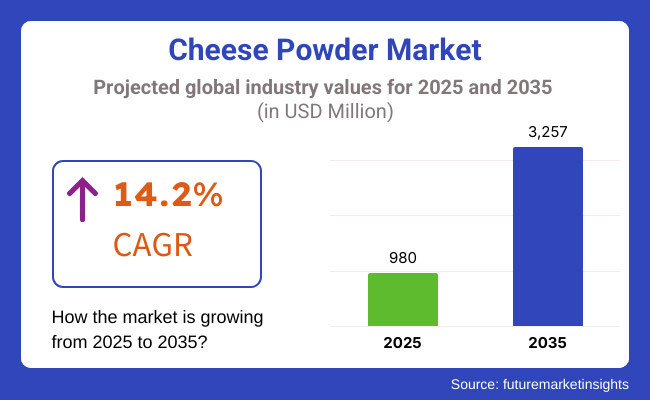

The cheese powder market is anticipated to witness significant growth between 2025 and 2035, fuelled by the rising demand for convenience foods, snack applications, and dairy ingredients in the food processing sector. The market is anticipated to grow from USD 980 million in 2025 to USD 3,257 million in 2035, with a compound annual growth rate (CAGR) of 14.2% during the forecast period.

Rising penetration of cheese powder in snack foods, sauces and dressings, ready-to-eat meals and bakery applications is another important factor boosting market growth.

The range of plant-based and clean-label food movements, together with technological progress in dehydration & spray-drying, are setting the stage for new market dynamics. Increasing consumer demand for natural flavors, long shelf-life products are other factors contributing to expansion of the market.

Furthermore, the sector confronts several obstacles, including price instability of dairy ingredients, food safety regulations, and competition from fresh cheese and artificial flavor substitutes, see a number of driver to market growth in the near future.

To tackle these obstacles and capture more market share, industry leaders are exploring product differentiation, sourcing for sustainable ingredients and expanding global distribution networks.

Explore FMI!

Book a free demo

The cheese powder market in North America is largely driven by high demand from the snack food, convenience food and bakery industries. Key players in the region are seen to be focusing on product innovations, clean-label formulations, and improved flavor profiles to accommodate changing consumer requirements, with the United States and Canada being the leading markets.

The growth of the market is driven by the increasing popularity of ready-to-eat and processed food products as well as increasing demand for shelf-stable cheese alternatives. Furthermore, the continuous developments in the spray-drying technology and the fortification of ingredients are driving the quality and applications of cheese powders.

However, aspects like changing dairy prices and the implementation of robust food safety requirements might affect the growth of the sector. With the growing segment of the health-conscious population, companies have shifted their focus towards plant-based cheese powders and organic cheese powders.

Europe constitutes an important market for cheese powder, with countries including Germany, France, the United Kingdom and Italy having strong cheese consumption due to their regional culturing of culinary traditions. To overcome it the processed food industry is turning to powder cheese which is cheap, does not expire quickly and reveals the utensils in its different applications like sauces, aperitifs, seasoning, etc.

As manufacturers continue to prioritize clean label and natural compliant products, organic, non-GMO, and additive free formulations have become increasingly popular.

Similarly, EU food safety and labelling standards are strict, which can create problems for market players needing to comply with the high-quality standards. In order to achieve this, companies are making investments in sustainable sourcing, new packaging solutions, and a wider range of products to meet changing consumer preferences and compliance obligations.

The Asia-Pacific region is expected to be the fastest-growing cheese powder market in the world, attributed to an increase in urbanization, increase in disposable incomes, and Westernization of diet trends in the countries such as China, India, Japan and Australia. Increasing market growth is attributed to the higher consumption volume of cheese in its flavored snacks, ready meals, and fast food.

From gluten-free mac and cheese to canned cheese balls, local food manufacturers are getting creative with cheese powder to meet changing consumer tastes. But factors, including low dairy intake in some areas, discrepancies in regulations, and the presence of plant-based substitutes might maintain an impact on market penetration.

Brands are emphasizing regionalized taste development, economical means of production, and collaboration with food processors to increase their footprint in the region.

Challenges

Regulatory Compliance and Health Concerns

Entrenched among the dominant imperfections in the cheese powder market is the stringent regulatory standards and health concerns surrounding processed as well as powdered dairy products. Regulatory agencies around the world are working to create tighter guidelines around food additives, preservatives and labelling practices, making manufacturers more transparent and focused on natural ingredient lists.

Moreover, consumers have become health-conscious which is anticipated to spur the demand for low-sodium, reduced-fat, and clean-label cheese powders. Retooling products to meet these changing expectations without sacrificing taste and texture is no small challenge.

To overcome this, companies need to invest in R&D to explore alternative processing techniques such as spray-drying that retains flavor without the negative nutritional implications. In addition, in order to meet regulatory approval and maintain consumer trust, complying with food safety standards in the supply chain is ensured by further quality control investments and compliance management across global supply chain networks.

Opportunities

Rising Demand for Convenience Foods and Plant-Based Alternatives

Cheese powder market is witnessing a huge opportunity from the growing demand for convenience foods and plant-based cheese alternatives. Cheese powders are taking off in snack foods, ready-to-eat meals and seasoning applications as consumers look for convenient and shelf-stable cheese products.

Furthermore, the rising population of vegan and lactose-intolerant consumers is fuelling the demand for plant-based cheese powders produced from nuts, soy, and other dairy alternatives. Instead of cash, companies are using cutting-edge food tech including microbial fermentation and enzyme modification, to develop dairy-free cheese powders that closely match conventional cheese flavours.

As e-commerce and foodservice industries continue to grow, opportunities for creative cheese powder applications like gourmet popcorn toppings, flavored pasta seasonings, and savory meal kit enhancers also expand. This unique spin on breakfast informs recipes and products, allowing factory producers to capitalize on consumer desires for ease of access and dietary involvement, all while leveraging new revenue opportunities and market expansion.

The cheese powder market was thriving from 2020 to 2024, propelled by a growing adoption of processed foods and the proliferation of snack food and fast-paced lifestyles. While market study reports show traditional dairy-based cheese powders, are used the most, the growing health-conscious lifestyle movement and the clean-label movement encouraged manufacturers to shift their focus towards non-dairy, natural and organic ingredient-based cheese powders.

Businesses that catered to less artificial additives, more transparency in products, and more ways to improve production efficiency, to address regulatory standards and consumer expectations.

Over the next 10 years (2025 to 2035), the innovation in food science, plant-based formulations and sustainable manufacturing will drive the market transformation. Personalised cheese powder solutions created with AI-powered food formulation and bioengineered bacteria will have a huge impact on taste and texture.

Sustainable sourcing of raw materials, eco-friendly packaging, and carbon-neutral production processes will become key differentiators. Emerging markets and dietary diversification trends further open up new opportunities for cheese powder applications in ethnic cuisine and functional food categories.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter food safety and labelling regulations |

| Technological Advancements | Expansion of spray-drying and flavor encapsulation |

| Industry Adoption | Growth in processed food applications |

| Supply Chain and Sourcing | Dependence on conventional dairy suppliers |

| Market Competition | Dominance of traditional dairy-based cheese powders |

| Market Growth Drivers | Demand for convenience foods and long-shelf-life products |

| Sustainability and Energy Efficiency | Initial adoption of eco-friendly packaging |

| Consumer Preferences | Preference for traditional cheese flavors in processed snacks |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Greater focus on clean-label, non-GMO, and organic compliance |

| Technological Advancements | AI-driven flavor customization and precision fermentation |

| Industry Adoption | Surge in plant-based and functional cheese powder alternatives |

| Supply Chain and Sourcing | Sustainable sourcing from plant-based and regenerative agriculture |

| Market Competition | Rise of innovative start-ups in vegan and organic cheese powders |

| Market Growth Drivers | Increased focus on dietary inclusivity and personalized nutrition |

| Sustainability and Energy Efficiency | Full-scale implementation of carbon-neutral production and minimal waste processing |

| Consumer Preferences | Rising demand for artisanal, organic, and ethnic cheese powder varieties |

Increasing consumer demand for convenient long shelf-life dairy and dairy products catalyses the growth of the cheese powder market in the United States. Growing use of cheese-containing snacks, ready-to-eat foods, and seasoning in food service and retail sectors greatly supports the growth of the market.

Moreover, the demand for natural cheese powders with reduced-fat products is instigating manufacturers to offer clean-label and organic cheese powder, Induced by health aware consumers. Innovations in drying and flavor-enhancing technologies enhance cheese powder, which is used in a variety of processed food applications, supporting market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 13.8% |

In the UK, the cheese powder market is growing due to the changing consumer behaviour preferences towards convenience products and gourmet snack products. The use of cheese powder in a variety of ready-to-eat meals, bakery products, and savory snacks has steadily increased. Looking further, the rising demand for plant-based cheese powders with the growing category of the vegan and vegetarian population is also changing the game for the cheese powder industry.

In addition, stringent food safety standards and a growing preference for natural and clean-label cheese powders catalyse manufacturers to innovate and improve product quality, thereby sustaining steady market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 13.2% |

The cheese powder in the European Union accounts for a significant fraction, led by France, Germany, and Italy. Growth is primarily driven by the strong dairy production industry, along with the wide use of cheese powder in processed foods, sauces, and seasonings.

The popularity of premium, organic, and plant-based cheese powders is another driving force for the market, as consumer preferences shift prompted by climate change and evolving diets. Furthermore, cheese-flavored snacks and convenience food products are gaining a lot of popularity, which is encouraging manufacturers to expand their product portfolios thus driving the ever-advancing growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 13.5% |

The cheese powder market is booming in Japan as cheese flavors are being incorporated into instant ramen, chips, and bakery products as it adds flavors to food.

Western-style fast foods, and cheese-flavored snacks have helped the expansion of that market. Japanese consumers favour mild, umami rich cheese powders, drawing the necessity for new and local formulations. Moreover, technology improvements in food processing allow manufacturers to improve the taste, texture and application versatility of cheese powders, which propel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.4% |

Instant foods, snacks and ready-made seasonings while drive the cheese powder mystery in South Korea as well. Rising trends towards Western diet and the growing fast food sector have propelled the demand for cheese powders and their applications across food. The influence of social media and K-food trends is also behind the cheese-flavored phenomena.

Moreover, with the increasing health-conscious consumer segment, there is a demand for natural, and organic, and low-fat cheese powder options that will continue to fuel market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.7% |

The global cheese powder market stands at the cusp of massive growth, owing to the increasing demand for long shelf-life, rich, and creamier cheese substitute in various food applications. The demand for cheese powder in snacks, bakery products, ready-to-eat meals, instant food formulations reflects its effectiveness as a taste, aroma, and texture enhancer, making it one of the essential ingredients key to its listed products.

Cheese powder market continues to grow as food manufacturer’s work to create clean-label formulations, organic options and new plant-based cheese alternatives.

Advances in spray-drying technology, natural flavor enhancement, and fat encapsulation techniques have driven cheese powder use in processing foods, prepared gourmet meals, and foodservice. Moreover, the need to manufacture high-protein, low-moisture cheese ingredients has fuelled cheese powder production innovation, aiding its adoption in global markets.

By type, cheese powder dominates in natural and processed cheese powder varieties friction on market particularities, depending on the requirements of the industry and consumer.

Natural cheese powder is made from aged or fresh cheese that has been dehydrated, offering the real flavor, nutrition and creaminess of cheese. This is especially useful in premium snack products, artisanal baked goods and gourmet seasonings, where natural ingredients are generally highly preferred.

The growing trend of consuming organic, non-GMO, and minimally processed cheese powders is also bolstering the growth of this segment. Similarly, with clean-label and health-conscious food trends becoming increasingly prominent, natural cheese powder is also expected to gain competitive differentiating in the market.

Processed cheese powder retains a major share based on enhanced shelf stability, affordable pricing, and improved melting properties. Processed cheese powder, a combination of natural cheese and emulsifiers and stabilizers, has a homogeneous product, longer storage, and higher versatility as an ingredient in fast food, instant soups, macaroni, and cheese and other meal kits.

Plastic cheese powder is still the product of choice for commercial food manufacturers and large-scale foodservice providers because it melts and combines so easily in sauces, dips, and snack coatings.

Ongoing innovations in natural and processed cheese powder segments are propelled by technology developments in flavor advancements, fat-reduction and functional ingredients inclusion. Checkered by changing consumer preferences towards clean label and healthier cheese products, cheese powder manufacturers are leaning toward optimizing nutritional profiles, minimizing artificial additives, and increasing organic cheese powder offerings, among others.

By Products, Cheddar and Parmesan cheese powders made up the final and most universally used segments across a number of food applications.

The largest segment, cheddar cheese powder, features a bold, tangy, and creamy flavor profile, making it a primary ingredient in snack seasonings, processed cheese sauces, and ready-to-eat meals. (Typically cheddar-flavored chips, crackers and pasta dishes have fuelled steady demand for this product.)

Moreover, manufacturers can tailor distinctive flavor profiles for varied applications with mild, sharp and extra-aged cheddar cheese powder, which provide a wide range of taste intensities. The increasing demand for high-quality ingredients (real cheese) in the form of snacks and convenience food products are likely to boost the demand for cheddar cheese powder in potential use in many snack products and other convenience foods.

Parmesan cheese powder majorly accounts for the market share in gourmet and fine-dining food segments. Famed for its nutty, umami-packed, and a mild level of salty flavor, parmesan cheese powder is widely used in pasta, soup, salad dressing, and high-end snack seasonings.

Growth in Opportunistic End-use Industries - The rising popularity of Mediterranean and Italian cuisine across the globe has resulted in high demand for authentic aged cheese powders including parmesan. The clean-label and minimally processed food products benefit from parmesan powder, as its ability to flavor compounds without imparting any preservatives makes it a preferred option over other alternatives in the segment.

Other cheese powders, like feta, mozzarella and roquefort, serve regional taste preferences and niche markets.

Feta cheese powder has seen a rise in demand in dishes inspired by Greek and Middle Eastern cuisines, whereas mozzarella cheese powder is extensively used in pizza toppings, frozen meals, and baked snacks. Roquefort and blue cheese powders are also in increasingly high demand within gourmet food applications, artisan snack products, and specialty sauces due to consumer interest in exotic flavors and bold new products.

With growing global travel, food and drink experiences becoming more diverse, and authentic, connoisseur-worthy, matured and international cheese flavors in demand, the cheese powder market is set for impressive growth. The industry is witnessing a growing trend of manufacturers developing formulations that are regionally specific, organic variants, and utilizing plant-based cheese powders to cater to evolving consumer preferences.

There is a growing prevalence of convenience foods and an increasing demand for user-friendly and instant products, which bolsters Cheese Powder Market trends. Cheese powder is extensively used in bakery products, sauces, seasonings, and processed foods owing to its extended shelf-life and improved taste.

Growing demand for plant-based and dairy-free cheese powder is also propelling innovation in the market. Moreover, the rapid commercial development of the food processing industry and QSR sectors also contribute to the increasing demand in the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kerry Group | 18-22% |

| Archer Daniels Midland (ADM) | 15-20% |

| Lactosan | 10-15% |

| Land O’Lakes | 8-12% |

| Aarkay Food Products | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kerry Group | Formulator of premium cheese powder, also for snacks, seasonings and sauces. |

| Archer Daniels Midland (ADM) | In the food processing industry, offers a variety of dairy and plant-based cheese powders. |

| Lactosan | Focuses on enzyme-modified cheese powders to enhance taste and aroma in food applications. |

| Land O’Lakes | Produces premium cheese powder with a focus on dairy-based flavor enhancement. |

| Aarkay Food Products | Develops natural and synthetic cheese powders tailored for diverse regional preferences. |

Key Company Insights

Kerry Group (18-22%)

Kerry Group is a major player in cheese powder solutions for snacks, soups, and bakery, with competencies in customized applications. The company's emphasis on clean-label and plant-based cheese powder formulations serves the needs of health-conscious consumer trends.

Archer Daniels Midland (ADM) (15-20%)

ADM's extensive portfolio of both dairy-based and plant-based cheese powders is meeting evolving consumer preferences. The firm places resources into sustainable bounce sourcing and flavor advancement to reinforce its economic position.

Lactosan (10-15%)

Lactosan specializes in enzyme-modified cheese powders, which provide excellent opportunities of gaining authentic cheese flavor in your food application, while maximizing the utilization of the cheese. The business's focus is that of extending its collection along with natural and natural cheese powder offerings.

Land O’Lakes (8-12%)

Land O’Lakes, a producer of high-end dairy-based cheese powders, and other products that find their way into snack foods, seasonings and sauces. In pursuit of superior product quality, the company utilizes advanced drying and flavor enhancing technologies.

Aarkay Food Products (5-10%)

Aarkay Food Products focuses on natural cheese powders, which suit different regional taste profiles. To keep pace with the increasing demand for vegan-friendly food, the plant-based cheese powder company has decided to expand its range of products.

Other Key Players (30-40% Combined)

Market growth is driven by new entrants as well as established players, each of whom has their own lenses on innovation and sustainability. Notable companies include:

The overall market size for the cheese powder market was USD 980 million in 2025.

The cheese powder market is expected to reach USD 3,257 million in 2035.

The cheese powder market is expected to grow at a CAGR of 14.2% during the forecast period.

The demand for the cheese powder market will be driven by increasing consumer preference for convenience foods, rising demand for dairy-based flavoring ingredients, expanding applications in the snack and ready-to-eat meal industries, growing interest in natural and organic food products, and advancements in food processing technologies.

The top five countries driving the development of the cheese powder market are the USA, Germany, France, China, and the UK.

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Pectin Market Analysis by Product Type, Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.