The acetaminophen industry will achieve a market value of USD 1,688.3 million by 2025, expanding at 4.4% annually, and is set to hit USD 2,596.9 million by 2035.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 1,688.3 million |

| Projected Value 2035 | USD 2,596.9 million |

| Value-based CAGR from 2025 to 2035 | 4.4% |

Osteoporosis is a condition of great concern in Western nations, the diagnosis rate is postponed, and the treatment rate is low, hence making China more prevalent in complications followed by hospitalization. Furthermore, urban migration has significantly reduced traditional calcium-rich diets, leading to lower bone density among younger populations. The Chinese government has initiated nationwide osteoporosis screening programs, integrating bone density testing into annual health checkups to address this growing crisis.

Leading global orthopedic companies are localizing their production and distribution strategies to capture market share in China. Johnson & Johnson has formed manufacturing collaborations with Chinese companies, which allow for low-cost production of advanced orthopedic implants customized for Chinese patients.

Newclip Technics introduces modular fixation plates and bioresorbable implants to capitalize on the demand that is increasingly sought in China to be customized and biodegradable surgical solutions. Zimmer Biomet has taken the robotic-assisted surgical technology to the top tier of Chinese hospitals, leveraging off the government's push for smart healthcare solutions.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

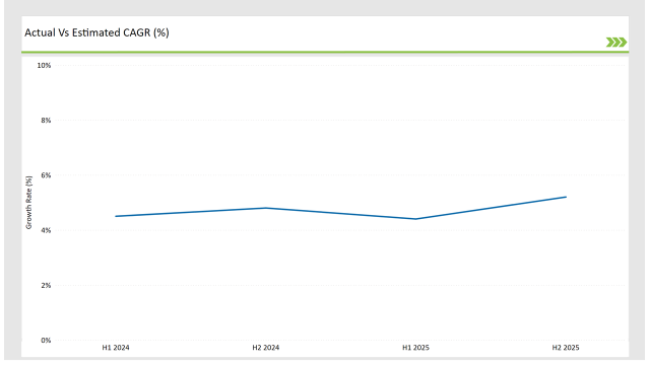

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the China acetaminophen market.

This semiannual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholders insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

China market is expected to grow in the Anti-Osteoporosis Fracture Healing sector at a CAGR of 4.5% in H1 of 2023, and by second half, it should be greater than 4.8%. This is expected to decline a bit at 4.8% in H1 of 2024. The same, however, should be up by H2 to 4.4%.

This pattern presents decline of 11 basis points in the first half of 2023 through to the first half of 2024, whereas it is higher in the second half of 2024 by 34 basis points compared with the second half of 2023.

These figures represent a dynamic and fast-changing China acetaminophen market, largely influenced by regulations, consumer trends, and improvements in acetaminophen. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Expansion: J&J has adopted a localized manufacturing approach in China, forming partnerships with state-owned enterprises and private medical device manufacturers to reduce costs and streamline market entry. |

| 2024 | Product Innovation: Pfizer Inc. is targeting China’s increasing preference for patient-specific implants. Additionally, Newclip has established joint R&D centers with Chinese universities, ensuring that its bone repair technologies comply with local anatomical and surgical preferences. |

| 2024 | Product Innovation: Zimmer Biomet is expanding its presence in Tier 2 and Tier 3 cities, where hospitals are increasingly adopting robotic surgery for complex orthopedic cases. |

Government-led reforms in healthcare and universal coverage expansion

The National Healthcare Security Administration of China encourages national osteoporosis screening programs, with bone density testing available as part of general check-ups for everyone in the country. Other policies include higher rebates for fracture drugs and treatments under the Healthy China 2030 policy, thereby creating more opportunities for both rural and low-income groups.

Government support is driving more osteoporosis diagnoses and demand for both pharmaceutical and surgical fracture healing treatments.

Shift towards smart hospitals and AI-driven orthopedic surgery.

China is one of the speediest places digitizing the health care industry. AI-based medical technologies, for instance, have found huge potential in orthopedics. Leaders in hospitals there are introducing robotic-assisted surgery, AI-powered imaging analysis, and cloud-based post-fracture rehabilitation monitoring. The move by companies such as Zimmer Biomet and J&J regarding the robotic surgical systems and data-driven orthopedic implants makes a great investment opportunity that takes advantage of the trend.

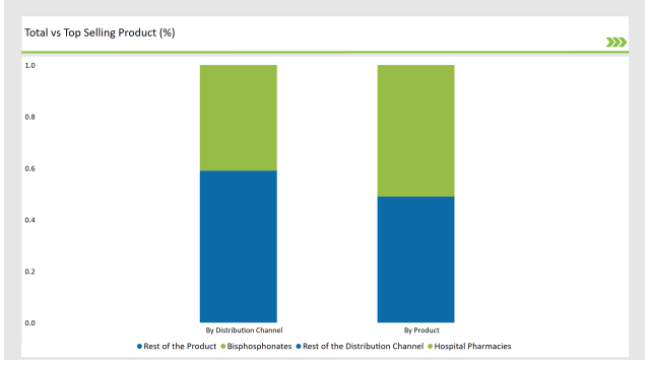

% share of Individual categories by Drug Type and by Distribution Channel in 2025

Bisphosphonates hold the largest market share in the treatment of osteoporosis in China, owing to high prescription rates, low prices, and favorable government reimbursement policies. Biologic drugs, on the other hand, remain expensive and are not as easily accessible.

Oral bisphosphonates like alendronate and zoledronic acid are covered by China's state healthcare insurance, while the NRDL frequently updates its coverage of generic bisphosphonates, ensuring stable market demand. Physicians also like bisphosphonates since they have a long history of proven efficacy in fracture prevention. Thus, the first-line treatment in both urban and rural health care settings remains bisphosphonates.

This is because of China's centralized prescription system and tight regulations on selling drugs directly to consumers. As opposed to other Western countries where retail pharmacies form the primary outlet, China has a prescription model that requires most osteoporosis medications to be dispensed by hospital-affiliated pharmacies.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

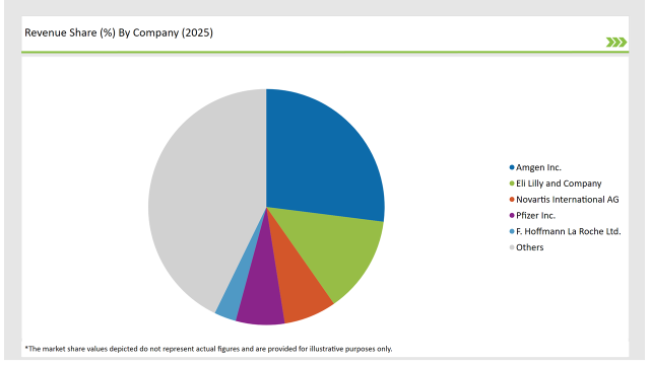

China's anti-osteoporosis fracture healing market is therefore a moderately competitive area of both multinational companies and rapidly growing local firms. Global leaders include Johnson & Johnson and Zimmer Biomet, which continue to dominate the market by teaming up with many Chinese hospitals and embedding smart medical technology.

Nevertheless, local medical device vendors are gaining share through government incentives for domestic manufacturers, very low pricing, and localization of orthopedic solutions.

A significant market dynamic is China's drive towards independence in medical equipment production through its Made in China 2025 initiative.

In this policy, the government has been promoting indigenous production of orthopedic implants, AI-enabled surgical instruments, and biosynthetic fracture-healing materials; this has a huge impact on foreign brands as they face high competition. Besides, e-commerce platforms like Alibaba Health and JD Health are extending direct-to-patient sales for osteoporosis drugs, directly competing with hospital pharmacies.

2025 Market share of China Anti-Osteoporosis Fracture Healing suppliers

Note: above chart is indicative in nature

In terms of drug type, the industry is divided into Bisphosphonates (Osteoporosis and Others), Calcitonin (Osteoporosis and Others), Estrogen or Hormone Replacement Therapy (Osteoporosis and Others), Anabolics (Osteoporosis and Others), others (Osteoporosis and Others)

In terms of route of administration, the industry is segregated into oral and injectable.

In terms of distribution channel, the industry is divided into Hospital Pharmacies, Retail Pharmacies, Drug Stores, E-commerce and Others.

By 2025, the China Anti-Osteoporosis Fracture Healing market is expected to grow at a CAGR of 4.4%.

By 2035, the sales value of the China acetaminophen industry is expected to reach China is 2,596.9 million.

The key drivers fueling the growth of the China acetaminophen market include government-supported bone health programs and high demand for bioengineered and resorbable implants.

Prominent players in the China acetaminophen manufacturing include Pfizer Inc., Sanofi, Janssen Pharmaceuticals (Johnson & Johnson), Bayer AG, GlaxoSmithKline plc, Teva Pharmaceutical Industries Ltd, Cardinal Health Inc., Novartis AG, Abbott, Sun Pharmaceutical Industries Ltd, Procter & Gamble Company, Amneal Pharmaceuticals among Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Explore Therapy Area Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.