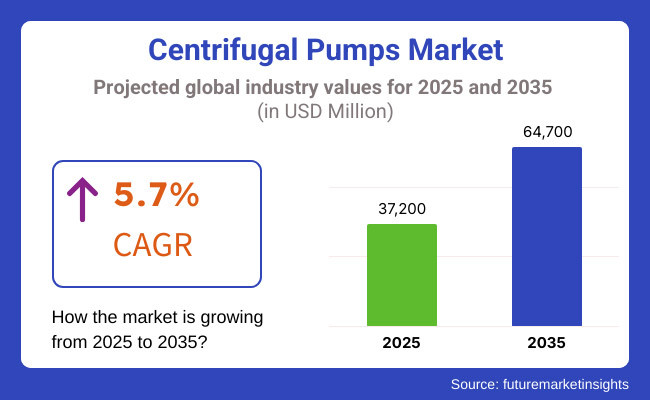

The market is projected to reach USD 37,200 Million in 2025 and is expected to grow to USD 64,700 Million by 2035, registering a CAGR of 5.7% over the forecast period. The integration of IoT in pump monitoring, expansion of the desalination industry, and increasing adoption of variable frequency drives (VFDs) in centrifugal pumps are shaping future growth.

The Centrifugal Pumps Market is expected to experience significant growth between 2025 and 2035, driven by rising demand in water treatment, increasing industrialization, and growing investments in oil & gas, chemical processing, and power generation. Centrifugal pumps, known for their efficiency, low maintenance, and wide application range, are essential in industries requiring fluid transfer, cooling, and circulation.

The market is also witnessing advancements in energy-efficient pumps, smart monitoring systems, and eco-friendly pump designs to meet sustainability goals.

Explore FMI!

Book a free demo

North America would account for a notable share in Centrifugal Pumps Market due to the growing spending in water and waste treatment; oil & gas exploration; and power generation and expansion plants.

The United States is the largest country in the region owing to increasing uptake in energy efficient pumps, regulatory policies fostering industrial sustainability, and growth of smart pump technologies.

The Environmental Protection Agency (EPA) and Department of Energy (DOE) are tightening the efficiency standards and applying strong pressure to the manufacturers to create the low-energyconsumption pumps with IoT-based remote monitoring and control systems.

Further market growth is also driven by upgrades to municipal water infrastructure and the broader use of corrosion-resistant pumps in chemical processing.

With industrial automation, renewable energy, and sustainable water management initiatives, Germany, the UK, France, and Italy account for a large portion of the European Centrifugal Pumps Market.

The energy efficiency regulations by the European Union (EU) are driving the demand for low-carbon high-efficiency centrifugal pumps in the industrial and commercial sectors.

With increasing applications of centrifugal pumps in HVAC system, smart irrigation, and district heating networks, the demand is further increasing. Furthermore, predictive maintenance solutions and Industry 4.0 investments fuel the creativity in smart IoT- and AI-based pump asset performance management.

The Asia-Pacific region is estimated to show the highest CAGR in the Centrifugal Pumps Market, due to rapid urbanization, increasing demand for clean water, and increased oil & gas refining capacities. Countries like China, India, Japan, and South Korea are at the forefront of infrastructure development, energy projects, and sophisticated industrial automation.

Growing investments in wastewater treatment plants and energy-efficient manufacturing in China are driving demand for high performance centrifugal pump. The centrifugal pumps usage is increased in the rural and urban water supply due to India’s expanding agriculture sector and smart irrigation projects.

In Japan and South Korea, something similar is taking place, with swimming for smart pump integration, AI-powered maintenance sites, and sustainable industrial processing technologies.

Challenges

High Energy Consumption and Maintenance Costs

High energy consumption especially in large scale industrial and municipal application is one of the major challenge faced by Centrifugal Pumps Market. Impellers, bearings and seals tend to wear out and require regular maintenance and repairs which add to operational expense as well.

Furthermore, the variable cost of basic materials for conscious elements of the pump (including forged iron, composite materials, and stainless steel) is expected to deliver pressure on the profit edge for the players. The disruptions in supply chains and availability of trained technicians for pump maintenance might pose challenges for market growth as well.

Opportunities

Smart Pump Technologies and Sustainability Initiatives

However, within the Centrifugal Pumps Market lies a story of burgeoning opportunities. Smart pumps with IoT sensors, AI-based fault detection, and remote monitoring features are promoting predictive maintenance, minimizing downtime, and enhancing efficiency.

The movement towards solar-powered and energy-efficient water pumps is ushering in new opportunities in agriculture, water desalination and off-grid water supply systems as well. Furthermore, the growing need for chemical-resistant and corrosion-proof pumps in industries such as pharmaceutical, food & beverage, and chemical processing is propelling material innovation in pump design.

This, coupled with the rising emphasis on sustainability and regulations regarding green energy across the globe, have compelled manufacturers to invest in green hydraulic products, leading to revenue generation across various setups.

From 2020 to 2024, the centrifugal pumps market grew consistently, thanks to increased demand for water treatment and industrial processing, along with energy-efficient fluid handling systems. Surge in urbanization and industrialization in Asia-pacific, North America, and Europe increased utilization of centrifugal pumps across the municipal water supply, sewage treatment, agriculture, and oil & gas industries.

From around October 2023, data-driven insights and advanced pump designs revealed high-efficiency pumps, adjustable speed drive (VFD) systems, along with corrosion-resistant materials that improved performance and durability.

The centrifugal pumps market will evolve with advanced AI-enabled predictive maintenance, smart IoT-connected pump systems, and energy-efficient hydraulic designs from 2025 to 2035. Moreover, AI-powered diagnostics and real-time condition monitoring can improve operational efficiency by decreasing downtime and energy consumption. 3D printing of pump components as well as nanocoatings for greater endurance will also spur innovation.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency standards, ISO 9906 performance testing, and EPA sustainability initiatives. |

| Technological Advancements | Growth in variable speed drives (VSD), corrosion-resistant alloys, and improved hydraulic efficiency. |

| Industry Applications | Used in water treatment, oil & gas, agriculture, pharmaceuticals, and HVAC systems. |

| Adoption of Smart Equipment | Integration of basic automation in pump operation and energy-efficient motors. |

| Sustainability & Cost Efficiency | Adoption of recyclable pump materials, energy-efficient systems, and digital twin technology. |

| Data Analytics & Predictive Modeling | Use of condition monitoring sensors and cloud-based analytics for performance tracking. |

| Production & Supply Chain Dynamics | Challenges in raw material sourcing, cost fluctuations, and import-export dependencies. |

| Market Growth Drivers | Growth fueled by industrial expansion, urbanization, and rising demand for efficient water management. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered regulatory compliance tracking, blockchain-based pump certification, and ultra-low-emission pump designs. |

| Technological Advancements | AI-driven predictive maintenance, IoT-integrated smart pumps, and nanomaterial-based pump coatings. |

| Industry Applications | Expanded into AI-powered real-time fluid management, decentralized smart irrigation, and next-gen desalination plants. |

| Adoption of Smart Equipment | Self-regulating pumps, AI-optimized performance monitoring, and smart water grid automation. |

| Sustainability & Cost Efficiency | Solar-powered pumps, AI-assisted energy savings, and decentralized eco-friendly water distribution networks. |

| Data Analytics & Predictive Modeling | AI-driven predictive maintenance, real-time pump efficiency optimization, and blockchain-backed supply chain analytics. |

| Production & Supply Chain Dynamics | 3D-printed pump components, AI-enhanced supply chain automation, and blockchain-based asset tracking. |

| Market Growth Drivers | Future expansion driven by AI-powered automation, ultra-efficient energy-saving pumps, and next-gen industrial process optimization. |

The Centrifugal Pumps Market in USA market is in a bullish cycle where the demand growth in the country is supported by rising infrastructure investments, increasing demand in water treatment applications and the expansion of industrial sectors including oil & gas, chemicals, and power generation. Strict water and wastewater management regulations, introduced by the USA Environmental Protection Agency (EPA) are promoting the implementation of high-efficiency centrifugal pumps in municipal and industrial applications.

Innovations that drive the sector include,Energy-efficient pump technology;VFD-controlled pumps;Smart monitoring systems. Furthermore, increasing demand for centrifugal pumps in desalination plants and agriculture irrigation due to the rise in government incentives for renewable energy projects and smart water management systems are anticipated to boost demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

The United Kingdom Centrifugal Pumps Market is growing owing to rising investments in water infrastructure, growing demand for energy-efficient pumping systems, and government-led sustainability initiatives. ADVERTISEMENTSThe UK Environment Agency is advocating for low-carbon, sustainable pumping solutions in a bid to enhance water and wastewater management across the industry.

The growth in demand for corrosion-free, high-efficiency centrifugal pumps in pharmaceuticals, food & beveridge and industrial processing business areas. Tech advancements Especially IoT-enabled pump monitoring solutions are helping businesses improve operational efficiency and minimize maintenance costs.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.5% |

The European Union Centrifugal Pumps market is anticipated to witness significant growth owing to strict environmental enforcement, growing industrial automation,and rising investments for renewable energy and water conservation projects. The Energy Efficiency Directive and the European Commission's Green Deal in Europe is adeptly driving the adoption rate of energy-efficient pumping technologies across a number of application genres, from waste water treatment, HVAC, and power generation.

Germany, France, and Italy are significant regional markets as well, and exhibit heavy investments in smarter water management, and chemical processing, and oil refining industries. Moreover, digitalized and AI-driven predictive maintenance solutions are fueling the need for smart centrifugal pump systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

The Japan Centrifugal Pumps Market is expanding on grounds of growing investments in smart water infrastructure, increasing demand in the electronics and semiconductor industries, and the rising adoption of precision-engineered pump systems. Japan's rapid innovation in energy-efficient technology of variable-speed or high-efficiency centrifugal pumps is being promoted by the Japanese Ministry of Economy, Trade, and Industry (METI) through supporting industrial automation and energy-efficient technology development.

Japanese manufacturers are increasingly focusing on small size, anti-corrosive and highly durable pump system requirements from industries including pharmaceuticals, food processing, and power generation. Furthermore, rising demand of smart monitoring and predictive maintenance systems improve efficiency and reliability of pumps.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

South Korea Centrifugal Pumps Market is intensely rising due to amplified investments in water treatment infrastructure, growing semiconductor and electronics sectors, and government subsidies for energy-efficient industrial solutions. In wastewater treatment and desalination plants, the South Korean Ministry of Environment are encouraging new pumping technologies for resource-efficient plants.

The OSDA (Open Smart Factory Demonstration), scheduled for May in South Korea, where Industry 4.0 and the automation of smart factories is a key focus area and the demand for digitally connected centrifugal pumps regularly monitored in real time and having an AI-based maintenance platform is being driven. Moreover, demand for PVC & battery manufacturing sectors due to EV growth is generating more demand for precision pump solutions in complex processing applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.0% |

Factors like growing industrialization, increased requirements for water and wastewater management, and expanding usage in oil and gas activities are fueling significant growth in the Centrifugal Pumps Market. Single stage pumps and multi stage pumps are the major product type which perfectly comprises of their respective characters of fluid transfer efficiency, cost effectiveness, and versatility to all industries.

The single stage centrifugal pumps are the most widely used pump due to their simple structure, ease of maintenance and economical. Single-stage pumps have a single impeller and casing, making them perfect for low to moderate pressure (low pressure) applications in industries such as water treatment, HVAC, food processing, and general industrial processes.

The single stage pumps market growth can be attributed to their high efficiency as compared to multi-stage pumps while handling clean water. Further, the implementation of energy-efficient pump designs and VFD integration are on the rise, leading to an improvement in performance and a lower total energy cost.

While these single stage pumps are versatile and can serve different purposes, they cannot be used for high pressure, which has limited their application in heavy duty industries like oil refining and extraction of water from deep wells. But the re-introduction of advanced impeller designs, corrosion-resistant materials, and smart monitoring systems is making them usable in increasingly demanding fluid-handling environments.

Multi stage centrifugal pumps find their applications in all industries that require the transfer of fluid at high pressure like power generation, chemical processing, water supply for tall buildings, etc. These are series of impellers which gives a higher pressure without losing efficiency.

As the demand for more efficient water desalination and boiler feed applications as well as enhanced oil recovery processes increase, so does the need for multi stage pumps with improved wear resistance and optimized hydraulic performance. Moreover, progress in automated control systems and real-time performance monitoring is improving their dependability and wear rate in vital operations.

However, high initial costs, greater maintenance complexity, and the reliance on skilled operators limit broad adoption. To solve these problem manufacturers are concentrating on modular pump design, self-priming, in addition to stronger coating materials to process life and lower working expense.

Industrial centrifugal pumps are currently dominating the market and find application across various industries including oil & gas, chemical processing, water & wastewater treatment, power generation and food & beverage. They play a critical role in fluid transfer, cooling processes, pressure boosting, as well as chemical handling for manufacturing, energy, and infrastructure projects.

As regulatory scrutiny of energy efficiency and eco-friendliness grows, manufacturers are rolling out smart, IoT-supported centrifugal pumps that maximize performance, detect faults in real-time, and help minimize energy loss. In addition, industrial players are also using corrosion-resistant materials, high-tech seals, and predictive maintenance solutions to extend pump life and reduce downtime.

Rising maintenance costs and danger of pump cavitation, as well as fluctuating prices of raw materials are hampering the adoption of industrial centrifugal pumps in the market. Continuous studies on advanced fluid dynamics, AI pump diagnostics and high-efficiency motor infusion will further enhance their operational stability and reduce costs.

The global demand for agricultural centrifugal pump is expected to grow due to rising importance for irrigation systems, groundwater extraction, and precise farming solutions. They help in the effective distribution of water and the watering of livestock and drain age systems, ensuring maximum crop yield and sustainable farming practices.

As water management is becoming crucial, farmers are increasingly turning to solar-powered centrifugal pumps and variable speed-driven irrigation pumps as cost-effective alternatives that help keep energy costs down. Government initiatives to promote rural electrification and sustainable water use further contribute to investments in modernized centrifugal pump technologies for agricultural applications.

These systems have benefits, however challenges in widespread adoption include pump wear from sediment-laden water, energy costs, and reliance on seasonal water supply. However, the cutting-edge technology of self-priming pump products, with the advent of remote irrigation monitoring systems, and eco-friendly pump materials will broaden its efficiency, affordability and long-term sustainability in agricultural applications.

The Centrifugal Pumps Market report provides information about the Global Industry, Trends, and Top Companies. Growing infrastructure development, increasing investments in energy sector, and the evolution of efficiency technologies for pumps all drive the market.

Companies are engaged in the development of high-performance energy-efficient and corrosion-resistant centrifugal pumps for improved fluid transfer efficiency, durability, and operational cost savings. This market is composed of major pump manufacturers, engineering companies, and industrial equipment suppliers, all of whom are aimed to provide technological advancements such as smart pumps, variable-speed drive, and predictive maintenance services.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Grundfos Holding A/S | 15-20% |

| Xylem Inc. | 12-16% |

| KSB SE & Co. KGaA | 10-14% |

| Sulzer Ltd. | 8-12% |

| Flowserve Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grundfos Holding A/S | Develops high-efficiency water and wastewater centrifugal pumps with digital monitoring systems. |

| Xylem Inc. | Specializes in smart pump solutions, energy-efficient water management, and industrial fluid transfer. |

| KSB SE & Co. KGaA | Manufactures corrosion-resistant centrifugal pumps for power plants, oil & gas, and chemical processing. |

| Sulzer Ltd. | Provides heavy-duty centrifugal pumps for industrial, marine, and oil refining applications. |

| Flowserve Corporation | Focuses on large-scale centrifugal pumps for power generation, petrochemicals, and wastewater treatment. |

Key Company Insights

Grundfos Holding A/S (15-20%)

Grundfos is the market leader for centrifugal pumps & features energy-efficient water pumps along with smart integrated IoT-based monitoring & control solutions.

Xylem Inc. (12-16%)

Xylem designs smart water infrastructure, including digitally connected centrifugal pumps for wastewater treatment and industrial applications.

KSB SE & Co. KGaA (10-14%)

KSB Manufacturer of Corrosion Resistant Centrifugal Pump for Power Generation, oil & gas and chemical industry.

Sulzer Ltd. (8-12%)

Sulzer designs high-efficiency centrifugal pumps for energy, marine, and industrial fluid handling applications.

Flowserve Corporation (6-10%)

Customized solutions for the petrochemicals, power, and municipal water sectors are provided by Flowserve, who uses its engineering expertise to produce large-scale centrifugal pumps.

Other Key Players (30-40% Combined)

Numerous industrial pump manufacturers, engineering companies, and providers of water treatment technologies play an important role in developing centrifugal pump efficiency, automation, and material durability. These include:

The overall market size for the Centrifugal Pumps Market was USD 37,200 Million in 2025.

The Centrifugal Pumps Market is expected to reach USD 64,700 Million in 2035.

Rising demand in water treatment, increasing applications in the oil & gas sector, and advancements in energy-efficient pump technologies will drive market growth.

The USA, China, India, Germany, and Brazil are key contributors.

Single-stage centrifugal pumps are expected to dominate due to their efficiency and widespread use in industrial and municipal applications.

Industrial Vacuum Evaporation Systems Market Analysis - Size & Industry Trends 2025 to 2035

Industrial Temperature Controller Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Power System Simulator Market Growth - Trends & Forecast 2025 to 2035

United States Plastic-to-fuel Market Growth - Trends & Forecast 2025 to 2035

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.