The global Cerebral Oximetry Monitoring Industry is valued at USD 249.95 million in 2025. It is expected to grow at a CAGR of 7.2% and reach USD 498.35 million by 2035. The Cerebral Oximetry Monitoring Industry saw steady advancements in sensor technology and widespread adoption in surgical procedures and increasing demand for non-invasive monitoring solutions in 2024.

The industry is expected to experience gradual expansion between 2025 and 2035, with the rising incidence of neurological disorders, increasing surgical interventions, and technological advancements in real-time monitoring solutions expected to high growth.

The growing emphasis on patient safety as well as improved perioperative outcomes will further improve adoption across hospitals and ambulatory care centers. Significant industry growth is expected in North America and Europe as they have established healthcare infrastructure. The Asia-Pacific region will exhibit rapid growth due to increased investment in healthcare.

The use of artificial intelligence and machine learning in cerebral oximetry devices will make predictive analytics more effective and improve the early diagnosis capabilities. Furthermore, approval of next-generation oximetry systems for clinical use by the regulatory authorities will add momentum to industry expansion. The industry will shift in 2035 toward consumables, as well as wearable and wireless monitoring devices, ensuring better patient mobility and remote monitoring options.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 249.95 million |

| Industry Value (2035F) | USD 498.35 million |

| CAGR (2025 to 2035) | 7.2% |

Explore FMI!

Book a free demo

The Market for cerebral oximetry monitoring is expected to be on a steady growth trajectory due to the rising incidence of neurological disorders; increasing number of surgical procedures and the advancements made in real-time monitoring technologies. Healthcare providers will benefit from better patient outcomes, especially hospitals and ambulatory care centres. At the same time, companies investing in AI-driven and wirelessmonitoring solutions will gain a competitive advantage. However, high device costs and regulatory challenges will, continue to pose significant barriers for smaller industry entrants.

The Cerebral Oximetry Monitoring Industry is expected to cover several surgical applications, including cardiac surgery, vascular surgery, and other operations in which brain oxygenation monitoring is clinically significant. In the field of cardiac surgery, cerebral oximetry serves an important role to prevent oxygen depletion to the brain during those complex procedures as bypass surgeries and valve replacements.

The adoption of accelerometer for neurorehabilitation as a part of advance medical equipment is anticipated to increase, as healthcare providers upgrade their machine to reduce post-surgical cognitive decline and the aid in post-surgical recovery of their patients.

Likewise, in vascular surgery, cerebral oximetry assists in monitoring cerebral perfusion during procedures such as carotid endarterectomy, in which the potential for stroke can occur due to blood flow interference.

The increasing adoption of a device for real-time monitoring of vascular disorders owing to recent advancements will propel its growth. Outside of these use cases, cerebral oximetry is also branching into other types of medical procedures, such as neurosurgery and other areas of critical care, as the push for patient safety and outcomes in hospitals continues.

The adult industry segment held a dominant industry share of around 67% in terms of sales. Since adult populations have a greater prevalence of neurological problems and cardiovascular ailments, adults dominate the Cerebral Oximetry Monitoring industry.

Increasing evidence of the importance of brain oxygenation to surgical outcome is prompting wider adoption of cerebral oximetry monitoring across ages, including pediatric and adult populations. In children, it is being used more frequently in congenital cardiac operations, where accurate oxygen assessment is critical to avoid later neurodevelopmental challenges.

The trend toward Mull over general and niche-oriented options in smaller sized human organs advanced medical gadgets, as cleaner administering and observing solutions have benefited from this case within inversion-based devices.

In the adult segment, the growing prevalence of cardiovascular and neurological disorders is driving the demand for cerebral oximetry in high-risk surgeries. Facilitated brain oxygenation management avoids post-operative cognitive dysfunction in adults submitted to complex procedures such as cardiac and vascular interventions. In Accu-Check, non-invasive and wearable cerebral oximetry solutions are expected to continue to gain traction across both geriatric and paediatric population, potentially enhancing patient monitoring in perioperative, as well as critical care settings.

The hospitals & clinics sector held the dominant position in the industry with about a 53% share. Given the substantial demand for these devices in these settings, the hospitals and clinics sector lead the global industry. Most surgical procedures that require brain oxygenation assessment is performed in hospitals and clinics, the analytical way of cerebral oximetry monitoring remains the largest end user. The growing implementation of cerebral oximetry in perioperative care is improving patient safety, especially in high-risk operations in cardiac and vascular procedures.

Implementing advanced monitoring solutions to improve surgical outcomes and mitigate complications arising from cerebral hypoxia is highly prioritized by hospitals Aligned on their way towards achieving effective surgical outcomes while minimizing cerebral hypoxic complications. The demand for cerebral oximetry is also increasing in ambulatory surgical centres due to the transition to outpatient surgical procedures.

With the rise of minimally invasive procedures, there is a growing demand for portable and user-friendly cerebral oximetry devices. And using cerebral oximetry monitoring, other types of healthcare centres - such as specialty clinics and emergency care centers- are also adapting these technologies for use within critical and trauma care settings, with this technology becoming a staple within the industry and allowing for easier access to effective patient management.

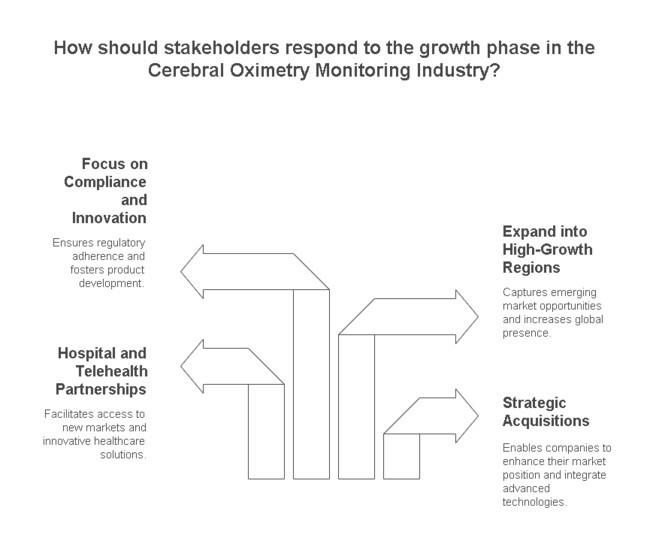

Invest in Next-Generation Monitoring Technologies

Executives should prioritize investments in AI-driven and wireless cerebral oximetry solutions to enhance real-time patient monitoring and predictive analytics. Strategic R&D efforts should focus on improving device accuracy, miniaturization, and integration with broader healthcare IT systems to drive adoption in both hospitals and ambulatory settings.

Align with Industry and Regulatory Shifts

Companies must stay ahead of evolving regulatory requirements by ensuring compliance with stringent approval processes in key industries like the UsA and Europe. Simultaneously, aligning product development with the growing demand for non-invasive and cost-effective monitoring solutions will be crucial in maintaining industry relevance and capturing emerging opportunities.

Strengthen Distribution and Strategic

Partnerships To accelerate industry penetration, stakeholders should build strong distribution networks and explore partnerships with hospitals, surgical centers, and telehealth providers. Investing in mergers and acquisitions to consolidate technological capabilities and expand global reach will provide a competitive edge in this rapidly evolving industry.

| Risk | Probability - Impact |

|---|---|

| Regulatory Hurdles - Delays in approvals for new cerebral oximetry technologies could hinder industry entry. | High - High |

| Cost Pressures - High device costs may limit adoption, especially in cost-sensitive healthcare industries . | Medium - High |

| Technological Competition - Rapid advancements in alternative monitoring technologies could disrupt industry share. | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Enhance Product Innovation | Accelerate R&D for AI-integrated, wireless cerebral oximetry solutions. |

| Regulatory Compliance Readiness | Strengthen compliance teams to navigate evolving approval requirements. |

| Market Expansion Strategy | Establish new distribution channels in emerging healthcare industries . |

The Cerebral Oximetry Monitoring Industry is entering a pivotal growth phase, and stakeholders must act decisively to secure their position. With regulatory landscapes tightening and demand shifting toward non-invasive, AI-powered monitoring, investing in next-generation technology is no longer optional-it’s a necessity. To maintain a competitive edge, companies should prioritize strategic acquisitions, forge hospital and telehealth partnerships, and expand into high-growth regions. A proactive approach to compliance, pricing strategies, and product innovation will be crucial in navigating industry complexities and unlocking long-term value. The time to act is now, with a focus on agility and technological leadership.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across medical device manufacturers, hospital administrators, neurosurgeons, and anaesthesiologists in North America, Europe, Asia-Pacific, and Latin America.)

Optimizing Patient Outcomes:

Cost-Effectiveness & Reimbursement Support:

Regional Variance:

Divergence in AI & IoT Integration:

Differing Views on Return on Investment:

Regional Variance:

Global Cost Pressures:

Regional Differences in Pricing Strategy:

Manufacturers:

Distributors:

Hospitals & End-Users:

Alignment:

Regional Variance:

North America:

Europe:

Asia-Pacific & Latin America:

Key Areas of Consensus:

Regional Differences:

| Countries/Regions | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA regulates cerebral oximetry devices under the Class II medical device category, requiring 510(k) premarket notification for industry entry. The Cybersecurity in Medical Devices Act mandates enhanced security compliance for AI-integrated monitoring systems. Reimbursement policies under Medicare and Medicaid influence hospital adoption rates. |

| European Union | The EU Medical Device Regulation (MDR 2017/745) enforces strict clinical evidence and post-market surveillance requirements for cerebral oximetry devices. The CE Marking is mandatory for product sales within the EU. Compliance with the General Data Protection Regulation (GDPR) is required for AI-enabled patient data monitoring systems. |

| China | The National Medical Products Administration (NMPA) classifies cerebral oximetry devices under Class II or III, requiring clinical trials for approval. The Made in China 2025 Initiative encourages local production, affecting foreign manufacturer industry entry. Hospitals prefer domestically certified devices due to local procurement incentives. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) requires Shonin (pre- industry approval) for new devices, often demanding clinical trials. Compliance with Japan Industrial Standards (JIS) is necessary for medical device safety. Reimbursement under the National Health Insurance (NHI) system influences pricing strategies. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) mandates a Good Manufacturing Practice (GMP) certification for imported and locally produced devices. Health Insurance Review & Assessment Service (HIRA) evaluations impact reimbursement eligibility, affecting industry access for premium-priced solutions. |

| India | The Central Drugs Standard Control Organization (CDSCO) classifies cerebral oximetry devices under Class C or D (high risk), requiring Import License & Registration for foreign products. The Make in India initiative encourages domestic production, influencing procurement policies. Bureau of Indian Standards (BIS) compliance is necessary for device safety. |

| Brazil | The Agência Nacional de Vigilância Sanitária (ANVISA) requires a Class III or IV certification for cerebral oximetry devices, with Good Manufacturing Practices (GMP) audits for approval. Local registration is mandatory for imported devices, increasing industry entry barriers for non-Brazilian manufacturers. |

| Canada | Health Canada regulates cerebral oximetry devices as Class II medical devices, requiring a Medical Device License (MDL) before commercialization. The Medical Device Single Audit Program (MDSAP) streamlines regulatory approvals for manufacturers selling in multiple regions (USA, EU, Japan, Australia). |

| Australia | The Therapeutic Goods Administration (TGA) mandates a Therapeutic Goods (Medical Devices) Order certification for industry entry. The Australian Register of Therapeutic Goods (ARTG) listing is required before sales. Devices with CE or FDA approvals may receive expedited review. |

| Middle East (UAE, Saudi Arabia) | The Saudi Food and Drug Authority (SFDA) and UAE Ministry of Health & Prevention (MOHAP) require medical device registration and local distributor partnerships for foreign companies. Compliance with Gulf Cooperation Council (GCC) medical device standards is necessary for regional sales. |

| Company | Estimated Market Share (%) |

|---|---|

| Medtronic plc | 24.5% |

| Edwards Lifesciences Corporation | 18.2% |

| Masimo Corporation | 16.8% |

| Nihon Kohden Corporation | 12.4% |

| Nonin Medical, Inc. | 9.6% |

| Hamamatsu Photonics K.K. | 7.1% |

| Ornim Medical | 5.4% |

| Others | 6.0% |

The USA cerebral oximetry monitoring industry is projected to grow at a CAGR of 7.8% from 2025 to 2035, surpassing the global average. The country remains the most lucrative industry, driven by its well-established healthcare infrastructure, high surgical volumes, and technological advancements. With an increasing number of cardiovascular and neurological surgeries, the demand for real-time cerebral oximetry monitoring is on the rise. The presence of key players such as Medtronic, Edwards Lifesciences, and Masimo further accelerates innovation and adoption.

Government initiatives supporting patient safety and perioperative monitoring have led to increased hospital adoption. The USA FDA has been approving next-generation non-invasive monitoring systems, enhancing industry penetration. Artificial intelligence (AI) and machine learning integration into cerebral oximeters are gaining traction, allowing for predictive analytics in critical care settings. Telehealth expansion is also fostering demand for wireless and remote monitoring devices, particularly in post-surgical patient management.

Reimbursement policies in the USA are relatively favorable compared to other regions, providing incentives for hospitals and ambulatory surgical centers to adopt advanced monitoring technologies. However, the industry faces challenges such as high device costs and regulatory compliance hurdles, which could impact smaller industry entrants. Nonetheless, rising awareness about perioperative complications and an increasing elderly population requiring surgical interventions will continue to drive industry expansion.

The cerebral oximetry monitoring industry in the UK is expected to grow at a CAGR of 6.9% from 2025 to 2035, slightly below the global average due to regulatory hurdles and NHS budget constraints. However, the industry remains promising, with a growing emphasis on patient safety in surgical settings and increased adoption of non-invasive monitoring technologies. The National Health Service (NHS) is actively investing in perioperative monitoring solutions to enhance surgical outcomes, which will support industry expansion.

The rising prevalence of cardiovascular and neurodegenerative diseases is boosting the need for cerebral oximetry devices, particularly in high-risk surgical procedures. UK-based hospitals are increasingly integrating AI-driven monitoring systems to improve surgical precision and reduce post-operative complications. Research collaborations between universities and medical technology companies are fostering innovation in brain monitoring solutions.

One of the biggest challenges in the UK industry is cost containment within the NHS, which limits the procurement of high-end medical devices. Additionally, Brexit-related regulatory uncertainties have affected the supply chain for imported medical equipment. However, increased private healthcare spending and government-backed initiatives to modernize hospital infrastructure are expected to drive adoption in the coming years.

France's cerebral oximetry monitoring industry is forecasted to grow at a CAGR of 6.7% from 2025 to 2035, slightly below the global average. The country’s strong public healthcare system and a well-regulated medical device industry contribute to stable industry growth. The increasing incidence of cardiovascular and neurosurgical procedures is driving the need for real-time cerebral oxygenation monitoring.

The French government has been actively promoting digital health technologies, including AI-powered patient monitoring systems, which will further support industry penetration. Leading hospitals and research institutions are working with medical device manufacturers to develop next-generation oximetry solutions. France also has a growing private healthcare sector, which is more likely to adopt advanced monitoring technologies compared to the public system.

However, the industry faces regulatory challenges, as France has stringent medical device approval processes under the European Medical Device Regulation (MDR). These regulations can slow down the introduction of innovative products. Additionally, budget constraints in public hospitals may limit widespread adoption. Nevertheless, the increasing use of cerebral oximetry in neonatal and pediatric care, along with the expansion of robotic-assisted surgeries, will contribute to steady industry growth.

Germany is anticipated to grow at a CAGR of 7.1% from 2025 to 2035, making it one of the leading industries in Europe. The country has a strong medical device industry, with a focus on technological innovation and high healthcare expenditures. German hospitals have been early adopters of non-invasive monitoring solutions, and cerebral oximetry is widely used in cardiac, vascular, and neurosurgical procedures.

The German government’s commitment to advancing healthcare technology through digitalization initiatives will further accelerate industry expansion. AI-based cerebral oximetry solutions are gaining traction, particularly in intensive care units (ICUs) and perioperative settings. The increasing prevalence of stroke and neurodegenerative diseases is also fueling demand for advanced brain monitoring devices.

However, stringent EU regulations under the MDR can slow down industry entry for new products. Additionally, Germany's emphasis on cost-effectiveness in healthcare procurement may create challenges for premium-priced monitoring solutions. Despite these obstacles, the presence of leading medical technology companies and strong investment in healthcare R&D will continue to drive industry growth.

The cerebral oximetry monitoring industry in Italy is projected to grow at a CAGR of 6.5% from 2025 to 2035, below the global average. The country has a well-established healthcare system, but economic challenges and budgetary constraints in public hospitals limit the adoption of advanced monitoring technologies.

Despite these challenges, the rising burden of cardiovascular and neurodegenerative diseases is increasing the demand for cerebral oximetry devices. Italy has a strong private healthcare sector, where the adoption of premium medical technologies is higher. Private hospitals and specialty clinics are more likely to invest in AI-driven and wireless monitoring solutions.

Government initiatives to modernize healthcare infrastructure and promote digital health will also support industry expansion. However, slow regulatory approvals and a complex reimbursement landscape could hinder the entry of new players into the Italian industry.

Japan is expected to grow at a CAGR of 7.4% from 2025 to 2035, above the global average, driven by an aging population and a high prevalence of stroke and neurological disorders. The country has a technologically advanced healthcare system and a strong medical device manufacturing industry, which supports industry expansion.

The Japanese government has been investing in AI-driven medical technologies, including predictive analytics for cerebral oximetry. Hospitals are increasingly using non-invasive monitoring solutions in perioperative care and intensive care settings. The growing adoption of wearable and wireless monitoring devices is also contributing to industry growth.

Regulatory challenges remain, as Japan has strict approval processes for medical devices. However, strong government support for digital health initiatives and high healthcare spending will continue to drive industry expansion.

China’s cerebral oximetry monitoring industry is forecasted to grow at a CAGR of 8.2% from 2025 to 2035, making it one of the fastest-growing industries globally. The country’s rapid healthcare infrastructure expansion, increasing surgical volumes, and growing awareness of perioperative complications are driving demand.

The Chinese government is actively promoting AI and digital health solutions, leading to increased adoption of smart monitoring systems. However, regulatory challenges and price sensitivity among public hospitals remain key barriers. Despite this, strong private-sector investment and rising healthcare expenditures will sustain long-term industry growth.

Australia is projected to grow at a CAGR of 7.0%, while New Zealand is expected to grow at 6.8% from 2025 to 2035. Both countries have strong healthcare systems and increasing demand for non-invasive monitoring solutions. The adoption of AI-powered monitoring devices is rising, particularly in perioperative and neonatal care settings.

Government initiatives to support digital health and telemedicine are also driving industry expansion. However, high device costs and limited reimbursement policies may slow adoption in smaller healthcare facilities. Despite these challenges, increasing awareness of brain monitoring in critical care will continue to fuel demand.

South Korea is expected to grow at a CAGR of 7.3% from 2025 to 2035, driven by strong government support for medical technology innovation. The country has a high surgical volume and is investing heavily in AI-driven healthcare solutions. Cerebral oximetry adoption is increasing in both hospitals and ambulatory surgical centers.

However, regulatory hurdles and price sensitivity remain challenges. Despite these issues, continued investment in smart healthcare infrastructure and telemedicine will support long-term growth.

The rising incidence of neurological disorders, increasing surgical procedures, and advancements in real-time monitoring technology are driving demand. Additionally, the shift toward non-invasive monitoring solutions and growing awareness of patient safety are contributing factors.

North America and Europe lead in adoption due to well-established healthcare infrastructure and regulatory support. The Asia-Pacific region is also witnessing rapid growth, driven by increasing healthcare investments and a higher demand for advanced monitoring solutions.

Innovations such as artificial intelligence, wireless monitoring, and improved sensor accuracy are enhancing real-time diagnostics. The integration of predictive analytics and machine learning is also improving early detection and patient outcomes.

High device costs, regulatory approval processes, and the need for trained medical professionals remain significant challenges. Additionally, limited reimbursement policies in some regions can slow adoption rates.

Leading companies such as Masimo, Medtronic, Edwards Lifesciences, Nonin, and GE Healthcare are actively investing in research and development. These firms are focusing on product innovation, regulatory approvals, and strategic partnerships to expand their presence.

Cardiac Surgery, Vascular Surgery, Others

Pediatric, Adult

Hospitals & Clinics, Ambulatory Surgical Centers, Others

North America Industry, Europe Industry, Asia Pacific Industry, Latin America Industry, Middle East & Africa Industry

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.