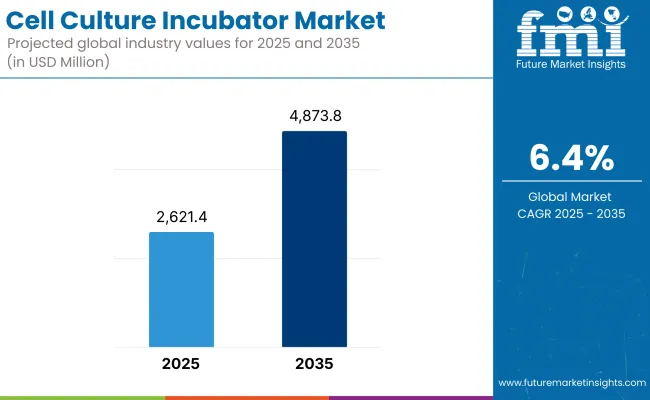

The cell culture incubator market is expected to reach approximately USD 2,621.4 million in 2025 and expand to around USD 4,873.8 million by 2035, reflecting a compound annual growth rate (CAGR) of 6.4% over the forecast period.

Cell culture incubators are projected to grow at a steady rate in the year 2025, and by 2035, the market will see exponential growth due to the growing demand for cell-based research in various industries such as drug development, regenerative medicine, vaccine production, and biomanufacturing.

Cell culture incubators create the optimum conditions needed to allow the growth of cells and tissues, which are vital for academic research, pharmaceutical screening and development, as well as industrial biotechnology. Further growth factors comprise the emergence of biologics and biosimilars, the extension of stem cell research, and technological developments in incubator design including CO2 monitoring, oxygen regulation, and contamination control.

Automation trends and integration with data management systems in order to enhance reproducibility are also aiding the market. Obstacles like high costs, maintenance requirements and low uptake in low-resource labs remain but a rise in investment for R&D and the global spread of healthcare is driving the market.

Key Market Metrics

| Metric | Value (USD Million) |

|---|---|

| Industry Size (2025E) | USD 2,621.4 Million |

| Industry Value (2035F) | USD 4,873.8 Million |

| CAGR (2025 to 2035) | 6.4% |

Cell culture incubator market has doings evolution, wherein devices are being use of as a solution in research, and bioproduction settings. Initially, the need was largely limited to academic institutions and basic research labs based on traditional CO₂ incubators for general cell culture applications. As increased investment in biotechnology, widening applications in drug development, and growing interest in regenerative medicine and immunotherapy drove market maturation.

This change increased demand for more sophisticated, automated, and contamination-free incubators. Market progress has included the adoption of air-jacketed and water-jacketed systems, multi-gas and hypoxia configurations to enable more advanced systems with multiple gas and nutrient levels. Regular technological advancements accompanied by increasing biopharmaceutical manufacturing capacity also played a major role in driving the evolution of the market into a key segment of life sciences infrastructure.

North America is predicted to dominate the cell culture incubators market owing to the established biopharmaceutical and biotechnology industries in the region, well-established academic research infrastructure and considerable amount of funding for life sciences.

The United States, being the largest contributor, backed by increasing demand for personalized medicine, cell-based therapies, and advanced cancer research. The presence of key participants in the market coupled with incessant technological advancement, particularly the automation and energy-efficient incubators, are fueling market penetration.

In addition, government endeavors supporting cell and gene therapy research are contributing to the growth of this market. The increasing awareness, highly trained professionals, and rapid regulatory framework in North America promote innovation and preserve quality standards, making North America an essential driver for the development of new technologies in cell culture.

Given the well-established pharmaceutical industry, growing global research in regenerative medicine, and supporting government funding, Europe accounts for a major share in the overall global cell culture incubator market. You have countries such as Germany, the United Kingdom, France which are in Vanguard, focused on academic cooperation in areas such as stem cell therapy and vaccine research.

Demand for technologically advanced and reliable incubators is driven by regulatory framework, which promotes laboratory safety and clinical research. Similarly, European institutions are investing in automated solutions to both increase laboratory productivity and minimize the chances of contamination. As demand for cell therapy and cancer biology begins to increase, the region is anticipated to witness sustained uptake of next-generation incubators enabling high-precision environmental control over sensitive cell cultures.

The cell culture incubator market in the Asia-Pacific region is projected to grow at the fastest rate owing to the growing biotechnology industries in these countries, increased investments in pharmaceutical R&D, and the rising adoption of cell-based research in China, India, Japan, and South Korea. The growth of advanced incubators is accelerated by government support for biotech innovation and the building of new biomanufacturing hubs.

Moreover, the rise of chronic diseases is increasing the interest in personalized medicine and regenerative therapies that need a stable cell culture background. Increasing collaboration between academia and industry, developing research capabilities, and international players entering the regional market are accelerating growth further. The trend toward automation and digitized lab environments is also gaining traction, further supporting the broader acceptance of intelligent incubator systems.

One of The Significant Restraints in The Cell Culture Incubator Market Is the Persistent Risk of Contamination.

The contamination risk and potential operational mistakes are major restraints on the market of the cell culture incubators as they can jeopardize the integrity of cell cultures. Precise management of temperature, CO₂, humidity and oxygen levels in a controlled and sterile environment is critical to the success of cell culture. Even slight differences can be caused by malfunction, misoperation, undermaintenance of equipment which can lead to microbial contamination or insufficient cell cultivation.

These directly impact experimental outcomes and reproducibility but also have massive financial implications in terms of wasted reagents, time, and labor [5]. Moreover, contamination events not only delay research timelines and jeopardize regulatory compliance in biopharmaceutical and clinical production environments, but also prevent broader adoption.

The Growing Emphasis On Stem Cell Research Presents a Significant Opportunity for The Cell Culture Incubator Market.

Stem cell research, cancer biology, and immunotherapeutics are increasingly under focus, which will likely present a large number of prospects for the cell culture incubator market. Regenerative therapies based on stem cells and precision oncology approaches are demanding cel types that, for their, need sensitive and complex in vitro environments. These applications demand incubators capable of tightly controlling temperature, CO₂, O₂, and humidity to maximize cell viability, differentiation, and functionality.

Investors and biopharmaceuticals know the urgent need for effective high-performance incubators because research institutions and biopharmaceutical companies are all doubling down on new processes for targeted therapies. The increasing incidence and prevalence of diseases, intensive clinical trials, and translational research further drive the growth of this lucrative market over the forecast period, as the need for sterility, reproducibility, and consistency leads to a higher need for cell culture incubators than ever before.

Multi-gas and Hypoxia Incubators

The increasing number of advanced cell culture requirements is driving the uptake of multi-gas and hypoxia incubators, especially, in oncology, and stem cell research. Beyond precisely regulating CO₂ and humidity levels, these incubators allow for accurate control of oxygen levels [9], which is paramount for recapitulating physiological or pathological environments (e.g., tumor microenvironments or hypoxic niches for stem cell maintenance [15]).

Hypoxia incubators are essential for cancer progression, metastasis and drug resistance research to better simulate physiological environment in vivo. As increasingly personalized medicine approaches, immunotherapies and regenerative treatments are on the rise, the demand for incubators facilitating low-oxygen culture environments is becoming even larger across gaily laboratories and clinical studies facilities.

Contamination Remains a Critical Concern in Cell Culture.

Contamination is still a vital threat to cell culture, particularly in high-stakes areas such as biopharmaceutical production, stem cell research, and clinical diagnostics. Contamination control technologies are becoming more prevalent in modern cell culture incubators to prevent this issue. HEPA filtration systems maintain particle-free air circulation, for example, while UV sterilisation provides regular decontamination without interrupting workflows.

The antimicrobial interiors and seamless designs of the chambers help to reduce the growth of microbes and make cleaning our units easy. He said "These innovations greatly minimize the potential for cross-contamination, leading to increased experimental reliability and overall productivity. With the research protocols becoming more sensitive, there is likely to be an increased demand for such sterile, high-performance incubators.

In the cell culture incubator market, steady growth was projected between 2020 and 2024 owing to the increasing adoption of cell culture techniques in research and biopharmaceutical manufacturing. Technological advancements in incubators like CO₂ and hypoxia incubators helped in achieving efficiency and reliability in cell culture processes. However, the market has encountered challenges, with high equipment costs, tight regulatory standards, and a lack of skilled personnel limiting wider adoption.

Looking ahead to 2025 to 2035, market growth will be sustained as biopharmaceutical innovation continues and investment in R&D increases. Automation and intelligence: An incubator with advanced monitoring means that cell culture processes would also be streamlined. Moreover, increasing applications in vaccine development, cancer research and regenerative medicine, as well as rising partnerships between academia and industry, are expected to supplement the demand in the market.

| Market Aspect | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Implementation of strict guidelines for the safety, efficacy, and quality of cell culture incubators as a means of standardization and increased oversight. |

| Technological Advancements | Introduction of new types of incubators, namely CO₂ incubators, shaking incubators, hypoxia incubators, increasing the efficiency and reliability of cell culture processes |

| Consumer Demand | Strong increasing dependence of cell culture incubators for bioproduction, drug discovery, and academic research with good and dependable cell-based assays and production systems. |

| Market Growth Drivers | Rising demand for biologics and biosimilars; advancement in cell culture technologies; and increase in outsourcing of cell culture activities to dedicated service providers. |

| Sustainability | Initial steps toward sustainable practices in incubator manufacturing, from energy-efficient designs through waste reductions in laboratory processes. |

| Supply Chain Dynamics | Dependence on specialist suppliers for high-quality incubators and parts, along with maximum efforts to keep them consistently available in changing regulatory conditions and demands. |

| Market Aspect | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Continual monitoring and possible harmonization of regulations across countries on safety and innovation with fast-track approvals for new incubator technologies addressing throbbing unmet research and clinical needs. |

| Technological Advancements | Development automated and intelligent incubators that will have advanced monitoring and control systems, thereby improving the precision, reproducibility, and scalability of cell culture processes and facilitating complex cell-based models and therapies. |

| Consumer Demand | Rapidly gaining popularity for their customizability and scalability, driven by the on-going development of personalized medicine and interest in patient-specific therapies, and likely to be used broadly over a range of therapeutic areas and research applications. |

| Market Growth Drivers | Biopharmaceutical pipelines on expansion, raising the investment ceiling for regenerative medicine and gene therapy, along with increasingly improving and disruptive innovations that enhance the efficiency of cell culture technology. |

| Sustainability | Implementation of green technology and sustainable manufacturing processes as a response to global sustainability initiatives that aim to reduce the environmental footprint of cell culture activities. |

| Supply Chain Dynamics | Strengthening of local manufacturing capabilities and diversification of supply sources to enhance supply chain resilience and reduce reliance on imports while meeting evolving regulatory standards and increasing demand for cell culture incubators across regions. |

Market Outlook

United States is the single largest and most technologically advanced market of cell culture incubators owing to strong biopharmaceutical production as well as advanced academia and extensive government and private expenditure in life sciences. The presence of leading players operating in the incubator market, well-defined and implementable infrastructure in hospitals, and a strong focus on regenerative medicine and personalized therapies are further contributing to the growth of the incubator market.

Rapid increase in cell-based research particularly within the domain of cancer, immunology, and vaccine development continues to generate the demand for technologically advanced and contamination resistant incubators. Furthermore, increasing emergence of automation and smart laboratory equipment is expediting the transition towards next generation incubators equipped with remote monitoring, energy efficient and advanced environmental control features.

Market Growth Factors

Market Forecast

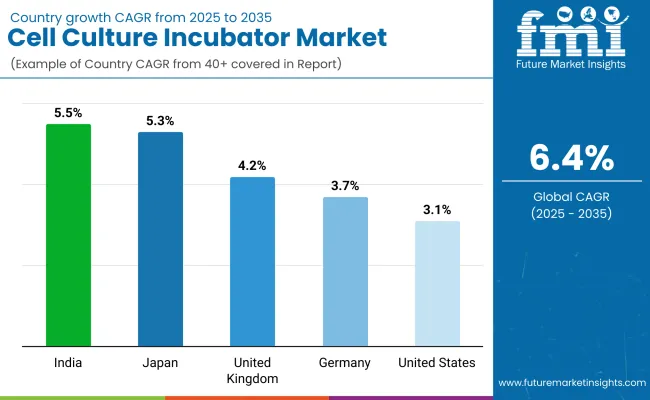

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.1% |

Market Outlook

Germany is a leading market for cell culture incubators in Europe, backed by a strong pharmaceutical and biotechnology sector, renowned research institutions, and significant government support for life sciences innovation. The country is a hub for stem cell and cancer research, creating steady demand for high-precision incubators with controlled environmental settings. German laboratories emphasize quality, sterility, and automation, increasing the preference for multi-gas, hypoxia, and contamination-resistant incubator models.

Moreover, Germany's role in EU-funded collaborative research programs and its push toward personalized medicine are strengthening market dynamics. As biomanufacturing capacity expands and academic-industry partnerships grow, the demand for smart, scalable incubator solutions is set to rise steadily.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.7% |

Market Outlook

The United Kingdom presents a mature and innovation-driven market for cell culture incubators, fueled by a thriving biotechnology sector, substantial academic research, and active investment in precision medicine. With a strong focus on stem cell therapy, cancer biology, and biologics development, UK-based institutions increasingly require advanced incubators that offer tight environmental control, reduced contamination risk, and automation capabilities.

Supportive regulatory policies and funding from organizations like UKRI and NIHR bolster ongoing life sciences research. Additionally, the country's emphasis on translational research and public-private collaboration supports market growth. As the UK accelerates its role in post-Brexit biotech leadership, the need for high-performance incubators is expected to continue growing.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

Market Outlook

The cell culture incubator market in Japan is known for high technology adoption with strong detection and research abilities and a well-developed pharmaceutical industry. With a focus on regenerative medicine, stem cell therapies and translational research, the country needs exact, contamination-free cell culture environments. Japanese manufacturers lead the pack on incubator innovations, often integrating automation, energy efficiency, and monitoring systems.

Laboratory expansions across academia and industry are being fueled by supportive governmental policies, such as funding for personalized medicine and biotech infrastructure. As such, Japan is leading the way in intelligent and high-performance incubator technologies, driven by the rising demand for bioprocessing tools that are both safe and efficient.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

Market Outlook

India’s cell culture incubator market is rapidly evolving, driven by growing investments in biotechnology, rising pharmaceutical R&D activities, and an expanding clinical research sector. The country’s increasing involvement in vaccine production, biosimilars, and stem cell research is creating strong demand for reliable and cost-effective incubator systems. Although infrastructure gaps and regulatory complexities present some challenges, government initiatives such as “Make in India” and support for biotech innovation are enhancing market prospects.

Domestic manufacturers are also beginning to offer affordable incubator solutions tailored to local needs. As academic-industry collaboration intensifies and research capabilities improve, India is poised to become a significant growth contributor to the global cell culture incubator market.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.5% |

Air-Jacketed Incubators Dominate the Market Due to Their Faster Temperature Recovery.

Air jacketed incubators rule the roost in the market with their rapid temperature recovery, energy efficiency, and less requirement of maintenance. Unlike water-jacketed models, these types warm the chamber through circulated warm air, yielding faster equilibration after door openings, a key determinant of culture integrity.

They’re also lighter, simpler to install, and don’t need water refilling, which limits the chances of leaks or microbial growth occurring within the jacket. Today's air-jacketed incubators are inherently stable, with the latest temperature and CO₂ uniformity innovation, so they are good choices for both routine research and both cell-based assay and clinical laboratories where usability and consistency in performance are the hallmarks.

Water-Jacketed Incubators Have Maintained a Strong Presence in The Market Because of Their Superior Thermal Stability.

Water-jacketed incubators have maintained a strong presence in the market because of their superior thermal stability and protection against temperature fluctuations and power outages. The water jacket serves as a thermal buffer to provide consistent heat distribution within the chamber regardless of external environment fluctuations.

Such features make them particularly suited for long term cultures, sensitive experiments and facilities with unreliable power. Despite being bulky and needing more maintenance, they are the best choice when it comes to precision temperature control due to their reliability and successful history in academic research as well as biopharmaceutical production. Their legacy use in [existing] labs also helps them maintain market dominance.

The Pharmaceutical & Biopharmaceutical Production Segment Dominated the Market Due to The High Demand for Scalable Cell Culture Environments.

Cell culture incubators play a critical role in the generation of biologics, vaccines, and biosimilars all requiring the cell to be maintained viability and reproducibility. These incubators enable workflows including clone selection, cell expansion, and viral vector production. As demand for monoclonal antibodies, CAR-T therapies and mRNA vaccines increase, so too does the use of incubators across GMP-compliant production facilities.

Large-capacity, stackable and contamination-resistant units are common in contract development and manufacturing organizations (CDMOs), major buyers. In North America, Western Europe and up-and-coming centers such as Singapore and South Korea, the market is booming. It is expected that incubators of the future will have automated cell growth analytics, SaaS bioreactor integration and also AI predictive maintenance systems.

The Academic and Research Laboratories Segment Dominated the Market Owing to The Extensive Use of Cell Culture Incubators in Basic and Translational Research.

Incubators used in basic cell biology, disease modeling, and drug discovery also have a large user base in academic & institutional research labs. These labs need small, versatile incubators compatible with diverse cell lines and experimental conditions. The growth is fueled by government-funded biomedical research initiatives, university partnerships with biotech startups, and an increasing focus on translational research. Examples of Several Key Regions: The USA, Germany, Japan, and India are Emerging as Robust Markets for Academic R&D Expenditures Low-footprint-incubators for space-limited labs, modular gas control systems, and intelligent interfaces connected to lab data management systems will support future demand.

The growth of the cell culture incubator market can be attributed to the growing adoption of cell-based technologies for drug discovery, regenerative medicine and vaccine development and consistent expansion of the life sciences sector. These incubators play a critical role in providing accurate environmental conditions- including temperature, CO₂, O₂, and humidity- necessary for optimal cell growth and health. Chemicals are part of a very competitive market where major players are emphasizing innovation to provide research and production needs.

Top industrial product providers expand their portfolios with energy efficient and high-quality incubators for CO₂ and multi-gas. For improved contamination control, or require integrated automated monitoring, advanced features are also available.

In addition to partnerships across the linear value chain, innovation through R&D investments and a concentrated effort in HEPA filtration, UV sterilization, and anti-microbial interiors are influencing the competitive landscape in high-growth areas including stem cell research and oncology.

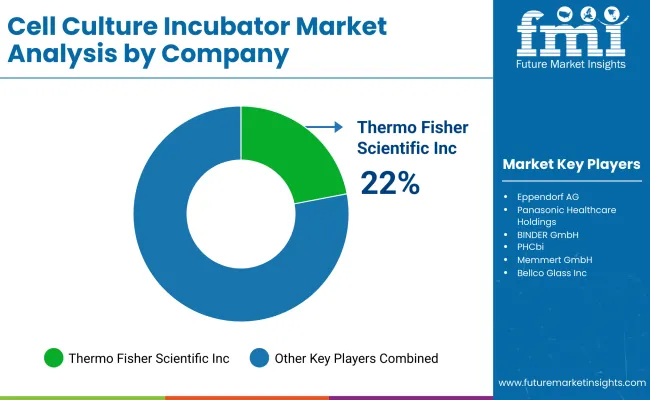

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Thermo Fisher Scientific Inc. | 22-26% |

| Eppendorf AG | 16-20% |

| Panasonic Healthcare Holdings | 12-16% |

| BINDER GmbH | 8-12% |

| PHCbi (PHC Corporation) | 5-9% |

| Other Companies (combined) | 20-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Thermo Fisher Scientific | Offers a wide range of CO₂ and tri-gas incubators with advanced contamination control and precise temperature regulation. |

| Eppendorf AG | Specializes in compact, energy-efficient incubators designed for academic and biotech research laboratories. |

| Panasonic Healthcare | Provides incubators with patented InCu-saFe and SafeCell UV technologies ensuring contamination-free environments. |

| BINDER GmbH | Manufactures high-performance incubators with humidity control, suitable for cell biology and pharmaceutical testing. |

| PHCbi | Offers CO₂ and multigas incubators with infrared sensors and antimicrobial interiors, ideal for stem cell and IVF labs. |

Key Company Insights

Other Key Players (20-30% Combined) Other contributors to the cell culture incubator market include:

These companies support the market through innovative incubator designs, regional distribution expansion, and product customization for research and production workflows.

Air-jacketed, Water-jacketed and Direct Heat.

Pharmaceutical & Biopharmaceutical Production, Cancer Research, Stem Cell Research, Academic and Research Laboratories and Clinical Diagnostics.

Infra-red and Thermal Conductivity.

Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Clinical & Diagnostic Laboratories, CROs (Contract Research Organizations), CMOs (Contract Manufacturing Organizations) and Hospitals and IVF Clinics.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

The global Cell Culture Incubator industry is projected to witness CAGR of 6.4% between 2025 and 2035.

The global Cell Culture Incubator industry stood at USD 2,463.7 million in 2024.

The global Cell Culture Incubator industry is anticipated to reach USD 4,873.8 million by 2035 end.

What is the expected CAGR for China during forecast period?

The key players operating in the global Cell Culture Incubator industry are Thermo Fisher Scientific, Eppendorf AG, Panasonic Healthcare, BINDER GmbH, PHCbi, Sheldon Manufacturing Inc. (Shellab), NuAire Inc., Memmert GmbH, Esco Micro Pte. Ltd., Bellco Glass Inc. and Others.

Table 01: Global Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 02: Global Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 03: Global Market Size Volume (Tons) Analysis and Forecast by Region, 2018 to 2033

Table 04: Global Market Size (US$ Million) Analysis and Forecast by Region, 2018 to 2033

Table 05: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 06: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 07: North America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 08: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 09: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 10: Latin America Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 11: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 12: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 13: Western Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 14: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 15: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 16: Eastern Europe Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 17: Russia and Belarus Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 18: Russia and Belarus Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 19: Balkan and Baltics Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 20: Balkan and Baltics Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 21: Central Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 22: Central Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 23: South Asia Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 24: South Asia Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 25: South Asia Pacific Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 26: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 27: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 28: East Asia Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Table 29: Middle East and Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Country, 2018 to 2033

Table 30: Middle East and Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Product Type, 2018 to 2033

Table 31: Middle East and Africa Market Size (US$ Million) and Volume (Tons) Analysis and Forecast by Application, 2018 to 2033

Figure 01: Global Market Historical Volume (Tons), 2018 to 2022

Figure 02: Global Market Current and Forecast Volume), 2023 to 2033

Figure 03: Global Market Historical Value (US$ Million), 2018 to 2022

Figure 04: Global Market Current and Forecast Value (US$ Million), 2023 to 2033

Figure 05: Global Market Incremental $ Opportunity (US$ Million), 2023 to 2033

Figure 06: Global Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 07: Global Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 08: Global Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 09: Global Market Absolute $ Opportunity by Monoammonium Phosphate (MAP) Segment, 2018 to 2033

Figure 10: Global Market Absolute $ Opportunity by Diammonium Phosphate (DAP)Segment, 2018 to 2033

Figure 11: Global Market Absolute $ Opportunity by Single Superphosphate (SSP) Segment, 2018 to 2033

Figure 12: Global Market Absolute $ Opportunity by Triple Superphosphate (TSP) Segment, 2018 to 2033

Figure 13: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 14: Global Market Share and BPS Analysis by Application, 2023 and 2033

Figure 15: Global Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness Analysis by Application, 2023 to 2033

Figure 17: Global Market Absolute $ Opportunity by Cereals & Grains Segment, 2018 to 2033

Figure 18: Global Market Absolute $ Opportunity by Oilseeds Segment, 2018 to 2033

Figure 19: Global Market Absolute $ Opportunity by Pulses & legumes Segment, 2018 to 2033

Figure 20: Global Market Absolute $ Opportunity by Fruits & Vegetables Segment, 2018 to 2033

Figure 21: Global Market Absolute $ Opportunity by Others Segment, 2018 to 2033

Figure 22: Global Market Share and BPS Analysis by Region, 2023 and 2033

Figure 23: Global Market Y-o-Y Growth Projections by Region, 2023 to 2033

Figure 24: Global Market Attractiveness Analysis by Region, 2023 to 2033

Figure 25: Global Market Absolute $ Opportunity by North America Segment, 2018 to 2033

Figure 26: Global Market Absolute $ Opportunity by Latin America Segment, 2018 to 2033

Figure 27: Global Market Absolute $ Opportunity by Western Europe Segment, 2018 to 2033

Figure 28: Global Market Absolute $ Opportunity by Eastern Europe Segment, 2018 to 2033

Figure 29: Global Market Absolute $ Opportunity by Russia and Belarus Segment, 2018 to 2033

Figure 30: Global Market Absolute $ Opportunity by Balkan and Baltic Segment, 2018 to 2033

Figure 31: Global Market Absolute $ Opportunity by Central Asia Segment, 2018 to 2033

Figure 32: Global Market Absolute $ Opportunity by South Asia Pacific Segment, 2018 to 2033

Figure 33: Global Market Absolute $ Opportunity by East Asia Segment, 2018 to 2033

Figure 34: Global Market Absolute $ Opportunity by Middle East and Africa Segment, 2018 to 2033

Figure 35: North America Market Share and BPS Analysis by Country, 2023 and 2033

Figure 36: North America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 37: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 38: North America Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 39: North America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 40: North America Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 41: North America Market Share and BPS Analysis by Application, 2023 and 2033

Figure 42: North America Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 43: North America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 44: Latin America Market Share and BPS Analysis by Country, 2023 and 2033

Figure 45: Latin America Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 46: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 48: Latin America Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 49: Latin America Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Share and BPS Analysis by Application, 2023 and 2033

Figure 51: Latin America Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness Analysis by Application, 2023 to 2033

Figure 53: Western Europe Market Share and BPS Analysis by Country, 2023 and 2033

Figure 54: Western Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 55: Western Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 56: Western Europe Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 57: Western Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 58: Western Europe Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 59: Western Europe Market Share and BPS Analysis by Application, 2023 and 2033

Figure 60: Western Europe Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 61: Western Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 62: Eastern Europe Market Share and BPS Analysis by Country, 2023 and 2033

Figure 63: Eastern Europe Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 64: Eastern Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 65: Eastern Europe Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 66: Eastern Europe Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 67: Eastern Europe Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 68: Eastern Europe Market Share and BPS Analysis by Application, 2023 and 2033

Figure 69: Eastern Europe Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 70: Eastern Europe Market Attractiveness Analysis by Application, 2023 to 2033

Figure 71: Russia and Belarus Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 72: Russia and Belarus Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 73: Russia and Belarus Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 74: Russia and Belarus Market Share and BPS Analysis by Application, 2023 and 2033

Figure 75: Russia and Belarus Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 76: Russia and Belarus Market Attractiveness Analysis by Application, 2023 to 2033

Figure 77: Balkan and Baltics Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 78: Balkan and Baltics Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 79: Balkan and Baltics Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 80: Balkan and Baltics Market Share and BPS Analysis by Application, 2023 and 2033

Figure 81: Balkan and Baltics Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 82: Balkan and Baltics Market Attractiveness Analysis by Application, 2023 to 2033

Figure 83: Central Asia Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 84: Central Asia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 85: Central Asia Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 86: Central Asia Market Share and BPS Analysis by Application, 2023 and 2033

Figure 87: Central Asia Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 88: Central Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 89: South Asia Pacific Market Share and BPS Analysis by Country, 2023 and 2033

Figure 90: South Asia Pacific Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 91: South Asia Pacific Market Attractiveness Analysis by Country, 2023 to 2033

Figure 92: South Asia Pacific Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 93: South Asia Pacific Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 94: South Asia Pacific Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 95: South Asia Pacific Market Share and BPS Analysis by Application, 2023 and 2033

Figure 96: South Asia Pacific Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 97: South Asia Pacific Market Attractiveness Analysis by Application, 2023 to 2033

Figure 98: East Asia Market Share and BPS Analysis by Country, 2023 and 2033

Figure 99: East Asia Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 100: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 101: East Asia Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 102: East Asia Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 103: East Asia Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 104: East Asia Market Share and BPS Analysis by Application, 2023 and 2033

Figure 105: East Asia Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 106: East Asia Market Attractiveness Analysis by Application, 2023 to 2033

Figure 107: Middle East and Africa Market Share and BPS Analysis by Country, 2023 and 2033

Figure 108: Middle East and Africa Market Y-o-Y Growth Projections by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 110: Middle East and Africa Market Share and BPS Analysis by Product Type, 2023 and 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth Projections by Product Type, 2023 to 2033

Figure 112: Middle East and Africa Market Attractiveness Analysis by Product Type, 2023 to 2033

Figure 113: Middle East and Africa Market Share and BPS Analysis by Application, 2023 and 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth Projections by Application, 2023 to 2033

Figure 115: Middle East and Africa Market Attractiveness Analysis by Application, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Cellular Vehicle-To-Everything (C-V2X) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA