The global CRBSI Treatment Market is projected to be valued at USD 1,718.0 Million in 2025 and is expected to reach USD 2,908 Million by 2035, registering a CAGR of 5.4% during the forecast period, driven by the increasing use of intravascular catheters in intensive care, oncology, and dialysis units.

Rising awareness of hospital-acquired infections and the growing emphasis on infection prevention protocols are encouraging healthcare providers to adopt advanced antimicrobial therapies and catheter-lock solutions. Innovations such as antimicrobial-coated catheters and combination antibiotic therapies are enhancing the efficiency of CRBSI management.

Furthermore, regulatory focus on improving clinical outcomes and reducing healthcare-associated complications is accelerating the adoption of evidence-based CRBSI prevention and treatment strategies. Expansion of outpatient care centers and rising demand for minimally invasive treatment options are further amplifying the market's potential.

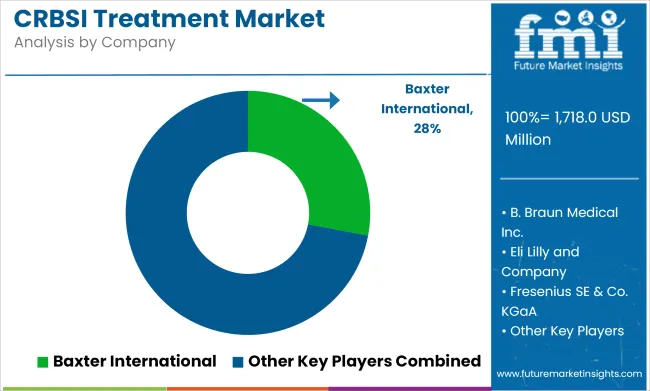

Leading players in the CRBSI treatment market include Citius Pharmaceuticals, CorMedix Inc., TauroPharm GmbH, Fresenius Medical Care, and Baxter International Inc. These companies are prioritizing innovation in catheter preservation, antimicrobial lock solutions, and biofilm disruption technologies.

In 2024, A novel antibiotic lock solution, Mino-Lok®, showed a statistically significant improvement in time to failure event compared with a control solution in patients with central line-associated bloodstream infections (CLABSI). Mino-Lok combines minocycline and ethanol with edetate disodium for patients with CRBSIs and is designed to salvage catheters in patients with CLABSI or CRBSI.

"We are extremely pleased by the strong results of the trial, which demonstrate the safety and efficacy of Mino-Lok in preserving indwelling catheters in patients with bloodstream infections,” Leonard Mazur, chairman, and CEO of Citius Pharma.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1,718 Million |

| Projected Market Size in 2035 | USD 2,908 Million |

| CAGR (2025 to 2035) | 5.4% |

In North America, advancements in CRBSI treatment have been strongly supported by a well-established regulatory framework and innovation-led care models. The integration of AI-powered diagnostics and biosensor-equipped catheters has been actively pursued by healthcare providers to enable early detection of bloodstream infections.

Widespread implementation of infection control protocols has been promoted through clinical guidelines and reimbursement incentives. Localized innovation has been fuelled by USA-based manufacturers through extensive R&D investment and collaborations with hospital networks. A strategic emphasis has been placed on reducing healthcare-associated infections, with long-term objectives tied to improved patient safety and optimized cost efficiency. The region’s leadership has been maintained through ongoing clinical innovation and regulatory support.

Across Europe, the CRBSI treatment landscape has been shaped by harmonized public health regulations and the prioritization of digital infection control solutions. In countries such as Germany, France, and the Netherlands, a transition to data-driven infection prevention strategies has been observed.

Collaborative initiatives between public health bodies and private manufacturers have been facilitated to accelerate the development and validation of antimicrobial therapies. Adoption of catheter lock solutions and antimicrobial coatings has been undertaken to improve patient outcomes. Regulatory alignment within the European Union has been leveraged to streamline product approvals and compliance.

The Vancomycin segment has been positioned as the leading contributor within the CRBSI treatment market contributing 28.7% revenue share, primarily due to its widespread use against resistant Gram-positive infections. Its utilization has been prioritized in clinical settings where methicillin-resistant Staphylococcus aureus (MRSA) and other coagulase-negative staphylococci are prevalent.

Endorsements from infectious disease guidelines have reinforced its frontline status in bloodstream infection protocols. Growth has been further supported by hospital formulary inclusion, proven clinical outcomes, and cost-effectiveness in both branded and generic forms.

Rising concerns over antimicrobial resistance have resulted in increased reliance on Vancomycin, particularly in intensive care and immunocompromised patient populations. As hospital-acquired infections continue to pose challenges, the use of Vancomycin has been sustained across inpatient therapeutic regimens.

Injectable formulations have been widely adopted route of administration holding around 69.1% in the CRBSI treatment landscape due to their suitability for rapid systemic action in acute care scenarios. Their usage has been emphasized in hospitalized patients where immediate therapeutic intervention is necessary, particularly in sepsis or bloodstream infections linked to central venous catheters.

Clinical protocols have mandated injectable antibiotics in cases where oral administration is unfeasible or inefficient. The dominance of this route has been reinforced by its alignment with infection control standards and availability of IV infrastructure in critical care settings.

Furthermore, injectable antibiotics have been favoured in outpatient parenteral antimicrobial therapy (OPAT) models, ensuring extended utility beyond hospital environments. This segment’s strength has been maintained by the efficacy, absorption speed, and clinical reliability of parenteral drug delivery.

Rising Antibiotic Resistance and Limited Treatment Options

Such a high occurrence of antibiotic-resistant bacteria strains is likely to impede the growth of Catheter-Related blood stream infection treatment market. The presence of multidrug-resistant organisms (MDROs), such as methicillin-resistant Staphylococcus aureus (MRSA) and vancomycin-resistant Enterococci (VRE), poses significant complications in treatment and reduces the efficacy of common antibiotics.

The lack of new classes of antimicrobial agents being developed serves to further limit treatment options. This problem needs to be countered by pharmaceutical companies in investing novel antimicrobial drug discovery, bacteriophage therapy, and combination treatment strategies for improving therapeutic efficacy against resistant pathogens.

High Treatment Costs and Hospital Resource Constraints

CRBSI management entails costly antibiotic treatments, lengthy hospitalizations, and ICU utilization, which further elevates healthcare expenditure. The number of catheter removals and replacements leads to increased health costs and longer recovery times for patients. A Budgetary constraint and restricted access to advanced treatment options is a great challenge that hospitals, predominantly in low-resource settings, face.

Healthcare providers should address this challenge through cost-effective infection prevention measures (e.g., hand hygiene, use of appropriate Personal Protective Equipment (PPE), sterilization procedures), encouraging antibiotic stewardship programs, and investing in diagnostics that ensure speedy/high-quality diagnostic testing and results to both minimize hospital costs and minimize delays in treatment.

Advancements in Antimicrobial Lock Therapy and Coating Technologies

Although determination of optimal strategies to combat CRBSI is ongoing, the introduction of antimicrobial lock solutions (ALS) and passive or actively coated catheters represent significant advances in CRBSI prevention and therapy. Antimicrobial lock therapy is a technique that involves instilling antibiotic or antiseptic solutions in the catheter lumen to kill off biofilm and prevent bacterial colonization.

Moreover, the catheter type is a strong predictor for improving patient outcomes, with the advent of antimicrobial-impregnated and heparin-coated catheters shown to reduce infection risks. Those companies developing novel catheter materials and biofilm-disrupting agents, as well as research into new, non-antibiotic antimicrobial pathways will benefit and out-pace competitors in this sector of infection control and CRBSI treatment.

Growth of Rapid Diagnostic Tools and Personalized Treatment Approaches

The growing acceptance of rapid molecular diagnostics, point-of-care testing, and AI-powered microbial identification methods are changing treatment of CRBSI. Rapid identification of bloodstream infections and pathogen specific susceptibility profiles allow for targeted therapy, minimizing the need for broad-spectrum antibiotics.

Moreover, personalized medicine strategies, including pharmacogenomics and immunomodulatory treatments, increase treatment accuracy and patient results. Furthermore, the demand for rapid diagnostics, artificial intelligence-driven antimicrobial resistance prediction models, and personalized approaches to infection management will fuel innovation and lead to improved treatment efficacy for CRBSI.

Market Dynamics in the CRBSI treatment market from 2020 to 2024 and Future Trends (2025 to 2035) The CRBSI treatment market observed the increased awareness towards hospital-acquired infections (HAIs) and stringent protocols for infection control between 2020 and 2024 Demand for better catheter care protocols and rapid diagnostic solutions accelerated during the COVID-19 pandemic, when the need for infection prevention became more pronounced.

But, high treatment costs, rising antibiotic resistance, and uneven access to advanced therapies all impacted market growth. In response, companies were investing in alternative therapies, A.I.-powered diagnostics and combination treatment regimens to tackle resistant infections more vigorously.

The data curated from 2025 to 2035 indicates that next-generation antimicrobial agents, nanotechnology-based infection control, and AI-integrated precision medicine will drive key market growth. Advances in synthetic antimicrobial peptides, bacteriophage-derived therapeutics and CRISPR-based gene editing for infection prophylaxis will transform CRBSI management.

Moreover, blockchain for real-time infection tracking, telemedicine driven infection management, and AI-enhanced predictive analytics will eliminate bottlenecks in patient care. The next stage of CRBSI treatment evolution will be led by the companies placing the greatest focus on innovation in rapid diagnostics, targeted antimicrobial strategies, and infection prevention solutions.

The United States is the leading revenue-generating region in the catheter-related bloodstream infection (CRBSI) treatment market, owing to the presence of a larger number of hospital-acquired infections (HAIs), rising awareness towards infection control strategies, and dominant standing of pharmaceutical and healthcare technology companies. Growing number of living immune-compromised patients are segmenting the market along with the growth of advance antimicrobial coatings.

Thus, increasing investment in hospital infection control programs and development of novel antibiotic-lock therapy and biofilm-resistant catheters would positively influence market outlook. Moreover, the use of AI-based diagnostics, rapid microbial detection, and real-time patient monitoring are also playing vital roles in improving infection management.

Researchers are also working on new antimicrobial agents and combination therapies to combat AMR effectively. The growing implementation of central line-associated bloodstream infection (CLABSI) prevention protocols continues to drive demand for CRBSI therapy within the USA healthcare system.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.6% |

The United Kingdom is a significant market for CRBSI treatment with the presence of stringent healthcare regulations, increased adoption of infection prevention strategies, and rising investments in advanced types of antimicrobial therapies. The focus on minimizing hone acquired contaminations in the NHS hospitals are also contributing to the market growth.

The market growth is accelerated by the government policies promoting antimicrobial stewardship programs and the development of rapid diagnostic technologies. Furthermore, these opportunities in catheter lock solutions, novel antibiotic formulations, and bioresorbable antimicrobial coatings are providing an impetus for innovations in the respective products. To help optimize treatment and prevention strategies, companies are also investing in AI-powered infection surveillance systems.

Rising emphasis on cost-effective CRBSI management and increasing preference for targeted antimicrobial therapies are further driving the market growth in the UK. Furthermore, there is a growing prevalence of multi-drug-resistant (MDR) infections that is driving demand for next-generation CRBSI treatments.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

Germany, France, and Italy hold the largest share of the European CRBSI treatment market, due to a robust healthcare infrastructure, rise in government initiatives aimed at reducing HAIs, and increasing investments in antimicrobial research and development.

Rapid market growth is aided by the European Union’s emphasis on infection control, in addition to the investments in rapid point-of-care diagnostics and next-generation antimicrobials.] The emergence of new biofilm-targeting therapies, advanced catheter technologies (e.g., antimicrobial or anti-biofilm catheters), and real-time microbial monitoring have also contributed to infection management.

Increasing focus on personalized medicine coupled with growing demand for alternative antimicrobial agents and immunotherapy-based CRBSI treatments is further driving the market growth. Increasing adoption across the EU is also underpinned by the expansion of collaborative clinical research initiatives and antibiotic resistance monitoring programs.

Notably, regulatory support for theitives under the EU One Health Action Plan promoting innovative antimicrobial development is expected to drive the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.3% |

Japan is strongly emphasizing infection prevention and is adopting advanced diagnostic tools at a higher rate owing to which the CRBSI treatment market in the country is growing. 2. Rising demand for effective antimicrobials treatment market is boosting the market growth.

A focus on precision medicine in the country, paired with AI-powered pathogen detection and rapid antimicrobial susceptibility testing, is spurring innovation. Additionally, the government regulation that is stringent with regards to infection control coupled with increase in research and development activities by the key players to produce a high-efficacy antimicrobial treatment in regards with catheter associated infection are likely to propel the overall market over the forecast years.

Increasing demand for nanotechnology-based antimicrobial coatings, biofilm-resistant catheter materials, and personalized treatment strategies are another contributing factors in growth of the market in Japan healthcare market. Also, investment into next-generation sepsis management and bloodstream infection therapeutics in Japan, will set the surface for the CRBSI treatment of tomorrow.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

Across South Korea, high rates of hospital-acquired infections, increased government efforts at infection prevention, and growing investments in antimicrobial innovation position the market as a leading market for CRBSI treatment.

The market growth is attributed to strict hospital safety regulations and rising penetrations of AI powered infection detection and targeted antibiotic therapies. The country’s focus on improving treatment efficacy through combination antibiotic therapies, rapid pathogen identification and immune-boosting therapeutics is also boosting competitiveness.

Market adoption is also being fueled by an increasing demand for catheter impregnated antimicrobial agents, alternative non-antibiotic therapies, and point of care diagnostic solutions. Novel approaches, including the use of antimicrobial peptides, bacteriophage therapies, and nanomaterial-based drug delivery, are being investigated by the companies.

The growth in South Korea is being fueled by the adoption of digital and technologically-enabled health technologies, and emergence of infection prevention AI systems, further supporting the need for advanced CRBSI management solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

The CRBSI treatment market is growing due to the increasing number of hospital-acquired infections, increasing usage of catheters and increasing awareness for infection prevention.

We are working diligently to develop antibiotics that possess broad-spectrum efficacy, antifungal therapies, and catheter lock products that reduce the risk of disease and improve outcomes for our patients. Antibiotic-coated catheters, combination therapy, and novel antimicrobial agents are at the forefront.

The overall market size for CRBSI treatment market was USD 1,718 Million in 2025.

The CRBSI treatment market expected to reach USD 1,380 Million in 2035.

The CRBSI market will be propelled by rising hospital-acquired infections, increasing number of central venous catheters, technological advancements in antimicrobial treatment, rising awareness for infection control, and expanding healthcare infrastructure with better diagnostic ability.

The top 5 countries which drives the development of CRBSI treatment market are USA, UK, Europe Union, Japan and South Korea.

Injectable therapies growth to command significant share over the assessment period.

Table 01: Global Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 02: Global Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 03: Global Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 04: Global Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 05: Global Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Region

Table 06: North America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 07: North America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 08: North America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 09: North America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 10: North America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 11: Latin America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 12: Latin America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 13: Latin America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 14: Latin America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 15: Latin America Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 16: Europe Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 17: Europe Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 18: Europe Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 19: Europe Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 20: Europe Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 21: South Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 22: South Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 23: South Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 24: South Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 25: South Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 26: East Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 27: East Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 28: East Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 29: East Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 30: East Asia Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 31: Oceania Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 32: Oceania Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 33: Oceania Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 34: Oceania Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 35: Oceania Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Table 36: Middle East & Africa Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Country

Table 37: Middle East & Africa Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Drug Class

Table 38: Middle East & Africa Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Route of Administration

Table 39: Middle East & Africa Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Indication

Table 40: Middle East & Africa Market Size (USD million) Analysis 2020 to 2025 and Forecast 2025 to 2035, By Distribution Channel

Figure 01: Global Market Value Share By Drug Class (2025 A)

Figure 02: Global Market Value Share By Route of Administration (2025 A)

Figure 03: Global Market Value Share By Indication (2025 A)

Figure 04: Global Market Value Share By Distribution Channel (2025 A)

Figure 05: Global Market Value Share By Region (2025 A)

Figure 06: Global Market Value Analysis (USD million), 2020 to 2025

Figure 07: Global Market Value Forecast (USD million), 2025 to 2035

Figure 08: Global Market Absolute Market Absolute $ Opportunity, 2025 to 2035

Figure 09: Global Market Share Analysis (%), By Drug Class, 2023(E) & 2033(F)

Figure 10: Global Market Y-o-Y Analysis (%), By Drug Class, 2025 to 2035

Figure 11: Global Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 12: Global Market Share Analysis (%), By Route of Administration, 2023 (E) and 2033 (F)

Figure 13: Global Market Y-o-Y Analysis (%), By Route of Administration, 2025 to 2035

Figure 14: Global Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 15: Global Market Share Analysis (%), By Indication, 2023 (E) and 2033 (F)

Figure 16: Global Market Y-o-Y Analysis (%), By Indication, 2025 to 2035

Figure 17: Global Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 18: Global Market Share Analysis (%), By Distribution Channel, 2023 (E) and 2033 (F)

Figure 19: Global Market Y-o-Y Analysis (%), By Distribution Channel, 2025 to 2035

Figure 20: Global Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 21: Global Market Share Analysis (%), By Region, 2023(E) & 2033(F)

Figure 22: Global Market Y-o-Y Analysis (%), By Region, 2025 to 2035

Figure 23: Global Market Attractiveness Analysis By Region, 2025 to 2035

Figure 24: North America Market Value Share By Drug Class (2025 A)

Figure 25: North America Market Value Share By Route of Administration (2025 A)

Figure 26: North America Market Value Share By Indication (2025 A)

Figure 27: North America Market Value Share By Distribution Channel (2025 A)

Figure 28: North America Market Value Share By Country (2025 A)

Figure 29: North America Market Value Analysis (USD million), 2020 to 2025

Figure 30: North America Market Value Forecast (USD million), 2025 to 2035

Figure 31: North America Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 32: North America Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 33: North America Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 34: North America Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 35: North America Market Attractiveness Analysis By Country, 2025 to 2035

Figure 36: Latin America Market Value Share By Drug Class (2025 A)

Figure 37: Latin America Market Value Share By Route of Administration (2025 A)

Figure 38: Latin America Market Value Share By Indication (2025 A)

Figure 39: Latin America Market Value Share By Distribution Channel (2025 A)

Figure 40: Latin America Market Value Share By Country (2025 A)

Figure 41: Latin America Market Value Analysis (USD million), 2020 to 2025

Figure 42: Latin America Market Value Forecast (USD million), 2025 to 2035

Figure 43: Latin America Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 44: Latin America Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 45: Latin America Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 46: Latin America Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 47: Latin America Market Attractiveness Analysis By Country, 2025 to 2035

Figure 48: Europe Market Value Share By Drug Class (2025 A)

Figure 49: Europe Market Value Share By Route of Administration (2025 A)

Figure 50: Europe Market Value Share By Indication (2025 A)

Figure 51: Europe Market Value Share By Distribution Channel (2025 A)

Figure 52: Europe Market Value Share By Country (2025 A)

Figure 53: Europe Market Value Analysis (USD million), 2020 to 2025

Figure 54: Europe Market Value Forecast (USD million), 2025 to 2035

Figure 55: Europe Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 56: Europe Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 57: Europe Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 58: Europe Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 59: Europe Market Attractiveness Analysis By Country, 2025 to 2035

Figure 60: South Asia Market Value Share By Drug Class (2025 A)

Figure 61: South Asia Market Value Share By Route of Administration (2025 A)

Figure 62: South Asia Market Value Share By Indication (2025 A)

Figure 63: South Asia Market Value Share By Distribution Channel (2025 A)

Figure 64: South Asia Market Value Share By Country (2025 A)

Figure 65: South Asia Market Value Analysis (USD million), 2020 to 2025

Figure 66: South Asia Market Value Forecast (USD million), 2025 to 2035

Figure 67: South Asia Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 68: South Asia Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 69: South Asia Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 70: South Asia Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 71: South Asia Market Attractiveness Analysis By Country, 2025 to 2035

Figure 72: East Asia Market Value Share By Drug Class (2025 A)

Figure 73: East Asia Market Value Share By Route of Administration (2025 A)

Figure 74: East Asia Market Value Share By Indication (2025 A)

Figure 75: East Asia Market Value Share By Distribution Channel (2025 A)

Figure 76: East Asia Market Value Share By Country (2025 A)

Figure 77: East Asia Market Value Analysis (USD million), 2020 to 2025

Figure 78: East Asia Market Value Forecast (USD million), 2025 to 2035

Figure 79: East Asia Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 80: East Asia Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 81: East Asia Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 82: East Asia Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 83: East Asia Market Attractiveness Analysis By Country, 2025 to 2035

Figure 84: Oceania Market Value Share By Drug Class (2025 A)

Figure 85: Oceania Market Value Share By Route of Administration (2025 A)

Figure 86: Oceania Market Value Share By Indication (2025 A)

Figure 87: Oceania Market Value Share By Distribution Channel (2025 A)

Figure 88: Oceania Market Value Share By Country (2025 A)

Figure 89: Oceania Market Value Analysis (USD million), 2020 to 2025

Figure 90: Oceania Market Value Forecast (USD million), 2025 to 2035

Figure 91: Oceania Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 92: Oceania Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 93: Oceania Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 94: Oceania Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 95: Oceania Market Attractiveness Analysis By Country, 2025 to 2035

Figure 96: Middle East & Africa Market Value Share By Drug Class (2025 A)

Figure 97: Middle East & Africa Market Value Share By Route of Administration (2025 A)

Figure 98: Middle East & Africa Market Value Share By Indication (2025 A)

Figure 99: Middle East & Africa Market Value Share By Distribution Channel (2025 A)

Figure 100: Middle East & Africa Market Value Share By Country (2025 A)

Figure 101: Middle East & Africa Market Value Analysis (USD million), 2020 to 2025

Figure 102: Middle East & Africa Market Value Forecast (USD million), 2025 to 2035

Figure 103: Middle East & Africa Market Attractiveness Analysis By Drug Class, 2025 to 2035

Figure 104: Middle East & Africa Market Attractiveness Analysis By Route of Administration, 2025 to 2035

Figure 105: Middle East & Africa Market Attractiveness Analysis By Indication, 2025 to 2035

Figure 106: Middle East & Africa Market Attractiveness Analysis By Distribution Channel, 2025 to 2035

Figure 107: Middle East & Africa Market Attractiveness Analysis By Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Anemia Treatment Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA