The CGRP Inhibitors industry is valued at USD 3.92 billion in 2025. As per FMI's analysis, the CGRP inhibitors industry will grow at a CAGR of 12.4% and reach USD 12.27 billion by 2035. The Calcitonin Gene-Related Peptide (CGRP) inhibitors industry is one of the largest and fastest-growing pharmaceutical sectors and is anticipated to witness continued expansion through the next decade.

This growth is due to the increasing prevalence of migraine and cluster headaches, advances in biologic therapies, and heightened awareness of the availability of specialized migraine treatments.

In 2024, the industry for CGRP (Calcitonin Gene-Related Peptide) witnessed significant developments shaping its trajectory. The launch of biosimilars and generics had a profound impact on the sector dynamics by providing affordable substitutes for branded CGRP inhibitors. This development improved patient access to migraine and cluster headache therapies, especially in areas with scarce healthcare resources.

New treatments have become available, clinical practice has evolved, and excitement and new hopes have come for the prevention and treatment of migraines through novel mechanisms of action with greater efficacy and tolerability compared to older options.

As awareness among patients and physicians grows over time, CGRP inhibitors are destined to be one of the cornerstone therapies in the management of migraine, altering the landscape of therapy and increasing the quality of life for millions of patients worldwide.

Key Market Insights

| Metric | Key Insights |

|---|---|

| Industry Size (2025E) | USD 3.92 billion |

| Industry Size (2035F) | USD 12.27 billion |

| CAGR (2025 to 2035) | 12.4% |

Explore FMI!

Book a free demo

CGRP inhibitors' sector is increasing at a speedy rate, pushed by rising diagnosis of migraines and robust clinical performance of such targeted therapies. Pharma firms developing innovative or biosimilar products gain, while established migraine drug producers lose industry position. Expanded access and results in the real world continuing to impress, CGRP inhibitors become the new gold standard in migraines.

Accelerate Differentiated R&D

Invest in next-generation CGRP products or delivery systems (e.g., long-acting injectables or oral fixed combinations) to keep ahead of biosimilar pressure and enhance patient compliance.

Grow Market Access & Reimbursement Footprint

Closely align with emerging payer expectations and real-world evidence requirements to secure wider reimbursement, especially in new sectors and underpenetrated territories.

Strengthen Strategic Alliances & Distribution

Seek strategic alliances with specialty pharmacies, neurology networks, and digital health platforms to increase patient access, simplify distribution, and foster brand loyalty prior to wider competition.

| Risk | Probability - Impact |

|---|---|

| Pricing Pressure from Biosimilars | High - High |

| Reimbursement Delays or Restrictions | Medium - High |

| Safety Concerns or Regulatory Setbacks | Low - High |

| Priority | Immediate Action |

|---|---|

| Expand Global Access | Run feasibility on tiered pricing models and local manufacturing partnerships |

| Strengthen Clinical Positioning | Initiate KOL and provider feedback loop on unmet needs and real-world outcomes |

| Accelerate Industry Penetration | Launch a pilot program for specialty pharmacies and digital channel partners |

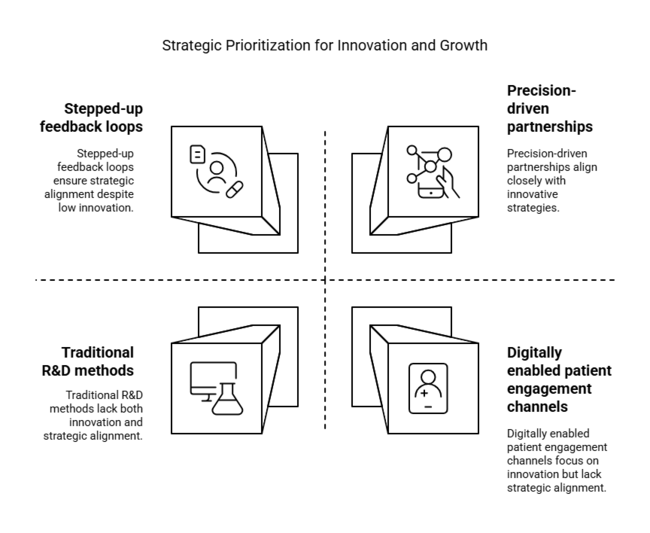

To stay ahead, the company must immediately shift to differentiated product innovation, global access strategies, and precision-driven partnerships. This report highlights a transition away from pure R&D-driven growth to value execution where payer alignment, real-world data, and targeted distribution will identify industry winners.

The roadmap now needs to focus on stepped-up feedback loops with prescribers, investment in adaptive price models for new sectors, and the deployment of and deploy digitally enabled patient engagement channels.

Regional Variance:

High Variance:

Convergent and Divergent ROI Views:

Consensus:

Variance:

Shared Challenge:

Regional Differences:

Manufacturers:

Prescribers:

Patients:

Alignment:

Divergence:

Key Variances:

Strategic Insight:

No single model will scale globally. Tailored strategies-injectables in the US, reimbursement agility in Europe, and cost-optimized oral options in Asia-are essential for long-term competitive edge.

| Countries/Region | Policy & Regulatory Impact |

|---|---|

| United States |

|

| Western Europe (EU) |

|

| Germany |

|

| France |

|

| United Kingdom |

|

| Japan |

|

| South Korea |

|

The USA sector for CGRP sales is projected to grow at a CAGR of around 7.8% during the forecast period 2025 to 2035. This increase is due to the high prevalence of migraine diseases, which affect approximately 12% of the population.

CGRP inhibitors like erenumab and fremanezumab became available, the way we treat migraines has changed because these drugs target specific processes in the body and are generally safe, giving patients new hope. The American Headache Society has actually endorsed these therapies, leading to further acceptance among healthcare providers.

The United Kingdom’s CGRP inhibitors sales are expected to grow at a CAGR of 8.1% during the coming 10 years. In the UK, CGRP inhibitor uptake has been slower than that in the USA, primarily because of rigorous cost-effectiveness evaluations by the National Institute for Health and Care Excellence.

These evaluations have impeded widespread use by healthcare professionals, migraine patients, and payers in a segment populated by numerous promising new treatments, the understanding of the potential unmet need in this space is growing, and as the effects of migraine management become more significant, and so will the demand for treatments as it matures over time.

The CGRP inhibitors sector in sales is likely to grow at a noteworthy CAGR of 8.0% during the forecast period of 2025 to 2035. The deliberate integration of CGRP inhibitors into clinical practice is the result of the French healthcare system's emphasis on assessment of therapeutic value and price negotiation.

Clinical proof of the efficacy of these treatments grows and patient demand rises as the industry is set for steady growth. Stakeholders will be critical in generating conditions for sector access, requiring collaborations between pharmaceutical companies and healthcare authorities to work through the difficulties of pricing and reimbursement.

The CGRP inhibitors sales in Germany is expected to witness a CAGR of around 8.5% over the forecast period. Germany's organized method of adding new medical treatments, along with a strong emphasis on how well they work and their costs, has influenced how quickly CGRP inhibitors are being used in medical practice.

However, Germany's extensive healthcare system and the presence of influential pharmaceutical companies make it well-positioned for sector expansion. Additional real-world data emerges confirming the effectiveness of CGRP inhibitors, their uptake is only likely to rise, underpinned by favorable reimbursement policies.

In Italy, between 2025 and 2035, the CGRP inhibitors sales are expected to expand with a CAGR of approximately 8.3%. This fragmentation has left the drug sector impacted by regional variability in drug approval and reimbursement across the Italian healthcare system.

Greater awareness of migraine management and innovative therapies will push demand upward. Streamlining of the approval process and ensuring that access to the products is uniform across geographies will be critical to achieving the potential growth of the sector.

The South Korean CGRP inhibitors sales is poised to grow at a significant CAGR of 12.8% over the forecast period of 2025 to 2035. The country's advanced medical infrastructure and rapid adoption of new technologies for health care reinforce this trend.

Continuing improvements in drug development and delivery systems, which optimize the effectiveness, convenience, and patient compliance associated with CGRP inhibitors, remain critical in supporting the growth of the sector. Increasing prevalence of migraine disorders and availability of novel therapeutics that use for managing migraine are anticipated to propel demand over the forecast period.

The CGRP inhibitors sales industry of Japan is anticipated to generate a CAGR of 13.2% during a forecast period. The favorable reimbursement policies and coverage under the national health insurance system are two of the factors contributing to patient access to CGRP inhibitors in the sector.

Increased awareness of migraine among the Japanese population also increases the use of such treatments. The presence of major pharmaceutical companies actively involved in research and development accelerates the industry growth.

The CGRP inhibitors sales are expected to grow in China at a strong CAGR of 13.5% by 2035. This enormous increase could be attributed to the country's growing healthcare infrastructure and rising disposable income, which have enabled people to afford better healthcare facilities.

There is a significant segment opportunity with a large patient pool suffering from migraine disorders. The Chinese government's efforts to promote innovative medical treatment and the increasing number of global pharmaceutical companies are also expected to facilitate industry growth.

The sales for CGRP inhibitors in Australia and New Zealand is expected to grow at a CAGR of over 8.5% between 2025 and 2035. High standards of health care and strong professional traditions of embracing new medical treatments. Increased awareness among healthcare professionals and patients, along with the rising prevalence of migraine disorders, drive industry growth.

Moreover, favorable reimbursement and the availability of specialized headache clinics further add to the growing usage of CGRP inhibitors in these sectors.

The sales for CGRP inhibitors in India are exceeding the global CAGR of 12.4% during the same period. The robust growth prospects are mainly attributed to growing recognition of migraine as a chronic neurological disorder, increasing stress levels in urban dwelling, and improvement in healthcare penetration.

CGRP inhibitors are still in early stages of penetration in the Indian sector. The need for effective prophylactic treatments is considerable, with many patients unable to prevent their headaches with conventional migraine therapies (including triptans, NSAIDs and beta-blockers).

The analysis estimates small molecule CGRP inhibitors to be the most profitable class in the CGRP therapeutics space in terms of revenue during 2025 to 2035 with a robust CAGR of 13.8%, overtaking large molecules during this period. The most significant contributor to this expansion is the growing use of oral gepants, which provide greater convenience, ease of administration, and wider access via pharmacies and telehealth platforms.

These drugs are appealing to a wider patient population since they address both the acute and preventive treatment requirements. They are also commercially attractive due to their lower production costs and rapid onset of action. They can be expensive, logistically complicated to administer, and pose tighter reimbursement barriers, limiting their broad adoption, particularly in emerging segments.

The preventive migraine treatment segment is expected to generate the highest revenue in the CGRP inhibitors landscape between 2025 and 2035, with an approximate CAGR of 14.2%. The robust growth is primarily attributable to the increasing prevalence of chronic migraine cases worldwide and the growing patient/physician inclination towards long-term management rather than episodic treatment.

Preventive treatments, especially CGRP-targeting monoclonal antibodies and new oral gepants like atogepant, have shown to be very effective in reducing the number of migraine days each month, which significantly improves patients’quality of life and daily functioning.

The oral route of administration is projected to be the most profitable segment of the CGRP inhibitors industry during the period between 2025 to 2035, with a CAGR of nearly 14.6%, followed by nasal and injectable delivery formats. This increase is mainly due to more patients wanting easy-to-use treatments that they can take themselves, especially the small molecule CGRP antagonists rimegepant and atogepant.

These treatments are rapidly utilized for acute and preventive migraine therapy with strong efficacy profiles and growing access through telehealth and virtual pharmacy. Moreover, it decreases reliance on healthcare professionals, thus leading to cost-efficiency and scalability, particularly in the emerging sectors.

The retail pharmacies end-user segment is anticipated to register the highest CAGR of 13.9% during the forecast period (2025 to 2035), and the CGRP inhibitors general industry is expected to be the highest-earning segment during 2025 to 2035. This is primarily due to the emergence of oral CGRP treatments that do not require specialist oversight or complex storage arrangements.

Retail pharmacies provide an unmatched access point for patients seeking both preventive and acute migraine treatment, making them the most accessible option in urban and semi-urban settings. Moreover, over-the-counter pharmaceutical models and the extension of pharmacist-prescribing rights across several sectors (e.g., North America, Europe) mean retail pharmacies are emerging as the lead channel for CGRP therapeutics.

The leading pharmaceutical contenders are competing on several strategic fronts in the CGRP inhibitors marketplace-pricing innovation, product differentiation, global expansion, and strategic alliances. AbbVie, Eli Lilly, Amgen, and Teva are using aggressive pricing models in sectors where they want to establish an early lead including places like Asia and Latin America that have cost-sensitive health-care systems.

On the upside, there are companies laying bets on novel CGRP-targeting molecules (oral small molecule antagonists (gepants), long-acting monoclonal antibodies, etc.) in great numbers. R&D efforts are multi-pronged, addressing both indications on efficacy-cluster headaches, medication overuse headaches-and even non-headache indications for neurological conditions across the CHPR pathways.

A class of drugs that block the calcitonin gene-related peptide pathway, which is involved in migraine attacks by causing blood vessels to dilate and carrying pain signals in Calcitonin gene-related peptide (CGRP) inhibitors.

Unlike older treatments, which often work to target symptoms once they have started, CGRP inhibitors can be deployed preventively and provide more specificity with fewer systemic side effects.

Yes, there are oral formulations (eg, the gepants) and injectables (eg, the monoclonal antibodies) of CGRP therapies available that provide patients and providers with options for flexible treatment.

Strong reimbursement infrastructure in North America and parts of Western Europe is enabling them to be the main lights at the present income points, while South Asia and Latin America are emerging zones for potential growth.

Significant players include AbbVie (ABBV), Amgen (AMGN), Eli Lilly (LLY), Teva (TEVA) and Pfizer (PFE) who have launched or are developing CGRP-focused therapies featuring novel delivery systems.

The industry is segmented into Small Molecule, Large Molecule

The industry is segmented into Preventive Migraine Treatment, Acute Migraine Treatment

The industry is segmented into Oral, Nasal, Injectables

The industry is segmented into Hospitals, Specialty Clinics, Mail Order Pharmacies, Retail Pharmacies

The industry is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Cardiovascular Diagnostics Market Report- Trends & Innovations 2025 to 2035

Prostate-Specific Antigen Testing Market Analysis - Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.