Due to poultry production doubling in progressing regions such as the USA, Germany, and the UK, a compelling need for mechanized plucking was created leading to investment in automated plucking solutions.

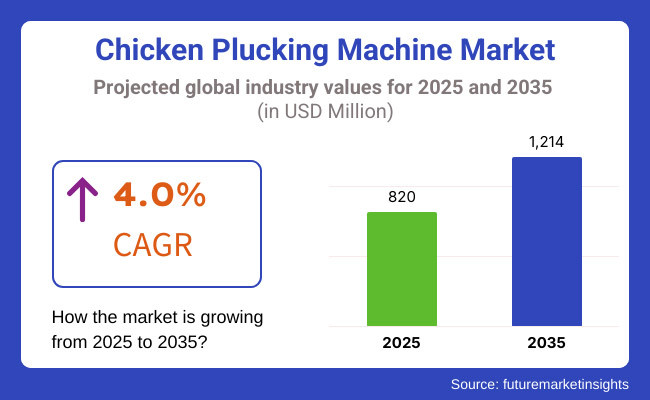

The industry is projected to develop at a stable CAGR of 4.0% going into 2025 and further, driven by on-going investment in smart processing technologies and energy-efficient options. Innovation to facilitate sustainable and high-capacity poultry processing will consequently fuel long-term industry growth.

While ever-increasing operating costs also fuelled industry adoption, regulatory mandates around hygienic and efficient processing also drove significant growth the industry. And yet, technological breakthroughs such as the Internet of Things (IoT) and artificial intelligence (AI) drove machine performance, maximizing productivity through automation.

Explore FMI!

Book a free demo

Insights gleaned from the recent survey conducted by Future Market Insights (FMI), comprising key stakeholders in the chicken plucking machine industry, including poultry farm owners, processing plant operators, equipment manufacturers, and regulatory authorities, have facilitated internal and external business stakeholders in tracking the data of the market.

According to the survey, more than 65% of respondents claimed that automation is the factor that satisfies growth for their industry. Stakeholders highlighted the increased demand for poultry meat and the need to reduce processing time and labour costs through the use of high-speed and low-maintenance plucking machines.

Top poultry processing consulting experts focus on waste and energy efficiency. With sustainability legislation tightening, manufacturers have better, greener designs in mind, specifically machines that consume less water and capture better.

Nearly 40% of poultry farm owners who were surveyed have said their primary challenge is now meeting hygiene and safety standards, which has led to the installation of automated plucking machines made out of stainless steel to meet food safety guidelines.

The survey also found regional differences in adoption rates. In North America and Europe, regions with highly regulated food-safety standards, they are already the norm. In Asia-Pacific and Latin America, price-consciousness is still a barrier to widespread adoption, and many small poultry businesses continue to rely on semi-automatic or manual plucking methods.

Government incentives and financing availability, industry leaders tell us, will be crucial to jump-start modernization in these areas. In the future, IoT-enabled smart machines that provide real-time monitoring and AI-driven optimization will transform poultry processing, say stakeholders.

More than 55% of equipment makers surveyed are already investing in digital technologies that improve machine efficiency and enable operational cost reductions. This hints towards a vertical race of automation and sustainability leading to robust growth of the industry.

| Countries | Regulation & Impact on Industry |

|---|---|

| USA | The USDA Poultry Products Inspection Act mandates strict hygiene standards for poultry processing, driving demand for automated, stainless-steel plucking machines that meet compliance requirements. |

| European Union | The EU Regulation (EC) No 852/2004 on Food Hygiene enforces stringent processing conditions, encouraging the adoption of high-speed, water-efficient machines in slaughterhouses. |

| China | The National Food Safety Standard (GB 2707 to 2016) requires mechanized poultry processing to reduce contamination risks, pushing smaller producers to modernize operations. |

| India | The Food Safety and Standards Authority of India (FSSAI) have introduced guidelines for poultry processing units, promoting semi-automated and automated plucking solutions to enhance hygiene. |

| Brazil | The MAPA (Ministry of Agriculture, Livestock, and Supply) regulations require poultry plants to adopt sanitary processing equipment, increasing demand for efficient plucking machines. |

Market Share Analysis

Baader Group, Foodmate BV, Marel, and Meyn Food Processing Technology B.V. are some of the major players in the global chicken plucking machine industry. The Baader Group is specialized in advanced plucking machines for the large operation; Foodmate BV is focused on compact and high-speed machines for the medium-sized poultry processor.

With automation-driven machines, Marel tends to earn a reputation for minimizing downtime and maximizing efficiency. With their precision-engineered pluckers, Meyn Food Processing Technology B.V. is a world leader with its top hygiene standards, and on that note, compliance with industry regulations. It is still a competitive industry as businesses strive for innovation, streamlined operations, and regulatory compliance in order to stay ahead.

Key Developments in 2024

In 2024, the chicken plucking machine industry witnessed notable technological innovations and strategic collaborations. Allana Group expanded its poultry processing operations by introducing integrated solutions to maximize efficiency in the industry.

To aid poultry processors with the growing demand, leading manufacturer’s integrated features such as automation, artificial intelligence, and IoT-enabled machines in their plucking machines, expecting to improve their overall operating procedures.

Some companies worked with local distributors and poultry farms to expand their commercial geography, while others focused on sustainability by creating green energy and water-saving plucking technologies. Such innovations are fuelling the industry and will revolutionize poultry processing in the future.

Product Benchmarking

There are different types of chicken plucking machines, which can be used from small-scale manual machines to fully automated industrial chicken plucking machines. These machines from the Baader Group are intended for larger poultry processors, with features such as high speed and minimal retained feathers on the carcass.

They offer space-saving devices for the medium scale of operations at a reasonable price only. Marel plucking machines are built for automation and reliability, which minimizes labour dependency and maximizes the efficiency of production.

Due to precision plucking and improved hygiene of machines, Meyn Food Processing Technology B.V. machines are preferred for integrated poultry processing plants. All of their products address specific industry demands that help poultry operations maximize their processing capacity and efficiency.

Meyn Food Processing Technology B.V.

Estimated Industry Share: ~25-30%

Global leader in poultry processing equipment with comprehensive product lines for all scales of operations. Known for advanced automation and high-capacity plucking systems with integrated water conservation features.

Marel hf

Estimated Industry Share: ~20-25%

Offers complete poultry processing solutions with highly efficient plucking technology. Strong presence in large-scale commercial applications across multiple continents with emphasis on traceability and food safety.

Baader Group

Estimated Market Share: ~15-18%

European manufacturer specializing in robust, durable plucking systems with precision defeathering capabilities. Particularly strong in mid to large-scale operations requiring consistent quality.

Foodmate B.V.

Estimated Market Share: ~10-12%

Growing rapidly through innovative technology focused on maximizing yield and minimizing damage during the plucking process. Strong in North American and European industries.

Poultry Processing Equipment Inc. (PPEI)

Estimated Industry Share: ~8-10%

Specializes in equipment for small to medium-sized operations with customizable solutions. Particularly strong in emerging industry and regional processing facilities.

Mayekawa Manufacturing Co.

Estimated Market Share: ~5-7%

Japanese company known for energy-efficient designs and integration of plucking systems with broader processing lines. Growing industry share in Asia-Pacific region.

Cantrell-Gainco Group

Estimated Industry Share: ~4-6%

Strong presence in North American industry with focus on aftermarket parts and service support for plucking equipment. Known for reliability and customer service.

The United States has been one of the major markets for chicken plucking machines, attributed to the highly advanced poultry industry and increasing demand for processed chicken products. USA holds approximately 36.0% share of the global chicken plucking machine industry.

The United States has a large and established network of factory operations, processing centres and slaughterhouses that are always investing in automation and other technologies that have helped improve their efficiency.

High-end poultry processing machines, such as high-speed plucking machines, are being adopted widely due to labour shortages and increasing hygiene standards. USA. industry is also derived from strict food safety regulations enforced by regulatory bodies like the USDA and FDA that drive manufacturers towards development of machines offering improved cleanliness and efficiency.

In addition, the demand for sustainability in the poultry processing business is motivating various companies to adopt energy-efficient plucking solutions with water-saving capabilities. Small and medium-sized poultry processors who are looking to boost productivity are also showing an increased preference for compact and automatic plucker machines.

The poultry processing sector in the UK is expanding steadily, thanks to high domestic consumption of chicken meat and growing exports to European industries. United Kingdom chicken plucking machine industry is projected to grow at a robust CAGR of 6.3%. With chicken plucking becoming less viable through manual processing following post Brexit labour shortages, the chicken plucking machine industry is driven by automating chicken processing plants.

UK poultry businesses are installing more plucking machines to boost efficiency and meet growing customer demand. Food safety and hygiene regulations imposed by the Food Standards Agency (FSA) also provoke the adoption of advanced processing technologies that ensure the least contamination risk.

Sustainable poultry processing is also increasing in the UK industry with the companies actively seeking for energy-efficient machines, which reduce water consumption. Also driving demand for specialized machines, such as those used to de-feather organic and free-range chicken, are the growing numbers of small poultry farms.

The industry is built on quality, organic farming and high food safety standards thanks to the well-established French poultry processing industry. Increasing automation in large poultry processing plants, along with the proliferation of small and medium-sized free-range poultry farms in the country, is driving demand for chicken plucking machines.

France’s stringent animal welfare rules call for poultry processors to use technologies that minimize the stress and damage that the birds experience during plucking, which affects how machines are designed. As a bonus, the meningkat quality of traditional and home project poultry products has boosted investment in specialized plucking machines for smaller-scale, higher value production.

This trend towards sustainable processing also led to the arrival of plucking solutions that save water and are energy efficient. In addition to the Turkish poultry industry, which is structured with the prospect of exports in mind, emphasis is also placed on further developing French poultry production to industries outside Europe, so demand for high throughputs in the form of high-speed processing will continue to dominate, due to increasingly high international export standards.

Germany represents a major chicken plucking machines industry backed by advanced poultry processing infrastructure and emphasis on food safety. Automated plucking machines are in high demand in the nation as poultry processors look to streamline production and control reliance on human effort. In Germany, firms assure superior techno- precision plucking, minimal wastage, low hygiene standards.

Additionally, the industry is impacted by stringent environmental regulations that require manufacturers to produce equipment that saves energy and water. Furthermore, the rising demand for organic and antibiotic-free poultry products is driving the need for specialized plucking machines suitable for more diverse niche production and smaller scales.

The poultry processing industry in Italy comprises a variety of large, industrial processors and smaller, traditional poultry farms. The Italian consumer attaches significant importance to quality and traditional poultry products such as free-range and organic poultry, which leads to a demand for plucking machines that are effective and gentle at the same time.

And processors are increasingly turning to mechanization as labour shortages and rising wages continue to prompt investment in automated plucking solutions, the industry source said. Sustainability is become more of a focus in the poultry sector in Italy and the industry is searching for energy-efficient and environmentally friendly processing equipment. Moreover, the country’s rich culinary culture and preference for high-quality poultry products push innovation in plucking machines that preserve the texture and appearance of the meat.

The poultry processing industry in South Korea has grown rapidly because of increasing domestic consumption of chicken products, especially fast food and convenience meals. As consumer demand increases, processing plants are upgrading their facilities and investing in chicken plucking machines, which has driven growth in the industry.

The adoption of advanced poultry processing technologies is also being propelled by strict food safety and hygiene regulations established by the Korean Food and Drug Administration (KFDA). Moreover, the growing trend for organic and locally produced poultry products has driven small- and medium-scale farms to invest in compact and efficient plucking machines.

Revolutionary trends in the poultry processing industries have paved the way in South Korea, where technology has been trending, from smart poultry processing solutions to IoT-enabled monitoring solutions.

Japan's poultry processing sector is highly developed, with particular focus on hygienic, efficiency and technical innovation. The demand for chicken plucking machines ultimately comes down to the desire for high-end automation that is executed with speed, accuracy and without compromising clean environment.

Japanese consumers also have a preference for high-quality poultry products with stringent safety standards, putting processing plants under pressure to invest in state-of-the-art plucking machines that reduce contamination risks. In a labour-short, high-operational-cost country like Japan, automation is of utmost importance and this translates to a great preference for robotic processing, with AI used in multi-faceted ways to augment the process.

Sustainability is becoming a priority, too, with poultry processors seeking energy-efficient machines that help them use less water. Japan's increasing poultry exports also contribute to the overall growth of the industry since international quality standards necessitate improved processing equipment.

China has one of the largest poultry-processing’s industries in the world. Chicken plucking machines market in China is likely to increase at 6.6% CAGR. The industry is driven by large scale poultry farms and processing plants aiming for increased productivity through automation.

Government in China is driving more food safety and modernization in meat processing, which is also enabling the companies to adopt advanced plucking technologies. The trend of full automation is prominent in the Chinese poultry processing industry, with more and more companies setting completely automated production lines combining high-performance plucking machines with associated systems for scalding and evisceration.

The increasing popularity of online shopping and food delivery services have also contributed to a surge in demand for effective poultry processing automation. Also, the focus on food exports in China has seen poultry companies making investments in high-quality plucking machines in line with international hygiene standards.

The Australian and New Zealand poultry industry is witnessing a steady growth; this can be attributed to high per capita chicken consumption and growing demand for processed poultry products. Poultry companies worldwide are looking for ways to improve efficiency and reduce reliance on labour, and chicken plucking machines are seeing increasing adoption.

The two countries have strict food safety standards that compel poultry processors to maintain strict hygiene standards, which are leading the demand for advanced plucking machines with less risk of contamination generation.

Sustainability is another big consideration, and the processors are investing in eco-friendly energy-efficient poultry processing equipment. Used in everything from chicken meat farms to those producing eggs and game birds, pluckers are a vital part of many organic and free-range poultry enoivrnments. Moreover, Australia and New Zealand's high-volume poultry export industries have resulted in investments in high-capacity, automated plucking solutions to adhere to international standards.

Horizontal chicken plucking machines sell more than vertical ones because they are preferred by large-scale commercial poultry processors. Their horizontal drum design allows for efficient feather removal by tumbling multiple birds simultaneously, increasing throughput and ensuring uniform plucking.

Businesses prioritize these machines to optimize processing time and maintain consistency in high-volume operations. In contrast, vertical pluckers cater to smaller farms and niche markets where space constraints and batch precision matter more. While vertical machines serve specific needs, horizontal pluckers dominate sales due to their superior efficiency and higher processing capacity.

Automatic chicken plucking machines are gaining the highest sales due to their efficiency, labor savings, and suitability for large-scale poultry processing. These machines streamline the plucking process, reduce manual intervention, and improve hygiene, making them the preferred choice for commercial poultry farms and meat processing plants.

Semi-automatic machines also hold a significant share, particularly among mid-sized poultry businesses that require some level of automation while keeping costs lower than fully automatic models. These machines allow partial manual control, making them ideal for businesses transitioning towards automation.

In contrast, manual plucking machines are declining in popularity, as they are labor-intensive, time-consuming, and less efficient. Small-scale farmers and backyard poultry keepers still use them due to their low cost and simplicity, but the demand for higher productivity and hygienic processing is pushing the market toward more automated solutions.

Chicken plucking machines are predominantly utilized in poultry farms, slaughterhouses, and food processing plants, where they streamline operations by automating the feather removal process, thereby reducing labor costs and increasing efficiency.

In contrast, hatcheries, which specialize in incubating and hatching eggs, do not typically engage in the slaughtering or processing of chickens and therefore have minimal use for plucking machines. Consequently, the demand for chicken plucking machines is highest in poultry farms, slaughterhouses, and food processing plants, with limited application in hatcheries.

In addition, the industry is segmented according to how these machines are distributed and sold. In traditional offline sales channels, specialized retailers and distributors are leading the industry due to customers needing to physically inspect the products before purchase, however online channels are starting to become increasingly popular due to their convenience and access to a larger range of products.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady growth driven by rising chicken consumption and mechanization in poultry processing. | Accelerated expansion with increasing automation and adoption of smart poultry processing technologies. |

| Gradual shift from manual and semi-automatic machines to automated solutions. | Widespread adoption of AI-integrated, IoT-enabled, and high-speed automated machines. |

| Stricter hygiene and food safety regulations driving the adoption of efficient processing equipment. | Governments expected to enforce more stringent animal welfare and food safety standards, boosting demand for compliant machines. |

| Demand surged in North America, Europe, and Asia-Pacific due to increased poultry production. | Stronger demand in emerging economies due to urbanization and rising protein consumption. |

| Industry dominated by established players with regional expansions. | Increased competition with new entrants and mergers & acquisitions shaping the industry. |

| Shift towards efficiency and cost-effective solutions. | Preference for sustainable, energy-efficient, and AI-driven machines. |

There are macroeconomic factors also influencing the chicken plucking machine industry, such as growing poultry consumption, growing automation in food processing, and food safety regulations. The poultry sector has a steady growth trajectory due to the increasing global demand for protein-rich diets, especially in emerging economies.

The global chicken products industry is expected to decelerate as per capita spending and growing income rates rise, and urbanization encourages poultry processing equipment trends and unmistakably contributes to the development of the poultry handling machinery industry.

Manufacturers face challenges due to inflation and also rising raw material prices, resulting in increased production costs. Nonetheless, with further advanced technology, including AI-powered automation and energy-efficient technologies, productivity enhancements, and lower operating costs, these issues should be alleviated.

Industry trends are being driven by government policies related to food safety, hygiene, and animal welfare, resulting in regulations and laws that require the adoption of efficient processing equipment. A labour shortage in many developed countries towards the poultry industry is also accelerating the switch to higher mechanization.

The global supply chain also plays a crucial role, with production hubs affecting machine supply and pricing depending on where you are. With increasing focus on sustainability, the demand for resource-efficient and eco-friendly plucking machines is projected to grow over the coming years.

Using AI and IoT in the plucking machine is innovative in the industry, which is helpful in efficiency, lowering labour costs, increasing precision, etc. Furthermore, growing poultry consumption in the developing regions such as Asia-Pacific and Latin America creates opportunities for manufacturers to launch cost-effective and high-speed machines to cater to local needs.

Sustainability is another big mover, as there's a trend towards energy-efficient machines or eco-friendliness to reduce water and energy while still delivering excellent productivity. A competitive advantage will also come from companies that develop modular and customizable solutions for both small-scale poultry farms and large processing plants. The transition towards direct-to-consumer sales and online distribution offers an opportunity to ensure the greatest available profit margins and build customer loyalty.

Manufacturers need to exercise strategic innovation and industry expansion to avail themselves of these opportunities. To keep up with the competitive trends of companies, they will invest in research and development to introduce AI-based automated sustainable plucking machines.

The impacts of poultry farms, slaughterhouses, and food processing units increase industry penetration, while mergers and acquisitions promote the growth of the company. The machines must also meet international food safety regulations, whether the machines are to be used in commercial stores or food processing facilities, where regulatory compliance is key for wider industry acceptance.

Adopting aggressive marketing strategies along with strong after-sales support (such as training programs and maintenance services) in high-growth regions would build long-term loyalty among customers. Implementing the above strategic initiatives will help businesses sustain growth and maintain a strong industry position in the chicken plucking machine industry.

The demand is driven by increasing poultry consumption, the need for automation in processing, and advancements in machine efficiency.

High adoption is seen in North America, Europe, and Asia-Pacific due to growing poultry production and technological advancements.

Machines are available in manual, semi-automatic, and fully automatic models, catering to different processing capacities.

Innovations such as AI integration, IoT-enabled monitoring, and energy-efficient designs are enhancing performance and reducing operational costs.

Challenges include regulatory compliance, high initial investment costs, and the need for continuous innovation to meet evolving industry standards.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Indoor Smokehouses & Pig Roasters Market – Smoked Meat Processing 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.