The chimeric antigen receptor (CAR) T-cell therapy market is valued at USD 4.00 billion in 2025. As per FMI's analysis, the industry will grow at a CAGR of 6.9% and reach USD 7.79 billion by 2035.

In 2024, the industry saw significant clinical advancements, particularly in solid tumor treatments, an area where CAR T-cell therapy have historically faced challenges. Several pharmaceutical companies reported positive Phase II and III trial results, showcasing improved efficacy and safety profiles.

Regulatory approvals expanded, with new indications being added, particularly for autoimmune diseases and refractory cancers. The year also marked advancements in manufacturing processes, reducing production time and cost. Allogeneic CAR-T therapies, which eliminate the need for patient-specific cell harvesting, gained momentum, addressing key scalability issues.

2025 onwards, the industry will see substantial change, fueled by significant innovation and growing adoption across multiple therapeutic classes. It will grow strongly as the therapies move beyond blood malignancies to target solid tumors, autoimmune conditions, and resistant cancers.

Improved efficacy and safety profiles from current clinical trials will promote wider adoption of these treatments. The creation of dual-targeted therapies will provide greater specificity in treatment, enhancing patient outcomes and minimizing side effects. Advances in CRISPR-based gene editing and other gene therapies will also expand the limit, targeting more types of cancers and rare diseases.

At the same time, the manufacturing process for CAR T-cells will continue to become more advanced, with higher levels of automation and improved supply chains resulting in lower production costs and time. These developments will ease the cost constraints that have restricted accessibility, particularly in developing landscapes.

Moreover, collaborations between pharmaceutical companies, healthcare providers, and regulatory agencies will facilitate market access and speed up the approval of new drugs, further sting the growth.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.00 billion |

| Industry Value (2035F) | USD 7.79 billion |

| CAGR (2025 to 2035) | 6.9% |

The CAR T-Cell Therapy Industry is poised for substantial growth, driven by advancements in treatment efficacy and expanding clinical applications, particularly in solid tumours. As production processes improve and costs decrease, more patients globally will gain access to these life-saving therapies. Companies that innovate in allogeneic CAR-T technologies and enhance supply chain capabilities will lead the industry, while those that fail to adapt may struggle with scalability and affordability challenges.

Accelerate Innovation in Allogeneic CAR-T Therapies

Invest in the development and scaling of allogeneic (off-the-shelf) CAR-T therapies to address current supply chain bottlenecks and reduce treatment costs. This technology offers the potential for more scalable, accessible, and cost-effective treatments, which can significantly increase industry penetration, especially in emerging industries.

Focus on Expanding Clinical Indications

Align with the growing demand for CAR-T therapies in solid tumors and autoimmune diseases. Strengthen partnerships with research institutions to expand clinical trials, targeting new patient populations and indications to stay ahead of competitors and diversify revenue streams.

Strengthen Manufacturing and Distribution Partnerships

Invest in expanding manufacturing capacities and forming strategic partnerships with healthcare providers, ensuring quicker, more cost-efficient production and distribution channels. This will enable broader industry access, particularly in regions with high unmet medical needs, and enhance the ability to scale rapidly as demand grows.

| Risk | Probability & Impact |

|---|---|

| Regulatory Delays and Approval Risks | High Probability-High Impact |

| Manufacturing Capacity Constraints | Medium Probability-High Impact |

| High Treatment Costs Limiting Accessibility | High Probability-Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

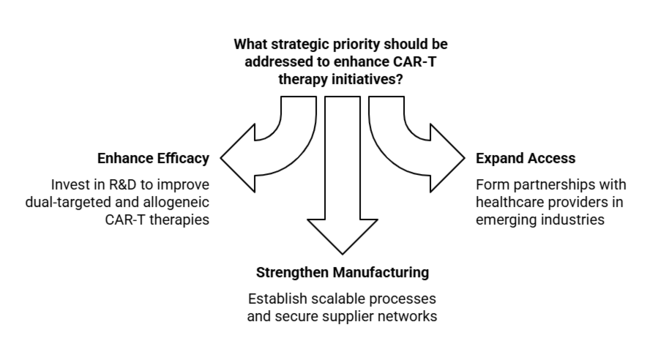

| Enhance CAR-T Therapy Efficacy | Invest in R&D to improve dual-targeted and allogeneic CAR-T therapies |

| Expand Industry Access | Form partnerships with healthcare providers in emerging industries to increase accessibility |

| Strengthen Manufacturing Capabilities | Establish scalable manufacturing processes and secure reliable supplier networks for CAR-T therapies |

To stay ahead, companies must focus on accelerating innovation in allogeneic CAR-T therapies and enhance their manufacturing capacities to meet the growing demand. The industry is evolving rapidly, with significant advancements in solid tumor treatments and regulatory approvals on the horizon.

To capitalize on this, firms should prioritize expanding clinical indications, particularly in solid tumors, and strengthen strategic partnerships to boost global accessibility. Additionally, investing in scalable production and cost-reduction strategies will be crucial to overcoming logistical barriers and reaching broader patient populations. With competition intensifying, focusing on these key areas will differentiate leading players and ensure long-term industry dominance.

Surveyed Q4 2024, n=450 stakeholder participants evenly distributed across pharmaceutical manufacturers, healthcare providers, researchers, and regulatory bodies in the USA, Western Europe, Japan, and South Korea

Regional Variance

High Variance USA: 64% of pharmaceutical manufacturers are integrating AI and machine learning for personalized CAR-T treatments.

Convergent and Divergent Perspectives on ROI

64% of USA stakeholders consider automation in CAR-T production to be worth the investment, whereas only 35% in Japan view it as a necessary step due to cost concerns.

Cell Culture Media: 68% overall selected synthetic media for better consistency and scalability in CAR-T manufacturing.

Variance

88% cited rising production costs (e.g., increased prices for synthetic media and viral vectors) as a primary challenge in CAR-T therapy development.

Regional Differences

Manufacturers

Healthcare Providers

Alignment

71% of global manufacturers plan to invest in improving automation in CAR-T production for better scalability.

Divergence

USA

72% of stakeholders are impacted by the FDA’s stringent approval processes, citing delays in gaining approval for new indications.

Western Europe

79% of stakeholders believe that the EU’s new CAR-T regulations will act as aindustry growth driver, encouraging innovation and patient access.

Japan/South Korea

Only 45% of stakeholders reported that local regulatory frameworks were significant barriers to adopting CAR-T therapies, citing weaker enforcement and slower adaptation.

High Consensus: Efficacy, safety, and regulatory compliance remain critical global priorities.

Key Variances

Strategic Insight: Industry entry strategies must be tailored regionally (e.g., focus on automation in the USA, cost-effectiveness in Asia, sustainability in Europe).

| Countries | Impact of Policies and Regulations |

|---|---|

| United States | FDA approval requires rigo rous clinical trials. Pricing and reimbursement policies are crucial. CAR-T products must comply with GMP and QC standards. |

| United Kingdom | The NHS (National Health Ser vice) has strict guidelines on the adoption and reimbursement of advanced therapies like CAR T-Cell Therapy. |

| Japan | PMDA approval needed. Regulatory delays due to low patient numbers. Health-economic evaluations for reimbursement. |

| South Korea | KFDA approval required. Pricing and reimbursement decisions influenced by KFDA. Bio similar regulations affect CAR-T therapies. |

| China | NMPA approval needed. Government policies aim to reduce CAR-T costs. Priority review pathways expedite approval. |

| Australia | TGA approval required. PBS policies affect accessibility. Regulatory alignment with EMA. |

| Canada | Health Canada approval needed. Public health insurance impacts accessi bility. Local health systems evaluate cost-effective delivery models. |

| France | The French government encourages the development of advanced therapies, incl uding CAR T-Cell Therapy, through public funding and research grants. |

| Italy | The Italian Medicines Agency (AIFA) oversees the regulation and approval of CAR T-Cell Therapy. |

The allogeneic CAR T-cell therapy type is anticipated to grow at the fastest rate with a CAGR of 7.1% from 2025 to 2035. This segment’s growth is primarily attributed to the ability to produce these therapies from healthy donor cells, making them more scalable, cost-effective, and accessible compared to autologous therapies. As the production process becomes more streamlined, allogeneic therapies are expected to become more prevalent.

This is especially applicable for healthcare systems looking for affordable treatment options to meet growing demand. With their high potential for mass production and reduced treatment costs, this segment is set for rapid expansion. Additionally, ongoing advancements in genetic engineering and cell manufacturing techniques are expected to further enhance the efficiency and affordability of allogeneic CAR T-Cell Therapy.

The cancer treatment application segment is projected to maintain its dominance in the industry with a CAGR of 7.0% from 2025 to 2035. This growth is driven by the global increase in cancer prevalence and the proven efficacy of CAR T-Cell Therapy in treating blood cancers such as leukemia and lymphoma. The demand for cancer treatment applications will continue to rise as more clinical trials demonstrate positive outcomes.

With advancements in immuno-oncology and personalized therapies, this segment is expected to lead the industry and drive innovation, attracting substantial investment and attention from healthcare providers worldwide. Furthermore, the growing number of collaborations between biotech firms and research institutions will further accelerate the development of cutting-edge therapies.

-t-cell-therapy-market-analysis-by-application.webp)

The hospitals and clinics end-user segment are projected to grow steadily at a CAGR of 6.9% from 2025 to 2035. This growth is driven by the increasing adoption of CAR T-Cell Therapy in specialized healthcare settings due to the ability to offer advanced treatments for life-threatening diseases like cancer.

Hospitals and clinics are well-equipped to handle the complex manufacturing and administration processes involved in CAR T-Cell Therapy. As healthcare infrastructure improves globally and the demand for these therapies increases, the adoption of CAR T-cell treatments by hospitals and clinics is expected to continue growing at a robust pace, providing a steady foundation for industry expansion.

-t-cell-therapy-market-analysis-by-end-user.webp)

Sales of chimeric antigen receptors in the United States is anticipated to grow at a CAGR of 7.0%. Due to advancements in research, strong healthcare infrastructure, and high demand for cutting-edge therapies, the USA holds a leading position in the global CAR T-cell therapy industry.

Backed by massive investment from major pharma players, a supportive regulatory environment in the form of the FDA, and an increased focus on personalized medicine, the USA is primed to experience massive growth. In addition, the growing number of cancer cases and the standard therapies, CAR T-Cell Therapy will accelerate this industry over the coming years.

The demand for chimeric antigen receptors in UK is anticipated to grow at a CAGR of 6.3% from 2025 to 2035. The healthcare system in the UK, led by the National Health Service (NHS), is increasingly adopting cutting-edge therapies, including CAR T-cell treatments.

With a strong focus on cancer research and treatment innovation, the UK presents significant opportunities in clinical trials, drug development, and patient access to advanced therapies. The UK's regulatory frameworks and research grants support CAR T-cell therapy growth, though affordability and NHS budget constraints pose challenges.

Demand for chimeric antigen receptors in France is anticipated to grow at a CAGR of 6.7% from 2025 to 2035. In France, these biotechnological businesses and cell-based therapies have more investment inflow, especially in oncology. Similar to other innovative therapies, CAR T-cell therapy has strong support from the French health care system.

With growing cancer burden and the high emphasis placed on medical research and clinical trials, France offers a conductive environment for the growth of CAR T-cell therapy. Nevertheless, reimbursement issues and patient access may provide a barrier to the widespread adoption of these therapies.

Sales in Germany is anticipated to grow at a CAGR of 6.9% from 2025 to 2035. The advanced healthcare system of Germany, combined with the facility for advanced biotechnology, makes it one of the prime industries for CAR T-cell therapy.

The country's strong regulatory landscape and high levels of investment in research and development will primarily drive industry growth.

Moreover, the growing prevalence of cancer and the strong pharmaceutical industry in the country present a significant opportunity for CAR T-Cell Therapy., Germany's commitment to healthcare innovation is expected to sustain growth in the CAR T-cell industry.

Demand for chimeric antigen receptors in Italy is anticipated to grow at 6.5% CAGR. Reforms are ongoing in Italy's healthcare system, with the goal of ensuring that patients have more access to innovative therapies There is an existing infrastructure for cancer treatment and clinical trials in the country that will aid the uptake of advanced therapies.

These strategic partnerships that Italy has with biotech companies and research institutions will contribute to the advancement and delivery of CAR T-cell treatments. While challenges like high treatment costs and reimbursement considerations could impact adoption rates in the near term, the long-term growth prospects remain strong.

Sales in South Korea are anticipated to grow at a CAGR of 7.2%. South Korea is becoming a centre for biopharmaceuticals and cutting-edge treatments, including CAR T-cell therapy. The government’s focus on healthcare innovation, along with a robust domestic pharmaceutical industry, ensures the cultivation and distribution of CAR T-Cell Therapy.

The country’s high-tech infrastructure and advanced stem cell research expertise offer considerable opportunity for CAR T-cell manufacturing. Cost of therapy and regulatory hurdles may slow the pace, but the country’s proactive approach to healthcare innovation is considered a growth industry.

Demand for chimeric antigen receptors in Japan is anticipated to grow at a CAGR of 6.2%. Japan has an advanced healthcare system, with an emphasis on high-quality medical care and cancer treatment. Despite high standards of practice and substantial biotechnology investments, Japan still does not widely adopt CAR T-Cell Therapy due to their cost.

It also has a slow regulatory environment for novel treatments, which poses hurdles to quick industry growth. Despite, Japan's aging population and growing number of cancer cases provide a strong long-term industry for CAR T-cell therapy.

Sales in China are anticipated to grow at a 6.5% CAGR between 2025 and 2035. China is rapidly building its healthcare infrastructure, and the uptake for advanced therapies such as CAR T-cell treatments will likely swiftly increase in China over the next decade. The country’s population is huge, and the growing burden of cancer presents a significant industry for new therapies.

But regulatory delays, the high costs of treatments, and disparities in access to health care could all slow growth. In spite of these difficulties, China's growing investment in biotechnology and supportive government policies for health care innovation pave a promising pathway for CAR T-cell industry growth.

Australia-New Zealand market is anticipated to grow at a 6.8% CAGR between 2025 and 2035. Australia and New Zealand have advanced health care systems that increasingly prioritize individualized medicine, such as CAR T-Cell Therapy for cancer treatment. Australia, has been rapidly investing in clinical trials and research, cementing itself for the adoption of these advanced therapies.

The overall industry size is smaller than in larger regions during this forecasting period, which is balanced out by the increasing awareness surrounding cancer therapies and the country’s commitment to innovation in the space, facilitating moderate growth in the CAR T-cell industry over next decade.

In 2024, several significant developments took place in the CAR T-cell therapy industry. Bristol Myers Squibb received FDA approval for Breyanzi (lisocabtagene maraleucel), bolstering its presence in hematologic oncology and expanding its leadership in CAR T-Cell Therapy.

Meanwhile, Gilead Sciences focused on enhancing the scalability and cost-effectiveness of its KTE-X19 therapy for B-cell malignancies, aiming to capture a larger share of the industry.

Novartis also strengthened its position by entering into a strategic partnership with Cellgene Therapeutics to co-develop next-generation CAR T-Cell Therapy, particularly for hematologic cancers.

In a move towards more affordable and accessible treatments, Allogene Therapeutics advanced its research in allogeneic CAR T-Cell Therapy, which could reduce production costs and improve patient accessibility.

Additionally, AstraZeneca and ImmunoGen merged in 2024 to expedite the development of CAR T-Cell Therapy targeting solid tumors, marking a significant step in expanding the scope of CAR T treatments beyond hematologic conditions.

-t-cell-therapy-market-analysis-by-company.webp)

Industry Share Analysis

Novartis (Kymriah)

Gilead Sciences (Kite Pharma-Yescarta/Tecartus)

Bristol-Myers Squibb (Breyanzi/Abecma)

Johnson & Johnson (Legend Biotech-Carvykti)

Pfizer (Allogene Therapeutics)

Cellectis (UCART)

Autolus Therapeutics (obecabtagene autoleucel)

Celyad Oncology

Precision BioSciences (azer-cel)

Caribou Biosciences (CB-010)

The industry is segmented into abecma, breyanzi, kymriah, tecartus, yescarta, and others.

The market is divided into leukemia, lymphoma, multiple myeloma, autoimmune disorders, and other applications.

The landscape is segmented into hospitals, and cancer care treatment centers.

The industry is studied across North America, Latin America, Europe, Asia Pacific, Middle East & Africa.

The industry is expected to reach USD 7.79 billion by 2035, growing at a CAGR of 6.9%.

Advancements in treatment efficacy, expanding clinical applications, and improved manufacturing processes are driving the growth.

South Korea is projected to grow at the highest CAGR of 7.2% from 2025 to 2035.

Regulatory delays, manufacturing capacity constraints, and high treatment costs are the key risks in the industry.

Allogeneic CAR-T therapies are expected to grow at the fastest rate, with a CAGR of 7.1% due to their scalability and cost-effectiveness.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 21: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Application, 2023 to 2033

Figure 19: Global Market Attractiveness by End User, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 37: North America Market Attractiveness by Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Application, 2023 to 2033

Figure 39: North America Market Attractiveness by End User, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 59: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 77: Europe Market Attractiveness by Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Application, 2023 to 2033

Figure 79: Europe Market Attractiveness by End User, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 102: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 103: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 104: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 109: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 112: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 113: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 114: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 115: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 116: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antigen Skin Test Market Growth – Trends & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Cancer Antigens Market

The Cryptococcal Antigen Lateral Flow Assay Test Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Mycoplasma Plate Antigens Market Size and Share Forecast Outlook 2025 to 2035

Carcinoembryonic Antigen (CEA) Market

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Activated Carbon for Sugar Decolorization Market Size and Share Forecast Outlook 2025 to 2035

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Calcium Carbonate Biocement Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Incontinence Care Products Market Size and Share Forecast Outlook 2025 to 2035

Baby Car Safety Seat Market Size and Share Forecast Outlook 2025 to 2035

Rice Water Skincare Market Size and Share Forecast Outlook 2025 to 2035

Value-based Healthcare Service Market Size and Share Forecast Outlook 2025 to 2035

Moisturizing Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA