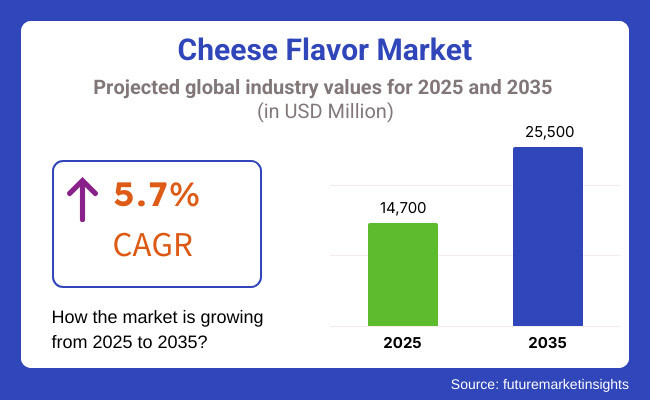

The market for cheese flavor is projected to see consistent growth from 2025 to 2035 due to rising demand within the food and beverage sector, surging customer interest in processed and ready-to-eat food, and new technologies for enhancing flavor. The market will touch USD 14,700 million in 2025 and will grow to USD 25,500 million in 2035, displaying a compound annual growth rate (CAGR) of 5.7% between 2025 and 2035.

The wide consumer acceptance of cheese flavors in bakery products, sauces, snacks, and convenience foods is attributed to the flavor enhancement function of cheese flavors. Market dynamics are also influenced by the increasing demand for plant-based and vegan cheese alternatives as well as clean-label and natural ingredient trends.

The development of enzyme-modified cheese (EMC) and fermentation technology can also help manufacturers create different and unique cheese flavors that are authentic.

Despite a stimulating factor of increasing prevalence of milk prices, regulatory restrictions on artificial flavoring, and increasing competition from non-dairy cheese substitutes among other market factors may provide caliber for market growth.

To tackle such sailing challenges as well as to withstand competition, stakeholders in the market are working towards enhanced product innovations, development of clean-label formulations, and expansion of the distribution networks.

Explore FMI!

Book a free demo

The cheese flavor market share for North America is substantial owing to a high consumer demand for cheese-based snacks, processed foods, and dairy products. The United States and Canada in the region, with focus on innovations in natural and artificial cheese flavors by major players to enhance the taste profiles in several food applications.

Market trends are characterized by increasing demand of clean label products & plant based cheese alternatives is playing major role in shaping the market. Furthermore, ongoing technological developments, such as flavor encapsulation and extended shelf-life solutions are propelling the market growth.

But challenges like volatile dairy prices and strict food safety regulations could hinder industry growth. With business culture on the shift, corporates are eager to develop natural flavors organically, replicate vegan cheese flavors, and expand the scope of formulation techniques.

In Europe, such as France, Italy, Germany, and United Kingdom, where cheese is integral to the cuisine pattern, the market of cheese flavors is high. The strong dairy heritage of the region, along with increasing demand for specialty and artisan cheese flavors, is propelling increasing interest in gourmet and premium food products.

Another trend in product innovation is the influence of plant based and lactose free cheese flavours. Moreover, due to rigorous EU food additive and flavouring agent directives, companies are compelled to focus on natural ingredients and sustainably sourced compounds.

However, growth may be hindered by high production costs and the challenges of regulatory compliance. To meet consumer demand, companies are focusing on clean-label formulations, regional cheese-inspired flavors, and increased sensory experiences.

The cheese flavor market in the Asia-Pacific across regions is in the fastest growing stage, supported by changing of dietary pattern towards westernization, increasing disposable incomes, and increasing demand from convenience food sectors in developing countries such as China, India, Japan, and Australia. The growth in fast food outlets and the increasing popularity of cheese-filled snacks fill up the market space.

Fortifying growth of health-conscious consumer trends have resulted in demand for low-fat, natural, and plant-based cheese flavors. Nevertheless, market penetration might be hindered by limited consumption of dairy in certain Asian cultures and regulatory discrepancies among countries. Businesses are focusing on unique flavour development, local taste preferences, and collaborating with food manufacturers to appeal to wider audiences and increase consumer acceptance.

Challenges

Stringent Regulatory Standards and Clean Label Demand

The growing regulatory scrutiny over food additives, flavoring agents, and labelling requirements is one of the major challenges in the cheese flavor market. The growing trend among consumers to know what goes into the products they consume is driving a shift toward clean label and natural alternatives.

Regulatory authorities in several countries have introduced stringent limits on artificial flavoring and preservatives, prompting manufacturers to reformulate products to meet changing safety requirements. Such transition has complicated production processes, and often when it comes to sourcing natural and organic ingredients, it has led to rising costs.

Producers also face the challenge of maintaining consistency in flavor profiles whilst making the shift away from synthetic additives, as natural flavour replacements can differ in taste and stability. Innovation in the area of natural fermentation techniques to create mature flavor profiles, developing enzyme-modified cheese, and creating plant-based flavoring solutions is critical, and companies need to focus their research and development portfolio in line with the regulatory and consumer mandates to compete.

Opportunities

Growing Demand for Plant-Based and Specialty Cheese Flavors

The success of specialty and plant-based cheese alternatives can also present a lucrative opportunity for the cheese flavor market. With an increasing number of consumers turning towards vegan, lactose-free, and health-aware diets, there is a growing appetite for genuine cheese flavours sourced from dairy-alternatives.

Other companies are using fermentation technology, microbes and plant-derived compounds to mimic the flavors in traditional cheese without employing any dairy ingredients. The growing trend toward gourmet and artisanal cheeses has also provided opportunities for distinctive, regionally inspired flavors that align with diverse culinary preferences.

Food producers and restaurants are adding specialty cheese flavors to snack foods, sauces, and ready-to-eat meals and premium grocery dairy products, increasing market potential even more.

The incorporation of states-of-the-art flavor enhancers, including enzyme-modified cheese and encapsulated flavors is also enabling manufacturers to provide deeper, more authentic tasting experiences, making plant-based cheese flavour profiles more attractive to mass-market customers.

Increased consumer demand for convenience foods like sauces, dips, snacks, and ready meals as well as processed cheese products and international cuisines propelled the cheese flavor market to grow rapidly between 2020 and 2024. The growth of the plant-based cheese alternatives sector and the clean-label movement affected industry developments, leading companies to seeking natural flavoring solutions and innovative formulations.

But there were challenges for manufacturers on the regulatory front and changing consumer expectations around artificial additives.

From 2025 to 2035, the market will continue to mature with an increasing focus on sustainability, responsible sourcing of fermentation feedstock’s (e.g., sugar, starch, or waste products), and precision fermentation methods. Manufacturers will be able to more precisely engineer and tailor cheese flavors through AI-driven flavor profiling and bioengineering, cutting out traditional dairy sources and making flavors more consistent and controllable.

Regional and artisanal cheese flavoring trends will also continue to make their thenuids with product innovation, particularly with a critical eye towards premium and exotic taste profiles. If companies invest now in cleaner production processes and all-natural, organic ingredients without genetic modification, they will be poised to take advantage of future consumer trends.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter policies on artificial additives and preservatives |

| Technological Advancements | Use of enzyme-modified cheese for enhanced flavors |

| Industry Adoption | Growth in processed cheese and dairy-based flavor products |

| Supply Chain and Sourcing | Dependence on dairy-based raw materials |

| Market Competition | Presence of conventional dairy flavor producers |

| Market Growth Drivers | Processed cheese demand in ready meals and snacks |

| Sustainability and Energy Efficiency | First steps towards natural ingredient sourcing |

| Consumer Preferences | Preference for familiar cheese flavors in mainstream products |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of clean-label regulations and natural flavor mandates |

| Technological Advancements | AI-driven flavor profiling and precision fermentation |

| Industry Adoption | Expansion of plant-based, artisanal, and gourmet cheese flavors |

| Supply Chain and Sourcing | Increased use of plant-derived and lab-cultured cheese flavor ingredients |

| Market Competition | Rise of innovative start-ups focusing on vegan and sustainable cheese flavors |

| Market Growth Drivers | Growing interest in premium, organic, and non-GMO cheese flavors |

| Sustainability and Energy Efficiency | Widespread adoption of green production and carbon-neutral processes |

| Consumer Preferences | Rising demand for bold, artisanal, and exotic cheese flavors |

As processed and flavored cheese product consumption continues to rise, the United States cheese flavor market is anticipated to continue growing at a stable rate. The industries of fast food and snacks are important contributors, with cheese-flavored snacks, sauces, and ready-to-eat meals showing increased demand.

The growing demand for natural and organic cheese flavors has propelled manufacturers to explore clean-label and plant-based options. The prevalence of large-scale food processing companies and the constant launches of new cheese flavor profiles are further driving the demand in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.4% |

United Kingdom's thriving bakery and snack and ready-meal industries are driving the demand for cheese flavor. The British consumer is searching for gourmet and artisanal cheese flavors, which in turn has encouraged manufacturers to diversify their product portfolios by introducing novel flavor variants.

There is also an increased interest in flavors for vegan and dairy-free cheeses that are growing in popularity which is creating an opportunity for innovation within the plant-based options. Furthermore, trending government regulations regarding food additives and flavoring agents is also propelling demand, promoting the evolution of natural and clean-label cheese flavoring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

France, Italy, and Germany continue to be the leading European producers and consumers of cheese flavors. To a significant extent, the expansion of the market is due to the region's formidable dairy industry and cultural inclination towards cheese. Trends towards health-conscious consumers are further boosting demand for reduced-fat and natural cheese flavouring solutions, whereas consumers are increasingly seeking out premium and gourmet cheese flavours.

The popularity of cheese flavors for use in processed foods, sauces and snacks remains on a trajectory of growth which is underpinning developments in flavor extraction and formulation technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

The cheese profile of the country is prompted by the growing interest from consumers in Western style dairy and fusion food. The rise in the consumption of cheese-flavored snacks, instant noodles and baked products is stimulating market growth. Furthermore, Japanese honey, which is milder, and corn syrup, which offers umami-rich flavors, have become flavor variants catered to regional tastes.

The increasing consumption of convenience food coupled with the ongoing innovation in cheese-based seasonings is likely to boost market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The cheese-flavor industry in South Korea is also growing as the country's diet becomes more westernized, and cheese-filled fast food and snacks become popular. Its popularity in products such as cheese-flavored ramen, chips, and baked goods is driving market growth.

Moreover, health-conscious consumers are increasingly looking for natural and premium cheese flavors. As new trends in cheese, such as Korean-themed cheese-dipped street eats and fusion cuisine, continue to dominate the landscape, steady expansion is anticipated for the market through coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

The cheese flavor market share had significant growth rate owing to increasing demand of authentic, rich and varieties of cheese flavors in overall food applications. Furthermore, cheese flavors are an integral component in improving the flavors, flavor, and texture of processed food, snacks, bakery products, and fast food.

From innovative formulations and clean-label ingredients to plant-based alternatives, food manufacturers are doing all they can to make formulations work for their target consumers while the demand for different flavors of cheese continues to grow.

Innovations in food tech, encapsulation processes, and natural flavor extraction, manufacturers are now featuring longer shelf-life, increased stability, and heightened cheese profiles in their merchandise. Also, the increasing inclination toward gourmet, and ethnic cheese flavors is further boosting the market growth.

Furthermore, an increase in plant-based cheese flavors and dairy-free alternatives encourages innovations in the segment, meeting the changing dietary demands of health-conscious and vegan consumers.

On the basis of sources, the Cheese Flavor Market is segmented into animal-based and plant-based cheese flavors to cater to different consumer needs and dietary requirements.

The traditional and most widely used segment of cheese flavors comes from natural sources derived from animals such as milk, cream, and fermented cheese cultures. These flavors provide a true and rich taste, texture and unique umami character that make them the animal-free choice for processed cheese, sauces, dressings and snack applications.

Increasing dairy-based product consumption, proliferating gourmet cheese flavors, and growing natural cheese extract demand are indicative of its segment growth.

Market of plant-based cheese flavours is increasing rapidly in all-different countries especially in the segments of vegan, lactose-intolerance and health consciousness. Made from things like nutritional yeast, fermented legumes, coconut and cashew-based ingredients, these flavors lend themselves to cheesy/dairy styles that can be creamy, tangy, and umami-rich.

As demand for dairy-free and clean-label products rises, food manufacturers are turning to fermentation technology, enzyme modification, and natural ingredient formulations to mimic authentic and sustainable plant cheese taste. Increasing acceptance of vegan cheese in snack foods, sauces, and ready-to-eat meals is also driving growth for this segment, the firm said.

The market for alternative protein sources and sustainable food production continue to increase, and growth in plant-based cheese flavor is anticipated to be driven by innovation and product development in the sector.

For consumers such as flexitarians who are looking to cut back on dairy without giving it up entirely, and the environmentally-conscious who want plant foods evoking classic dairy flavors, companies are working to improve their plant-based cheese flavour’s texture, aging methods and nutritional content.

Of applications, Cheese flavors have most consumption in baking & snack food products industry which is growing as cheese-infused bakery items are widely consumed.

Cheese flavors are a major focus for the snacks industry because they add flavor to chips, popcorn, pretzels, crackers and extruded snacks. As consumers seek bolder, more savory, more unusual snack flavors, manufacturers are introducing new cheese seasonings blends, fusion flavors and gourmet cheese coatings.

The increasing popularity of premium and artisanal and international cheese made such as cheddar, gouda, blue cheese, parmesan-inspired seasonings is also driving the demand of the market. Similarly, the rising demand for low-fat, organic, and non-GMO cheese styles plays a bias in the product development of cheese variation snacks.

Apart from this, the bakery industry is another prominent sector, propelling the demand for cheese flavors, especially in breads, pastries, biscuits, and savory baked products. The subtle richness and creaminess of cheese flavors, with a hint of tartness, make them attractive to the retail and foodservice markets in baked applications.

The growing market is propelled by the introduction of frozen and ready-to-bake items, cheese-laced artisan breads, and an increasing preference for cheese-based fillings and toppings.

As consumers increasingly seek indulgent and novel cheese-flavored baked goods, manufacturers are trying their hands at fermented cheese flavors, dairy-free cheese alternatives, as well as fusion bakery offerings.

Thus, the growing use of functional and clean-label cheese flavor solutions in the bakery industry is anticipated to offer novel growth opportunities for both conventional and plant-based cheese flavor suppliers.

Growing consumer preference towards processed food and convenience foods, increasing trend for gourmet and artisan cheese, and development in the flavoring technologies are the key factors for the growth of cheese flavor market. Due to a growing demand for cheesiness in the form of cheese flavors in snacks, sauces, seasonings, and ready-to-eat meals, cheese flavors are used extensively for taste and aroma enhancement.

Rise in plant-based and dairy-free cheese alternatives are also driving the innovation of natural & synthetic cheese flavor formulations market. The growth in the food processing industry and the establishment of quick-service restaurants (QSRs) are among other factors that are expected to drive the growth of the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Kerry Group | 18-22% |

| Givaudan | 15-20% |

| Archer Daniels Midland (ADM) | 10-15% |

| International Flavors & Fragrances | 8-12% |

| Symrise | 5-10% |

| Other Industry Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Kerry Group | Works in both natural and reconstituted cheese flavors for food applications. |

| Givaudan | Natural, clean-label ingredients-based innovative cheese-flavors. |

| Archer Daniels Midland (ADM) | Preaches a variety of dairy and plant-based cheese to snack on and top dishes. |

| International Flavors & Fragrances | Provides advanced flavoring solutions for cheese-infused food products and beverages. |

| Symrise | Focuses on sustainable and organic cheese flavor formulations catering to the health-conscious market. |

Key Company Insights

Kerry Group (18-22%)

Kerry Group is a top supplier of cheese flavor solutions, including natural and artificial flavors designed for snacks, sauces, and bakery products. The company is closely working on clean-label and plant-based cheese alternative options to cater to evolving consumer preferences.

Givaudan (15-20%)

Givaudan specializes in cheese flavor innovation, with a strong emphasis on fermentation and enzyme-based technologies to develop authentic taste profiles. To meet the growing need for clean-label products, the company highlights the use of sustainable and natural flavoring ingredients.

Archer Daniels Midland (ADM) (10-15%)

ADM provides a portfolio of cheese flavor and dairy-based ingredients for the food and beverage industries. To ensure comfort for the growing demand for vegan and lactose-free options, the company has added onto its flavored cheese to include a small range of plant-based options.

International Flavors & Fragrances (IFF) (8-12%)

IFF Essences is protein, and commercial seasoning and specialty cheese flavor solutions for both other processed foods applications such as snacks, dressings, and ready meals. We're investing in biotechnology-driven approaches for flavor development to make cheese profiles more authentic.

Symrise (5-10%)

Symrise has organic and natural prototypes for cheese solutions with sustainability and health-conscious formulation focus. It works with food manufacturers to custom create cheese flavor solutions to suit regional taste preferences.

Other Key Players (30-40% Combined)

The market also includes emerging and established players investing in flavor innovation and sustainability, such as:

The overall market size for the cheese flavor market was USD 14,700 million in 2025.

The cheese flavor market is expected to reach USD 25,500 million in 2035.

The cheese flavor market is expected to grow at a CAGR of 5.7% during the forecast period.

The demand for the cheese flavor market will be driven by the growing popularity of processed and convenience foods, increasing consumer preference for dairy-based flavors, rising demand for natural and organic flavoring agents, expanding applications in the snack and bakery industries, and technological advancements in flavor formulation.

The top five countries driving the development of the cheese flavor market are the USA, France, Germany, China, and the UK.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.