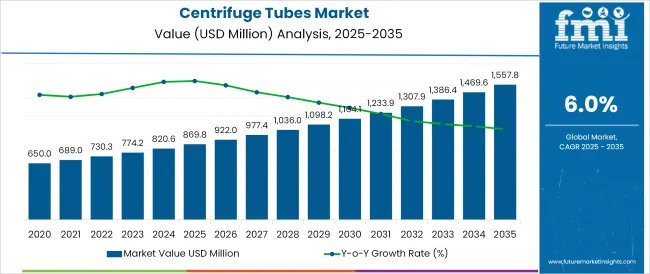

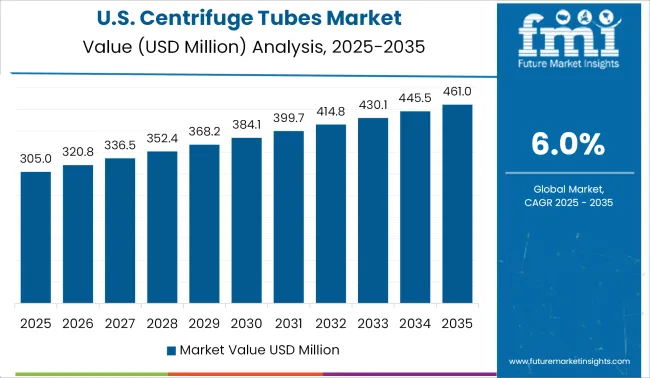

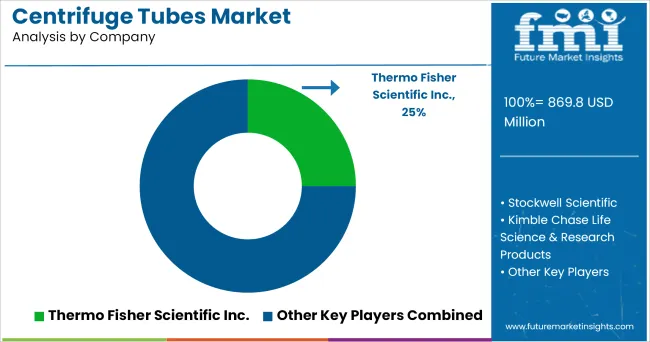

The Centrifuge Tubes Market is estimated to be valued at USD 869.8 million in 2025 and is projected to reach USD 1,557.8 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The centrifuge tubes market is witnessing steady growth, supported by rising demand from life sciences research, clinical diagnostics, and biopharmaceutical manufacturing. The shift toward precision medicine, expansion of molecular biology applications, and heightened focus on laboratory safety and contamination control are driving adoption of advanced tube formats.

Enhanced product quality, material innovations, and improved manufacturing practices have positioned centrifuge tubes as indispensable components in laboratories globally. Future growth is expected to be shaped by increasing investments in research and development, the proliferation of high-throughput testing, and stricter regulatory standards mandating reliable and contamination-free consumables.

The market outlook remains positive, as laboratories prioritize efficient workflows, sustainability considerations, and compliance with international quality norms, paving the way for technological enhancements and broader application coverage.

The market is segmented by Type, Base Shape, Cap Type, Capacity, Material, and End-use and region. By Type, the market is divided into Sterile, Heat Sterile, Gas Sterile, and Non-Sterile. In terms of Base Shape, the market is classified into Conical Base, Round Bottom Base, and Flat Bottom Base. Based on Cap Type, the market is segmented into Screw Cap and Ventilation Cap. By Capacity, the market is divided into Standard Centrifuge, Below 25 mL, 25-50 mL, 50-75 mL, Above 75 mL, Micro Centrifuge, Less than 1 mL, and 1-2 mL.

By Material, the market is segmented into Polypropylene, Glass, Polystyrene, PET (Polyethylene terephthalate), and Others. By End-use, the market is segmented into Hospitals, Biotechnology Industries, Pharmaceutical Industries, Pathological Laboratories, Academic & Research Institutes, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

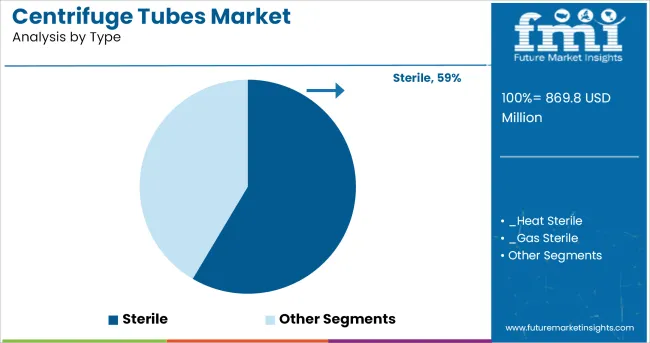

When segmented by type, sterile centrifuge tubes are projected to account for 58.5% of the market revenue in 2025, maintaining their leading position. This dominance is attributed to the critical requirement for contamination-free sample handling in clinical, pharmaceutical, and research settings.

Laboratories have increasingly adopted sterile tubes to ensure sample integrity, improve experimental accuracy, and comply with stringent quality and regulatory protocols. Sterile formats have been favored for their role in reducing the risk of cross-contamination and safeguarding against microbial interference, particularly in sensitive assays.

The convenience of ready-to-use sterile tubes has also contributed to their prominence by minimizing preparation time and enhancing operational efficiency. This strong preference for sterility in handling biological and chemical samples has firmly anchored this segment at the forefront of the market.

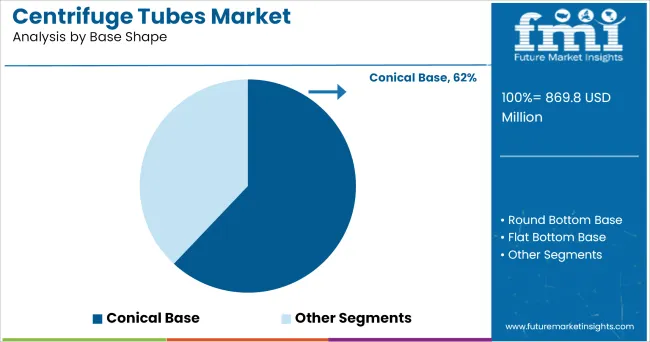

Segmenting by base shape reveals that conical base centrifuge tubes are expected to capture 62.0% of the market revenue in 2025, emerging as the leading configuration. This leadership has been driven by the functional advantages of conical bases in facilitating efficient sedimentation and easy recovery of pellets after centrifugation.

Laboratories have increasingly preferred conical designs for their ability to maximize sample recovery, minimize residue, and enhance clarity during separation procedures. The ergonomic compatibility of conical tubes with standard centrifuge rotors and racks has also reinforced their widespread adoption.

In high-throughput environments, the conical base has proven advantageous for handling small volumes with precision, thereby improving workflow reliability. These operational benefits have positioned conical base tubes as the preferred choice across diverse applications where accuracy and efficiency are paramount.

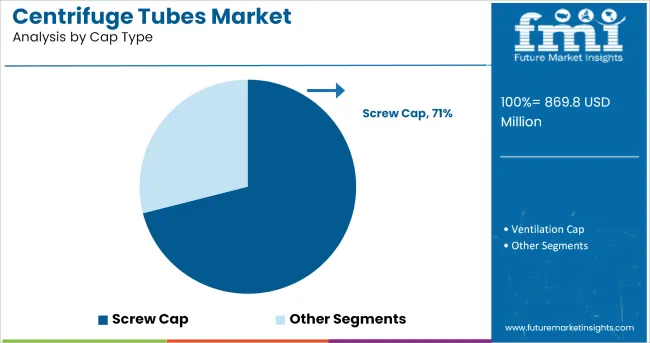

When segmented by cap type, screw cap centrifuge tubes are anticipated to hold a commanding 71.0% share of the market revenue in 2025, establishing themselves as the dominant closure system. This prominence stems from the superior sealing performance and leak-proof assurance offered by screw caps, which have become indispensable in both routine and critical laboratory procedures.

Laboratories have increasingly chosen screw cap tubes to ensure secure containment of samples, prevent evaporation, and maintain sterility during storage and transport. The durability and reusability of screw caps, along with their ability to withstand rigorous centrifugation forces and temperature fluctuations, have further reinforced their acceptance.

These attributes have made screw cap tubes the preferred option for long-term sample handling and compliance with safety protocols, solidifying their leadership within the market.

Due to the large number of R&D testing labs, hospitals, academic laboratories, and research institutes with superior state of the art facilities and technology, these countries have a promising demand of centrifuge tubes. Other aspects that may contribute to the market's growth include globalization, rising chronic disease prevalence, and increased need for disposable tubes in academic research.

At a CAGR of 5%, the global clinical laboratory services market is expected to reach USD 869.8 billion by 2025. The increased demand for early and accurate illness detection, growing public-private investments, and research funding and grants to create innovative laboratory testing equipment, as well as developments in clinical diagnostic techniques, are all propelling the market forward.

In every academic or scientific institute, centrifuge tube is one of the most crucial devices. They're utilized to separate biological fluids, cells, and other materials for a range of applications, including diagnosis and treatment. Academic institutions have embraced centrifuge tubes because they are cost effective and less time-consuming & easy cleaning processes.

In hospitals, disposable centrifuge tubes are used to collect blood samples. It's a one-time-use tube that doesn't require any pre- or post-use cleaning or sterilization. Owing to above mentioned factors the market for centrifuge tubes is expected to reach heights to high investment from government for enriching research and development.

Manufacturers of centrifuge tubes confront a number of problems, including:

Furthermore, due to protracted lockdowns and a scarcity of raw materials and labour, the emergence of coronavirus in 2024 has hindered industrial units, while the financial crisis slowed industry expansion even further.

Despite several challenges, the sector is improving, and new innovations, together with the recovery of end use industries, are projected to support demand growth in the near future.

Key industry participants from all over the globe are watching the United States, which is the prime country in North America's centrifuge tubes market. The United States is expected to maintain its lead over the predicted period, owing to its strong biotechnology and pharmaceutical sectors.

The global healthcare sector increased at a 7.3 percent compound annual growth rate (CAGR) to almost USD 8,452 billion in 2020, and is expected to grow at an 8.9 percent CAGR to over USD 11,908.9 billion by 2025. The United States presently tops the world in overall healthcare spending. In 2020, the United States spent USD 3.8 trillion for healthcare, accounting for 17.8% of its GDP.

Between 2020 and 2024, the United States spent USD 194.2 billion on medical and health research and development, up 6.4 percent. For the third year in a row, investment in medical and health R&D outpaced overall health spending. The aforementioned causes have fueled significant growth in the North American region over the evaluation period.

Some of the prominent players in the Centrifuge Tubes are

These players holds the substantial share of global centrifuge tubes market.

To supplement their product variety and create viable variants, players are turning to mergers and acquisitions and purposeful alliances as inorganic growth options.

Eppendorf AG and Koki Holdings Co., Ltd., for example, have agreed that, Eppendorf acquiring Koki's centrifuge business, which includes the premium Himac brand. Both corporations signed a comparable agreement in Tokyo.

Across the regional players, common organic growth tactics of enhancing centrifuge tubes efficiency, reliability, and other related applications have been observed. Moreover, the market for centrifuge tubes, appears to be comparatively open for business, as considerably more research is currently being undertaken, paving the way for the product's innovative growth.

Across the globe, key players are investing in and improving the durability of centrifuge tubes leading to gain potential market over the long run.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments.

The report also maps the qualitative impact of various market factors on market segments by product type, by end use industry type and by geographies.

The global centrifuge tubes market is estimated to be valued at USD 869.8 million in 2025.

The market size for the centrifuge tubes market is projected to reach USD 1,557.8 million by 2035.

The centrifuge tubes market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in centrifuge tubes market are sterile, heat sterile, gas sterile and non-sterile.

In terms of base shape, conical base segment to command 62.0% share in the centrifuge tubes market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA