After 2025, demand for castor oil derivatives will continue to grow for cosmetics, pharmaceuticals, lubricants, biodiesel production, food additives, and other industries until 2035. Castor oil & its derivatives are renewable & bio-based, hence they are an alternative to petroleum-based chemicals thus providing an opportunity to meet the growing environmental concern & regulation for sustainable material.

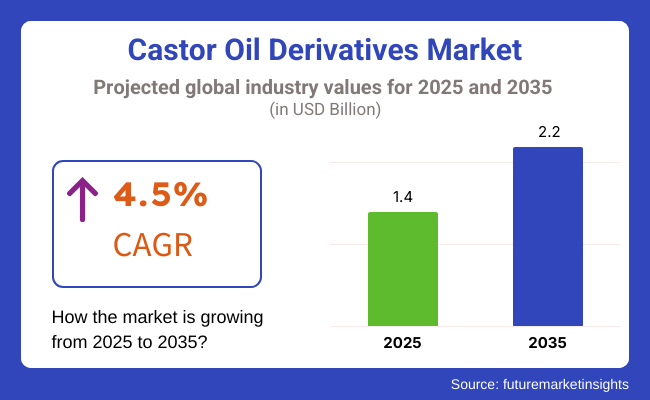

In 2025, the market value for such compound was also approx USD 1.4 Billion which is expected till 2035 to number about USD 2.2 Billion at a CAG of 4.5%. Key factors driving such growth include increasing demand for bio-based surfactants and polymers, expanding applications in personal care products, and the increasing utilization of castor oil derivatives in industrial formulations.

In addition, the steady development of new derivatives such as ricinoleic acid, sebacic acid and undecylenic acid enable manufacturers to serve niche applications in specialty chemicals, aviation lubricating oils and pharmaceuticals. With their properties such as high viscosity, biodegradability and multifunctionality, castor oils remain an important renewable resource for the chemicals and materials used in new technologies.

The castor oil derivatives segment is distinguished by a wide market share due to the growing trend in the industry towards bio-based chemicals focused on sustainability, reducing dependence on petroleum-derived replacements, and improving efficiency across numerous industrial applications; sebacic acid and undecylenic acid is contributing to this market share.

So these derivatives of castor oil play a significant role in providing high chemical stability, high thermal transfer capability and biodegradable properties, are required mainly by end-use companies such as cosmetics, these lubricants and polymers and pharmaceutical companies.

Since its early start, Sebacic acid is one of the best used castor oil derivative showing good thermal stability, excellent corrosive resistant, and better compatibility with several polymeric formulations [6]. Sebacic acid, in contrast to synthetic dicarboxylic acids, is also sourced from renewable castor oil sources giving it lower carbon footprints and better environmental sustainability.

Sebacic acid is largely used in bio-based polymers and its demand is on the rise as manufacturers transition towards high efficiency, lightweight and biodegradable plastics, which require sebacic acid-derived polyamides and polyesters, thus, promoting the use of sebacic acid in industries including packaging, automotive, textiles, etc. Studies show that polyamides derived from sebacic acid increase polymer plastics by improving impact and long-term durability for automotive, packaging and consumer goods applications.

The market is primarily driven by the growing penetration of sebacic acid in high-performance lubricants and the availability of biodegradable, non-toxic and high-viscosity formulations for industrial and automotive engines is expected to result in the increased demand for the product to facilitate higher deployment in sustainable lubricant solutions.

Combined with the improvement of chemical resistance, superior adhesion, and high-temperature stability have contributed to the increasing use sebacic acid in bio-based adhesives and coatings which ensure good properties in aerospace, marine, and industrial coatings as well.

The market growth has been optimally augmented by sebacic acid-derived biodegradable plastics which includes those with lower carbon footprint polyesters and renewable polyurethanes ensuring stronger adoption in sustainable packaging and eco-friendly consumer goods.

Sebacic acid-based pharmaceutical intermediates with long-chain dicarboxylic acid formulations for the encapsulation of drugs and controlled-release applications have further bolstered market growth, enabling enhanced drug stability, increased bioavailability, and prolonged shelf life.

Though sebacic acid offers advantages with respect to sustainability in polymers, performance in lubricants, and the potential formulation of biodegradable materials, it faces challenges regarding the volatility of the feedstock price, the complexity of the production process itself, as well as the regulatory difficulties associated with bio-based certification standards.

Nevertheless, new technologies resulting in cost-effective AI-aided polymer synthesis, enzyme-catalyzed sebacic acid production, and integration within novel bio-refinery processes are tackling challenges related to cost, production scalability, and environmental efficiency, thereby sustaining demand for sebacic acid-based castor oil derivatives

Utilization of undecylenic acid in antimicrobial and personal care applications is expected to rise with the bolster of companies.

With varied applications in the pharmaceutical, personal care, and specialty chemical formulations industries, undecylenic acid has witnessed strong market adoption because it is being increasingly employed by these industries to improve the efficacy of products, enhance antimicrobial properties, and procure the ingredients required by the organizational goals in an eco-friendly way.

While surfactants and antimicrobial agents based on petroleum have been widely utilized in the cosmetic and healthcare sectors due to their functionality, undecylenic acid delivers natural antifungal, antibacterial and emollient performance ensuring the best quality in formulation.

Besides, the increasing trend for the use of non-toxic, bio-based formulations for dermatological applications in pharmaceutical antifungal treatments has propelled the adoption of undecylenic acid-based medicated creams, ointments, and lotions as healthcare providers prefer plant-based active ingredients rather than synthetic products.

Undecylenic acid is known to have antifungal activity, long-acting therapeutic effect, and less irritating potential than synthetic antifungal agents.

Rising utilization of undecylenic acid in natural cosmetic and personal care formulations with skin-conditioning, moisturizing, and antimicrobial features has bolstered market demand and drives them to be consumed in larger scale in organic skin care, hair care, and deodorant formulations.

Moreover, the inclusion of undecylenic acid in bio rates surfactants and emulsifiers such as biodegradable high-foaming, mild cleansing and environmentally friendly detergent formulations are promoting the adoption of undecylenic acid in end-use products that outperform sulfate-free shampoos, natural hand sanitizers, and biodegradable household cleaning products, thereby buttressing market growth.

Undecylenic acid-based specialty polymers such as medical-grade elastomers, antibacterial coatings, and biodegradable food-grade bioplastics accelerated the market progress owing to their enhanced consumability in healthcare packaging, surgical devices, and biomedical coatings.

The utilization of undecylenic acid in nature-derived agrochemical formulations incorporating natural fungicides, green plant growth stimulators, and organic pest repellents has propelled market growth as they offer better compliance with sustainability-focused agriculture programs and regulatory bans on chemical-based pesticides.

Undecylenic acid has some inherent advantages such as natural antifungal properties, personal care applications and biodegradable formulation but faces challenges in terms of competition from synthetic alternatives in cost sensitive segments, limited supply chain availability and poor formulation stability in high temperature applications.

Lubricants and biodiesel are two critical drivers in the marketplace, as manufacturers, energy producers, and industrial operators around the world embrace castor oil derivatives to improve efficiency, increase sustainability, and move away from petroleum-based substitutes.

Actually, lubricants have become one of the most significant applications for castor oil derivatives because more and more bio-based lubricants are being adopted in industrial, automotive, and aerospace sectors to improve their use as friction reduction, thermal stability, and long-term follow-up machinery performance.

Compared with such typical petroleum based lubricants castor oil derived lubricants offer fantastic viscosity index, outstanding oxidative stability and biodegradable and therefore sustainable and regulatory compliant in nature.

Favorable growth prospects of castor oil-derived lubricants in high-temperature applications, such as thermal-resistant formulations for aircraft engines, hydraulic systems, and industrial machinery, have driven adoption of high-performance biodegradable lubricants amid a shifting focus of engine manufacturers and industrial operators toward eco-friendly solutions over synthetic oils.

Castor oil-derived lubricants offer sustainable, thermally stable, and biodegradable mineral oil alternatives; however, their raw material price volatility, oxidation sensitivity, and limited cold-flow in severe winter environments often limit their application.

But it is innovations such as AI-assisted lubricant formulation, nano-enhanced castor oil additives, and bio-synthetic lubricant hybrids, improving performance fidelity, market competitiveness and application versatility, that is guaranteeing further growth for bio-lubricants.

Due to its advantages over conventional products in terms of performance, cost and sustainability, its market adoption has been robust across diverse applications, especially in biobased energy, green transportation and off-grid energy production, where energy producers are focusing on castor oil-based biodiesel as a means of improving fuel efficiency, lowering carbon footprints and ensuring compatibility with existing diesel infrastructure.

Castor oil-based biodiesel offers more lubricity, higher flashpoints and better oxidative stability than conventional fossil diesel, extending the viability of the fuel and compliance with legislation.

Governments and energy companies are focusing on renewable fuel mandates and emission reduction targets, both of which have driven the adoption of castor oil-derived biodiesel in eco-friendly transportation and carbon-neutral shipping, with blends of bio-based fuels for commercial fleets, marine vessels, and railway engines.

Castor oil-based biodiesel has advantages as an energy source from the standpoint of emission reduction, regulatory compliance, and fuel sustainability, though production cost competitiveness, feedstock scalability, and energy efficiency optimization are still challenges that need solving.

Emerging AI-tech driven biodiesel production methods along with enzyme mediated transesterification and bio-refinery waste valorization are currently evolving by enhancing fuel economy, feedstock availability and commercial viability and thus a fall in demand for biodiesel obtained from castor oil is highly unlikely in the upcoming years.

North America The fuel of end-use industries like personal care, automotive and industrial chemicals continue to remain the vigorous market for castor oil derivatives. Research and development in the region have resulted in the development of new formulations, which are extensively utilized in high-performance lubricants and bio-based polymers.

Growing sustainability Ichinger, in turn, is creating a need for castor oil-based biodiesel in the United States as regulation frameworks, such as the Renewable Fuel Standard (RFS) and state-level programs, support the switch to renewable fuels. The rising demand for environmentally friendly plastics and composites in the automotive and packaging industries across the region is also adding to the market growth.

The food and pharmaceutical industries in Canada are increasing the use of castor oil derivatives in food-grade emulsifiers, laxatives, and pharmaceutical excipients, which is propelling the country’s market share. The North America market is pegged for steady growth throughout the forecast period, as countries in the region are now leading the way on green chemistry and sustainable manufacturing.

Climate policies and regulatory frameworks promoting bio-based substitutes empower Europe to dominate the castor oil derivatives market. The European Union’s strict directives for limiting greenhouse gas emissions and plastic waste is incentivizing industry to invest in renewable and biodegradable raw materials.

Leading consumers of castor oil derivatives, particularly in industrial lubricants, automotive components, and personal care products include Germany, France, and Italy. Demand for ricinoleic acid is particularly strong in the production of detergents and surfactants since manufacturers would be in need for safer, environmentally friendly ingredients that will help them meet the EU standards.

In addition, Europe’s pharmaceutical industry is increasingly utilizing derivatives of castor oil as excipients and active ingredients in the preparations of medicines. Owing to the region’s well-developed chemical production and infrastructure, it has become a centre for innovation and development of castor oil-based products.

The castor oil derivatives market in the Asia-Pacific region is expected to register the highest growth rate, owing to the high population, rapid industrialization, and urbanization. China, India, and Japan are leading producers and consumers of castor oil derivatives for pharmaceutical, cosmetic, industrial chemical, and renewable energy applications.

India, one of the largest producers of castor seeds, is a major supplier of castor oil and derivatives to global markets. Domestically, the government push for renewable resources and bio-economy initiatives are further incentivizing industries to set up or expand castor oil processing capacities.

Sustainable growth in China in durable segments has led to growing market share of castor oil based polyols and biopolymers for construction materials, automotive interior and consumer electronics manufacturers.

In Japan, which already boasts a fully developed cosmetics business, derivatives of castor oil are being employed as natural emulsifiers, stabilizers, and moisturizing agents, playing into the more general trend towards organic and bio-based products among consumers.

As the middle-class population in the region grows and spending on personal care products, and eco-friendly products increases, new opportunities for manufacturers are emerging. Thanks to ongoing investments in production technologies and a robust agricultural base, Asia-Pacific is positioned to remain the leading consumer of castor oil derivatives, in terms of volume, by 2035.

Inconsistent Raw Material Costs and Limited Supply Chain Stability

There are several challenges in the Castor Oil Derivatives Market including fluctuating prices of raw material and supply chain constraints. Castor oil manufacturing is highly reliant on climatic and geographic availability, especially in India, which supplies the majority of the world.

Forecasts are subject to change, which could lead to unpredictable weather patterns, inconsistent yields, and increasing demand for castor oil derivatives. And, logistical constraints and trade policies restrict the free flow of raw materials and derivatives across global markets.

Companies should also invest in diversified sourcing, supply chain resilience, and advanced processing techniques that optimize efficiency and lessen reliance on a single production locale in order to weaken these pressures. Innovative agriculture practices, data-driven weather analytics, and enhanced transparency through block chain are just some of the solutions in the pipeline to cement market stabilization.

Increasing Demand for Bio and Sustainable Chemicals

The growing sustainability focus and the trend of bio-based chemicals are also providing lucrative opportunities to the Castor Oil Derivatives Market. Due to their renewability and versatility, castor oil derivatives have significant applications in pharmaceuticals, cosmetics, lubricants, and bioplastics.

Increasing consumer awareness about eco-friendly products and regulatory support for the use of bio-based alternatives to petrochemicals is bolstering demand. Excellent market potential is guaranteed by the expansion of applications of castor oil in industries that are correspondingly growing such as biopolymers and bio-lubricants.

The companies that develop new processing technologies, improve product quality, and contribute to circular economy initiatives will have a greater competitive advantage in this changing landscape. Further, partnerships with research institutes will provide novel applications including bio-based adhesives and high-performance polymers, thus providing a wide market opportunity.

The Castor Oil Derivatives Market has grown at a steady pace between 2020 and 2024 owing to their increasing adoption in industrial oriented applications and usage in cosmetic and personal care products as well as increasing demand for bio-based lubricants.

This resulted in improved transparency and sustainable sourcing practices in the castor oil supply chain due to pressure from governments and corporations alike. Limited production and price volatility introduced uncertainties in supply, impacting market stability.

Firms concentrated on improving extraction processes and optimizing product formulations to suit industry-specific needs. Automation and integration of AI-driven quality control systems allowed manufacturers to further optimize their production processes, leading to better efficiency overall, and enabling them to keep up to the same standards as before despite varying quantities of raw materials.

The castor oil market has been anticipated to continue its growth in future from 2025 to 2035 owing to technological advances in biotechnology, continued investments in sustainable chemicals, and an increased penetration of castor oil derivatives in green chemistry applications.

Enzymatic processing innovations and genetic modifications for castor crops to produce higher-yield grains will further improve production efficiency. The increasing usage of castor-based polyamides, surfactants, and coatings in automotive and construction industries will also drive market growth.

With regulatory frameworks becoming increasingly favourable to bio-based chemicals relative to petroleum-based options, high-growth castor oil derivatives will witness increased demand in pharmaceutical excipients, biodegradable plastics and high-performance lubricants. Entering untapped markets and utilizing AI to generate predictive analysis for demand forecasting will also allow manufacturers to scale more efficiently.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Moderate enforcement: Support for bio-based chemicals |

| Technological Advancements | Advancing novel techniques of castor oil extraction and purification. |

| Industry Adoption | Expansion in personal care, pharmaceuticals and bio-lubricants |

| Supply Chain and Sourcing | Heavy dependence on India for castor oil supply |

| Market Competition | Presence of regional players and established chemical manufacturers |

| Market Growth Drivers | Rising demand for sustainable personal care and lubricant products |

| Sustainability and Circular Economy | Early-stage adoption of eco-friendly castor-based products |

| AI and Automation in Production | Limited use of automation in castor oil processing |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter policies incentivizing bio-based alternatives and limitations on petroleum-based chemicals. |

| Technological Advancements | Biotechnology in high-yield crop cultivation and enzymatic conversion of oils |

| Industry Adoption | More growth in bioplastics, sustainable polymers and specialty chemical applications. |

| Supply Chain and Sourcing | Diversified sourcing strategies and investments in castor crop cultivation in new regions. |

| Market Competition | Increased competition from biotech firms and large-scale sustainability-focused enterprises. |

| Market Growth Drivers | Expansion into biodegradable plastics, green coatings, and circular economy-driven industries. |

| Sustainability and Circular Economy | Full integration of castor oil derivatives into sustainable supply chains and low-carbon industrial processes. |

| AI and Automation in Production | AI-driven optimization, robotics-assisted production, and real-time quality control implementation. |

In the United States the castor oil derivatives market is growing at a steady rate owing to the increasing demand for bio-based chemicals, increasing applications in pharmaceuticals and growing usage in the cosmetics industry. The United States Food and Drug Administration (USA FDA) has approved the use of castor oil and its derivatives as pharmaceutical excipients and coatings, increasing their adoption in drug formulations.

Increasing demand for natural emollients and bio-based surfactants in skin care products, hair care products, and organic beauty products also drives the cosmetics & personal care sector on the global market. Furthermore, United States automotive and aerospace companies are employing castor oil-based lubricants and greases to improve biodegradability and high thermal stability.

Some of the leading companies for castor oil derivatives in the USA are innovating their products through R&D investments to boost its bio-based materials and sustainability measures, which is expected to assure the steady growth of the castor oil derivatives market in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

The growth of United Kingdom castor oil derivatives market is being propelled by growing demand for eco-friendly personal care products, growing usage in the pharmaceutical sector, and increasing application in the industrial lubricant segment. This shift to bio-based castor oil derivatives is being driven by the UK’s regulatory focus on limiting the use of synthetic chemicals in markets such as cosmetics, coatings, and plastics.

The pharmaceutical sector is one of the key consumers as castor oil derivatives are used in excipients, drug delivery systems, and specialty coatings. Moreover, the cosmetics and personal care sector is also experiencing growing penetration of castor oil-derived emollients, surfactants and waxes in green formulations.

Rising consumer adoption of sustainable ingredients as well as increased investment into bio-based chemistry will create moderate growth for the castor oil derivatives market in the UK.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.3% |

The European Union castor oil derivatives market is growing consistently, aided by stringent environmental regulations, surging demand for bio-based chemicals, and rising consumption in industrial applications. Germany fringes France and Italy as top consumers with applications from automotive to pharmaceuticals, cosmetics, and bioplastics.

The push towards biodegradable and sustainable chemicals is fostering demand for castor oil-based polymers as well as lubricants and coatings, consequent to the EU’s Green Deal & REACH regulations. The automotive and aerospace industries, especially in Germany and France, are adopting bio-based lubricants and greases to meet stricter environmental requirements.

Also, the personal care and cosmetics industry has a growing demand for castor oil-based emollients and surfactants because Greek preferences are shifting towards organic and plant-based formulary.

The EU castor oil derivatives market is expected to grow steadily as the EU offers robust regulatory support with fresh investment in green chemistry and sustainable products.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

The Japanese market for castor oil derivatives has been growing steadily, with high-performance lubricants among the prominent end-use sectors driving demand, followed by electronics and personal care. Leading consumers include Japan’s automotive and electronics industries, where castor oil-based coatings, lubricants and thermal stabilizers are employed in high-temperature applications.

Another major sector is the pharmaceutical industry, where castor oil derivatives are used in excipients and drug formulations. Natural and bio-based ingredients are also on the rise within Japan’s cosmetic industry, creating a growing market for castor oil-derived emollients and waxes.

The Japanese castor oil derivatives market is anticipated to undergo moderate expansion as bio-based chemistry and environmentally friendly industrial applications continue to develop.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The South Korea castor oil derivatives market is witnessing steady growth, driven by an increase in demand for bio-based cosmetics, growth of applications in pharmaceutical applications, and growing involvement in high performance lubricants. South Korea’s cosmetics industry, famed for K-beauty innovations, is a significant consumer of castor oil-based waiting surfactants, emollients and waxes.

In drug formulations and coatings, both the pharmaceutical gland and the nutraceutical gland are being used as castor oil derivatives. Furthermore, bio-based lubricants and greases are becoming more popular in the automotive and industrial industries for sustainable manufacturing.

The South Korea castor oil derivatives market is expected to show a stable growth due to the supportive government initiatives toward green chemistry along with increasing demand for bio-based formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

Demand for bio-based chemicals, sustainable industrial applications, and eco-friendly substitutes to petrochemicals has been driving the castor oil derivatives market. High Purity Hydrogenated Castor Oil, Sebacic Acid production, and the use of bio-polyamide applications are being explored to improve renewability, biodegradability, and cost efficiency by companies.

Market coverage: The market consists of global specialty chemical producers and regional castor oil manufacturers, each being responsible for discoveries in bio-based coatings, lubricants, polymers, and pharmaceuticals.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Jayant Agro-Organics Ltd. | 15-20% |

| Hokoku Corporation | 12-16% |

| Gokul Agro Resources Ltd. | 10-14% |

| BASF SE | 8-12% |

| NK Industries Ltd. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Jayant Agro-Organics Ltd. | Develops hydrogenated castor oil (HCO), sebacic acid, and bio-based lubricants for industrial applications. |

| Hokoku Corporation | Specializes in castor-based polyamide resins, surfactants, and plastic additives for automotive and coatings. |

| Gokul Agro Resources Ltd. | Manufactures high-purity castor derivatives such as 12-hydroxy stearic acid (12-HSA) and undecylenic acid for cosmetics and pharmaceuticals. |

| BASF SE | Provides castor oil-based polyamides, bio-lubricants, and green solvents for industrial and automotive applications. |

| NK Industries Ltd. | Offers bio-based plasticizers, castor oil esters, and biodegradable polymer additives. |

Key Company Insights

Jayant Agro-Organics Ltd. (15-20%)

Jayant Agro-Organics a Leader in Castor Oil Derivatives,Sebacic Acid, Ricinoleic Acid, High Performance Bio-Based Lubricants; Provides AI-Powered Production Monitoring for Efficiency.

Hokoku Corporation (12-16%)

Hokoku, which focuses on automotive coatings and high-performance plastic additives, specializes in castor-based polyamides and biodegradable surfactants.

Gokul Agro Resources Ltd. (10-14%)

Gokul Agro formulates pharmaceutical-type castor derivatives and highly pure bio-chemicals that improve cosmetics, food and medical formulations.

BASF SE (8-12%)

Castor oil derivatives use in industrial coatings, lubricants, and polymer applications at BASF provides sustainable and high-performance bio-based solutions.

NK Industries Ltd. (5-9%)

NK Industries also provides biodegradable plastic additives, and specialty esters from castor oil to create bio-based replacements to synthetic lubricants.

Several chemical and bio-based material manufacturers contribute to next-generation castor oil derivatives, AI-assisted process optimization, and sustainable polymer innovations. These include:

The overall market size for Castor Oil Derivatives Market was USD 1.4 Billion in 2025.

The Castor Oil Derivatives Market expected to reach USD 2.2 Billion in 2035.

The demand for the Castor Oil Derivatives Market will be driven by the growing use of castor oil derivatives in industries such as cosmetics, pharmaceuticals, biodiesel production, and lubricants. Increasing consumer demand for sustainable and eco-friendly products will further boost market growth.

The top 5 countries which drives the development of Castor Oil Derivatives Market are USA, UK, Europe Union, Japan and South Korea.

Sebacic Acid and Undecylenic Acid Drive Market to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilotons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 4: Global Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 10: North America Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 16: Latin America Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 22: Europe Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 28: Asia Pacific Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Kilotons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product , 2018 to 2033

Table 34: MEA Market Volume (Kilotons) Forecast by Product , 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Kilotons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product , 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Kilotons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 9: Global Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product , 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product , 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 27: North America Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product , 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product , 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 45: Latin America Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product , 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product , 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 63: Europe Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product , 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product , 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 81: Asia Pacific Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product , 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product , 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Kilotons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product , 2018 to 2033

Figure 99: MEA Market Volume (Kilotons) Analysis by Product , 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product , 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product , 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Kilotons) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product , 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Castor Oil Polyol Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil-Based Biopolymer Market Size and Share Forecast Outlook 2025 to 2035

Castor Oil Market Growth – Trends & Forecast 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA