The global CCTV camera market is set to experience USD 12.4 billion in 2025. The industry is poised to witness a 7.2% CAGR from 2025 to 2035, reaching USD 25 billion by 2035.

The rising security issues, expanding urbanization, and the increasing use of intelligent surveillance methods are reported to be driving the growth of industry between 2025 and 2035. Artificial intelligence-driven security products, facial recognition technology, and cloud video analytics are increasingly being used by organizations, governments, and consumer households to augment threat detection and overall security performance.

A Closed-Circuit Television (CCTV) camera is a security monitor system utilized at homes, organizations, and public spaces. It records and plays back video images, which may be displayed in near real-time or recorded for later viewing.

Different types of CCTV cameras are available such as dome, bullet, PTZ (pan-tilt-zoom), and IP cameras with attributes such as night vision, motion detection, and remote view. CCTV systems are used extensively today for crime prevention, traffic monitoring, and protection at the workplace. They are preinstalled with AI and cloud storage for sophisticated tracking and thus become a critical part of security infrastructure.

The technological revolution is happening with IoT-based monitoring, 4K resolution cameras, and AI-powered monitoring solutions. The effectiveness and reliability of CCTV solutions in various industries are being improved with motion detection, night vision and real-time remote viewing features. In addition, smart city initiatives and public safety initiatives are being actively encouraged by governments and businesses, which is contributing to the demand for high-performance surveillance systems in urban and industrial areas.

Sustained technologies of edge computing and cybersecurity and energy-efficient cameras are supporting industry development. The need for enhanced security infrastructure has led to players directing efforts to create automated surveillance systems, secure video storage, and 360-degree surveillance platforms. Governments and organizations are interested in scalable, low-cost security solutions that deliver live analytics back and improve situational awareness owing to the evolved state of surveillance technology.

As the security of the workplace and prevention of crime, along with the protection of critical infrastructure, become increasingly important, demand for AI-powered surveillance will grow even more. As more and more businesses shift toward cloud-based and converged security systems, demand for CCTV cameras will keep rising, opening up the future of surveillance with better, data-centric monitoring technologies.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 12.4 billion |

| Industry Value (2035F) | USD 25 billion |

| CAGR (2025 to 2035) | 7.2% |

Explore FMI!

Book a free demo

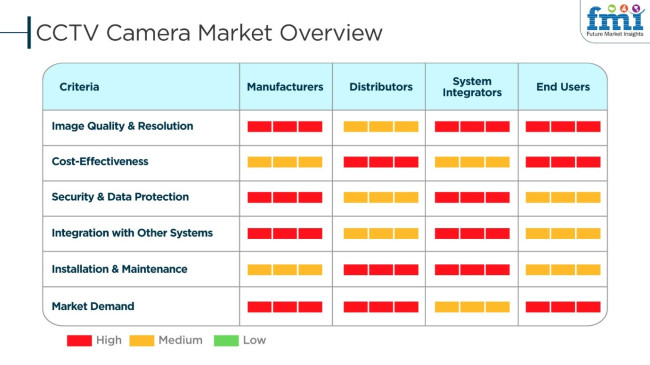

The global industry is thriving as a result of rising security, surveillance, and crime prevention concerns among residential, commercial, and industrial sectors. Manufacturers are working on refining high-resolution cameras that have AI analytics features, facial recognition, and night vision, all of which are necessary to meet the security solution that is constantly evolving. Distributors focus on low-cost buying and supply chain management as means to ensure perpetual product availability.

System integrators' function in the customization of security is crucial, considering they also provide for the smooth introduction of other components, including access control, alarms, and IoT devices. Businesses, governments, and homeowners, the main customers, want low-cost and user-friendly installations that are guaranteed to be failure-proof such as cloud storage, remote monitoring, and motion detection.

Moreover, advances in 4K surveillance, smart AI-powered cameras, wireless technology, and cybersecurity improvements are also acting as drivers for the industry. Despite issues like data privacy problems, expensive installation, and cybersecurity threats, the introduction of edge computing and cloud-based security solutions is the strongest driver of the industry, which is constantly growing.

| Company | Diputación de Guadalajara |

|---|---|

| Contract/Development Details | The Diputación de Guadalajara announced a contract for the maintenance of 500 surveillance cameras across various municipalities in the province, with plans to add approximately 30 cameras annually over the next three years. The contract includes an initial two-year term, with the possibility of a two-year extension. |

| Date | March 2024 |

| Contract Value (USD Million) | Approximately USD 3.4 million |

| Estimated Renewal Period | 2 years, extendable by two additional years |

| Company | Hikvision |

|---|---|

| Contract/Development Details | Hikvision terminated five surveillance contracts in Xinjiang, China, in response to international scrutiny and sanctions. This strategic move reflects the company's shift away from government contracts and a focus on new markets. |

| Date | December 2024 |

| Company | Queensland State Government |

|---|---|

| Contract/Development Details | The Queensland State Government allocated funds for the installation of a state-of-the-art CCTV system and the establishment of a permanent police presence in the Nambour Central Business District. This initiative aims to enhance public safety and address anti-social behavior in the area. |

| Date | January 2025 |

| Contract Value (USD Million) | Approximately USD 1.1 million |

In 2024 and early 2025, the industry witnessed significant activities, including new contracts and strategic shifts. The Diputación de Guadalajara's investment in expanding and maintaining its surveillance infrastructure underscores the growing emphasis on public safety in local communities. Hikvision's decision to terminate specific contracts in Xinjiang indicates a strategic realignment in response to global regulatory pressures.

Meanwhile, the Queensland State Government's commitment to enhancing security in Nambour reflects a proactive approach to combating anti-social behavior through technological means. These developments highlight the dynamic nature of the industry, influenced by technological advancements, regulatory environments, and evolving public safety needs.

The industry faces issues of data privacy, cyber threats, and expensive storage costs. Compliance with stringent rules covering video monitoring, facial recognition, and data-holding policies becomes difficult for producers. Furthermore, the growing vulnerability to hacking and illegal entry demands high-quality encryption and security practices. The expense of high installation and upkeep costs may discourage small business firms and residential users from adopting.

In spite of these issues, there are meaningful opportunities in the industry. AI-powered video analytics, 5G networks, and cloud-enabled surveillance solutions are improving security functions and cutting operational costs. Edge computing and real-time monitoring support faster detection and response to threats, enhancing overall security efficiency.

Smart city, home automation, and industrial IoT growth are opening up new development opportunities for integrated security ecosystems. Besides, solar-powered, wireless, and low-energy CCTV solutions are widening the market's footprint to off-grid and remote areas.

Between 2020 and 2024, the industry for CCTV cameras grew immensely owing to increased security needs, urbanization, and the development of AI-powered surveillance. The use of high-definition (HD) and ultra-high-definition (UHD) cameras, as well as cloud-based video management systems, improved real-time monitoring in public and private spaces.

Governments and companies use AI-enabled facial recognition, behavior analysis, and automatic number plate recognition (ANPR) to prevent crime and manage traffic. The COVID-19 pandemic increased demand for CCTV solutions with thermal screening, occupancy counting, and mask detection.

However, data privacy concerns, cyber threats, and exorbitant deployment costs remained a challenge in developing markets. Between 2025 and 2035, AI-driven autonomous surveillance, quantum-encrypted video transport, and decentralized security networks will reshape the CCTV industry.

Smart surveillance systems will combine real-time threat recognition, predictive analysis, and response automation. Blockchain-secured storage of data will bolster cybersecurity, and quantum encryption will safeguard sensitive video.

Edge computing based on AI will provide localized video processing to decrease dependence on the cloud and increase efficiency. Self-powering, solar-powered cameras, and AI-driven privacy filters will find the right balance between security and ethical surveillance techniques and meet new regulatory frameworks that change with the times.

Industry Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulations on facial recognition and video retention policy compliance. | Frameworks for governing AI in biometric surveillance, compliance with quantum-encrypted video storage, and blockchain-protected surveillance policies. |

| Facial recognition using AI, video analytics based on the cloud, and behavior analysis based on deep learning. | Quantum-encrypted video surveillance, autonomous AI-driven security cameras, and self-learning predictive security analytics. |

| CCTV used for crime prevention, traffic monitoring, public safety, and industrial security. | AI-assisted autonomous surveillance, predictive threat detection, and smart home-integrated security systems. |

| High-definition IP cameras, edge AI surveillance, and 5G-powered remote monitoring. | Solar-powered AI cameras, IoT-integrated smart security systems, and blockchain-secured surveillance data storage. |

| Cloud-based video storage, AI-driven analytics for cost optimization, and smart energy-efficient surveillance systems. | Self-sustaining, renewable energy-powered surveillance networks, decentralized security infrastructure, and AI-optimized data storage. |

| AI-powered real-time security alerts, deep learning-driven threat detection, and cloud-based video forensic analysis. | Quantum computing-enabled security, autonomous fault detection using AI, and ability to predict crimes. |

| Industry challenges were chip shortages, cybersecurity threats, and expensive AI-based CCTV deployment costs. | AI-optimized supply chains for surveillance gear, decentralized manufacturing of CCTV, and blockchain-enabled security device tracking. |

In the industry of the CCTV sector, one of the major hazards is cybersecurity threats. As more surveillance systems are interconnected through IoT and cloud-based platforms, they are becoming more and more vulnerable to hacking, data breaches, and unauthorized access. Insecure encryption, obsolete firmware, and unsecured networks can lead to the exposure of sensitive video footage, thus violating privacy and adding security risks.

The point of industry saturation and the bitter competition also bring disadvantages. The CCTV industry has great players like Hikvision, Dahua, and Axis Communications which makes it tough for smaller companies to promote their innovations. Price competition and commoditization could be the reasons behind low profitability, which could pressure firms to pour money into R&D to remain competitive.

Technological progress and product obsolescence are pushing continuous innovation forward. AI-based analytics, facial detection, and cloud video storage have turned into the new industry standards.

Box cameras maximize potential when the user needs to choose the lens. Therefore, they are commonly used in commercial and industrial surveillance with high-performance imaging solutions. These cameras have excellent zoom features that help monitor larger spaces such as parking lots, warehouses, and highways. This additional layer of protection allows for long-term placement even in harsh environments, outside or indoors; box cameras can be mounted with waterproofing housing.

The box cameras are equipped with advanced features, including AI-powered analytics, night vision, and high-definition (HD) video recording, offered by leading solution providers in the industry, such as Axis Communications and Honeywell International Inc. They also come with long-range focus, which allows for clear imaging over distances.

For smaller businesses and home property owners, an analog CCTV system provides a more affordable option, as does a way to connect with legacy surveillance networks. These systems send video signals via coaxial cables to Digital Video Recorders (DVRs), where they are stored and managed.

Analog CCTV from companies like CP Plus and Pelco come with improved night vision, motion detection, and weatherproof housing for outside use. The reason many companies still prefer working with analogue systems is simply because they are less expensive; they can work without an internet connection and thus prevent the company from being a target of an Internet-based cyber-attack.

| Countries | CAGR (%) (2025 to 2035) |

|---|---|

| USA | 8.5% |

| UK | 8.2% |

| European Union | 8.4% |

| Japan | 8.3% |

| South Korea | 8.6% |

The USA industry is growing with organizations using more smart security equipment and AI surveillance. Companies use high-definition cameras for better security, reduced crime rates, and more efficient real-time video analysis. Face recognition, motion detection, and cloud observation software strengthen the industry.

Retail outlets, transportation hubs, and military installations invest in sophisticated CCTV systems to secure public spaces and guard key infrastructures. Laws compel businesses to utilize high-performance, energy-saving security systems according to safety standards. FMI predicts the USA industry to grow at 8.5% CAGR during the forecast period.

| Growth Drivers in the USA | Details |

|---|---|

| AI-Powered Surveillance | Companies implement AI-driven analytics for crime prevention and live monitoring. |

| Cloud-Based Monitoring | Firms adopt remote viewing technology for wider accessibility and storage efficiency. |

| Regulatory Support | Governments' supportive policies promote adopting an energy-efficient and high-definition CCTV system. |

| Retail & Transportation Demand | Mass-market security investment by malls, airports, and transport systems drives industry growth. |

The UK industry expansion is due to governments and enterprises offering security using AI surveillance technology. Organizations apply improved surveillance technologies in a bid to deter robbers, monitor public space, and improve the provision of police services.

The demand for protecting smart cities, cloud-based and AI-based video analysis and CCTV cameras are the major industry growth drivers. Government initiatives also promote high-definition surveillance adoption to integrate with metropolitan infrastructures seamlessly. The UK industry is anticipated to grow at 8.2% CAGR during the study period, cites FMI.

| Growth Drivers for the UK Industry | Details |

|---|---|

| Smart City Initiatives | Cities adopt CCTV networks backed up by AI-analytical modules for city protection. |

| AI-Driven Surveillance | Companies and police departments use face recognition and behavioral analysis. |

| Cloud-Based Solutions | Cloud storage penetration increases remote data management and access. |

| Government Policies | Policies encourage high-definition and GDPR-compliant surveillance solutions. |

The European Union industry is expanding as governments and enterprises implement AI-powered surveillance systems for safety. Germany, France, and Italy dominate the industry by implementing solutions in public spaces, transportation systems, and business zones.

Stringent GDPR-aligned EU data privacy laws compel manufacturers to create GDPR-aligned security products. Real-time analytics and video compression technologies enable the growing adoption rate of smart CCTV solutions across various industries. FMI anticipates the European Union industry to grow at 8.4% CAGR over the forecast period.

| Drivers of the Growth of the European Union | Details |

|---|---|

| AI-Based Public Safety | Governments fund AI-based surveillance for law enforcement and transportation. |

| GDPR Compliance | Strong privacy regulations drive the implementation of secure CCTV systems. |

| Smart Infrastructure Development | Firms install smart surveillance systems for industries and cities. |

| Technological Innovations | Video compression and analytical advancements improve system performance. |

Japan's industry has grown with the adoption of high-definition imaging, AI-based video analytics, and IoT-enabled surveillance solutions. Organizations deploy CCTV solutions for active threat detection, traffic monitoring, and public security. The country's smart infrastructure and crime prevention focus fuels the integration of cutting-edge security solutions. Retail, logistics, and transport industries invest in AI-based monitoring solutions for maximum operational effectiveness.

| Growth Drivers in Japan | Details |

|---|---|

| AI & IoT Integration | Firms utilize AI-powered cameras with IoT connectivity for smart surveillance. |

| Traffic & Public Safety | Government agencies invest in CCTV networks to secure cities. |

| Retail & Logistics Demand | Companies use video analytics to improve operation management and anti-theft capabilities. |

| High-Resolution Imaging | Technological advancements allow for ultra-HD monitoring for accurate threat identification. |

The South Korean industry is growing as companies deploy AI-based security solutions, facial recognition, and cloud monitoring. The government also invests in smart city programs to improve public safety and urban security programs. Companies employ 5G-enabled CCTV cameras, live video monitoring, and AI-based analytics to increase surveillance capacity. Secure video and remote monitoring storage via strong cybersecurity solutions fuel industry growth.

| Growth Drivers in South Korea | Details |

|---|---|

| AI-Powered Security | Organizations deploy facial recognition and behavior analysis technology. |

| 5G-Enabled CCTV | Timely connectivity speeds up real-time video transmission and analytics. |

| Smart City Investments | Government-funded initiatives propel the mass deployment of surveillance systems. |

| Cybersecure Storage | Tech offers encrypted video storage for the safe handling of data. |

The global CCTV camera market is highly competitive, with a boost from mounting security concerns, smart cities, and technological development in surveillance. The expansion is also boosted by the high demand for HD video surveillance, AI-enabled analysis, and cloud-based security solutions in various verticals such as commercial, residential, and government.

Industry leaders like Hikvision, Dahua Technology, Axis Communications, Bosch Security Systems, and Honeywell Security hold considerable industry power with a wide range of IP cameras, thermal imaging products, and AI-driven analytics. These players are leading the way in facial recognition, motion detection, and real-time remote monitoring to improve situational awareness and threat prevention.

On the contrary, new players and mid-market security providers are making their space in the CCTV surveillance solution with customized offerings that cater to an economical cost in retail, healthcare, and transportation industries, among others.

Other compliance demands, cybersecurity needs, and support for the IoT ecosystem will drive the industry as well. As cloud-based monitoring and AI-driven automation keep improving, any cloud CCTV business focusing on smooth connectivity, data encryption, and intelligent analytics will be able to compete in the fast-transforming CCTV camera industry.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hikvision Digital Technology | 20-25% |

| Dahua Technology | 15-20% |

| Axis Communications | 12-17% |

| Bosch Security Systems | 8-12% |

| Honeywell Security | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hikvision Digital Technology | Leads in AI-powered surveillance, facial recognition, and thermal imaging cameras. |

| Dahua Technology | Develops smart CCTV solutions, cloud-based video storage, and intelligent video analytics. |

| Axis Communications | Specializes in network cameras, advanced motion detection, and real-time security solutions. |

| Bosch Security Systems | Focuses on AI-integrated surveillance, IoT-enabled monitoring, and high-resolution security cameras. |

| Honeywell Security | Provides advanced security cameras, remote monitoring solutions, and enterprise surveillance systems. |

Key Company Insights

Hikvision Digital Technology (20-25%)

Hikvision leads the biz for CCTV cameras with AI-driven facial recognition, smart city cameras, and best-in-class security solutions.

Dahua Technology (15-20%)

Dahua provides innovations in the field of cloud-based video analytics, motion detection, and high-end security camera systems.

Axis Communications (12-17%)

Axis Communications is the standard setter in network camera solutions, intelligent video surveillance, and AI-based movement detection.

Bosch Security Systems (8-12%)

Bosch Security Systems develops AI-powered CCTV cameras, IoT-integrated monitoring, and real-time security analytics.

Honeywell Security (5-9%)

Honeywell Security deals in enterprise-grade CCTV, remote surveillance technologies, and cloud-integrated security systems.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 12.4 billion in 2025.

The industry is predicted to reach USD 25 billion by 2035.

Key companies include Hikvision Digital Technology, Dahua Technology, Axis Communications, Bosch Security Systems, Honeywell Security, Samsung Techwin (Hanwha), Avigilon (Motorola Solutions), Panasonic i-PRO Sensing, FLIR Systems, and Uniview Technologies.

South Korea, slated to grow at 8.6% CAGR during the forecast period, is poised for the fastest growth.

Box cameras are being widely used.

By model type, the market covers box cameras, dome cameras, PTZ cameras, fixed bullet cameras, positioning cameras, onboard cameras, and others.

In terms of technology, the market includes analog CCTV systems and IP/network-based CCTV systems.

By camera sensor type, the market includes CCD sensor-based cameras and CMOS sensor-based cameras.

By application, the market includes CCTV cameras for residential use, CCTV cameras for commercial use, CCTV cameras for industrial use, and CCTV cameras for government use.

In terms of region, the market covers North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.