The castration-resistant prostate cancer (CRPC) industry is valued at USD 13.5 billion in 2025. As per FMI’s analysis, the castration-resistant prostate cancer (CRPC) industry will grow at a CAGR of 9.5% and reach USD 33.3 billion by 2035. This high-growth path is largely fueled by the increasing worldwide incidence of prostate cancer cases progressing to castration-resistant phases.

In 2024, the treatment paradigm of castration-resistant prostate cancer (CRPC) witnessed a dramatic shift, driven by accelerated research activities and swift integration of personalized medicine in clinical practice.

Pipeline development became pharmaceutical firms' top priority, with a focus on next-generation androgen receptor inhibitors and emerging radiopharmaceuticals. This realignment came in conjunction with a strategic move toward the incorporation of companion diagnostics, allowing for more accurate patient stratification and enhanced therapeutic response.

Looking forward to 2025, the CRPC treatment industry is set to witness rapid growth. The intersection of precision oncology, real-world evidence, and AI-powered decision-making tools will optimize treatment protocols and improve patient management. In addition, growing clinical adoption of combination therapies-especially those combining targeted agents with immunotherapies-will redefine standard care practices.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 13.5 billion |

| Industry Value (2035F) | USD 33.3 billion |

| CAGR (2025 to 2035) | 9.5% |

Explore FMI!

Book a free demo

The castration-resistant prostate cancer (CRPC) treatment industry is on a solid growth path, fueled by the increasing incidence of prostate cancer and innovation in targeted therapies. The growing use of precision medicine and combination therapies is transforming care delivery to the advantage of pharmaceutical innovators and diagnostics companies. Conventional monotherapy strategies could lose share as more effective, customized solutions become increasingly popular.

Drive Innovation in Targeted Therapies

Invest in the research and development of new-generation androgen receptor inhibitors, radiopharmaceuticals, and combination therapy to manage drug resistance and enhance clinical outcomes in CRPC patients.

Aspire towards Precision Medicine and Diagnostic Integration

Prioritize product pipeline alignment with the increasing need for individualized treatment by integrating genomic testing, biomarkers, and advanced imaging in therapeutic approaches.

Enhance Strategic Partnerships and Clinical Trials Network

Develop expanded partnerships among biotech companies, academia, and clinical research organizations to drive R&D more rapidly, simplify regulatory routes, and improve industry access through collaborative commercialization.

| Risk | Probability - Impact |

|---|---|

| Delayed regulatory approvals for new therapies: Extended approval times can delay the commercialization of innovative treatments, slowing industry momentum. | Medium - High |

| High cost of treatment constraining patient accessibility in developing economies: Costly treatments can limit uptake, particularly in low-resource economies without reimbursement. | High - Medium |

| Limited long-term efficacy information for recent combination regimens: Lack of post-marketing data can raise concerns regarding longer-term benefits, impacting clinician confidence and uptake. | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Diversify and fortify the therapeutic pipeline. | Perform feasibility studies and early-stage trials for next-generation androgen receptor antagonists and radiopharmaceuticals against advanced CRPC pathways. |

| Advanced diagnostic-therapy convergence | Build strategic partnerships with diagnostic companies to co-develop companion diagnostics such as genomic profiling and liquid biopsy tests for the early detection of and monitoring of CRPC. |

| Expand global access and commercialization reach | Develop region-by-region pricing structures and reimbursement models; launch stakeholder engagement programs in under-penetrated sectors to drive therapy adoption. |

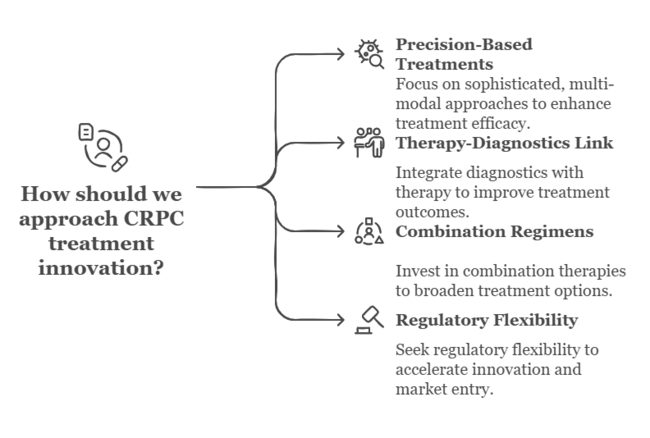

To stay ahead, companies must swiftly shift to precision-based, multi-modal treatment approaches that capture the increasing sophistication of castration-resistant prostate cancer (CRPC). This insight emphasizes the imperative to bring R&D in sync with genomic and biomarker-led innovation, even as it shores up access approaches through value-based pricing and focused global expansion.

Companies that link therapy with diagnostics, invest in combination regimens, and work collaboratively across the oncology ecosystem will be most well placed to realize long-term value. Board-level attention should now turn towards speeding up product pipelines, broadening clinical trial landscapes, and winning regulatory flexibility to lead the next wave of CRPC treatment innovation.

Hormonal therapy is anticipated to be the most profitable therapy type in the sector for castration-resistant prostate cancer (CRPC) treatment between 2025 and 2035. This segment is likely to grow at a CAGR of 10.2%, higher than the global average, because of the extensive clinical usage of sophisticated androgen receptor signaling inhibitors like enzalutamide, apalutamide, and abiraterone. These drugs continue to show substantial efficacy in slowing disease progression and enhancing survival rates, even in metastatic disease.

Their oral route of administration, safety profile relative to chemotherapy, and increasing use in combination with other modalities such as radiopharmaceuticals add to their popularity among patients and clinicians alike.

Non-steroidal antiandrogens are projected to dominate CRPC drug class sales between 2025 and 2035, with a CAGR of 10.5%, above the global average. This dominance is fueled by sustained clinical choice for drugs such as enzalutamide, apalutamide, and darolutamide, which potently inhibit androgen receptor signaling-a critical driver of CRPC growth.

These agents are increasingly being used as first-line and second-line therapies because they can prolong survival with tolerable side effects. Their use in combination regimens with corticosteroids or chemotherapy is also growing, further increasing treatment customization and efficacy.

The large number of active clinical trials and next-generation pipeline molecules in this class further solidifies its leadership and long-term growth potential in the emerging CRPC treatment paradigm.

The oral route is anticipated to continue being the most profitable drug delivery route for castration-resistant prostate cancer (CRPC) therapies between 2025 and 2035, growing at a CAGR of 10.1%. This is due to the extensive use of orally active non-steroidal antiandrogens like enzalutamide and abiraterone, which are currently the cornerstone treatments in CRPC management.

Oral therapies provide improved patient compliance, convenience of administration in the outpatient setting, and lower healthcare costs related to hospital-based infusions. With the CRPC therapeutic environment moving increasingly toward chronic disease management and home care, the need for oral agents will increase substantially.

Hospital pharmacies are expected to be the most profitable distribution channel for CRPC treatments from 2025 to 2035, expanding at a CAGR of 9.8%. The channel leads because CRPC management is complicated and usually needs multidisciplinary management, combination regimens, and access to expensive therapies under clinical supervision.

Hospital pharmacies are key to ensuring the timely delivery of advanced hormonal agents, chemotherapy, radiopharmaceuticals, and immunotherapies, particularly in metastatic or advanced cases. Regulatory compliance, reimbursement procedures, and clinical trial enrollment are also better managed within hospital-based systems.

The United States will be a leader in the CRPC treatment landscape, supported by advanced oncology infrastructure, high treatment availability, and early uptake of new therapeutics. Precision medicine is a key thrust, with extensive use of genomic profiling and companion diagnostics for targeting therapy selection.

Pharmaceutical firms are in a race to launch next-generation antiandrogens and radioligand therapies, with the FDA's accelerated approval pathway remaining a key driver for fast-track drug development.

Reimbursement systems are strong, particularly for expensive treatments, and the USA provides an optimum launch platform for international drug launches. Clinical trial take-up is also above global standards, providing real-world learning that further refines treatment pathways. FMI forecasts that the CAGR of the United States is 10.1% from 2025 to 2035.

India's CRPC treatment scenario is changing, spurred by a rise in the incidence of prostate cancer, growing health penetration, and government initiatives to enhance accessibility of cancer care.

Although late-stage diagnosis continues to pose a challenge, urbanization and enhanced diagnostic outreach are promoting earlier treatment. The base of generic drug manufacturing is allowing cost-efficient therapy, especially hormone therapy and chemotherapeutics.

Medical tourism also favors the industry, with India charging much lower costs of treatment in comparison to the West. The emergence of online pharmacies and tele-oncology platforms is also increasing CRPC treatments. FMI is of the opinion that India's CAGR will be 9.2% from 2025 to 2035.

China is becoming a prominent growth driver for CRPC therapies due to aggressive healthcare reform, demographic changes, and expanding cancer awareness. The expansion of oncology centers is supported by the government's "Healthy China 2030" policy, which accelerates diagnosis and treatment access. National funding-backed local biotech companies are launching new molecular entities for CRPC, minimizing imports.

The growing adoption of PSA screening and genomic testing has resulted in increasing early detection rates, allowing for timely treatment. Reforms in regulation in China, particularly expedited approvals through the National Medical Products Administration (NMPA), are driving innovation. FMI forecasts that the CAGR of China is 10.3% from 2025 to 2035.

The UK CRPC treatment industry is picking up pace with NHS-led universal access and aggressive oncology policies. Early screening and accelerated treatment are priorities of the government's Cancer Strategy, resulting in increasing adoption of targeted therapies. NICE has played a crucial role in expediting approvals for new agents such as next-generation antiandrogens and radiopharmaceuticals.

The UK is also host to a robust ecosystem of research university institutions and clinical trial networks, which makes it a center for the development of drugs that are used to investigate.

AI integration for cancer diagnostics, especially in pathology and imaging, will go a long way in further improving patient outcomes. FMI opines that the CAGR of the United Kingdom is 9.1% from 2025 to 2035.

Germany is leading the way in CRPC treatment innovation, supported by robust pharmaceutical R&D, excellent clinical standards, and organized health insurance coverage. Precision oncology is a focus area for the country, with molecular profiling informing treatment choice in CRPC patients.

German biotech companies are actively engaged in the development of hormonal agents, radioligand therapies, and immunotherapies against advanced prostate cancers.

The decentralized system of healthcare provides regional innovation, primarily in academic medical centers with advanced clinical trials. Evidence-based medicine and pharmacovigilance in Germany create a high standard of treatment optimization. FMI forecasts that Germany's CAGR will be 9.4% from 2025 to 2035.

South Korea is experiencing rapid growth in CRPC treatments, driven by high healthcare digitization, a technology-driven pharmaceutical industry, and rising public health investments. The government's "Biohealth Industry Vision" seeks to position Korea as a global biopharma hub, which is evident in its growing pipeline of cutting-edge therapeutics.

Hospitals are incorporating AI and machine learning into cancer diagnosis, allowing for early and precise detection of disease progression. South Korean firms are becoming contract manufacturers for international CRPC drug developers and producing indigenous treatments.

In addition, government-sponsored screening programs are increasing the level of early-stage detection, enhancing long-term survival. FMI opines that the CAGR of South Korea is 9.6% from 2025 to 2035.

Japan's CRPC treatment model is defined by its high priority for geriatric care, pharma industry driven by innovation, and heavy use of molecular diagnostics. The Ministry of Health, Labour and Welfare (MHLW) offers accelerated approvals of cancer therapies, allowing prompt industry entry of new therapeutics. Japanese firms are specializing in radiopharmaceuticals and immune-oncology convergence.

The nation is at the forefront of carrying out real-world evidence research, especially with respect to the long-term effects of antiandrogens and radioligand therapies. Precision medicine is directly encouraged through national genomic programs. FMI forecasts that the CAGR of Japan is 9.3% from 2025 to 2035.

France's CRPC treatment industry is growing steadily as a result of a well-balanced combination of public sector support, pharma innovation, and high clinical standards. The national cancer plan in the country encourages early detection, with PSA screening being widely available.

French oncologists are taking advantage of combination regimens and increasingly prescribing targeted therapies on the basis of biomarker profiles. The availability of a vast academic-clinical research environment, supported by EU collaborations, is speeding up trial activity in immunotherapy and hormone-refractory disease.

France is also investigating AI-facilitated diagnostic workflows and laboratory automation for rapid turnaround times. FMI is of the opinion that the CAGR of France is 9.2% from 2025 to 2035.

Italy is investing in regional oncology networks to enhance CRPC treatment access and reduce diagnosis-to-treatment times. The Italian Medicines Agency (AIFA) has simplified its drug evaluation procedures, resulting in quicker reimbursement approvals for new therapies.

Rome, Milan, and Florence oncology centers are performing high-impact research on radioligand therapy and new hormone inhibitors. The focus on public health campaigns for prostate cancer awareness is enhancing early-stage detection. Italian drug companies are collaborating with biotech startups to co-develop targeted treatments, particularly for hormone-refractory instances.

Electronic health record integration is facilitating personalized treatment monitoring and enhanced patient management across geographies. FMI opines that the CAGR of Italy is 9.1% from 2025 to 2035.

Australia and New Zealand remain promising locations for oncology trials, particularly for advanced prostate cancer. Australia's Therapeutic Goods Administration (TGA) has a forward-thinking approach to expediting approvals for life-saving medicines, while New Zealand's PHARMAC system is becoming more supportive of innovative oncology treatments. Early screening programs are common, and the region has one of the highest healthcare quality scores in the world.

CRPC treatment guidelines are becoming more uniform due to national clinical guidelines and tracking of real-world outcomes. FMI projects that the CAGR of both regions is 9.4% from 2025 to 2035.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across oncologists, pharma executives, hospital procurement heads, and regulatory experts in the USA, Western Europe, Japan, and South Korea)

| Countries | Regulatory & Policy Impact |

|---|---|

| USA | FDA breakthrough & fast-track designations streamline drug approvals; CMS value-based cancer care model reforms encourage value-based cancer care models. |

| India | CDSCO regulates approvals, but uncertainty and lack of fast-tracking for oncology products restrain sector entry, and pricing below the NPPA ceiling. |

| China | NMPA reforms facilitate conditional approval of cancer drugs; inclusion in NRDL is pivotal for adoption, with domestic over foreign brands preferred. |

| UK | NICE has high cost-effectiveness thresholds; the Cancer Drug Fund (CDF) allows coverage of expensive treatments under conditional coverage. |

| Germany | AMNOG price law requires early benefit assessment; industry access is promoted, but is contingent on HTA assessments. |

| South Korea | HIRA rigidly uses reimbursement assessment; delayed price negotiations slow down the launch of new agents, especially imported drugs. |

| Japan | PMDA approval is relatively rapid, but twice-yearly drug price revisions and low reimbursement constrain innovation-led product launches. |

| France | HAS and CEPS determine coverage and price; ASMR scores heavily determine reimbursement and industry success. |

| Italy | Regional alignment to achieve full industry access is needed to obtain AIFA approval; MEAs are also commonly employed in the case of expensive CRPC medications. |

| Australia & New Zealand | TGA approval and subsequent consideration by PBAC decide access; reimbursement only for documented survival benefit cases. |

The industry for Castration-Resistant Prostate Cancer (CRPC) treatment is moderately concentrated, with a few large global pharmaceutical players holding sway in the industry.

Leading majors are distinguishing themselves with pricing models, product development, strategic alliances, and entering developing sectors. R&D expenditure is aimed at next-generation medicines, such as radioligand treatments, targeted inhibitors, and enhanced antibody-drug conjugates (ADCs).

AstraZeneca bought Fusion Pharmaceuticals in 2024 for as much as USD 2.4 billion, a step to enhance its radioconjugate therapy in cancer treatment, such as in advanced prostate cancer.

Novartis also took a big step in acquiring Mariana Oncology in May 2024 to fortify its radioligand therapy (RLT) portfolio with a view to addressing unmet needs in advanced oncology, such as prostate cancer.

In the meantime, Johnson & Johnson finalized its acquisition of Ambrx Biopharma in March 2024, gaining control over a pipeline that features ARX517, a PSMA-targeting ADC designed for the treatment of metastatic CRPC.

Johnson & Johnson (32%)

Leads with AR inhibitor Zytiga and Erleada for advanced prostate cancer.

Pfizer/Astellas (28%)

Leads with Xtandi, the most prescribed AR inhibitor in the world.

Bayer (15%)

Disrupted with differentiated AR antagonist Nubeqa with improved safety profile.

Novartis (10%)

Disrupting with Pluvicto, a targeted radiopharmaceutical therapy.

AstraZeneca (8%)

Focusing on precision medicine with PARP inhibitor Lynparza for BRCA+ patients.

Merck & Co. (5%)

Examining combinations of immunotherapies with Keytruda in CRPC.

Advances in radioligand therapies, androgen receptor inhibitors, and novel hormonal agents are driving therapeutic innovation.

Pharmaceuticals are making investments in dual-mechanism therapies and developing combination regimens to maximize efficacy against resistant tumor pathways.

Precision oncology is revolutionizing treatment paradigms by facilitating patient-specific therapies based on genomic and molecular profiling.

Regulatory agencies are streamlining accelerated approval processes, particularly for breakthrough therapies, forcing companies to innovate quickly while ensuring safety compliance.

Asia-Pacific and some Latin American nations are seeing increased adoption owing to increasing incidence, improved diagnostics, and improved access to advanced therapeutics.

Hormonal therapy, Chemotherapy, Immunotherapy, Radiotherapy

Antineoplastic, Non-steroidal Antiandrogen, Corticosteroids, Microtubule Inhibitor

Oral Route, Injectable Route

Hospital Pharmacies, Retail Pharmacies, Online Pharmacies

North America, Latin America, Europe, South Asia, East Asia, Oceania, MEA

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.