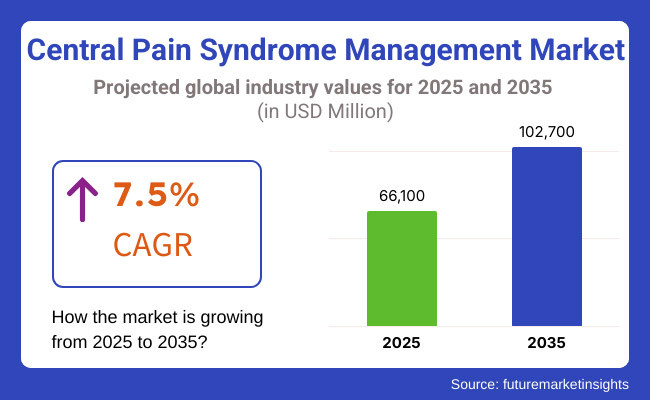

The market is projected to reach USD 66,100 Million in 2025 and is expected to grow to USD 1,02,700 Million by 2035, registering a CAGR of 7.5% over the forecast period. Increasing investments in personalized medicine, AI-powered pain diagnostics, and non-opioid pain relief solutions are further shaping the industry's future.

Additionally, rising adoption of deep brain stimulation (DBS), transcranial magnetic stimulation (TMS), and advancements in spinal cord stimulation (SCS) are expected to enhance treatment options.

The Central Pain Syndrome (CPS) Management Market is poised for significant growth between 2025 and 2035, primarily driven by the rising prevalence of neurological disorders and growing awareness of chronic pain management. CPS is a complex and debilitating condition caused by damage to the central nervous system (CNS), often associated with stroke, multiple sclerosis, spinal cord injuries or traumatic brain injury.

The burgeoning crowd of CPS sufferers, combined with huge numbers of elderly living alone who are more potential for neurological damage has driven demand for effective treatment options. Furthermore, advanced diagnostic techniques and patient awareness are leading to earlier identification and treatment, shifting attention to comprehensive long-term strategies for pain management.

Governments and medical organizations are playing a key role by funding research, and incorporating CPS treatments into national pain management schemes has thus helped lift the market further.

Factors accelerating this market include the growing acceptance of multimodal pain management bypasses multi-symptom medications, neural stimulators, and regenerative medicine. While medications such as opioids, anticonvulsants, and psychedelics that were initially developed to treat pain remain crucial in conventional pain relief, side effects and addiction have pushed people in the direction of more natural therapies.

Recently, stimulation techniques such as spinal cord stimulation reside (SCS) and transcranial magnetic stimulation (TMS) plus deep brain stimulation (DBS) are attracting notice due to their effects on how pain feels. In addition, researchers at home and abroad are intent upon pushing leaps forward in the treatment of long-term pain with stem cell therapy as well as gene therapy.

Explore FMI!

Book a free demo

North America will be the big driver of Central Pain Syndrome Management Market, mainly due to its well developed healthcare infrastructure, substantial R&D investment in pain management, and the increasing use of neuromodulation devices.

The USA and Canada are leaders in this situation: They both have a high prevalence rate for CPS cases, they are becoming more aware of Non-Opioid Pain Relief methods gradually as well as increasing insurance coverage for treating chronic pain.

The FDA’s approval of new neurostimulation devices and the increasing use of AI-driven pain assessment tools, digital therapeutics are driving this market up. In addition, major pharmaceutical companies and biotech companies are actively developing new regenerative treatments and novel drugs that can treat CPS (Chronic Persistent Pain).

Europe has long dominated sizable shares of the CPS Management Market, with nations including Germany, the United Kingdom, France, and Italy at the forefront of customized pain medicine, neurostimulation studies, and complementary solutions.

Both the European Pain Federation (EFIC) as well as government-led chronic pain administration programs are advocating for the usage of multidisciplinary pain treatment tactics, reducing reliance on opioids.

However, the growing adoption of wearable pain relief devices, AI-powered pain diagnostics apps, and telehealth-centered pain management is driving requirements for non-intrusive and targeted therapies.

Additionally, clinical trials in regenerative medical research, stem cell-founded nerve repair strategies, and gene treatment for CPS are amplifying choice of treatments.

New breakthroughs and partnership across countries continue propelling the region's leadership in personalized and technology-assisted agony administration.

The Asia-Pacific region is positioned to see the highest compound annual increase in the Chronic Pain Solutions Management industry owing to the rising frequency of neurological illnesses, consistently increasing healthcare costs, and a heightened cognizance of different chronic pain treatments.

Nations such as China, Japan, India, and South Korea are at the vanguard of pain exploration, neurorehabilitation plans integrating the newest technologies, and artificial intelligence-propelled analysis.

Meanwhile, many patients struggle with debilitating conditions while others respond well to multi-faceted remedies. Healthcare systems strive to complement cures with human sympathy and support.

China's flourishing biotechnology sector combined with government incentives promoting integrative medicine and complementary pain management are propelling market growth. Meanwhile, India's rapidly proliferating pain clinics and improved access to reasonably priced neurostimulation devices are broadening chronic pain treatment accessibility.

Additionally, Japan and South Korea are pioneering research delving into the interface between brain and machine, robot-assisted chronic ache direction, and artificially intelligent neurotherapy solutions tailored for each unique patient.

Challenges

High Treatment Costs and Limited Awareness

One of the prominent struggles in the Central Pain Syndrome Management Market is the steep costs for treatment, especially for sophisticated neurostimulation appliances and biological cures. Numerous sufferers, predominantly in low-income zones, have restricted access to cutting-edge agony administration innovations.

However, numerous general professionals lack comprehension regarding CPS, bringing about late determination and imperfect symptom administration, influencing treatment results. The complex pathways of central pain additionally make successful treatment problematic, as various interventions give just fractional alleviation of manifestations.

New advancements, similar to refined neurostimulators and targeted cell treatments, hold guarantee yet require expanded research and investment funds to turn into an attainable solution for a larger number of patients enduring from this perplexing condition.

Opportunities

AI-Powered Pain Management and Expansion in Non-Pharmacological Treatments

Despite the challenges, the Chronic Pain Solutions Management market presents momentous growth opportunities if we have the courage to embrace them. Revolutionary innovations such as artificially intelligent pain assessment devices, wearable neurostimulation technologies that interface directly with our nervous systems, and immersive virtual reality therapies for distraction and relief are giving patients new means for overcoming suffering and regaining independence.

Complementary modalities like acupuncture guided by electrical impulses, cell therapies that regenerate damaged tissues, and biofeedback strategies for modulating pain sensations in the brain continue gaining clinical validity. Moreover, the rise of personalized medicine tailored for each individual's unique biology, neural mapping at microscopic scales with AI, and precisely targeted neuromodulation revolutionize treatment possibilities.

The expansion of remote healthcare services delivered to wherever patients are, digital therapeutics personalized through software, and mobile health apps continuously engaging users in their recovery outside clinical settings additionally maximize participation and compliance with care plans.

Governments and medical organizations also fund groundbreaking research into neuroplasticity-dependent approaches for pain relief and noninvasive brain stimulation technologies, enhancing long-term solutions.

Between 2020 and 2024, there was solid growth in the central pain syndrome (CPS) management market. Increased public awareness of neuropathic pain disorders, alongside advancements in neurostimulation therapies and expanding pharmaceutical treatments, was responsible for this Central Pain Syndrome (CPS), a debilitating neurological condition caused by damage to the central nervous system (CNS) as a result of stroke, multiple sclerosis, spinal cord injury and traumatic brain injury, continued to be a major challenge for caregivers in view of few treatments and poor responses to even standard first-line painkillers.

Between 2025 and 2035, the management market for CPS will undergo dramatic changes through gene-based therapies, AI-powered precision pain medicine and bioelectronic neuromodulation systems.AI-powered pain assessment platforms can help increase early recognition and personalized treatment approaches, combining neuroimaging, genetic profiling, real-time pain monitoring to custom-tailored solutions for individual patients.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | FDA, EMA approval for neuropathic pain drugs, neurostimulation devices, and clinical trial guidelines. |

| Technological Advancements | Growth in anticonvulsants, antidepressants, opioid alternatives, and spinal cord stimulation (SCS). |

| Industry Applications | Used in stroke, multiple sclerosis, spinal cord injury, traumatic brain injury pain management. |

| Adoption of Smart Equipment | Increased use of neuromodulation devices, TMS, and physical therapy for pain relief. |

| Sustainability & Cost Efficiency | High costs of pain management therapies, opioid dependency, and limited reimbursement for neuromodulation. |

| Data Analytics & Predictive Modeling | Use of basic pain assessment scales and neuroimaging for pain detection. |

| Production & Supply Chain Dynamics | Challenges in high-cost neurostimulation device production, limited access to advanced CPS treatments. |

| Market Growth Drivers | Growth fueled by rising CPS prevalence, increasing investment in neuromodulation, and demand for non-opioid pain relief solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed personalized pain tracking, AI-powered regulatory compliance, and genetic-based pain therapy approvals. |

| Technological Advancements | AI-driven neuro-pain mapping, CRISPR-based neural repair, and smart wearable neurostimulation implants. |

| Industry Applications | Expanded into AI-powered real-time pain monitoring, neuroregenerative medicine, and digital therapeutics for CPS. |

| Adoption of Smart Equipment | Brain-computer interfaces (BCIs), real-time AI-driven pain modulation, and at-home bioelectronic pain therapy solutions. |

| Sustainability & Cost Efficiency | AI-optimized pain therapy cost reduction, decentralized neuromodulation clinics, and gene-based regenerative pain treatments. |

| Data Analytics & Predictive Modeling | AI-powered real-time pain biomarker tracking, blockchain-enabled pain treatment records, and predictive AI pain progression modeling. |

| Production & Supply Chain Dynamics | AI-enhanced neurodevice manufacturing, decentralized pain management therapy hubs, and precision pain medicine supply chains. |

| Market Growth Drivers | Future expansion driven by AI-powered personalized pain diagnostics, bioelectronic pain management, and regenerative neural therapy breakthroughs. |

In the United States, the Central Pain Syndrome (CPS) Management Market is on a steady growth curve, thanks to increasing cases of neurological disorders, higher adoption rates of high-level pain management therapies and government support that remains strong for chronic pain research.

At the behest of the National Institutes of Health (NIH) and the Food and Drug Administration (FDA), non-opioid treatments for neuropathic pain are actively funded through clinical practice promotion programs both here at home overseas.

At the same time, the broader spectrum of conditions nanostructured neuro & delirium also becomes a part of its treatment efforts. Applying antidepressants, antiepileptics and NMDA receptor inhibitors for central pain syndromes treatment has significantly riven market demand. Also, improvements in techniques for Spinal Cord Stimulation(S CS), Transcranial Magnetic Stimulation (TMS), Deep Brain Stimulation(DBS), and so forth are developing completely new channels of refinement.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

Due to increased awareness of chronic pain conditions and greater access to treatments for neuropathic pain in the United Kingdom as well as government research initiatives that have been backed by government, Central Pain Syndrome Management Markets generally in the United Kingdom are booming.

In personal words, the National Health Service (NHS) and the National Institute for Health and Care Excellence (NICE). Therefore they say multi-modal pain control includes cognitive behavioral therapy (CBT), physical rehabilitation and pharmacologic treatments.

The need for alternatives to opioids and non-invasive neuromodulation therapies is promoting the use of nerve blocks, spinal cord stimulators and biofeedback techniques in treating chronic pain syndromes. Moreover, the expansion of specialized pain clinics is providing a greater opportunity to perform personalized care on such sufferers.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The Central Pain Syndrome Management Market across European nations has observed stable growth owing to a rising occurrence of post-stroke and multiple sclerosis-induced suffering, innovations in alleviation apparatuses, and supportive medical policies. Both the European Medicines Agency and Horizon Europe financing program are promoting exploration into targeted pain relief therapies as well as next-generation neurostimulation devices.

Germany, Italy, and France guide the industry, with healthcare providers incorporating a mix of therapies comprising medicinal treatments, physiotherapy, and non-evasive neuromodulation methods. Moreover, the enlargement of patient assistance plans for neuropathic suffering disorders is bettering accessibility to care.

Additionally, certain facilities are exploring brief intensive treatment options alongside standard multi-week outpatient programs for particular neuropathic anguish, which has demonstrated promise.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.5% |

The expanding Central Pain Syndrome Management Market in Japan has been fueled by the nation's aging population along with higher incidences of stroke-induced central pain syndrome. Growing precision medicine initiatives are also contributing factors.

The Ministry of Health, Labour, and Welfare support for cutting-edge chronic pain research is exemplified through backing for AI-driven diagnostic tools and wearable neurostimulation technologies. Meanwhile, Japanese pharmaceutical firms are progressing novel NMDA receptor impeding drugs, TRPV1 antagonists, and cannabinoid treatments for central pain syndrome management.

In addition, robotic rehabilitation adoption and AI-powered assessment platforms are advancing customized treatment planning for individuals experiencing pain. Advanced solutions are enhancing quality of life for many throughout the country's overburdened healthcare system.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The burgeoning Central Pain Syndrome Management sector in South Korea has witnessed moderate growth in recent years, driven by escalating investments toward innovative pain research endeavors as well as a rising populace demanding alternative therapeutic solutions for agony. To cultivate the employment of non-opioid pain relievers and cutting-edge neuromodulation innovations, the South Korean Ministry of Food and Drug Safety has championed promotion of such means.

Throughout the nation, numerous South Korean biotech firms and hospitals have begun merging artificial intelligence-powered pain evaluation algorithms, digital technologies such as virtual reality to assist pain therapy, and regenerative medical approaches to enhance long-term outcomes regarding management of pain.

Furthermore, the rising adoption of home-based neuromodulation gadgets has provided patients with easier access to non-invasive Central Pain Syndrome treatments, giving them greater autonomy in handling their persistent pain.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

The Central Pain Syndrome marketplace continues to develop largely because of the rising frequency of neuropathic suffering, increasing cognizance of persistent suffering administration, and innovations in neuropharmacology.

Amongst the numerous pharmaceutical categories, antidepressants and anticonvulsants rule the industry by offering helpful symptom regulation, better suffering modulation, and an elevated calibre of living for patients. Meanwhile, healthcare professionals aim to optimize remedies and outcomes via a custom-fitted interdisciplinary strategy that addresses both physiological and psychological elements.

Central pain syndrome management relies substantially on antidepressants, for they recalibrate neurotransmitter function, decrease sensed agony, and elevate related melancholy and unease. Specifically, serotonin-norepinephrine reuptake inhibitors and tricyclic antidepressants, oft prescribed, with duloxetine and amitriptyline pervasively applied for neurogenic suffering succor.

Furthermore, SNRIs seem most competent for ongoing therapy, as TCAs may cause troublesome unintended effects. Duloxetine has shown considerable capability in frequent dosages to assuage soreness and mitigate the despair and anxiety which so usually accompany this condition.

The rising preference for antidepressants in handling CPS stems from their twin rewards, where they not solely alleviate lasting pain yet to address the psychological distress related to CPS. Additionally, their long-term efficacy, cost-effectiveness, and widespread availability construct them a usual initial treatment alternative.

Despite their healing benefits, side consequences such as dizziness, weight gain, and sedation remain challenges. However, enhancements in discriminating antidepressants with fewer adverse effects, individualized dosing schedules, and AI-assisted medicine development are improving results for CPS patients.

Neurogenic pain conditions such as thalamalgia respond particularly well to anticonvulsant drugs, which help to cure the pain by fixing the neuronal signaling. It additionally suppresses that excessive excitement, thus preventing symptoms from starting up again. Medicines such as gabapentin and Pregabalin can have a remarkable effect on nerve-generated sufferance associated with CPS. They improve sleep quality and aids in daily performance.

Clinical reviews increasingly endorse the strategic use of anticonvulsants for CPS therapy owing to evidence of their proficiency in diminishing intensity of pain, especially in post-stroke and spinal cord injury patients. Moreover, a dual treatment method combining antidepressants and anticonvulsants is rapidly becoming a preferred approach for achieving superior alleviation and amplified response rates among individuals.

However, drowsiness, dizziness, and the risks of forming a dependence represent complications in long-term administration. The advancement of next-generation neuropathic analgesics with reduced adverse effects, extended-release formulations, and customized medicine methods is anticipated to stimulate further innovations in managing CPS.

The demand for CPS treatment is influenced by route of administration preferences, with oral and intravenous (IV) formulations being the most commonly utilized delivery methods.

Antidepressants and anticonvulsants principally come as oral formulations, permitting self-care and better adherence to healing plans. The predominance of pills for CPS management offers benefit, simplicity of use, and suitability for long-lasting cure. Furthermore, the need for oral neuropathic suffering medications is fuelled by drug advances in sustained-launch tablets, combined therapy formulas, and enhanced bioavailability of active fixings.

In addition, rising adoption of telemedicine and web pharmacy services expands access to oral CPS treatments. However, delayed effect onset, changeable absorption rates, and gastrointestinal side consequences stay issues for some patients. Innovations in speedy-acting, dissolvable, and prolonged-release oral drug models are addressing these difficulties, boosting the power of treatments by mouth.

The progressing embracement of telehealth and online pharmacies has moreover amplified access to solutions.

Intravenous (IV) medications have increasingly been utilized in severe CPS cases where prompt agony help is expected, or when oral organization is inadequate. IV-administered anticonvulsants and depressants give quick medication retention, focused on agony adjustment, and upgraded bioaccessibility, making them suitable for clinic patients and those experiencing intense agony administration.

The expanding acknowledgement of IV treatment in torment the board centers and particular neurologic treatment focuses is driving development in this portion. What's more, inquire about into novel IV agony help advances, including ketamine infusions and natural treatments, is extending CPS treatment choices. The rising use of IV treatment has led to speedier and more centered agony help.

Notwithstanding, higher expenses, the need for restorative supervision, and disturbing organization hindrances limit IV use for long haul treatment. Examinations into patient-accommodating infusion gadgets and home-based IV organization administrations could expand open doors for constant IV treatment.

The Central Pain Syndrome (CPS) Management industry is growing due to an increasing occurrence of neuropathic agony issues, innovations in torment administration therapies, and developing exploration into novel treatment methodologies. This commercial center is driven by expanding interest for multimodal torment treatment, advancement of non-opioid analgesics, and headways in neuromodulation innovations.

Organizations center around pharmaceutical treatments, restorative gadgets, and optional medicines to upgrade agony help, patient consistence, and long haul side effect administration.

This commercial center incorporates driving pharma firms, restorative gadget producers, and specialized torment the executives suppliers, every one adding to progressions in focused on medication conveyance, spine string energizing, and non-invasive agony adjustment procedures. Some leading companies invest substantial resources in clinical trials for new analgesic drugs and devices targeting specific pain pathways.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer Inc. | 18-22% |

| Eli Lilly and Company | 12-16% |

| Abbott Laboratories | 10-14% |

| Boston Scientific Corporation | 8-12% |

| Medtronic plc | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer Inc. | Develops neuropathic pain medications such as pregabalin (Lyrica) for CPS treatment. |

| Eli Lilly and Company | Specializes in serotonin-norepinephrine reuptake inhibitors (SNRIs) like duloxetine (Cymbalta) for chronic pain management. |

| Abbott Laboratories | Manufactures spinal cord stimulation (SCS) devices and neuromodulation systems for pain relief. |

| Boston Scientific Corporation | Provides advanced deep brain stimulation and pain-modulating implants for CPS patients. |

| Medtronic plc | Focuses on implantable pain management devices, including spinal cord stimulators for neuropathic pain control. |

Key Company Insights

Pfizer Inc. (18-22%)

Pfizer is a leader in neuropathic pain medication, offering pregabalin (Lyrica) and gabapentin-based therapies for CPS symptom relief.

Eli Lilly and Company (12-16%)

Eli Lilly specializes in serotonin-norepinephrine reuptake inhibitors (SNRIs) such as duloxetine (Cymbalta) to manage chronic central pain conditions.

Abbott Laboratories (10-14%)

Abbott develops spinal cord stimulation (SCS) and neuromodulation devices, providing non-pharmacological pain relief for CPS patients.

Boston Scientific Corporation (8-12%)

Boston Scientific focuses on deep brain stimulation (DBS) and peripheral nerve stimulation (PNS) devices for long-term central pain management.

Medtronic plc (6-10%)

Medtronic offers implantable pain management technologies, including spinal cord stimulators and targeted drug delivery systems.

Other Key Players (30-40% Combined)

Several biopharmaceutical firms, medical device companies, and alternative therapy providers contribute to advancements in CPS treatment, non-invasive neuromodulation, and personalized pain management. These include:

The overall market size for the Central Pain Syndrome Management Market was USD 66,100 Million in 2025.

The Central Pain Syndrome Management Market is expected to reach USD 1,02,700 Million in 2035.

Increasing prevalence of neurological disorders, advancements in pain management therapies, and rising demand for non-opioid treatment options will drive market growth.

The USA, Germany, China, Japan, and France are key contributors.

Pharmacological treatments, particularly anticonvulsants and antidepressants, are expected to dominate due to their efficacy in managing chronic neuropathic pain.

The Spinal Fusion Market is segmented by Product, Procedure and End User from 2025 to 2035

The Laser Therapy Devices Market is segmented by Device Type and End User from 2025 to 2035

The Dementia Care Products Market is segmented by Memory Exercise & Activity Products, Daily Reminder Products and Dining Aids from 2025 to 2035

The Intraoperative Radiation Therapy Systems Market Is Segmented by Disease Indication and End User from 2025 To 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

The Stabilometric Platform Market Is Segmented by Types and End User from 2025 To 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.