The Ceramic Membranes North American industry is expected to register high growth during the forecast period through and beyond 2024 in the ceramic membranes industry with an increasing adoption rate of ceramic membranes in filtration technologies, including water treatment, beverage preparation, and the pharmaceutical industry.

The increasing demand for water purification, which requires sustainable and long-lasting membrane solutions for municipal and industrial applications, is a major growth driver.

Companies fast-tracked investments into research and development to bolster membrane efficiency, while synergies between material science companies and filtration technology players increased significantly. A further notable development was the increasing adoption of ceramic membranes in biopharma processes, particularly in virus filtration and protein separation. Both start-ups and incumbents launched inexpensive and high-performance membrane variants, driving price competition.

Government policies promoting advanced filtration technology, such as stricter wastewater treatment regulations and incentives for sustainable solutions, will drive growth from 2025 onwards. The driving factors for growth in the Asia-Pacific region are industrialization and stringent wastewater treatment regulation.

By 2035, the integration of AI systems for monitoring membrane technology operations is expected to yield significant performance improvements, reducing downtime and operating expenses. The Industry is forecasted to grow rapidly at a CAGR of 11.2% and reach up to USD 19.49 billion. In the meantime, advancements in ceramic nanofiltration membranes will broaden the range of applications, thereby bolstering industry growth over time.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.74 billion |

| Industry Value (2035F) | USD 19.49 billion |

| CAGR (2025 to 2035) | 11.2% |

Explore FMI!

Book a free demo

A recent study by Future Market Insights highlighted a strong interest among key stakeholders in the ceramic membranes industry to sustain durability. The risk of longer service life and lower operating expenses were the reasons for using ceramic membranes rather than polymeric membranes for over 68% of respondents. Indeed, Water treatment and food & beverage processing are among the fastest-growing sectors, with demand expected to rise significantly due to regulatory and sustainability concerns.

A theme throughout the survey was advances in technology. Nearly three-fourths of industry players indicated that this trend was responsible for the growth of the industry, coupled with advances in ultrafiltration and nanofiltration.

Stakeholders emphasized the importance of having more selective membranes that exhibit enhanced rejection of contaminants and reduced energy consumption. Besides, manufacturers are treading the path of automation and AI-based monitoring system investment to boost membrane performance and reduce downtime.

Regulatory elements also significantly influenced industry dynamics. Over 60% of the participants stated that stringent environmental policies were leading industries toward increasingly efficient filtration systems. Compliance requirements are driving growth for ceramic membranes, particularly in the Asia-Pacific and Europe industries.

Industry players expect that government incentives for water-saving technologies will accelerate growth. Stakeholders believe that cross-industry collaborations will drive industry growth by accelerating the development of cost-effective ceramic membranes with broader application potential.

| Countries | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | EPA Clean Water Act (CWA)-Industrial wastewater treatment must be stringent. Novelty Food & Distribution FDA & USDA approval for ceramic membrane food applications and pharmaceuticals. NSF/ANSI 61: For drinking water applications. |

| United Kingdom | UK Water Treatment Standards: Regulates rigorous filtration requirements. WRAS Approval: Required for potable water treatment systems. The FSA Standards are mandatory for food and beverage applications. |

| France | France’s Law on Drinking Water: Requires Highly Efficient Filtration Systems. ACS (Attestation de Conformité Sanitaire): Certification for ceramic filter membranes in water treatment. Food safety management ISO 22000 compliance |

| Germany | DIN 19628: Covers ceramic membrane applications in WWTPs. - DVGW Certification: Drinking water applications must be certified with DVGW. EU Food Contact Regulation (EC) 1935/2004: The regulation's scope includes materials used in food processing. |

| Italy | Italian Ministry of Health Standards: Regulates the use of membranes in water purification systems in Italy. MOCA Certificate: Required for food contact materials, ceramic membranes, and more. |

| South Korea | K-Water Regulations: Requires treatment of drinking water under strict quality requirements. [Ministry of Food and Drug Safety (MFDS)] The Ministry of Food and Drug Safety (MFDS) requires compliance for membranes used in food and pharmaceutical applications. |

| Japan | Japan Water Works Association (JWWA): Water Filtration Membranes Certification. FSC Japan: Provides control of food-grade membrane use. MoE Guidelines: Encourages reuse of treated wastewater and advanced filtration |

| China | 2021 National Standard GB/T 5750: Drinking Water Filter. CFDA Certification—Required for pharmaceutical-grade membranes RoHS compliance for China: Bill of materials that allows for environmental safety in manufacturing. |

| Australia-NZ | Australian Drinking Water Guidelines (ADWG): Ceramic membrane compliance requirement. WaterMark Certification Scheme: Plumbing products that ensure safety. It is obligatory for food and beverage industries. |

| India | Central Pollution Control Board (CPCB) Norms: Reliably enforces wastewater treatment standards. BIS IS 10500: Regulates the purification of drinking water. FSSAI Certification: Required for food-grade ceramic membranes. |

Alumina accounts for the fastest-growing material segment in the ceramic membranes industry due to its high mechanical strength, excellent chemical resistance, and low costs. It has a wide range of applications, including water and wastewater treatment and food and beverage, which has helped it gain popularity in end-user fields. Zirconium oxide is the fastest-growing segment in the biopharmaceutical and biotechnology industries due to its better thermal stability and high resistance to extreme pH conditions.

It is increasingly used in virus filtration and protein purification. Titania membranes are gaining attention in high-performance nanofiltration applications, especially for advanced wastewater treatment in industry and separation processes that use catalysis. The other part includes new materials, such as composite and mixed-oxide membranes, which are gradually being introduced to the industry through ongoing studies on enhanced durability and low-cost manufacturing processes.

The demand for membrane separation Technologies has an industry tendency to increase in water and wastewater treatment, which is still the main application and accounts for the maximum share of the ceramic membrane industry due to increasing regulatory pressure on industrial effluents and an increase in worldwide water scarcity.

The utilization of ceramic membranes is increasing for numerous utilities, such as water treatment plants, desalination, and recycling industrial wastewater. The food & beverage processing industry is also witnessing significant growth, with increasing demand for high-purity filtration in dairy processing, beer and wine clarification, and juice concentration.

Emerging applications with high growth prospects include pharmaceuticals and biotechnology, where high-efficiency separation technology is essential for drug production, blood plasma filtration, and enzyme recovery. The increasing need for single-use and ultra-high-performance filtration products in biotech research is also propelling demand.

Ceramic membranes with longer life and resistance to operating conditions are gaining traction among other industries, including chemical processing, electronics manufacturing, and gas separation.

Ultrafiltration is the leading technology segment, widely used in water treatment, food processing, and pharmaceuticals. It is effective in removing bacteria, viruses, and high molecular weight molecules. It is one of the most effective technologies for industrial wastewater treatment and milk processing.

Microfiltration is a prevalent technology that is used mainly in the food and beverage and biotechnology sectors to provide clarification, sterilization, and removal of suspended solids. Nano-filtration is the industry segment that is growing the fastest.

This is because it is still in high demand in specialized separation processes like softening, desalination, and pharmaceutical filtration. Because of its ability to screen out small impurities while maintaining excellent throughput efficiency, it is rapidly becoming more widely used. New advanced filtration technologies, including hybrid membrane systems and catalytic filtration methods, are emerging to enhance selectivity and energy efficiency in separation processes.

The United States ceramic membranes industry held approximately USD 372 million in 2025 and is anticipated to grow at a CAGR of 10.5% from 2025 to 2035, owing to strict environmental regulations, increasing investments in wastewater treatment, and high penetration from pharmaceutical and food & beverage industries. Driven by the Clean Water Act (CWA) and EPA regulations, industries continue to adopt newer filtration technologies, with ceramic membranes providing an integral part of treatment for municipal and industrial waste.

For instance, the pharmaceutical industry is utilizing ceramic membranes for virus filtration and bioprocessing, while the food & beverage industry is deploying membranes for dairy filtration, juice clarification, and brewing. Leading American manufacturers are also investing in AI-based filtration monitoring systems to maximize efficiency and reduce maintenance expenses.

The UK ceramic membranes industry is projected to witness a CAGR of 9.8% during the forecast period, i.e., 2025 to 2035. WRAS certification ensures the treatment of potable water at a higher level of safety, leading to the increasing utilization of ceramic membranes in both industrial and municipal sectors. Food & beverage: The compositions of dairy, brewing, and fruit juice sectors in the UK consume the greatest levels of ceramic membranes because they can retain greater purity & efficiency levels.

Furthermore, the forthcoming UK net-zero emissions targets for 2050 are spurring industries to turn to green filtration technologies. The increasing adoption of ceramic membranes across industries is driven by a focus on recycling, advanced water treatment, and low energy consumption.

The France ceramic membrane industry is projected to grow at a CAGR of 10.2% through 2025 to 2035, owing to strict water quality regulations by the government along with its rising application in food & beverage as well as the pharmaceutical industry. The French Decree on Water Quality and ACS (Attestation de Conformité Sanitaire) certification both call for high-performance filtration systems.

This is a big reason why ceramic membranes are used in municipal and industrial water treatment plants. Ceramic membranes are used in filtration and separation applications in the dairy and wine industries, as the primary drivers for using ceramic membranes in the dairy and wine industries are to ensure product purity and extend shelf life, which is crucial for the French economy. In the biopharmaceutical industry, ceramic membranes are being used more and more for sterile filtration and enzyme recovery.

The German ceramic membrane industry is anticipated to grow at a 10.4% CAGR from 2025 to 2035, primarily influenced by regulations directed to industrial wastewater treatment, high demand from food & beverage processing, and sustainable innovations related to biopharmaceutical filtration. Customers in the industrial sector prefer ceramic membranes due to their durability and chemical resistance.

These membranes are used for drinking water and wastewater and have to meet the requirements of the DIN 19628 standard and DVGW certification. Ceramic membranes are heavily used by the German brewing and dairy industries. In contrast, pharmaceutical and biotech industries are augmenting investments in membrane-based virus filtration and drug purification.

The industry for ceramic membranes in Italy is likely to register a revenue CAGR of 9.9% from 2025 to 2035, attributable particularly to the food & beverage sector, rigorous water purification standards, and increasing industrial wastewater treatment applications. Food-grade filtration must comply with the Italian Ministry of Health standards and MOCA certification, making ceramic membranes the preferred choice for cheese production, wine filtration, and fruit juice processing.

Italy's pharmaceutical and textile sectors are already embedding ceramic membranes into their wastewater treatment systems to reduce environmental footprints, as well. Ceramic membranes, known for their durability and superior filtration, are expected to experience rapid growth, particularly in niche industries such as specialty chemicals and biotechnology.

The South Korean ceramic membrane industry is expected to witness a CAGR of 10.6% between 2025 and 2035, attributed to growing government investment in clean water infrastructure, pharmaceutical R&D, and semiconductor production. These stringent K-Water regulations for drinking water treatment have been prompting the usage of these ceramic membranes in both municipal and industrial filtration processes.

The biopharmaceutical industry, a key driver of South Korea’s economic growth, increasingly relies on ceramic ultrafiltration and nanofiltration for sterile drug manufacturing and protein purification. Furthermore, ceramic membranes find application in the electronics industry for high-purity water filtration in semiconductor production.

Japan’s ceramic membrane industry is projected to grow at a CAGR of 10.3% for the forecast period of 2025 to 2035 due to tight water quality standards, advancements in biotechnology, and strong industrial filtration demand. The Japan Water Works Association (JWWA) certification demands very strict compliance in some fields, such as drinking water and sewage treatment; this section is dominated by ceramic membranes.

Japan's biopharmaceutical industry supplements the industry growth by utilizing ceramic membrane filtration for viruses, drug manufacturing, and enzyme washing. In addition, the food & beverage industry promotes soy sauce and sake production processes that require separation services, which fuels demand all the more. As more and more investment is being put in place to help with automated filtration systems and water management that embrace sustainability, ceramic membranes remain an increasingly important component of both industrial and municipal industries across Japan.

The Chinese ceramic membrane industry is poised to grow at a double-digit CAGR of 11.0% in the period 2025 to 2035 and is one of the fastest-growing industries in the world. The National Standard GB/T 5750-2021 has stringent water quality requirements and encourages the application of ceramic membranes in industrial and municipal water treatment plants. The industrial boom in China has led to the growth of chemical processing, food & beverage, and pharmaceutical industries, resulting in more applications of ceramic membranes.

The CFDA certification, which ensures compliance in the pharmaceutical industry, increases the demand for its high-purity filtration systems. Government programs promoting sustainable water management and pollution control have resulted in ceramic membranes being at the core of China’s clean water supply infrastructure.

Amidst the rapidly evolving landscape, the Australia & New Zealand ceramic membranes industry, driven by water conservation practices, increasing demand for food-grade filtration, and stringent water safety regulations, is poised to grow at a CAGR of 9.7% from 2025 to 2035.

In industrial and municipal segments, ceramic membranes are used in highly stable filtration standards that focus on meeting Australian Drinking Water Guidelines (ADWG) and the WaterMark Certification Scheme. The dairy industry is a big consumer of the industry, using ceramic membranes to separate the milk protein and produce cheese. Both nations are emphasizing sustainable water recycling and desalination projects, which will increase the need for energy-conserving, effective filtration systems.

The Indian ceramic membranes industry is expected to grow at a CAGR of 10.8% during the forecast period 2025 to 2035 due to an increase in the need for industrial wastewater treatment, rising pharmaceutical production, and increased demand from the dairy industry.

Central Pollution Control Board (CPCB) and BIS IS 10500 regulations are driving more and more industries to adopt ceramic membranes. India is becoming a growing industry for advanced filtration technology as the F&B processing and biotechnology sectors advance.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| The industry recorded moderate growth, supported by a rising demand for water and wastewater treatment solutions. | The industry is expected to grow at a healthy rate, owing to the stringent environmental laws and industrial sustainability initiatives. |

| The COVID-19 pandemic caused supply chain impacts, temporarily delaying manufacturing and project deployments. | The post-pandemic recovery and technological revolutions are driving widespread adoption across sectors. |

| Major application sectors were food & beverage, pharmaceuticals, and biotechnology. | Industry-leading sectors continued to see strong demand, with increased adoption in industrial water recycling and chemical processing. |

| Stricter regulations on industrial discharge and drinking water safety accelerated the adoption of ceramic membranes. | Tighter global water regulations and sustainability requirements will significantly contribute to further industry growth. |

| Manufacturing costs were too high, and awareness was poor in emerging industries. | Costs are expected to decrease as manufacturing efficiency improves and adoption increases in emerging economies. |

| Ultrafiltration and microfiltration technologies accounted for the largest segment of the industry. | The fastest growth is predicted in nanofiltration and hybrid membrane systems. |

Industrial policies, macroeconomic trends, and sustainability campaigns have a significant effect on the overall growth of the global ceramic membranes industry. Countries like China, India, and Southeast Asia, where industrial growth and rapid urbanization necessitate the use of next-generation filtration technology, have experienced significant growth in this industry.

The economies of matured nations announcing AI and IoT-based monitoring tools with the adoption of advanced technology and sophisticated filtration processes are the forerunners, including the United States, Germany, and Japan.

Increasing water scarcity and stricter pollution control regulations have driven investments in wastewater treatment plants for businesses and municipalities. This has made ceramic membranes an important part of clean water infrastructure. The need for high-purity filtration in the food and pharmaceutical industries is a major growth driver for both sectors.

Economic uncertainty, including fluctuating raw material prices and geopolitical challenges, is putting pressure on industry growth. However, increased government subsidies for clean water programs, advancements in nanotechnology, and increased R&D spending will create steady industry growth in 2025 to 2035.

The ceramic membranes industry's top players compete with the pricing model, technology innovations, strategic partnerships, and global expansion. Firms like Pall Corporation, Veolia, and Saint-Gobain invest in research to develop products that are low-energy focused and membranes with higher durability and efficiency. Nanostone Water and LiqTech focus on cost-effective solutions, serving industries that require scalable filtration systems.

Partnerships and acquisitions are key strategies where firms collaborate with water treatment companies and industrial players to enhance industry presence and achieve consolidation. Here, expansion into the emerging industries of India and Southeast Asia is accelerating as companies benefit from increasing industrialization coupled with greater demand for sustainable filtration technologies.

Industry Share

Pall Corporation (a subsidiary of Danaher Corporation)

Industry share: ~20-25%

Pall Corporation is a global leader in filtration, separation, and purification technologies, offering an advanced product portfolio and extensive R&D facilities for ceramic membranes. It focuses on water treatment, biopharmaceuticals, and industrial applications.

SUEZ Water Technologies & Solutions

Industry Share: ~15-20%

SUEZ is among the prominent players in the ceramic membranes industry, addressing the needs of the water and wastewater treatment. It has a strong industry position, especially in municipal and industrial sectors, by leveraging its international presence and alliances.

Veolia Environnement

Industry Share: ~10-15%

The other player, Veolia, is also worth mentioning as an important player in the ceramic membranes industry with a focus on the circular economy and sustainability solutions. Veolia also performed well in water treatment and management technologies, which helped it achieve a good industry share.

TAMI Industries

Industry Share: ~10-12%

TAMI Industries-a French company that specializes in ceramic membranes. The company trades in sectors such as food and beverage, pharmaceuticals, and chemicals.

Atech Innovations GmbH

Industry Share: ~8-10%

Atech Innovations Atech Innovations is a German company specializing in ceramic membrane solutions, offering a wide range of products for applications in process and environmental engineering. The firm develops high-performance membranes for gas and liquid filters.

LiqTech International, Inc.

Industry Share: ~5-8%

LiqTech is a Danish company that develops and manufactures ceramic membranes for water treatment, diesel particulate filters, and liquid filtration. LiqTech has been consolidating its presence in North America and Asia.

Metawater Co., Ltd.

Industry Share: ~5-7%

Metawater, a Japanese company, specializes in water and environmental infrastructure solutions, including ceramic membranes. Metawater already has a strong presence in the Asia-Pacific region with a focus on Japan and Southeast Asia.

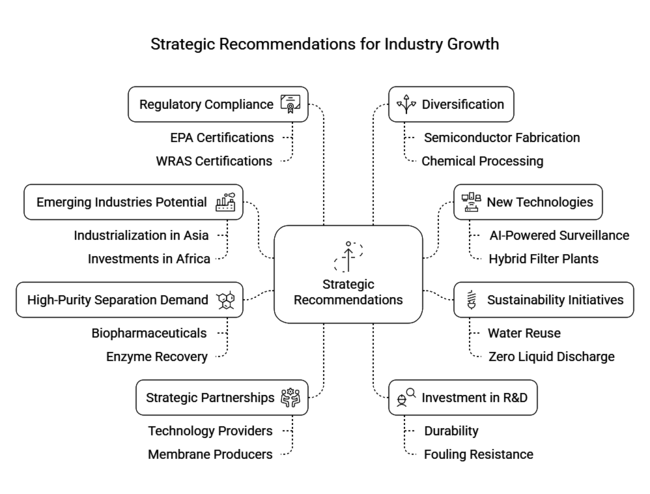

Emerging Industries Potentia - Industrialization in countries like India and Southeast Asia and rising public sector investments in water treatment plants in countries like Africa make economic growth look promising.

New Technologies - Using cutting-edge technologies like AI-powered surveillance, hybrid filter plants, and nanofiltration systems can greatly increase efficiency, which can help lower the cost of running the business.

Sustainability & Circular Economy Initiatives - Increasing focus on water reuse and ZLD systems is driving demand for long-lasting, energy-efficient ceramic membranes.

Increased demand for high-purity separation processes in biopharmaceuticals, enzyme recovery, and virus filtration is creating lucrative opportunities for pharmaceutical and biotechnology growth.

Strategic partnerships and M&A - Cooperation among technology providers, membrane producers, and water treatment companies can drive innovation and lend industry momentum.

Investment in R&D - Keeping the edge: Companies need to continue to drive R&D related to the development of membranes with higher durability and fouling resistance at lower cost.

Regulatory Compliance - Obtaining local certifications such as EPA, WRAS, CFDA, JWWA, and BIS is necessary for industry entry.

Diversification into High - Growth Segments-Entering industries such as semiconductor fabrication, chemical processing, and desalination can unlock new revenue opportunities.

Sustainable Manufacturing Practices - The carbon generation involved with the production of ceramic membranes can be minimized to suit international eco-friendly initiatives and consumers in search of maintainable alternatives.

Both initial and recurring revenue streams can be generated through aftersales and service offerings

These ceramic membranes are more robust, have better chemical resistance, have a long life, and make them suitable for aggressive industrial processes.

The sectors that depend on ceramic membranes for effective filtration are water purification, pharmaceuticals, food & beverage, biotechnology, and chemical processing.

While ultrafiltration removes larger molecules like proteins and bacteria, nanofiltration removes smaller particles like divalent salts and other small substances.

They promote water reuse, decrease waste generation, and increase energy efficiency, contributing to global sustainability goals.

Yes, many governments do subsidize, offer tax credits, and fund schemes to industries using advanced filtration methods.

The industry is segmented into alumina, zirconium oxide, titania, silica, and others

It is segmented among water & wastewater treatment, food & beverage, pharmaceuticals, biotechnology, and others

It is fragmented into ultrafiltration, microfiltration, nano-filtration, and others

The sector is studied across North America, Latin America, Europe, East Asia, South Asia, Oceania, and The Middle East & Africa.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.