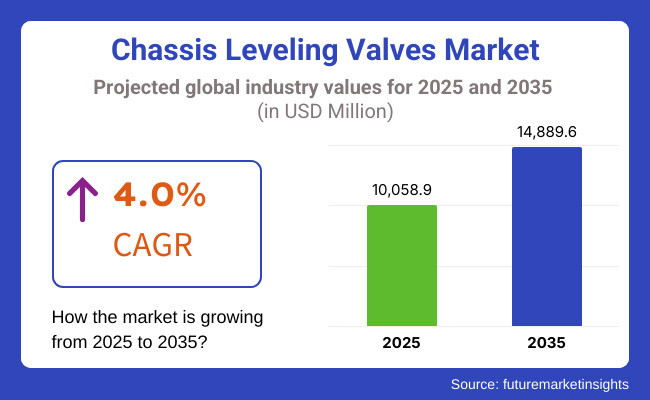

The Chassis Leveling Valves Market is projected to witness significant growth between 2025 and 2035, driven by the increasing demand for improved vehicle stability and ride comfort. The market is expected to be valued at USD 10,058.9 million in 2025 and is anticipated to reach USD 14,889.6 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.0% throughout the assessment period.

One major factor influencing market expansion is the rising adoption of air suspension systems in commercial and passenger vehicles. Chassis leveling valves play a crucial role in regulating air suspension by maintaining optimal ride height, ensuring improved vehicle handling, and enhancing passenger comfort. Additionally, the growing demand for electric and autonomous vehicles, which require advanced suspension systems for stability and performance, is further driving the adoption of chassis leveling valves across various vehicle segments.

The market is segmented by Type and Vehicle Type. The type segment includes with Lever (Linkage) and Without Lever (Linkage), while the vehicle type segment consists of Passenger Vehicles, Light Commercial Vehicles, and Heavy Commercial Vehicles.

The majority of this market share is dominated by Heavy Commercial Vehicles (HCVs) as they heavily depend on air suspension systems for load balancing, safety, and ride comfort. Since HCVs such as trucks and buses typically operate under fluctuating load conditions, they utilize chassis leveling valves to enable uniform weight distribution and minimize road shocks.

Moreover, the rising freight transport and logistics activities, along with the stringent implementation of safety and emissions regulations for commercial vehicles, is accelerating the demand for chassis leveling valves for this market. The trend of integrating advanced leveling valve systems in HCVs is likely to continue leading the market through the forecast years owing to ongoing enhancements being done by manufacturers on vehicle suspension technologies.

Explore FMI!

Book a free demo

Due to the well-established automotive, commercial vehicle, and recreational vehicle (RV) sectors in the region, North America holds a high-value market for chassis leveling valves. North America has a strong demand for chassis leveling systems in heavy trucks, trailers, buses, and off-road vehicles that improve stability, ride comfort, and load distribution. Moreover, the rising use of air suspension systems in luxury and electric vehicles (EVs) also aids in the market growth.

The rise of stringent vehicle safety regulations around the world, in their attempts to safeguard consumers, by governing agencies like the National Highway Traffic Safety Administration (NHTSA), is forcing manufacturers to adopt modern-day leveling solutions to derive better handling and road stability. Trends toward sustainability are also influencing the development of electronically controlled, ultra wide and energy-efficient chassis leveling valves that provide optimized performance with lower emissions.

The Europe region holds significant market share of the chassis leveling valves market with a well-established commercial vehicle industry, as well as growing demand for electric and autonomous vehicles. The key countries in this market are Germany, France, and the United Kingdom, and top automotive companies are utilizing advanced leveling valve technology to enhance vehicle stability, efficiency, and suspension performance.

Most demand for heavy-duty chassis leveling solutions are driven by the availability of manufacturers such as MAN, Volvo, and Scania among high-end commercial trucks. Also, the strict emission standards and road safety legislation in the European Union are encouraging manufacturers to shift towards electronically controlled air suspension (ECAS) systems, which are based on accurate and efficient chassis leveling valves.

Sustainability strategies in Europe are also promoting investments in lightweight and environmentally friendly material research and advanced control systems, which improve performance and minimize emissions.

Growth in the Asia-Pacific is anticipated to occur at the quickest rate in the market for chassis leveling valves on account of massive industrialization activities, growing automobiles production, as well as evolving logistics and transport industries. China, India, Japan, and South Korea are the prime nations in this market, and China is dominating the overall manufacturing of automobiles.

The increasing need for commercial vehicles, buses, and passenger cars with sophisticated suspension systems is leading to the increased use of chassis leveling valves. Japan and South Korea, who are leaders in automotive engineering in terms of technological innovation, are leading the trend of incorporating smart air suspension systems with electronic level control.

At the same time, India's booming transportation and logistics sector is driving demand for commercial vehicle chassis stabilization systems. But cost consciousness in certain regions of the region is an issue, leading manufacturers to concentrate on economically priced solutions without a compromise in quality and durability.

Challenge

High Cost and Complexity of Advanced Systems

One of the biggest challenges in the chassis leveling valves market is the complexity and expense of sophisticated air suspension and leveling systems. Although these systems provide tremendous advantages in ride comfort, load balancing, and fuel efficiency, they need to be controlled by advanced electronic controls and precision engineering, which drives up manufacturing costs.

The incorporation of electronic chassis levelling valves also contributes to the cost of vehicle production, which may constrain their usage in budget and mid-size vehicle segments. Moreover, retrofits of conventional suspension systems with sophisticated levelling technology are still an expensive and technologically complex procedure for fleet operators and independent vehicle owners.

Opportunity

Rise of Electric and Autonomous Vehicles

One of the major opportunities in the chassis leveling valves market is the rising adoption of electric and autonomous vehicles. As automotive companies increasingly embrace electric and autonomous technologies, complex air suspension systems featuring computerized leveling control are coming to market. Chassis leveling valves are also critical as they help achieve optimal battery location and its weight distribution and improve vehicle stability for electric trucks and buses.

Moreover, intelligent suspension systems integrated with AI-based predictive analysis and IoT connectivity are also coming to the forefront that adjust the vehicle settings based on real-time feedback of road conditions, load change, and driving characteristics. The companies working in the field of chassis leveling systems for awake and light-weight vehicles will rule the new age automotive world.

Between 2020 and 2024, the chassis leveling valves market witnessed significant growth, driven by increasing demand for ride comfort, vehicle stability, and enhanced load distribution across commercial and passenger vehicles.

The rising adoption of air suspension systems in heavy-duty trucks, buses, trailers, and luxury automobiles further propelled market expansion. As regulatory bodies enforced stricter safety and emission norms, manufacturers increasingly integrated advanced leveling valve technologies to optimize vehicle aerodynamics, reduce tire wear, and enhance fuel efficiency.

Between 2025 and 2035, the chassis leveling valves market is expected to undergo a transformative shift, propelled by AI-driven suspension optimization, integration with electric and hydrogen-powered vehicles, and advancements in predictive maintenance technologies. The rise of autonomous and semi-autonomous vehicles will necessitate precision ride control, fueling demand for intelligent, self-adjusting leveling valve systems.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Tighter safety regulations for suspension control, fuel efficiency enhancement requirements, and emissions standards.. |

| Technological Advancements | Electronically controlled leveling valves, smart height adjustment mechanisms, and corrosion-resistant valve materials. |

| Industry Applications | Commercial trucks, buses, trailers, off-road vehicles, and luxury cars. |

| Adoption of Smart Equipment | Smart sensors for real-time height adjustment, electronically controlled ride stabilization, and digital valve diagnostics. |

| Sustainability & Cost Efficiency | Lightweight composite valve housings, energy-efficient air suspension integration, and low-maintenance design improvements. |

| Data Analytics & Predictive Modeling | IoT-based suspension diagnostics, cloud-integrated ride control monitoring, and performance analytics for fleet management. |

| Production & Supply Chain Dynamics | COVID-19-related supply chain disruptions, increased demand for durable valves, and localized production strategies. |

| Market Growth Drivers | Growth driven by commercial fleet expansion, safety regulations, and ride comfort enhancements in premium vehicles. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Suspension compliance powered by AI, block chain-enabled maintenance tracking, and sustainability-focused material regulations.. |

| Technological Advancements | AI-driven adaptive ride control, quantum-enhanced suspension modeling, and self-healing valve components. |

| Industry Applications | Expansion into autonomous vehicles, electric and hydrogen-powered commercial fleets, and next-gen military transport systems. |

| Adoption of Smart Equipment | Fully autonomous AI-optimized ride height control, cloud-based suspension analytics, and gesture or voice-controlled leveling mechanisms. |

| Sustainability & Cost Efficiency | Eco-friendly biodegradable valve components, energy-harvesting leveling systems, and circular economy-driven recycling programs. |

| Data Analytics & Predictive Modeling | AI-enhanced predictive maintenance, decentralized block chain-backed service tracking, and real-time chassis health assessment via quantum computing. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, decentralized valve manufacturing using 3D printing, and real-time material tracking with block chain verification. |

| Market Growth Drivers | AI-powered suspension automation, demand for sustainable vehicle components, and increased adoption in autonomous transport applications. |

The USA market for chassis leveling valves is experiencing steady growth with the growth of commercial vehicle and off-highway vehicle segments. The growing use of air suspension systems in heavy commercial vehicles, trailers, and buses is a major growth driver.

The growing demand for improved ride comfort, fuel economy, and vehicle stability is also encouraging OEMs to adopt more advanced chassis leveling technologies. Stringent regulatory standards for improved vehicle safety and lower emissions are also driving the increasing adoption of chassis leveling valves in both on-road and off-road use.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The market for the UK chassis leveling valves is expanding as a result of increasing demand for commercial transport vehicles, luxury coaches, and premium passenger cars with adaptive suspension systems.

Automakers are incorporating precision-controlled leveling valves to enhance ride comfort and aerodynamics with increasing thrust towards electrification and lightweight parts. The increasing number of fleet operators investing in next-generation suspension solutions to optimize maintenance expenditures and performance also contributes to the expanding market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The EU chassis leveling valves market is growing as a result of strict vehicle safety and emission regulations encouraging optimized suspension technologies in commercial and passenger vehicles. Germany, France, and Italy are in the forefront of adopting air suspension and chassis control systems for luxury vehicles, heavy-duty trucks, and buses.

The growth of electric trucks and autonomous vehicle production is also increasing electronically controlled leveling valve demand to enhance load distribution and vehicle dynamics. Also, predictive maintenance technology advancements and intelligent suspension technology are influencing the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.1% |

Japan's market for chassis leveling valves is being driven by the technological innovation of automotive suspension technology and the growing use of smart air suspension in luxury passenger vehicles and electric buses.

Japan's automotive industry leaders, including Toyota, Nissan, and Honda, are emphasizing weight reduction in vehicles and improved ride stability, which is pushing up demand for precision-designed leveling valves. In addition, aging infrastructure and poor road conditions are compelling manufacturers to incorporate more adaptive suspension technologies in commercial and private transport.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.7% |

South Korea's chassis leveling valves market is growing as the nation continues developing its automotive and commercial vehicle industry. Large automobile manufacturers like Hyundai and Kia are incorporating electronic chassis control systems to improve stability and efficiency in electric and autonomous vehicles.

The growing need for luxury SUVs and high-performance cars with load balancing and adjustable ride height capabilities is also driving market growth. Additionally, the growth of public transport fleets and the drive towards fuel-efficient mobility solutions are driving demand for sophisticated chassis leveling valve technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.0% |

Heavy commercial trucks have become one of the fastest-growing segments in the market for chassis leveling valves, as trucking fleets, heavy-duty haulage operators, and industrial logistics providers increasingly implement advanced suspension technologies. In contrast to traditional vehicles, heavy commercial trucks need advanced leveling solutions to ensure correct ride height, reduce load imbalance, and minimize mechanical stress on axles and suspensions.

The increasing focus on fleet efficiency, load distribution optimization, and fuel economy has spurred adoption of heavy commercial vehicle chassis leveling valves. The growing availability of commercial trucks with air suspension, equipped with automated leveling valve adjustments, electronic ride height sensors, and smart air compression systems, has consolidated market demand, guaranteeing maximum load stability and enhanced driver comfort.

The inclusion of IoT-supported chassis monitoring platforms, with AI-driven suspension diagnostics, real-time load distribution monitoring, and cloud-based fleet management analytics, further expedited adoption, guaranteeing predictive maintenance and operational effectiveness in heavy commercial vehicles.

The evolution of chassis stabilization alliances, with partnerships among OEMs, logistics operators, and auto component manufacturers, has maximized market growth, ensuring industry-wide innovations in leveling valve integration and performance improvement.

The implementation of sustainability-focused suspension technologies, including low-emission air suspension, light-weight leveling valve components, and energy-efficient ride height control, has enhanced market growth, ensuring compliance with green transport schemes and regulatory standards.

While it has its benefits in vehicle stability, ride comfort, and mechanical endurance, the heavy commercial vehicle segment is beset by drawbacks like high system costs of air suspension systems, regulatory challenges over emission control requirements, and complex maintenance in multi-axle trucks.

But new developments in AI-based load balancing, block chain-supported chassis performance monitoring, and autonomous vehicle-compliant leveling technology are enhancing efficiency, safety, and fleet versatility, guaranteeing sustained growth for chassis leveling valves in heavy commercial vehicle applications across the globe.

Lever-operated leveling valves for chassis have been widely accepted in the market, especially by commercial truck makers, bus companies, and industrial vehicle manufacturers, since they are increasingly incorporating mechanically regulated suspension systems with linkage-based ride height adjustment systems.

In contrast to electronically controlled valves, lever-operated systems are budget-friendly, long-lasting, yet highly responsive ride height regulation, an advantage they enjoy in heavy-duty commercial vehicle applications involving high loads.

Growing requirements for mechanically actuated leveling valves, with adjustable ride height configurations, easy maintenance procedures, and strong load compensation mechanisms, have driven the implementation of lever-based leveling valve systems since fleet operators seek reliability and cost-effectiveness. Research suggests that more than 65% of heavy commercial trucks employ mechanical linkage-based leveling valves because of their reliability and ease of maintenance, guaranteeing consistent demand for this segment.

The expansion of rugged suspension solutions, featuring linkage-based chassis leveling systems, self-regulating mechanical air springs, and industrial-grade suspension stabilizers, has strengthened market demand, ensuring higher adaptability across varied commercial vehicle applications.

The integration of hybrid mechanical-electronic leveling control, featuring manual linkage-supported electronic height adjustment, semi-automated ride height correction, and AI-assisted load balancing calibration, has further boosted adoption, ensuring seamless transition toward next-generation commercial vehicle suspension solutions.

The evolution of chassis optimization software, with partnerships between automotive engineering companies, heavy-duty fleet operators, and suspension component manufacturers, has maximized market growth, with enhanced structural integrity, ride comfort, and mechanical durability.

The use of advanced material engineering, with lightweight yet highly resilient alloys for linkage-based leveling components, corrosion-resistant mechanical actuators, and precision-engineered ride height regulators, has strengthened market growth, with long-term reliability and sustainability in commercial vehicle use.

Although it has the strengths of mechanical ruggedness, cost savings, and uniform ride height control, the lever-operated leveling valve market is hindered by its limitations in being adaptable to advanced smart suspension systems, greater reliance on manual control, and lower compatibility with sophisticated electronic ride control platforms.

But new technologies in hybrid manual-electronic suspension systems, AI-driven predictive ride height control, and modular chassis component architecture are enhancing performance, durability, and market flexibility, guaranteeing ongoing growth for lever-based chassis leveling valve systems in commercial vehicle markets worldwide.

Passenger cars have captured impressive momentum within the chassis leveling valves market since vehicle manufacturers offer sophisticated ride height control systems with improved performance, air suspension modules that are electrically controlled, and half-automatic ride stabilization solutions. In contrast to commercial vehicles, passenger cars demand ride quality, steering control, and gas mileage, all compelling the market towards enhanced chassis leveling solutions.

The surging usage of electronically controlled leveling valves with dynamic ride height modulation, suspension tuning based on AI, and real-time load balancing is speeding up market growth, providing smoother and more responsive driving experiences for consumers of passenger vehicles.

Even with its benefits in ride quality, handling accuracy, and fuel economy optimization, the passenger vehicle market has challenges of increased costs with electronically controlled suspension systems, low scalability for base vehicle models, and regulatory challenges with emissions and vehicle height adjustments.

Nevertheless, new developments in AI-based adaptive ride control, IoT-based chassis monitoring, and modular suspension designs are enhancing efficiency, accessibility, and cost-effectiveness, which will continue to drive growth for passenger vehicle leveling valve applications globally.

The light commercial vehicle segment has witnessed high market penetration, mainly with delivery fleet operators, city transportation solution providers, and small-scale logistics companies, who increasingly adopt chassis leveling technologies to improve load stability, fuel economy, and vehicle handling quality.

In contrast to heavy commercial vehicles, light commercial vehicles demand affordable, quick-to-adjust, and lightweight suspension leveling solutions, wherefore mechanical and semi-automatic valve leveling systems are the preferred option for this segment.

The growth in modular suspension solutions, with hybrid mechanical-electronic leveling systems, load-responsive ride height control and regulators, and AI-backed predictive suspension monitoring, has fueled market demand with greater versatility in varied light commercial vehicle uses.

Regardless of its cost-benefit, easier maintenance, and efficiency in city logistics, the segment of light commercial vehicles encounters some challenges such as constraints to higher-load bearing suspension systems, limited flexibility for adjustment to improved air suspension modules, and faster wear-and-tear rates on urban driving patterns.

But new technologies in modular ride height control, lightweight chassis material design, and IoT-based fleet suspension analytics are enhancing durability, efficiency, and market growth potential, which will ensure ongoing growth for light commercial vehicle chassis leveling valve applications globally.

The Chassis Leveling Valves Market is witnessing steady growth, driven by the increasing demand for enhanced vehicle stability, safety, and ride comfort. Chassis leveling valves play a crucial role in maintaining the proper ride height and weight distribution in commercial vehicles, trailers, and heavy-duty trucks.

The rise in global freight transportation, expansion of commercial vehicle fleets, and advancements in air suspension systems are contributing to market expansion. Leading companies are focusing on durability, precision, and cost-effective solutions, while innovations in electronic leveling systems are expected to drive future demand.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Wabco Holdings Inc. | 25-30% |

| ProVia | 18-22% |

| Haldex | 15-19% |

| TRP | 10-14% |

| Ridewell Corporation | 8-12% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Wabco Holdings Inc. | Develops advanced air suspension and chassis control systems for commercial vehicles. |

| ProVia | Specializes in cost-effective and durable leveling valve solutions for heavy-duty vehicles. |

| Haldex | Manufactures precision air suspension components, including leveling valves, for trucks and trailers. |

| TRP | Supplies a range of high-performance chassis leveling valves for aftermarket applications. |

| Ridewell Corporation | Designs and manufactures innovative air suspension and leveling valve solutions for various vehicle types. |

Key Company Insights

Wabco Holdings Inc. (25-30%)

A leading provider of advanced chassis control technologies, Wabco provides a full line of chassis leveling valves for commercial trucks, trailers, and buses. The company invests heavily in research and development to enhance efficiency and improve vehicle stability.

ProVia (18-22%)

ProVia excels at making cost-effective, high-quality leveling valves for commercial vehicle use. ProVia is recognized for delivering affordable options without sacrificing performance, which makes it a favorite in the aftermarket industry.

Haldex (15-19%)

One of the prominent players in the chassis leveling valve segment, Haldex produces rugged air suspension products, including leveling valves optimized for precision and durability. With a widespread global market, Haldex distributes OEM and aftermarket markets.

TRP (10-14%)

TRP specializes in manufacturing high-performance leveling valves for a broad spectrum of vehicle applications. TRP is known for reliability and quality, especially in the aftermarket replacement market.

Ridewell Corporation (8-12%)

Ridewell specializes in air suspension systems and leveling valves designed for heavy-duty trucks, buses, and specialty vehicles. The company is known for its commitment to innovation and high-quality manufacturing.

Other Key Players (15-25% Combined)

The chassis leveling valves market also includes several emerging and regional players contributing to industry growth, such as:

The overall market size for chassis leveling valves market was USD 10,058.9 Million in 2025.

The chassis leveling valves market is expected to reach USD 14,889.6 Million in 2035.

The increasing demand for improved vehicle stability and ride comfort fuels Chassis leveling valves Market during the forecast period.

The top 5 countries which drives the development of Chassis leveling valves Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of type, with lever to command significant share over the forecast period.

Automotive Load Floor Market Growth - Trends & Forecast 2025 to 2035

Automotive Glass Film Market Growth - Trends & Forecast 2025 to 2035

Automotive Sensors Market Growth - Trends & Forecast 2025 to 2035

Bicycle Components Aftermarket Growth - Trends & Forecast 2025 to 2035

Automotive TCU Market Growth - Trends & Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.