growth across numerous segments.

Expanding E-commerce and Retail Networks

Hyperhidrosis treatments are now readily accessible across the entire length and breadth of China with the swift increases in e-commerce platforms such as Alibaba and JD.com. Online retailing is very efficient in targeting the urban and rural population to ensure that products like Perspirex or Botox-related solutions are available across the country.

Apart from it the partnerships with local pharmacy chains such as Watsons, which have integrated online and offline sales models. Purchase of such products online has also contributed the sales expansion in China, especially among younger, more tech-savvy consumers.

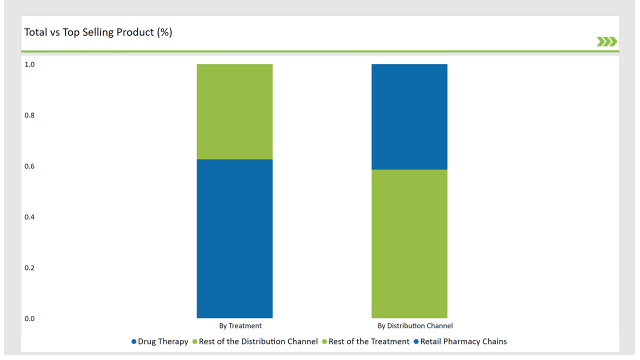

% share of Individual categories by Product Type and End User in 2025

In China, drug therapy is increasingly becoming the dominant treatment for hyperhidrosis as patients are now opting for medical-grade treatments. Botox is the most effective solution for severe cases and has gained popularity among urban patients.

he influence of dermatology professionals is increasing, and cosmetic clinics are on the rise in cities like Beijing and Shanghai, which contributes to the high demand for injectable treatments. Such therapies, with regulatory approvals and increased accessibility through healthcare providers, are making drug therapy the preferred course of treatment for those looking to achieve long-term results for hyperhidrosis.

The over-the-counter hyperhidrosis products in China are largely distributed through retail pharmacy chains due to increased reliance on convenient, accessible treatments by consumers. Pharmacy chains like Watsons and pharmacies in supermarkets have a high distribution level of popular brands like Perspirex.

Their trustworthiness, combined with the fact that they exist in major cities and smaller towns, makes them a major distribution channel for OTC treatments. In addition, such chains usually have focused promotions, thereby making it easy for the consumers to gain affordable and reliable ways of managing hyperhidrosis.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

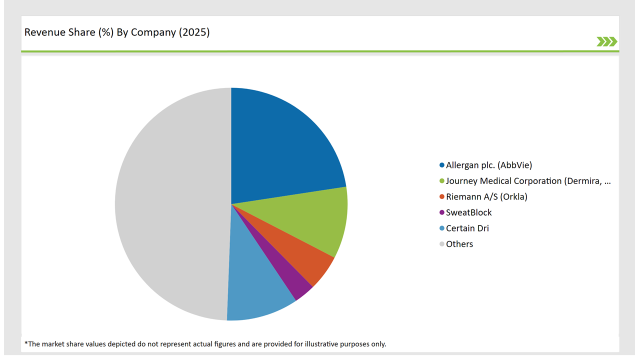

Axillary hyperhidrosis treatment in China is highly competitive with a combination of global and local players. Competition in the market is moderately concentrated with major international companies such as Allergan plc. (AbbVie) and GlaxoSmithKline Plc. taking the lead in the clinical treatment of Botox and Drysol.

These brands carry their good reputation with them along with a chain of healthcare professionals, particularly in the first-tier cities of Beijing and Shanghai. The market also has local brands, for example, Riemann A/S (Orkla), providing over-the-counter solutions in the form of Perspirex, a solution that has won consumer hearts.

2025 Market share of China Axillary Hyperhidrosis Treatment suppliers

Note: above chart is indicative in nature

China's pharmaceutical sector is undergoing transformation and expanding access to local as well as international companies that have the capability of launching new, innovative treatments. Increased online sites like JD.com and Taobao, along with retail pharmacy network expansion through Watsons, create increased competition since the product now reaches a greater market.

The more competitive the market, the more companies opt for localization strategies. The product formulations will suit the Chinese consumers' needs, and collaborating with dermatology clinics and professionals will increase consumer trust and sales in the country, hence a dynamic market outlook.

In terms of treatment, the industry is divided into- drug therapy, botulinum toxins, and medicated wipes.

In terms of end user, the industry is segregated into- hospitals, general physician’s clinics, retail pharmacy chains and online sales

By 2025, the China axillary hyperhidrosis treatment market is expected to grow at a CAGR of 9.6%.

By 2035, the sales value of the China axillary hyperhidrosis treatment industry is expected to reach China is USD 240.8 million.

Key factors propelling the China axillary hyperhidrosis treatment market include rising middle-class health consciousness and expanding e-commerce and retail networks

Prominent players in the China axillary hyperhidrosis treatment manufacturing include Allergan plc. (AbbVie), Journey Medical Corporation (Dermira, Inc.), Riemann A/S (Orkla), SweatBlock, Certain Dri. among others These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Explore Therapy Area Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.