Energy-efficient HVAC system integration and the need to comply with green building and environmental laws across 2025 to 2035 are vital for the expected significant growth of the global market for the chilled beam system. Chilled beam system, which requires the sectional cooling of ceilings and is primarily used for convective ventilation, ensures that occupants enjoy optimal thermal comfort and purified indoor air quality by consuming only a fraction of the energy that conventional HVAC systems consume.

A global inclination towards sustainable development in the construction industry, specifically in commercial buildings, hospitals, hotels, and educational institutions, has led to the increased utilization of both active and passive chilled beam systems. The compliance by governmental authorities and regulatory bodies to the energy efficiency standards drives the architects, builders, and facility managers towards the implementation of low-carbon cooling.

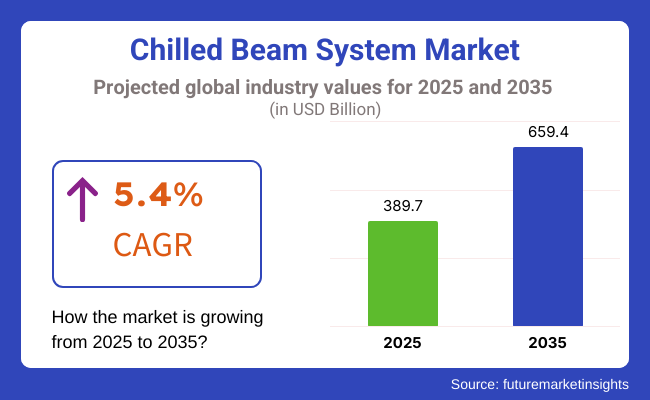

A CAGR 5.4% of the market, from USD 389.7 Billion in 2025 will be the total worth, whereas by 2035 it will grow up to USD 659.4 Billion. This growth figure itself will be supported by the implementation of efficient building automation, IoT-based climate control technology, and the increasing popularity of smart HVAC solutions among building owners.

The widespread of chilled beam systems being deployed in hospitals and office spaces to battle disease-causing air pollutants is due to the rising IAQ concerns. Slimmer ductwork installation is one of the mentioned advantages over a traditional HVAC unit. As a result, less structural space is required which leads to a cost-efficient construction of tall buildings.

The mix of radiant cooling with displacement ventilation is the new invention of hybrid chilled beam systems that is being tried out in residential, commercial, and industrial settings. The future's HVAC technology would virtually be incomplete if this is not the case with the growing trend of net-zero energy buildings (NZEBs) and sustainable architecture driving the demand for chilled beam technology.

Explore FMI!

Book a free demo

North America claims the biggest share in the chilled beam system market, because of increasing energy-efficient cooling technologies awareness, government regulations on emissions, and the high number of green buildings. The United States and Canada put a lot of money in the development of environmental infrastructure, in this area LEED-certified and net-zero energy projects play the first fiddle in the adoption of chilled beam systems.

The growth of commercial offices, healthcare facilities, and educational institutions is the main reason for steady demand for chilled beam installations. USA Green Building Council's sustainability standards and ASHRAE energy-efficiency codes are compelling architects and HVAC designers to include chilled beams in new construction.

Conversely, in North America, the retrofit market is also driving growth as older buildings are upgrading their HVAC systems to become more energy-efficient to comply with energy codes. Likewise, the adoption of smart building automation is such that it allows us to leverage the integration of chilled beams that are IoT-enabled, which in turn results in real-time monitoring and proper climate control.

Though the costs of the initial investment are high, the gains of decreased operational expenses, energy savings, and improved occupant comfort are those which are pushing the market to expand. The North American market is expected to grow at a moderate pace, with the major cities being the first to introduce green-building policies to encourage low-energy cooling solutions.

Europe continues to be a leading market for chilled beam systems, supported by stringent environmental policies, carbon reduction targets, and proactive investments in green buildings. Germany, the UK, France, and Scandinavia are among the top countries in terms of energy-efficient construction, hence chilled beams becoming the HVAC choice of preference for commercial and institutional applications.

The European Union's 2030 energy efficiency plans are pushing forward the uptake of low-energy cooling solutions. In light of its heavy emphasis on cutting carbon emissions, European governments are promoting the implementation of radiant cooling and demand-controlled ventilation solutions, in which chilled beams particularly excel.

The building and office education segments are leading the charge, with European corporate offices, universities, and research institutions clamoring for low-maintenance HVAC solutions. Incorporating intelligent climate control systems in contemporary buildings is also increasing the efficiency of chilled beams, making them a central part of green urban planning.

In addition, escalating energy prices in Europe are urging building owners to invest in cost-effective cooling solutions with long-term cost benefits. Rapid development in prefabricated and modular building is adding further momentum to the market for compact and adaptable chilled beam systems in new as well as retrofit construction.

The Asia-Pacific chilled beam system market is poised to record the highest CAGR owing to factors such as rapid urbanization, development of commercial infrastructure, and smart, energy-efficient building construction.

Asian countries are among the fastest-growing economies in the world and they are taking the lead in building the HVAC solutions of the future, primarily those in the building segment which are next in line for this innovation.

China, being the largest construction market in the world, is currently witnessing augmented uptake of smart contracting technology in large buildings and office high-rises. This is all due to government programs that support the use of environmentally friendly technologies such as China’s Three-Star Rating System thus bolstering governments' intentions. India has experienced growth in the commercial sector which is also caused by the increase in IT parks, hospitals, and smart cities. Thus, the need for chilled beam technology will increase. The Indian

government’s focus on sustainable urban development is expected to speed up the adoption of passive and active chilled beam systems in the near future. Japan and South Korea are the pioneering countries when it comes to the application of energy-efficient and advanced HVAC technologies in the market. High

reliance on emerging technologies, such as smart homes, automated office buildings, and zero-energy buildings (ZEBs), has been a game-changer in the field of cooling solutions. These markets are expected to lead the adoption of chilled beam technology as a response to the expected demand for compact, high-performance cooling systems that are also low carbon emitting.

However, lack of awareness and high upfront installation costs are some of the challenges that may hinder further implementation in developing countries. For that reason, development and investment in the structure and infrastructure in the countries of the region together with different educating programs and the use of government incentives will be the major boost of securing the market.

Challenges

High initial cost and installation complexity: In contrast to traditional HVAC systems, chilled beams need to be controlled for precise humidity to avoid condensation, which adds to system design complexity and demands skilled professionals for proper installation.

Another issue is market awareness. Europe and North America are mature markets for chilled beam systems, but developing markets still use conventional air conditioning as a result of lack of awareness and skilled personnel. Manufacturers and industry associations have to work on raising awareness among contractors, engineers, and building owners regarding the long-term advantages of chilled beam technology.

Moreover, lack of space in current buildings can hinder opportunities for retrofitting chilled beams since they need special ceiling heights and compatibility with ventilation systems. Overcoming these challenges will demand technological innovations in small and modular chilled beam designs.

Opportunities

The increasing green building and smart city trend provides tremendous growth potential for chilled beam systems. Carbon reduction regulations, government incentives, and strict energy-efficiency norms are fuelling demand for low-energy HVAC technology, making chilled beams a sustainable cooling option of choice.

Combination of smart climate control, IoT-based HVAC, and AI-backed energy optimization is further boosting chilled beam market value. Growing utilization of hybrid chilled beam systems integrating displacement ventilation and radiant cooling brings new opportunities to commercial, healthcare, and education markets.

In addition, increasing investments in prefabricated and modular buildings are generating demand for space-efficient, lightweight HVAC systems, in which chilled beams are superior. Compact, high-performance, and economical design manufacturers will be the winners in the unfolding market.

From 2020 to 2024, the chilled beam system market witnessed substantial growth as the demand for energy-efficient, sustainable, and high-performance HVAC solutions increased. As commercial buildings and industries looked for low-energy cooling options, chilled beam systems became a popular choice for lowering operational expenses, improving indoor air quality, and complying with green building standards. Governments and regulatory authorities implemented strict energy efficiency standards, fuelling adoption in offices, healthcare facilities, schools, and hospitality industries.

The building construction industry, especially in commercial and institutional buildings, saw growing application of passive and active chilled beam systems. The systems provided low-noise operation, low maintenance, and high thermal comfort, making them a desirable option compared to conventional HVAC units.

Concerns about lowering carbon footprints, enhancing indoor environmental quality (IEQ), and obtaining LEED certification also supported market demand. Furthermore, advances in automation, intelligent sensors, and adaptive air control mechanisms improved chilled beam solutions' performance and efficiency.

The healthcare sector was among the early adopters of chilled beam systems, especially for hospitals, laboratories, and pharmaceutical manufacturing plants, where exact temperature and humidity control was important. The COVID-19 crisis brought increased recognition of airborne infection transmission, with facility managers taking steps to purchase ventilation systems with better air movement while minimizing contamination risk.

Low-air-movement chilled beam systems, which are low in cross-contamination potential, became more popular in the healthcare sector to provide a healthy and comfortable environment for patients and staff.

Even with robust market growth, issues like high upfront costs of investment, low awareness in developing economies, and retrofitting limitations in aging buildings created obstacles for mass adoption. Industry players, however, concentrated on affordable installation methods, enhanced compatibility with existing HVAC systems, and hybrid chilled beam product development to overcome these challenges.

Building automation system (BAS) advancements, demand-controlled ventilation, and real-time energy monitoring also helped promote market growth. The chilled beam system market will keep developing with a robust focus on energy-efficient innovation, intelligent climate management, and sustainable building integration.

With industries shifting towards green cooling solutions, AI-driven automation, and high-performance HVAC technologies, chilled beam manufacturers need to embrace next-generation chilled beam designs, fault-tolerant energy distribution models, and smart ventilation systems to remain competitive globally.

The market for chilled beam systems, during 2025 to 2035, will be revolutionized through smart climate control technologies, decarbonisation policy, and building management system adoption of AI technologies. Sustainable cooling technologies, low-GWP refrigerants, and net-zero buildings will see a global drive in the transformation of the market space.

The convergence of IoT and AI in HVAC equipment will maximize energy optimization, real-time performance monitoring, and proactive maintenance. Intelligent chilled beams will come with adaptive cool algorithms, temperature control depending on occupancy levels, and automatically regulated climate control for greater overall building efficiency. There will be an increasing need for hybrid systems integrating chilled beams with geothermal cooling, radiant heating, and ERV as multi-functional, high-performance solutions for contemporary buildings.

The commercial space will be driving market expansion, with corporate space, skyscrapers, and schools being the leaders in embracing sustainable HVAC systems. Governments will enforce tighter energy codes and building standards, which will require the adoption of low-energy cooling solutions. The concept of smart cities, smart buildings, and green infrastructure will enhance the use of chilled beam systems.

The residential market will also see an increasing demand for chilled beam cooling, especially in luxury apartment buildings, upscale housing complexes, and green homes. With homeowners looking for quiet, energy-efficient, and attractive cooling systems, chilled beam technology will become a preferred choice over traditional air conditioning. The widespread use of district cooling networks and renewable energy-powered HVAC systems will supplement chilled beam installations, maximizing overall cooling efficiency.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments promoted energy-efficient cooling standards and green building certifications. |

| Technological Advancements | Companies developed smart chilled beams, automated airflow control, and hybrid cooling systems. |

| Industry Applications | Chilled beam systems were widely used in commercial offices, healthcare, and educational buildings. |

| Environmental Sustainability | Companies adopted low-energy cooling strategies and demand-controlled ventilation. |

| Market Growth Drivers | Demand was driven by sustainability objectives, thermal comfort requirements, and reduced operational expenses. |

| Production & Supply Chain Dynamics | Supply chains faced installation complexities, high material costs, and limited adoption in retrofits. |

| End-User Trends | Businesses prioritized green building solutions and energy-efficient HVAC systems. |

| Infrastructure Development | High-rise buildings and commercial spaces drove chilled beam system demand. |

| Health & Indoor Air Quality | Awareness of airborne contaminants and ventilation efficiency increased adoption. |

| Investment in R&D | Companies developed improved heat exchangers and integrated climate control sensors. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral HVAC policies and mandatory low-energy cooling solutions will dominate regulations. |

| Technological Advancements | Future innovations will focus on AI-driven optimization, thermal energy storage, and IoT-enabled predictive cooling. |

| Industry Applications | Expansion into luxury residential complexes, smart city infrastructures, and net-zero energy buildings. |

| Environmental Sustainability | Industry-wide adoption of water-efficient, zero-emission, and fully recyclable chilled beam systems. |

| Market Growth Drivers | Growth will be fuelled by smart climate control, AI-powered predictive maintenance, and integration of renewable energy. |

| Production & Supply Chain Dynamics | Companies will invest in modular chilled beam solutions, localized manufacturing, and sustainable material sourcing. |

| End-User Trends | Future demand will emphasize smart HVAC integration, noise-free cooling, and adaptive climate control. |

| Infrastructure Development | Increased investments in smart buildings, autonomous climate control, and AI-driven energy management systems. |

| Health & Indoor Air Quality | Future designs will focus on air-purifying coatings, allergen-free cooling, and personalized climate zones. |

| Investment in R&D | Research will expand into biodegradable materials, nanotechnology-driven cooling, and advanced thermal adaptation systems. |

United States chilled beam system market is growing substantially due to increased demand for energy-efficient HVAC systems in schools, hospitals, and commercial buildings. With increasing sustainability goals and green building ratings such as LEED (Leadership in Energy and Environmental Design), there is an increased focus on reducing energy consumption in heating, ventilation, and air conditioning (HVAC) systems.

The intersection of smart building technologies and rising electricity costs are also propelling the adoption of chilled beam systems, which are defined by reduced energy consumption and improved thermal comfort compared to traditional air-based HVAC systems.

USA federal and state energy efficiency regulations, such as the Department of Energy (DOE) and Environmental Protection Agency (EPA), are encouraging green HVAC solutions, and demand for active and passive chilled beam systems is on the rise. Additionally, developments in air conditioning and dehumidification have led to improved chilled beam performance, reducing the likelihood of condensation and improving energy efficiency in humid climates like Florida and Texas.

High-rise business structures in major metropolitan areas such as New York, Chicago, and San Francisco now incorporate chilled beam technology to reduce HVAC energy consumption by up to 30%, resulting in significantly reduced operating costs. The medical field is a significant adopter, as chilled beam systems help eliminate airborne pathogens, and are thus optimally designed for use in hospitals and labs.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.1% |

Growing UK chilled beam system is becoming familiar with the market due to energy efficiency regulation rigidity, net-zero carbon ambitions, and increasing use in commercial office buildings. As part of the UK government's decarbonization efforts for the built environment, HVAC solutions such as chilled beams are gaining popularity due to their low energy consumption and ability to reduce the overall greenhouse gas emissions.

Green Building Council (UKGBC) deems currently occupied office buildings and schools in cities such as London, Manchester, and Birmingham to be some of the most ideal locations for the application of the UKGBC's sustainability platform. One can also note the tighter regulation of energy usage in buildings, for example, Part L of the UK Building Regulations, which is driving developers and facility managers to replace traditional HVAC systems with chilled beam technology.

Market growth in the UK as a result of an increasing need for smart buildings is a salient factor. A large number of commercial building owners and property developers are among the first to get IoT-plus-HVAC systems, which are key to having live data on the condition of the air such as airflow, temperature as well as humidity. This is providing a necessary improvement in energy efficiency and indoor air quality in office.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

European Union chilled beam system market is witnessing fast growth through stringent environmental regulations, rising implementation of green buildings, and great emphasis on cutting HVAC energy use. Germany, France, and the Netherlands are at the forefront of the use of chilled beams in new as well as renovated buildings based on EU directives towards carbon neutrality and building energy efficiency.

The EU's Energy Performance of Buildings Directive (EPBD) requires high energy efficiency levels for commercial and residential buildings, promoting the adoption of low-energy HVAC solutions like chilled beam systems. The need for hybrid ventilation and cooling solutions is increasing in office buildings, minimizing reliance on energy-hungry air conditioning systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japan's chilled beam system market is strongly growing owing to technological progress, energy efficiency regulations, and accelerating adoption in hi-tech commercial buildings. Japan possesses an advanced real estate and infrastructure market, which makes it a primary market for smart cooling solutions.

The energy saving policies of the government in Japan, like the Zero Energy Building (ZEB) scheme, are encouraging the use of green cooling technologies, like chilled beams. Japan's own hot and humid climate has long presented challenges to chilled beam implementation, but new devices, like humidity-controlled active chilled beams, are bypassing these disadvantages.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea's chilled beam market is expanding with increasing demand for energy-efficient HVAC solutions, urbanization, and the growth of smart cities. The nation is leading in smart infrastructure, with Seoul and Busan being the key cities to invest in green building.

As the Korean government has set ambitious carbon neutrality targets, commercial and public buildings are becoming more inclined to use sustainable cooling systems. Corporate giants like Samsung and LG are also pushing innovation in the HVAC sector, and as a result, smart chilled beam technologies with built-in humidity control and air purification capabilities are being developed.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

Active and multiservice chilled beams command a strong portion of the chilled beam market due to commercial and industrial spaces valuing low-maintenance, energy-efficient solutions for climate control. Active and multiservice chilled beams offer improved thermal comfort, lower energy usage, and better indoor air quality and are therefore sought after for today's green buildings, hospitals, and high-performance commercial buildings. Active Chilled Beams Improve Energy Efficiency and Air Distribution in Commercial Buildings

Active chilled beams are the go-to technology for office blocks, schools, and hospitals as they combine induced air movement with accurate temperature control to provide ideal indoor climate regulation. The active chilled beam functions by employing main air from the ventilation system to induce room air via cooling or heating coils and provides improved airflow and consistent temperatures compared to traditional HVAC systems.

The emergence of intelligent buildings and LEED-certified energy-efficient buildings has hastened the use of active chilled beams, as they enable lower energy usage, quieter operation, and lower carbon footprints. In contrast to traditional fan-coil or variable air volume (VAV) systems, active chilled beams do not use mechanical fans, resulting in lower operating noise and lower maintenance needs.

Architects and mechanical engineers use active chilled beams in their preferred choice of new commercial and institutional building constructions, as these enhance thermal comfort without the need for excessive ductwork, while permitting aesthetic flexibility and space efficiency.

Active chilled beams offer hygienic, draft-free air flow in healthcare applications, a necessity for patient recovery rooms, laboratories, and medical research laboratories. The need for infection-control-friendly HVAC products has further reinforced the hospital and cleanroom market for active chilled beams.

The European and North American markets drive the implementation of active chilled beam technology with the stringent building energy codes, government incentives to construct sustainably, and increased focus on indoor air quality (IAQ) standards. On the other hand, Asia Pacific and the Middle East are observing increased demand for energy-efficient cooling technologies as a result of increased urbanization, infrastructure growth, and the focus on sustainable building designs.

Active chilled beams, though widely used, are challenged by up-front installation expenses and humidity control issues. Nevertheless, dehumidification technology improvements, integration with intelligent climate control systems, and creative coil designs will likely improve system efficiency and market appeal. Multiservice chilled beams provide integrated HVAC, lighting, and building automation for high-performance environments

Multiservice chilled beams (MSCBs) have gained firm market momentum, especially in corporate office spaces, high-technology research labs, and luxury residential complexes, since they integrate complete HVAC, lighting, electrical, and communication systems in a single, streamlined package. Such systems integrate chilled beam technology with intelligent building infrastructure to provide holistic climate control and workplace functionality.

Building owners and facilities managers like multiservice chilled beams for their compact size, lowered ceiling clutter, and improved energy management features. MSCBs incorporate air distribution, lighting, motion sensing, and fire detection functions within a single product, permitting an integrated, intelligent building solution in contrast to free-standing HVAC systems.

The corporate and commercial real estate sectors are increasingly investing in MSCBs to improve workspace efficiency, air quality, and employee productivity. Modern offices require modular, flexible HVAC solutions that adapt to changing occupancy levels, and MSCBs provide seamless integration with IoT-based smart building systems, ensuring real-time climate adjustments and energy optimization.

Schools and research institutions are also embracing multiservice chilled beams because these institutions need to have uniform temperature control, low noise, and flexible infrastructure for classrooms, lecture theatres, and research laboratories. MSCBs provide customized climate zones without sacrificing aesthetic homogeneity and low maintenance.

Though more expensive initially, multiservice chilled beams provide long-term energy efficiency, enhanced space use, and lower operating costs. As building automation technologies improve, the need for smart, integrated HVAC systems will increasingly promote the use of MSCBs in high-performance building construction.

Standard and bespoke chilled beam systems lead the market scene, as commercial and residential markets require efficient, flexible cooling solutions that meet specific architectural and operational requirements.

Traditional chilled beams continue to be the first choice for commercial offices, hotels, and institutional buildings, where pre-engineered, plug-and-play HVAC solutions provide quicker installation and reduced cost. These systems adhere to standardized dimensions, airflow rates, and performance criteria, which make them perfect for retrofitting existing structures or incorporating into standardized building plans.

Developers and firms prefer standard chilled beams because they offer consistent performance, energy savings, and adaptability to existing conventional HVAC equipment. Pre-engineered units also make specification and purchasing easier, enabling quicker project completion and minimizing engineering complexity.

With the growth of green building certification schemes like LEED and BREEAM, the demand for standardized, energy-efficient HVAC components keeps increasing. Government policies encouraging low-energy buildings have also supported the market development of standard chilled beams, especially in areas with high energy prices and stringent environmental regulations.

Though cost-effective and quickly deployable, standard chilled beams are limited in highly specialized or architecturally distinct projects where specialized HVAC solutions must be created.

Engineered chilled beams are picking up market steam, with architects and engineers looking for specialized HVAC products that meet the requirements of contemporary building design, spatial limitations, and energy-saving aspirations. Standard products are not the same, with engineered chilled beams offering customized design parameters, sophisticated airflow patterns, and incorporation of high-tech smart building integration.

Luxury apartments, art galleries, museums, and advanced research facilities depend on tailored chilled beams to provide rigid climate control within strict architectural limitations. Tailor-made solutions allow for more flexibility in design, allowing for concealed air distribution pathways, sound reduction improvements, and customized ventilation patterns.

The hospitality industry has also adopted tailored chilled beams, especially in boutique hotels, resorts, and spas, where guest comfort and visual appeal are paramount. Hotels opt for low-noise, draft-free climate solutions that integrate well with interior design aspects, providing an upscale experience without sacrificing energy efficiency.

Tailored chilled beams entail greater up-front capital investment and longer design timelines, but provide unprecedented flexibility, best-in-class energy performance, and improved occupant comfort. As architectural fashions promote open floor plans, sleek ceiling aesthetics, and converged smart building controls, market demand for customized chilled beam solutions will steadily increase.

The market for chilled beam systems is transforming at a fast pace, spurred by growing needs for energy-efficient HVAC systems, green cooling technologies, and better indoor air quality. Market players emphasize high-end cooling efficiency, minimal carbon footprint, and connectivity with smart building management systems.

The market consists of global market leaders and niche manufacturers, all driving technological innovations and business expansion in commercial properties, healthcare facilities, schools, and homes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Halton Group | 12-16% |

| FläktGroup | 10-14% |

| TROX GmbH | 9-12% |

| Swegon Group | 7-11% |

| Caverion Corporation | 5-9% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Halton Group | Specializes in active and passive chilled beams for commercial buildings and healthcare facilities. Focuses on customized indoor climate solutions. |

| FläktGroup | Offers modular and integrated chilled beam systems with energy-efficient airflow control for office spaces and educational institutions. |

| TROX GmbH | Develops advanced chilled beam systems with smart air management technology, integrating demand-based ventilation controls. |

| Swegon Group | Manufactures high-efficiency chilled beams for indoor climate optimization, emphasizing sustainability and CO2 reduction. |

| Caverion Corporation | Provides smart building solutions with chilled beam integration, ensuring thermal comfort and reduced operational costs. |

Key Company Insights

Halton Group (12-16%)

Halton Group is a global leader in chilled beam systems, providing customized indoor climate solutions for commercial environments, healthcare, and schools. The company is specialized in high-performance air distribution technology and energy-efficient cooling solutions to address the needs of the global market for effective HVAC systems.

FläktGroup (10-14%)

FläktGroup is a specialist in modular chilled beam systems, enhancing air quality and energy efficiency in commercial buildings. The company incorporates smart airflow management in its systems, aligning with contemporary building automation trends.

TROX GmbH (9-12%)

TROX GmbH is known for its intelligent air management technology, offering smart-controlled chilled beams. The company invests in high-performance heat exchange technology, ensuring superior cooling efficiency in offices, hotels, and educational facilities.

Swegon Group (7-11%)

Swegon Group produces high-efficiency chilled beams that concentrate on sustainable indoor climate control. The company focuses on CO2 reduction and energy-efficient HVAC solutions, which makes it a popular choice for green building projects.

Caverion Corporation (5-9%)

Caverion Corporation integrates chilled beam technology with smart building solutions, ensuring thermal comfort and operational cost reduction. The company specializes in customized climate control for modern buildings, enhancing indoor air quality.

Several other companies contribute to technological advancements, cost-effective solutions, and regional expansion. These include:

The overall market size for Chilled Beam System was USD 389.7 Billion in 2025.

The Chilled Beam System is expected to reach USD 659.4 Billion in 2035.

The demand for chilled beam is expected to rise due to its widespread use in chemicals, pharmaceuticals, and agriculture. Its role as an intermediate in fine chemicals, pesticides, and industrial solvents drives market growth. Advancements in chemical synthesis and the shift toward sustainable production further boost adoption. Additionally, increasing demand in coatings, resins, and fragrances supports market expansion.

The top 5 countries which drives the development of Chilled Beam Systemare USA, UK, Europe Union, Japan and South Korea.

Concealed Chilled Beam Systems are anticipated to hold a significant share of the market over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

United Kingdom Magnetic Separator Market Analysis by Over band/Cross Belt Separator and Magnetic Roller Separator through 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.