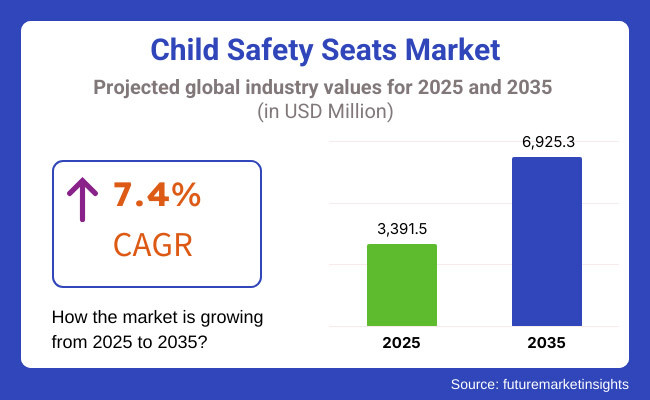

The global child safety seats market is projected to witness significant growth between 2025 and 2035, driven by rising awareness of child passenger safety, stricter government regulations, and increasing disposable incomes. The market is expected to reach USD 3,391.5 million in 2025 and expand to USD 6,925.3 million by 2035, reflecting a compound annual growth rate (CAGR) of 7.4% during the forecast period.

Child safety seats, also called car seats or child restraint systems (CRS), are intended to minimize the likelihood of injuries in accidents by providing additional protection and infants and young child's proper restraint. The rising concern on traffic accidents, the adoption of stringent child passenger safety laws, and the increasing demand for high-quality and ISOFIX-compatible car seats by consumers are the primary reasons for the market development.

Advancement of smart safety features, the addition of AI-based crash protection systems, and the use of environmentally friendly material in products are also adding to the market expansion. As the automotive industry grows and vehicle ownership rises in developing countries, child safety seats are likely to see a jump in the demand over the next few years.

The principal causes of the market development are the rapidly increasing application of child safety seat regulations in various countries in North America, Europe, and Asia-Pacific, along with the heightened awareness of road traffic safety. Besides, improvements in material or car seat technology, by being lighter, absorbing impacts better, and regulating the temperature, are forecasted to bring the market some new chances.

Explore FMI!

Book a free demo

Strict government rules, a great number of cars per inhabitant, and a more and more concerned attitude of the parents towards the child passenger safety are the main driving forces for North America being the largest market of child safety seats. USA and Canada maintain a full scheme of child restraint system (CRS) laws, that make it obligatory to use the right one according to the age of the kid, baby car seats for infants and small toddlers.

On the other hand, the National Highway Traffic Safety Administration (NHTSA) and Transport Canada demand strict crash-testing and safety certification rules for child safety seats, thereby encouraging the use of the best quality and premium safety solutions. Moreover, the introduction of high-tech luxury child safety seats with temperature-adjustable padding, nearby impact protection, and elaborate harness systems that are emerging in the premium segment is contributing to the market growth.

The European child safety seats market is expanding due to stringent EU child safety regulations, increasing road safety awareness, and the rising adoption of ISOFIX-compatible car seats. Countries such as Germany, France, and the UK have strict laws requiring the use of child car seats until a certain age and height threshold, driving market penetration.

The European Union’s ECE R129 (i-Size) regulations are promoting the adoption of height-based car seat classifications and enhanced side-impact protection features, leading to wider adoption of advanced child restraint systems. Additionally, rising demand for eco-friendly, recyclable, and chemical-free seat materials is shaping market trends in sustainability-focused European markets.

The child safety seats market in Asia-Pacific is growing the fastest with urbanization going very fast, the middle-class being rich, and the car sale's number increasing. On one hand, the cities of China and India and then of Japan and South Korea are the locations where public sector initiatives are being taken to tackle the problem of road traffic accidents involving children as well as promote adopter of car seats via ad campaigns.

The automotive sector in China is up and running despite the birth rates that are now increasing and the number of middle-income families who are now able to afford it is the reason for the high demand not only for affordable but also for premium child car seats.

Additionally, India has been seeing a drive for the introduction of the obligatory child restraint systems on the automotive vehicles, even though still the regulation of the industry is in the stage that is quite primitive and the connotation of the people concerning it is as well. On the other hand, Japan, and South Korea together are at the forefront of technological innovations in safety and have been the ones to create new telescope backrest configurations for their car seats.

The adoption of child safety seats is slowly progressing in the Middle East and Africa region, which is mainly due to higher vehicle ownership, greater road safety initiatives, and the rise of consumer spending on child safety products. Saudi Arabia, UAE, and South Africa are among the countries where premium child car seats with additional safety are in demand, and consumer needs are diversifying.

The spread of luxury car brands and adherence to international safety regulations are the factors that steered the growth in the child safety seat distribution channel. Nevertheless, the absence of commitment in enforcement and poor consumer knowledge in some areas of the region are still the challenges faced for the development of the market.

Lack of Awareness and Low Adoption in Emerging Markets

Despite the stringent safety regulations in developed regions, many emerging economies still lack strong child passenger safety laws and enforcement mechanisms. In countries where vehicle ownership is rising, the adoption of child safety seats remains low due to a lack of awareness and cultural perceptions regarding child transportation.

Additionally, economic constraints and affordability concerns prevent widespread adoption of high-end child safety seats in price-sensitive markets. Governments and safety organizations need to implement educational campaigns, incentives, and stricter enforcement policies to promote the use of child car seats in developing regions.

Counterfeit and Non-Certified Products

The market faces a significant problem due to the massive influx of counterfeit and substandard child safety seats. Many of the inexpensive, unapproved car seats found in the market do not meet safety standards and could seriously endanger children in case of an accident. Mismanagement of the regulatory framework, as well as poor quality surveillance cantors, allows for the unsafe sale of child restraint systems, to the detriment of consumers.

In order to tackle the challenge, the regulatory bodies, and the producers have to improve the standards for product certification, as well as the steps for compliance, and have to train the consumers on the drawbacks related to the child safety seats that did not receive certification.

Advancements in Smart and AI-Powered Child Safety Seats

The increased use of smart technology in child safety seats is contributing to the rise of market growth. Sensors that measure temperature or change, crash alerts, AI-engineered impact absorption systems, and child positioning monitoring systems that operate in real-time are the types of devices being integrated by the crew of researchers and engineers. Car seat manufacturers are creating smart child car seats with Bluetooth technology, GPS locator, and IoT safety features that parents can activate.

The advantages of these smart child car seats are real-time notifications about the safety of the kid and the automatic transmission of emergency alert in case of an accident. The integration of IoT in the automotive industry and the development of AI-based safety features are expected to lead the transition to newer models of child safety seats.

Growing Demand for Sustainable and Ergonomic Designs

The growing interest in products that are environmentally safe and have long life span is resulting in new market opportunities. Specifically, companies are making child car seats that are done with recyclable plastic, organic fabric, and naturally flame-retardant materials that no harmful toxins are involved to fulfill the demand of the customers looking for products that are environmentally friendly.

Furthermore, the ergonomic and multi-functional car seats, which can be used from infancy to childhood are now the most sought product by the budget-oriented as well as the convenience-seeking parents. The development of compact, foldable, and ultra-lightweight child car seats, which could be carried on trips has benefited the market in both advanced and developing countries.

Between 2020 and 2024, the market for child safety seats experienced a steady increase owing to the stricter measures taken by the government, the increasing parental awareness related to child safety as well as the innovation of seat design and materials. The global governments have made infant and toddler car seats significantly safer by adopting more laws that enforce the use of these seats, thus car seat adoption is at a higher level.

Further, features like electronic car seat technologies, impact-resistant materials, and enhanced side-impact protection systems added to the development of the sector. In addition, urbanization, income growth, and above all, the increase of car ownership in developing countries supported the expansion of consumer purchasing power. Besides, the presence of the high-cost issue, the problem of standardization across regions, and the lack of awareness in developing countries were the challenges that were faced.

Looking at the future market from 2025 up to 2035, the child safety seat segment will be hi-tech and green with items such as AI crash detection, monitoring by smart devices and sustainable, eco-friendly materials added. The movement will all be sensor-enabled, allowing real-time monitoring of children, materials such as temperature-regulating fabrics, and IoT-based emergency alert systems.

Aside from that, there will be biodegradable, non-toxic materials, AI-assisted seat installation guides, and advanced ergonomic designs, which will completely change the way that child passenger safety is observed.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Compliance & Safety Standards | Tighter regulations (e.g., ECE R129, FMVSS 213) enforced mandatory child safety seat usage in many countries. |

| Integration of Smart Safety Technologies | Some seats featured basic impact protection, ISOFIX/LATCH systems, and adjustable headrests. |

| Sustainability & Eco-Friendly Materials | Gradual shift toward low-toxicity, flame-retardant, and BPA-free materials. |

| Ergonomic & Adaptive Seat Design | Growing demand for multi-stage convertible seats, side-impact protection, and lightweight travel seats. |

| Growth in Emerging Markets & Affordability | Rising adoption in developing regions due to increasing middle-class incomes and car ownership. |

| Vehicle Integration & AI Monitoring | Some luxury cars offered built-in child seat monitoring features with alert systems. |

| Market Growth Drivers | Growth fueled by increasing safety awareness, regulatory mandates, and new material innovations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Compliance & Safety Standards | AI-powered compliance tracking, smart car seat testing with digital crash simulation, and blockchain-backed certification transparency. |

| Integration of Smart Safety Technologies | AI-based real-time crash detection, IoT-enabled seatbelt tension monitoring, and smart sensors for child presence alerts. |

| Sustainability & Eco-Friendly Materials | Biodegradable, plant-based fabrics, 3D-printed recycled plastic frames, and non-toxic chemical-free padding. |

| Ergonomic & Adaptive Seat Design | Adaptive AI-driven car seats with auto-reclining head support, real-time body temperature regulation, and pressure-sensitive padding for comfort. |

| Growth in Emerging Markets & Affordability | Affordable, AI-assisted, modular child safety seats with cost-effective production and localized distribution. |

| Vehicle Integration & AI Monitoring | Connected safety seats with car-integrated monitoring, automated child weight-adjustment mechanisms, and AI-driven impact mitigation. |

| Market Growth Drivers | Market expansion driven by AI-integrated safety enhancements, sustainable materials, and smart vehicle connectivity for child safety. |

The United States child safety seats market is widening as a result of governmental initiative, parents become more concerned about the safety of the children, and automobile ownership is on the rise. The National Highway Traffic Safety Administration (NHTSA) has stringent rules for the use of a car seat for children, namely those that are appropriate for age and weight.

This is because of the fact that parents tend to ignore directives and always put the child's seat in the front. Be it as it may, the latest technology such as smart sensors on the child safety seat for knock, temperature control, and monitoring by the phone app, is making such seating more attractive for hi-tech lovers. Beside this, the e-commerce sector is the other strong factor that supports the expansion of the market. It is thanks to the rise of online shops that families have the opportunity to choose and purchase various types and features of car seats for their children with no difficulty.

An additional increase in the number of ridesharing services, which specifically appeal to families, is becoming an important factor in the demand for portable and foldable car seats. Moreover, state laws compelling the use of booster seats up to the age of 8 or older are further underpinning the market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

The United Kingdom child safety seats market is on the rise, thanks to the adherence to stringent legal mandates, people opting for high-end goods, and greater cognizance about road safety for children. The Road Traffic Act in the UK requires all children under 12 years or 135 cm in height to use child car seats, subsequently increasing sales of such age-appropriate car seats.

Furthermore, the market shows a growing trend in the ISOFIX-compatible child seat sales as the manufacturers prioritize both the hassle-free installation and the increased safety. An additional example is the emergence of the eco-friendly and sustainable car seat materials, which are made of recycled fabrics and non-toxic plastics, that are certainly very attractive to the parents who care about the environment.

Moreover, the insurance benefits provided to parents that use the certified child safety seats are the other efficient driving factors for the adoption. The advent of online-shopping platforms that are offering safety-rated child seats is also adding to the market access success.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

The European Union child safety seats market is developing rapidly owing to the establishment of the safety regulations, an increase in the education of child safety in transport, and the broadened government involvement. To a considerable extent, the demand for quality child seats that comply with the new regulations is facilitated by the ECE R129 (i-Size) regulation, which requires the use of rear-facing car seats for at least 15 months and longer in some cases.

In addition, the market expansion is clearly influenced by the preeminently high use of premium and luxury car seats in countries such as Germany, France, and the Netherlands. Environmental concerns and the EU's directive on safety innovation are also the reasons for this shift, the development of recyclable car seats and the use of smart monitoring systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

The child safety seats market in Japan is experiencing a continuous expansion, mainly due to the implementation of stringent traffic safety regulations, the birth rate increase, and the development of child-friendly mobility solutions. According to the Japanese Road Traffic Act, children below 6 years must use child safety seats which has resulted in the wide acceptance of them.

With the technological edge, Japan is witnessing more and more innovations in children's safety seats, such as fabric that can regulate temperature, suspension designs for impact resistance, and AI-integrated safety monitoring. Furthermore, as compact vehicles and an urban driving environment are predominant in Japan, the need for lightweight and space-saving car seats is being effective.

The surge of nuclear families and the need for premium baby products are also the factors that drive the sales of convertible and all-in-one car seats which provide long-term value and adaptability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The expansion of the South Korea child safety seats market is due to the government-supported road safety initiatives, increase in disposable income, and urbanization. The government of South Korea directs the mandatory use of a child safety seat for kids under 6 years which is a factor that causes the demand for high-quality and budget-friendly car seats to increase.

The robust e-commerce sector of the country is also an important factor driving the online sales of child safety seats. As a result, premium and internationally certified seats are accessible to the customers. Besides, intelligent security features, such as temperature control and motion sensors, are becoming trendy with tech-savvy parents.

Manufacturers are also responding to the growing interest in sustainability by producing car seats made of non-toxic, BPA-free, and recycled materials, which are sought after by eco-friendly consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The decision of convertible child safety seats to remain on the top of the market is due to their versatility and long-term usability as they fit both rear-facing and forward-facing positions. This type of seat is a popular choice for parents because of its low cost, which allows them to have one product for both uses as the child grows.

Convertible seats that are rear-facing give you longer usage periods, which you have from birth up to toddlerhood. Thus, they are always in great demand among the budget-conscious and safety-focused consumers. The sale of high-quality, crash-tested convertible seats is made easy by the enactment of safety regulations and the rising parental awareness of the extended rear-facing benefits.

On top of that, the addition of side-impact protection, energy-absorbing foam, and adjustable harness systems has been notable improvement. This not only makes them safer but also provides convertible child seats with better comfort features, hence their popularity is further encouraged.

As car manufacturers equip vehicles with ISOFIX and LATCH (Lower Anchors and Tethers for Children) systems, the compatibility of convertible child seats with modern cars has emerged as a crucial selling point.

The demand for booster seats is climbing which is specially being observed for ta with children aged four years and more, as governmental safety regulations require the proper height and weight positioning before transitioning to standard seat belts. The seats not only help the child sit at the right height but also the seat belt is positioned correctly, hence in a case of an accident the seat belt will be less effective thus reducing injury risks.

Due to the increasing consumer education about the necessity of booster seats for older kids, parents are deciding on high-backed and backless booster seats that provide more neck, head and side-impact protection. In contrast to convertible and baby seats, boosters are more adaptable, lighter, and easier to fit, this it makes them perfect for families with several cars or ridesharing needs.

As seating eventually evolves, manufacturers reduce sizes and weight by introducing lazy adjustments, foldable designs for travel convenience, and rainproof extra cushioning for enhanced comfort.

Online distribution is the fastest-growing sales channel in the child safety seat market, driven by e-commerce growth, convenience, and access to a wide range of products. Consumers are increasingly purchasing child safety seats through online platforms, as they offer detailed product reviews, side-by-side comparisons, and exclusive discounts. Leading e-commerce platforms such as Amazon, Walmart, and specialized baby product retailers are expanding their digital presence, offering features such as virtual installation guides, expert recommendations, and customer feedback integration.

Compared to physical retail stores, online channels provide competitive pricing, home delivery, and easy return policies, making them the preferred choice for busy parents. Additionally, as direct-to-consumer (DTC) brands and smart baby gear innovations grow, online platforms are seeing an increase in premium child safety seat sales.

The retail market for specialty baby products is still being headed by these channels, especially for the new parents who rely on the guidance of professionals and the demonstration of the product. They offer face-to-face meetings, trial of apparatus, and certified technician services, thus guaranteeing that the furniture is installed correctly and that the local authority safety regulations are met.

In contrast to supermarket chains, stores specialize in offering top-shelf safety seats with state-of-the-art technology, thus, satisfying the needs of customers who prefer tailored and premium products. The advent of small and exclusive stores along with fairly personalized shopping journeys and fun, interactive, in-store presentations has also led to a rise in sales in this category.

As the regulations for child safety resonate in the near future, the specialized store will be the first place to go for children-specific, safety-certified, and high-performance child seats.

The international child safety car seats market is experiencing a steady climb as it is propelled by increased awareness of child safety in cars, tougher government rules, and the ever-growing number of vehicles worldwide. Child car seats are the ones that offer the most protection, as they facilitate the diminishing of injury possibility, as well as the adherence to road safety laws; hence they have to be used for infants and toddlers to sit in a car safely.

The sector is influenced by the breakthroughs in the production of materials that are resistant to impact, the adoption of smart safety features, and the requirement for lightweight, portable, and ergonomic car seats. Major producers are putting the spotlight on customizable seating solutions, the addition of comfort, and simple installation systems and targeting automotive safety regulations and the dynamic consumer preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Britax Römer | 10-12% |

| Graco Children's Products Inc. | 9-11% |

| Diono Inc. | 8-10% |

| Chicco (Artsana Group) | 6-8% |

| Evenflo Company, Inc. | 5-7% |

| Other Companies (combined) | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| Britax Römer | A global leader in high-performance child safety seats, offering advanced side-impact protection and ISOFIX installation systems. |

| Graco Children's Products Inc. | Develops multi-stage convertible car seats, integrating one-hand adjustment and reinforced impact resistance technology. |

| Diono Inc. | Specializes in foldable, compact child safety seats, ensuring easy portability and high crash protection standards. |

| Chicco (Artsana Group) | Provides lightweight and ergonomic child car seats, integrating climate-control fabric and enhanced padding for comfort. |

| Evenflo Company, Inc. | Offers affordable, high-safety rated child seats, featuring extended rear-facing positions and energy-absorbing foam technology. |

Key Company Insights

Britax Römer

Britax Römer stands out as a frontrunner in the production of child car seats of the highest safety standards, which entails the side-impact protection, ISOFIX-compatible installations, and features for enhanced stability. The company’s Dualfix and Advansafix series introduce the most excellent touchscreen comfort, turn fully at 360 degrees, and they can be used in rear-facing mode for the extended period.

Britax Römer is throwing resources to the technological innovations of intelligent safety sensors and artificial intelligence powered crash detection, therefore gives out immediate notifications to the people on site and also records the impact of the security of the place.

Graco Children's Products Inc.

The main focus of the Graco brand is to make various multi-staged car seats facilitating the full of life adjustable harness systems, steel framed reinforced, and high-density energy-absorbing foam, etc. The brand 4Ever DLX and Extend2Fit of Graco provide 10 years of usability, a one-hand recline adjustment, and best-in-class side-impact protection. Graco broadens its line of the eco-friendly child seat, which includes the use of sustainable materials and fabrics that are free from flame retardants.

Diono Inc.

Diono is a brand that is primarily concentrated on the development of compact and foldable child safety seats that are both space-saving and travel-friendly. Their Radian and Monterey lines are the ones that boast of aluminum-reinforced side walls, memory foam padding, and the addition of extended 5-point harness systems. In addition to that, Diono is also in the process of upgrading its smart latch technology, which will allow for fast installation and the adaptive positioning of the seat for the growing child.

Chicco (Artsana Group)

Chicco is one of the reputable lightweight and ergonomic child car seats with climate-control fabric, energy-absorbing foam, and reclinable positions. The company's KeyFit and NextFit series embody the integral features in an easy installation, comfort, and dual-layer impact protection. Chicco is introducing its automated fit-guide systems, which will be installed at the local shops for parents to choose the model easily based on their child's weight and height.

Evenflo Company, Inc.

Evenflo is a manufacturer that gives affordable child seats with high safety ratings and offers longer rear facing capabilities, and advanced crash-tested impact protection. The company's EveryStage and Symphony series feature energy-absorbing foam, side-impact bolsters, and multi-position recline functions. Evenflo applies the digital safety technology by having QR-coded installation guides and real-time crash alert systems.

The global child safety seats market is projected to reach USD 3,391.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 7.4% over the forecast period.

By 2035, the child safety seats market is expected to reach USD 6,925.3 million.

The specialty stores segment is expected to dominate due to the availability of certified child safety seats, expert recommendations, and growing consumer preference for in-store testing and demonstrations before purchasing.

Key players in the child safety seats market include Britax, Graco, Chicco, Maxi-Cosi, and Evenflo.

Convertible, Booster, Infant, Combination Seat, All in One

Rear Facing, Forward Facing

Plastic, Steel, Composite

Online, Specialty Stores, Mega Retail Stores

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa

Sales of Used Bikes through Bike Marketplaces Market- Growth & Demand 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Start Stop System Market Growth – Trends & Forecast 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Automotive Door Guards Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.