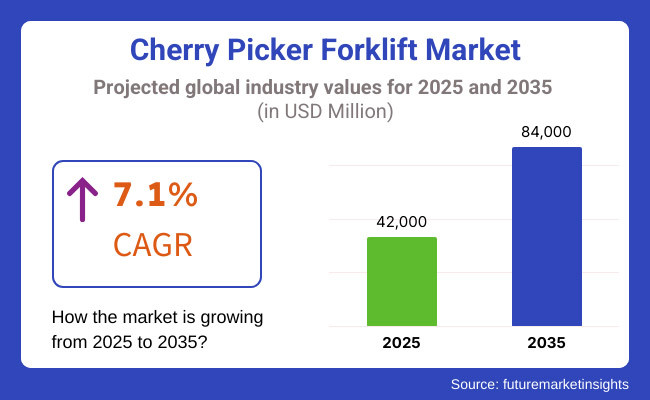

The cherry picker forklift market is anticipated to grow steadily by 2025 from 2035, in response to the rising need for effective materials handling solutions, improved warehouse automation, and an expanding e-commerce logistics market. On the other hand, in 2025 market approximate USD 42,000 million and similar to 2035 up-to USD 84,000 million, demonstrating CAGR of 7.1% during the forecast period.

Cherry picker forklifts are utilized in warehouses, construction sites, and industrial operations, due to their increased height, safety features, and operational efficiency; eliminating unnecessary labour costs. Market growth is driven by the rising adoption of electric and autonomous forklifts, the integration of IoT-based technology, telematics, and the emergence of smart & green forklifts. Moreover, stringent workplace safety regulations and the increasing focus on energy-efficiency, sustainable lifting equipment are propelling purchase decisions.

Important challenges around implementation and analysis such as high initial investment costs, high maintenance costs, and skilled operators act as a concern. To address these challenges and enhance overall operational efficiency, industry players are investing in automation, AI-based fleet management, and ergonomic design improvements.

Explore FMI!

Book a free demo

The cherry picker forklift market is dominated by North America, due to population building, rise in ecommerce sector, expansion in warehousing, utilities and construction sectors. Market growth is driven by major investments by the United States and Canada in automation and material handling technologies.

Electric and hybrid cherry picker forklifts are being adopted rapidly to comply with government rules to reduce emissions while abiding by environmental sustainability initiatives. Improved operational efficiency: as well as specific safety features and telematics, and remote monitoring solutions Nonetheless, factors such as high initial cost and maintenance cost may impede the market growth. Several companies are working towards more economical and energy-efficient devices to appeal to a wider audience.

Germany, France, the United Kingdom, and Italy are some of the major markets for cherry picker forklifts in Europe. The growing focus on workplace safety regulations, automation, and efficient warehouse operations is contributing to the market growth.

The industry is being transformed by the increasing adoption of lithium-ion powered forklift trucks and intelligent fleet management solutions. But strict environmental regulations and volatile raw material prices may in all likelihood act as a deterrent for manufacturers. To keep with the changing needs of end-user, companies are redesigning products with new looks, light stays and performance.

The Asia-Pacific region witnessed the highest growth in the cherry picker forklift market in industry due to rapid industrialization, increasing e-commerce logistics and infrastructural developments in countries such as China, India, Japan and Australia. Increasing demand for effective material handling in warehouses and distribution centers is driving market growth.

Government initiatives aiming to promote industrial automation and safety compliance are also propelling forklift adoption. Nonetheless, factors like the high price of advanced forklifts and lack of awareness in some developing regions may impede market penetration. Manufacturers are putting efforts into localized manufacturing, reduced leasing prices, and top-notch ergonomic designs to gain maximum market share and meet the need of different industries.

Challenges

High Maintenance Costs and Operational Complexity

The high cost of maintenance and operations is one of the challenges in Cherry Picker Forklift Market. Other products rely on complicated hydraulic and electrical systems, requiring frequent servicing and increasing operational costs. It also requires specialized training for operators to safely use the equipment, which increases labour costs.

Moreover, industries that rely heavily on cherry picker forklifts for material handling or warehouse operations feel the brunt of the productivity loss due to the threat of mechanical breakdowns and downtime. In order to meet these challenges, manufacturers are working to develop technologies that improve component resiliency; integration of predictive maintenance technologies, and user-friendly automation capabilities that reduce reliance on skilled operators.

Opportunities

Rising Demand for Electrification and Autonomous Operations

The trend of increasing sustainability and efficiency is opening new avenues of growth for the Cherry Picker Forklift Market. The increasing shift towards electric power forklifts as opposed to traditional fuel-based alternatives encourages the demand for eco-friendly alternatives that curb carbon emissions and reduce operational costs.

Moreover, automation and AI-based navigational systems are making way for autonomous operation of forklift trucks, improving safety and efficiency in work environments. The companies that also put effort in developing battery-powered cherry picker forklifts and enabling equipment with IoT-powered fleet management systems are likely to stay on top of the architecture of the evolving market landscape. Another positive force is the further adoption of the use of innovative forklift solutions, thanks to government regulations by way of green energy initiatives and workplace safety standards.

Market growth was rapid between the years to 2020 and to 2024, owing to the booming e-commerce, construction, and warehousing sectors. As the demand for more material handling equipment grew, industries adopted more cherry picker forklifts to streamline their processes.

Nonetheless, factors, including high equipment cost, supply chain disruptions and low automation technologies adoption rate limits market growth. To address these challenges, manufacturers concentrated on developing battery technology, providing better safety features in their forklifts, and offering operator training programs.

Over the next decade from to 2025 to 2035, the market will lead to a paradigm shift, with electric and autonomous forklifts dominating. The adoption of AI and machine learning in real-time fleet optimization, boosted by the rollout of connected forklift systems, will not just change how the industry conducts its business.

In addition, sustainability initiatives will propel the growth of energy efficient lithium-ion and hydrogen fuel cell-powered forklifts. The growing use of robotics and automation in warehouses and logistics will also foray faster the growth of the market as this will make cherry pucker forklift more cost-effective and automated.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. to 2025 to 2035)

| Market Shift | 2020 to to 2024 Trends |

|---|---|

| Regulatory Landscape | Growing focus on workplace safety regulations |

| Technological Advancements | Development of hybrid forklifts and basic automation |

| Industry Adoption | Adoption primarily in warehousing and retail sectors |

| Supply Chain and Sourcing | Dependence on traditional fuel-based forklifts |

| Market Competition | Dominance of established forklift manufacturers |

| Market Growth Drivers | Warehouse automation and logistics demand rising |

| Sustainability and Energy Efficiency | Incremental adoption of energy-efficient forklifts |

| Consumer Preferences | Focus on cost-effective and durable equipment |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter emissions regulations and incentives for electric forklifts |

| Technological Advancements | AI-driven autonomous forklifts and IoT-enabled fleet management |

| Industry Adoption | Expansion into smart logistics, e-commerce hubs, and manufacturing |

| Supply Chain and Sourcing | Shift towards electric and hydrogen-powered forklifts |

| Market Competition | Emergence of tech-driven forklift start-ups and robotics integration |

| Market Growth Drivers | Faster adoption of AI, electrification and sustainability goals |

| Sustainability and Energy Efficiency | Floodgate of sustainable forklift solutions |

| Consumer Preferences | Preference for automated, low-emission, and AI-driven solutions |

The United States dominates the cherry picker forklift market owing to rapid industrialization, growth in the construction sector, and increasing need for efficient material handling solutions. As the demand for productivity and logistic optimization grows within companies, the focus on warehouse automation has led to rapid developments in forklift technology.

Also contributing to demand: The growth of e-commerce and the growth of demand for high-reach equipment in fulfilment centers. The electric and hybrid cherry picker forklifts are also being increasingly adopted in the industry as sustainability initiatives and government regulations to curtail emissions in industrial operations become more prevalent.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.7% |

The United Kingdom cherry picker forklift market is in a steady growth phase owing to rising investments in warehouse automation and logistics infrastructure, as well as urban development projects. With the growing demand for e-commerce, the need for efficient movement by means of material handling equipment, especially cherry picker forklifts, to streamline operations in the distribution centers is at all-time high.

The UK government’s drive towards carbon-neutral manufacturing is also driving the uptake of electric-powered forklifts. Moreover, the integration of smart technologies, such as IoT-based fleet management systems, is also contributing towards the expansion of market space by enhancing operational efficiency and safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.3% |

A rise in industrial automation as well as stringent worker safety regulations, and an increasing emphasis on sustainable material handling solutions are favouring the European Union cherry picker forklift market in the Germany, France, and Italy among others, demanding sectors like manufacturing, construction, and warehousing are propelling the rapid expansion of the market.

The increased use of these kinds of vehicles is tied to the rising number of battery-powered forklifts owing to the EU’s drive towards green energy that can alter the market dynamics. Furthermore, increasing investments to develop smart logistics and advanced lifting equipment to increase the efficiency of supply chain operations are driving the demand for cherry picker forklifts in Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

The reason behind the boom of cherry picker forklifts in Japan is the advancement in the field of robotics, automation and precision engineering. With the country’s workforce aging, and with it an imminent threat to efficiency in warehouses and industrial facilities, the market in growing for automated and semi-automated forklifts and trucks to improve efficiency and reduce human labour reliance in warehouses and industrial facilities.

KDU has recently become a dealer for Hyundai electric forklift trucks, which are one of the world's leading brands of electric forklifts powered by lithium-ion batteries as Japanese industries are moving towards eco-friendly and cost-effective solutions. Advances in AI-centric navigation and remote-controlled cherry picker forklifts will likely also optimize operational productivity in the logistics and construction sectors across Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

The demand for cherry picker forklifts in South Korea is rising due to rapid industrial development, the growing e-commerce industry, and more investment in intelligent logistics. With the country’s keen focus on automation and robotics, it is helping to drive the adoption of advanced material handling solutions that include AI-integrated forklifts for warehouse management.

Plus, Government backing for green energy projects is encouraging businesses to swap diesel-powered forklifts for electric and hybrid models. Another driver of growth in South Korea is the expanded urban construction, improvement projects & high reach lifting equipment requirement.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

The cherry picker forklift market is growing at a considerable pace due to the increasing need for efficient material handling solutions in various sectors. Built for improving productivity and safety, these appliances are indispensable in logistics, retail & manufacturing industries.

In addition, with several industries, businesses are investing heavily in cherry picker forklifts to enhance their inventory management and improve operational efficiency. With the growth of the e-commerce industry and warehouse automation, cherry picker lift truck demand is rapidly increasing.

To meet this demand, manufacturers are working on providing advanced cherry picker forklifts that are energy efficient, ergonomic, high-performance etc. Moreover, integrated telematics, advanced safety features, and environmentally friendly power sources are other form factors that are contributing to the current increasing trend of the market. The competitors in the electric model pillar are facing tougher competition as adoption is expected to increase, as of conservation warehousing solutions.

The market share of cherry picker forklifts vary from one type to another, for example, electric motor and internal combustion areas are expected to lead in their revenue generation due to their efficient and adaptability.

The electric motor forklifts has seen huge increase in popularity specifically for indoor warehouse applications due to zero emissions, lower maintenance costs and quieter operation. Due to their economic and environmentally friendly material handling features, electric powered cherry picker forklifts are gaining popularity among businesses searching for cost efficient solutions for moving materials.

These types of forklifts provide greater manoeuvrability, making them best suited for narrow aisle storage, high-rack warehousing, and order picking use. Battery technology advances, such as lithium-ion and fast-charging types, also contributed to the trend by decreasing downtime and delivering higher operational efficiency.

Electric forklifts have become the preferred option for e-commerce warehouses, food storage facilities and the pharmaceutical industry due to the increasingly strong push for green logistics and energy-efficient solutions. Electric cherry picker forklifts manufacturers anticipate a steadily increasing demand for their products as government’s ramp up emission policies and companies work towards all-time high sustainability targets.

And while internal combustion engine forklifts are still a mainstay of outdoor and heavy duty applications. These forklifts, on the other hand, provide higher load capacities, longer operating times, and better performance on rough terrains. Internal combustion models still dominate in industries like construction, shipping and warehouse operations where heavy materials need moving and long hours are required.

With emissions and energy saving being a huge concern, manufacturers have developed fuel-efficient internal combustion forklifts along with low-emission engines, advanced engine technologies, and hybrid fuel forklifts to meet emission and environmental standards. Internal combustion forklifts are stronger and more durable, physical attributes that make them crucial in industries where materials handling is paramount, ensuring their prominent position in the market.

In balancing their operational needs, sustainability vs power efficiency plays a huge role in businesses' decision to opt for either electric or internal combustion forklifts. Hybrid and other alternative fuel options are on the rise and only serve to reinforce the market's evolution and options available for efficient and environmentally responsible transportation.

The Cherry Picker Forklift Market is segmented, by application into, and expected to be dominant is Class II (Electric Motor Narrow Aisle Forklifts) and Class III (Electric Pallet Jacks, Stackers, and Tow Tractors) due to the flexibility in warehouse and distribution centre operations.

Industries where high-density storage and fast order fulfillment are necessary have adopted Class II forklifts, including reach trucks and order pickers. The growth of e-commerce, shorter inventory runs, and urban warehousing have led to an increase in demand for these types of forklifts, which optimize vertical space in storage areas and enhance picking speed.

Reach trucks have been very common in distribution centers and automated storage where precision and efficiency are a must. This ability to reach and pull loads in tight spaces and remain stable in that position is why they're one of the most important parts of a modern warehouse.

Order pickers, a different critical segment of Class II forklift types, are designed to facilitate swift and precise order picking. These forklifts are preferred by retailers and logistics providers for enhanced operator visibility, ergonomic design, and safety features.

Smart warehouses and automation, another growing trend, includes the integration of Class II forklifts with warehouse management systems (WMS) and inventory tracking technologies to improve operations ultimately increasing the adoption of such vehicles.

Electric pallet jacks, stackers, and tow tractors (Class III forklifts) are increasingly being used in "horizontal" movement of goods over a short distance and last-mile warehouse operations. These forklifts serve a range of businesses that need simple, economical, and versatile material handling solutions.

Some of the reasons electric pallet jacks and stackers are preferred over others are their ease of use, compact design, and ability to easily navigate tight spaces. The increasing focus toward improved workplace safety, decreased operator fatigue, and enhanced productivity has increased the demand for these types of forklifts in various industry verticals.

Tow tractors are equally fundamental components of Class III forklifts, which generally focus on industries like automotive production, logistics, and airport cargo operations. Therefore they are used mostly in such places where the flow of materials does not remain stagnant and multiple loads are carried at once with a minimum operational effort.

As more factories pour investments into their automation and digital logistics, tow tractors with the latest autonomous navigation and fleet management abilities are anticipated to garner a deeper foothold in the region.

Class II and Class III forklifts are a joint holding this evolution to warehouse and distribution center operations. With companies working toward enhanced adoption of space optimization, time, and resource efficiency to ensure swift order processing, the market for dedicated cherry picker forklifts catering to the demands of niche sectors will be registering amongst the fastest growing trends in the marketplace.

The cherry picker forklift market is benefiting from rising demand as end-use industries such as construction, warehousing, logistics, and retail drive its growth. Cherry picker forklifts are designed to lift workers and materials to great heights safely, making them indispensable in modern industrial applications.

This market is being driven by factors that include unprecedented urbanization, emerging e-commerce sectors, and improved material handling technologies. Electric and autonomous cherry picker forklifts were integrated into the warehouse operations, increasing efficiency and safety, and resulting in them being the preferred picking equipment’s for business. Growing workplace safety regulations and the need to enhance productivity in warehousing and logistics are further propelling the market’s growth.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| JLG Industries, Inc. | 20-25% |

| Terex Corporation | 15-20% |

| Haulotte Group | 10-15% |

| Skyjack (Linamar Corporation) | 8-12% |

| Snorkel International | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| JLG Industries, Inc. | Provides electric-powered and diesel-powered cherry picker forklifts for construction and industrial applications. |

| Terex Corporation | This will provide: A broad range of access platforms with advanced safety & automation features. |

| Haulotte Group | Focuses on compact and eco-friendly cherry picker forklifts with enhanced manoeuvrability. |

| Skyjack (Linamar Corporation) | Develops durable, easy-to-maintain cherry pickers with hydraulic-based lifting technology. |

| Snorkel International | Provides lightweight and high-capacity cherry picker forklifts for diverse industrial applications. |

Key Company Insights

JLG Industries, Inc. (20-25%)

The global cherry picker forklift market is dominated by JLG Industries and offers electric, diesel, and hybrid cherry pickers. Known for innovative safety features, such as advanced stability controls, expanded platform capacities, and telematics-based fleet management systems. Through its ongoing investments in autonomous and semi-autonomous lifting solutions, the company is positioning itself as a leader in the space.

Terex Corporation (15-20%)

Terex Corporation is an industry leader in the aerial work platform space by providing highly versatile and tough cherry picker forklifts. While they are a company that creates designs that are fuel-efficient and earth-friendly, companies looking to limit their carbon footprints have made them a leading driver in the industry. Terex has been expanding its rental and leasing capabilities to serve a broader customer base.

Haulotte Group (10-15%)

Haulotte Group manufactures light and compact, plugging cherry picker forklifts. Known for its ergonomic control systems, the organization has advanced safety mechanisms in place. Haulotte research targets 100 pct electric and hybrid cherry pickers in line with the industry trend towards sustainability.

Skyjack (Linamar Corporation) (8-12%)

Skyjack manufactures durable cherry picker forklifts that last for years and are inexpensive to maintain. They are focusing on hydraulic based lifting systems, with intuitive user interfaces in order to enhance operator efficiency. To thrive in the marketplace, Skyjack is continually expanding its worldwide distribution network.

Snorkel International (5-10%)

Snorkel International specialize in manufacturing cherry picker forklifts using lightweight materials for maximum load carrying capacity. With a focus on improved manoeuvrability and personalization, the company is a formidable player in the space. To enhance operational efficiency, Snorkel continues to push forward with its telemetry-based monitoring systems.

Other Key Players (30-40% Combined)

A number of new and established organizations are assisting with market growth from product innovations and rental services to automation technologies. Notable players include:

The overall market size for the cherry picker forklift market was USD 42,000 million in 2025.

The cherry picker forklift market is expected to reach USD 84,000 million in 2035.

The cherry picker forklift market is expected to grow at a CAGR of 7.1% during the forecast period.

The demand for the cherry picker forklift market will be driven by increasing adoption in warehouse and logistics operations, rising construction and infrastructure development activities, growing demand for automated and electric forklifts, advancements in safety and efficiency technologies, and expansion of the e-commerce sector requiring improved material handling solutions.

The top five countries driving the development of the cherry picker forklift market are the USA, China, Japan, Germany, and India.

Electric Winch Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Commercial RAC PD Compressor Market Growth - Trends & Forecast 2025 to 2035

Commercial Induction Cooktops Market Growth - Trends & Forecast 2025 to 2035

Electric & Hydraulic Wellhead Drives for Onshore Application Market Insights - Demand, Size & Industry Trends 2025 to 2035

Echo Sounders Market Insights - Demand, Size & Industry Trends 2025 to 2035

Industrial Motors Market Insights - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.